Now Reading: India’s Smart Home Market: The $47 Billion Investment Frontier for UHNIs

- 01

India’s Smart Home Market: The $47 Billion Investment Frontier for UHNIs

India’s Smart Home Market: The $47 Billion Investment Frontier for UHNIs

India’s smart home market stands at an unprecedented inflection point, presenting a compelling $47 billion opportunity for Ultra-High-Net-Worth Individuals (UHNIs) and High-Net-Worth Individuals (HNIs) by 2033. Valued at $6.70 billion in 2024, the market is surging at a 24.3% compound annual growth rate (CAGR)—dramatically outpacing the United States (15%), Europe (16%), and matching the aggressive expansion trajectory of the UAE (27.9%).

This is not merely a technology story. It is a generational wealth creation opportunity where India’s burgeoning affluent class—13,263 UHNIs in 2024 projected to reach 19,908 by 2028 (+50%)—is channeling 22-25% of their portfolios into prime residential real estate. Smart home integration has evolved from a luxury amenity to a value multiplier, commanding 15-20% price premiums over conventional properties while delivering 30-40% energy cost reductions and positioning assets as future-proof generational holdings.

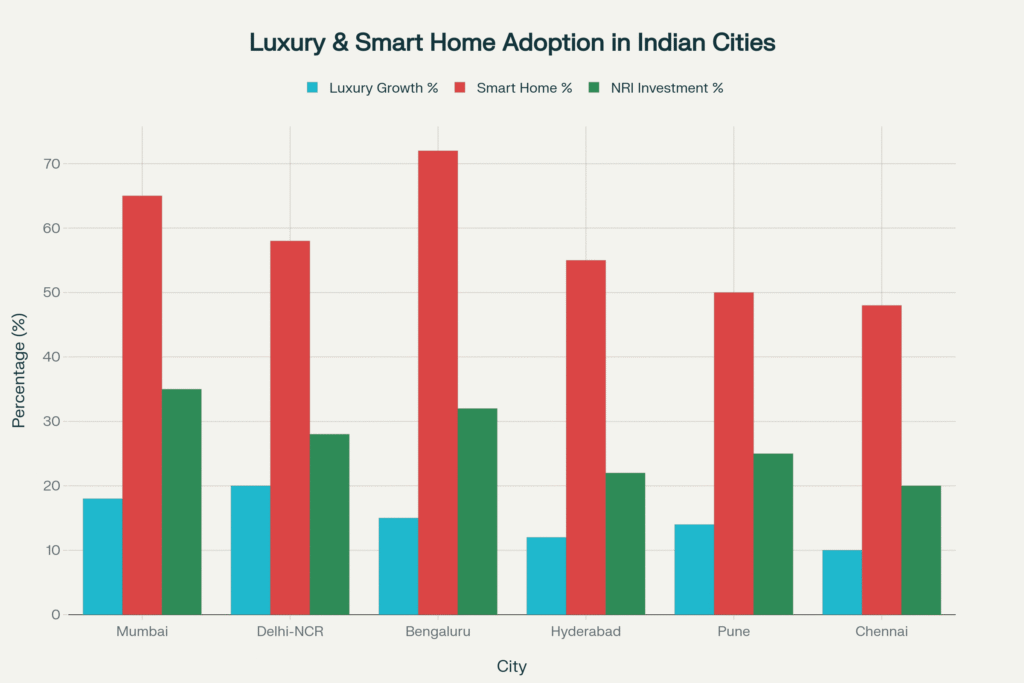

For the globally sophisticated investor, India offers a rare trifecta: explosive market growth, favorable rupee-dollar dynamics for NRIs, and infrastructure-driven appreciation in gateway metros and emerging tech hubs. With luxury home sales surging 37.8% year-on-year in 2024, 52 ultra-luxury transactions (₹40 crore+) closed in Mumbai alone, and Bengaluru achieving 72% smart home penetration in premium properties, the investment thesis is unequivocal.

Market Dynamics: India vs Global Smart Home Growth

India’s Competitive Advantage: The 24.3% CAGR Story

India’s smart home market isn’t simply growing—it’s compounding at nearly double the pace of Western incumbents. While the United States commands the largest absolute market size at $43 billion (2024), its 15% CAGR pales against India’s acceleration. The Asia Pacific region collectively posts the highest growth at 32.2% CAGR, with India anchoring this expansion alongside Southeast Asian markets.

