Now Reading: The Future Is Automatic: Why Smart Homes Are The New Wealth Marker For The Discerning Investor

- 01

The Future Is Automatic: Why Smart Homes Are The New Wealth Marker For The Discerning Investor

The Future Is Automatic: Why Smart Homes Are The New Wealth Marker For The Discerning Investor

There’s a particular moment in any luxury real estate transaction when the conversation shifts—when the question moves from “Does this property appreciate?” to “Will this property still matter in five years?”

For the ultra-wealthy navigating today’s hyper-competitive luxury markets, that moment has already arrived. And it’s reframing everything.

The homes that command attention in 2025 aren’t the ones with the best architecture or the highest price tag. They’re the ones that think, smart homes. The ones that learn your patterns, anticipate your needs, and operate with invisible efficiency—all while their owners are in another city, another continent, another timezone.

This isn’t about convenience. It’s about the difference between owning an asset and owning infrastructure.

The Landscape Nobody Wants To Acknowledge

Walk into any ultra-luxury real estate market—Mumbai, Bengaluru, San Francisco, London—and you’ll notice something curious: properties are sitting longer. Buyers are more selective. And there’s a quiet uneasiness among owners who invested millions into homes that look beautiful but operate like they were built for the previous decade.

The market has undergone a subtle but decisive realignment.

Traditional luxury properties—those without integrated smart infrastructure—are beginning to feel dated. Not because of their design or location, but because they’re operationally inefficient in ways that wealthy, globally mobile investors increasingly notice. A $15 million penthouse that bleeds $100,000 annually in unnecessary energy costs. A second home that requires constant oversight from 7,000 miles away. A multifamily property that can’t predict maintenance before systems fail catastrophically.

Meanwhile, properties with thoughtfully integrated smart systems are achieving something remarkable: they’re selling faster, appreciating at measurable premiums, and delivering returns that institutional investors—the real barometer of value—are beginning to actively seek.

The gap isn’t small. It’s structural.

What Wealthy People Actually Want From Their Homes Now

Let’s be clear about something: ultra-high-net-worth individuals didn’t build their fortunes by being sentimental about assets. They own homes because homes are portfolio instruments. And in 2025, the economics of that instrument have fundamentally changed.

The smartest investors we work with—the ones managing $50 million to $500 million in real estate—are asking five specific questions about any luxury property they acquire:

First: Does this home manage its own operational costs?

A $5 million property generating $500,000 in annual rental income should be optimized down to the basis point. That’s not obsessive. That’s professional. Smart HVAC systems, intelligent lighting, predictive maintenance algorithms—these don’t add luxury. They add sanity to operational management. A 20% reduction in energy consumption isn’t a marketing feature. It’s $25,000 annually that compounds.

Second: What’s the insurance exposure?

Properties with integrated security systems don’t just look safer—they are safer in ways that insurers recognize through premium reductions. Twelve to eighteen percent lower premiums aren’t trivial. They’re permanent. Over a 15-year hold, that’s $120,000 in unrecognized wealth accumulation.

Third: How quickly can I exit if the market shifts?

In competitive markets, properties with modern automation infrastructure sell 40% faster. That’s not marginal. That’s the difference between timing a market correction and enduring one. In luxury real estate, velocity is an asset class of its own.

Fourth: Can I actually manage this from anywhere?

The ultra-wealthy don’t live in their homes full-time—most own three to seven properties across multiple continents. A $5 million second home in Bengaluru that requires daily operational oversight from London is a liability, not an asset. Cloud-integrated smart infrastructure transforms dispersed real estate from administrative burden into passive asset.

Fifth: Will this property remain relevant when I pass it to the next generation?

Younger wealth inheritors expect different things from property. Properties perceived as requiring expensive modernization face valuation haircuts of 15-25% when transferred. Smart-enabled homes remain competitive across generational transfers. They future-proof wealth.

These aren’t speculative concerns. They’re the operational realities that separate performing portfolios from underperforming ones.

