Now Reading: Smart Home Security: Why Ultra-Wealthy Investors Are Making It Their Wealth Fortress

- 01

Smart Home Security: Why Ultra-Wealthy Investors Are Making It Their Wealth Fortress

Smart Home Security: Why Ultra-Wealthy Investors Are Making It Their Wealth Fortress

The penthouse overlooks Manhattan’s Central Park. Floor-to-ceiling windows frame a view worth the $85 million price tag. Inside, the owner—a tech entrepreneur with $1.2 billion in net worth—touches a single button on his phone. Doors lock. Cameras activate. Perimeter sensors come alive. He’s in Buenos Aires. His family sleeps soundly 6,000 miles away, protected not by guards alone, but by an invisible network of AI-powered intelligence that would rival a government security apparatus.

This isn’t science fiction. This is the new standard for ultra-luxury real estate.

For decades, wealth protection meant hiring more security personnel, installing higher walls, and buying property in gated enclaves. Today’s Ultra High Net Worth Individuals (UHNWIs) have discovered something far more powerful: integrated smart security systems that transform homes into intelligent fortresses. And they’re willing to pay significant premiums—sometimes 35% above comparable properties—for this technological edge.

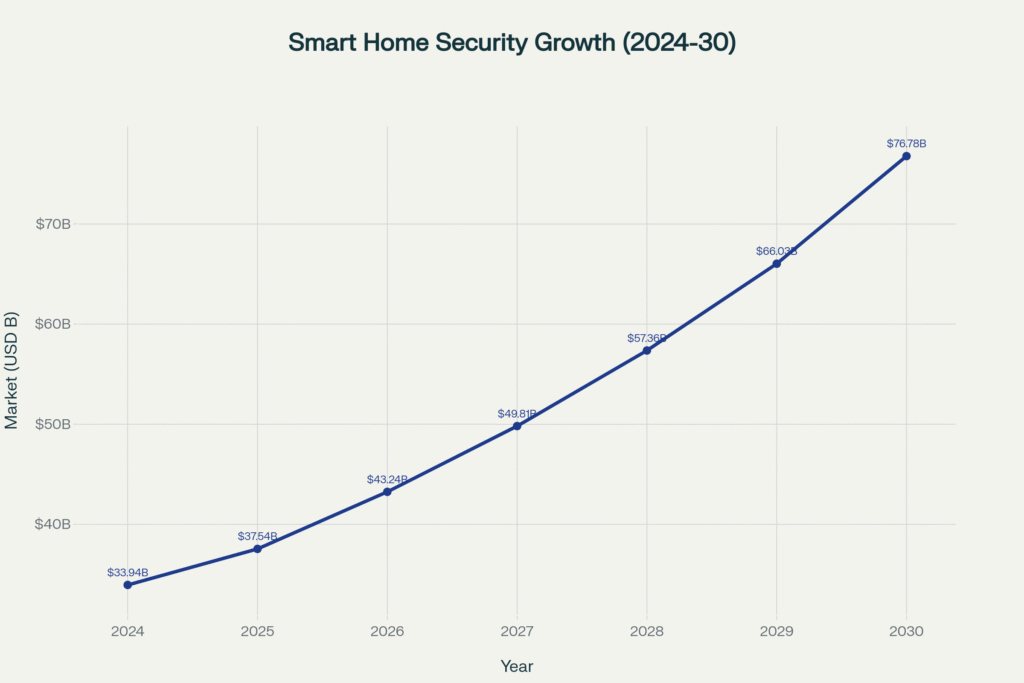

The smart home security market is projected to reach nearly $77 billion by 2030. But more importantly, properties equipped with these systems are commanding price premiums of 8-35% depending on geographic market, with some luxury properties selling 25-40% faster than their traditional counterparts. For the wealthiest investors, the question isn’t whether to invest in smart security, but how to deploy it strategically across their global property portfolios.

The Shift: From Guards to Intelligence

A decade ago, “smart home security” meant cameras you could view on your phone. Today’s systems are fundamentally different. They’re predictive. They’re intelligent. They operate autonomously.

Consider what professional monitoring has become. A UHNI household invests approximately $200,000 annually for 24/7 expert monitoring—but this isn’t someone watching screens in a dark room. It’s behavioral analysis powered by artificial intelligence. The system learns normal activity patterns, then flags anomalies instantly. An unexpected visitor at 3 AM triggers immediate first-responder coordination. A pattern of visitors during owner absence gets flagged for investigation. The technology doesn’t just react—it anticipates.

This intelligence layer is what’s driving the shift. Eighty-four percent of luxury property buyers now expect integrated smart security, making it no longer an amenity but a baseline expectation in properties above $10 million. Dubai’s ultra-luxury segment, where villas have appreciated nearly 100% since 2020, increasingly features AI-powered threat detection as standard. Mumbai’s emerging UHNI class—projected to grow 50% by 2028—is similarly demanding these capabilities, with smart-enabled properties commanding 12% premiums.

