Now Reading: How HNIs Use Real Estate Trusts and REITs to Multiply Wealth Across Borders

- 01

How HNIs Use Real Estate Trusts and REITs to Multiply Wealth Across Borders

How HNIs Use Real Estate Trusts and REITs to Multiply Wealth Across Borders

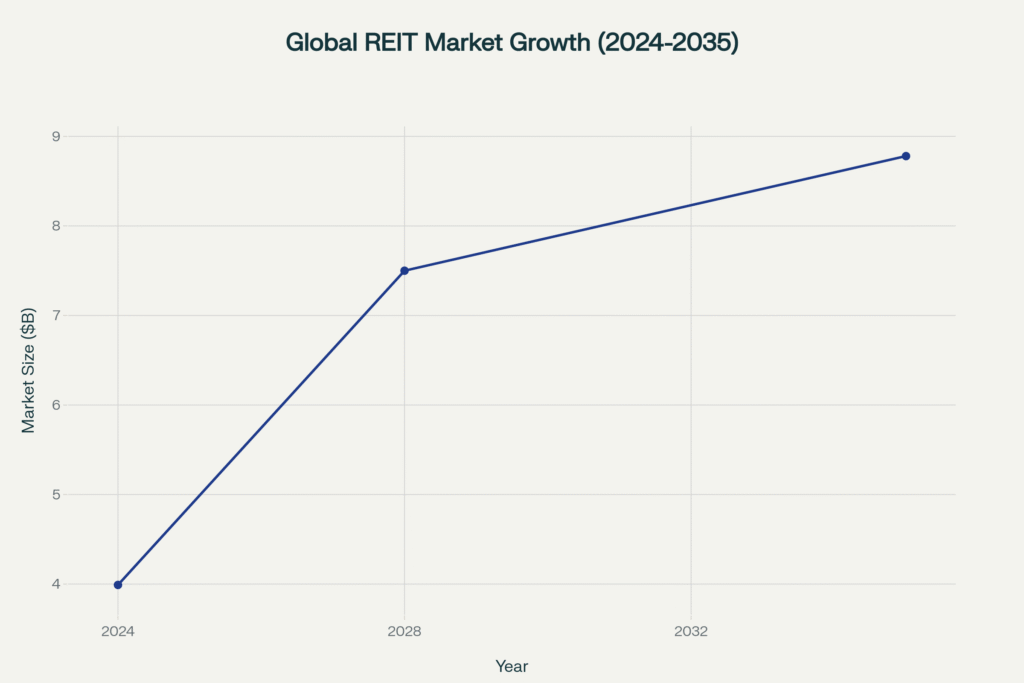

The convergence of global monetary policy shifts, demographic transformations, and technological innovation has created an unprecedented opportunity for High-Net-Worth Individuals (HNIs) and Ultra-High-Net-Worth Individuals (UHNIs) to multiply wealth through strategic Real Estate Investment Trust (REIT) deployment across international markets. With India’s UHNI population projected to surge 50% by 2028 and global REIT markets expanding at a 7.44% CAGR through 2035, sophisticated investors are increasingly leveraging cross-border real estate trusts as a cornerstone of wealth multiplication strategies.

This comprehensive analysis reveals how elite investors are capitalizing on regulatory arbitrage, currency diversification, and emerging market premiums to generate superior risk-adjusted returns while maintaining liquidity and geographical flexibility in an uncertain global economic landscape.

Global Market Dynamics and Contextual Shifts

The global REIT landscape is experiencing a transformative phase, with market capitalization projected to grow from $3.99 billion in 2024 to $8.78 billion by 2035. This expansion is primarily driven by cross-border investment flows, which increased 31% year-over-year to $37 billion in H2 2024, signaling a fundamental shift in how institutional and ultra-high-net-worth capital views real estate as a globally tradable asset class.

Regional Investment Dynamics

Asia-Pacific Emergence: The region recorded the most dramatic growth in cross-border real estate investment, with inflows surging 221% year-over-year to $6.3 billion in H2 2024. This meteoric rise reflects sophisticated investors’ recognition of structural undervaluation and superior growth prospects in emerging Asian markets, particularly Singapore’s position as the region’s premier REIT listing hub with 80% of listed REITs holding offshore assets.

European Stability: Europe maintained its position as the largest recipient of cross-regional investment with $21.63 billion in inflows, representing a 10% increase despite political uncertainties. The region’s appeal lies in its regulatory maturity, currency stability, and institutional transparency – factors that resonate strongly with wealth preservation strategies of global UHNIs.

North American Premium: While recording $9 billion in cross-border inflows (+40% YoY), North America continues to command premium valuations due to its deep capital markets, legal certainty, and reserve currency status. For elite investors, U.S. real estate trusts offer unparalleled liquidity and exit flexibility.

Data-Rich Insights

UHNI Population Explosion

India’s UHNI segment (individuals with net worth exceeding $30 million) is experiencing unprecedented growth, expanding from 13,263 individuals in 2023 to a projected 19,908 by 2028 – a remarkable 50% increase that outpaces global UHNI growth of 28.1%. This wealth creation tsunami is predominantly driven by technology entrepreneurship, financial services expansion, and manufacturing sector transformation.

