Now Reading: Temple Towns, Heritage Cities, and Wellness Destinations: Shifts in UHNI Investment Strategy

- 01

Temple Towns, Heritage Cities, and Wellness Destinations: Shifts in UHNI Investment Strategy

Temple Towns, Heritage Cities, and Wellness Destinations: Shifts in UHNI Investment Strategy

While ₹10 crore+ homes in Mumbai and Delhi NCR command headlines—recording 85% year-on-year growth in H1 2025—a parallel movement is emerging in locations previously considered peripheral to institutional capital flows.

Temple towns revitalized by infrastructure spending, heritage cities leveraging cultural capital, and wellness destinations attracting global families are absorbing a growing share of high-net-worth allocations. This isn’t speculative tourism real estate. It represents a structural recalibration of how India’s fastest-growing UHNI population views residential assets within diversified wealth portfolios.

The shift reflects three converging forces: India’s post-pandemic affluence cycle reaching tier-two cultural centers, NRI capital seeking emotional anchors with investment discipline, and a maturing understanding that legacy assets need not conform to traditional metro hierarchies. For family offices and global allocators tracking India, these secondary signals warrant primary attention.

India’s Global Positioning

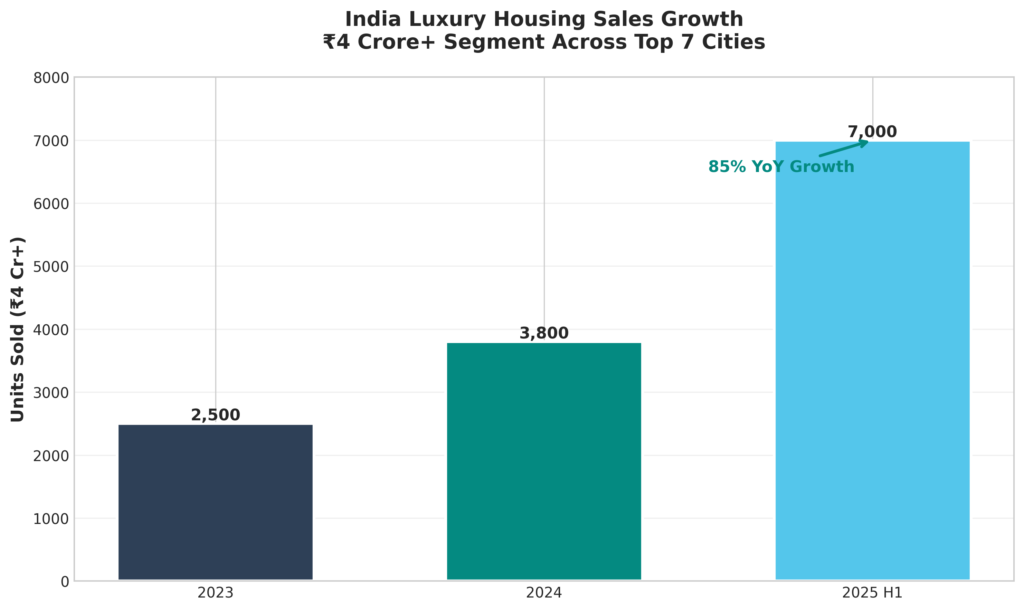

India’s luxury residential segment has transitioned from cyclical recovery to sustained structural expansion. The numbers tell a clear story: luxury housing sales (₹4 crore+) across India’s top seven cities reached 7,000 units in the first half of 2025, an 85% increase year-on-year, according to CBRE India and ASSOCHAM. Delhi NCR accounted for 57% of this volume, with Mumbai contributing 18%.

But the more revealing data sits beneath these headline figures. Knight Frank India reports that homes in the ₹10-20 crore bracket registered 170% year-on-year growth in Q3 2025. This isn’t broad-based premium housing—this is ultra-luxury concentration, signaling that India’s wealth creation at the upper tier is outpacing even optimistic projections.

