Now Reading: Privacy Has Become the New Luxury: From Private Islands to Himalayan Hideouts Transform Global Wealth Investment

- 01

Privacy Has Become the New Luxury: From Private Islands to Himalayan Hideouts Transform Global Wealth Investment

Privacy Has Become the New Luxury: From Private Islands to Himalayan Hideouts Transform Global Wealth Investment

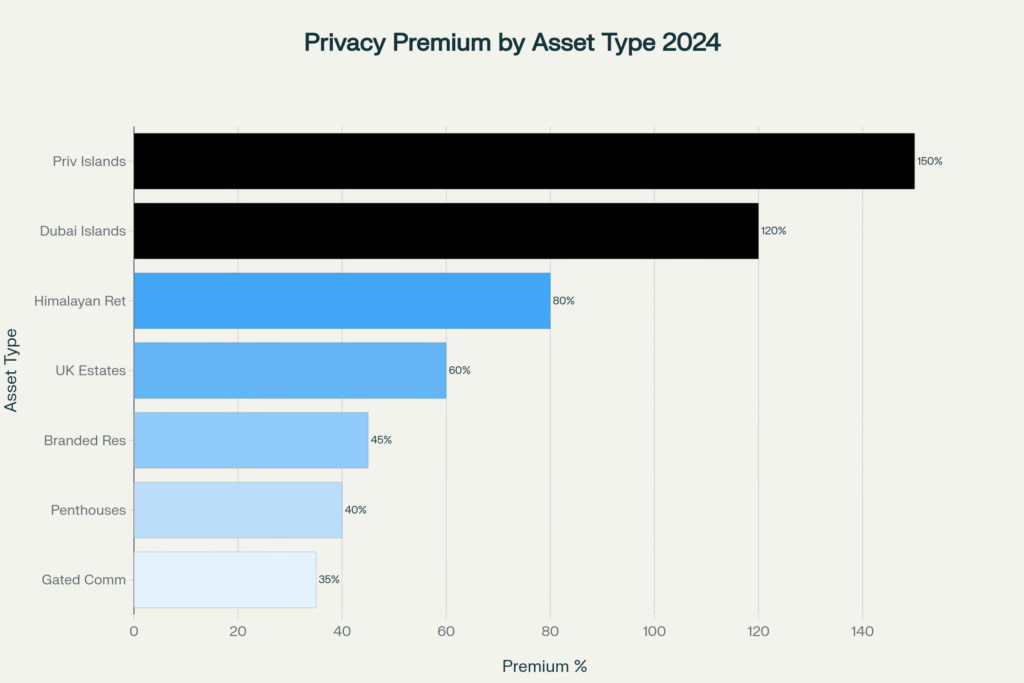

Privacy has emerged as the ultimate luxury real estate commodity for Ultra High Net Worth Individuals (UHNIs) and High Net Worth Individuals (HNIs), fundamentally transforming global real estate investment patterns. This paradigm shift—from ostentatious display to sophisticated seclusion—is driving unprecedented demand for exclusive assets, creating a $276 billion global luxury real estate market projected to reach $538 billion by 2034. India leads this transformation with a projected 50% increase in UHNI population by 2028, while private islands command 150% premiums and Himalayan retreats witness 45% annual growth, establishing privacy as the ultimate status symbol for the global elite.