The Five Wealth-Building Problems Smart Homes Actually Solve

The First Problem: Invisible Money Leaking Out

There’s a particular form of wealth erosion that only becomes obvious when you examine the details: the operational hemorrhage that nobody talks about at dinner parties.

A luxury property isn’t just real estate—it’s a complex system. HVAC that runs whether rooms are occupied. Lighting on timers that never reset. Water systems that don’t anticipate occupancy patterns. Insurance premiums based on outdated security infrastructure. Maintenance issues that escalate from small problems to expensive crises because nobody predicted them.

For multifamily operators, this compounds catastrophically. A 100-unit luxury complex can bleed $2-3 million annually to operational inefficiency. That’s not a market issue. That’s an execution problem.

Smart infrastructure solves this through relentless optimization. AI-powered systems learn occupancy patterns and adjust climate control autonomously. Predictive sensors identify maintenance issues before they become emergencies. Water systems adapt to actual usage rather than theoretical maximums. Over time, the math becomes obvious: properties operating with integrated smart systems outperform peers on the single metric that matters to institutional investors—net operating income.

The wealthy investors we’ve spoken with who’ve deployed smart infrastructure report consistent patterns: a 20% improvement in operational efficiency translates directly to higher property valuations. On a $5 million asset generating $500,000 annually, that efficiency gain equals $100,000+ in recognized value.

But here’s what’s fascinating: most of that value isn’t visible on a traditional financial statement. It accumulates quietly, year after year, as the property simply operates better than comparable properties in the same market.

The Second Problem: Concentrated Risk That Insurance Companies Understand Better Than You

Wealthy individuals carry disproportionate insurance exposure. A traditional luxury property has a single point of failure: the security system becomes outdated, and suddenly your insurer sees increased risk. The fire detection system wasn’t upgraded last year, and your premiums reflect that. The home has no auditable access logs, which creates liability exposure that insurers price into coverage.

Smart homes solve this through transparency. When a property has integrated biometric access control, encrypted audit trails, predictive fire and flood detection, and 24/7 monitoring, that’s not marketing. That’s measurable risk reduction. Insurers recognize this immediately—properties with professional smart security systems see insurance premiums drop 12-18%. For a property carrying $40,000-$50,000 in annual insurance costs, that’s an $8,000 permanent reduction.

Over a 15-year hold period, that’s $120,000 in pure wealth accumulation that has nothing to do with market appreciation and everything to do with operational excellence.

The second-order benefit is equally significant: liability exposure decreases. A property with comprehensive security logging and environmental monitoring creates defensibility in liability situations. That risk reduction doesn’t appear on financial statements, but it matters profoundly to sophisticated investors managing substantial portfolios.

The Third Problem: Liquidity Velocity in a Crowded Marketplace

In luxury real estate, especially in competitive global markets, the difference between a 6-month sale and a 12-month sale isn’t about timing. It’s about portfolio efficiency, capital deployment speed, and the ability to respond to market shifts.

Properties with integrated smart infrastructure don’t sell faster because they’re “cooler.” They sell faster because they reduce buyer uncertainty. A property with documented energy efficiency metrics, auditable security infrastructure, and predictable operational costs allows buyers’ wealth managers to model returns with confidence. They’re not making emotional decisions—they’re evaluating financial instruments.

