Now Reading: India’s Luxury Real Estate Renaissance: Mumbai, Delhi, Bangalore Lead $1.1 Trillion Wealth Migration

- 01

India’s Luxury Real Estate Renaissance: Mumbai, Delhi, Bangalore Lead $1.1 Trillion Wealth Migration

India’s Luxury Real Estate Renaissance: Mumbai, Delhi, Bangalore Lead $1.1 Trillion Wealth Migration

India’s luxury real estate market has reached an inflection point, with the nation’s triumvirate of Mumbai, Delhi NCR, and Bangalore emerging as global magnets for ultra-high-net-worth (UHNI) capital deployment. The sector recorded a historic 53% surge in luxury home sales during 2024, while India’s UHNI population is projected to expand by an extraordinary 50% to reach 19,908 individuals by 2028. This represents the fastest wealth creation velocity among major global economies.

The market transformation transcends mere statistical growth—it signals India’s elevation from emerging market participant to established luxury destination. With Delhi ranking 18th globally for prime property price appreciation, Mumbai maintaining its status as the financial capital’s residential epicenter, and Bangalore leveraging tech-wealth concentration, these metros have collectively attracted over $14.2 billion in NRI investments, positioning India as the epicenter of Asia’s luxury real estate renaissance.

This unprecedented wealth accumulation, anchored by India’s $1.1 trillion billionaire wealth surge, creates sustainable demand fundamentals that distinguish India’s luxury markets from cyclical speculation patterns observed in mature economies.

Market Shift + Global Context

India’s Ascendancy in Global Wealth Architecture

India’s luxury real estate surge reflects broader structural shifts in global wealth distribution. The nation now hosts 191 billionaires with combined wealth of $950 billion, ranking third globally behind the United States and China. This concentration creates cascading effects throughout the luxury ecosystem, as wealthy Indians allocate 22-25% of their portfolios to prime residential assets.

Unlike traditional luxury markets driven by inherited wealth, India’s luxury surge stems from first-generation entrepreneurs, technology innovators, and pharmaceutical pioneers. This demographic exhibits distinct investment patterns—prioritizing legacy creation, sustainable luxury, and technology integration over traditional ostentation markers.

Comparative Global Analysis: India vs. Established Markets

India-Dubai Dynamics: Dubai’s luxury market, while posting robust 16.9% growth, operates within a mature tax-optimization framework. However, India’s domestic wealth creation velocity offers superior long-term fundamentals. The value proposition becomes evident when comparing purchasing power—$1 million secures 1,065 sq ft in Mumbai versus 1,282 sq ft in Dubai, with India offering significantly higher appreciation potential.

India-London Convergence: London’s prime central market demonstrated modest 2.2% annual growth, reflecting mature market constraints and regulatory headwinds. Indian cities, conversely, benefit from infrastructure expansion and economic dynamism absent in established Western capitals. Delhi’s advancement from 37th to 18th position globally exemplifies emerging market advantages unavailable in London’s saturated ecosystem.

India-Singapore Value Arbitrage: Singapore’s space-constrained luxury market offers limited growth potential compared to India’s expanding urban infrastructure. With $1 million purchasing merely 344 sq ft in Singapore versus 2,238 sq ft in Delhi, India presents compelling value arbitrage for sophisticated international investors seeking growth exposure.

Data-Rich Market Intelligence

Transaction Volume Dynamics

The luxury segment (properties ≥₹4 crore) demonstrated exceptional performance metrics across multiple indicators:

Annual Growth Trajectories

- 2024: 12,625 luxury units transacted (37.8% YoY growth)

- Q3 2024: 4,360 units (82% YoY increase)

- Jan-Jun 2025: 7,000 units (85% YoY surge)

Metropolitan Market Share Analysis

- Delhi NCR: 46% national market share, 5,855 units (72% growth)

- Mumbai: 32% market share, 3,820 units (18% growth)

