Now Reading: 2025 Market Outlook: Where the World’s Rich Are Investing Their Billions

- 01

2025 Market Outlook: Where the World’s Rich Are Investing Their Billions

2025 Market Outlook: Where the World’s Rich Are Investing Their Billions

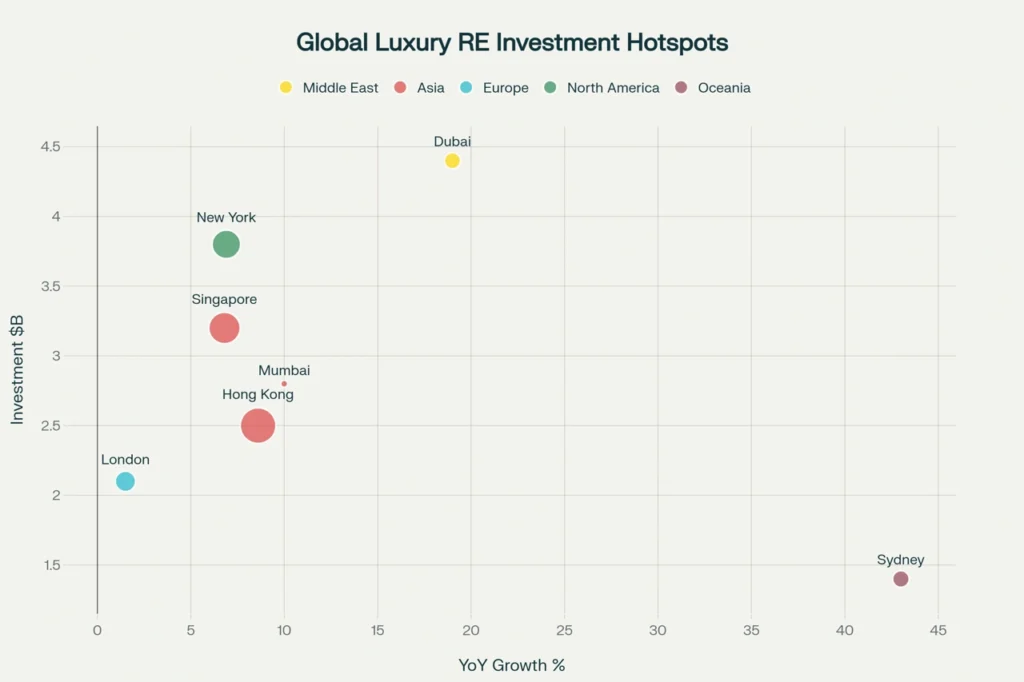

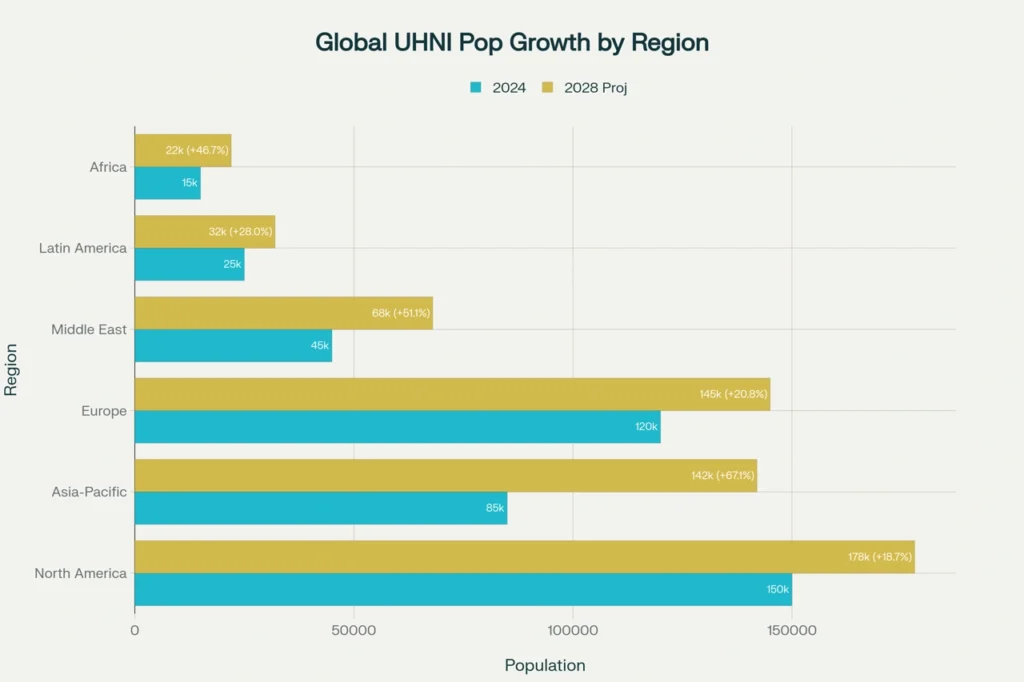

The global ultra-high-net-worth (UHNI) population is experiencing unprecedented growth, with Asia-Pacific leading at 67.1% expansion by 2028. In 2025, luxury real estate commands $432.8 billion globally, growing at 6.3% CAGR, while HNI portfolios diversify into alternatives at record pace. Dubai emerges as the premier investment destination with $4.4 billion in UHNI flows and 19% price appreciation, as Indian NRIs channel $14.2 billion into domestic luxury properties. The convergence of post-pandemic wealth creation, geopolitical shifts, and digital transformation is reshaping the UHNI investment trends, where the world’s richest deploy capital—from Miami’s 61% rental surge to Singapore’s family office boom.

The Wealth Migration

Asia-Pacific’s Meteoric Rise

The tectonic plates of global wealth are shifting eastward with unprecedented velocity. Asia-Pacific’s UHNI population is projected to surge 67.1% by 2028, transforming from 85,000 to 142,000 individuals. This acceleration reflects fundamental economic rebalancing—China’s technological ascendancy, India’s demographic dividend, and Southeast Asia’s infrastructure revolution creating generational investment opportunities.

Singapore has crystallized as the region’s wealth management nucleus, attracting over 2,000 family offices with 40% year-over-year growth. The city-state’s 244,800 millionaires now surpass London, while its strategic positioning between China and India creates unparalleled access to Asia’s growth markets.

