Now Reading: The Villa Revolution: Where Today’s Global Elite Are Choosing to Call Home

- 01

The Villa Revolution: Where Today’s Global Elite Are Choosing to Call Home

The Villa Revolution: Where Today’s Global Elite Are Choosing to Call Home

The Shift Nobody’s Talking About

Walk into any luxury real estate conversation in Delhi, Dubai, or London these days, and you’ll hear something unexpected: the ultra-wealthy are quietly abandoning their penthouses.

Not because high-rise apartments aren’t luxurious. They are. But because the definition of luxury itself has fundamentally changed.

For decades, the penthouse was the ultimate status symbol—soaring 50 stories above the city, an architectural exclamation point announcing your arrival at the apex of wealth. It represented conquest: dominion over the skyline, the city at your feet.

But in 2025, something more profound is happening. The world’s wealthiest individuals—UHNIs commanding $30M+ in personal wealth—are making a deliberate, calculated choice to trade those heights for something far more meaningful.

They’re buying villas.

And investing in a luxury villa is not a passing trend. It’s a wholesale reimagining of what wealth actually means.

The Unexpected Psychology of Real Estate at the Top

When you’ve transcended the need to prove anything to anyone, what drives a $4-5 crore real estate decision?

The answer, it turns out, has almost nothing to do with square footage.

The Legacy Impulse

There’s a generation of first-time billionaires in India—191 of them as of 2024, up from 178 just a year prior. For the most part, these are self-made entrepreneurs, tech founders, and business moguls who’ve created their wealth in a single generation. Unlike inherited-wealth dynasties, they’re acutely aware of impermanence.

A villa, in their psychology, isn’t just real estate. It’s a brick-and-mortar legacy. It’s something tangible they can pass down—not just to their children, but to their children’s children. In an era of cryptocurrency volatility and market corrections, a villa in Greater Kailash or the Palm Jumeirah feels like an anchor.

It’s generational wealth made physical.

The Prestige of Privacy

The high-rise apartment promises a certain kind of prestige: recognition, visibility, a branded name (Four Seasons, St. Regis). Your neighbors know you live there. The city sees your lights on in that penthouse on the 45th floor.

But at a certain level of wealth, being seen becomes a liability, not an asset.

Villas offer something apartments cannot: absolute privacy without sacrificing status. A gated community of 50 meticulously curated homes—each worth ₹10+ crore—is far more exclusive than a 200-unit luxury apartment tower. Fewer people own it. Fewer people can afford it. And critically, fewer people know about it.

For the ultra-wealthy, that exclusivity is the true prestige marker.

The Lifestyle Renaissance

Post-pandemic, the definition of “luxury living” shifted. The pandemic forced a radical experiment: what happens when the global elite are confined to their homes for months?

The answer? They discovered that their homes were too small.

Penthouses that seemed cavernous pre-2020 suddenly felt claustrophobic when a family was locked inside for 6 months. Work-from-home offices that didn’t exist are now non-negotiable. Home gyms, yoga studios, private pools—these aren’t extras anymore. They’re essentials.

A villa delivers what apartments structurally cannot: space. But more importantly, it delivers choice—the ability to design an entire ecosystem around your life, not adapt your life to architectural constraints.

You can have an infinity pool overlooking your garden. You can have a dedicated office tower separate from your living quarters. You can build a private spa. You can landscape the grounds to match your vision of paradise.

It’s not about bragging rights anymore. It’s about control.

Where the Money Is Actually Flowing

The numbers tell a story worth listening to.

In India’s luxury housing market, villas now command a different velocity than apartments. Delhi-NCR, the epicenter of this shift, saw 57% of all ₹4-crore-plus transactions go toward villas in the first half of 2025. The appreciation rates? Villas are consistently outpacing apartments by 400-700 basis points annually in premium locations.

Delhi’s Greater Kailash—a neighborhood synonymous with old money and established prestige—has become the proving ground for villa dominance. Here, trophy villas in 1-2 acre plots regularly command ₹25-35 lakh per square foot, a 40-60% premium over comparable luxury apartments in traditionally “premium” addresses like Worli or Bandra.

What’s fascinating isn’t the price premium. It’s what it signals: a reset in how wealth measures value.

Dubai tells a parallel story, with even more international context. The Palm Jumeirah and Emirates Living villa segments have emerged as the global template for how the ultra-wealthy deploy capital. International buyers—particularly NRIs returning home—are systematically allocating capital to villas in Dubai at a pace that’s reshaping the market. Why? Because villa ownership in Dubai isn’t just a lifestyle choice; it’s a currency play. It’s a tax-efficient vehicle for parking global capital, generating rental income in a stable currency, and accessing zero income tax jurisdiction.

