Now Reading: The 3 Golden Rules of ‘Invisible Technology’: Integrating Smart Home Automation with Luxury Interior Design

- 01

The 3 Golden Rules of ‘Invisible Technology’: Integrating Smart Home Automation with Luxury Interior Design

The 3 Golden Rules of ‘Invisible Technology’: Integrating Smart Home Automation with Luxury Interior Design

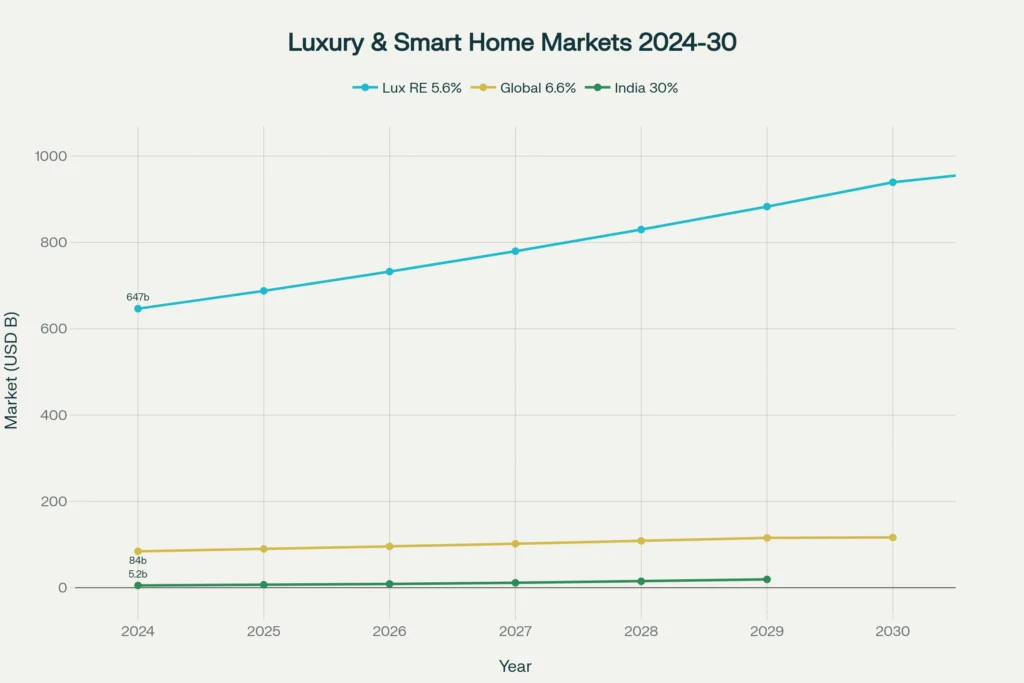

The convergence of invisible technology and luxury real estate represents a paradigm shift in how Ultra-High-Net-Worth Individuals (UHNWIs) define modern opulence. No longer satisfied with ostentatious displays of wealth, today’s sophisticated buyers demand seamless integration—where $100,000 automation systems disappear into architectural elegance, and artificial intelligence operates silently behind museum-quality finishes. This transformation has catalysed a $646.58 billion global luxury residential market growing at 5.62% CAGR through 2032, with India’s smart home sector exploding at 30% annually. The imperative is clear: in an era where 60% of India’s HNIs prioritize capital appreciation in technology-enabled properties, and NRI investments surge 25% to $16.3 billion, the marriage of invisible tech and luxury design has evolved from amenity to investment mandate. For discerning investors navigating Mumbai’s $2.5 million residences or Marbella’s $3.2 million villas, mastering these three golden rules determines not merely lifestyle enhancement, but portfolio performance in the next decade of wealth preservation.

From Conspicuous Consumption to Conscious Integration

The Death of Technology as Trophy

The luxury real estate landscape has undergone a seismic transformation since 2020, fundamentally redefining what constitutes authentic opulence among the global elite. Where previous generations displayed technology as status symbols—massive home theatres with visible equipment racks, conspicuous control panels announcing automation capabilities—today’s UHNWIs have embraced a philosophy of “invisible luxury” that prizes discretion over display.