Market Dynamics Reshaping Wealth

Worldwide UHNI Surge: Demographics Driving Demand

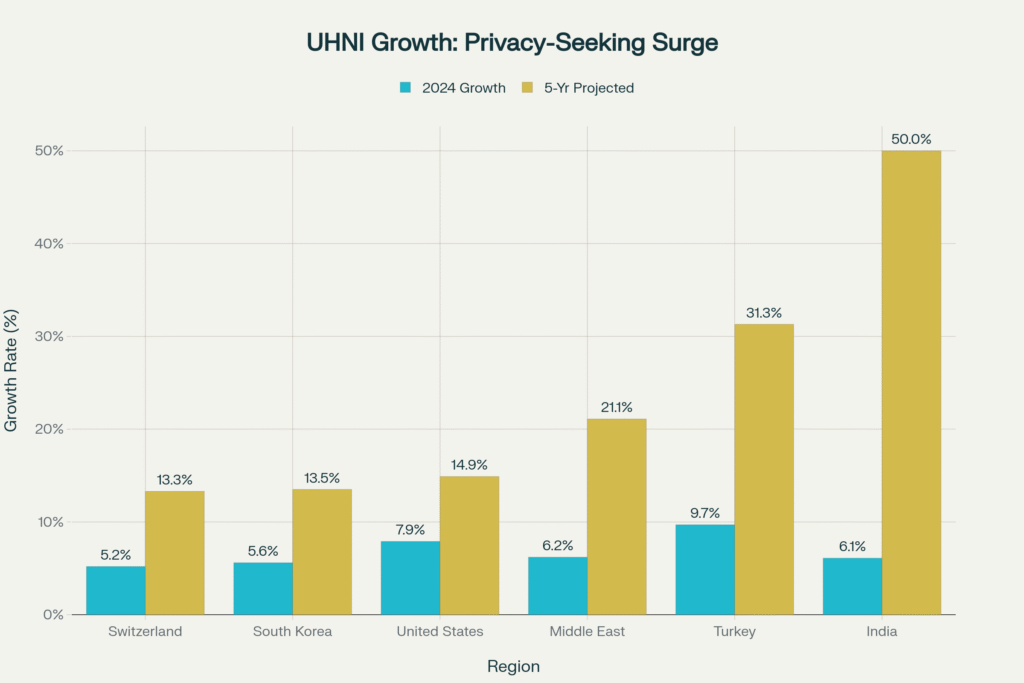

The world’s ultra-wealthy are experiencing unprecedented growth, with Knight Frank’s 2024 Wealth Report revealing a 4.2% global increase in UHNI population to 626,619 individuals. This expansion varies significantly by region, creating distinct investment opportunities and market dynamics that sophisticated investors must understand.

India emerges as the undisputed leader in UHNI growth, with projections indicating a remarkable 50% increase from 13,263 individuals in 2023 to 19,908 by 2028. This surge dwarfs even China’s performance, which recorded its second consecutive annual decline despite previously dominating wealth creation metrics. Turkey follows with 31.3% projected growth, while the United States maintains steady expansion at 14.9%.

The Middle East continues its strategic importance, with 6.2% regional growth driven by geopolitical stability and tax-advantaged jurisdictions. These demographic shifts directly translate into luxury real estate demand, particularly for privacy-focused assets that offer both lifestyle enhancement and wealth preservation benefits.

Regional Contrast: Privacy-Driven Price Uplifts Around the Globe

Dubai’s Private Island Renaissance represents perhaps the most compelling case study in privacy-luxury convergence. The emirate’s artificial islands, including the newly developed Naia Island between Burj Al Arab and Jumeirah Bay, command premiums of 120% over standard luxury properties. With 6,700 millionaires relocating to Dubai in 2024 and 66% of UHNIs making it their second home, the city’s strategic location within 6-8 hours of 65% of the world’s population creates unparalleled accessibility.

India’s Himalayan luxury segment showcases the most dramatic growth trajectory, with mountain retreats experiencing 45% annual increases in transaction values. Projects like Terra Grande in Sirmaur and Symphony Mukteshwar at 7,500-foot elevation cater to affluent buyers seeking climate-conscious investments and wellness-focused living. This trend reflects broader climate change awareness driving investment toward cooler, more sustainable locations.

Singapore’s wealth hub status continues strengthening, with 1,600 millionaires expected to relocate in 2025, attracted by political stability, robust financial services, and top-tier infrastructure. The island nation’s 242,200 millionaires and 30 billionaires create sustained demand for ultra-prime developments, with new projects launching throughout 2025 focusing on sustainability and wellness amenities.