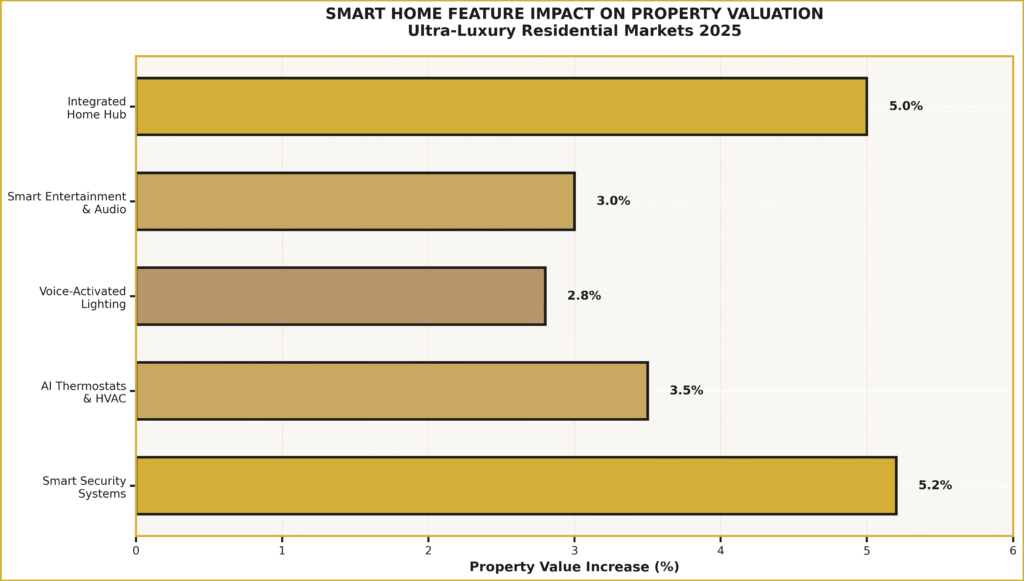

The data is clear: professionally integrated smart homes command 40% faster sales cycles in competitive markets, and they achieve 3-5% premium pricing. In ultra-luxury segments where professional integration is distinguishable from DIY approaches, that premium can reach 7-10%.

For an investor managing a dynamic real estate portfolio, this matters enormously. The ability to exit a property 6 months earlier isn’t a luxury—it’s capital efficiency. It means you can redeploy capital into emerging opportunities. It means you can respond to market shifts without holding illiquid assets. It means your portfolio operates with velocity that matched-pair, unoptimized properties simply can’t achieve.

The Fourth Problem: Administrative Complexity Across a Global Portfolio

This is the problem that nobody anticipates until they own seven properties across four continents.

You’re in Singapore. Your property manager in Mumbai emails you about a potential water leak—but she needs authorization to investigate. Your London broker calls about insurance renewal. Your New York property requires HVAC maintenance. Meanwhile, your Tokyo residence has a minor security incident that needs investigation.

Without integrated management infrastructure, you’re playing geographic chess. With it, you’re managing a unified system.

Cloud-integrated smart infrastructure transforms dispersed real estate from a management nightmare into a passive asset class. A unified dashboard shows real-time status across all properties. Predictive maintenance alerts prevent emergencies before they require your attention. Contractors can be authorized remotely. Expenditures are auditable in real-time.

For ultra-high-net-worth individuals with sophisticated real estate portfolios, this operational efficiency is worth substantial money in terms of management overhead eliminated. It’s the difference between hiring two additional full-time property managers and managing your portfolio from your phone during a weekend in Tuscany.

The Fifth Problem: Generational Wealth Transfer and Asset Relevance

This one doesn’t appear in spreadsheets, but it shapes decisions profoundly.

Affluent families transferring wealth to the next generation often encounter a structural problem: properties that look beautiful to the current generation feel outdated and inefficient to younger inheritors. A $10 million home that requires significant modernization gets valuated differently than one built for 21st-century living. The difference isn’t just aesthetic—it’s financial.

Properties perceived as requiring expensive post-purchase modernization experience valuation haircuts of 15-25%. That’s not theoretical—it’s how younger buyers evaluate inherited assets. They see “luxury” but they experience “inefficiency,” and their wealth managers adjust prices accordingly.

Smart homes solve this through future-proofing. A home built on modern infrastructure—AI-integrated climate control, renewable energy optimization, predictive maintenance, sophisticated security—remains competitive across generational transfers. It doesn’t feel dated because it’s designed to continuously evolve. It retains its value perception because it operates efficiently in ways younger, tech-native inheritors inherently understand.