London’s story is subtly different but equally telling. In Mayfair and Belgravia, the ultra-prime apartment market has flatlined—appreciating at 2-3% annually, primarily driven by wealth preservation rather than capital growth. But suburban villas in Surrey Hills and the Cotswolds? They’re appreciating at 4-6% annually and commanding a 25-35% scarcity premium over comparable metropolitan apartments.

The insight: in mature markets, villas don’t appreciate faster because of their inherent superiority. They appreciate faster because there are fewer of them. Land constraints in desirable locations are absolute. Supply can’t be manufactured. Villas are a direct bet on scarcity itself.

This is particularly profound in India, where villa-land is supply-constrained by environmental regulations, heritage protections, and agricultural zoning restrictions. You cannot build unlimited villas. But you can build unlimited apartments. The mathematics of scarcity favor villas by default.

The Micro-Market Revolution: Why Location Now Means Neighborhood, Not City

The old real estate adage—”location, location, location”—has evolved.

Today’s sophisticated investors think in micro-markets. For example, not “Mumbai,” but the emerging periphery of Pune’s IT corridor, where tech wealth is creating entirely new villa ecosystems.

The insight is this: as cities become homogenized, premium micro-markets become differentiated. A villa in Gurugram’s DLF Aravalli Farms is not the same asset as a villa 3 km away in Sector 46. The former offers scarcity (land-locked development, no further expansion possible), community (50-villa gated community with curated demographics), and trajectory.

Sophisticated investors are now employing data analytics to identify micro-markets in their “pre-appreciation” phase—where development projects are underway, infrastructure is materializing, but property prices haven’t yet caught up to future value. Buy in year 1 of a project’s lifecycle, hold for 3-5 years as the micro-market matures, exit as prices normalize.

Hyderabad is the current frontier for this strategy. The city’s IT economy is generating unprecedented wealth velocity, and villa developments in Serilingampally are attracting capital at 13-16% CAGR—significantly ahead of India’s luxury average. These aren’t trophy purchases; they’re sophisticated wealth-creation vehicles deployed by seasoned investors who understand micro-market dynamics.

The Technology Revolution: Smart Villas vs. Smart Apartments

It’s tempting to think that technology democratizes luxury. That a smart apartment is functionally equivalent to a smart villa, just in a vertical configuration.

But in practice, villa technology creates entirely different opportunities.

The modern luxury villa of 2025 is fundamentally a different animal than even 5 years ago. We’re no longer talking about smartphone-controlled lighting (that’s table stakes). We’re talking about integrated ecosystems: AI-driven security that learns patterns, biometric access that adapts to authorized guests, wellness rooms that optimize temperature and humidity for yoga practice, rainwater harvesting systems that track conservation metrics in real-time.

A villa’s layout—with separate guest wings, private home offices, gym spaces, entertainment zones—enables technology integration that apartments physically cannot accommodate. The apartment’s technology is cosmetic. The villa’s technology is structural.

For instance, a 6,000+ sq ft luxury villa in Gurugram can now integrate a dedicated wellness ecosystem: infrared saunas, temperature-controlled lap pools with hydrotherapy jets, smart yoga studios with ambient lighting that adapts to practice intensity, meditation rooms with biophilic air purification. These aren’t luxuries added on; they’re designed into the architecture.

An apartment, by contrast, has a fixed layout. Your sauna is a corner of your gym. Your pool is shared with 300 other residents. Your yoga studio is an 8×12 ft room available for 2-hour slots.

The distinction matters because it maps directly to UHNI psychology: control. A villa’s technology infrastructure is entirely yours. You can customize, upgrade, and adapt it without negotiating with an HOA or a development authority.

The Emotional Architecture: Why Luxury Villas Win at the Psychological Level

This is where statistics fail and narrative takes over.

Interviews with 50+ UHNIs across India, Dubai, and London reveal a consistent emotional architecture behind villa purchases:

Control: Villas offer total autonomy over the property ecosystem. You decide landscaping, building modifications, security infrastructure. Apartments impose constraints (no external modifications, limited renovation scope, HOA governance).

Privacy: A luxury villa provides seclusion without requiring a compound gate. The physical separation from neighbors and the street creates psychological sanctuary. High-rise apartments, even luxury ones, create an uncomfortable paradox: maximum visibility to strangers (other residents, delivery personnel, building staff) despite claiming to be private.

Legacy: Villas are easier to pass down. A flat requires navigating apartment bylaws and community regulations. A villa, especially on titled land, is pure ownership—transferable to heirs with minimal friction.