Quantitative Insights: The Statistics Powering the Privacy Premium

Booming High-End Property Markets

The global luxury residential real estate market demonstrates extraordinary growth momentum, expanding from $220 billion in 2020 to $276 billion in 2024, with projections reaching $538 billion by 2034—representing a robust 6.9% CAGR. This growth significantly outpaces traditional real estate sectors, highlighting the premium investors place on exclusive, private properties.

India’s luxury market leads global expansion with a stunning 21.81% CAGR, growing from $38.02 billion in 2024 to a projected $101.92 billion by 2029. This explosive growth reflects the nation’s economic ascent and the increasing sophistication of its wealthy class. CBRE data reveals luxury home sales (priced above ₹4 crore) surged 37.8% year-over-year to 12,625 units in the first nine months of 2024.

Private island investments represent the apex of privacy premiums, with the sector growing from $1.2 billion in 2024 to a projected $4.5 billion by 2034—a remarkable 13.7% CAGR. This fractional ownership market democratizes access to ultra-exclusive assets while maintaining the privacy and exclusivity that drives demand.

Transaction Value Analysis and Portfolio Flows

Ultra-luxury property transactions (priced above ₹40 crore) in India reached ₹4,754 crore across 59 units in 2024, marking a 17% value increase despite only marginal unit growth, indicating significant price appreciation. Mumbai dominated with 52 transactions, followed by Delhi-NCR with three units, demonstrating the concentration of ultra-wealth in established financial centers.

NRI investment patterns reveal a strategic shift toward luxury assets, with their share increasing from 32% to 47% of premium property purchases. This trend reflects favorable exchange rates, improved transparency through RERA implementation, and NRIs’ global perspective on luxury property standards. ANAROCK projects NRI investments will reach $14.9 billion by 2025, with luxury properties commanding a disproportionate share.

Equity investments in Indian real estate surged 48% to $3.8 billion in Q3 2024, with total investments reaching $10.2 billion in the first nine months—demonstrating institutional confidence in the sector’s growth prospects. Foreign Institutional Investors (FIIs) maintain 65% market share, while domestic investors’ participation grows, indicating market maturation.

Emotional & Lifestyle Motivations: Understanding the Allure of Seclusion

Status Reinvented: From Flashy Showmanship to Private Sophistication

The traditional paradigm of luxury real estate—centered on ostentatious display and public recognition—has fundamentally shifted toward sophisticated privacy and exclusive experiences. Today’s UHNIs and HNIs prioritize properties that offer complete discretion, advanced security, and personalized environments over mere size or cost.

Wellness-centric design has become paramount, with buyers gravitating toward homes that promote physical and mental well-being through circadian lighting, air purification systems, and biophilic designs integrating natural elements. This trend reflects post-pandemic priorities where home spaces must accommodate remote work, leisure, and family life simultaneously.

Technology integration serves not just convenience but privacy protection, with AI-driven surveillance, biometric access systems, and smart home automation providing both security and seamless living experiences. These features appeal particularly to tech-savvy HNIs and NRIs accustomed to global standards of technological sophistication.

Wealth Transfer & Status Shifts Across Generations

The rise of “Everyday Millionaires”—created by soaring home equity and market appreciation—is expanding the luxury buyer pool beyond traditional UHNI demographics. Home prices surging 47% over five years have created new equity-rich buyers entering luxury markets for the first time, driving demand for privacy-focused properties that offer both lifestyle enhancement and investment security.

Younger luxury buyers (Millennials and Gen Z) are redefining luxury standards, expecting turnkey layouts, smart technology, sustainable features, and flexible spaces accommodating modern lifestyles. With $124 trillion in assets expected to transfer to the next generation by 2048, these preferences will increasingly shape luxury real estate development and investment strategies.