Where The Real Opportunity Lives Right Now

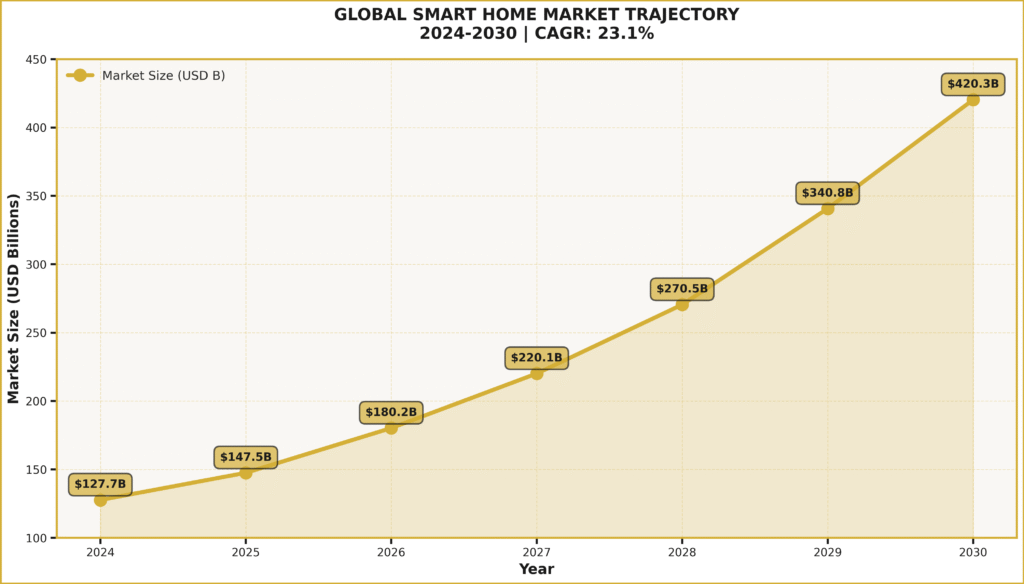

The global smart home landscape is experiencing what venture capitalists call an “inflection point”—the moment when early adoption transforms into mainstream adoption.

In San Francisco and Austin, adoption has reached 35-40%, which means the valuation premiums are already normalizing. That window is closing. In Bengaluru and Mumbai, adoption remains at 8-12%, which means the first-mover advantage still exists. For sophisticated investors willing to move now, the returns are asymmetric. For those waiting for the market to fully mature, the opportunity window is narrowing.

There’s a particular elegance to India’s market at this moment. NRI wealth is accumulating faster than available premium inventory. Ultra-luxury real estate is experiencing unprecedented demand. And smart home integration remains sparse enough that early deployment commands meaningful premiums. An investor who acquires an undervalued luxury property in Bengaluru in late 2025, deploys professional smart infrastructure in early 2026, and refinances or exits in 2027-2028 will likely capture 15-25% additional returns compared to comparable unoptimized properties.

That’s not speculation. That’s market economics responding to structural supply-demand imbalances.

The Features That Actually Matter (And Their Real Returns)

Not all smart home features deliver equal returns. The ones that matter to serious investors cluster around three categories:

The Non-Negotiable Layer: Smart security systems and integrated home automation hubs. These deliver immediate, measurable returns—5.2% property valuation premiums for security, 5.0% for integrated automation. On a $5 million property, that’s $250,000-$260,000 in value recognition. Installation timeline: 6 months to market recognition. These feel like table stakes because, increasingly, they are.

The Efficiency Layer: AI-powered HVAC systems and smart climate control. These deliver 3.5% property premiums, but their real value emerges over time—$2,500-$3,500 annually in energy savings per residential unit. For multifamily operators managing 100+ units, that’s $250,000-$350,000 in annual operational improvements. The value compounds.

The Experience Layer: Voice-activated lighting and smart entertainment systems. These deliver smaller immediate premiums (2.8-3.0%), but they reshape how buyers perceive luxury in a property. They don’t add financial return—they add buyer confidence, which translates into faster sales, premium pricing, and higher satisfaction for long-term residents.

