Now Reading: The Contrarian’s Playbook: Identifying Distressed Luxury Assets in Overheated Markets

- 01

The Contrarian’s Playbook: Identifying Distressed Luxury Assets in Overheated Markets

The Contrarian’s Playbook: Identifying Distressed Luxury Assets in Overheated Markets

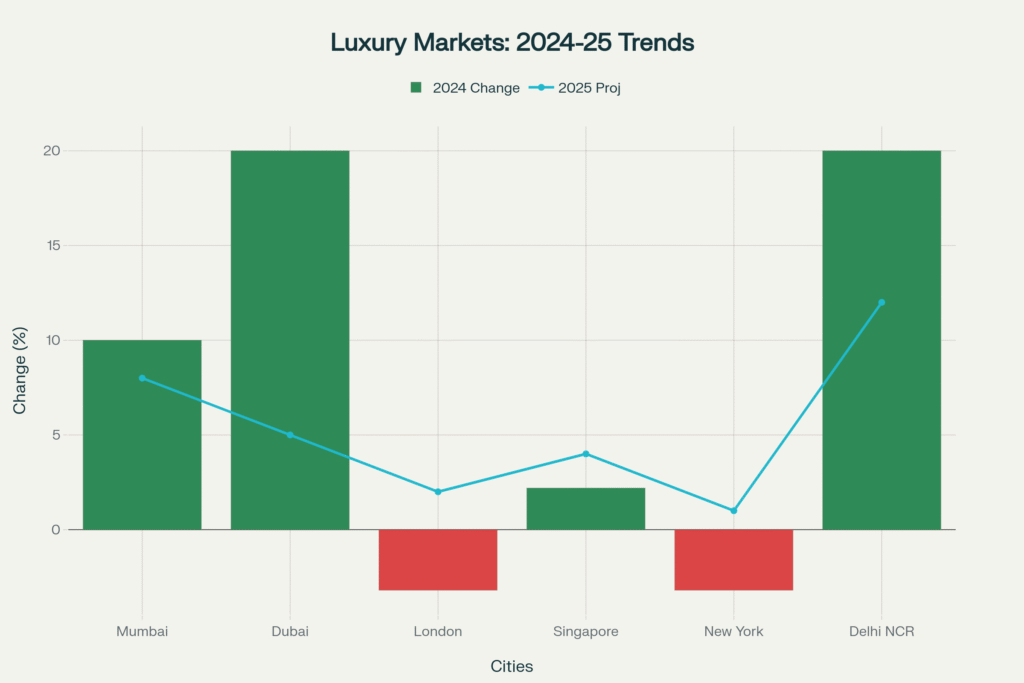

The global luxury real estate landscape is experiencing a dramatic polarization in 2025, presenting unprecedented opportunities for sophisticated investors who embrace contrarian strategies. While markets like Mumbai and Dubai command 10-20% annual price gains, London’s Prime Central district has declined 20% from peak valuations, and select US luxury markets face 3-8% corrections. With the global luxury real estate market projected to reach $515.3 billion by 2032 (growing at 6.5% CAGR), and India’s UHNI population surging 50% by 2028, the astute investor recognizes that today’s distressed luxury real estate assets in oversupplied or politically volatile markets represent tomorrow’s generational wealth. This comprehensive analysis reveals where contrarian capital should flow, backed by data from Knight Frank, CBRE, Anarock, and Bloomberg, to capture alpha in an increasingly bifurcated luxury ecosystem.

The Great Divergence

The Bifurcation of Global Luxury

The luxury real estate sector has entered an era of unprecedented market divergence. No longer can investors rely on blanket geographic strategies—the “rising tide lifts all boats” thesis has been replaced by acute micro-market dynamics driven by geopolitical stability, tax policy, and demographic tsunamis.