- Bangalore: 15% market concentration, driven by tech wealth

Wealth Creation Acceleration Metrics

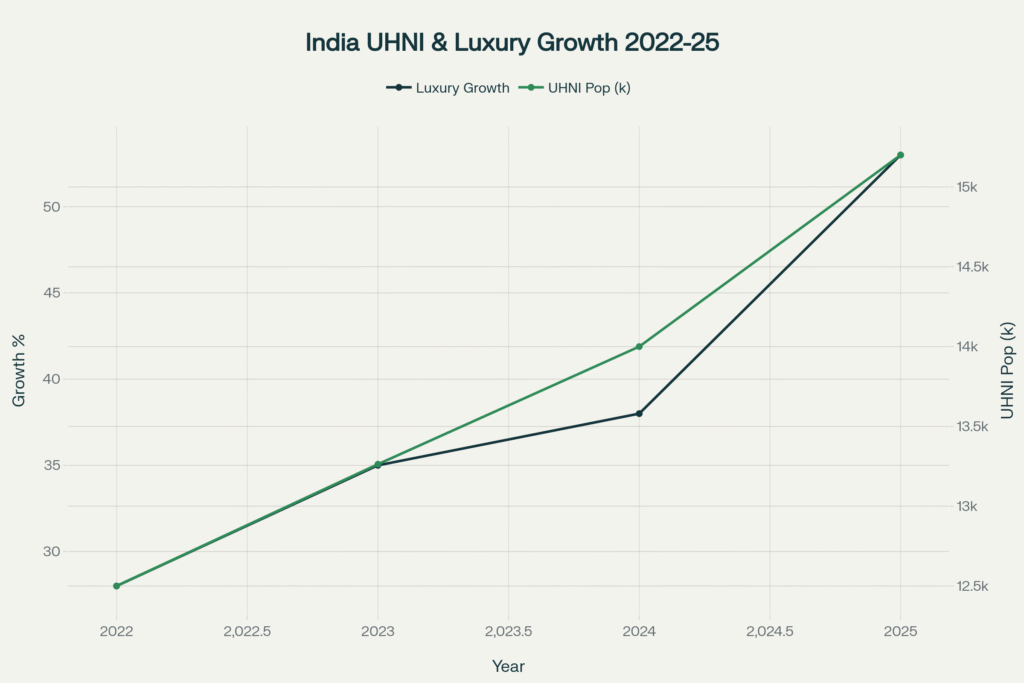

UHNI Population Expansion Timeline:

- 2023: 13,263 individuals (6.1% annual growth)

- 2024: 14,000+ projected

- 2028: 19,908 projected (50% cumulative increase)

Capital Deployment Patterns:

- Total luxury market valuation: $58 billion (2024)

- NRI investment contribution: $14.2 billion annually

- Projected NRI investment ceiling: $14.9 billion (2025)

Price Appreciation Analysis

Global Ranking Performance:

- Delhi: 6.7% annual growth, global rank #18

- Mumbai: 6.1% appreciation, global rank #21

- Bangalore: 4.1% growth, global rank #40

Comparative Space Value Analysis:

Emotional & Lifestyle Architecture

Prestige Evolution Beyond Ostentation

Contemporary luxury buyers have fundamentally redefined prestige markers, shifting from conspicuous consumption toward curated experiences. Branded residence partnerships with hospitality giants like Ritz-Carlton and Four Seasons surged 143% in Mumbai’s $2.3-5.78 million segment, indicating demand for globally recognized service standards rather than mere square footage accumulation.

Generational Wealth Expression Patterns

India’s nouveau riche—comprising technology entrepreneurs, financial services leaders, and pharmaceutical innovators—approach luxury real estate as legacy creation mechanisms rather than status symbols. This demographic prioritizes architectural innovation, environmental sustainability, and technological integration over traditional wealth display patterns.

Post-pandemic lifestyle recalibration has intensified demands for privacy, wellness integration, and space optimization. CBRE research reveals 89% of Indians aged 18-35 with annual incomes exceeding ₹1 crore prefer property ownership over rental arrangements, with luxury buyers specifically seeking:

- Exclusivity Premium: Gated communities experienced 30% demand surge

- Biophilic Integration: Natural elements incorporated into urban design

- Technology Convergence: Smart home automation and AI-enabled living

- Wellness Architecture: Dedicated spa facilities, yoga studios, meditation spaces

- Sustainability Leadership: Carbon-neutral developments and renewable energy systems

Cultural Identity Preservation

Unlike Western luxury markets focused on individual expression, Indian luxury buyers seek properties that accommodate extended family structures while maintaining global sophistication standards. This cultural requirement creates unique architectural demands absent in Western luxury developments.

Strategic Investment Framework

Immediate Opportunity Window (2025-2026)

Market Entry Positioning: Luxury inventory in the ₹10-20 crore segment presents optimal risk-adjusted entry points. Delhi NCR offers superior growth potential driven by government proximity and infrastructure expansion, while Mumbai provides stability premiums through financial sector concentration. Bangalore’s technology ecosystem ensures sustainable demand fundamentals supported by continuous wealth creation.