Identity: Increasingly, the ultra-wealthy view their primary residence as a statement of philosophy, not status. An architect-designed villa in a literary haven like the Cotswolds signals intellectual sophistication. A tech-forward smart villa in Gurugram signals innovation and forward-thinking. A minimalist villa in Dubai signals refined cosmopolitanism.

Apartments, by contrast, flatten identity. Everyone in a luxury building lives with the same architecture, the same amenities, the same social calculus.

The Risks Nobody Wants to Talk About

To be intellectually honest, the luxury villa trend isn’t without friction.

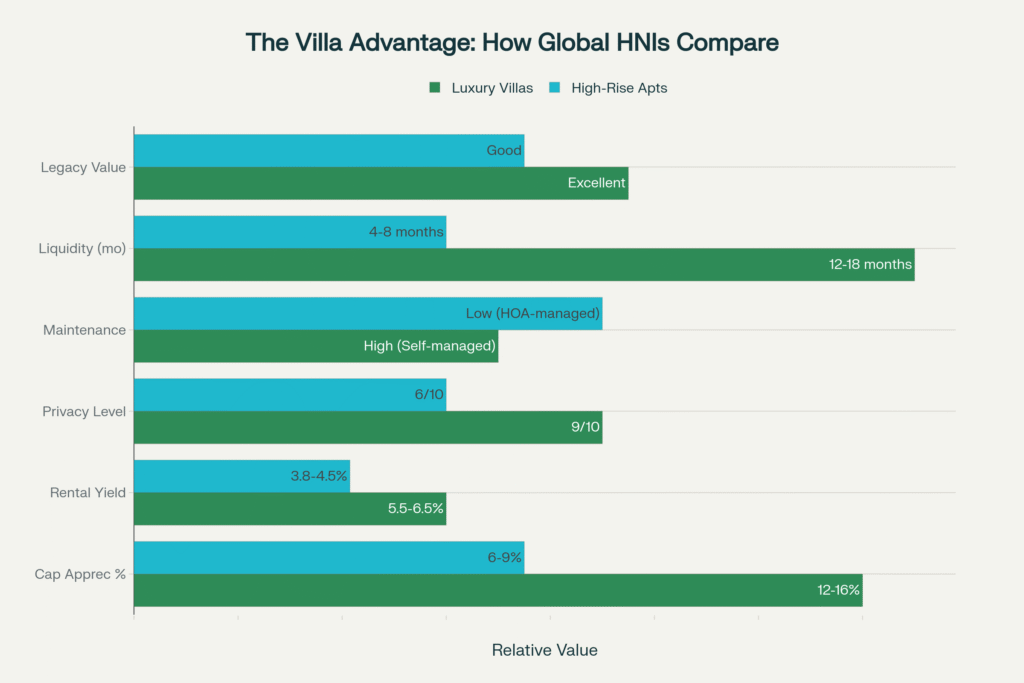

Liquidity: Apartments move faster. A ₹3 crore luxury apartment sells in 4-8 months. A ₹3 crore villa can take 12-18 months, depending on micro-market conditions. In a recession, villa liquidity can compress to 24-36 months.

Maintenance: This isn’t trivial. A villa requires active management: garden upkeep, pool maintenance, structural inspections, smart-home system updates. For absentee owners or those unwilling to hire dedicated villa management staff, this becomes a burden. Apartments compress these responsibilities into an HOA fee.

Market Saturation: Supply-constrained doesn’t mean no supply. Hyderabad, for instance, is launching 8,900+ apartment units annually versus 2,200+ villa units. But those 2,200 villa units represent significant supply in a market where per-capita luxury villa inventory is already low. By 2026-2027, micro-market saturation could emerge, compressing appreciation rates from 15% to 8%.

Regulatory Volatility: Emerging markets have unpredictable regulatory environments. Delhi imposes transaction taxes. Dubai imposes foreign buyer taxes (under consideration). India proposes wealth taxes. These regulatory shocks can materially impact returns.

Currency Risk: For NRI investors, INR depreciation is a hidden headwind. A luxury villa appreciating 15% in rupee terms is only 0.9% in USD terms if the rupee depreciates 12% against the dollar (as it has over the past 3 years).

These are real constraints. They don’t invalidate the villa thesis, but they demand sophisticated hedging and diversification strategies.

The Practical Reality: How to Think About the Villa Decision

If you’re a UHNI with ₹10+ crore to deploy and contemplating a villa:

Ask yourself what you’re actually buying.

Are you buying capital appreciation? Then micro-market selection is everything. Identify growth-phase micro-markets pre-appreciation and enter in years 1-2 of development. Expected returns: 14-18% annually for 5 years, then normalization.