The transformation reflects a deeper reality: for those with the most to protect, traditional security feels increasingly inadequate. One cybersecurity firm specializing in wealthy families reported a 1,500% increase in threat assessment requests from high-net-worth individuals. The global UHNI population has reached nearly 677,000 individuals controlling almost $60 trillion in combined wealth. They’re visible. They’re vulnerable. And they’re willing to invest substantially to remain invisible.

Where the Money Is: Geographic Arbitrage

Geography matters profoundly in smart security adoption. Understanding this creates investment opportunities for discerning portfolios.

Dubai leads the world with 35% property value premiums for smart-enabled luxury homes. The emirate recorded 435 ultra-luxury transactions exceeding $10 million in 2024—the highest volume globally—with villa prices surging 20% annually. Properties on Palm Jumeirah now incorporate biometric entry systems, AI-powered concierge services, and automated perimeter security as standard. One&Only Private Homes there command 45% resale premiums largely due to their integrated technology and branded hospitality services.

Singapore ranks second with 15% premiums, reflecting the city-state’s tech-savvy population and uncompromising home safety standards. Average ultra-luxury transactions reach $32 million, with smart automation viewed as essential rather than optional.

India presents the most intriguing opportunity. Mumbai’s ultra-luxury market surged 50% in recent years, with NRIs driving 20-25% of investment volume. Properties with smart security systems command 12% premiums. But here’s the opportunity: only 42% of luxury properties currently feature integrated smart systems, with projections showing this reaching 78% by 2027. Early adopters in India’s emerging ultra-luxury markets—Bangalore, Hyderabad, Pune—are positioned to capture 2-3x premium appreciation as the market matures. India’s luxury real estate is projected to grow at 21.81% CAGR through 2029, with smart technology as a primary value driver.

London’s established luxury market shows more modest 8% premiums, while New York reflects just 5%—not because technology is unimportant but because saturation means 78% of ultra-luxury properties already include smart features. It’s baseline expectation, not differentiation. This pattern reveals a crucial insight: the highest ROI comes from emerging markets where smart adoption lags mature markets by 5-10 years.

The ROI Reality: What Investors Actually Gain

Numbers matter, but context matters more. Here’s how smart security investments actually perform:

Immediate gains (Year 1-2): Properties appreciate 3-5% upon professional installation. Insurance carriers offer 10-15% premium reductions—substantial on policies covering $10-50 million assets. A property insured at $25 million saves $250,000-375,000 annually. This alone recovers 50% of the $650,000 annual security investment cost among UHNI households.

Transaction velocity improves dramatically. Smart-enabled properties sell 25-40% faster than traditional luxury homes. In competitive markets, this means avoiding months of carrying costs, reduced vacancy if renting, and psychological certainty that your property appeals to the widest buyer pool.

Mid-term performance (3-5 years): Rental yields surge 12-18% higher than comparable properties lacking smart systems. In technology hubs like Bangalore and Gurgaon, smart-enabled luxury apartments find tenants 30-40% faster, reducing vacancy periods substantially. Properties in IT-concentrated areas command particular premiums, as young entrepreneurs and corporate leaders specifically seek this lifestyle integration.

Long-term strategic value (5+ years): Properties retain 8-15% value premiums versus comparable properties, while systematically avoiding depreciation that affects neglected luxury assets. More importantly, they’re positioned for the next market cycle. As smart technology transitions from luxury amenity to baseline requirement—as smartphone cameras did a decade ago—properties without these systems will increasingly face discounts, not premiums.

The Psychological Dimension: Privacy as Status

Beyond numbers, something deeper is happening. Privacy has become the ultimate luxury.

For billionaires navigating scrutiny from media, competitors, and increasingly sophisticated cybercriminals, a home that offers complete privacy and control is invaluable. Smart glass that adjusts tint automatically. Biometric access preventing unauthorized entry. AI systems detecting anomalies instantly. These features aren’t just protective—they’re psychologically reassuring.

One family office managing $150 million in assets described it this way: “With three properties across three continents, our family needs unified security protocols where we can maintain standards everywhere. Smart systems let us do that—whether someone is in our London townhouse or our Dubai villa, they experience identical security and automation. That consistency is priceless.”

This integration speaks to a broader shift in UHNI thinking. Generational wealth isn’t about ostentatious display anymore—it’s about invisible, seamless sophistication. Properties like DLF Camellias in Gurgaon, where apartments range from $6-24 million, exemplify this. They feature seven-star concierge services, AI-powered smart controls, and biometric systems—but you’d barely notice. The technology disappears into the lifestyle. That’s the actual luxury.