Developer Partnership Strategy: International investors should prioritize relationships with publicly-listed, Grade A developers demonstrating consistent delivery track records. Companies like Godrej Properties (31% sales growth) and Lodha Group (21% booking increase) offer institutional-grade investment opportunities with professional management standards.

Mid-Term Growth Catalysts (2026-2028)

Infrastructure Multiplication Effects: Mumbai’s coastal road completion, Delhi’s metro network expansion, and Bangalore’s peripheral connectivity improvements will create location premium redistributions. Strategic positioning in emerging micro-markets adjacent to infrastructure nodes presents asymmetric return opportunities before mainstream recognition.

Regulatory Environment Optimization: RERA implementation and streamlined approval processes favor established developers, creating market consolidation opportunities beneficial for institutional investors seeking portfolio concentration in quality assets.

Long-Term Wealth Creation (2028-2030)

Demographic Dividend Realization: India’s UHNI population trajectory ensures sustained luxury demand through demographic expansion rather than cyclical speculation. Combined with accelerating urbanization—projected 50 million additional metropolitan residents—supply-demand imbalances favor sustained price appreciation.

Global Capital Integration: India’s luxury markets will progressively integrate with international capital flows through REITs expansion, fractional ownership platforms, and sovereign wealth fund participation, normalizing institutional investment approaches while maintaining growth premiums.

Case Study Analysis

Mumbai: Financial Capital Resilience Model

Mumbai’s luxury ecosystem demonstrates remarkable anti-fragility despite space constraints and regulatory complexity. The city’s role as India’s financial nucleus—housing 60% of private banking assets—creates sustained demand from wealth management professionals and financial entrepreneurs.

Performance Indicators:

- Annual transactions: 96,187 units (11% growth)

- Luxury market contribution: 32% national share

- Price positioning: $149/sq ft, offering value versus global financial centers

The recent market re-entry of DLF Limited after 13 years, launching apartments priced above ₹50 million, signals institutional confidence in Mumbai’s fundamentals despite short-term volatility.

Investment Thesis: Mumbai’s scarcity premium—limited coastal developable land combined with financial sector expansion—ensures long-term appreciation despite cyclical adjustments.

Global Benchmarking: Dubai vs. India

Dubai’s luxury real estate provides instructive comparison for India’s trajectory. While Dubai achieved 6.8% price growth supported by tax optimization and residency programs, India’s domestic wealth creation offers superior fundamentals.

Dubai serves transaction-oriented investors seeking tax efficiency, while Indian metros cater to legacy-building mindsets requiring generational stability. This fundamental difference suggests more sustainable demand patterns in Indian luxury markets.

Strategic Differentiation:

- Dubai: Transaction optimization focus

- India: Wealth preservation emphasis

- Result: Higher demand stability in Indian markets

London: Mature Market Reference Point

London’s luxury sector serves as the mature market benchmark, with prime areas posting 2.2% annual growth. The market’s stability reflects regulatory maturity, established wealth, and currency strength.

However, Indian markets offer growth premiums unavailable in London’s mature ecosystem. Sophisticated Indian investors increasingly employ London for capital preservation while utilizing domestic markets for wealth generation, creating complementary global strategies.

Professional Investment Recommendations

Portfolio Optimization Strategy

Strategic Allocation Framework:

- Mumbai: 40% allocation (stability and liquidity advantages)

- Delhi NCR: 35% position (growth and appreciation potential)

- Bangalore: 25% exposure (emerging wealth demographic capture)

Risk Management Protocols

Market Risk Assessment:

- Regulatory policy modifications affecting foreign investment flows

- Interest rate environment changes impacting affordability matrices

- Economic growth deceleration reducing wealth creation velocity

Mitigation Strategies:

- Geographic diversification across metro markets

- Developer partnership concentration with established entities

- End-user demand focus rather than speculative positioning

Due Diligence Framework

Developer Evaluation Criteria:

- Operational history validation (minimum 10-year track record)

- Financial stability analysis (optimal debt-to-equity ratios)

- Delivery timeline consistency measurement

- Post-sales service quality assessment

Location Selection Matrix:

- Infrastructure development timelines and completion probabilities

- Micro-market demand fundamental analysis

- Regulatory approval status and bureaucratic risk assessment

- Exit liquidity considerations and market depth evaluation

Professional Investment Insights

Elite-Level Strategic Considerations

UHNI Portfolio Diversification Strategy: Ultra-high-net-worth individuals should allocate luxury real estate investments across multiple Indian metros to capture different growth drivers while minimizing concentration risk. The optimal allocation balances Mumbai’s stability premium, Delhi’s government proximity advantages, and Bangalore’s technology wealth creation.