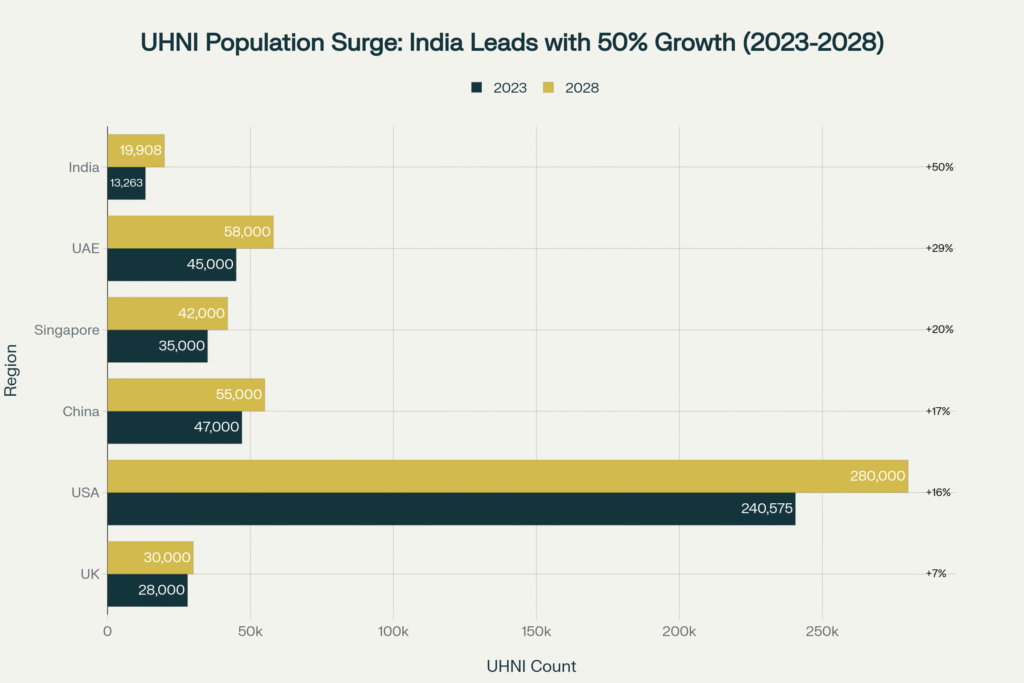

According to Knight Frank’s Wealth Report 2025, the global UHNI population is projected to grow from 626,619 individuals in 2024 to 745,000 by 2028, representing a 19% increase. However, this growth is far from uniform. India leads with an explosive 50% UHNI growth trajectory (from 13,263 to 19,908 individuals), while the UK languishes at just 7% growth amid non-dom tax clampdowns and political uncertainty.

The luxury real estate market, valued at $289.6 billion in 2023, is expected to reach $328.6 billion in 2025 and eventually $515.3 billion by 2032, maintaining a steady 6.5% CAGR. Yet beneath these aggregate figures lies a market in violent flux. Dubai posted 20% year-over-year price appreciation in 2024, while London’s Prime Central luxury segment hemorrhaged value, declining 3.2% annually since 2022, with cumulative drops exceeding 20% from 2014 peaks.

This divergence creates the foundation for contrarian wealth creation. As Warren Buffett’s timeless maxim suggests: “Be fearful when others are greedy, and greedy when others are fearful”. In 2025, the contrarian playbook demands capital reallocation from overheated emerging markets to distressed legacy luxury hubs.

Comparative Geo-Analysis: Opportunity vs. Risk

India: The Overheated Engine

India’s luxury residential market has transformed from niche to mainstream, with properties priced above ₹1.5 crore (approximately $180,000) capturing 38% of new supply in Q3 2025, according to Anarock. The luxury segment grew at a remarkable 9% CAGR from 2019 to 2024 across gateway cities. Mumbai Metropolitan Region (MMR) led with 30,260 unit sales in Q3 2025, while unsold luxury inventory above ₹2.5 crore surged 36% year-over-year to 8,420 units in Q1 2025—the first increase since 2022.