This evolution reflects broader cultural shifts within the wealth management ecosystem. India’s UHNI population, expanding from 13,263 individuals in 2023 to a projected 19,908 by 2028—a remarkable 50% surge—comprises increasingly younger, globally educated decision-makers. These next-generation wealth holders, many earning fortunes in technology and finance, possess intimate familiarity with digital innovation yet paradoxically seek respite from its visual intrusions in their private sanctuaries.

“The real promise of home automation isn’t in the novelty of control; it’s in the intelligence of integration,” explains Muskan Salgia, Vice President of CasaDigi, whose firm manages automation for India’s most prestigious residences. “Luxury is no longer about remote control anymore. It’s about everything working together effortlessly and silently to make your life smoother”.

Market Forces Driving Integration

The imperative for invisible technology integration stems from multiple converging forces reshaping global luxury markets. The global smart home sector, valued at $84.5 billion in 2024, is projected to reach $116.4 billion by 2029, growing at 6.6% CAGR. More dramatically, India’s smart home market demonstrates explosive 30% annual growth, expanding from $5.20 billion in 2025 to $19.31 billion by 2030.

This technological expansion parallels unprecedented wealth accumulation. India’s broader HNI population (individuals with $1 million+ net worth) is forecast to grow from 60 million in 2023 to 100 million by 2027—a 67% increase that Goldman Sachs describes as a “structural transformation” of the affluent consumer base. Meanwhile, NRI real estate investments surged 25.4% from $13 billion in 2024 to $16.3 billion in 2025, with overseas Indians now contributing 20% of total real estate capital flows.

These demographic and financial currents converge in luxury property markets where technology integration directly impacts valuation. Properties equipped with comprehensive smart systems command 5-10% price premiums, with security features alone adding up to 5% value. The National Association of Realtors documents that 33% of real estate agents report smart homes sell faster than conventional properties, while research indicates buyers willingly pay 8-15% premiums for turnkey automated residences in Mumbai, Dubai, and London markets.