What drives India’s structural advantage?

Government-Led Infrastructure: The Smart Cities Mission, encompassing 100 cities with ₹2.4 trillion investment, mandates IoT and automation standards, creating regulatory tailwinds for residential smart adoption. The Digital India initiative has propelled internet penetration to 79.8% household smart device ownership in 2025, projected to hit 87.7% by 2029.

Demographic Dividend: India’s 100 million affluent consumers by 2027 (Goldman Sachs) represent a customer base larger than most Western markets’ total HNI populations. This cohort, enriched by India’s 6-7% GDP growth, views smart homes as lifestyle statements and capital preservation vehicles.

Urbanization Velocity: With 600 million urban residents expected by 2031, demand for premium, technology-enabled housing in metro corridors is structurally assured. Unlike mature markets facing saturation, India is in the early adoption S-curve, where penetration rates still offer runway.

Comparative Insight: The UAE, with its 27.9% CAGR, presents the closest competitive parallel. However, Dubai’s luxury market trades at 40-60% premiums over comparable Indian properties, making India the superior cost-adjusted ROI destination for capital appreciation seekers.

Global Investment Arbitrage: Where the Money Flows

When juxtaposed against London, Singapore, or Manhattan, India’s luxury smart home segment offers asymmetric risk-reward profiles. London and Paris command heritage premiums but deliver single-digit appreciation in saturated markets. Singapore’s limited land supply creates scarcity value but at $15 million+ ultra-luxury entry points that dwarf India’s ₹8-20 crore sweet spot.

NRI Investment Logic: For Non-Resident Indians, rupee depreciation against the dollar (historical 3-5% annually) combined with domestic property appreciation of 12-15% creates a compounding advantage. Knight Frank reports $14.9 billion NRI capital flow into Indian real estate by 2025, with 35% channeled into Mumbai luxury.

The arbitrage is stark: $500,000 (₹4.1 crore) in Bengaluru buys a smart-enabled 3,000 sq ft luxury apartment with IoT security, energy management, and AI-driven automation. In London, the same budget secures a non-smart 600 sq ft studio in Zone 2. For UHNIs building global portfolios, India represents the growth engine, while Western holdings serve as stabilizers.

UHNI/HNI Wealth Patterns and Real Estate Allocation

The Expanding Affluent Class: 13,263 to 19,908 UHNIs by 2028

India’s wealth creation machine is accelerating. Knight Frank’s Wealth Report 2025 documents 13,263 UHNIs (net worth >$30 million) in 2024, with 191 billionaires—26 new entrants in a single year. By 2028, UHNI ranks will swell to 19,908, a 50% expansion driven by equity market wealth, IPO exits, real estate holdings, and inherited generational transfers.

The broader HNI cohort (>$10 million net worth) numbered 85,698 in 2024 and is projected to reach 93,753 by 2028—a 6% annual growth rate. Below this tier, the ₹1 crore+ liquid asset segment will add 40 million households by 2027, forming the aspirational luxury buyer base.

What does this mean for smart home demand?

Each UHNI typically owns 2-3 residential properties: a primary luxury residence (₹15-50 crore), a secondary home in a tech hub or lifestyle destination (₹8-15 crore), and often a fractional ownership in resort or overseas locations. With 90%+ preferring domestic property ownership and 65% planning upgrades within a year, the luxury pipeline is robust.

Portfolio Allocation: The 22-25% Real Estate Rule

Wealthy Indians allocate 22-25% of investable assets to prime residential real estate—in line with global HNI best practices but with a critical difference: 80-90% is concentrated in India, unlike Western UHNIs who diversify 40-50% internationally.

Why the domestic bias?

Capital Appreciation Certainty: Gateway metros like Mumbai, Delhi-NCR, and Bengaluru have delivered 12-20% annual price growth in luxury segments over the past five years. Noida recorded 152% appreciation since 2019; Kolkata luxury surged 153% post-pandemic.

Rental Yield Optimization: Tech corridors (Bengaluru, Pune, Hyderabad) offer 4-6% gross rental yields, enhanced by 20-30% smart home premiums over conventional units. Corporate housing demand for expats and senior executives sustains occupancy.

