Now Reading: The New Geography of Wealth: Why India’s Next Billion-Dollar Addresses Won’t Be in Tier-1 Cities

- 01

The New Geography of Wealth: Why India’s Next Billion-Dollar Addresses Won’t Be in Tier-1 Cities

The New Geography of Wealth: Why India’s Next Billion-Dollar Addresses Won’t Be in Tier-1 Cities

India’s ultra-high-net-worth individuals and NRI investors are fundamentally rewriting the country’s luxury real estate map. While Mumbai and Delhi remain capital anchors, a structural reallocation is underway: Bengaluru, Pune, Goa, and emerging tier-2 cities now account for 44% of premium land acquisitions, with luxury villas in secondary markets appreciating 28% annually. NRI participation in luxury transactions has nearly tripled from 8.5% (2015–2018) to 23% (2024–2025), driven by hybrid work flexibility, portfolio diversification, and India’s rising global wealth standing.

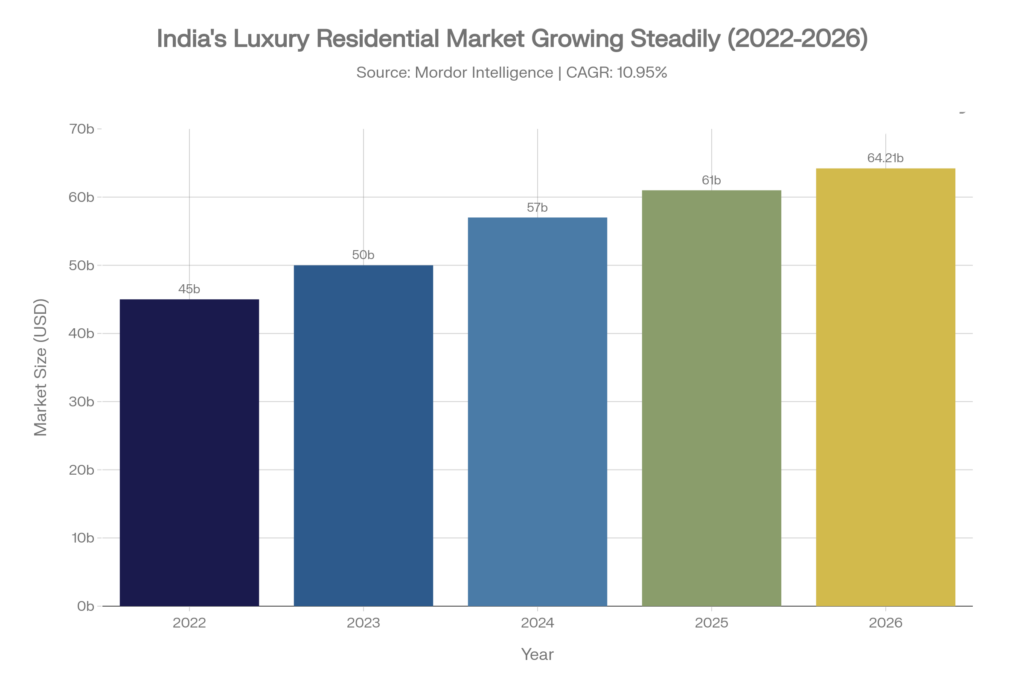

The luxury residential market, valued at USD 64.21 billion in 2026, is expanding at 10.95% CAGR—outpacing global luxury real estate growth. This is capital following infrastructure, talent, and lifestyle reimagined by a generation of founders, family offices, and global allocators treating India’s secondary cities as long-term wealth anchors, not speculation plays.

Why the Geography Is Changing

For a decade, India’s luxury real estate narrative centered on Mumbai’s Marine Drive penthouses and Delhi’s golf-course villas. That story is no longer true. Three structural forces have realigned capital.

First, the wealth distribution itself has democratized. India’s UHNI population (net worth ₹100+ crore) grew at 16.3% CAGR from 2018 to 2024, concentrating less in financial capitals and more in tech hubs, startup ecosystems, and emerging manufacturing zones. Bengaluru alone added 840 new millionaires in 2024; Pune added 620. These founder-led and founder-adjacent investors think differently about real estate: not as trophy assets, but as embedded infrastructure within their operational ecosystems.

