Now Reading: Ultra-Luxury Real Estate: The Strategic Asset Class Redefining UHNI Wealth Preservation in India

- 01

Ultra-Luxury Real Estate: The Strategic Asset Class Redefining UHNI Wealth Preservation in India

Ultra-Luxury Real Estate: The Strategic Asset Class Redefining UHNI Wealth Preservation in India

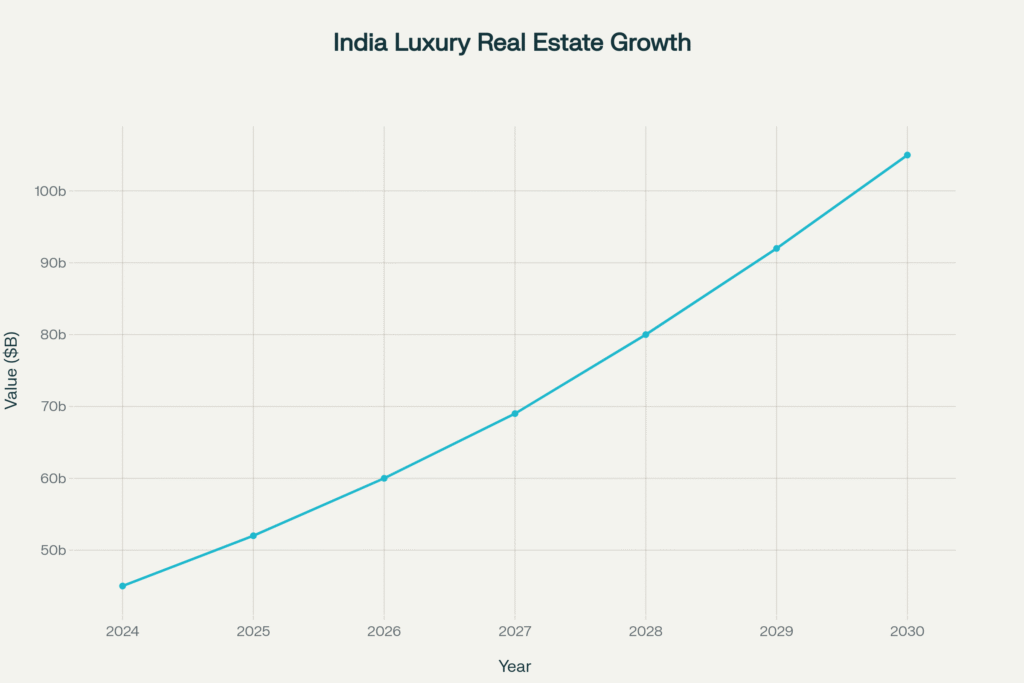

India’s ultra-luxury real estate market has transcended its traditional role as a lifestyle statement, emerging as a cornerstone of strategic wealth preservation for the nation’s growing cohort of Ultra-High Net Worth Individuals. With the UHNI population expanding by 6.1% in 2024 and luxury housing sales surging 53% year-on-year, this asset class now represents a calculated investment vehicle delivering both aspirational living and robust financial returns. As the market projects growth from $45 billion in 2024 to $105 billion by 2030, representing a 15% CAGR, discerning investors are repositioning luxury real estate from pure consumption to strategic portfolio diversification.

The Wealth Preservation Revolution: From Lifestyle to Legacy

The paradigm shift in ultra-luxury real estate investment reflects a maturing investor mindset among India’s affluent class. In 2025, 55% of HNIs and UHNIs cited capital appreciation as their primary motivation for luxury property investments, marking a significant increase from 44% in 2024. India now hosts 191 billionaires with collective wealth of $950 billion, alongside 85,698 HNWIs representing 3.7% of global wealthy individuals. This expanding wealth base creates unprecedented demand for premium real estate assets.

Mumbai’s luxury market alone recorded transactions worth ₹14,750 crore in H1 2025, representing an 11% increase from the previous year and underscoring sustained appetite for ultra-premium homes.

