Now Reading: Top 7 Global Cities Redefining Ultra-Luxury Living in 2025

- 01

Top 7 Global Cities Redefining Ultra-Luxury Living in 2025

Top 7 Global Cities Redefining Ultra-Luxury Living in 2025

The global ultra-luxury real estate market is undergoing a seismic transformation in 2025, with seven cities emerging as the definitive sanctuaries for Ultra-High Net Worth Individuals (UHNWIs) seeking the ultimate lifestyle assets. Monaco continues to reign supreme with record-breaking prices of $57,164 per square meter, while Dubai demonstrates explosive market velocity with 16.9% annual appreciation. This comprehensive analysis reveals how London, Singapore, New York, Mumbai, and Paris are redefining luxury living standards, collectively representing $258.48 billion in premium real estate value and attracting unprecedented capital flows from the world’s most affluent investors.

Market Shift & Global Context

The Great Wealth Migration

2025 marks a pivotal moment in global wealth distribution, with Knight Frank’s Wealth Report revealing a 4.4% increase in HNWI population to 2,341,378 individuals worldwide. This expansion is driving unprecedented demand for ultra-luxury properties across strategic global locations, fundamentally reshaping traditional real estate hierarchies.

Asia-Pacific’s Unprecedented Ascendancy

The Asia-Pacific region is experiencing explosive wealth creation, with Singapore’s luxury market projected to reach $13.87 billion by 2030, growing at a remarkable 7.91% CAGR. Mumbai’s luxury segment alone generated ₹14,750 crore ($1.8 billion) in the first half of 2025, with properties above ₹4 crore representing 62% of total residential sales.

Middle East Renaissance

Dubai has emerged as the undisputed growth champion, achieving $63.5 billion in total real estate sales volume for 2025. The emirate’s weekly luxury transactions exceeded AED 18.6 billion in August 2025, attracting over 9,800 HNWIs throughout the year and establishing itself as the fastest-growing ultra-luxury destination globally.

European Resilience Amid Headwinds

Despite regulatory challenges and economic uncertainties, London maintains its ultra-prime appeal with a $45 billion luxury market capitalization. Paris demonstrates recovery potential with luxury prices reaching €22,730 per square meter in premium arrondissements, while Monaco delivers absolute scarcity value as the world’s most expensive real estate market.

Data-Rich Market Insights

Price Performance Analytics

Monaco commands the global luxury hierarchy at $57,164 per square meter, with ultra-prime districts like Larvotto and Monte Carlo exceeding €100,000 per square meter. New York Manhattan follows at $25,000 per square meter, with luxury contracts above $4 million jumping 29% year-over-year. Singapore maintains strong positioning at $20,000 per square meter, supported by robust UHNWI inflows and limited supply in the Core Central Region.

