Now Reading: Real Estate Investment for Beginners: Your Gateway to Wealth in the Luxury Era

- 01

Real Estate Investment for Beginners: Your Gateway to Wealth in the Luxury Era

Real Estate Investment for Beginners: Your Gateway to Wealth in the Luxury Era

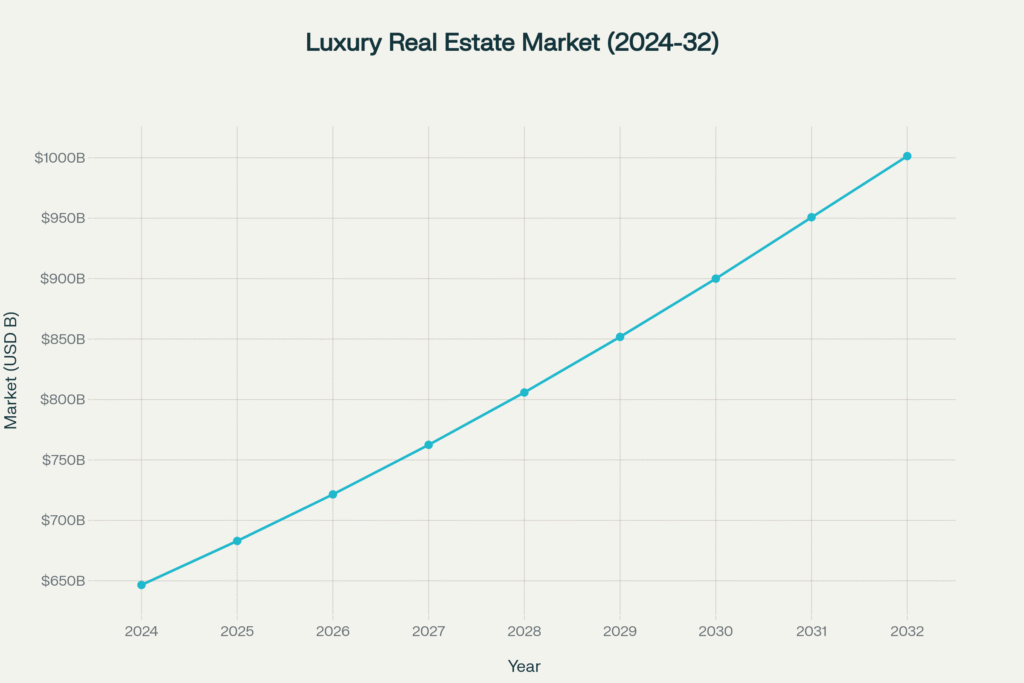

Picture this: A Silicon Valley executive purchases a Mumbai apartment for ₹2.8 crore in 2020. Five years later, it’s worth ₹4.1 crore. A family office acquires a Dubai villa, gains 21% appreciation, secures a Golden Visa, and pays zero taxes. A dynasty family buys a Singapore bungalow that becomes a three-generation wealth anchor. Considering real estate investment for beginners, these aren’t lottery wins—they’re strategic moves in a market poised to reach $1 trillion by 2032, driven by the fastest wealth creation event in modern history.

The Wealth Revolution You Can’t Ignore

Something extraordinary is happening in the world of luxury real estate, and if you’re reading this, you’re either already wealthy or on your way there. The question isn’t whether real estate belongs in your portfolio—it’s how to position yourself before the window closes.

India is minting ultra-high-net-worth individuals faster than any nation in history. We’re talking about a 50% surge in people with over $30 million in assets by 2028. These aren’t just numbers—they’re your future neighbors, competitors, and collaborators in a market that’s fundamentally reshaping how wealth is created and preserved.

The luxury real estate sector has become the ultimate wealth multiplier, delivering 12-18% annual returns while offering something stocks and bonds never can: a tangible asset you can see, touch, and even live in. But here’s what makes this moment unique—traditional barriers are crumbling. You don’t need ₹5 crore anymore to access ultra-luxury properties. Fractional ownership platforms let you own a slice of a penthouse for ₹15 lakh. REITs give you institutional-grade exposure for ₹50,000.

Why Now? The Perfect Storm of Opportunity

Think of wealth creation like surfing. The best surfers don’t wait for the perfect wave to pass—they position themselves early, read the ocean, and ride the momentum. Right now, we’re witnessing three massive waves converging:

The Asia Wealth Tsunami

India isn’t just growing—it’s exploding. By 2028, the country will have over 20,000 ultra-wealthy individuals, up from 13,350 just three years ago. These aren’t inherited fortunes from old money. This is entrepreneurial wealth, tech wealth, global wealth flowing back home. And wealthy people don’t stuff cash under mattresses—they buy real estate.