Despite robust demand from HNIs and NRIs (who invested $16.5 billion in Indian real estate in 2025, with 65% allocated to luxury properties), the market exhibits classic bubble symptoms: speculative frenzy, developer oversupply, and price appreciation outpacing income growth. Average residential prices in India’s top cities grew 9% year-over-year in Q3 2025, with NCR posting a staggering 24% annual increase. JLL data reveals that 62% of H1 2025 sales exceeded ₹1 crore, signaling premiumization—but also vulnerability.

London: The Distressed Aristocrat

In stark contrast, London’s ultra-prime market presents a textbook distressed opportunity. Bloomberg reported in September 2025 that Prime Central London property values have declined persistently since tax reforms targeting non-domiciled residents. Sales of ultra-prime homes (£10+ million) in central London dropped significantly, with buyers migrating to outer boroughs or international markets.

Knight Frank data indicates that properties in Mayfair, Belgravia, and Knightsbridge—historically the planet’s most resilient luxury addresses—now trade 15-20% below 2014 peaks in inflation-adjusted terms. Transaction volumes have collapsed, inventory has ballooned, and motivated sellers are accepting aggressive discount negotiations. For the contrarian investor with a 5-10 year horizon, this represents the most compelling risk-adjusted entry point in a generation.

The catalyst for mean reversion? London remains the world’s premier global city, with unmatched cultural capital, legal infrastructure, educational institutions, and time-zone advantages for transatlantic business. Political cycles are temporary; London’s structural advantages are permanent.

Dubai: The Moderating Supernova

Dubai luxury real estate posted extraordinary 20% gains in 2024, but Savills Middle East and local consultancies project moderation to 5-8% in 2025 as supply catches up with speculative demand. With Emaar announcing 40,000 new luxury homes in the Dubai Mansions project alone, and overall transaction volumes hitting AED 525.87 billion in 2025, the market faces potential oversupply by 2026-2027.

While Dubai remains attractive for its 0% income tax, golden visa programs, and lifestyle infrastructure, the contrarian recognizes that today’s “can’t lose” narrative often precedes tomorrow’s correction. Early-stage investors who entered in 2020-2021 are now profit-taking, creating an ideal environment for patient capital to wait for re-entry at 15-20% discounts within 18-24 months.

Singapore & US Luxury Markets: Selective Distress

Singapore’s Core Central Region (CCR) luxury segment posted modest 2.2% growth in 2024, with projections of 4% for 2025—stable but unremarkable. The city-state’s strict Additional Buyer’s Stamp Duty (ABSD) of 60% for foreigners has cooled speculation, creating a rational, fundamentals-driven market that rewards long-term holders but offers limited alpha.

US luxury markets present geographic fragmentation. San Francisco’s luxury segment experienced a renaissance driven by AI wealth, with more $20+ million sales in 2024 than any prior year. However, secondary luxury markets in Florida (excluding Miami), Texas, and the Mountain West face inventory buildups and 3-5% price corrections as high interest rates dampen demand. Sotheby’s International Realty’s 2025 Luxury Outlook Report notes that while the S&P 500’s 23.3% gain in 2024 bolstered UHNI purchasing power, rising insurance costs and climate risks create headwinds in specific micro-markets.

Following the Money

UHNI Population Dynamics

The Knight Frank 150 Global Family Office Investment Strategies Report 2025 reveals that real estate consistently ranks as the top alternative asset class for family offices, with 32% of portfolios allocated to property—up from 28% in 2023. UBS Global Family Office Report 2025 confirms that 135,000 HNWIs migrated internationally in 2025, with the UAE attracting 6,700 UHNIs (the most globally), followed by the US, Singapore, and Australia.