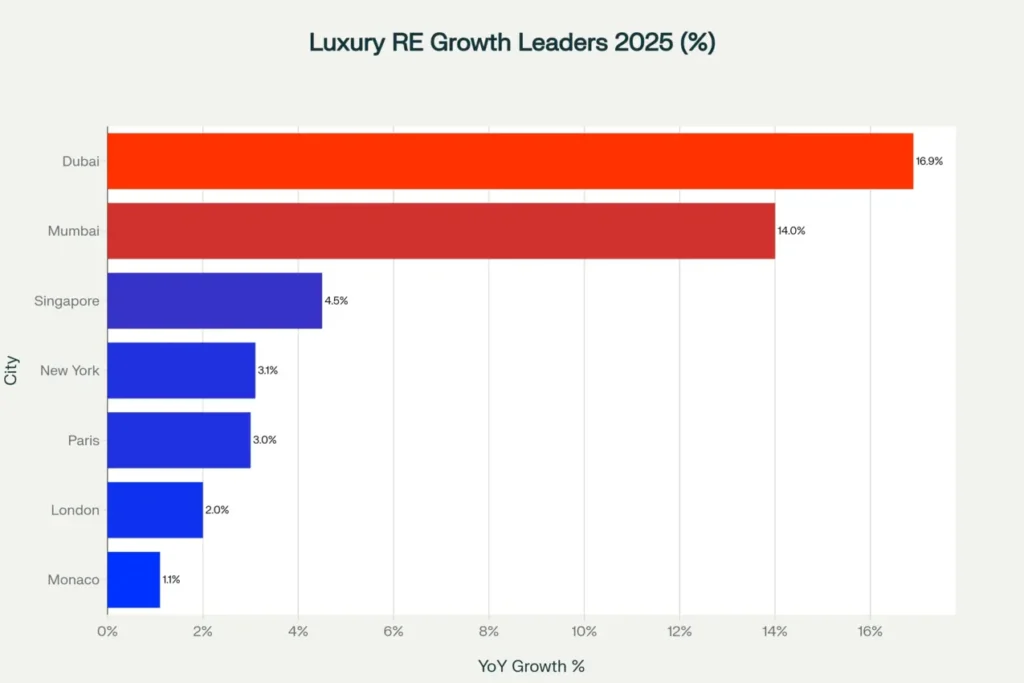

Growth Velocity Leaders

Dubai leads global appreciation trajectories with exceptional 16.9% year-over-year growth, followed by Mumbai’s remarkable 14% surge driven by luxury housing demand. Singapore demonstrates steady 4.5% growth, while New York, Paris, and London show modest but stable appreciation patterns reflecting market maturity.

HNWI Population Dynamics

North America maintains dominance with 905,413 HNWIs (5.2% growth), while Asia-Pacific shows the strongest momentum with 750,000 HNWIs expanding at 5.0% annually. India’s HNWI population reached 85,698 in 2024, projected to grow to 93,753 by 2028, representing a 50% increase in ultra-wealthy individuals.

Ultra-Prime Transaction Intelligence

Monaco recorded 85 ultra-prime deals above $10 million with an average transaction value of $45 million. New York completed 850 luxury transactions above $4 million, while Dubai processed 1,200 ultra-luxury deals exceeding $10 million. London maintained 450 super-prime sales despite regulatory headwinds, and Singapore completed 180 ultra-luxury transactions in the Core Central Region.

Emotional & Lifestyle Drivers

Prestige & Exclusivity Premium

Ultra-luxury real estate in 2025 transcends mere accommodation, representing the ultimate expression of success, taste, and global citizenship. Monaco properties offer unparalleled prestige with zero personal income tax and Mediterranean lifestyle appeal. New York Manhattan provides the ultimate urban sophistication with proximity to global financial centers and cultural institutions.

Generational Wealth Transfer

The Great Wealth Transfer is fundamentally reshaping luxury real estate demand patterns, with Knight Frank identifying that 89% of Indians aged 18-35 with incomes over ₹1 crore prefer property ownership. Millennials and Gen X buyers are driving substantial luxury home purchases, seeking larger spaces and premium amenities post-COVID.

Status & Social Capital

Ownership in these seven cities provides immediate social positioning within global elite circles. Dubai’s Golden Visa program has attracted 81,000 millionaires, creating an exclusive community of international wealth. Singapore’s good-class bungalows appreciated 4% year-over-year, representing the ultimate status symbol in Asia.

Strategic Investment Horizons

Immediate Opportunities (6-12 months)

Dubai’s Pre-Supply Window: Position before 150,000 new homes hit the market between 2025-2027, with branded residences from Bulgari, Bugatti, and Ritz-Carlton leading premium development. Ultra-luxury deals above $10 million nearly doubled in H1 2025, indicating accelerating high-end demand.

Mumbai’s Redevelopment Surge: South Mumbai luxury redevelopment projects offer exceptional value, with Bandra West experiencing 192% sales value increase from ₹362 crore to ₹1,057 crore in H1 2025. Premium properties above ₹10 crore launches surged 110% year-over-year.

Mid-term Value Creation (2-4 years)

New York Recovery Play: Manhattan luxury market poised for sustained growth with $6.56 billion in Q3 2025 sales volume, up 10% annually. Federal Reserve interest rate normalization expected to unlock pent-up luxury demand with 90% of closings completed in cash.

London Post-Adjustment Value: Prime Central London properties down 13% from 2022 peaks create strategic entry opportunities. Knight Frank projects 2% growth for 2025, marking the strongest annual gain since 2014, with medium-term appreciation of 9% over five years.