Middle Eastern Wealth Consolidation

The UAE continues its remarkable wealth magnetism, attracting a record 9,800 millionaires in 2025 with $63 billion in accompanying capital flows. Dubai’s luxury real estate transactions reached nearly AED 500 billion in nine months, representing 33.7% growth. This momentum stems from strategic diversification beyond oil—technology, logistics, and financial services creating sustainable wealth ecosystems.

The Numbers Behind UHNI Investment Flows

Portfolio Allocation Revolution

HNI asset allocation in 2025 reflects sophisticated diversification strategies:

This shift represents a fundamental recalibration—wealthy investors reducing low-yield bonds while increasing exposure to illiquid premiums through private markets and real estate.

Luxury Real Estate Performance Matrix

Global luxury markets demonstrate divergent trajectories across key investment destinations:

This shift represents a fundamental recalibration—wealthy investors reducing low-yield bonds while increasing exposure to illiquid premiums through private markets and real estate.

Alternative Investment Explosion

The alternatives market reached $1.9 trillion in AUM by 2025, with infrastructure investments leading at 30% growth. Indian AIFs crossed ₹13.49 lakh crore in commitments, driven by UHNI appetite for illiquidity premiums.

Beyond Financial Returns

The Psychology of Luxury Investment

Today’s UHNI investments transcend mere financial metrics—they represent identity, legacy, and global mobility. Post-pandemic lifestyle evolution prioritizes experiential luxury over material ostentation. Dubai’s branded residences (Waldorf Astoria, Aston Martin) exemplify this shift, offering turnkey luxury ecosystems rather than traditional properties.