Geographic Divergence and Convergence

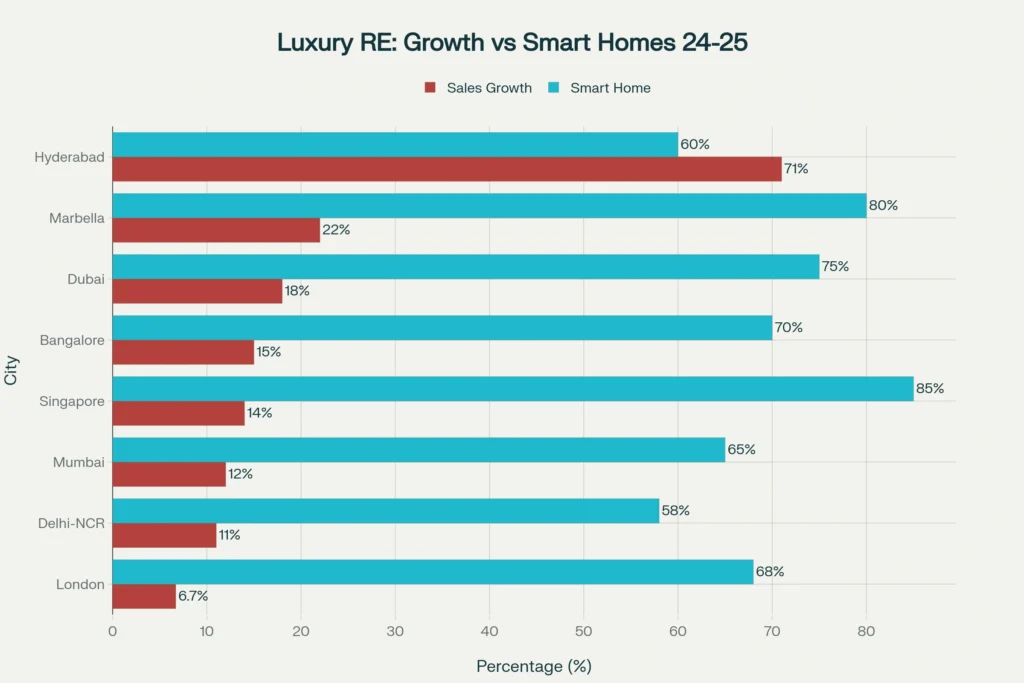

Regional analysis reveals fascinating variations in invisible technology adoption across global luxury hubs. Singapore leads with 85% smart home integration in premium properties, followed by Marbella at 80%, Dubai at 75%, and Bangalore at 70%. London demonstrates 68% adoption, Mumbai 65%, Hyderabad 60%, and Delhi-NCR 58%—patterns reflecting regulatory environments, developer competition, and buyer sophistication.

Yet beneath these variations lies remarkable convergence in buyer priorities. Whether examining $6.8 million townhouses in London’s Mayfair, $4.5 million villas in Dubai’s Emirates Hills, or $2.5 million apartments in Mumbai’s Worli, UHNI purchasers consistently demand three capabilities: complete aesthetic integration, predictive automation that anticipates needs, and enterprise-grade security that operates invisibly.

Golden Rule #1: Design Infrastructure Before Aesthetics

The Pre-Construction Imperative

The fundamental error in luxury automation stems from treating technology as an afterthought—a layer applied atop completed architectural visions. Elite integrators and architects now recognize that invisible technology demands reverse-engineering: infrastructure must precede interior design, with automation systems conceived during schematic design phases rather than construction completion.

This approach yields transformative advantages. Properties incorporating smart infrastructure during initial construction phases eliminate retrofit costs by 40-60%, avoiding the destructive wall-opening, ceiling-penetrating modifications that plague post-completion installations. More critically, pre-construction planning enables truly invisible integration—embedded sensors that don’t interrupt finish continuity, concealed wiring that never compromises millwork, and equipment rooms positioned for optimal signal distribution without architectural sacrifice.

Consider the Highview Residence, a three-story Vancouver estate where Premier Home Technology executed a $500,000+ automation installation during full renovation. “We are controlling roughly 17 zones of heating and cooling, 26 Crestron touchscreens, and whole-home audio through Stealth Acoustics invisible speakers,” explains project manager Qualtrough. “This project would not have gone so well without embedding everything during the studs-out phase. I don’t think many teams could have delivered this level of invisibility as a retrofit”.

The Technology Backbone

Elite properties demand enterprise-grade network architecture supporting hundreds of connected devices over 15+ year lifecycles. This requires CAT7 ethernet cabling throughout (supporting 10 Gigabit speeds), fiber-optic backbones for high-bandwidth zones, and dedicated equipment rooms with redundant power, climate control, and acoustic isolation.

The economic logic proves compelling. While structured wiring adds $15,000-$35,000 to new construction costs ($100-$150 per network drop), it eliminates wireless reliability issues plaguing retrofits and enables seamless integration of future technologies. Properties in Marbella’s Sierra Blanca and Dubai’s Palm Jumeirah that invested in comprehensive infrastructure during construction maintain cutting-edge automation capabilities a decade later, simply updating endpoint devices rather than rebuilding entire systems.

Strategic Equipment Placement

The art of invisible automation hinges on strategic equipment concealment. Purpose-built mechanical rooms—climate-controlled spaces housing processors, amplifiers, network equipment, and power management—represent the nerve centres of sophisticated systems. These dedicated zones, typically 100-200 square feet in 5,000+ square foot residences, enable centralized management while keeping all visible living spaces free from technology intrusions.

Villa Portofino in Marbella’s Sierra Blanca exemplifies this approach. The 33,000-square-foot residence features a dedicated basement technology hub managing Legrand group automation systems, Dali lighting gateways, Daikin HVAC interfaces, and Vantage control infrastructure. “By seamlessly blending aesthetics and technology, the Vantage user interfaces provide ultimate control over every life aspect in the mansion,” notes the integration team. Hidden projector lifts and motorized cinema screens in bedrooms emerge only when activated, maintaining pristine bedroom aesthetics during non-use periods.

