Now Reading: The Second Home Is No Longer a Luxury. It’s a Risk Strategy.

- 01

The Second Home Is No Longer a Luxury. It’s a Risk Strategy.

The Second Home Is No Longer a Luxury. It’s a Risk Strategy.

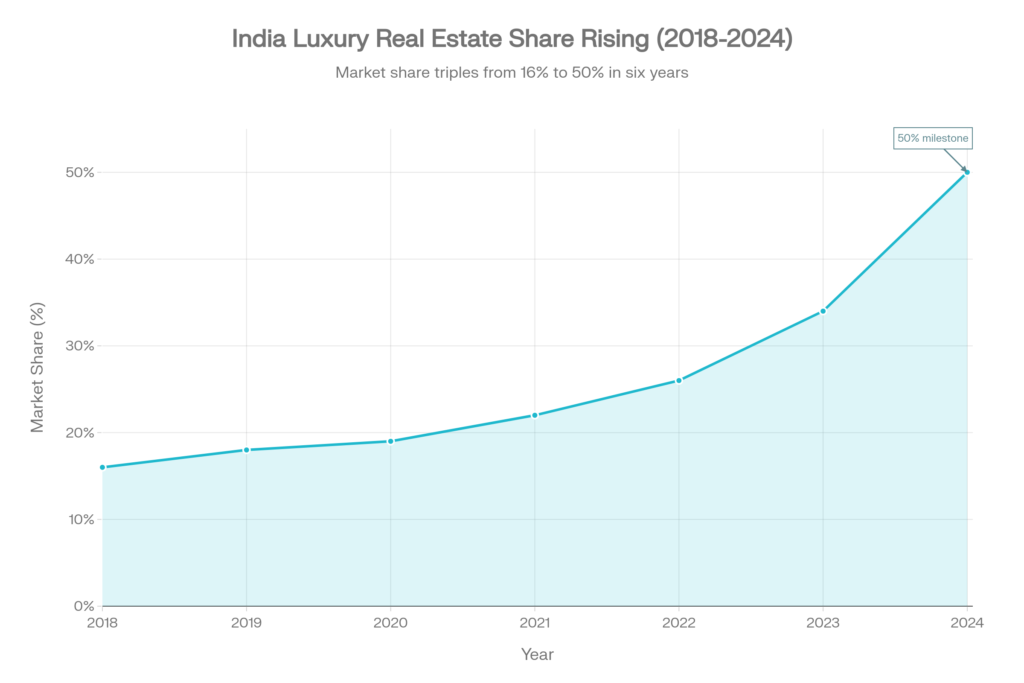

India’s ultra-high-net-worth investors are quietly restructuring their real estate allocation architecture. What was once purely aspirational—a second residence in a marquee Mumbai tower or Goa peninsula estate—has become a deliberate risk management instrument. As rupee volatility persists, global capital flows remain uncertain, and domestic markets concentrate wealth at the top, sophisticated allocators are deploying capital into ultra-luxury residential assets (₹4 crore and above) not for lifestyle alone, but as anchors in a diversified portfolio.

This strategic shift reflects a fundamental change: premium second homes are no longer discretionary status symbols. They are capital allocation decisions made with the same rigor applied to equity portfolios, private markets, and alternative assets.

The second home has evolved from aspiration to architecture—a deliberate capital deployment vehicle that offers scarcity, optionality, lifestyle integration, and long-term wealth preservation aligned with global diversification frameworks.

The Macro Context

Between 2019 and 2024, India’s ultra-high-net-worth population grew at approximately 6% annually. Over the same period, global wealth allocators faced persistent headwinds: currency instability, geopolitical fragmentation, and the relative decline of developed-market equities. For Indian investors—particularly those with exposure to global capital, foreign currency earnings, or diaspora networks—the question became urgent: Where do I anchor capital with real optionality?

Real estate, especially in micro-markets with enduring scarcity (Mumbai’s central business district, prime Bengaluru neighborhoods, coastal Goa), offered an answer that equities and bonds alone could not.