What makes this different from previous booms? This wealth is sophisticated. These investors have seen global markets, understand diversification, and think in generations, not quarters. They’re not buying property—they’re building dynasties.

The Premiumization Wave

Here’s a fascinating shift: luxury properties now command 62% of all residential sales, up from 52% just last year. But dig deeper and the story gets more interesting. Properties above ₹4 crore saw 85% sales growth while the overall market was essentially flat.

This isn’t a bubble—it’s a fundamental rebalancing. Developers learned their lesson from the 2013-2020 stagnation. They’re building less but building better. Quality over quantity. And wealthy buyers are rewarding this shift with their wallets.

The Global Indian Renaissance

Non-resident Indians are channeling nearly $17 billion into Indian real estate this year alone. But they’re not being sentimental about it. They’re making cold, calculated decisions based on returns that make London (4% appreciation) and New York (3-5%) look pedestrian compared to Mumbai’s 13% and Delhi’s 17%.

The rupee’s weakness? That’s not a bug for NRIs—it’s a feature. It gives them 15-20% currency arbitrage before they even consider property appreciation. Add in rental yields double what they’d get in London, and suddenly India stops being a nostalgic investment and becomes a strategic one.

The Geography of Wealth: Where Smart Money Flows

Let’s talk about where to actually deploy capital, because real estate is intensely local even when you’re thinking globally.

India: The Appreciation Engine

Mumbai remains the emotional heart of Indian luxury real estate, but it’s the suburbs that tell the more interesting story. Santacruz, once considered “too far,” delivered 46% returns over five years for one NRI investor we studied. Why? It offers 80% of Worli’s lifestyle at 60% of the price, with improving infrastructure making it more accessible every month.

Delhi NCR surprises many by leading price appreciation at 17% annually despite moving the highest volume—4,000 luxury units in just six months. This isn’t contradictory; it’s supply-demand economics in action. The city is developer-friendly, land acquisition is aggressive, and wealthy buyers from Punjab, Haryana, and Rajasthan treat Delhi as their natural capital.

Bengaluru offers something unique: tech wealth that understands real estate as an asset class, not an emotional purchase. These are founders who’ve seen startup valuations swing wildly and want hard assets as ballast. They’re buying in Whitefield and Indiranagar not for social status but for portfolio stability.

Dubai: The Tax Optimization Hub

Dubai has evolved from nouveau-riche playground to serious wealth management jurisdiction. The Golden Visa program changed everything—spend $270,000 on property and get 10-year residency, zero taxes, and a business-friendly environment.

For Indian families, this solves multiple problems simultaneously. Wealth diversification? Check. Tax efficiency? Check. International education for children? Check. The fact that properties also deliver 8-12% appreciation with 6-9% rental yields almost feels like a bonus.

Emirates Hills, Palm Jumeirah, Downtown—these aren’t just addresses. They’re wealth preservation instruments with the added benefit of being homes. Indian buyers now represent 22% of Dubai’s foreign real estate transactions, or roughly AED 35 billion annually. That’s not sentiment—that’s strategy.

Singapore: The Dynasty Anchor

Good Class Bungalows in Singapore represent the ultimate expression of generational wealth thinking. Only 2,800 exist, government-protected, supply-constrained forever. One Indian family paid SGD 28 million in 2018; it’s now worth SGD 38 million, but that 36% gain almost misses the point.

What they really bought was a family office jurisdiction with political stability you can’t find elsewhere in Asia, a climate-resilient location that won’t be underwater in 50 years, and a financial ecosystem where managing $100 million is routine, not exceptional. The property isn’t an investment—it’s the anchor around which they’ve structured tax-efficient wealth transfer across three generations.

Investment for Beginners Strategies: From ₹50,000 to ₹50 Crore

The beauty of 2025’s real estate landscape is that entry points exist across the wealth spectrum. Let’s break down your options.

The REIT Revolution: Starting Small, Thinking Big

Real Estate Investment Trusts changed everything about real estate accessibility. For ₹50,000, you can own a piece of Embassy Office Parks—the same portfolio that leases to Google, Microsoft, and Amazon. You get 6-9% annual dividends, stock market liquidity, and professional management you’d never achieve buying a property directly.