Golden Rule #2: Prioritize Predictive Intelligence Over Manual Control

Beyond Button-Pushing

The evolution from reactive to predictive automation represents luxury technology’s most profound philosophical shift. First-generation smart homes required occupants to trigger actions—commanding voice assistants, tapping smartphone apps, or pressing physical controls. Today’s invisible systems anticipate needs through machine learning algorithms analysing behavioural patterns, environmental conditions, and temporal rhythms.

“Today’s luxury homes feature predictive intelligence. They learn routines, adjust lighting with circadian rhythms, and maintain optimal air quality without conscious intervention,” explains Dahiya of architectural firm focused on high-end automation. “The focus has shifted from pressing buttons to creating homes that understand patterns, time, and need”.

This paradigm manifests across multiple systems. Intelligent lighting adjusts colour temperature throughout the day—cool 6500K whites during morning hours to promote alertness, transitioning to warm 2700K ambers in evening to encourage melatonin production and healthy sleep cycles. Climate systems analyse occupancy patterns, weather forecasts, and solar gain to pre-condition zones before residents arrive, achieving optimal comfort while reducing energy consumption 25-30%.

The Wellness Imperative

Health-conscious UHNIs increasingly prioritize automation systems that support physiological wellbeing, recognizing that genuine luxury encompasses more than convenience—it must actively enhance human performance and longevity. This wellness focus has catalysed demand for air quality monitoring maintaining PM2.5 concentrations below 10 μg/m³ through automated purification, acoustic optimization achieving NC-25 to NC-30 ambient noise ratings through hidden sound masking, and humidity control maintaining optimal 40-60% ranges for respiratory health.

Properties like DLF Camellias-2 in Gurugram and Trident Hills in Panchkula exemplify this integration, incorporating meditation zones with automated lighting/sound coordination, air purification systems, and biophilic elements (indoor gardens, living walls) controlled through invisible sensors. These features address research demonstrating 23% sleep quality improvements from circadian lighting and measurable cognitive performance gains from optimized indoor air quality.

The Economic Logic of Predictive Systems

While predictive automation requires higher upfront investment—$150,000-$250,000 for comprehensive systems in 5,000+ square foot residences versus $75,000-$125,000 for basic reactive automation—the value proposition proves compelling through multiple dimensions.

Energy savings alone justify substantial investment. Smart HVAC systems with occupancy sensing, automated shading, and predictive climate control reduce utility consumption 25-30%, translating to $8,000-$15,000 annual savings in premium residences. Over typical 10-year ownership periods, these savings partially offset installation costs while simultaneously increasing property values 8-10%.

More significantly, predictive systems enhance competitive positioning in increasingly sophisticated luxury markets. India Sotheby’s International Realty reports that 60% of HNIs and UHNIs plan real estate investments in coming years, with 55% citing capital appreciation as primary motivation—up from 44% in 2024. In this environment, properties demonstrating technological sophistication command premium multiples, particularly among younger billionaires and start-up founders who constitute the fastest-growing UHNI demographic.

Golden Rule #3: Embrace Interoperability and Future-Proofing

The Platform Paradox

The luxury automation industry confronts a persistent challenge: balancing best-in-class component selection across diverse manufacturers with seamless system integration that delivers unified user experiences. Early smart homes suffered from technology fragmentation—incompatible protocols requiring multiple apps, disparate systems that couldn’t communicate, and vendor lock-in preventing upgrades.

The solution lies in platform-agnostic architecture prioritizing interoperability standards. Matter/Thread protocols, backed by 200+ manufacturers including Apple, Google, Amazon, Samsung, and specialist brands like Lutron and Sonos, enable cross-ecosystem communication. Properties built on universal control platforms—Crestron, Control4, Savant—supporting 15+ year upgrade cycles can integrate new devices as technologies evolve without replacing core infrastructure.