Generational Wealth Transfer Dynamics

The impending $68 trillion generational wealth transfer is reshaping investment priorities. Millennials and Gen-Z inheritors prioritize ESG alignment, digital integration, and social impact—driving demand for sustainable luxury developments and technology-enabled investment platforms.

Status Through Sophistication

Modern wealth signalling emphasizes sophisticated asset allocation over conspicuous consumption. Family offices showcase diversified portfolios spanning private equity, art, and impact investments—demonstrating financial acumen rather than material excess.

Investment Horizons

Immediate Opportunities (2025-2026)

Dubai Real Estate Momentum: With 52% decline in prime listings and 65% reduction in $10+ million inventory, supply constraints create immediate appreciation potential.

Indian Luxury Housing: 85% growth in luxury sales (H1 2025) signals sustained momentum, particularly in Delhi-NCR’s 57% market share.

Singapore Family Office Hub: Regulatory advantages and strategic location create first-mover advantages for wealth structuring.

Mid-Term Positioning (2027-2030)

Asia-Pacific Infrastructure: Regional connectivity projects (Belt and Road, ASEAN integration) creating multi-decade investment themes.

Climate Resilience: ESG-compliant luxury developments commanding 15-20% premiums as regulatory pressure intensifies.

Technology Integration: AI-powered wealth management platforms and blockchain-based fractional ownership democratizing luxury access.

Long-Term Wealth Preservation (2030+)

Demographic Arbitrage: Asia’s young, growing population versus Western aging demographics creating sustained growth differentials.

Currency Diversification: Multi-geography portfolios hedging against individual country risks while capturing global growth.

Legacy Structures: Family office establishment and generational planning becoming standard UHNI practices.

Case Study 1: Dubai’s UHNI Magnetism – The New Switzerland

Dubai’s transformation from regional trading hub to global wealth destination exemplifies strategic positioning excellence. Knight Frank data reveals 96% of Saudi and 69% of Indian UHNWIs consider Dubai property investment.

The Numbers: Q1 2025 witnessed $1.9 billion in ultra-luxury transactions across just 111 deals, averaging $17.1 million per transaction. Prime villa values rose 94% from 2020-2024, while residential prices grew 19% in 2024 alone—13.3% above 2014 peaks.

The Strategy: Dubai’s success stems from regulatory innovation—Golden Visa programs, zero property taxes, and freehold ownership rights attracting international capital. The emirate’s $1 million provides 840 square feet in prime areas—2-3x more space than London, New York, or Singapore.

Market Dynamics: Off-plan purchases comprise 70% of transactions, indicating confidence in future delivery. Ultra-prime apartment sales (80 deals) overtook villas (63 deals) for the first time since 2023, reflecting urban luxury preference shifts.

Case Study 2: India’s NRI Investment Renaissance – Homeland Capital Returns

Non-Resident Indians represent one of global real estate’s most sophisticated investor cohorts, channeling $14.2 billion into domestic property markets in 2025. This 35% surge reflects strategic recalibration—currency advantages, regulatory reforms, and lifestyle arbitrage driving unprecedented capital repatriation.

Market Penetration: NRIs contribute 20% of India’s total real estate investments, concentrated in luxury segments above ₹4 crore. Mumbai suburbs (Santacruz, Vile Parle, Goregaon) emerge as primary targets, offering global-standard amenities at fraction of international costs.

Investment Logic: India’s 6-6.5% GDP growth provides macro stability, while luxury housing delivers 10-12% annual appreciation in prime markets. Regulatory clarity through RERA and digital transaction platforms reduce investment friction traditionally deterring overseas buyers.

Portfolio Strategy: Successful NRI investors employ dual-market arbitrage—leveraging overseas earning power (USD, GBP, AED) while capturing India’s growth premium. Technology integration enables remote property management, while professional services (Sotheby’s India, Knight Frank) provide institutional-grade due diligence.