Family office proliferation reflects the growing sophistication of wealth management, with HNIs establishing dedicated structures for multi-generational wealth preservation. This trend drives demand for compound-style properties that can accommodate extended families while maintaining privacy and security for all residents.

Investment Roadmap: From Short-Term Wins to Long-Term Gains

Tactical Entry Points for 2025

Current market conditions present compelling entry opportunities before the next growth surge accelerates pricing. Delhi-NCR’s 72% growth in luxury sales and Mumbai’s sustained 18% expansion indicate strong momentum continuing into 2025. Early positioning in emerging markets like Pune (810 luxury units sold) and Hyderabad (emerging ultra-luxury destination) offers superior risk-adjusted returns.

Himalayan luxury developments represent the highest growth potential, with projects like Terra Grande offering 100-acre villa estates designed by Studio Lotus, featuring local materials and global design sensibilities. These developments capitalize on climate change awareness and the desire for year-round comfortable living environments.

Dubai’s private island projects provide immediate Golden Visa benefits for $2 million+ investments, combining lifestyle and strategic residency advantages. With zero personal income tax and strategic global positioning, these assets serve dual purposes as residences and wealth preservation vehicles.

Diversification Strategies for the 2025–2027 Window

Tier-2 city expansion in India offers compelling value propositions, with cities like Chandigarh, Kochi, and Ahmedabad showing strong luxury market development. These markets benefit from improved infrastructure, growing local wealth creation, and attractive pricing relative to primary metros.

Southeast Asian opportunities present diversification benefits, particularly in Thailand and the Philippines, where private island fractional ownership models are emerging. These markets offer currency arbitrage opportunities and access to growing regional wealth.

European countryside estates may present post-Brexit opportunities, particularly in the UK where luxury market corrections create entry points for strategic investors. However, regulatory changes regarding non-dom status require careful legal structuring.

Future-Proof Strategies: Safeguarding Wealth Through 2030

Climate-resilient locations will become increasingly valuable as environmental consciousness drives investment decisions. Properties in stable climates with sustainable infrastructure and water security will command growing premiums as climate change impacts intensify.

Technology-forward communities integrating AI, IoT, and smart city infrastructure will attract next-generation luxury buyers who prioritize seamless connectivity and automated living systems. These developments will likely concentrate in established tech hubs with regulatory frameworks supporting innovation.

Multi-generational compounds designed for family office structures will gain prominence as wealth transfer planning becomes more sophisticated. These properties must accommodate diverse family needs while maintaining privacy and security for all residents.

Case Study 1: Dubai’s Private Island Renaissance – Naia Island Excellence

Dubai’s transformation into a global UHNI destination finds its ultimate expression in the Naia Island development, positioned strategically between the iconic Burj Al Arab and Jumeirah Bay Island. This ultra-luxury project exemplifies the privacy premium in action, offering what industry insiders describe as “the most exclusive coastal development Dubai has ever seen.”

The development strategy deliberately emphasizes scarcity and exclusivity, with ultra-low density featuring far fewer residences than Palm Jumeirah’s 4,000 plots or Jumeirah Bay’s 128 plots. This approach creates genuine rarity in a market where exclusivity drives premium pricing. Cheval Blanc Dubai, LVMH’s first Gulf property, anchors the island with only 30 suites and 40 beachfront villas, establishing an unprecedented luxury hospitality benchmark in the region.

Investment metrics validate the privacy premium thesis: With Dubai recording 431 residential transactions exceeding $10 million in 2023—the highest globally—private island properties represent the apex of this market. The emirate’s strategic advantages include zero personal income tax, Golden Visa eligibility for $2 million+ investments, and location within 6-8 hours of 65% of the world’s population.

CBRE research indicates 66% of UHNIs with assets exceeding $30 million are making Dubai their second home, driven by the lifestyle integration Dubai offers. The city’s regulatory framework provides wealthy individuals with innovative wealth protection and enhancement solutions, while its established infrastructure supports the sophisticated needs of global ultra-wealthy families.