Why Premium Residential Real Estate Functions Differently

Unlike listed stocks or bonds, premium residential real estate carries three distinct properties that appeal to ultra-wealthy allocators:

Tangibility and jurisdictional diversity. A ₹5 crore apartment in a Mumbai prime location is a real asset—not a claim on a corporation or government. For NRIs and OCI investors, it offers geographic distribution that cash balances or equity portfolios cannot. When rupee volatility creates hedging costs elsewhere in the portfolio, a real asset denominated in INR provides a natural counterbalance.

Inelastic supply. There are only so many 4-bedroom penthouses with sea views in Worli, or prime villas in Goa’s Vagator promontory, or new construction ultra-luxury units in Bengaluru’s Indiranagar or Koramangala. Scarcity, in a growing market, is a fundamental value driver. Demand that has outpaced supply expansion. This concentration is structural, not cyclical.

Discretionary holding periods. Unlike publicly traded assets, a second home has no forced liquidity event. An investor can hold for five years or fifty, renting it out, occupying it seasonally, or simply letting it appreciate as a silent store of value. This optionality is underpriced by many buyers and overly constrained in their thinking.

Holding Period Data: Evidence of Longer-Term Thinking

Properties purchased by HNI and UHNI investors between 2015 and 2019 are being held longer today. Average holding periods extended from 5–7 years to 8–12 years, suggesting investors are treating these assets as medium to long-term stores of value rather than trading vehicles. This behavioral shift is critical: it indicates that luxury real estate is being integrated into wealth management architecture, not treated as speculative inventory.

City-Specific Performance

Mumbai: Luxury residential sales grew 15% year-on-year in 2024. Capital appreciation in prime locations (Bandra-Worli, South Mumbai, Powai) averaged 8–12% annually over the past decade. Rental yields in premium areas range from 2–5%, with prime locations approaching 4–5% gross yield. Mumbai remains the NRI preference, accounting for nearly one-third of all non-resident Indian luxury purchases.

Delhi NCR: The surprise outperformer. Luxury property prices grew 20% year-on-year in 2024—the highest among metros. Gurugram alone accounted for 64% of all luxury residential launches in 2024, driven by gated communities on Golf Course Road, Dwarka Expressway extensions, and Sector 150 (Greater Noida West). Delhi NCR’s rental yields range around 3-5%, making it attractive for yield-plus-appreciation investors. NRI interest is concentrating in gated, security-first developments.

Bengaluru: The tech-driven appreciation engine. Price growth in 2024 reached 14% year-on-year, with premium micro-markets (Indiranagar, Koramangala, Whitefield extensions) seeing faster appreciation. Rental yields range from 3.5–4.5%, with IT corridor locations achieving 5–7% in select cases. Bengaluru’s appeal lies in dual drivers: strong end-user demand from tech professionals and steady investor interest from family offices seeking operational diversification.

The Lifestyle Dimension: Why It Still Matters

Here’s where the narrative must not become purely transactional.

Yes, sophisticated investors are thinking about second homes as risk hedges. But they’re also thinking about how and where they want to live, and what their family’s connection to India is—or will become.

For many UHNI investors, especially those with diaspora networks or extended families across continents, a premium second home in India serves three simultaneous functions:

A lifestyle anchor

There’s a difference between owning an asset and inhabiting a place. The investor who maintains a four-month residence in Goa isn’t just deploying capital; they’re designing a life rhythm that straddles multiple geographies. The quality of that experience—the architecture, the views, the neighborhood—isn’t incidental. It shapes how the asset gets used and, by extension, how it appreciates. A poorly positioned property becomes a liability; a well-positioned home becomes increasingly valuable as the investor’s life evolves.

A generational transfer vehicle

For family offices and ultra-wealthy entrepreneurs, premium properties in India often function as both asset and symbol. They’re vehicles for passing on not just capital, but a connection to geography, heritage, and long-term thinking. A well-positioned property in Mumbai or Bengaluru becomes a node in the family’s multigenerational wealth architecture. It’s where board meetings happen. Where the family gathers annually. Where the next generation maintains its connection to India.