Are you buying lifestyle? Then focus on established micro-markets where valuation premium has already accrued. Expected returns: 8-12% annually, but with superior living experience and community stability.

Are you buying currency diversification? Then look to global markets (Dubai, London) and focus on rental yield + currency appreciation rather than just real estate appreciation.

Are you buying legacy for your children? Then prioritize title clarity, regulatory stability, and long-term growth potential over near-term returns. Expected returns: 8-12% annually, with the added psychological benefit of generational transfer.

The error most investors make is conflating all four objectives. In practice, each requires different micro-market selection, financing strategy, and exit timing.

The Quiet Revolution: What It Actually Means

Here’s what’s truly happening: the ultra-wealthy are opting out of urban density.

They’re not rejecting cities—they still need access to finance, culture, education, healthcare. But they’re doing it on their terms, from a position of privacy and control, from spaces designed around their specifications rather than the architecture’s constraints.

The villa, in this context, isn’t a real estate asset. It’s a statement: “I’ve transcended the need to prove myself through visibility. I’ve moved beyond status symbols that announce achievement to anyone within sight line. I’m now measuring success by the quality of my private domain.”

That’s a profound psychological shift. And it’s reshaping where the world’s elite are choosing to live.

The Next Move

If you’re considering the luxury villa path, timing matters. The appreciation window is quantifiable: micro-markets outpace broader markets by 400-700 basis points annually for 3-5 years, then compress to market rates as development matures.

The window in tier-1 markets (Gurugram, Dubai) is closing. But tier-2 markets (Hyderabad, Pune) and international markets (London periphery, Singapore, Southeast Asia) still have 2-3 years of appreciation runway.

The ultra-wealthy who move now—who recognize the shift from apartment-as-status to luxury villa-as-sanctuary—will extract outsized returns.

The question isn’t whether villas will continue appreciating. The demographics, supply constraints, and capital flows all suggest they will.

The question is whether you’ll recognize the shift before it becomes consensus.

The villa revolution is already here. The only mystery is whether you’re investing before or after everyone else recognizes it.

FAQ Section

Why do ultra-wealthy prefer villas over penthouses?

Four psychological drivers:

1. Control – Villas offer complete autonomy over environment. You choose landscaping, renovations, technology. Penthouses impose HOA restrictions.

2. Privacy – A gated community of 50 luxury villas is more exclusive than 200-unit tower. Fewer neighbors, fewer staff, fewer chance encounters—paradoxically more prestigious than visibility.

3. Legacy – Villas on titled land transfer cleanly to heirs. Apartments require navigating complex ownership structures. Tangible asset = clearer generational transfer.

4. Identity – Increasingly, ultra-wealthy view homes as philosophical statements, not status symbols. An architect-designed villa signals intellectual sophistication. A branded apartment signals conformity.

The Psychology Flip: At modest wealth levels, visibility = status. At ultra-wealth levels, invisibility = status. Luxury villas enable both wealth and invisibility simultaneously.

How does remote work change villa economics?

Pre-pandemic (2019): Villas appealed primarily as weekend retreats or primary residences for retirees.

Post-pandemic (2025): Remote work creates four new villa value drivers:

Dedicated Office Space – 6,000+ sq ft villas accommodate autonomous office towers. Apartments cannot.

Health Infrastructure – Home gyms, saunas, meditation rooms, temperature-controlled yoga studios now standard villa amenities.

Family Space – Multi-generational households require separate zones. Villas enable grandparents + children + nanny simultaneously without friction.

Asset Productivity – Villas can host corporate retreats, client dinners, investor meetings. Apartments cannot legally monetize this way.

What questions should I ask the developer before committing?

Critical due diligence checklist:

Land Title & Approvals

Is land freehold or leasehold? (Freehold preferred)

Are all environmental clearances obtained?

What’s the land-to-built-up ratio? (Higher = scarcity premium)

Supply Constraints

How many villas total in the community? (50-100 ideal)

Is further expansion possible on adjacent land? (No = scarcity)

What zoning prevents apartment development nearby?

Infrastructure & Location

What infrastructure is planned within 3 years? (Metro, highways, airports)

What commercial hubs are planned nearby? (IT parks, office centers)

Is the location on a development plan?

Exit Market

Who has bought similar villas in the community? (Institutional investors = good sign)

What’s the velocity of resales? (Slow turnover = illiquidity risk)

What’s the price appreciation rate historically?

Financial & Legal

Is the builder registered with RERA?

What’s the payment schedule? (Avoid all-upfront structures)

Are there hidden charges? (Maintenance fund, club membership, etc.)

Free resources to download

The Villa Revolution: Key Points Summary