Four Seasons recognized this trend when they launched integrated residential digital experiences globally, allowing homeowners to manage properties, coordinate services, and access priority reservations through seamless platforms. It transformed real estate from static asset to dynamic lifestyle hub. Properties with this integration consistently command 20-30% premiums.

Status, ultimately, has shifted from “I have more security” to “I have invisible security.” And that appeals to the wealthiest tier.

The Practical Strategy: Where to Invest

If you’re a UHNI or serious HNI investor, here’s what actually works:

Allocate strategically. Rather than retrofitting existing properties, target new ultra-luxury developments where security infrastructure is designed into architecture from day one. Dubai’s branded residences, Mumbai’s super-luxury projects, and Singapore’s tech-forward developments offer this. Systems designed during construction cost 30-40% less than retrofits while performing dramatically better.

Prioritize Matter protocol compatibility. This emerging industry standard ensures your systems remain valuable and upgradeable as technology evolves. Proprietary systems typically depreciate 30-50% faster than standards-based infrastructure. Matter will become the baseline by 2026—don’t get locked into proprietary approaches.

Coordinate with insurance underwriters before purchasing. Insurance carriers now offer 10-20% premium reductions for verified smart security systems, but they have specific requirements. Pre-approval prevents costly surprises and maximizes financial returns. Some underwriters now mandate smart systems for ultra-high-value policies.

Target emerging markets showing 15-17% annual adoption growth. Asia Pacific’s 17% CAGR through 2030 compared to North America’s 14% suggests where future premiums will emerge. Early movers in India, Southeast Asia, and Middle Eastern markets capture disproportionate appreciation as these regions mature.

Maintain geographic diversity. A portfolio incorporating UAE exposure (35% premiums, high transaction volume), Singapore positioning (15% premiums, stability), Mumbai emergence (12% premiums, 2-3x growth potential), and Western anchors (London/New York for stability and liquidity) balances current returns against future opportunities.

The Risks Worth Acknowledging

Smart technology isn’t without complications. Privacy concerns among homeowners increased from 23% to 27% in recent years—reflecting growing awareness of data vulnerabilities. IoT devices create potential attack surfaces. GDPR compliance for European properties creates regulatory complexity. Manufacturers’ track records on privacy vary wildly.

The honest assessment: basic security excellently executed outperforms complex systems poorly maintained. A property with simple, robust monitoring, professional-grade cameras, reliable access control, and consistent expert oversight will deliver superior outcomes than cutting-edge AI systems lacking proper maintenance, cybersecurity protocols, and operational oversight.

Additionally, luxury markets showing 99.8% appreciation (Dubai villas) and 44% year-over-year growth (Mumbai under-construction) demonstrate late-cycle characteristics. Technology premiums may not insulate from broader corrections if economic conditions tighten. The wealthiest investors historically profit not by chasing momentum in frothy markets but by maintaining patience and optionality.

The Forward View

Smart home security for ultra-wealthy investors represents a genuine transformation, not hype. The market dynamics are real: $77 billion globally by 2030, 15% annual growth, consistent property premiums of 8-35%, measurable insurance savings, and accelerating adoption across every major luxury market.

But the actual opportunity lies deeper than technology. It lies in understanding where adoption curves are climbing fastest (Asia Pacific, India), where early movers capture maximum appreciation (emerging luxury markets), and where properties lacking these systems will increasingly face discounts rather than commanding premiums (within 3-5 years).

For discerning investors, smart security infrastructure has shifted from optional amenity to strategic wealth preservation tool. The properties that will command premium valuations through the next market cycle will combine three elements: intrinsic location excellence, timeless architectural quality, and seamlessly integrated security ecosystems designed for decades of reliable protection.

The ultra-wealthy aren’t investing in technology for its own sake. They’re investing in peace of mind, competitive market positioning, and systematic value creation across their global property portfolios. That’s why it matters. That’s why it’s here to stay.test assumptions; avoid emotional attachment to trophy assets.

FAQ Section

Is smart home security investment suitable for 3-5 year holding periods or longer?

Smart security works best for 5+ year holds due to technology refresh cycles and market maturation dynamics. In 3-5 year periods, you capture insurance savings and rental premiums but may miss the full appreciation curve as markets transition smart features from luxury amenity to baseline expectation. Properties held 8-10 years—the typical UHNI intergenerational holding period—benefit from continuous technological upgrades (matter protocol-compatible systems), compounded loss prevention value, and full market transition premiums. For shorter holds, focus on high-growth markets (Dubai, emerging India) where appreciation curves steepen faster. For longer holds, prioritize properties where smart infrastructure provides generational wealth preservation and seamless family handoff capabilities.

Is NRI investment in India’s smart luxury homes a reliable leading indicator?