Goldman Sachs projects India’s affluent consumer base will grow from 60 million in 2023 to 100 million by 2027, creating an enormous capital pool seeking sophisticated investment vehicles. Knight Frank’s data indicates that 29% of UHNI portfolios are allocated to real estate assets, with 45% preferring commercial properties over residential alternatives.

Cross-Border Investment Acceleration

The industrial and logistics sector attracted 47% of all cross-regional real estate investment in H2 2024, reflecting the global supply chain reconfiguration and e-commerce expansion. This trend is particularly pronounced in Asia-Pacific markets, where Singapore’s Ascendas REIT completed $438 million in strategic acquisitions to strengthen its logistics portfolio.

India’s institutional real estate investment reached a record $8.9 billion in 2024, representing a 51% increase from the previous year. Foreign institutional investors contributed 63% of total investments, while domestic capital accounted for 37% – a clear indication of India’s emergence as a premier destination for global real estate capital.

Portfolio Performance Metrics

Embassy Office Parks REIT, India’s pioneering listed REIT backed by Blackstone, has delivered annualized total returns of 11.3% since listing, significantly outperforming traditional real estate investment vehicles. The trust’s success stems from its high-quality tenant base (83% international occupiers), strategic geographic concentration (76% in Bengaluru), and professional management structure.

Emotional & Lifestyle Drivers

Generational Wealth Preservation

For ultra-high-net-worth families, cross-border REITs represent more than investment vehicles – they embody generational wealth preservation strategies that transcend political boundaries and currency volatility. The ability to hold income-generating assets across multiple jurisdictions provides both psychological comfort and practical diversification benefits that resonate deeply with families who have experienced political or economic upheaval.

Status and Exclusivity

Participation in premium REIT offerings signals sophisticated investment acumen and provides access to exclusive investment communities. Knowledge Realty Trust’s recent IPO, which was oversubscribed 12.5x, demonstrates the prestige associated with early access to institutional-quality real estate investments previously available only to pension funds and sovereign wealth entities.

Lifestyle Flexibility

Cross-border real estate trusts enable UHNIs to maintain global lifestyle flexibility while preserving investment ties to high-growth markets. This is particularly relevant for Non-Resident Indians (NRIs) who seek to benefit from India’s economic growth while maintaining international residence status.

Strategic Takeaways

Immediate Horizon (0-12 months)

- Regulatory Arbitrage: SEBI’s reduction of minimum InvIT investment from ₹1 crore to ₹25 lakh creates immediate access opportunities for emerging HNIs

- Currency Positioning: The strengthening dollar environment favors strategic entry into U.S. dollar-denominated REITs for non-U.S. investors

- Sector Rotation: Industrial and logistics REITs offer superior near-term prospects due to supply chain evolution and e-commerce growth

Mid-term Horizon (1-3 years)

- Market Expansion: Small & Medium REITs (SM REITs) are expected to scale 10x to $5 billion by 2030, providing access to niche real estate opportunities

- Geographic Diversification: Asia-Pacific markets offer superior growth potential with Singapore serving as the optimal listing jurisdiction for cross-border exposure

- Interest Rate Sensitivity: Declining interest rate environment expected globally will drive REIT re-rating and multiple expansion

Long-term Horizon (3-10 years)

- Structural Growth: India’s Grade-A office market, with REITs currently owning only 20% of available stock, presents massive expansion opportunities

- Institutional Adoption: Government’s National Monetization Pipeline is expected to triple InvIT AUM to ₹21 trillion by FY2030

- ESG Integration: Sustainable and green REITs will command premium valuations as ESG considerations become mandatory for institutional capital

Case Studies

Case Study 1: Embassy Office Parks REIT – India’s Pioneer Success

Embassy Office Parks REIT, jointly sponsored by Blackstone and Embassy Group, represents India’s most successful REIT launch to date. The trust owns 32.6 million square feet of commercial office space across major Indian cities, maintaining occupancy rates above 87% with a diversified tenant base of over 255 blue-chip companies.

Performance Highlights:

- Delivered annualized total returns of 11.3% since March 2019 listing

- Increased in-place rent from ₹63 to ₹87 per square foot (+38%)

- Expanded occupier base from 165 to 255 tenants (+55%)

- Distributed cumulative returns of approximately ₹99 billion to unitholders

The REIT’s success stems from Blackstone’s global expertise combined with Embassy Group’s local market knowledge, demonstrating how international partnerships can create superior value for investors. With 83% of rental income derived from international occupiers and 76% of assets concentrated in Bengaluru’s technology corridor, the trust provides direct exposure to India’s technology sector growth.

Case Study 2: CapitaLand Ascendas REIT – Singapore’s Cross-Border Champion

Singapore-listed CapitaLand Ascendas REIT exemplifies the city-state’s emergence as Asia’s premier cross-border REIT hub. The trust recently completed a $438 million acquisition of three industrial and logistics properties as part of a $1.3 billion domestic investment drive.