Regional Focus: Mumbai leads with 23% of luxury sales, followed by Delhi-NCR at 49%. Bangalore’s dramatic scale-up from 20 units (Q1 2024) to 190 units (Q1 2025) exemplifies emerging market potential.

Case Study 3: Singapore’s Family Office Revolution – Asia’s Wealth Command Center

Singapore’s evolution into Asia’s premier family office jurisdiction exemplifies strategic regulatory positioning. The city-state hosts over 2,000 family offices managing combined assets exceeding $200 billion, growing 40% annually.

Regulatory Excellence: Singapore’s Variable Capital Company (VCC) structure provides unprecedented flexibility for family wealth structuring. Tax incentives, regulatory sandboxes, and professional infrastructure create compelling propositions for UHNI families seeking Asian exposure.

Market Dynamics: Prime shophouses command $25.5+ million (Ray Dalio’s Bridgewater purchase), while luxury condominiums offer branded residence experiences with MRT connectivity. Limited freehold supply (99-year leaseholds dominate) creates scarcity premiums.

Investment Thesis: Singapore serves as Asia-Pacific gateway—proximity to China, India, and Southeast Asian growth markets while maintaining Western legal frameworks and English language business environment. Political stability and currency strength provide safe-haven characteristics amid regional volatility.

Portfolio Integration: Family offices utilize Singapore as operational headquarters while deploying capital across Asia’s growth markets. Real estate represents 22-30% of typical allocations, concentrated in prime districts and luxury developments with international appeal.

Future Trajectory: Government targets 1,000 additional family offices by 2026, while infrastructure investments (Changi Airport expansion, Greater Southern Waterfront) enhance long-term attractiveness for ultra-wealthy families.

Pro Tips: Elite-Level Investment Strategies

Multi-Geography Portfolio Arbitrage: Leverage currency differentials and market cycles across Dubai (tax-free appreciation), Singapore (family office structuring), Mumbai (growth exposure), and London (safe-haven stability) for optimized risk-adjusted returns.

Illiquidity Premium Harvesting: Allocate 15-20% to private market alternatives (private equity, infrastructure, private credit) capturing 300-500 basis points annual premium over public markets while reducing correlation volatility.

Branded Residence Strategy: Target internationally-recognized hospitality brands (Waldorf Astoria, Four Seasons) for luxury property investments—professional management, global recognition, and institutional-grade exit liquidity.

ESG Integration Alpha: Prioritize LEED Platinum, WELL-certified developments commanding 15-20% premiums as regulatory and investor ESG mandates intensify globally.

Family Office Establishment Threshold: Consider formal family office structure above $100 million net worth for tax optimization, multi-generational planning, and sophisticated investment access previously reserved for institutional investors.

Navigating Uncertainty

Regulatory Tightening Risks

Global governments increasingly target wealth concentration through progressive taxation and capital controls. Singapore’s recent cooling measures, UK’s non-dom reform, and potential US wealth taxes create regulatory headwinds for international wealth flows.

Market Concentration Vulnerabilities

Luxury real estate’s dependence on UHNI demand creates concentration risk—economic downturns disproportionately impact high-end markets. Dubai’s 2008-2009 experience demonstrates vulnerability to credit cycle reversals and capital flight.

Currency and Geopolitical Exposure

Multi-geography strategies introduce currency volatility and geopolitical risks. US-China tensions, Middle East instability, and European energy challenges create macro headwinds potentially overwhelming micro investment fundamentals.

Technology Disruption Challenges

Digital transformation threatens traditional wealth management models—robo-advisors commoditizing investment advice while blockchain technology potentially disintermediate established financial intermediaries.

Sustainability Transition Costs

ESG compliance requirements and carbon neutrality mandates impose significant retrofit costs on existing luxury properties. Stranded asset risks increase for non-compliant developments as regulatory frameworks tighten.