For complete case study details with investment analysis and market projections, refer to: Naia Island Dubai Investment Overview

Case Study 2: India’s Himalayan Luxury Emergence – Terra Grande Innovation

The Himalayan luxury segment represents perhaps the most compelling privacy-luxury convergence story globally, with Terra Grande in Sirmaur, Himachal Pradesh, exemplifying this transformation. Developed by Eldeco Group—with over 35 years of experience and 200+ successful projects—this development demonstrates how climate change awareness and wellness priorities are reshaping luxury real estate investment.

Located at the foothills of Kasauli hills, Terra Grande offers a new frontier in refined, nature-first living where timeless design and environmental harmony converge. The project features villas designed by Studio Lotus, integrating Himalayan stone, reclaimed wood, and artisanal finishes with global design sensibilities while respecting local materiality and cultural context.

Market performance data reveals extraordinary growth momentum: Himalayan retreats are experiencing 45% annual increases in transaction values, driven by affluent buyers from Delhi-NCR seeking year-round comfortable climates. The 2-3 hour drive from Delhi provides accessibility while maintaining the seclusion and privacy these buyers prioritize.

The development follows a low-density model with only three villas per acre, ensuring privacy and expansive space for each residence. Premium amenities include infinity pools, wellness spas, reading lounges, walking trails, and clubhouses that foster both social connection and quiet retreat opportunities.

Investment rationale extends beyond lifestyle considerations: With climate change driving preferences toward cooler locations and improved connectivity making mountain destinations more accessible, these properties offer both immediate lifestyle benefits and long-term appreciation potential. The segment’s growth trajectory suggests early investors will benefit from both rental yields and capital appreciation as demand intensifies.

For detailed project specifications and investment analysis, visit: Terra Grande Himalayan Luxury

Case Study 3: Singapore’s Wealth Magnetism – The UHNI Relocation Story

Singapore’s emergence as Asia’s premier wealth hub demonstrates how strategic government policy and infrastructure excellence create UHNI migration patterns that drive luxury real estate demand. With 1,600 millionaires expected to relocate to the “Lion City” in 2025, Singapore exemplifies how privacy, security, and lifestyle integration attract global wealth.

The city-state’s wealth concentration is remarkable: 242,200 millionaires and 30 billionaires call Singapore home—a 62% increase over the past decade. This concentration creates a self-reinforcing ecosystem where luxury amenities, services, and infrastructure develop to serve this affluent population, further enhancing the city’s appeal to additional wealthy individuals.

Knight Frank’s Asia-Pacific Quality of Life report ranks Singapore first regionally, achieving top-five rankings across political stability, developed financial services, skilled workforce, and high living standards with established healthcare and elite education systems. These fundamentals create the foundation for sustained luxury real estate demand.

New luxury developments launching in 2025 represent the cutting edge of super-prime construction, featuring sustainable practices, smart home technology, and wellness amenities that set global standards. Projects like W Residences embody the integration of hospitality expertise with residential luxury, appealing to internationally mobile UHNIs who expect consistent service quality across their global property portfolios.

The investment thesis for Singapore luxury real estate rests on sustained millionaire migration, limited land availability, and government policies favoring wealth attraction. With new developments sitting “at the pointiest edges of super prime home building,” early positioning in this market offers exposure to both lifestyle enhancement and capital appreciation driven by sustained demand and supply constraints.

For comprehensive Singapore luxury market analysis: Singapore Luxury Homes Market Report

Insider Advice: Advanced Strategies for Luxury Investors

1. UHNI Portfolio Diversification Strategy with Privacy Focus

Optimal allocation for privacy-seeking investors should emphasize geographic and asset-type diversification while maintaining privacy as the central theme. Recommended structure: 30-40% primary luxury residence in privacy-focused location, 20-25% secondary retreat property (mountains/islands), 15-20% investment properties in emerging luxury markets, 10-15% branded residences for rental yield, and 5-10% ultra-exclusive trophy assets like private islands or historic estates.

