Discover the 29.5% hidden costs beyond purchase price in ultra-luxury property ownership. Expert analysis for UHNI, HNI & NRI investors with global market data.

Investment3- Page

Dubai delivers 23% returns, India surges 305%. Data-driven luxury property investment strategies for UHNI/HNI investors seeking rental income + capital appreciation in 2025.

GST 2025 reality check: Homebuyers save only 1-3%, not the promised 5-10%. Expert analysis on actual luxury property price impact in India's major cities.

How UHNIs Use Cross-Border REITs to Multiply Wealth: 2024 Investment Guide

Discover where the world’s richest are investing in 2025: ultra-high-net-worth flows into Asia-Pacific and the Middle East, luxury real estate gains in Dubai & India, and the rise of family offices in Singapore. Explore market-shifting trends and strategic take-aways for HNIs and wealth advisors.

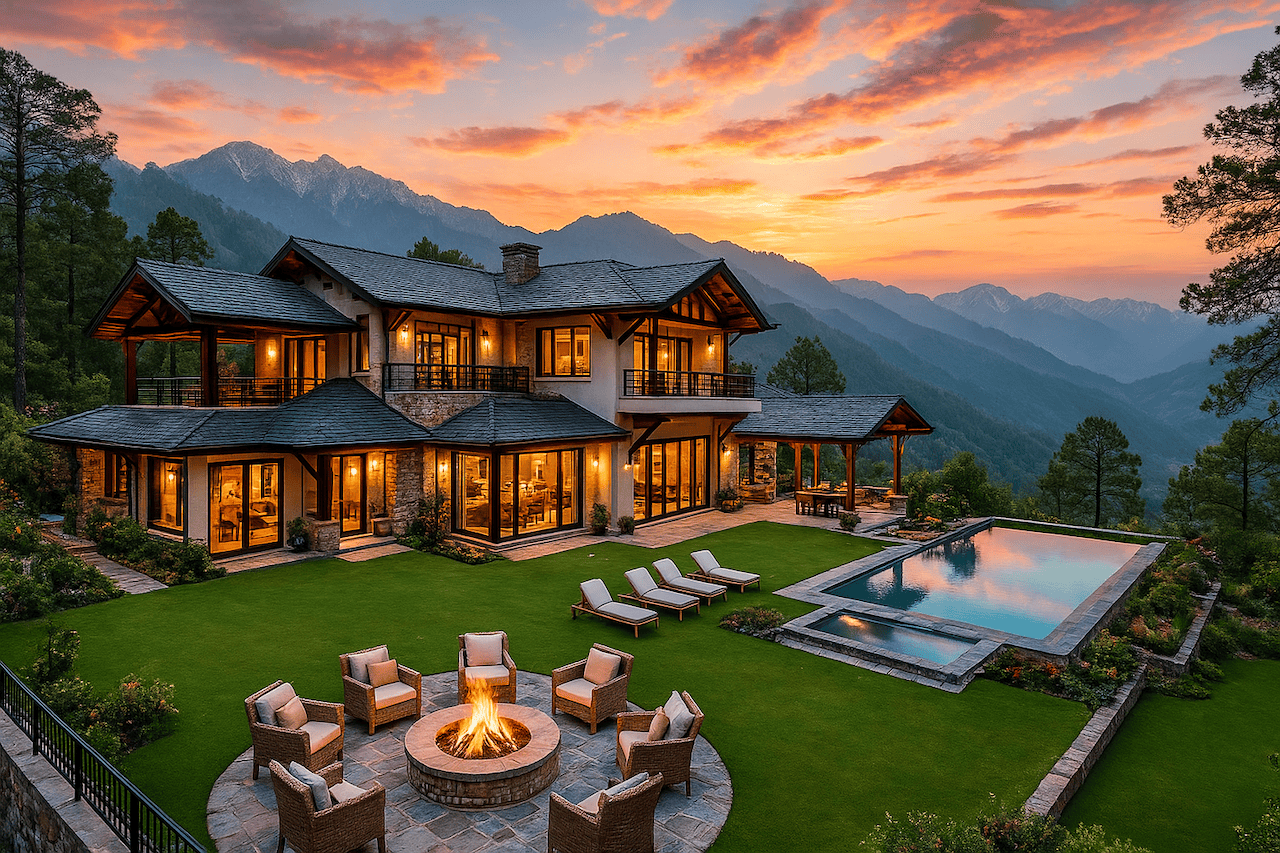

India’s ultra-luxury real estate market has transcended its traditional role as a lifestyle statement, emerging as a cornerstone of strategic wealth preservation for the nation’s growing cohort of Ultra-High Net

Officials approved a new city budget allocating funds to improve road safety through better signage, lighting, and traffic enforcement.