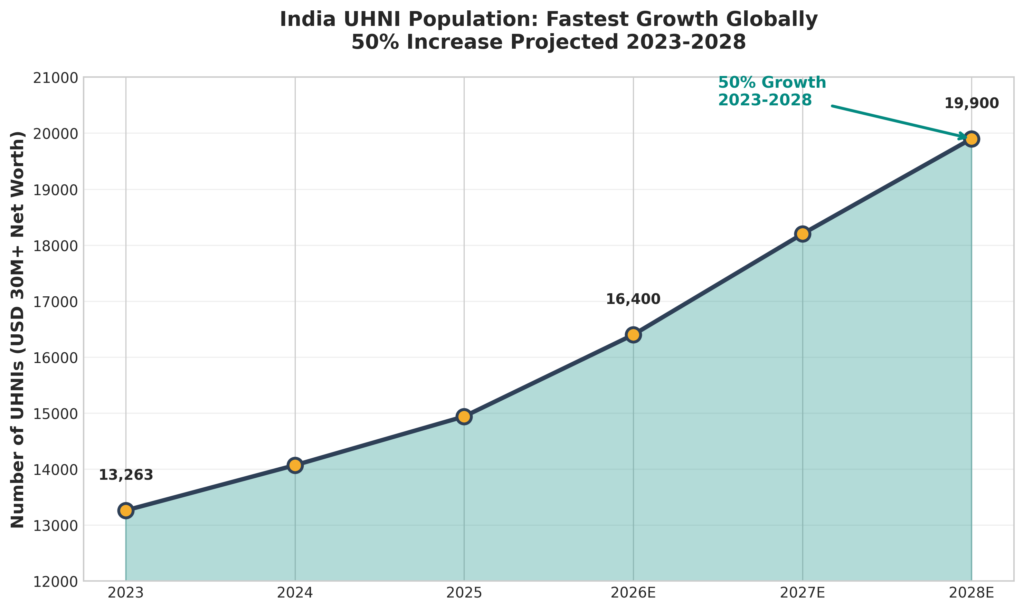

Context matters. India now hosts 13,263 ultra-high-net-worth individuals (USD 30 million+ net worth), a figure that Knight Frank projects will reach nearly 20,000 by 2028—the fastest growth rate globally. This isn’t temporary liquidity finding parking spots. It represents generational wealth seeking permanent allocation strategies.

Comparatively, India’s luxury segment operates in a distinct value band. While London’s prime central locations command ₹6-10 lakh per square foot and Singapore’s core districts range ₹4-7 lakh, Mumbai’s luxury markets sit at ₹45,000-75,000 per square foot. Dubai, with its tax advantages, offers ₹1.5-2.5 lakh per square foot—but India provides something Dubai cannot replicate: demographic momentum, cultural rootedness, and the institutional stability that comes from regulated, transparent markets under RERA frameworks.

Watch: India’s Real Estate Sector Boom 2025 Analysis – Money9’s institutional perspective on the sustained luxury upcycle now in its fifth year.

Data-Backed Intelligence

Table 1: India Luxury Housing Sales Growth

| Period | Units Sold (₹4 Cr+) | YoY Growth | Leading Cities |

|---|---|---|---|

| 2023 | 2,500 | – | Mumbai, Delhi NCR |

| 2024 | 3,800 | 52% | Mumbai, Delhi NCR, Hyderabad |

| 2025 H1 | 7,000 | 85% | Delhi NCR (57%), Mumbai (18%) |

Source: CBRE India, ASSOCHAM (2025)

Several metrics clarify the current trajectory:

Luxury Housing Growth: India’s luxury residential real estate market is valued at USD 64.21 billion in 2026, with Mordor Intelligence projecting growth at a 10.95% CAGR to reach USD 107.99 billion by 2031.