The tax treatment is compelling: dividends are tax-exempt, and capital gains get concessional rates. Compare this to rental income taxed at your slab rate (potentially 42.74% including cess), and REITs start looking like the smartest entry point for any portfolio.

Fractional Ownership: Democratizing Ultra-Luxury

Fractional ownership platforms have cracked a code that eluded real estate for centuries: how to make ₹5 crore properties accessible to ₹15 lakh investors. You’re not buying a time-share (please, we’ve evolved past that). You’re buying a legally recognized fraction of a property, recorded on blockchain, with transparent rental income distribution and eventual exit through either sale or platform buyback.

The real innovation? Geographic diversification. You can own fractions of properties in Mumbai, Goa, Lonavala, and Bangalore—spreading risk across markets and property types in ways impossible with direct ownership unless you’re commanding serious wealth.

Direct Ownership: Control Meets Commitment

Owning property outright remains the gold standard for those who can deploy ₹1-2 crore or more. You get absolute control, leverage potential (mortgage 60-70% at 8-9% to generate 18-25% levered returns on equity), tax benefits from depreciation, and the pride of ownership that alternative structures can’t replicate.

But direct ownership demands work. You’re selecting locations, negotiating with developers, ensuring RERA compliance, managing tenants, handling maintenance, and navigating tax implications. This is where wealth creates more wealth—if you have the capital, connections, and commitment to treat it like the serious business it is.

The Risks Nobody Talks About (Until It’s Too Late)

Let’s have an honest conversation about what can go wrong, because real estate’s tangibility creates a dangerous illusion of safety.

Market Cycles Are Real

India experienced seven years of price stagnation from 2013-2020. Properties that should have appreciated sat flat or declined. Liquidity evaporated. Developers went bankrupt. Investors who over-leveraged lost everything.

The lesson isn’t “don’t invest in real estate.” It’s “respect the cycle.” If you’re deploying capital assuming uninterrupted 15% annual appreciation forever, you’re not investing—you’re gambling. Build in conservatism. Assume some years will be flat. Don’t leverage beyond 40% of your net worth. Maintain 24 months of expenses in liquid reserves.

Liquidity Is a Feature, Not a Bug

Real estate’s illiquidity frustrates beginners until they understand it’s actually a wealth preservation mechanism. You can’t panic-sell a property at 2 AM because markets crashed. Transaction costs of 5-8% make you think twice about churning. Three-to-six-month sale cycles force discipline.

But this cuts both ways. If you need money fast—medical emergency, business opportunity, margin call—real estate doesn’t help. This is why sophisticated portfolios maintain 30-40% in liquid instruments and use REITs (which are liquid) for a portion of real estate exposure.

Regulatory Complexity Scales with Ticket Size

RERA transformed Indian real estate from the Wild West into something resembling a regulated market. But compliance creates complexity. Title verification, statutory approvals, environmental clearances, encumbrance checks—miss one and you’ve bought someone else’s legal nightmare.

For purchases above ₹2 crore, professional legal counsel isn’t optional. Budget ₹1-2 lakh for proper due diligence. It’s the best insurance you’ll ever buy.

Case Studies: Strategy in Action

The NRI Tech Executive (Mumbai, 2020-2025)

He spotted an opportunity most missed: Santacruz (East) offered Mumbai’s lifestyle without Worli’s price tag. In 2020, while COVID had everyone spooked, he deployed ₹2.8 crore for a 3-BHK. His logic was simple—NRIs like him wanted Mumbai proximity without South Bombay premiums, Western Express Highway made commutes manageable, and the developer had a clean RERA record.

Five years later: ₹4.1 crore valuation (46% gain), ₹65,000 monthly rent, and a real estate position that outperformed his tech stock portfolio. He managed everything remotely through property management platforms, proving geography isn’t destiny anymore.

The Family Office (Dubai, 2022-2024)

They weren’t buying a villa—they were buying a jurisdiction. AED 12 million ($3.27 million) secured an Emirates Hills property, but more importantly, it secured Golden Visas for the entire family, zero tax on their global income, and a business hub to expand operations.

The 21% appreciation and 4.3% rental yield were almost secondary benefits. What they really bought was optionality: for their children’s education, for business expansion, for succession planning. The property was the vehicle; the strategy was the destination.

The Dynasty Family (Singapore, 2018-2025)

SGD 28 million for a Good Class Bungalow sounds extravagant until you understand what they were actually purchasing: a family office jurisdiction that would structure tax-efficient wealth management across three generations.

