Now Reading: Where Will Tomorrow’s Elite Call Home? AI Reveals the Hidden Luxury Paradises

- 01

Where Will Tomorrow’s Elite Call Home? AI Reveals the Hidden Luxury Paradises

Where Will Tomorrow’s Elite Call Home? AI Reveals the Hidden Luxury Paradises

The Crystal Ball Moment for Ultra-Wealthy Investors

Imagine having a crystal ball that could reveal the next Monaco, the future Mayfair, or tomorrow’s Manhattan before anyone else notices. That crystal ball exists today—it’s called artificial intelligence, and it’s revolutionizing how the world’s wealthiest individuals discover and invest in luxury real estate.

The game has changed dramatically. While traditional investors still rely on gut instinct and outdated market reports, AI is quietly identifying luxury hotspots with laser precision, months before they hit mainstream radar. The global luxury property market is transforming into something far more exciting and accessible than ever before—a treasure hunt where technology holds the map.

The New Reality

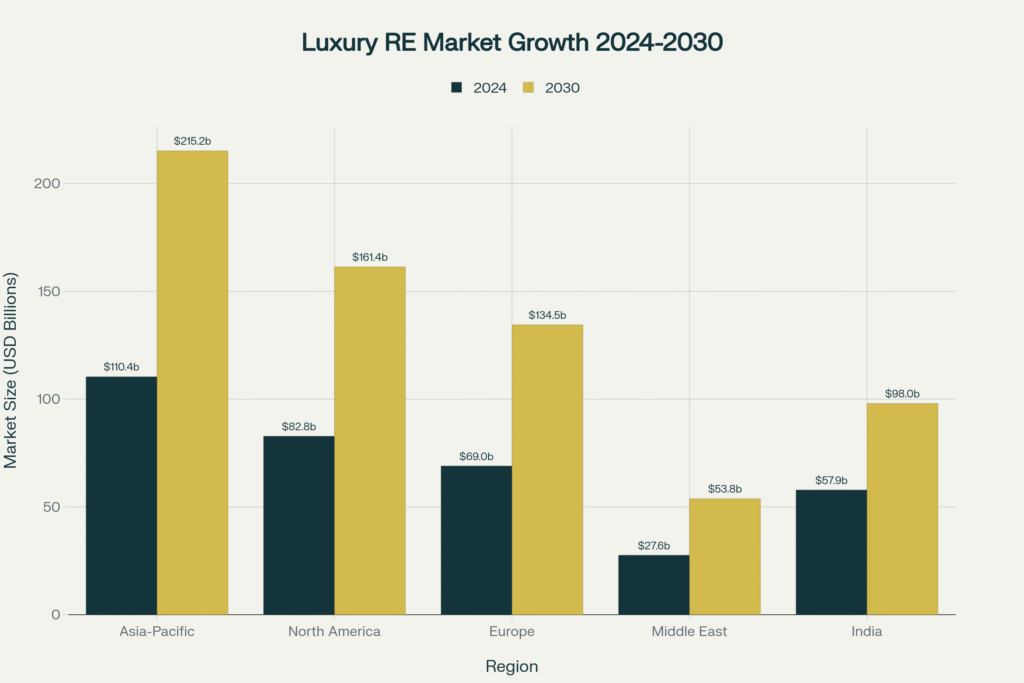

India emerges as the ultimate frontier, with its millionaire population set to double in just four years. Meanwhile, Dubai transforms into a digital playground where you can own a slice of a luxury villa for less than the cost of a high-end watch. Singapore’s luxury rental market delivers returns that would make hedge fund managers envious, while Perth quietly becomes Australia’s best-kept secret for luxury investment.

This isn’t just about buying property anymore—it’s about joining an exclusive club where artificial intelligence whispers the secrets of tomorrow’s most coveted addresses.

The future of luxury living combines elegance with intelligent technology.

The Great Migration: Where Wealth Flows in the Digital Age

Technology Transforms the Hunt for Luxury

Gone are the days when finding the perfect luxury property required months of globe-trotting with real estate agents. Today’s most sophisticated investors are discovering their next penthouse from their current penthouse, using AI platforms that can predict market movements with almost mystical accuracy.

Picture this: While you sip your morning coffee in London, AI algorithms are simultaneously analyzing satellite imagery of infrastructure development in Mumbai, parsing social media sentiment about Dubai’s new districts, and cross-referencing flight patterns to identify emerging wealth corridors. The result? A treasure map of luxury opportunities that updates in real-time.

The New Geography of Wealth:

Asia-Pacific has quietly become the epicenter of luxury innovation, not just following Western models but creating entirely new paradigms. Cities like Singapore are experimenting with blockchain property ownership, while Indian developers are building smart cities from scratch with AI woven into their very foundation.

What makes this shift fascinating isn’t just the money—it’s the mindset. Eastern markets are embracing technology-first approaches to luxury, creating properties that don’t just house the wealthy but anticipate their every need through intelligent systems.