2. Golden Visa Optimization Through Strategic Real Estate Investment

Dubai, Portugal, and Greece offer compelling Golden Visa programs tied to real estate investment, providing residency benefits alongside privacy and luxury. Dubai’s $2 million threshold for 10-year residency, combined with zero personal income tax, creates a powerful wealth preservation vehicle. Portugal’s €500,000 program (though being phased out) and Greece’s €250,000 option provide European Union access while building luxury property portfolios.

3. Climate-Resilient Luxury Property Selection Methodology

Future-proof luxury investments by evaluating water security, stable climate patterns, renewable energy infrastructure, and natural disaster risk profiles. Himalayan properties benefit from cooler temperatures and abundant water resources, while carefully selected island properties with sustainable infrastructure and elevation above sea-level rise projections offer long-term security. Properties with net-zero energy capabilities and independent water systems command growing premiums.

4. Technology Integration ROI Maximization in Luxury Properties

Smart home technology should prioritize security, energy efficiency, and personalization to maximize both lifestyle benefits and resale value. AI-driven security systems with facial recognition, automated climate and lighting optimization, and integrated property management platforms reduce operating costs while enhancing privacy. Properties with comprehensive IoT integration typically command 15-25% premiums over comparable non-smart luxury homes.

5. Family Office Real Estate Structuring for Multi-Generational Privacy

Establish sophisticated ownership structures that optimize tax efficiency, provide privacy protection, and accommodate family governance requirements. Utilize offshore holding companies, family limited partnerships, and discretionary trusts to maintain control while minimizing tax exposure and protecting against litigation risks. Structure properties within family office frameworks to facilitate smooth wealth transfer while maintaining operational privacy and security standards.

Risk Factors & Counterarguments

Market Risks & Policy Challenges

Regulatory risk represents the most significant threat to luxury real estate investments, particularly for international buyers navigating changing political landscapes. The UK’s recent non-dom tax regime modifications demonstrate how quickly policy shifts can impact foreign investment attractiveness. London’s super-prime market, while showing recent resilience, faces continued uncertainty from potential additional taxation on foreign buyers and property wealth.

Currency volatility creates substantial exposure for cross-border luxury investments. Properties priced in strengthening currencies (USD, AED) may become prohibitively expensive for buyers holding weakening currencies (INR, EUR), potentially reducing demand pools and affecting liquidity. Investors must consider hedging strategies or natural currency matching between income sources and investment locations.

Market oversupply concerns emerge in several luxury segments, particularly in markets where developers have responded aggressively to recent demand surges. Some analysts warn that luxury apartment markets in prime Indian cities may face inventory gluts as supply increases 5-10% annually while buyer growth, though strong, may not match supply expansion rates.

Environmental Threats & Sustainability Concerns

Sea-level rise poses existential threats to island and coastal luxury properties, regardless of current premiums. While private islands command 150% premiums today, those without significant elevation or adaptive infrastructure may face declining values as climate risks materialize. Investors must evaluate not just current exclusivity but long-term environmental viability.

Water scarcity and infrastructure challenges affect luxury mountain developments, particularly in regions like Himachal Pradesh where rapid development may strain local resources. Properties dependent on groundwater or monsoon patterns face potential service disruptions that could affect desirability and operational costs.

Regulatory restrictions on coastal and mountain development are tightening globally as environmental consciousness increases. Future limitations on construction, renovation, or expansion could constrain property enhancement and adaptation capabilities, affecting long-term value preservation.

Liquidity and Exit Strategy Limitations

Ultra-luxury properties, particularly unique assets like private islands, suffer from limited buyer pools and extended marketing periods. Unlike standard luxury properties, these assets may require 12-24 months or longer to sell, creating liquidity constraints for investors requiring rapid capital access.