India’s UHNI growth trajectory is unmatched: 50% expansion from 2023 to 2028 translates to 6,645 new ultra-wealthy individuals seeking luxury real estate. With 71% of wealthy Indians surveyed by Sotheby’s in 2024 expressing intent to invest in luxury real estate within 12-24 months, and NRI remittances hitting record highs in FY2025, the capital inflows are structural, not cyclical.

Comparatively, the USA’s UHNI population is projected to grow 16% (from 240,575 to 280,000), while China faces headwinds with only 17% growth amid economic slowdown and capital controls.

Transaction Values & Portfolio Flows

Anarock Capital reported that foreign private equity investments in Indian real estate reached $3.1 billion in FY2025, up from $2.6 billion in FY2024. Institutional investments in Q2 2025 surged 122% quarter-over-quarter to $1.8 billion, primarily targeting commercial assets, with 89% of foreign inflows from US, Japanese, and Hong Kong investors.

Luxury residential sales across India’s top seven cities generated ₹1.52 lakh crore ($18.2 billion) in Q3 2025, a 14% increase year-over-year despite a 9% volume decline—evidence of premiumization. Properties priced above ₹4 crore ($480,000) posted 28% year-over-year sales growth in Q1 2025.

In contrast, CBRE data shows that European luxury markets experienced capital outflows, with London prime sales volumes down 30% from 2019 peaks. However, opportunistic distressed debt funds raised $12-15 billion globally in 2024-2025 specifically to target real estate dislocation.

CAGR Trajectories & Forward Projections

- Global Luxury Real Estate Market: 6.5% CAGR (2023-2032), reaching $515.3 billion

- India Luxury Residential: 5-9% CAGR (2023-2028), with Delhi NCR and Mumbai leading

- Branded Residences: 150% growth over the past decade; market valued at $66 billion in 2024

- NRI Investment in Indian Real Estate: 17.9% YoY growth in 2025, projected to exceed $20 billion by 2027

PWC’s Emerging Trends in Real Estate 2025 report highlights that distressed asset returns historically outperform during recovery cycles by 300-500 basis points versus stabilized assets, with luxury residential offering the highest appreciation potential post-correction.

Emotional & Lifestyle Drivers: The Intangibles That Drive Premiums

Prestige as Currency

For UHNIs, luxury real estate transcends shelter—it is identity architecture. A Mayfair pied-à-terre or a Bulgari Lighthouse penthouse in Dubai signals membership in an exclusive global elite. Forbes research indicates that 72% of UHNIs cite “prestige and status” as primary motivators, with capital appreciation ranking second at 68%.

Branded residences by Fendi, Armani, Bentley, and Baccarat command 25% premiums over comparable non-branded properties, yet sell rapidly. Sotheby’s 2025 report notes that Miami and Dubai are epicenters for this trend, with the Dolce & Gabbana 90-story Miami tower (starting at $2.1 million) offering Italian travertine floors, golden bead entrances, and bespoke tailoring services—merging couture with real estate.

This emotional premium is recession-resistant. During the 2008-2009 financial crisis, while mid-market properties collapsed 30-40%, London prime property declined only 10-15% and recovered within 18 months. Scarcity—true scarcity of irreplaceable assets—defies conventional cycles.

Generational Wealth & Legacy Creation

India Sotheby’s Luxury Outlook Survey 2024 revealed that 63% of affluent Indian investors prioritize “creating assets for the next generation”. This intergenerational mindset underpins luxury real estate’s stickiness. Unlike equities or crypto, physical trophy properties offer tangible legacy value.

UBS reports that $84 trillion in wealth transfer from Baby Boomers to Gen X and Millennials is underway through 2045. Single women now represent 20% of US homebuyers (up from 11% in 1981), and female UHNIs increasingly drive luxury acquisition decisions, prioritizing security, location, and lifestyle amenities over ostentatious displays.

Exclusivity & The “White Lotus Effect”

Sotheby’s coined the “White Lotus Effect”—the phenomenon of television and media glamorizing luxury destinations, creating aspiration-driven demand. Post-pandemic, UHNIs crave experiential living: homes as private resorts with 4,000 sq ft pool decks, Michelin-caliber private chef services, wellness spas, and concierge-curated experiences.