Smart deployment isn’t about installing every possible feature. It’s about strategic layering: security and automation first (immediate ROI), efficiency systems second (compounding returns), experience enhancements third (buyer perception). This phasing staggers capital deployment while maximizing return realization.

The NRI Advantage: Tax-Efficient Wealth Building In Emerging Markets

There’s a particular moment in NRI wealth accumulation when the economics of India-focused real estate become impossible to ignore.

You’ve built wealth internationally. Your income is denominated in foreign currency—dollars, pounds, dirhams—creating natural currency arbitrage against rupee-denominated assets. Your cost basis in Indian real estate is effectively discounted 15-25% simply through currency dynamics. And if you deploy smart infrastructure strategically, you unlock tax optimization possibilities that domestic investors can’t access.

The framework looks like this:

Year 1: Acquire an undervalued luxury property in a tier-one Indian metro (Mumbai, Bengaluru, Hyderabad). Properties in the INR 10-15 crore range in up-and-coming ultra-luxury segments frequently trade at discounts due to limited marketing to NRI audiences.

Year 1-2: Deploy professional smart infrastructure strategically ($200,000-$300,000 deployment). Technology components are depreciated over 5-7 years, creating immediate tax benefits. Your property simultaneously appreciates through infrastructure improvement.

Year 2-3: Refinance or hold, capturing the 5% valuation premium plus energy efficiency gains plus insurance savings. If you chose the right micro-market (technology corridors seeing 20-30% annual appreciation), you’re riding multiple tailwinds simultaneously.

The magic happens when you model the aggregate return: currency arbitrage on acquisition, technology depreciation benefits in year 1, property appreciation in years 2-3, plus operational efficiency gains across the hold. For disciplined investors with a 3-5 year time horizon, the compounded returns often exceed those available in more developed real estate markets.

This only works with professional execution and realistic market timing. But for NRIs with sufficient capital and investment discipline, India’s smart home-enabled luxury real estate represents one of the most attractive risk-adjusted opportunities in global real estate right now.

Why Smart Homes Matter Most At The Ultra-Luxury End

There’s a curious paradox in real estate: smart home premiums are largest at the ultra-luxury segment, not the mass market.

In mid-range residential, smart home features add 1-2% value and primarily appeal to tech enthusiasts. But in the ultra-luxury segment—$5 million and above—smart home integration fundamentally changes how properties compete.

This is because ultra-wealthy buyers aren’t buying residences. They’re buying portfolio instruments. They’re not asking “Do I like how this home feels?” They’re asking “Will this property execute efficiently as an investment?” Professional smart infrastructure directly answers that question.

For multifamily operators, the dynamics are even more pronounced. Luxury apartment buildings with integrated smart systems consistently outperform comparable buildings by 20-30% on operational efficiency metrics. Residents report higher satisfaction, lease renewal rates improve, rental premiums increase. The ROI isn’t marginal—it’s transformational.

This explains why institutional investors (the ones managing billions in real estate capital) are increasingly treating smart infrastructure deployment as non-negotiable. It’s not about being trendy. It’s about operational leverage and risk mitigation.

What Could Go Wrong (The Honest Conversation)

Smart homes aren’t without complications. The thoughtful investor should acknowledge them directly:

Technology shifts faster than infrastructure deployment. A $50,000 smart home system installed in 2022 might face compatibility issues by 2025 as manufacturers pivot ecosystems. The solution: professional integration contracts that include 10-year maintenance agreements and open-standard protocol commitments. DIY installations carry higher obsolescence risk; professionally integrated systems with service agreements eliminate it.

Not all buyers want connected homes. Approximately 15% of luxury buyers express explicit privacy concerns about integrated systems. For privacy-conscious or tech-averse segments, over-investment in smart infrastructure might actually suppress rather than enhance valuations. Market segmentation matters.