Emotional Anchoring: Unlike equities or bonds, real estate provides tangible wealth, social prestige, and family legacy. For UHNIs, a ₹50 crore Mumbai penthouse is simultaneously a residence, a status marker, and a generational asset appreciating across decades.

Contrast with NRIs: Overseas Indians maintain 40-50% real estate allocation, split 70% India / 30% overseas (typically UAE, UK, US). The rupee-dollar arbitrage enables them to acquire premium Indian properties while retaining foreign lifestyle assets.

Luxury Real Estate Convergence: City-Level Intelligence

Mumbai: The Ultra-Luxury Command Center

Mumbai remains India’s luxury capital, accounting for 88% of ultra-luxury transactions (₹40 crore+) in 2024. 52 of 59 homes priced above ₹40 crore were sold in Mumbai, with 17 exceeding ₹100 crore—a market segment non-existent outside Mumbai and select Delhi-NCR micro-markets.

Key Micro-Markets:

- Malabar Hill/Worli/Altamount Road: ₹1,00,000-₹1,40,000 per sq ft for ultra-luxury

- Bandra/Juhu: ₹80,000-₹1,20,000 per sq ft, strong NRI demand (35% share)

- Powai/BKC (Business District): ₹60,000-₹90,000 per sq ft, corporate executives

Smart Home Penetration: 65% of luxury properties integrate automation, rising to 90%+ in ₹20 crore+ segment. AI-powered climate control, biometric security, and voice-enabled systems are baseline expectations. Mumbai’s ranked 8th globally in Knight Frank’s Prime Global Cities Index for luxury residential prices.

Investment Thesis: Limited land supply in South Mumbai and prime Western suburbs ensures scarcity value. With 18% YoY luxury sales growth and average prices rising 2% in eight months despite premium positioning, Mumbai offers capital preservation with modest appreciation (8-12% annually).

Delhi-NCR: The High-Growth Powerhouse

Delhi-NCR dominated 2024 luxury sales, posting 20% YoY growth—the highest among metros. Gurugram remains the epicenter, with Golf Course Road, New Gurugram, and Dwarka Expressway commanding ₹12,000-₹25,000 per sq ft for branded residences.

Luxury Segment Breakdown:

- ₹5-10 crore: 112% YoY growth (fastest nationally)

- ₹10-20 crore: Consistent 15-18% appreciation

- ₹20 crore+: 3 ultra-luxury transactions in 2024

Smart Home Adoption: 58% penetration in luxury tier, with government-backed smart infrastructure (metro extensions, expressways) accelerating demand. Gurugram’s proximity to corporate corridors drives HNI occupancy from finance, consulting, and tech sectors.

Infrastructure Catalysts: Noida International Airport (2025 operationalization) positions Greater Noida and Noida Extension for 5-7% annual price appreciation in affordable luxury (₹3-6 crore). Dwarka Expressway connectivity reduces Mumbai-NCR travel premium, attracting Mumbai-based NRIs seeking larger spaces.

Investment Thesis: Land availability exceeds Mumbai, enabling plotted developments and villas popular with UHNIs. Price-per-sq-ft advantage (40-50% below Mumbai) with comparable or superior growth rates makes NCR the value-growth play for portfolio diversification.

Bengaluru: The Tech-Driven Smart Home Leader

Bengaluru achieves 72% smart home adoption in luxury properties—India’s highest. The city’s tech-savvy population, 5.8 million IT professionals, and GCC expansion (India tech revenues: $283 billion by FY2025) fuel demand for IoT-integrated living.

Prime Localities:

- Whitefield/Sarjapur Road: ₹8,000-₹15,000 per sq ft, IT corridor adjacency

- Koramangala/Indiranagar: ₹12,000-₹20,000 per sq ft, central connectivity

- North Bangalore (Yelahanka/Devanahalli): ₹6,000-₹10,000 per sq ft, airport proximity

Smart Home Features: Bengaluru properties lead in AI-driven energy management (solar+storage), smart water recycling, and EV charging infrastructure. IGBC/GRIHA certifications are standard in ₹8 crore+ projects, appealing to ESG-conscious UHNIs.

NRI Demand: 29% of NRIs prefer Bengaluru for investment (highest nationally), drawn by 32% NRI investment share and strong rental yields (5-7% gross). The city’s cosmopolitan culture and moderate climate make it ideal for repatriation planning.