Cultural Shifts Reshaping Luxury Living

The definition of luxury itself is evolving. Today’s elite aren’t just buying square footage and marble countertops—they’re investing in properties that learn their preferences, optimize their environment, and even predict their needs before they articulate them.

In Dubai, properties sell out within minutes to hundreds of international investors who have never physically visited the development. In India, NRIs are purchasing luxury homes through virtual reality tours so realistic that they can inspect the thread count of Italian linens from their offices in Silicon Valley.

Beyond Numbers: The Human Stories Behind Market Evolution

The Psychology Behind Tomorrow’s Luxury Choices

What drives a billionaire to choose one city over another? The answer is increasingly complex, blending traditional status symbols with cutting-edge lifestyle innovations. Today’s ultra-wealthy are digital natives who expect their homes to be as intelligent as their businesses.

Consider the emerging trend of “experience-first luxury”—properties designed not around ostentation but around seamless living experiences. These homes anticipate when you’ll arrive, adjust lighting and temperature to your circadian rhythms, and can even recommend wine pairings based on your dinner plans and stress levels measured through wearable technology.

The Generational Divide in Luxury Preferences

Younger wealth creators prioritize sustainability and smart technology over traditional luxury markers. They’re drawn to properties with carbon-negative footprints and AI systems that optimize energy usage without compromising comfort. Meanwhile, established wealth appreciates how technology can enhance privacy and security while maintaining the exclusivity they value.

Emotional Connections in the Age of Algorithms

Paradoxically, as technology becomes more sophisticated, the emotional connection to place becomes more important. AI helps identify not just profitable investments but properties that resonate with individual lifestyle aspirations and values.

The most successful luxury developments now tell compelling stories—about sustainability, innovation, community, or cultural significance—that create emotional bonds beyond mere financial returns. This narrative approach transforms property ownership from a transaction into a form of personal expression and legacy building.

Winning Strategies for the Modern Elite Investor

The Art of Timing in Algorithmic Markets

The secret to extraordinary returns lies not in following crowds but in recognizing patterns before they become obvious. AI excels at identifying these subtle market signals—the infrastructure investments that will transform a neighborhood, the demographic shifts that will drive demand, the policy changes that will unlock value.

Smart investors are learning to read these digital tea leaves, positioning themselves in markets just as they begin their transformation journey. It’s like investing in Apple stock in 1982, but for real estate.

Strategic Thinking for the Next Decade

The most sophisticated investors are building portfolios that balance established luxury markets with emerging opportunities identified through AI analysis. They’re not just buying properties; they’re curating collections of assets that tell a story about the future of luxury living.

This approach requires thinking beyond traditional geographic boundaries. A portfolio might include a smart penthouse in Mumbai, a tokenized villa share in Dubai, and a sustainable luxury retreat in Perth—each chosen not just for returns but for how they collectively position the investor for the next era of luxury living.

Technology as the Ultimate Concierge

Modern luxury properties don’t just shelter—they serve. AI-powered building systems can coordinate with your calendar, your travel patterns, even your health data to create living environments that enhance your life in ways you never imagined possible.

Imagine properties that automatically adjust not just temperature and lighting but air composition based on your wellness goals. Or buildings that can seamlessly coordinate with your other homes worldwide, ensuring your preferences follow you wherever you go.

Tales from Tomorrow’s Luxury Capitals

Dubai: The Digital Oasis Redefining Possibility

Dubai has transformed into something resembling a real estate laboratory from the future. Here, you can own a fraction of a luxury villa for the price of a weekend getaway, thanks to blockchain technology that makes property investment as simple as buying stocks.

The emirate’s appeal goes beyond financial innovation. It’s become a testing ground for luxury concepts that seemed impossible just years ago—from underwater hotel rooms to sky gardens connecting neighboring skyscrapers. The city attracts investors not just seeking returns but wanting to participate in redefining what luxury living can become.

What makes Dubai’s story compelling isn’t just the technology—it’s the vision. The emirate positions itself as a bridge between traditional luxury and digital innovation, creating spaces where Silicon Valley entrepreneurs feel as comfortable as European aristocrats.

India: The Awakening Giant with Digital DNA

India’s luxury real estate story reads like a thriller about hidden treasure. Beneath the surface of a developing economy lies one of the world’s fastest-growing concentrations of extreme wealth, with homegrown billionaires and returning NRIs creating unprecedented demand for sophisticated luxury properties.

But this isn’t just about new money seeking status symbols. India’s luxury market is being built with digital intelligence from the ground up. New developments integrate AI systems that would be retrofits in Western markets, creating properties that leapfrog traditional luxury amenities to deliver experiences unavailable anywhere else.

The most fascinating aspect is how Indian luxury developments blend cultural heritage with technological innovation, creating properties that honor tradition while embracing the future—palatial homes that remember your grandmother’s recipe preferences while optimizing your biorhythms through environmental controls.

Singapore: The Sophisticated Ecosystem

Singapore approaches luxury real estate like a master chess player—every move calculated, every development part of a larger strategy. The city-state has created an ecosystem where luxury properties aren’t just homes but nodes in a sophisticated network of services, experiences, and opportunities.