This lifestyle inflation is inelastic. Once accustomed to such amenities, HNIs resist downgrading, sustaining demand even during economic turbulence.

Strategic Takeaways: The Contrarian’s Timeline

Immediate Horizon (0-12 Months)

1. Deploy Capital to London Prime Central

Target: Mayfair, Belgravia, Knightsbridge properties at 15-20% discounts. Rationale: Political risk is overpriced; structural demand from Middle Eastern, Asian, and American UHNIs remains robust. Entry Strategy: Off-market distressed sales, estate liquidations, motivated relocations. Expected IRR: 12-18% over 5 years, assuming mean reversion to 2019 valuations.

2. Accumulate US Secondary Luxury Markets (Selective)

Target: Miami (non-branded condos facing supply glut), Austin, Nashville distressed new developments. Rationale: Inventory overhang + interest rate normalization = 10-15% discounts by Q2 2026. Entry Strategy: Pre-foreclosure negotiations, bank REO portfolios. Expected IRR: 10-15% over 3-5 years.

3. Hedge India Exposure

Action: Lock in gains on overvalued Mumbai/Delhi NCR luxury holdings acquired pre-2022. Rationale: Unsold inventory spike (+36% YoY) signals demand saturation; regulatory tightening likely. Strategy: Partial exit (50-60%), reallocate to distressed global markets.

Mid-Term Horizon (12-36 Months)

1. Re-Enter Dubai Post-Correction

Timing: Wait for 10-15% price normalization (expected H2 2026 – H1 2027). Target: Off-plan branded residences from tier-1 developers with payment plans. Rationale: Structural fundamentals remain strong; supply surge is temporary. Expected IRR: 8-12% over 5 years.

2. Opportunistic Singapore CCR Acquisitions

Target: Distressed sales from overleveraged mainland Chinese sellers facing liquidity crunches. Rationale: Singapore’s stability and rule of law offer superior risk-adjusted returns despite modest appreciation. Expected IRR: 6-9% over 7-10 years (wealth preservation play).

3. Position for Next-Generation Indian Cities

Target: Hyderabad, Pune, Bengaluru luxury projects in emerging micro-markets. Rationale: India’s growth is durable; second-tier cities offer better value than Mumbai/Delhi. Expected IRR: 10-14% over 5-7 years.

Long-Term Horizon (3-7 Years)

1. Build Core Portfolio in Global Gateway Cities

Allocation: 40% London, 25% New York, 20% Singapore, 15% selective emerging (Dubai, Mumbai). Philosophy: “Buy fear, sell greed” across cycles; global diversification hedges local volatility. Expected Portfolio IRR: 10-12% nominal, 6-8% inflation-adjusted.

2. Allocate to Branded Residences

Rationale: 150% sector growth, 25% premiums, and lifestyle alignment make this the luxury sector’s fastest-growing segment. Target: Pre-launch branded projects from Bulgari, Four Seasons, Aman, Ritz-Carlton. Expected IRR: 12-16% over 7-10 years.

3. Tax Optimization & Structuring

Utilize offshore holding structures (Singapore, Dubai, Mauritius for India exposure). Leverage trusts, family offices, and real estate investment trusts (REITs) for liquidity. Engage specialized cross-border tax counsel to maximize after-tax returns.

Case Studies: Contrarian Winners

Case Study 1: London Prime Central – The Patient Capital Thesis (UK)

Market Context:

Since the UK’s 2017 non-dom tax reforms and 2025 Labour government’s additional restrictions, London’s ultra-prime market has faced relentless headwinds. Knight Frank reports that £10+ million transactions declined 40% from 2014-2016 peaks. Bloomberg analysis in September 2025 highlighted that sellers are accepting 15-20% discounts, with average days-on-market exceeding 450 days for properties above £15 million.