Investment Thesis: Consistent 15% YoY luxury sales growth with ₹5.8 crore average prices (40% below Mumbai) offers affordability-growth balance. With 2 ultra-luxury transactions (₹40 crore+) in 2024, Bengaluru is graduating into the ultra-HNI tier.

Hyderabad, Pune, Chennai: Emerging Contenders

Hyderabad posts 12% luxury sales growth and ₹4.5 crore average prices, positioned as the affordable luxury alternative. Hitech City and Financial District drive corporate demand, while 22% NRI share reflects diaspora engagement. 2 ultra-luxury transactions signal UHNI interest.

Pune achieves 14% growth with ₹5.2 crore average prices, benefiting from Mumbai spillover and automotive/IT sector prosperity. 25% NRI investment share (second-highest after Mumbai) underscores appeal for secondary homes and rental portfolios.

Chennai grows at 10% with ₹4.8 crore average prices, offering value entry for HNIs. 20% NRI share reflects Tamil diaspora ties, while smart home adoption (48%) trails but is rising rapidly with IT Services sector expansion.

Smart Home Technology Integration in Premium Properties

Feature Adoption by Price Segment: The ₹1 Crore to ₹20 Crore+ Continuum

Smart home integration correlates directly with property pricing, creating a technology premium curve that rewards early adopters and penalizes laggards.

₹1-2 Crore (Entry Luxury):

- 35% basic automation (lighting, fans, HVAC scheduling)

- 25% advanced security (CCTV, motion sensors, door locks)

- 20% IoT integration (smart appliances, voice assistants)

- 10% AI systems (predictive energy, basic learning)

- 30% energy management (solar readiness, consumption tracking)

₹2-5 Crore (Established Luxury):

- 55% basic automation (whole-home control via app/voice)

- 45% advanced security (biometric access, perimeter monitoring)

- 40% IoT integration (connected appliances, smart water management)

- 25% AI systems (adaptive climate, occupancy-based automation)

- 50% energy management (solar+storage, demand optimization)

₹5-10 Crore (Premium Luxury):

- 75% basic automation (scene-based control, geofencing)

- 70% advanced security (AI surveillance, facial recognition)

- 65% IoT integration (unified smart ecosystems, Matter protocol)

- 50% AI systems (predictive maintenance, wellness integration)

- 70% energy management (grid independence, EV charging)

₹10-20 Crore (Super Luxury):

- 90% basic automation (voice/gesture control, ambient computing)

- 88% advanced security (edge AI processing, cyber-physical security)

- 85% IoT integration (building-wide mesh networks, redundancy)

- 75% AI systems (circadian lighting, air quality optimization)

- 85% energy management (net-zero capable, battery backup)

₹20 Crore+ (Ultra-Luxury):

- 98% basic automation (fully integrated smart home OS)

- 95% advanced security (military-grade encryption, SOC monitoring)

- 92% IoT integration (5G-enabled, real-time analytics)

- 90% AI systems (behavioral prediction, wellness biohacking)

- 95% energy management (off-grid capable, hydrogen-ready)

The Technology Value Proposition: 15-20% Price Premiums

Smart-enabled properties command measurable premiums validated across markets. Knight Frank and CBRE data show:

Capital Appreciation Premium: Properties with 70%+ smart integration sell 15-20% above comparables in the same micro-market. A ₹10 crore conventional Bengaluru villa becomes ₹11.5-12 crore when retrofitted with comprehensive smart systems.

Sales Velocity Advantage: Smart homes sell 40-50% faster than conventional units. Average absorption: 3-6 months vs 8-12 months, reducing holding costs and capital lockup.

Rental Premium: Corporate and expatriate tenants pay 20-30% higher rents for smart-enabled properties, valuing convenience, security, and energy savings. A ₹80,000/month conventional apartment becomes ₹1,00,000-1,05,000/month with smart integration.

Operational Savings: 30-40% energy cost reduction through AI-driven HVAC optimization, demand-based lighting, and solar-storage systems. For a ₹15 crore home with ₹2 lakh monthly energy bills, savings compound to ₹7-9 lakh annually.