A currency and jurisdiction hedge

For rupee-sensitive investors, owning a ₹10 crore asset in India isn’t just a real estate play. It’s a bet on India’s long-term economic trajectory and a way to maintain liquidity in the jurisdiction where much of their business or network resides. As the rupee has depreciated to ₹90+ per USD in late 2025—near multi-year lows driven by FPI outflows and trade uncertainties—NRI demand for rupee-denominated assets has strengthened. This is not coincidental. It’s deliberate hedging.

These three functions—economic, generational, and psychological—are what make the second home resilient as an allocation. A pure financial instrument fails if sentiments shift. A second home that is also a place you actually use, that your family enjoys, and that connects to your legacy? That survives multiple market cycles.

Case Studies

Case 1: The NRI Return — Mumbai Waterfront, 2022–2024

The Investor: A second-generation technology founder, based in Silicon Valley, with annual revenue exposure in USD and a family business still headquartered in Mumbai.

The Decision: In Q2 2022, with the rupee under pressure and equity markets volatile, he deployed ₹12 crore into a 4-bedroom penthouse in a new ultra-luxury development on the Bandra-Worli Sea Link. The property offered direct sea views, smart home integration, and privacy—critical for someone managing an international profile.

The Logic: He wasn’t abandoning his US base. But he recognized that half his net worth was India-exposed (business, family assets), and he wanted a capital store in INR that would appreciate, could be used three months annually, and could eventually pass to his children as a legacy asset. The ₹12 crore deployment represented approximately 5% of his net worth—material enough to matter, conservative enough not to overconcentrate.

The Outcome (to date): He’s built a practice: three months in India, four months in the US, and the flexibility to adjust based on business cycles. The property is now functioning as both a capital store and a lifestyle anchor. When business pressures intensify, he can extend his India stay. When India markets are volatile, he has a geographic hedge.

Key Insight: The decision wasn’t made in isolation. It was part of a broader portfolio rebalancing that included reviewing his tax residency, his USD-INR hedging, and his long-term India-exposure thesis. The real estate deployment wasn’t about Mumbai’s market; it was about architecture—his own.

Case 2: The Family Office Diversification — Bengaluru, 2023–Present

The Investor: A first-generation pharmaceutical entrepreneur with a family office managing ₹250 crore+ in assets.

The Decision: In late 2023, after a comprehensive capital allocation review, the family office deployed ₹8 crore into two premium residential properties in Bengaluru—one in the emerging ultra-luxury cluster near Indiranagar/Koramangala (₹5 crore), and one in a gated community on the city’s outskirts with potential for seasonal rental income (₹3 crore).

The Logic: The family office’s portfolio was overweighted toward pharma equities and real estate development projects. Premium residential real estate, particularly in India’s fastest-growing major city, offered diversification without sector overlap. Bengaluru’s growing ultra-high-net-worth population and quality of life made it attractive for both personal use and appreciation potential. The rental yield opportunity in the second property provided cash flow diversification.

The Outcome: One property is being used for executive visits and family stays; the other is generating 3–3.5% rental yield while appreciating at projected 12–14% annually. The allocation is performing both as a use-asset and a yield-bearing capital store.

Key Insight: Family offices are increasingly treating residential real estate as a liquid alternative category, not a legacy indulgence. Bengaluru’s emergence as a wealth-creation hub (tech founders, healthcare entrepreneurs) has made premium residential a credible allocation for sophisticated investors seeking non-correlated returns and operational optionality.

Case 3: The Generational Transfer — Delhi NCR Farmhouse, 2020–Present

The Investor: A 65-year-old business patriarch with three adult children, planning succession and estate structuring.

The Decision: In 2020, he purchased a ₹6.5 crore farmhouse property in Delhi NCR’s premium micro-market (Greater Noida West, Sector 150 area). The property sits on 2+ acres, includes guest facilities, and is positioned as a family gathering point.

The Logic: This wasn’t about capital appreciation alone. It was about creating a tangible, undividable asset (via proper trust structures) that would remain a family touchstone across generations and geographies. His children, spread across Mumbai, Singapore, and the US, could gather annually. The property would be a physical anchor for family identity and wealth continuity.

The Outcome: The property has become a family node—a place where the business can conduct board meetings, where family decisions happen, where the next generation maintains connection to India. From a pure tax and estate-planning perspective, it’s also proved valuable as a legacy asset that can be structured to optimize succession and minimize liquidity pressures on the estate.