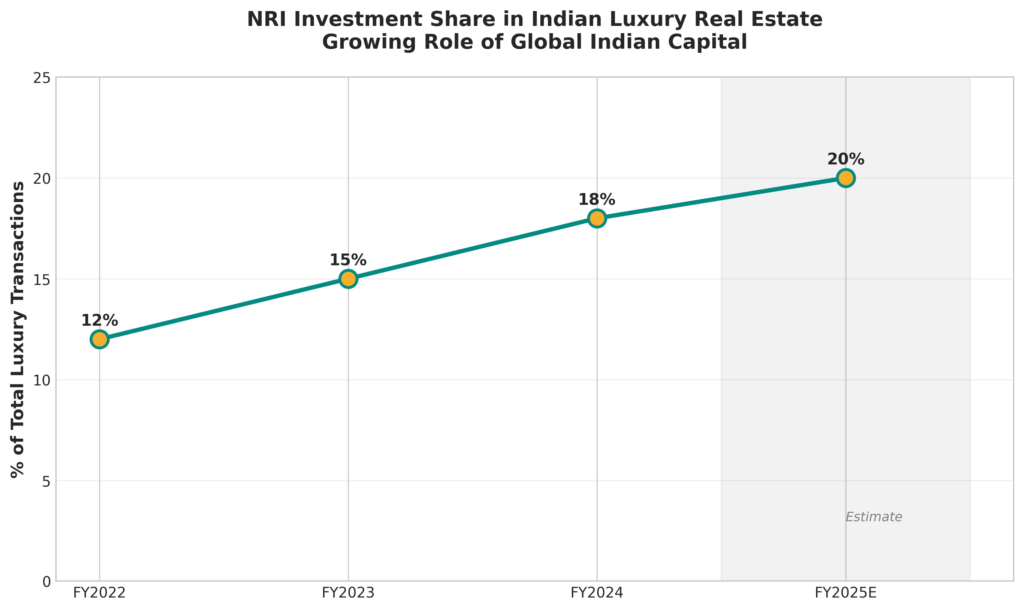

NRI Investment Share: Non-resident Indians now represent approximately 18-20% of India’s luxury property transactions, up from 12% in FY2022. Knight Frank estimates NRI real estate investment reached USD 14 billion by 2025, driven by record remittances of USD 135.46 billion in FY2025 (14% year-on-year increase, per Government of India data).

Table 2: NRI Investment in Indian Luxury Real Estate

| Financial Year | NRI Share of Luxury Transactions | Total NRI Investment (USD Billion) | Key Target Cities |

|---|---|---|---|

| FY2022 | 12% | 10.4 | Mumbai, Bengaluru |

| FY2023 | 15% | 12.8 | Mumbai, Bengaluru, Gurugram |

| FY2024 | 18% | 14.0 | Mumbai, Bengaluru, Pune, Hyderabad |

| FY2025 (Est.) | 20% | 14.9 | All Top 8 + Heritage Cities |

Source: Knight Frank India, ANAROCK (2024-2025)

Watch: 3 Ways NRIs Are Investing in Real Estate in 2025 – NRIShaala breaks down conservative, balanced, and aggressive NRI investment strategies.

Price Appreciation Patterns: Luxury housing prices in India’s top cities rose from ₹14,530 per square foot in 2022 to ₹20,300 per square foot by December 2025, per ANAROCK—a sustained appreciation cycle reflecting demand-driven fundamentals rather than speculative froth.

Table 3: India UHNI Population Growth (USD 30M+ Net Worth)

| Year | UHNI Count | YoY Growth | Global Rank by Growth |

|---|---|---|---|

| 2023 | 13,263 | 6.1% | #1 |

| 2024 | 14,070 | 6.1% | #1 |

| 2025 | 14,940 | 6.2% | #1 |

| 2026 (Est.) | 16,400 | 9.8% | #1 |

| 2027 (Est.) | 18,200 | 11.0% | #1 |

| 2028 (Est.) | 19,900 | 9.3% | #1 |

Source: Knight Frank Wealth Report 2024, McKinsey & Company (2025)

Capital Flows to Heritage and Temple Towns: While institutional data remains sparse, property consultancy reports from Colliers India identify 17 high-potential spiritual and heritage cities—including Ayodhya, Varanasi, Puri, Udaipur, and Jaipur—where real estate development is accelerating across hospitality, retail, and premium residential segments. Land prices in Ayodhya’s approved residential zones escalated from ₹20,000 per 100 square yards to over ₹1 crore within four years, driven by the Ram Temple corridor and infrastructure investments totaling ₹85,000 crore.