Yes, increasingly so. NRIs drive 20-25% of India’s luxury investment volume, particularly in Mumbai. They’re globally sophisticated, tech-aware, and specifically seeking properties combining modern security with luxury. NRI demand for smart-enabled properties has grown significantly, suggesting broader global UHNI adoption patterns may precede local adoption. When NRIs—who own properties across multiple countries—specifically prioritize smart systems, it signals these features are becoming globally standardized among the ultra-wealthy. This creates self-reinforcing cycle: as more international UHNWIs demand smart features, local developers integrate them as standard, accelerating adoption curves. For investors tracking market trends, rising NRI participation in smart-tech luxury segments often precedes broader market transition by 12-18 months.

What’s Matter protocol and why should UHNI investors mandate it?

Matter is an emerging industry standard for smart home devices supported by Apple, Google, Amazon, Samsung, and 100+ manufacturers. It ensures cross-platform compatibility—devices work seamlessly together regardless of brand. For UHNI investors, this matters profoundly: proprietary systems (where devices only work within one manufacturer’s ecosystem) depreciate 30-50% faster than standards-based systems. Matter-enabled homes retain 30-40% higher technology value over 5 years. More importantly, Matter prevents technology lock-in—you’re not wedded to one company’s ecosystem as their market position changes. By 2026, Matter will become industry baseline, so properties lacking Matter compatibility will face obsolescence penalties. For new purchases, mandate Matter protocol compliance across all security components. For existing properties, prioritize upgrades toward Matter-compatible systems over next 2-3 years.

What’s the difference between professional monitoring and AI automation—and how much should UHNI households spend on each?

Professional monitoring ($200K annually for UHNI households) means 24/7 human experts with first-responder coordination. It’s not just watching screens—modern monitoring includes behavioral analysis, anomaly detection, and immediate escalation protocols. AI automation ($150K annually) means systems learning normal patterns and flagging deviations automatically. They complement rather than replace each other. Professional monitoring provides human judgment and rapid response; AI provides tireless detection and pattern recognition humans miss. Best-practice UHNI households use both: AI handles 24/7 detection while professional monitors provide expert assessment and coordination. Combined, they create layered intelligence no single approach delivers. Allocating roughly 55% of security spend to professional monitoring and 25% to AI provides balanced institutional-grade protection that mirrors $100M+ family office standards.

Are smart home systems vulnerable to hacking? Should UHNI investors be concerned about cybersecurity?

Yes, vulnerabilities exist and UHNI investors should take them seriously. IoT devices create potential attack surfaces; GDPR compliance adds complexity for European properties; manufacturer privacy practices vary significantly. However, risk is manageable through professional practices. Implement multi-layer encryption, use GDPR-certified vendors with verified compliance track records, conduct annual security audits, segment IoT networks from critical systems, and maintain isolated local storage as backup to cloud systems. The key insight: basic security excellently executed outperforms complex systems poorly maintained. A property with simple, robust monitoring, professional-grade cameras, reliable access control, and consistent expert oversight delivers superior security than cutting-edge AI lacking proper maintenance and cybersecurity protocols. For UHNI households, prioritize vendor reputation, security certifications, and professional oversight over bleeding-edge technology.

Should UHNI investors retrofit existing properties with smart security or only target new developments?

Prioritize new developments. Properties designed with security infrastructure during construction cost 30-40% less than retrofits while performing dramatically better. Integration is seamless; wiring is concealed; systems are optimized for architecture. Retrofit projects often face aesthetic compromises, hidden costs, and integration challenges. If you already own ultra-luxury properties, retrofit selectively: focus on master suites, entry systems, and professional monitoring first (these deliver 70% of value at 40% of retrofit cost). For new acquisitions, specifically target developments where smart security is designed-in: DLF Camellias, Four Seasons Residences globally, branded Dubai developments. These properties command premiums precisely because security infrastructure is invisible yet comprehensive. They’ve also pre-coordinated with insurance carriers, simplifying compliance and maximizing financial returns.

How should I coordinate smart security purchases with insurance carriers?

Coordinate before purchasing. Insurance carriers now mandate specific security configurations for ultra-high-value policies ($10M+) and offer 10-20% premium reductions for verified smart systems. Pre-approval prevents costly surprises—what you install might not qualify for carrier benefits. Request underwriter specifications early: they’ll specify camera types, monitoring requirements, access control standards, and backup systems. Many carriers now mandate smart monitoring for policies exceeding $25M valuation. Alignment before purchase ensures maximum financial returns (insurance savings often offset 30-50% of annual monitoring costs) and prevents claims disputes. Insurance coordination also drives system selection—you’re not choosing technology in vacuum but selecting vendor-specific systems your carrier has already approved and rates favorably.

YouTube Learning Resources

Free resources to download

Smart Home Security for UHNI Investors: Executive Summary