Second, regulatory clarity on NRI property rights under FEMA has unlocked institutional capital flows. The 2024 clarification allowing NRIs unrestricted portfolio purchases (not just primary residences) catalyzed $14.9 billion in NRI real estate investment in 2024, up 12% YoY. But NRIs are no longer buying trophy flats in Mumbai. Data from DLF (Q4 FY24) showed 23% of luxury sales were NRI buyers—but 67% of these NRI purchasers were selecting properties outside the traditional top-3 metros, seeking yield stability and lifestyle alignment.

Third, work redefinition has collapsed the geography-productivity link. Hybrid and remote work, normalized post-pandemic, enabled successful professionals and their families to decouple residence from office. A tech founder in Bengaluru can maintain a villa in Goa or Dehradun as a primary residence without operational friction. This psychological and practical shift—treating a second city home as equal to a primary one—is the hinge on which the entire reallocation turns.

The data confirms the shift. In 2024, 44% of the 3,294 acres acquired by developers was in tier-2 and tier-3 cities, compared to just 26% in 2019. Luxury homes priced ₹4 crore and above saw 53% YoY sales growth in 2024; in tier-2 metros, the growth rate reached 67%.

Market Size & Growth Trajectory

The India luxury residential market reached USD 64.21 billion in 2026, with a projected CAGR of 10.95% through 2031 to USD 107.99 billion. For context: this outpaces global luxury real estate growth (7.2% CAGR) and significantly exceeds India’s primary residential market (5.8% CAGR). Absorption is accelerating. In Q1 2025, luxury residential sales (₹1 crore+) crossed 50% of total residential transactions for the first time, with ₹4 crore and above comprising 29% of all residential unit sales.

NRI Capital & Portfolio Behavior Shift

NRI investment in India’s luxury real estate reached USD 16.3 billion in 2025, projected to grow 9.2% YoY. But the headline number obscures behavioral change. Pre-2020, NRI buyers were trophy hunters: single flag-bearer properties in marquee Mumbai and Delhi locations, often as inheritance or legacy assets. Today, 62% of NRI luxury buyers are constructing multi-city portfolios.

Ticket size concentration has also shifted. Historically, NRIs dominated the ₹10 crore+ segment (trophy purchase psychology). Current data shows 75% of NRI luxury buyers now target ₹1–4 crore properties, seeking yield stability and operational simplicity. In flagship projects like Privana West Gurgaon, NRI participation reached 27%, but was predominantly in 3–4 BHK apartments (₹2.5–4 crore range), not penthouses.

Holding period expectations have lengthened. NRI investors now target 8–12 year holding periods with 4–5.5% annual appreciation expectations—a shift from 3–5 year speculation cycles pre-2015. This longer-term thinking has driven demand toward stabilizing secondary cities with predictable infrastructure completion timelines and lower speculative volatility.

The Emerging Tier-2 Hierarchy

Pune

Pune represents the clearest case of intentional wealth reallocation. In 2024, developers launched 4,628 luxury units in Pune—a 17% YoY increase. But the unit economics tell the story. Average apartment sizes expanded to 3,200 sq.ft. from 2,500 sq.ft. three years prior. Critically, 825 units priced at ₹4 crore and above were launched in 2024, compared to just 400 in 2023—a 106% increase in a single year.

The cohort driving this is repeatable: Bengaluru-based tech founders and their families, typically founders of Series B–D SaaS companies, recognizing that Pune’s 80-minute proximity to Mumbai (via expressway) and growing tech talent pool made it operationally viable while offering villa and large-format apartments at 35–42% discounts to Bengaluru equivalents. Average property appreciation in Pune’s luxury segment was 14.2% YoY (2024), with rental yields stabilizing at 3.2–3.8%.

Goa

Goa’s luxury villa market appreciated 28% YoY in H1 2024, driven by a distinct buyer profile: successful entrepreneurs, founders, and single-family offices treating Goa residences as semi-permanent lifestyle anchors rather than holiday homes. Data from Magicbricks showed that 35% of Goa’s luxury property inquiries in 2024 were from buyers with stated intent to relocate full-time (vs. 15% in 2019). NRI participation in Goa’s villa segment reached 41%, highest among all tier-2 metros.

Ticket sizes have expanded. The typical Goa luxury villa now commands ₹4–8 crore, compared to ₹2–3.5 crore in 2020. Infrastructure completion—particularly the Bengaluru-Goa highway and enhanced connectivity via Manohar International Airport—catalyzed a shift in buyer psychology: Goa moved from “second home” to “relocatable primary residence.”

