Now Reading: GST 2025 Real Estate: The Truth About Home Price Savings in India

- 01

GST 2025 Real Estate: The Truth About Home Price Savings in India

GST 2025 Real Estate: The Truth About Home Price Savings in India

What luxury homebuyers actually save after GST 2025 reforms vs what developers promised

Why Your Dream Home Costs Almost the Same After GST Cuts

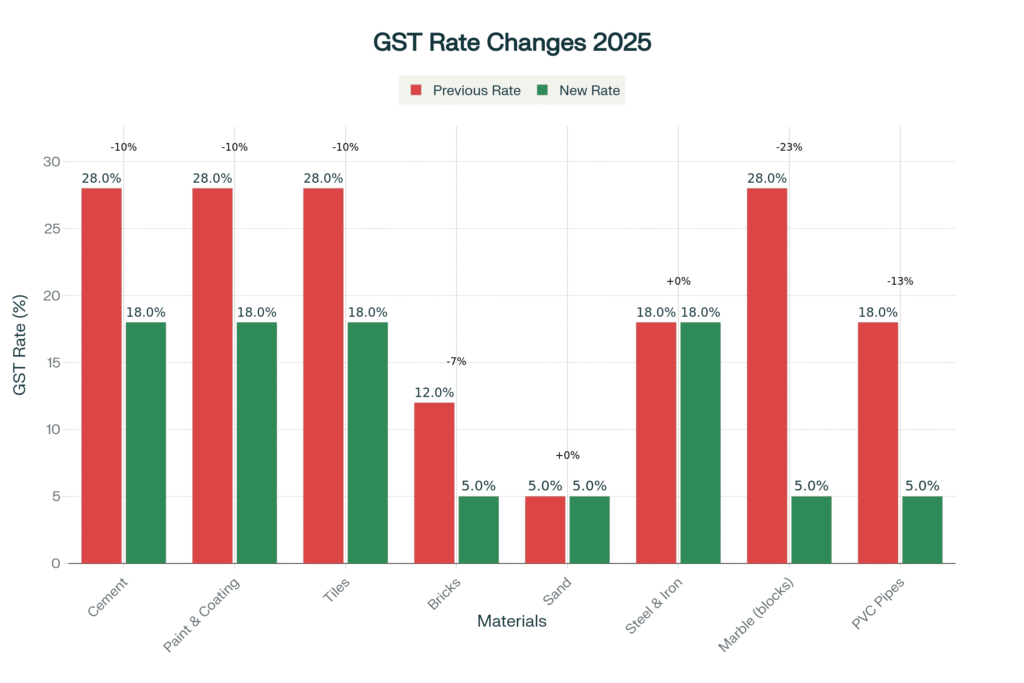

Three months after India’s September 2025 GST reforms, it’s time for some straight talk. While newspapers screamed about “massive price drops” and “real estate revolution,” the reality for luxury homebuyers tells a different story—one that every smart investor needs to know before signing their next property deal.

The reforms were well-intentioned and structurally smart, but the actual savings on your property purchase have been much smaller than all the marketing buzz suggested. Here’s what’s really happening in India’s luxury real estate market right now.

The Real Math: How Much You Actually Save

Let’s get to the actual numbers that matter for your wallet. Yes, cement GST dropped from 28% to 18%—sounds huge in headlines. But here’s what property ads don’t tell you: cement only makes up 15-20% of total construction costs in luxury projects.

Your Actual Savings on a ₹1 Crore Apartment:

- Cement portion of total cost: ₹17.5 lakh

- Real GST savings on cement: ₹1.16 lakh

- Your net property savings: 1.16%

That’s about ₹1.15 lakh saved on a ₹1 crore purchase—nice to have, but nowhere near the dramatic cost cuts many expected.

What GST Can’t Touch: The Biggest Cost Drivers

Here are the major expenses that GST reforms couldn’t—and can’t—change:

Land Prices (30-40% of your home’s cost): Zero impact from GST. Mumbai prime locations saw land costs jump 15-20% this year alone, eating up any construction savings.

Labor Costs (20-25% of total cost): Worker wages have skyrocketed 150% since 2019, with another 25% hike just this year. GST doesn’t control wage inflation.

Government Fees (5-8%): Stamp duty, registration, and approval costs stay the same across all states.

Builder Profits (15-20%): The key factor deciding if any savings reach your pocket.

Why Builders Keep Most GST Savings for Themselves

Here’s the uncomfortable truth: developers are dealing with construction costs that have risen 40% from 2019 to 2024. For them, GST savings are a way to protect profit margins, not necessarily reduce your home price.

What’s Really Happening: Most luxury builders are quietly pocketing GST benefits to offset other rising costs, especially in markets where buyers aren’t price-sensitive and demand stays strong.

Behind-the-scenes conversations reveal the reality: builders in hot markets prefer keeping margins healthy over cutting prices, particularly when luxury buyers keep coming.

When You’ll Actually See Price Benefits

Right Now (Oct 2025 – March 2026): Almost no price drops on ongoing projects. Builders are using up materials bought before GST cuts.

Next 6-12 Months (April-Dec 2026): New project launches might show 1-3% lower prices in competitive areas.