Strategic Positioning:

- Total Singapore portfolio value of $12.3 billion, representing 68% of total assets under management

- Properties fully leased to tenants in technology, logistics, and life sciences sectors

- Weighted average lease expiry of 5.5 years providing income stability

- Expected net property income yield of 6.1% after costs

The trust’s success reflects Singapore’s regulatory sophistication, with 80% of Singapore REITs holding offshore assets across Asia-Pacific, North America, and Europe. This geographic diversification enables investors to access regional growth while benefiting from Singapore’s political stability and currency strength.

Case Study 3: Blackstone’s Global REIT Strategy – Cross-Border Wealth Creation

Blackstone Group’s real estate investment approach in India demonstrates how global institutional capital can create wealth through strategic REIT development. The firm has invested over $12.6 billion in India across private equity and real estate deals, with real estate investments exceeding $6.6 billion.

Strategic Framework:

- Pioneered India’s first REIT through Embassy Office Parks partnership

- Planning second REIT with K Raheja Corp in Mumbai

- Knowledge Realty Trust IPO represents India’s largest REIT offering at ₹6,200 crore

- Focus on Grade-A commercial assets in technology and financial services hubs

Blackstone’s approach emphasizes professional management, institutional-quality assets, and strategic partnerships with local developers. This model has created substantial wealth for investors while establishing new benchmarks for transparency and governance in Indian real estate markets.

Pro Tips for Elite Investors

- UHNI Portfolio Diversification Strategy: Allocate 15-25% of real estate holdings to cross-border REITs to capture geographical arbitrage opportunities while maintaining liquidity

- Regulatory Structure Optimization: Utilize Singapore REIT platforms for Asian exposure and UK REITs for European access to benefit from favorable tax treaties and regulatory environments

- Currency Hedging Integration: Implement natural currency hedging through REITs denominated in target currencies for international lifestyle expenses and education costs

- Sector Concentration Approach: Focus on industrial logistics and data center REITs to capitalize on structural technology trends and supply chain evolution

- Exit Strategy Sophistication: Leverage REIT liquidity for rapid capital reallocation during market cycles while maintaining underlying real estate exposure through institutional partnerships

Potential Pitfalls

Regulatory Evolution Risk

The REIT regulatory landscape remains dynamic, with potential changes in tax treatment, leverage restrictions, and foreign investment policies creating uncertainty for long-term investors. India’s evolving REIT regulations, while generally supportive, could face political pressure if foreign capital dominance becomes a domestic concern.

Interest Rate Sensitivity

Rising interest rates globally pose significant risks to REIT valuations, particularly for highly leveraged trusts. The correlation between bond yields and REIT performance suggests potential volatility as central banks navigate inflation concerns while supporting economic growth.

Market Concentration Concerns

Many emerging REIT markets exhibit high concentration risks, with a small number of sponsors controlling significant market share. This concentration could lead to liquidity constraints during market stress and limit diversification benefits.

Currency and Political Risk

Cross-border REIT investments expose investors to currency volatility and potential political interference. Recent tensions in various regions highlight the importance of geographic diversification and careful jurisdiction selection.

Frequently Asked Questions

What minimum investment is required for HNI participation in Indian REITs?

Following SEBI’s recent regulatory changes, the minimum investment for privately placed InvITs has been reduced to ₹25 lakh, while publicly listed REITs can be purchased with significantly lower amounts in the secondary market.

How do cross-border REITs provide tax efficiency for global investors?

Cross-border REITs offer tax optimization through treaty benefits, foreign tax credits, and jurisdiction arbitrage. Singapore REITs, for example, provide favorable tax treatment for distributions to non-resident investors.

What are the key performance metrics for evaluating REIT investments?

Focus on Net Operating Income (NOI) growth, Distribution Per Unit (DPU) sustainability, portfolio occupancy rates, tenant quality, and geographic diversification. Average rental escalations and lease expiry profiles are equally critical.

How liquid are cross-border REIT investments compared to direct real estate?

Listed REITs provide significantly higher liquidity than direct real estate investments, with daily trading volumes averaging ₹80 crore in India. However, liquidity can vary significantly based on market conditions and REIT size.

Conclusion

The convergence of demographic trends, regulatory evolution, and technological transformation has created an unprecedented opportunity for sophisticated investors to multiply wealth through strategic cross-border REIT deployment. As global monetary policy normalizes and emerging markets mature, the next decade will likely witness the institutionalization of real estate as a truly global asset class.

Ultra-high-net-worth investors who position themselves strategically across multiple REIT markets – leveraging Singapore’s regulatory sophistication, India’s growth dynamics, and developed market stability – stand to benefit from both income generation and capital appreciation. The key lies in understanding that modern REIT investing transcends traditional real estate investment, offering instead a sophisticated tool for wealth multiplication, geographic diversification, and generational wealth preservation.

For elite investors seeking to navigate this evolving landscape, the opportunity exists not merely to participate in real estate markets, but to access the expertise, relationships, and deal flow that have historically been the exclusive domain of institutional investors. The democratization of this access, combined with the professional management and transparency that REITs provide, represents a fundamental shift in how wealth is created and preserved in the 21st century.

YouTube Resources

Free resources to download

Cross-Border REITs: The Elite Investor’s Guide to Global Wealth Multiplication