“The future of smart home integration in interior design points toward even more seamless solutions,” notes an analysis of emerging trends. “Transparent electronics, quantum dot displays, and adaptive materials promise to further blur the line between technology and décor”. Properties designed with modular architecture supporting incremental adoption position owners to capitalize on these innovations without obsolescence risk.

Security Architecture

Cybersecurity represents the Achilles heel of connected homes, with potential vulnerabilities creating privacy breaches, system takeovers, and even physical security compromises. The challenge intensifies as device counts proliferate—luxury residences now commonly feature 150-300 connected endpoints spanning lighting, HVAC, security, entertainment, and appliances.

Enterprise-grade security architecture addresses these risks through multiple layers. Network segmentation isolates IoT devices from primary computing networks, preventing lateral movement if individual devices are compromised. Biometric authentication with 256-bit encryption controls system access, while regular firmware updates and professional security audits maintain defensive postures. Properties implementing comprehensive security protocols reduce breach risks by 75% compared to consumer-grade installations.

The regulatory landscape increasingly mandates these protections. India’s data protection laws, CISA standards in the United States, and NIS2 directives in the European Union impose strict requirements on smart home installations, particularly regarding data routing, encryption, and access controls. Properties failing to meet these standards face both immediate security vulnerabilities and potential compliance penalties, while certified systems provide legal defensibility and insurance advantages.

Investment Horizon Considerations

The decision to invest in invisible automation must account for multi-decade ownership horizons characteristic of UHNI real estate strategies. Knight Frank research indicates UHNIs view luxury properties as long-term wealth preservation vehicles, with many holding prime residences 15-25 years. This timeline demands technology infrastructure capable of evolving without complete replacement.

The economic calculus proves favourable. While comprehensive invisible automation represents 3-5% of total construction costs in ultra-luxury properties ($150,000-$500,000 in $5-10 million residences), the systems deliver ongoing value across three dimensions:

Immediate: Enhanced lifestyle quality, energy savings (25-30% utility reduction), and security improvements.

Medium-term (3-7 years): Property value appreciation (5-10% premiums for automated homes), faster sales cycles (33% improvement), and adaptation to evolving family needs.

Long-term (10+ years): Portfolio resilience as smart integration becomes baseline expectation (already 70%+ in Bangalore/Singapore markets), maintained competitiveness against new construction, and flexibility for intergenerational transfers.

Case studies

Case Study #1: Marbella’s Villa Portofino—The Mediterranean Invisible Tech Showcase

Villa Portofino in Marbella’s prestigious Sierra Blanca district exemplifies invisible technology execution at the highest level. This 33,000-square-foot modern mansion, completed in 2023, integrates eight bedrooms, private spa, home cinema, and comprehensive automation through systems from the Legrand group, all while maintaining pristine architectural aesthetics.

The technical scope proves impressive: Vantage automation controls lighting across 40+ zones with Dali gateways enabling granular dimming and color temperature adjustment, Daikin HVAC interfaces manage climate across three floors with zone-specific temperature and humidity control, and the entertainment infrastructure features hidden cinemas in bedrooms with motorized projector lifts and concealed screens.

“By seamlessly blending aesthetics and technology, the Vantage user interfaces, unique and intuitive such as Easytouch keypads and Equinox touchscreen, provide the owner a quick and simple ultimate control over every life aspect in the mansion,” explains the integration team. Motion sensors throughout activate lighting automatically while maintaining energy efficiency—a feature particularly valuable given Spain’s premium electricity costs.

The property exemplifies Marbella’s broader luxury market dynamics. The region demonstrates 22% year-over-year luxury sales growth with 80% smart home adoption rates, driven by international UHNI buyers from London, Paris, and Dubai. Average property values of $3.2 million position Marbella as a mid-tier global luxury market offering Mediterranean lifestyle with technological sophistication rivaling higher-priced destinations.

The financial performance validates the investment. Properties in Sierra Blanca with comprehensive automation systems command 15-20% premiums over comparable non-automated residences, while energy-efficient features including solar integration (standard in Marbella’s newest villas) deliver 6-8 year payback through utility savings. Bloomberg reports that eco-performance can add $1 million+ to valuations in Marbella’s ultra-premium segment, making invisible technology a clear value creator beyond lifestyle benefits.