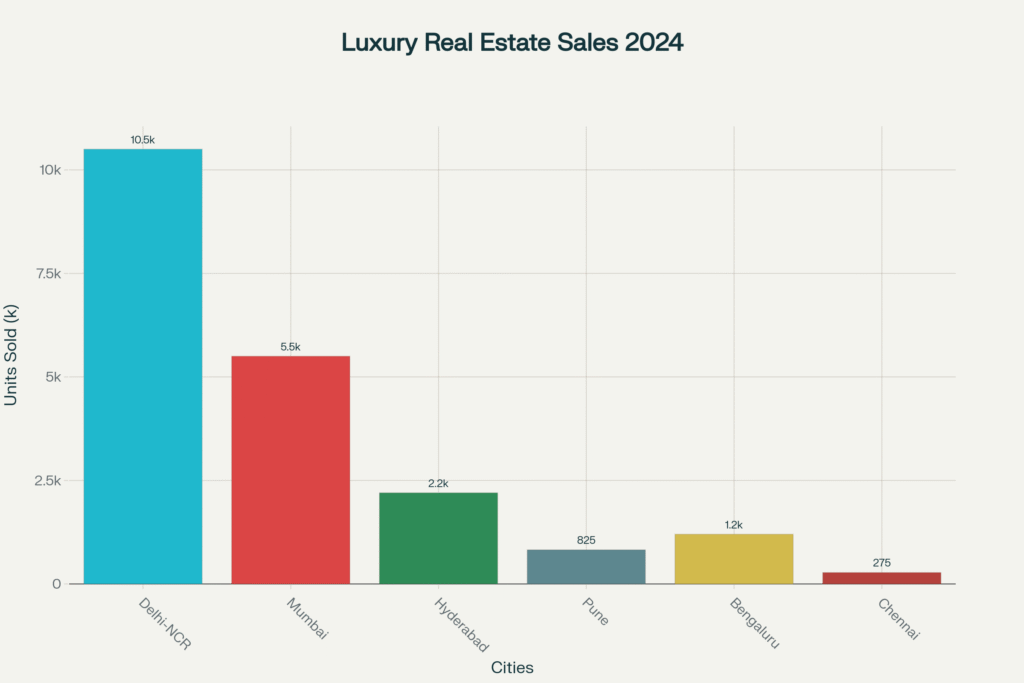

Market Dynamics: The Data Behind the Boom

Delhi-NCR emerged as the dominant force, recording 10,500 luxury unit sales in 2024—a remarkable 90% year-on-year growth. Mumbai followed with 5,500 units sold, while emerging markets like Pune demonstrated explosive growth with 106% increase in luxury sales.

City-wise Luxury Housing Sales Performance in India (2024) – Units priced ₹4+ crore

Capital appreciation rates vary significantly across markets, with Delhi-NCR leading at 27% annual growth, followed by Bengaluru at 12% and Hyderabad at 11%. These returns substantially exceed traditional fixed-income instruments while providing tangible asset backing and inflation hedging capabilities. Rental yields in the luxury segment typically range between 2-4%, with total returns of 10-15% annually over 5-10 year investment horizons.

India’s Luxury Residential Real Estate Market Growth Projection (2024-2030) with 15% CAGR

Geographic Epicenters of Ultra-Luxury Investment

Mumbai: The Premium Nucleus

Mumbai continues to dominate India’s luxury landscape, contributing 40% of the nation’s luxury inventory. Worli retained its leadership contributing 22% of primary sales value, while Bandra West recorded 192% growth and Tardeo surged 254%.

Delhi-NCR: The Growth Engine

The National Capital Region emerged as the fastest-growing luxury market, with Golf Course Road and Dwarka Expressway witnessing increasing interest from the ultra-wealthy. Delhi improved its global ranking from 37th to 18th position due to 6.7% year-on-year luxury residential price increases.

Emerging Luxury Corridors

Bengaluru moved from 59th to 40th place in global luxury rankings, driven by its technology hub status. Hyderabad and Pune are experiencing significant growth, with even Tier-II cities like Amritsar, Ayodhya, and Dwarka witnessing organized luxury development.

The NRI Factor: Global Capital Meets Indian Opportunity

Non-Resident Indians represent a transformative force, projected to contribute 25% of total real estate investments by 2025. NRI remittances hit a record $135.46 billion in FY25, representing 14% year-on-year growth. The favorable dollar-to-rupee exchange rate makes Indian luxury property increasingly attractive compared to global alternatives.

NRI investment patterns demonstrate sophisticated market understanding, with 65% preferring ready-to-move-in options and 85% exclusively purchasing from reputed developers. The preferred budget range has shifted from ₹1-4 crore for 75% of NRIs post-COVID.