Rajasthan’s heritage cities present similar patterns. Jaipur recorded 8-12% annual luxury property appreciation in 2025-2026, positioning it alongside established metros. Udaipur and Jodhpur are witnessing growing demand for heritage-inspired villas and boutique estates, particularly from NRI families seeking second homes that double as legacy anchors and destination wedding venues.

Goa continues evolving beyond its beach-resort identity. Luxury residential projects in the ₹1-5 crore band are drawing remote-working professionals, retirees, and wellness-focused investors. The MOPA International Airport and improved connectivity have transformed Goa from leisure destination to viable long-term residential option for affluent families seeking lifestyle integration.

Table 4: Global Luxury Real Estate Market Comparison

| City/Market | Avg Luxury Price (₹/sq ft) | Rental Yield | Capital Appreciation (Annual) |

|---|---|---|---|

| Mumbai | ₹45,000-75,000 | 3-4% | 7-8% |

| Delhi NCR | ₹35,000-60,000 | 3.5-4.5% | 8-10% |

| Bengaluru | ₹20,000-35,000 | 4-5% | 8-9% |

| Dubai | ₹1.5-2.5 lakh | 6-8% | 10-12% |

| London | ₹6-10 lakh | 2.5% | 2-3% |

| Singapore | ₹4-7 lakh | 3% | 3-4% |

Source: Knight Frank, CBRE Global, JLL (Q4 2025)

Emotional, Lifestyle & Legacy Drivers

The allocation logic extends beyond yield calculations. For India’s UHNI and NRI communities, luxury residential assets increasingly function as:

Legacy Architecture: Properties in heritage cities and temple towns carry cultural permanence that metro apartments, however luxurious, struggle to replicate. These are not flipped on five-year cycles—they anchor multi-generational family narratives.

Lifestyle Hedges: Post-pandemic preferences for space, wellness infrastructure, and proximity to natural or spiritual environments have solidified into structural demand. Wellness destinations in Kerala, Uttarakhand, and Himachal Pradesh attract families prioritizing health-centric living over urban density.

Global Anchors: For NRIs navigating tax-friendly residencies in Dubai or Singapore, premium Indian properties provide emotional and financial tethering. They are not speculative bets—they are calculated holdings within diversified portfolios that span multiple currencies and jurisdictions.

Family offices managing ₹100 crore+ portfolios now allocate 15-20% to real estate, with growing interest in direct investments over institutionalized vehicles like REITs. This shift toward control, transparency, and alignment with family values makes heritage and wellness properties particularly attractive—they deliver both financial returns and experiential value that commercial assets cannot match.

Watch: Family Offices in India: Legacy to Institutional Real Estate Investment – GRI Institute interview with CIO of Dinesh Hinduja Family Offices on evolving investment strategies.

Case Studies

Ayodhya’s Infrastructure-Led Transformation

Ayodhya exemplifies how policy-driven infrastructure can reposition entire real estate markets. The Ram Temple consecration in January 2024 catalyzed ₹85,000 crore in infrastructure investments, including the Ayodhya International Airport, expanded roadways, and the Ayodhya Master Plan 2031 designating smart city status.

Residential property rates in Ayodhya’s core zones now average ₹5,000 per square foot, with commercial properties reaching ₹8,000 per square foot—comparable to established NCR micro-markets. Monthly rentals for 2BHK units range ₹18,000-20,000, but homestay conversions yield ₹45,000 monthly, reflecting tourism-driven demand projected to reach 10 crore annual visitors by 2030.

Investment interest from family offices and HNIs has grown substantially, with buyers viewing Ayodhya holdings as dual-purpose assets: rental income generators during pilgrimage seasons and legacy properties tied to cultural significance. According to Bloomberg coverage, NRI interest has been particularly pronounced, with diaspora families purchasing properties for eventual retirement relocation or family reunification anchors.