Insurance Benefits: Smart security systems qualify for 10-15% insurance premium reductions on homeowner policies. A ₹50 lakh annual premium drops to ₹42.5-45 lakh with comprehensive monitoring.

Best-in-Class Technology Stack for UHNIs

Ultra-luxury (₹20 crore+) properties should integrate:

Security & Access:

- AI-powered surveillance with facial recognition, perimeter intrusion detection, and edge processing (Hikvision AI, Axis Communications)

- Biometric access (fingerprint, iris, facial) at entry points and secure zones

- Video intercoms with remote unlock and visitor management

- Panic buttons integrated with 24/7 security operations center (SOC)

Climate & Energy:

- AI HVAC with occupancy sensors, predictive pre-cooling, and zonal control (Nest, Ecobee, Honeywell T-series)

- Solar+storage with grid independence capability (10-20 kW rooftop, 20-40 kWh battery backup)

- Smart lighting with circadian tuning, automated dimming, and scene presets (Philips Hue, Lutron)

- EV charging (7-22 kW Level 2 chargers) with solar integration

Appliances & Convenience:

- Smart kitchen (IoT refrigerators, ovens, dishwashers from Samsung, LG, Bosch)

- Automated blinds/curtains with sun-tracking and privacy scheduling (Somfy, Lutron)

- Voice assistants (Alexa, Google Home) with whole-home integration

- Smart water management (leak detection, consumption analytics)

Wellness & Lifestyle:

- Air quality monitoring with HEPA filtration and VOC detection

- Circadian lighting synced to resident schedules for sleep optimization

- Smart gym equipment with health tracking

- Integrated audio/video (Sonos, Bose) with multi-room distribution

Unified Control:

- Central smart home hub (Samsung SmartThings, Apple HomeKit, Control4) for unified management

- Mobile app with remote access, real-time alerts, and automation scheduling

- Voice/gesture control for hands-free operation

- Matter protocol compatibility for future-proofing and interoperability

Risk Assessment

Market Risks: The Bull Case Skepticism

While projections are compelling, sophisticated investors must stress-test assumptions:

1. Affordability Ceiling in ₹10 Crore+ Segment

Risk: If India’s GDP growth moderates to 5-5.5% (from current 6-7%), HNI wealth creation slows, potentially plateauing luxury demand. The ₹10-20 crore segment, which grew 15-18% in 2024, could face demand saturation if the UHNI pipeline doesn’t replenish as projected.

Mitigation: Focus on ₹5-10 crore “aspirational luxury” tier growing 112% YoY—this segment has larger addressable market (HNIs vs UHNIs) and resilience to economic cycles. Diversify into income-generating properties (tech hub rentals) to offset capital appreciation risk.

2. NRI Repatriation Uncertainty

Risk: Geopolitical shifts (US immigration policy, Middle East instability, UK economic challenges) could alter NRI investment appetite. If rupee appreciates against the dollar (defying historical trends), NRI purchasing power erodes, reducing the 35% Mumbai luxury demand and 28% NCR share.

Mitigation: Target domestic HNI demand in tech hubs (Bengaluru, Hyderabad) where NRI share is lower (22-32%). Structure investments to appeal to both NRI and domestic buyers (smart integration, rental yield focus).

3. Luxury Inventory Glut in Select Micro-Markets

Risk: Developers, attracted by 37.8% luxury sales growth, may oversupply certain micro-markets (e.g., Noida Extension, Gurugram Sectors 70-90), leading to absorption delays and price corrections.

Mitigation: Conduct supply-demand analysis before entry. Avoid markets with >24-month unsold inventory. Prefer branded residences and limited-edition projects (<50 units) with built-in scarcity.

Technology Obsolescence: The 5-Year Upgrade Cycle

Risk: Smart home systems installed today (2025) may be outdated by 2030 as AI, 5G, and edge computing evolve. Proprietary systems (e.g., brand-specific protocols) create lock-in and upgrade friction.

Mitigation: Insist on open-standard platforms (Matter, Zigbee, oneM2M) that ensure interoperability and future upgradability. Budget ₹5-10 lakh every 5 years for technology refresh. Negotiate technology upgrade clauses in purchase agreements with developers.