Opportunity:

A Belgravia townhouse, originally listed at £22 million in 2019, transacted at £17.5 million in October 2025—a 20.5% discount. Adjusted for inflation, the real decline exceeds 30%. The buyer, a Middle Eastern family office, acquired the property with the intention of holding 7-10 years.

Investment Rationale:

London remains the world’s #1 city for legal framework, education (LSE, Imperial, UCL), and cultural capital. Political cycles reverse; structural demand from Asia, Middle East, and US remains. Supply is constrained (listed buildings, greenbelt laws); new luxury supply is negligible. GBP depreciation (vs. USD) enhances purchasing power for international buyers.

Expected Outcome:

Assuming mean reversion to 2019 prices by 2030 (modest 2% annual appreciation), the property would be valued at £24+ million—a 37% gross return over 5 years (6.5% annualized). Including rental yields of 2-3% annually, total returns could reach 12-15% IRR.

Case Study 2: Dubai’s Luxury Moderation – Timing the Cycle (UAE)

Market Context:

Dubai luxury real estate surged 20% in 2024, fueled by golden visa programs, zero income tax, and lifestyle infrastructure investments. However, Anarock and Savills Middle East project moderation to 5-8% growth in 2025-2026 as supply ramps up. Emaar’s Dubai Mansions project alone adds 40,000 units, while overall transaction volumes hit AED 525.87 billion in 2025.

Opportunity:

A Singapore-based UHNI family purchased a 4-bedroom villa in Emirates Hills in June 2024 for AED 18 million ($4.9 million). By October 2025, comparable properties were listed at AED 21.5 million—a 19.4% appreciation in 16 months.

Investment Rationale:

Early-cycle entry captured peak momentum. Exit strategy: Sell in Q4 2025 or Q1 2026 before supply-induced correction. Reinvest proceeds into distressed London or US markets.

Contrarian Twist:

The same investor is now waiting on the sidelines, anticipating a 10-15% correction by H2 2026. Target re-entry: Off-plan branded residences (Bulgari, Armani) at pre-launch discounts, with 70% financing at 4-5% rates.

Expected Outcome:

If the correction materializes, re-entry at AED 18-19 million (vs. current AED 21.5 million) positions the investor for the next up-cycle, with projected values of AED 25-28 million by 2030 (8-10% annualized).

Case Study 3: India’s Luxury Surge – Riding the Tiger (India)

Market Context:

India’s luxury residential market has been on a tear, with sales above ₹4 crore rising 28% YoY in Q1 2025. Mumbai, Delhi NCR, and Bengaluru dominate, driven by India’s explosive UHNI growth (50% by 2028). However, unsold inventory above ₹2.5 crore surged 36% YoY in Mumbai Q1 2025, signaling potential oversupply.

Opportunity:

A US-based NRI purchased a 4,500 sq ft luxury apartment in South Mumbai’s Worli district in March 2022 for ₹12 crore ($1.44 million). By September 2025, comparable units in the same building were transacting at ₹18.5 crore—a 54% gain in 3.5 years (13% annualized).

Investment Rationale:

NRI remittances hit record highs in FY2025; 65% allocated to luxury real estate. India’s GDP growth (6-7% annually) and UHNI population surge underpin structural demand. Limited supply in prime micro-markets (Malabar Hill, Worli, Bandra West) creates scarcity premium.

Contrarian Action:

The investor is now partially exiting (selling 60% stake) to lock in gains, reallocating to London Prime Central at 20% discounts. Retains 40% exposure to India for long-term wealth creation.

Expected Outcome:

By reallocating, the investor captures 54% gains in India while positioning for 12-18% IRR in London over the next 5 years. Diversification reduces concentration risk in a single overheated market.