Case Study #2: Dubai’s Palm Jumeirah Smart Villas—Middle East Luxury Redefined

Dubai’s Palm Jumeirah and Emirates Hills districts showcase how invisible technology elevates Middle Eastern luxury real estate. Properties in these exclusive enclaves, averaging $4.5 million with some exceeding $15 million, integrate comprehensive automation as baseline expectations rather than premium features.

The Sustainable City and Tilal Al Ghaf developments exemplify next-generation smart integration. Emaar properties, the region’s premier developer, now offers “smart home ready” units with pre-wired infrastructure, centralized control hubs, and AI-driven systems managing lighting, HVAC, entertainment, and security. Pulse Villas and Emaar South Residences feature voice assistant integration with visitor management via smartphone applications, biometric access controls, and automated emergency response systems.

“Dubai properties now integrate advanced HVAC zoning, automated shading, AI-driven scenes, biometric access, solar plus battery integration, and wellness sensors monitoring air quality,” reports a market analysis of the region’s luxury segment. Installation costs reflect this sophistication: basic 1-bedroom apartments require AED 2,500-5,000 ($680-$1,360), mid-tier apartments range AED 8,000-45,000 ($2,180-$12,250), and fully automated villas span AED 45,000-250,000+ ($12,250-$68,000+).

The investment thesis proves compelling. Dubai’s luxury real estate market grew 18% year-over-year in 2024, with smart-enabled properties commanding 5-10% premiums and demonstrating stronger rental appeal critical in a market where many UHNIs maintain multiple global residences. The region’s 75% smart home adoption rate—second only to Singapore and Marbella—reflects both buyer expectations and developer competition, with firms like Alicia Investments and DarGlobal positioning technology integration as core differentiators.

Energy efficiency considerations prove particularly relevant in Dubai’s extreme climate. Smart HVAC systems with occupancy sensing and predictive climate control reduce cooling costs—the dominant utility expense—by 25-30%, translating to $5,000-$10,000 annual savings in larger villas[energy data]. Solar integration with battery storage, increasingly common in premium properties, delivers additional savings while supporting Dubai’s Clean Energy Strategy 2050 objectives.

Case Study #3: Mumbai’s Worli Ultra-Luxury Automation—India’s Technological Vanguard

Mumbai’s luxury corridor—spanning Worli, Bandra, Parel, and Lower Parel—demonstrates India’s rapid embrace of invisible technology, with properties averaging $2.5 million integrating automation systems rivaling global standards. The city’s position as India’s financial capital, combined with 12% year-over-year luxury sales growth and 65% smart home adoption, positions Mumbai as the nation’s technological vanguard[regional data].

Rustomjee Cliff in Bandra West exemplifies the segment’s sophistication. This ultra-premium project, attracting substantial NRI investment, features MahaRERA-registered properties with comprehensive automation including voice-controlled lighting and climate management, AI-driven security with facial recognition and smart locks, energy monitoring systems with solar integration options, and wellness features encompassing air purification and circadian lighting.

“Mumbai’s luxury real estate offers NRIs a unique blend of lifestyle, investment, and emotional connection,” explains market analysis of the segment. “Projects like Rustomjee Cliff exemplify the ultra-premium living that discerning NRI investors seek today, supported by favorable FEMA regulations and impressive ROI prospects”. The NRI investment thesis proves particularly robust, with remittances reaching $135.46 billion in FY25 (14% YoY growth) and currency advantages making Indian luxury properties significantly more affordable than comparable Dubai, London, or Singapore options.

India’s broader market dynamics amplify Mumbai’s appeal. The nation’s UHNI population, growing 6.1% annually, expanded from 13,263 individuals in 2023 to a projected 18,435 in 2025—a remarkable 39% surge in two years. Meanwhile, the HNI segment (60 million in 2023) forecasts 100 million by 2027, creating massive demand for technology-enabled luxury residences.