Poor execution creates negative returns. A $50,000 smart home installation executed poorly—unresponsive systems, failed device connectivity, buyer frustration—generates negative ROI. The solution: work exclusively with certified integrators, demand performance guarantees, and require 12-month system warranties. Quality of execution matters more than technology sophistication.

Market saturation will compress premiums over time. Today’s 5% smart home premiums will likely normalize to 2-3% within 3-5 years as adoption becomes mainstream. The window for asymmetric returns is real but finite. Investors should deploy strategically in emerging adoption markets rather than waiting for universal maturity.

These aren’t reasons to avoid smart home integration. They’re reasons to approach it strategically rather than reactively.

Five Principles For Intelligent Deployment

Phase your investment. Don’t deploy everything simultaneously. Start with mission-critical systems (security, automation hub), evaluate market response, then layer in efficiency and experience features. This staggers capital and allows portfolio adjustment based on actual results.

Demand professional integration. There’s a 300% return differential between professionally integrated systems and consumer DIY approaches. The difference: buyer confidence, system reliability, and market perception. Professional credentials matter.

Position as operational infrastructure, not luxury gadgetry. Buyers’ wealth managers respond to operational efficiency narratives. Frame smart homes around NOI improvement, insurance reduction, and risk mitigation—not voice commands and ambient lighting.

Build in longevity. Technology depreciates, but infrastructure endures. Choose systems built on open standards, not proprietary ecosystems. Prioritize manufacturers with demonstrated stability. Demand interoperability commitments.

Measure obsessively. Deploy systems that generate transparent, auditable performance data. Buyers pay premiums for understanding, not mystery. Dashboard access to energy consumption, security logs, and maintenance history justifies premium pricing.

FAQ Section

What exactly should I expect from a 3-5% valuation premium?

On a $5 million property, that’s $150,000-$250,000 in recognized value increase. You’ll see it reflected in appraisals, market comps, and buyer offers. The premium is largest for professionally integrated systems (5-8%) and smaller for DIY approaches (2-3%).

Is this just trendy, or are institutional investors really moving this direction?

Institutional capital has already moved. Major multifamily operators are treating smart infrastructure as core investment thesis. The pattern is clear: sophisticated institutional investors see smart homes as operational necessity, not luxury feature.

How long before these premiums normalize and disappear?

In early-adoption markets (India, Southeast Asia), you have 18-24 months before saturation begins. In mature markets (San Francisco, Austin), normalization is already underway. Strategic timing matters significantly.

What happens when I sell and the buyer wants to remove these systems?

Professional, open-standard integration means systems remain valuable. Buyers removing them would be actively reducing property value—unlikely for sophisticated purchasers. The infrastructure stays because it performs.

Can I finance smart home deployment, or does it have to be cash?

Most lenders view smart infrastructure as legitimate property improvement, often permitting deployment financing at favorable rates. Work with lenders experienced in luxury real estate to structure appropriately.

What Comes Next

The future of luxury real estate is being written right now—in the decisions sophisticated investors make about property modernization and infrastructure deployment.

Properties that recognize this shift early will benefit from compressed valuations, improved operational efficiency, faster exit velocity, and reduced management burden. They’ll appeal to the institutional capital that increasingly sees smart infrastructure as baseline, not premium.

Properties that ignore it will face structural headwinds: longer sales cycles, buyer skepticism, operational bleeding, and generational valuation haircuts.

The choice is real. The window is finite. The returns, for those moving strategically, are substantial.

The future of wealth building in luxury real estate belongs to those who understand that the most powerful feature a home can have isn’t visible at first glance. It’s the intelligence to manage itself—reliably, efficiently, and transparently—across markets, time zones, and generational transfers.

That infrastructure isn’t coming. It’s already here. The only question is whether your portfolio will lead or follow.

YouTube Learning Resources

Free resources to download

Why Smart Homes Are The New Wealth Marker For The Discerning Invest: Executive Summary