Pro Tips: Elite-Level Insights

- Master Micro-Market Intelligence: Luxury real estate is hyper-local. In London, a property in Eaton Square (Belgravia) commands 30% premiums over Pimlico—200 meters away. Engage local boutique brokers, not large chains, for off-market deal flow. UHNI portfolio diversification strategy demands granular geographic knowledge.

- Leverage Distressed Debt Funds: Rather than direct property acquisition, consider allocating 15-20% of real estate capital to opportunistic distressed debt funds targeting luxury markets. These funds offer liquidity, professional management, and 12-18% net IRRs. Platforms like Blackstone, Starwood Capital, and regional players provide access.

- Tax Arbitrage is Alpha: Structure acquisitions through tax-efficient jurisdictions. A Dubai-based holding company purchasing London property avoids UK stamp duty surcharges (up to 17% for non-residents). Consult big-four tax advisors (PwC, Deloitte, EY, KPMG) for structuring.

- Pre-Launch Branded Residence Allocations: Branded residences (Aman, Four Seasons, Bulgari) often allocate 20-30% of units to VIP buyers pre-launch at 10-15% discounts. Cultivate relationships with developers’ private client teams and family office networks to access these opportunities.

- Contrarian Currency Plays: GBP depreciation makes London cheaper for USD, AED, and SGD buyers. Similarly, INR appreciation (if sustained) enhances exit values for foreign investors in India. Currency hedging strategies can enhance IRRs by 200-300 basis points.

The Devil’s Advocate

Overheated Market Correction Risk (India, Dubai)

The luxury markets in Mumbai, Delhi NCR, and Dubai exhibit classic late-cycle exuberance: surging unsold inventory, speculative buying, and price growth outpacing fundamentals. A 15-25% correction within 18-24 months is plausible if:

- Interest rates remain elevated (RBI, Fed tightening)

- Regulatory crackdowns on speculative buying (India’s RERA, benami property laws)

- Global recession reduces UHNI liquidity

Mitigation: Maintain 30-40% cash reserves; avoid leverage above 50% LTV; diversify geographically.

Political & Regulatory Risks (London, Singapore)

London’s non-dom tax regime could worsen under Labour government; Singapore’s ABSD could rise further. Regulatory shifts can erode 10-15% of property values overnight.

Mitigation: Engage legal counsel for cross-border tax planning; structure holdings to optimize flexibility (trusts, offshore entities).

Liquidity & Exit Challenges

Luxury real estate is illiquid. A $10+ million property may take 12-24 months to sell, especially during downturns. Transaction costs (stamp duty, agent fees, legal) can total 8-12% of value.

Mitigation: Allocate only 20-30% of net worth to illiquid real estate; maintain diversified portfolios (equities, bonds, private equity).

Climate & ESG Risks

Rising sea levels threaten Miami, Dubai coastal properties; wildfires impact California luxury estates. ESG-conscious UHNIs increasingly favor green-certified developments.

Mitigation: Prioritize properties with LEED, BREEAM, or equivalent certifications; avoid high-risk coastal zones; allocate to climate-resilient markets (London, Singapore).

Overconfidence in “Safe Haven” Assets

The belief that luxury real estate “always recovers” is dangerous. Japan’s luxury market collapsed in the 1990s and has never fully recovered. London prices (inflation-adjusted) remain below 2007 peaks in many boroughs.

Mitigation: Adopt rigorous valuation discipline; stress-test assumptions; avoid emotional attachment to trophy assets.

FAQ Section

What defines a “distressed” luxury asset, and how do I identify one?

A distressed luxury asset exhibits one or more of the following: (1) Pricing 15-30% below comparable recent transactions or inflation-adjusted historical peaks; (2) Extended days-on-market (300+ days for properties above $5 million); (3) Motivated seller circumstances (estate liquidations, divorce, overleveraged developers, non-performing loans). Identify opportunities through off-market brokers, distressed debt funds, bank REO departments, and courthouse foreclosure auctions. Engage local market experts and forensic valuation specialists to confirm true distress vs. structural decline.