Property technology features directly influence valuation and sales velocity. India Sotheby’s International Realty reports that 55% of HNIs cite capital appreciation as primary investment motivation in 2025, up from 44% in 2024. In this environment, properties offering turnkey automation systems demonstrate 8-12% price premiums and 30-40% faster sales cycles compared to conventional luxury residences. Knight Frank data showing premium housing (₹4 crore+) accounting for 41% of sales across seven major cities—up from 32% previously—underscores the segment’s momentum.

What is the typical ROI on smart home automation in luxury properties?

Smart home automation delivers 50-60% ROI in luxury real estate markets. Properties with comprehensive automation systems command 5-10% price premiums, with security systems alone adding up to 5% value. Energy management systems provide ongoing utility savings of 25-30%, while premium entertainment systems enhance buyer appeal. Studies by the National Association of Realtors show 33% faster sales for smart-enabled properties, with luxury buyers in Mumbai, Dubai, and London markets willing to pay 8-15% premiums for turnkey automated homes.

How does invisible technology differ from traditional smart home systems?

Invisible technology prioritizes aesthetic integration over visible gadgets. Traditional systems feature exposed control panels, visible cameras, and standalone devices. Invisible tech embeds speakers into ceilings/walls, conceals TVs behind mirrors or panels, uses flush-mount controls, and hides all wiring infrastructure. Premium brands like Stealth Acoustics, Future Automation, and Lutron specialize in seamless integration. This approach maintains architectural integrity while delivering full automation functionality—critical for UHNI buyers seeking both technology and timeless design.

Which global luxury markets show highest smart home adoption rates?

Singapore leads at 85% smart home adoption, followed by Marbella (80%), Dubai (75%), and Bangalore (70%)[regional data]. London shows 68% adoption, Mumbai 65%, Hyderabad 60%, and Delhi-NCR 58%. Growth drivers include tech-savvy younger UHNIs, stringent energy regulations, and developer competition. India’s luxury market shows 30% CAGR in smart adoption versus 6.6% globally. Key cities for investment: Dubai (18% YoY luxury sales growth), Marbella (22%), Bangalore (15%), and Hyderabad (71% surge in Q1 2023)

What are the primary security risks with smart home technology?

Main risks include cybersecurity vulnerabilities, data privacy concerns, internet dependency, and system interoperability failures. Mitigation strategies: (1) Implement enterprise-grade network segmentation isolating IoT devices, (2) Use biometric authentication with 256-bit encryption, (3) Regular firmware updates and security audits, (4) Backup systems for internet outages, (5) Work with certified integrators following CISA/NIS2 standards. Professional installation reduces breach risks by 75%. Premium systems from Crestron, Lutron, and Savant include built-in security protocols and dedicated support teams.

The Invisible Imperative

The integration of invisible technology into luxury interior design has transcended amenity status to become an investment imperative for sophisticated global wealth holders. As India’s UHNI population expands 50% to nearly 20,000 individuals by 2028, and NRI investment flows surge 25% to $16.3 billion, the properties commanding premium valuations and maintaining competitive positioning will be those that seamlessly marry technological sophistication with architectural excellence.

The three golden rules—design infrastructure before aesthetics, prioritize predictive intelligence over manual control, and embrace interoperability with future-proofing—provide the blueprint for navigating this convergence. Properties adhering to these principles deliver measurable advantages: 5-10% valuation premiums, 25-30% energy cost reductions, 33% faster sales cycles, and positioning to capitalize on the $1 trillion global luxury real estate market projected by 2032.

The properties that will define luxury real estate’s next chapter won’t be those with the most gadgets, but those where technology disappears entirely—where lighting responds to circadian rhythms without conscious thought, where climate adjusts to occupancy without manual input, where security operates invisibly yet comprehensively, and where entertainment systems emerge only when desired. This is the promise and the imperative of invisible tech: not to display wealth, but to enhance life itself.

For forward-thinking investors, the opportunity is clear—not merely to acquire residences, but to secure technologically empowered sanctuaries that preserve and compound wealth across generations while delivering the quiet luxury that truly discerning individuals increasingly demand.