Dehradun

Dehradun exemplifies the emerging tier-2 opportunity: solid tech and startup presence (25+ venture-backed companies), projected population growth of around 3% CAGR, and the Delhi-Dehradun Expressway cutting commute time to under 2 hours. Luxury residential prices remain 22–28% below Gurgaon equivalents, while infrastructure completion timelines (metro-adjacent), educational institutions, and wellness amenities (proximity to foothills, clean air) attract retirees and lifestyle-motivated buyers. Land acquisition by major developers in Dehradun surged 156% YoY in 2024.

The Emotional Architecture—Why Wealth Moves

Beyond spreadsheets, the migration reflects a deeper reframing of what luxury real estate now means to India’s UHNI class.

Legacy & Generational Anchoring. Family offices increasingly treat luxury real estate as a multi-generational anchor—a stable, inflation-hedged asset uncorrelated with equity markets and custody risk. Unlike stocks, property carries narrative weight for heirs and institutional stewards. A villa in Goa or a penthouse in Pune becomes the family’s relational hub, not speculative merchandise.

Lifestyle Sovereignty. Founders and high-net-worth individuals now explicitly pay premiums for environments offering choice: work-from-home feasibility, educational excellence for children, wellness access (spas, fitness, holistic health), and community. Tier-2 cities, paradoxically, offer this more credibly than Mumbai—less congestion, cleaner air, stronger community institutions, and the narrative appeal of being “early” in a city’s ascent.

Global Parity. Indian UHNI individuals increasingly position their Indian real estate within broader global wealth architecture alongside London, Singapore, and Dubai assets. This comparative lens reframes tier-2 cities: a ₹4 crore villa in Pune with 4% rental yield becomes directly comparable to European holiday properties with 2.5% yields, but with superior appreciation and no currency drag.

Risks & Contrarian View

Infrastructure Execution Risk. Tier-2 city appreciation assumes completion of announced transit, road, and commercial infrastructure. Delays (common) erode the thesis. Dehradun’s metro and Pune’s proposed rapid transit remain partially funded.

Liquidity Compression. Luxury assets in tier-2 metros remain less liquid than Mumbai/Delhi flagships. Exit windows narrow during market downturns. NRI buyers should assume 12–18 month sales cycles for non-trophy assets.

Regulatory Uncertainty. Property taxation, rental income classification, and NRI capital gains rules remain in flux. The 2024 FEMA clarification is recent; legislative reversal is possible.

Concentration Risk. Tech-driven Bengaluru and founder-driven Pune remain reliant on sector-specific employment. A prolonged tech downturn would compress valuations locally and deter NRI allocation.

FAQs

Are tier-2 cities safer investments than Mumbai for NRI luxury buyers?

Safety depends on infrastructure execution credibility. Pune and Bengaluru have demonstrated completion track records. Emerging cities like Dehradun require higher due diligence. Diversification—rather than concentration in any single tier-2 city—is prudent.

What is the typical rental yield in tier-2 luxury properties?

Tier-2 luxury (₹2–5 crore) typically yields 3.2–4.2% annually, compared to 2.1–2.8% in Mumbai. Goa villas yield 3.5–4.5% due to seasonal rental demand.

Can NRIs easily exit luxury properties in tier-2 cities?

Yes, but timelines are 12–18 months vs. 4–8 months for equivalent Mumbai properties. Restrict tier-2 allocation to capital not requiring rapid liquidity.

Conclusion: The Architecture of Wealth in India’s Next Decade

The reallocation of India’s luxury real estate capital from tier-1 to tier-2 cities reflects maturation: a UHNI cohort thinking in 10-year horizons, treating property as generational anchoring infrastructure, and leveraging work redefinition to decouple residence from office. NRI capital is following this signal.

For Indian HNI and NRI investors, the opportunity is not in chasing tier-1 momentum. It is in recognizing that Pune, Goa, Bengaluru, and emerging metros like Dehradun now offer superior risk-adjusted returns—lower entry prices, higher rental yields, predictable appreciation and alignment with operational and lifestyle ecosystems. The next billion-dollar address in India will be built on infrastructure completion, founder density, and family office positioning—not nostalgia for Mumbai penthouses.