How much capital should UHNIs allocate to distressed luxury real estate in 2025?

Portfolio allocation depends on risk tolerance, liquidity needs, and diversification. A balanced UHNI portfolio might allocate 15-25% to real estate, with 30-40% of that (i.e., 5-10% of total net worth) directed to distressed opportunities. Pair distressed allocations with stabilized income-producing properties (REITs, commercial real estate) to balance risk. Never exceed 50% LTV on distressed assets to preserve liquidity and downside protection.

What are the tax implications of cross-border luxury real estate investment, and how can they be optimized?

Cross-border luxury investments trigger multiple tax layers: (1) Acquisition taxes (UK stamp duty up to 17%, India registration 5-7%); (2) Holding taxes (property taxes, wealth taxes); (3) Income taxes (rental income); (4) Capital gains taxes (20-30% in most jurisdictions). Optimization strategies include: offshore holding companies (Singapore, Dubai, Mauritius), trusts (US, UK), tax treaties (India-Mauritius, UK-US), and 1031 exchanges (US). Engage big-four tax advisors early in structuring phase to maximize after-tax IRRs, which can improve by 300-500 basis points.

How do branded residences (Bulgari, Four Seasons, Armani) fit into a contrarian luxury portfolio?

Branded residences command 25% premiums and have grown 150% over the past decade, representing the luxury sector’s highest-growth segment. For contrarians, the opportunity lies in pre-launch allocations (10-15% discounts) in markets facing near-term corrections (Dubai, select US cities). Branded residences offer: (1) Predictable appreciation due to scarcity and brand cachet; (2) Superior amenities and services that sustain demand during downturns; (3) Liquidity advantages (faster sales cycles than non-branded). Allocate 15-20% of luxury real estate capital to branded projects from tier-1 developers with proven track records (Emaar, Omniyat, Related Group).

The Art of Contrarian Mastery

The luxury real estate landscape of 2025-2030 will be defined not by those who chase momentum, but by those who possess the intellectual courage to deploy capital where consensus fears to tread. London’s Prime Central district, trading at generational lows, offers the thinking investor’s ultimate asymmetric bet: limited downside, immense upside, and the intangible prestige of owning irreplaceable assets in the world’s premier global city.

Conversely, the euphoria gripping Mumbai, Dubai, and select US markets presents a textbook case for disciplined profit-taking. History teaches that trees do not grow to the sky, and unsold inventory spikes are the canary in the coal mine.

The contrarian playbook is not for the faint of heart. It requires rejecting herd behavior, embracing illiquidity, and maintaining conviction through volatility. But for UHNIs, NRIs, and family offices with 5-10 year horizons, the rewards are generational: 12-18% IRRs, inflation-hedged hard assets, and trophy properties that signal membership in the global elite.

As global wealth concentrates ($84 trillion in intergenerational transfer through 2045), luxury real estate will remain the ultimate store of value and legacy vehicle. The question is not whether to invest, but where—and when. The contrarian knows: the time to buy is when there’s blood in the streets, even if it’s your own.

Strategic Call to Action:

For discerning investors seeking to capitalize on today’s market dislocations, consider engaging private wealth advisory platforms specializing in cross-border luxury real estate. Firms such as Knight Frank Private Office, Sotheby’s International Realty Private Client Group, and CBRE Global Luxury offer bespoke transaction services, off-market deal flow, and tax-optimized structuring. Additionally, allocate consultative capital to distressed debt funds from Blackstone Real Estate Income Trust (BREIT), Starwood Opportunity Funds, or regional specialists to access diversified distressed portfolios with professional management.

The convergence of geopolitical volatility, demographic tsunamis, and market polarization has created the most compelling contrarian opportunity set in luxury real estate since the 2008-2009 global financial crisis. Fortune favors the prepared mind—and the patient investor.

YouTube Learning Resources

Free resources to download

The Contrarian’s Playbook: Executive Investment Brief