What distinguishes Singapore’s luxury market is its integration with the broader wealth management infrastructure. Properties become platforms for accessing exclusive investment opportunities, private banking services, and cultural experiences available nowhere else in Asia.

The government’s cooling measures haven’t dampened luxury appeal—they’ve refined it, ensuring that only the most sophisticated investors participate while maintaining the exclusivity that makes Singaporean luxury properties so coveted globally.

The Insider’s Guide to Tomorrow’s Luxury Markets

Mastering the New Rules of Elite Investment

Success in tomorrow’s luxury real estate market requires thinking like a venture capitalist rather than a traditional property buyer. The biggest wins come from identifying markets and concepts before they reach mainstream recognition, then positioning for the inevitable wave of follower investment.

The key insight? Technology doesn’t replace human judgment—it amplifies it. The most successful investors combine AI-powered market intelligence with deep understanding of lifestyle trends, cultural shifts, and human nature.

Building Wealth Through Intelligent Diversification

Modern portfolio theory meets luxury real estate in fascinating ways. Smart investors are building collections that balance geographic regions, property types, and technology integration levels to optimize both returns and personal satisfaction.

This might mean owning traditional luxury in established markets for stability, emerging market properties for growth, and technology-enhanced assets for future positioning—creating a portfolio that tells a coherent story about how luxury living is evolving.

The Sustainable Luxury Revolution

Perhaps the most significant trend reshaping luxury real estate is the integration of sustainability with sophistication. Properties that once demonstrated wealth through consumption now showcase it through conservation—homes that generate more energy than they use while delivering uncompromised luxury experiences.

This shift represents more than environmental consciousness—it’s about future-proofing investments. Properties that anticipate and exceed tomorrow’s environmental standards will command premium valuations as regulations tighten and consciousness rises.

Navigating the Risks in Paradise

The Shadows Behind the Golden Opportunities

Every revolution creates both opportunities and pitfalls. The AI-powered transformation of luxury real estate is no exception. Smart investors recognize that technology can amplify both gains and losses, making careful risk management more crucial than ever.

The most significant risk isn’t market correction—it’s overconfidence in algorithmic predictions. AI provides powerful insights, but markets remain fundamentally human, driven by emotions, politics, and unpredictable events that no algorithm can fully anticipate.

Market Cycles in the Age of Acceleration

Technology has accelerated market cycles, compressing what once took decades into years or even months. This creates opportunities for nimble investors but also amplifies the consequences of poor timing or excessive leverage.

The key to surviving these compressed cycles is maintaining flexibility—financial, geographic, and strategic. The investors who thrive are those who can pivot quickly when conditions change, whether that means shifting between markets, adjusting leverage, or even completely reimagining their investment thesis.

Your Questions Answered

How do I know if AI predictions are trustworthy for luxury real estate investments?

Think of AI as an incredibly sophisticated research assistant rather than a crystal ball. The best AI platforms achieve impressive accuracy by analyzing vast amounts of data, but they work best when combined with human insight and local market knowledge. Successful investors use AI to identify opportunities, then apply traditional due diligence to validate and refine those insights.

Can smaller investors participate in these AI-identified luxury opportunities?

The beauty of the current transformation is democratization through technology. Fractional ownership platforms now allow investors to participate in luxury properties with investments starting from around $120,000, while blockchain-based systems can go as low as $540 for tokenized properties. This opens luxury real estate investment to a much broader range of sophisticated investors.

Which global markets offer the most exciting opportunities right now?

The most compelling opportunities exist where three factors converge: rapid wealth creation, advanced technology adoption, and supportive regulatory environments. Currently, this points to select markets in India, the UAE, and Australia as offering the most attractive combination of growth potential and investment accessibility.

How is AI changing the actual experience of luxury living?

AI is transforming luxury properties from static assets into dynamic, responsive environments. Modern luxury homes can learn your preferences, anticipate your needs, and optimize your living environment in real-time. This goes far beyond smart thermostats—we’re talking about properties that can adjust everything from air quality to lighting to acoustics based on your schedule, health data, and even mood.

The Dawn of a New Era

The convergence of artificial intelligence and luxury real estate isn’t just changing how we invest—it’s redefining what luxury means in an interconnected, intelligent world. We’re witnessing the birth of a new category of assets: properties that don’t just shelter wealth but actively enhance the lives of their owners through technological sophistication.

For those with the vision to embrace this transformation, the opportunities are extraordinary. The next decade will see the emergence of luxury markets that today exist only in imagination—cities that didn’t exist five years ago becoming tomorrow’s most coveted addresses, properties that learn and adapt becoming the new standard of sophistication.

The investors who position themselves thoughtfully in this evolving landscape won’t just generate impressive returns—they’ll participate in shaping the future of how humanity’s most successful individuals live, work, and express their values through their living spaces.

The revolution is here. The question isn’t whether to participate, but how boldly to embrace the future of luxury living.

YouTube Learning Resources

Free resources to download

AI Reveals the Hidden Luxury Paradises – Key Insights