FAQ Section

What minimum net worth qualifies as UHNI status for luxury investment access?

Ultra-High-Net-Worth status typically begins at $30 million liquid assets, providing access to exclusive investment opportunities including private placements, family office services, and direct real estate deals with institutional-grade due diligence and preferred pricing structures.

Which global cities offer the best luxury real estate appreciation potential in 2025-2030?

Dubai leads with 19% current growth and supply constraints, followed by Delhi-NCR (17% growth) and Singapore (strategic family office demand). Miami shows 61% five-year rental appreciation, while Asian markets benefit from demographic tailwinds and infrastructure development creating sustained appreciation potential.

How should NRIs structure international property investments for tax optimization?

NRIs benefit from careful jurisdiction selection—Dubai’s zero property tax environment, Singapore’s family office incentives, and India’s FEMA compliance requirements. Professional structuring through international trusts, holding companies, and tax treaty optimization can significantly enhance after-tax returns while ensuring regulatory compliance.

What alternative investment allocation percentage is optimal for UHNI portfolios in 2025?

Leading family offices allocate 15-25% to alternatives including private equity (18% average), real estate funds (22%), and infrastructure investments. This allocation captures illiquidity premiums while maintaining portfolio diversification across public markets, private investments, and direct holdings for optimized risk-adjusted returns.

Explore these premium investment perspectives:

Luxury Property Tours & Market Analysis

HNI Investment Strategies

India Market Opportunities

The Decade of Asian Wealth Ascendancy

The 2025 investment landscape represents a historic inflection point—the confluence of technological acceleration, demographic transformation, and geopolitical realignment creating unprecedented wealth creation and deployment opportunities. Asia-Pacific’s 67.1% UHNI growth trajectory signals the region’s emergence as the global economy’s gravitational center, while Dubai’s strategic positioning captures the intersection of Eastern growth and Western sophistication.

For discerning investors, the decade ahead offers extraordinary prospects through strategic diversification across growth markets, alternatives allocation capturing illiquidity premiums, and family office establishment providing institutional-grade investment access. The convergence of Indian economic dynamism, Middle Eastern capital abundance, and Southeast Asian demographic advantages creates a unique window for generational wealth building.

The sophisticates who recognize these patterns early—embracing Asia’s rise while maintaining global diversification—will capture the premium returns defining this transformative decade. The future belongs to those who position themselves where demographic momentum, economic fundamentals, and regulatory innovation align.

Ready to explore exclusive investment opportunities? Contact premier wealth management advisors for personalized consultation on global portfolio optimization and family office structuring strategies tailored to your specific objectives and risk parameters.

References

- Knight Frank. (2025). The Wealth Report 2025: America First. London: Knight Frank Research.praxisga

- CBRE South Asia & ASSOCHAM. (2025). The New Paradigm in Indian Housing. Mumbai: CBRE India.gangarealty

- Long Angle. (2025). 2025 High-Net-Worth Asset Allocation Study. New York: Long Angle Research.longangle

- JLL Global Research. (2025). Global Real Estate Perspective, August 2025. Chicago: Jones Lang LaSalle.equiruswealth

- Anarock Property Consultants. (2025). Ultra Luxury Homes Market Report 2024-25. Mumbai: Anarock Research.tridentrealty

- Sotheby’s International Realty India. (2025). India Luxury Residential Outlook Survey 2025. Mumbai: Sotheby’s India.gordonpsi

- Henley & Partners. (2025). Private Wealth Migration Report 2025. London: Henley Global Partners.fincart

- Dubai Land Department. (2025). Real Estate Transaction Analysis Q1-Q3 2025. Dubai: DLD Statistics.luxuryhomemarketing

- Capgemini Research Institute. (2025). World Wealth Report 2025. Paris: Capgemini Financial Services.juliusbaer

- Goldman Sachs Private Wealth Management. (2025). 2025 Family Office Investment Insights Report. New York: Goldman Sachs Research.pmsbazaar