Long-term Wealth Preservation (5+ years)

Monaco’s Ultimate Scarcity: Limited supply of 159 new apartments delivered in 2024 (highest since 1993) against infinite global demand from UHNWIs. Properties exceeding €20 million doubled in recent transactions, with seven sales surpassing €100 million.

Singapore’s Asian Switzerland Strategy: Positioned as Asia’s premier wealth preservation destination with stable political framework and strategic geographic location. Expected 40,000 new completions through 2025 will stabilize rental markets while maintaining ultra-prime appreciation.

Case Studies

Dubai’s Exponential Trajectory

Dubai exemplifies the new paradigm of ultra-luxury real estate growth, with prime residential prices rising 6.8% in 2024 and forecasts suggesting 15-20% appreciation in 2025. The emirate’s zero-income tax regime, simplified regulations, and strategic location between East and West create compelling fundamentals for sustained luxury demand.

Key Performance Indicators demonstrate Dubai’s market strength: 99,000 sales worth AED 328.8 billion in H1 2025 alone, representing the most successful half-year period in Dubai real estate history. Off-plan sales comprised over 60% of transactions, indicating strong future delivery pipeline and buyer confidence in new developments.

The branded residences segment flourishes with 140 luxury projects expected by 2031, including developments from Bulgari, Bugatti, Ritz-Carlton, and Waldorf Astoria. This unprecedented concentration of ultra-luxury brands validates Dubai’s emergence as a global lifestyle destination comparable to Monaco and New York.

Mumbai’s Premium Market Evolution

Mumbai’s luxury real estate market demonstrates the power of demographic and economic transformation, with properties above ₹4 crore generating ₹14,750 crore in sales during H1 2025. This represents a fundamental shift toward premium housing, with 62% of total residential sales occurring in the luxury segment compared to 51% in the previous year.

South Mumbai continues to command premium pricing with properties in Malabar Hill and Walkeshwar trading at ₹1.25-1.75 lakh per square foot. Lodha Walkeshwar sets new benchmarks at ₹1.5-1.6 lakh per square foot, establishing unprecedented luxury pricing standards for Indian real estate markets.

The market benefits from strong end-user demand rather than speculative investment, with buyers seeking larger living spaces and premium amenities. Bandra West’s 192% sales value increase demonstrates the rapid appreciation potential in Mumbai’s established luxury corridors.

London’s Resilience Strategy

London’s ultra-prime market showcases remarkable resilience despite regulatory headwinds, with international buyers maintaining strong interest in prestigious postcodes like Knightsbridge, Mayfair, and Belgravia. Recent £80 million penthouse listings at The Knightsbridge Apartments and £60 million One Hyde Park transactions demonstrate continued demand at the apex of the market.

Knight Frank’s Prime London Forecast projects gradual recovery with 2% growth in 2025, supported by economic stability and clearer tax frameworks. The market benefits from currency advantages, with strengthening USD providing American buyers enhanced purchasing power in premium London properties.

Prime Central London’s correction from 2022 peaks creates strategic opportunities for sophisticated investors, with Savills forecasting 9% cumulative appreciation over five years despite near-term volatility. The combination of reduced pricing and high-quality inventory presents optimal entry conditions for long-term wealth preservation strategies.

Pro Tips: Elite Investment Strategies

UHNI Portfolio Diversification Framework: Allocate 60% to established luxury markets (Monaco, London, New York) for stability and prestige, 30% to high-growth emerging markets (Dubai, Mumbai) for appreciation potential, and 10% to opportunistic recovery plays (Paris, Singapore) for value capture opportunities.

Ultra-Prime Timing Intelligence: Leverage Dubai’s pre-supply surge window (2025-2027) for maximum appreciation potential before 150,000 new homes enter the market. Position in Singapore’s Core Central Region before inventory expansion affects pricing dynamics.

Currency Arbitrage Optimization: USD strength creates 15-20% purchasing power advantage for American UHNWIs in European luxury markets, particularly Paris and London during post-correction phases. Monitor exchange rate fluctuations for optimal acquisition timing.

Generational Wealth Preservation Matrix: Monaco and London properties offer intergenerational stability with proven long-term appreciation, ideal for family office legacy planning and multi-generational wealth transfer strategies.