Key Insight: For ultra-wealthy families, the second home transcends real estate. It’s an instrument of generational continuity, a hedge against diaspora drift, and a way to embed family identity in something tangible. Its financial returns matter less than its structural role in wealth architecture.

Risks & Contrarian View

Regulatory and Taxation Complexity

While RERA and FEMA frameworks have improved significantly, regulatory implementation remains uneven across states. Mumbai, Bengaluru, and Delhi have strong enforcement; smaller metros have inconsistent application. Tax audits on NRI property transactions can be complex, especially for non-residents managing multiple properties. Changes to tax policy, as evidenced by the July 2024 reform, can affect return calculations. Sophisticated investors should maintain detailed records and consider engaging tax advisors early.

Liquidity Cycles in Ultra-Luxury Assets

Properties in the ₹10 crore+ segment have limited buyer pools. A sale in a down market could take 12–18 months if optimal pricing is maintained. While long-term appreciation is compelling, investors must be comfortable with illiquidity horizons of 8–12 years minimum.

Overconcentration Risk in Micro-Markets

Mumbai’s central business district, Delhi’s Gurugram core, and Bengaluru’s premium IT corridors have experienced rapid appreciation. But this concentration creates vulnerability: a significant negative shock (regulatory change, infrastructure disruption, local economic downturn) could impact multiple properties simultaneously. Sophisticated investors should avoid overexposure to a single micro-market.

Currency Risk (Both Ways)

While rupee depreciation (currently ₹90+ per USD) makes Indian properties cheaper for NRIs in USD terms, it also creates repatriation risk. If an NRI buys at ₹80/USD and the rupee strengthens to ₹78/USD by exit, currency gains are reduced. Conversely, further weakening of the rupee amplifies appreciation in USD terms. This asymmetry should be explicitly modeled in return expectations.

Rental Yield Ceiling

Indian luxury properties typically yield 2–5% gross annual rent, compared to Dubai’s 5–11% or established Western markets’ 3–6%. Net yields (after taxes, maintenance, vacancy) drop further. For investors prioritizing cash flow over appreciation, India’s rental yields may underwhelm relative to alternative allocations.

Regulatory And Strategic Outlook For 2026

Anticipated Policy Directions

India’s government has consistently supported real estate formalization and foreign direct investment in the sector. The Real Estate Investment Trust (InvIT) framework is being liberalized, potentially creating additional institutional investment vehicles. GST on luxury residential (currently 5% on ready-to-move properties) is stable. No major tax changes are anticipated in the near term, though monitoring remains essential.

The Ministry of Housing continues to push RERA enforcement, which benefits organized players and legitimate buyers. This trend is likely to accelerate, making smaller, unregulated developers riskier.

Impact of Rupee Volatility

As the rupee hovers near ₹90 per USD (January 2026), NRI demand should remain strong. FPI outflows and trade uncertainties may continue to pressure the currency in the near term, making rupee-denominated real estate attractive as a hedge. RBI intervention suggests policy support for stability, which could limit further sharp depreciation but doesn’t guarantee appreciation.

Conclusion

India’s second home is no longer a luxury statement. It is a disciplined allocation decision, made with the same rigor applied to private equity, public equities, and alternative assets. The structural drivers are enduring: India’s UHNI population will grow 50% by 2028, supply of premium real estate remains inelastic, and the currency and geopolitical environment favors geographic diversification into rupee-denominated assets.

For sophisticated allocators—UHNI investors, family offices, global NRIs, and CXOs—a strategic second home in India serves multiple purposes: capital appreciation (8–12% annually in premier locations), currency hedging, generational transfer, lifestyle integration, and portfolio diversification. The best opportunities exist in supply-constrained micro-markets: Mumbai’s Bandra-Worli corridor, Delhi NCR’s Gurugram core, and Bengaluru’s premium IT-corridor neighborhoods.

Investors should approach this not as speculative real estate plays but as part of long-term wealth architecture. A 10-12 year holding horizon, clear family or investment mandate, and geographic diversification across 2–3 cities are hallmarks of serious capital deployment.

The second home is no longer discretionary. It is strategic.