The Second Homes Phenomenon

India’s second homes market represents one of the most dynamic segments, valued at $3.2 billion and projected to grow at 22-23% CAGR. Goa leads this transformation, with 55% of wealthy individuals expressing serious interest in luxury second homes in coastal destinations. The post-pandemic work-from-anywhere culture has accelerated demand for properties in scenic locations like Lonavala, Alibaug, and hill stations.

Exemplars of Strategic Luxury Investment

Case Study 1: DLF’s Mumbai Market Entry Strategy

DLF’s debut in Mumbai with the West Park project in Andheri represents a landmark moment. Priced between ₹5.5-7.5 crore, the project spans 5.2 acres demonstrating how established developers leverage brand equity to command premium pricing in new markets.

Case Study 2: Lodha’s Luxury Ecosystem Development

Lodha Group’s comprehensive luxury strategy encompasses World Towers in Lower Parel, Lodha Park in Worli, and international expansion to London’s Mayfair. The “By The Sea” luxury portfolio targeting waterfront locations demonstrates sophisticated market positioning.

Case Study 3: Mumbai’s ₹100+ Crore Transaction Matrix

Mumbai’s ultra-luxury segment recorded 21 transactions exceeding ₹100 crore in 2024, totaling ₹2,200 crore in sales value. These transactions concentrated in prime locations like Worli and Bandra West, indicating a maturing ultra-luxury market.

Strategic Investment Framework: The Three-Horizon Approach

Immediate Horizon (0-6 months): Foundation Building

Focus on comprehensive market research, team assembly, and strategic positioning. Prioritize location analysis, developer credibility assessment, and legal due diligence with low risk tolerance.

Mid-term Horizon (6-24 months): Selective Acquisition

Strategic property acquisitions in prime locations targeting 12-18% total returns through combined capital appreciation and rental yields. Medium risk tolerance for calculated investments in emerging luxury markets.

Long-term Horizon (2-10 years): Portfolio Optimization

Emphasis on portfolio optimization, generational transfer strategies, and legacy asset creation. Expected returns of 15-25% CAGR with medium-high risk tolerance for ultra-luxury segments.

Developer Ecosystem: The Luxury Triumvirate

Tier 1: National Champions – DLF, Lodha Group, and Godrej Properties represent India’s most established luxury developers with combined market valuations exceeding ₹4 lakh crore.

Tier 2: Regional Specialists – Oberoi Realty, Prestige Group, and Brigade Enterprises provide focused luxury development with deep local expertise and premium positioning.

Pro Tips for Ultra-Luxury Real Estate Investment

Location Intelligence: Prioritize properties within 5 kilometers of business districts, international airports, or premium educational institutions for superior long-term appreciation.

Developer Due Diligence: Select developers with minimum ₹10,000 crore market capitalization, 15+ years operational history, and consistent delivery records.

Infrastructure Correlation: Invest ahead of major infrastructure developments. Properties within 2 kilometers of announced infrastructure projects typically appreciate 25-40% upon completion.

Timing Strategy: Monitor interest rate cycles and seasonal patterns. Luxury property purchases during monsoon months often provide 5-10% negotiation advantages.

Frequently Asked Questions

Knight Frank recommends 22-25% of total wealth allocation to prime residential real estate for Indian HNIs, with ultra-luxury properties comprising 15-20% of real estate portfolios.

Luxury real estate in prime locations delivers 8-15% annual capital appreciation plus 2-4% rental yields, totaling 10-18% annual returns, typically exceeding fixed deposits and many equity mutual funds.

Delhi-NCR leads with 90% year-on-year growth, followed by Mumbai’s market stability and Bengaluru’s technology-driven demand. Emerging markets like Pune and Hyderabad provide higher growth potential.

Conclusion

India’s ultra-luxury real estate market stands at an inflection point where sophisticated investors recognize its transformation from lifestyle indulgence to strategic wealth preservation vehicle. The confluence of expanding UHNI population, robust economic fundamentals, and evolving investor sophistication creates unprecedented opportunities for generational wealth creation through premium real estate assets.

With projected market growth to $105 billion by 2030 and sustained demand from India’s expanding wealthy class, strategic positioning in this sector offers both financial returns and lifestyle enhancement benefits. For discerning UHNIs seeking to preserve and multiply wealth across generations, India’s luxury real estate market represents not just an investment opportunity, but a strategic imperative for comprehensive wealth management.

Relevant YouTube Videos

Free resources to download

City wise luxury performance document shows…… (one more line to be added)