Udaipur and Jaipur’s Heritage Premium

Rajasthan’s luxury segment is maturing rapidly. Jaipur recorded transaction volumes in the ₹5-10 crore bracket that surprised market analysts, with Knight Frank noting sustained absorption in premium gated communities and heritage-style villas. Udaipur has leveraged its lakeside setting and destination wedding economy to attract boutique estate developments targeting global Indian families.

R-Tech Group and similar regional developers report NRI-focused investments rising significantly, with buyers from the UK, UAE, and US seeking properties that blend royal architectural character with modern amenities. These are not speculative purchases—average holding periods exceed 10 years, indicating long-term family use and legacy planning.

JLL India data suggests Rajasthan’s luxury market benefits from three converging factors: global appeal as a wedding destination, UNESCO heritage site proximity, and relatively lower entry price points (₹3-7 crore for premium villas) compared to Mumbai or Delhi NCR equivalents. For sophisticated allocators, Rajasthan offers cultural capital appreciation alongside financial returns—a rare combination in residential real estate.

Goa’s Evolution Beyond Leisure

Goa’s real estate narrative has shifted from vacation homes to primary residences. Luxury projects in the ₹1-5 crore range cater to remote-working professionals, early retirees, and wellness-focused families seeking permanent relocation.

ANAROCK estimates NRI investments in Goa properties reached $1.2 billion in FY2024-25, with buyers favoring properties near wellness retreats, Ayurvedic centers, and international schools. The MOPA International Airport has reduced travel friction, making Goa accessible for families maintaining professional ties to Mumbai, Bengaluru, or international locations.

Forbes India coverage highlights a demographic shift: Goa buyers now skew toward 40-55-year-old CXOs and founders seeking lifestyle upgrades without sacrificing connectivity. Rental yields of 4-5% exceed metro averages, while capital appreciation tracks 7-8% annually—modest but stable returns for investors prioritizing quality of life alongside financial performance.

Strategic Takeaways for Investors

- Allocation is shifting from speculation to legacy: India’s UHNI families increasingly view luxury residential assets—particularly in heritage cities and temple towns—as multi-generational anchors rather than cyclical trades. This reflects maturation from wealth creation to wealth preservation mindsets.

- NRI capital is disciplined, not sentimental: While emotional connection to India motivates NRI real estate purchases, investment decisions follow institutional discipline. Currency advantage (strong dollar/dirham), rental yield comparisons (India: 3-4% vs. London: 2.5%), and capital appreciation (India: 7-8% vs. Singapore: 3-4%) drive allocations, per Knight Frank and JLL data.

- Secondary cities offer primary opportunities: Markets like Ayodhya, Jaipur, Udaipur, and Goa provide entry price points (₹3-7 crore) that metro luxury (₹10 crore+) cannot match, with infrastructure momentum creating appreciation runways that established markets have exhausted. For family offices seeking value-driven exposure, these locations warrant serious due diligence.

- Wellness and spirituality are not lifestyle fads—they’re structural demand drivers: Post-pandemic preferences for health-centric living, space, and cultural rootedness have solidified into permanent allocation themes. Properties near temples, Ayurvedic retreats, and heritage sites attract buyers willing to pay premiums for environmental quality and spiritual proximity—features that metro density cannot replicate.

- Family offices are bypassing institutionalized vehicles: With 15-20% real estate allocations, Indian family offices increasingly favor direct property investments over REITs, seeking control, transparency, and alignment with family values. This shift benefits developers offering curated, heritage-integrated projects that deliver experiential value alongside financial returns.

Risks & Contrarian View

Any honest assessment of India’s luxury real estate expansion must acknowledge structural challenges:

Regulatory and Taxation Complexity: While RERA has improved transparency, navigating state-level regulations, stamp duties and capital gains taxation remains cumbersome. For NRIs, repatriation limits and currency conversion requirements add friction that Dubai or Singapore markets do not impose.