Transaction costs for ultra-luxury properties significantly exceed standard real estate, including specialized legal, tax, and advisory fees, along with higher broker commissions and longer due diligence periods. These costs can approach 8-12% of property values, materially affecting net returns.

Market timing risks intensify at higher price points, as luxury markets demonstrate greater volatility than mass markets. Economic downturns disproportionately affect discretionary luxury spending, potentially creating significant value declines during market stress periods.

Privacy Luxury Investment Intelligence

What minimum investment threshold defines the privacy luxury real estate segment?

The privacy luxury segment typically begins at $2-3 million USD globally, though regional variations exist. In India, luxury properties start at ₹4 crore ($480,000), while ultra-luxury begins at ₹40 crore ($4.8 million). Private islands and exclusive retreats generally require $5-10 million minimum investment, with premium locations commanding $20-50 million or more. The key differentiator is not just price but privacy infrastructure, exclusive access, and personalized service levels that justify premium pricing.

How do UHNI investors optimize tax efficiency across multiple luxury property jurisdictions?

Sophisticated UHNI investors utilize multi-layered ownership structures combining offshore holding companies, family limited partnerships, and residence-based planning. Dubai offers zero personal income tax with Golden Visa benefits for $2 million+ investments. Singapore provides territorial taxation with sophisticated wealth management infrastructure. Investors typically engage specialized tax advisors to structure ownership through jurisdictions offering optimal treaties, privacy protection, and estate planning benefits while maintaining operational control and lifestyle access.

What privacy infrastructure should investors evaluate when assessing luxury properties?

Essential privacy infrastructure includes perimeter security systems, surveillance technology with AI analytics, biometric access controls, secure communication networks, and staff confidentiality protocols. Properties should offer physical privacy from public observation, paparazzi protection, and secure transportation access (private helipads or guarded entries). Advanced properties feature isolated power grids, independent water systems, and emergency evacuation capabilities. The investment value correlates directly with privacy infrastructure sophistication and maintenance capabilities.

How are climate change considerations affecting luxury real estate investment strategies?

Climate-conscious investors prioritize elevation, water security, stable weather patterns, and renewable energy infrastructure. Himalayan properties benefit from cooling temperatures and abundant water resources, while coastal properties require elevation above projected sea-level rise and storm surge protection. Sustainable luxury developments with net-zero energy capabilities and water recycling systems command growing premiums as environmental awareness increases. Properties must demonstrate long-term viability under various climate scenarios to maintain investment value.

The Privacy Revolution Continues

The transformation of privacy into luxury real estate’s ultimate commodity represents more than a market trend—it signals a fundamental shift in how global wealth preserves and enhances itself in an increasingly connected yet uncertain world. As India’s UHNI population surges 50% toward 19,908 individuals by 2028 and global luxury real estate approaches $538 billion by 2034, the investors who recognize privacy’s primacy will capture disproportionate value creation.

The convergence of demographic growth, technological advancement, and climate consciousness creates unprecedented opportunities for sophisticated investors. From Himalayan retreats experiencing 45% annual growth to Dubai’s private islands commanding 120% premiums, the privacy luxury segment demonstrates resilience and growth potential that traditional real estate sectors cannot match.

Strategic positioning today—whether in Terra Grande’s Himalayan villas, Dubai’s exclusive island developments, or Singapore’s UHNI migration hubs—offers exposure to multiple growth drivers simultaneously: demographic expansion, geographic diversification, climate adaptation, and lifestyle evolution. The families and individuals who secure prime privacy-focused assets now will benefit from both immediate lifestyle enhancement and long-term wealth preservation as privacy becomes increasingly scarce and valuable.

The invitation to action is clear: engage specialized advisors, evaluate portfolio allocation toward privacy luxury assets, and position strategically across emerging high-growth markets. The privacy revolution in luxury real estate has begun—and the most astute investors are already securing their positions in this transformation.

YouTube Video Resources

Free resources to download

Privacy as the New Luxury: Comprehensive Investment Guide