NRI Capital Optimization Methodology: Non-resident Indians leveraging favorable exchange rates should prioritize branded developments with international design standards and professional management systems. Focus on properties offering rental yield potential and capital appreciation through infrastructure development cycles.

Institutional Investment Approach: Family offices and wealth management platforms should consider fractional ownership in ultra-luxury developments (₹25+ crore properties) to access exclusive locations while maintaining portfolio diversification. SM-REIT structures provide institutional-grade liquidity for high-value residential assets.

Tax-Efficient Structuring: Sophisticated investors should explore holding company structures in favorable jurisdictions for luxury real estate acquisitions, optimizing capital gains treatment and inheritance planning while maintaining investment flexibility.

Technology Integration Investment: Properties incorporating smart home ecosystems, AI-enabled building management, and sustainable energy systems command premium valuations and attract tech-savvy luxury buyers, particularly in Bangalore’s ecosystem.

Risk Assessment & Contrarian Analysis

Market Vulnerability Factors

Despite optimistic growth projections, several structural factors warrant conservative analysis:

Inventory Absorption Challenges: Ultra-luxury segment properties (₹20-50 crore) demonstrate extended 17-quarter absorption timelines, indicating potential supply-demand imbalances in specific price categories. This suggests selective market entry rather than broad-based luxury exposure.

Affordability Pressure Points: Construction cost inflation reaching 40% over five years, combined with uncertain interest rate environments, may constrain buyer sentiment in lower luxury segments (₹4-10 crore range).

Global Economic Sensitivity: India’s export-dependent economy remains vulnerable to global recession scenarios, which could impact wealth creation velocity and luxury demand fundamentals.

Regulatory Transformation Risks

Foreign Investment Policy Evolution: Potential modifications to FDI regulations in real estate could affect international investment flows and market liquidity.

Tax Policy Adjustments: Changes to capital gains treatment, property transaction taxes, or wealth taxes could impact investment returns and buyer behavior patterns.

Urban Planning Restrictions: Municipal authorities may implement density controls, environmental regulations, or affordable housing mandates affecting luxury development profitability.

Frequently Asked Questions

What makes Mumbai, Delhi, and Bangalore superior to other Indian cities for luxury real estate investment?

These three metros concentrate 93% of India’s luxury housing transactions due to convergent factors: financial sector dominance (Mumbai), government proximity (Delhi), and technology wealth creation (Bangalore). Their infrastructure maturity, international connectivity, and established luxury ecosystems create sustainable demand fundamentals absent in emerging cities.

How does India’s luxury real estate compare with international markets for UHNI investors?

India offers compelling value arbitrage—$1 million purchases significantly more space than established markets like Singapore (344 sq ft) or London (364 sq ft), while providing superior growth potential. Delhi’s 6.7% appreciation exceeds London’s 2.2% growth, combining emerging market dynamics with increasing institutional sophistication.

What are the optimal investment horizons for different luxury real estate segments in India?

Short-term (2-3 years): Focus on completed luxury projects in prime locations for rental yield and liquidity. Medium-term (5-7 years): Under-construction branded developments near infrastructure projects. Long-term (10+ years): Ultra-luxury developments in emerging micro-markets with demographic growth potential.

Which investor profile types achieve optimal returns in India’s luxury real estate market?

NRI investors leveraging favorable exchange rates, domestic UHNIs seeking portfolio diversification, and institutional investors through fractional ownership structures demonstrate superior risk-adjusted returns. End-user buyers in stable career trajectories also benefit from long-term appreciation while enjoying lifestyle benefits.

Future Market Evolution

India’s luxury real estate trajectory intersects with broader economic modernization patterns, positioning the sector for sustained expansion through 2030. The convergence of demographic dividends, infrastructure acceleration, and wealth creation velocity creates investment opportunities unavailable in mature markets.

As India approaches its $5 trillion GDP milestone, luxury real estate will transition from domestic wealth preservation vehicle to recognized global asset class. This evolution attracts institutional capital participation, sovereign wealth fund involvement, and international private equity deployment, enhancing market sophistication while maintaining growth premiums.

The sector’s progression from developer-driven supply models toward demand-responsive luxury experiences indicates market maturation without sacrificing appreciation potential. For sophisticated investors, India’s luxury real estate represents a unique convergence of emerging market growth dynamics with institutional investment infrastructure—a compelling proposition for long-term wealth creation and global portfolio diversification strategies.

You might want to check these out

Free resources to download

India’s Luxury Real Estate Renaissance: Key Summary Points