Liquidity Cycles in Ultra-Luxury: Properties above ₹10 crore face elongated sale cycles, particularly in tier-two cities. While Mumbai’s Worli or Delhi’s Golf Course Road maintain active secondary markets, heritage city properties may require 12-18 months to find suitable buyers—constraining liquidity for investors needing rapid exits.

Overconcentration Risk: The outsized performance of specific micro-markets (Ayodhya, select Goa zones) has attracted speculative interest, inflating land prices faster than underlying fundamentals support. Buyers entering late-stage appreciation cycles risk holding overvalued assets if infrastructure projects delay or tourism demand moderates.

Infrastructure Delivery Risk: Many tier-two city valuations assume timely completion of airports, expressways, and smart city projects. India’s infrastructure execution, while improving, remains uneven. Delays in critical connectivity projects could stall anticipated appreciation, leaving buyers in holding patterns longer than modeled.

Cultural vs. Commercial Viability: Heritage properties require maintenance investments that standard apartments do not. Restoration costs, regulatory restrictions on modifications, and limited scalability (each property is unique) mean these assets demand patient capital and long time horizons—they are not suitable for investors seeking standardized, liquid exposures.

The contrarian take: India’s luxury real estate boom may be concentrating capital in markets where supply will eventually catch demand. If the next three years see aggressive launches in heritage cities—developers chasing proven demand—oversupply could compress yields and moderate appreciation. Selectivity, not broad exposure, remains essential.

FAQs

What are the key differences between investing in luxury real estate in Mumbai versus emerging heritage cities like Jaipur or Udaipur?

Mumbai offers liquidity, established secondary markets, and price discovery transparency, with properties in the ₹10-20 crore bracket finding buyers within 6-12 months. Heritage cities provide lower entry points (₹3-7 crore), cultural capital appreciation, and lifestyle integration but face longer sale cycles (12-18 months) and less institutionalized infrastructure. Mumbai suits investors prioritizing liquidity; heritage cities favor legacy-focused, patient capital.

How are NRIs structuring their luxury property investments in India to optimize tax and repatriation?

NRIs typically fund purchases through NRE (Non-Resident External) accounts to ensure full repatriation rights upon sale, per RBI guidelines. They structure purchases in their own names rather than through entities to avoid higher capital gains taxes. Many use power of attorney for transaction execution while maintaining direct ownership. Tax optimization includes holding beyond 24 months to qualify for 12.5% long-term capital gains rates versus short-term rates (per Income Tax Act, 2025 amendments).

Are temple towns and heritage cities sustainable luxury real estate markets, or are they speculative bubbles?

Sustainability depends on infrastructure delivery and demand diversity. Ayodhya, backed by ₹85,000 crore government investment and projected 10 crore annual visitors by 2030, shows institutional commitment beyond speculation. Udaipur and Jaipur benefit from established tourism economies and wedding destination status, providing revenue stability. However, markets where valuations run ahead of infrastructure completion (some Vrindavan micro-markets seeing 500% price jumps) carry correction risk. Due diligence on project timelines and developer credibility remains critical.

Conclusion

India’s luxury residential market is no longer a single narrative centered on South Mumbai or Lutyens’ Delhi. It has fragmented into multiple opportunity sets, each serving distinct investor profiles and wealth preservation strategies.

For global allocators and family offices, the lesson is clear: India’s fastest-growing UHNI population is thinking beyond metro convenience. They are building wealth architectures that span financial returns, cultural capital, and multi-generational legacy—and they are doing so in locations that offer authenticity, space, and spiritual resonance that urban density cannot provide.

The investors positioning now in carefully selected heritage cities, temple towns, and wellness destinations are not chasing trends. They are anticipating a decade where India’s affluence reaches tier-two cultural centers with the same force it transformed Mumbai and Bengaluru over the past twenty years.

Patience and selectivity will separate enduring portfolios from speculative missteps. For those with both, India’s secondary luxury markets offer primary opportunities.