Yield-Growth Optimization Strategy: Dubai’s 7% rental yields combined with 16.9% appreciation create unmatched total returns exceeding 23% annually. Mumbai’s 14% growth provides emerging market exposure with 3.5% income generation for balanced portfolios.

Risks & Contrarian Perspectives

Regulatory Evolution Challenges

Singapore’s Additional Buyer’s Stamp Duty increase to 60% for foreign purchasers significantly impacts acquisition velocity and total investment costs. London’s abolition of non-dom tax status and increased stamp duties create ongoing price pressure in traditional ultra-prime segments.

Paris faces potential market correction risks, with Investropa forecasting 7-15% price declines by 2026 due to overreliance on interest rate dynamics and declining rental yields. French government transfer tax increases effective April 2025 accelerated early transactions but may dampen future demand.

Market Oversupply Concerns

Dubai’s ambitious development pipeline raising 150,000 new homes through 2027 creates potential oversupply risks in certain segments. However, branded residences and ultra-luxury categories maintain scarcity value with limited supply relative to global UHNWI population growth.

Mumbai’s luxury market concentration in South Mumbai and Bandra creates geographic dependency risks, with limited expansion opportunities constraining future supply growth. Infrastructure development and transportation improvements remain critical for sustained luxury market expansion.

Economic Volatility Impacts

Global economic uncertainty, including potential trade tensions and interest rate volatility, affects luxury real estate demand patterns. However, historical analysis demonstrates ultra-luxury markets’ resilience during economic downturns, with wealthy individuals viewing prime real estate as safe-haven assets.

Currency fluctuations create both opportunities and risks for international investors, requiring sophisticated hedging strategies and local market expertise for optimal positioning across multiple jurisdictions.

Frequently Asked Questions

Which city offers the best ultra-luxury real estate investment returns in 2025?

Dubai leads with 16.9% annual price appreciation plus 7% rental yields, creating total returns exceeding 23%. Mumbai follows with 14% growth, making both emerging markets attractive for growth-oriented UHNWIs seeking maximum appreciation potential.

What is the minimum investment threshold for ultra-luxury real estate in these global cities?

Entry points vary significantly: Monaco requires $10-15 million minimum for prime properties, New York Manhattan starts at $8-12 million for luxury condominiums, while Dubai and Mumbai offer luxury entry from $3-5 million in premium locations with strong growth potential.

How do currency fluctuations affect international luxury real estate investments?

USD strength in 2025 provides American buyers 15-20% enhanced purchasing power in European markets like London and Paris. Conversely, Asian wealth benefits from local currency appreciation, creating natural hedging opportunities for geographically diversified portfolios.

What are the primary risks in ultra-luxury real estate investment for 2025?

Key risks include regulatory changes (Singapore’s 60% ABSD, London’s non-dom tax modifications), interest rate volatility affecting leverage costs, potential oversupply in certain markets, and geopolitical tensions impacting cross-border capital flows.

Conclusion

The ultra-luxury real estate landscape of 2025 presents an unprecedented convergence of demographic shifts, wealth creation, and global mobility trends that will define the next decade of elite property investment. While traditional bastions like Monaco and London continue to offer prestige and stability, emerging powerhouses like Dubai and Mumbai provide explosive growth potential that can fundamentally transform investment portfolios.

Success in this rarefied market requires sophisticated understanding of regulatory frameworks, currency dynamics, and cultural preferences across multiple jurisdictions. UHNWIs who position strategically across these seven cities will benefit from both exceptional lifestyle enhancement and significant wealth appreciation, creating lasting value for current and future generations.

The current market window represents optimal entry conditions across multiple segments, with interest rate stabilization, regulatory clarity, and supply-demand imbalances creating once-in-a-decade opportunities. Sophisticated investors who act decisively while maintaining geographic diversification will capitalize on the greatest wealth creation period in luxury real estate history.

Strategic Imperative: Engage with specialized luxury real estate advisors who understand cross-border investment structures, tax optimization strategies, and the nuanced requirements of ultra-high-net-worth property acquisition across these premier global destinations.

Relevant YouTube Videos

Free resources to download

Top-7-Global-Cities-Redefining-Ultra-Luxury-Living-in-2025: Key Summary