Long Term (2027+): Full GST benefits might kick in, but rising land and labor costs will likely cancel them out.

Which Home Buyers Benefit Most from GST Cuts

Ultra-Luxury Homes (₹5+ crore): Minimal savings. Rich buyers care more about location and lifestyle than small cost cuts. Builders often spend GST savings on better amenities instead of price reductions.

Premium Homes (₹2-5 crore): Some 1-2% price cuts possible in new launches where builders compete hard.

Mid-Range Luxury (₹1-2 crore): Best chance for real savings, especially where multiple projects compete.

Budget Premium (<₹1 crore): Should benefit most in theory, but these builders have the tightest margins and biggest cost pressures.

GST 2025 Real Estate Impact: Market Expectations vs Ground Reality

The Problem: Builders Won’t Show You the Real Numbers

Unlike other industries, real estate pricing stays mostly hidden. Builders don’t have to prove they’re passing GST savings to you.

What Smart Buyers Should Demand:

- Detailed before/after GST material cost breakdowns

- Clear proof of how savings are shared with buyers

- Comparison with similar projects launched before September 2025

- Written promises about benefit sharing percentages

How GST Impact Varies by City

Mumbai: High land costs and limited supply mean builders absorb most GST benefits. Coastal Road projects showing tiny 1-2% price cuts in some new launches.

Delhi NCR: Better competition means slightly more savings passed to buyers, especially in Gurugram’s new luxury areas.

Bengaluru: Strong international buyers and tech money mean builders face little pressure to cut prices despite GST savings.

NRI Buyers: Currency Matters More Than GST

For overseas Indians, rupee-dollar exchange rate changes dwarf any GST impact. A 2-3% rupee rise against the dollar wipes out GST savings completely, while rupee falls give much bigger purchasing power boosts.

Smart Strategy: NRIs should focus on currency timing and big economic trends rather than small GST savings when buying luxury property.

How to Invest Smart in the New GST Reality

For New Home Purchases:

- Only look at projects launching after October 2025 for any real GST benefits

- Negotiate hard on projects using lots of construction materials

- Choose builders known for transparent, honest pricing

For Existing Bookings:

- Don’t expect price cuts on projects already under construction

- Focus on delivery dates and quality specs instead of cost savings

For Long-term Investment:

- GST benefits slightly improve returns but don’t change the basic investment case

- Infrastructure and demand trends still matter most

Hidden Opportunities in the GST Gap

The difference between expectations and reality has created some interesting chances:

New Launch Negotiations: Builders launching now face buyer pressure to share GST benefits, giving you negotiation power.

Competitive Markets: In oversupplied areas, GST savings let builders cut prices to win market share.

Quality Upgrades: Some premium builders reinvest GST savings in better fittings and finishes, giving more value without headline price cuts.

The Big Picture: What GST Really Means Long-Term

GST 2025 reforms represent good structural improvements to India’s property sector—just not the instant price revolution many hoped for. Benefits are real but gradual, meaningful but modest.

For Ultra-Rich and NRI Buyers: The core reasons to invest in Indian luxury real estate—population growth, urbanization, infrastructure development, and global value compared to other countries—stay compelling. GST savings are a nice bonus, not the main reason to buy.

Market Growth: This shows India’s luxury property market is getting more sophisticated. Buyers analyze better, builders strategize smarter, and pricing reflects real value rather than policy excitement.

Bottom Line for Smart Property Investors

September 2025 GST reforms deserve credit for structural improvements and long-term cost benefits. But expecting immediate, big price drops was always unrealistic given market realities and property cost complexity.

Smart investors who understand this truth—and plan accordingly—will find better opportunities than those chasing headline promises. Luxury real estate’s real appeal lies in location value, lifestyle benefits, and long-term growth potential that go way beyond tax policy changes.

The smartest money isn’t waiting for GST savings to make luxury property attractive—it understands that India’s property market strength makes such benefits a pleasant add-on to an already solid investment story.

Quick Answers: What Homebuyers Really Want to Know

Will I actually save money buying luxury property after GST cuts?

Maybe 1-3% on brand new launches if builders share benefits honestly, but forget the 5-10% cuts initially promised. Savings are real but small.

Should I wait for GST benefits before buying?

Only if you’re looking at projects launching after October 2025. Ongoing projects offer minimal benefits due to existing material stocks.

Are builders really giving savings to buyers?

Mixed bag—about 60% of savings passed through in competitive markets, much less in premium segments where demand stays hot.

Which property types benefit most from GST reforms?

Mid-luxury homes (₹1-2 crore) in competitive markets show best savings pass-through, while ultra-luxury often sees benefits go into better amenities instead of price cuts.

Smart Buyer Strategies:

Use Buyer Power: Leverage GST benefit expectations in negotiations for new launches

Choose Transparent Builders: Pick developers who show clear GST benefit accounting over those with vague marketing

Time Your Purchase: Plan for 12-18 months out when new cost structures fully reflect in pricing

Target Right Segments: Focus on mid-premium markets where competition forces real savings sharing

Currency Strategy for NRIs: Time purchases with favorable exchange rates rather than domestic policy changes

YouTube Resources

Free resources to download

GST 2025 Real Estate Impact: Executive Summary