Regulatory Evolution: RERA, Tax Policy, IoT Standards

Risk: RERA implementation varies across states; Maharashtra and Karnataka enforce rigorously, but some states lag, creating trust issues. Property tax policy changes (e.g., progressive rates on luxury) could increase holding costs. IoT regulations around data privacy and cybersecurity are still evolving in India.

Mitigation: Focus on RERA-compliant states (Maharashtra, Karnataka, Tamil Nadu, Telangana). Engage legal counsel specializing in luxury real estate to navigate state-specific regulations. For smart home tech, prioritize on-premise data storage over cloud-only systems to mitigate privacy risks.

FAQ Section

What is the projected growth of India’s smart home market?

India’s smart home market is valued at $6.70 billion in 2024 and projected to reach $47.46 billion by 2033, representing a compound annual growth rate (CAGR) of 24.3%. This growth significantly outpaces mature markets like the US (15% CAGR) and Europe (16% CAGR), driven by rising UHNI wealth, government Smart Cities initiatives, and rapid technology adoption.

How much do HNIs invest in real estate in India?

High-Net-Worth Individuals (HNIs) in India typically allocate 22-25% of their wealth to prime residential real estate, with 80-90% concentrated in domestic properties. Ultra-HNIs allocate approximately 25% to real estate. This allocation includes luxury smart homes, which command a 15-20% premium over conventional properties due to technology integration.

Which Indian city has the highest smart home adoption?

Bengaluru leads India in smart home adoption with 72% penetration in the luxury real estate segment, driven by its tech-savvy population and proximity to IT corridors. Mumbai follows with 65% adoption, particularly in ultra-luxury properties (₹40 crore+), while Delhi-NCR shows 58% adoption with the highest YoY luxury sales growth at 20%.

Are smart homes a good investment for NRIs?

Yes, smart homes are highly attractive for NRIs due to rupee-dollar arbitrage (15-20% purchasing power advantage), future-ready technology for repatriation, and 20-30% rental premiums over conventional properties. $14.9 billion NRI capital is projected to flow into Indian real estate by 2025, with 35% targeting Mumbai luxury and 29% preferring Bengaluru.

What smart home features add the most value?

AI-powered security (biometric access, surveillance), energy management systems (solar+storage, smart HVAC), and IoT integration (voice control, automated lighting/climate) deliver the highest value. Properties with 70%+ smart integration command 15-20% premiums, sell 40-50% faster, and achieve 20-30% rental uplifts while reducing energy costs by 30-40%.

Forward-Looking Conclusion: The Strategic Imperative

India’s smart home market represents a once-in-a-generation convergence of demographic expansion (50% UHNI growth by 2028), technological adoption (79.8% household penetration in 2025), and infrastructure investment (Smart Cities Mission, Digital India). The $6.70 billion market in 2024, surging to $47.46 billion by 2033 at 24.3% CAGR, offers risk-adjusted returns that outpace Western markets while providing lifestyle elevation and generational wealth preservation.

For the discerning UHNI or HNI, the investment thesis is unambiguous:

Gateway metros (Mumbai, Delhi-NCR) provide capital preservation through scarcity value and ultra-luxury positioning (₹40 crore+ transactions recording 17% YoY value growth). Tech hubs (Bengaluru, Hyderabad) deliver income through 5-7% rental yields plus 12-15% appreciation fueled by corporate housing demand. Tier-2 cities (Chandigarh, Coimbatore) offer asymmetric growth with 18-25% appreciation as infrastructure catalysts unlock previously overlooked markets.

Smart home integration is no longer a luxury amenity—it is a value multiplier. Properties with 70%+ adoption command 15-20% premiums, sell 40-50% faster, and achieve 20-30% rental uplifts while reducing operational costs by 30-40%. As AI, IoT, and 5G mature, homes without intelligent infrastructure will trade at growing discounts, making early adoption a strategic imperative.

The window of maximum opportunity exists now. Market maturation will compress returns; the current early adoption phase (2024-2027) offers entry multiples unavailable in 5-10 years. For those positioned correctly, India’s smart home luxury segment promises not just financial returns, but a cornerstone of multi-generational wealth and aspirational lifestyle befitting the global elite.

The question is not whether to invest in India’s smart luxury residential market, but where, when, and at what scale. Armed with this intelligence, the path forward is clear.

YouTube Learning Resources

Free resources to download

India’s Smart Home Market: Executive Summary