The 36% property appreciation paled next to the real value—managing a $50 million AUM with tax exemptions that generate $3 million annual savings. The GCB wasn’t an expense; it was infrastructure for perpetual wealth creation.

Your Action Plan: From Reading to Doing

Months 1-3: Education and Foundation

Stop thinking about “buying property” and start thinking about “constructing a real estate portfolio.” Study Knight Frank’s Wealth Report, CBRE’s market analyses, and JLL’s projections. Understand that information is the only sustainable edge you’ll have.

Calculate your real capacity: liquid net worth minus 24 months expenses minus planned major expenditures. That’s your deployable capital. Don’t stretch beyond this for fear of missing out.

Months 4-6: Strategy Selection

Are you after appreciation (India luxury), yield (Dubai), or preservation (Singapore)? There’s no wrong answer, but there is a wrong fit for your life stage, risk tolerance, and wealth level.

For most beginners: Start with REITs (₹2-5 lakh) for immediate exposure and learning, then add fractional positions (₹10-15 lakh) for luxury segment access, and only then consider direct ownership (₹1 crore+) once you’ve made and learned from smaller mistakes.

Months 7-12: Execution and Optimization

Due diligence isn’t paperwork—it’s your entire return profile. Verify everything. RERA registration, clear titles, statutory approvals, developer track records. Assume everyone is lying until documentation proves otherwise.

Structure financing intelligently. If you can mortgage at 8.5% and generate 12-18% returns, leverage is your friend. But cap total debt at 40% of net worth. Pride of ownership isn’t worth bankruptcy risk.

The Bottom Line: Your Strategic Choice

We’re living through the largest wealth creation event in peacetime history, concentrated in Asia, accelerating in India, and flowing into real estate because wealthy people understand what beginners often miss: real assets compound differently than paper assets.

You can participate from ₹50,000 or ₹50 crore—the strategies scale. But what doesn’t scale is time. Early movers capture arbitrage that disappears once institutional capital awakens. The families building generational wealth today aren’t smarter than you—they just acted while others analyzed.

Real estate isn’t magic. It’s math, strategy, timing, and discipline. But it’s also the asset class that’s created more millionaires than any other in history, offering leverage, tax advantages, inflation hedging, and tangible value that exists independent of market sentiment.

The question isn’t whether luxury real estate will reach $1 trillion by 2032—it will. The question is whether you’ll be positioned to benefit when it does, or you’ll be looking back wondering why you didn’t act when the signals were everywhere.

FAQ Section

What is the minimum capital required to start real estate investing in luxury or premium markets?

The minimum entry point varies by strategy: Indian REITs allow institutional-grade exposure from ₹50,000, fractional ownership in luxury properties starts around ₹10-15 lakh, while direct premium metro property investments typically require ₹1-2 crore or more. International luxury markets (e.g., Dubai, Singapore) often start at $270,000 and above.

How do luxury real estate returns compare to traditional investments like stocks or bonds?

Over the past decade, luxury and premium real estate in India has delivered 12-18% annualized returns, often outperforming equity indices and fixed income. Real estate also offers inflation protection, leverage advantages, and uncorrelated portfolio diversification compared to stocks and bonds—but requires longer holding periods and careful market selection.

What key risks do new investors need to watch for in luxury and cross-border property deals?

Risks include market downturns (e.g., India’s 2013–2020 stagnation), regulatory compliance failures (e.g., missing RERA certification), liquidity constraints (slow sales, high costs), and currency/exchange volatility for cross-border investments. Due diligence, legal vetting, portfolio diversification, and conservative leverage (debt <40% net worth) help mitigate these risks.

What are the main advantages of using REITs or fractional platforms instead of buying property directly?

REITs and fractional platforms democratize access to luxury real estate, offering liquidity, diversification, professional management, and scalable entry points. Investors avoid operational headaches (tenant issues, maintenance) and can trade or liquidate positions more easily. They’re ideal for UHNI/NRI investors building global portfolios or seeking passive income.

How can NRIs optimize their taxes and repatriate funds from Indian real estate investments?

NRIs benefit from 20% long-term capital gains tax in India (with indexation benefits) and can repatriate proceeds after compliance with RBI/CA approvals (Form 15 CA/CB). Most countries have Double Taxation Avoidance Agreements, allowing credits for taxes paid in India. Professional tax advice and holding periods above 24 months often maximize after-tax gains.

YouTube Learning Resources

Free resources to download

Real Estate Investment for Beginners: Executive Summary-01