Now Reading: Luxury Real Estate Rental Yields vs Capital Gains: 2025 Investment Guide

- 01

Luxury Real Estate Rental Yields vs Capital Gains: 2025 Investment Guide

Luxury Real Estate Rental Yields vs Capital Gains: 2025 Investment Guide

The Defining Question for Modern Wealth Builders

Picture this: A tech entrepreneur in Silicon Valley, a second-generation industrialist in Mumbai, and a hedge fund manager in London—all grappling with the same question that keeps them awake at night. Should they chase the steady heartbeat of monthly rental income, or bet big on the explosive potential of property values doubling within a decade?

This isn’t just an investment decision. It’s a philosophy. A reflection of how you view wealth, risk, and legacy.

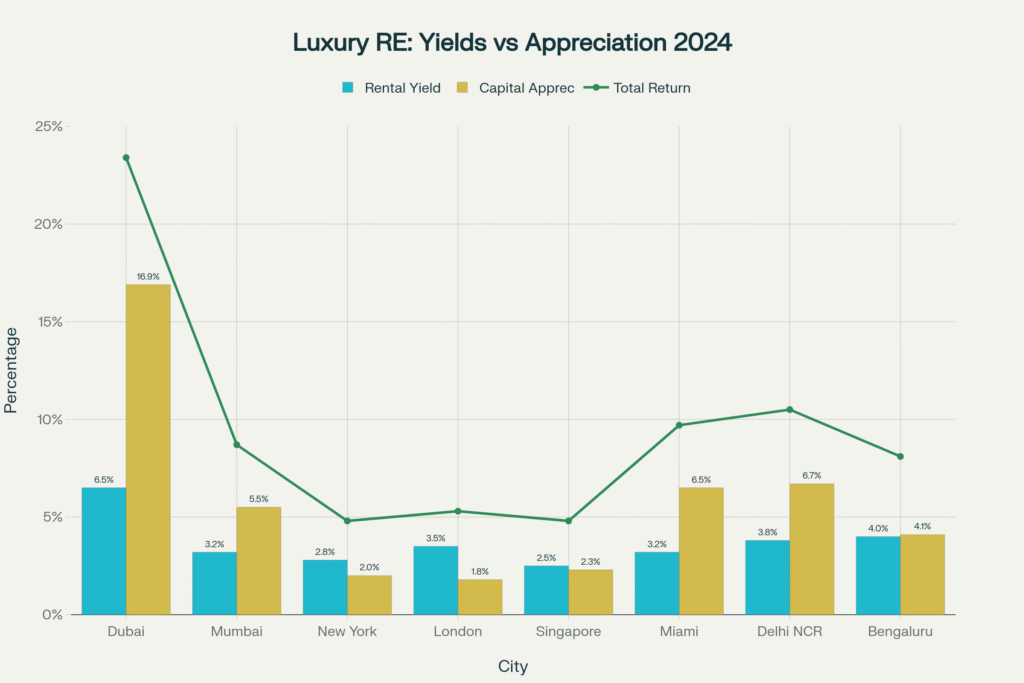

In 2025, as India’s luxury real estate market explodes with 305% growth since 2020 and Dubai delivers jaw-dropping 23% annual returns, the stakes have never been higher—or the opportunities more intoxicating. The Ultra-High-Net-Worth universe is witnessing a seismic shift: property has become the new status symbol, surpassing Rolexes, Ferraris, and even private jets as the ultimate marker of success.

This guide cuts through the complexity to reveal something powerful: the most sophisticated investors aren’t choosing between rental yields and capital gains. They’re mastering both, building portfolios that generate income today while creating generational wealth tomorrow.

Two Paths to Real Estate Riches

The Yield Hunter: Cash Flow as King

Meet Rajesh, a 52-year-old entrepreneur who sold his pharmaceutical business for ₹80 crore. After decades of operational intensity, he craves predictability. His strategy? Commercial Grade A offices in Gurugram’s Cyber City and Dubai Marina apartments—assets generating 8-10% annual yields that fund his lifestyle without touching principal.

Every month, ₹32 lakh hits his account like clockwork. No stock market volatility. No business headaches. Just clean, recurring income from tenants who signed multi-year leases.

The Yield Strategy Appeals When You:

- Need regular income to fund lifestyle or retirement

- Value sleep-at-night stability over home-run returns

- Can handle tenant management (or hire professionals)

- Operate in high-tax environments where capital gains get favorable treatment

- Plan shorter investment horizons (3-7 years)

Where Yield Hunters Thrive:

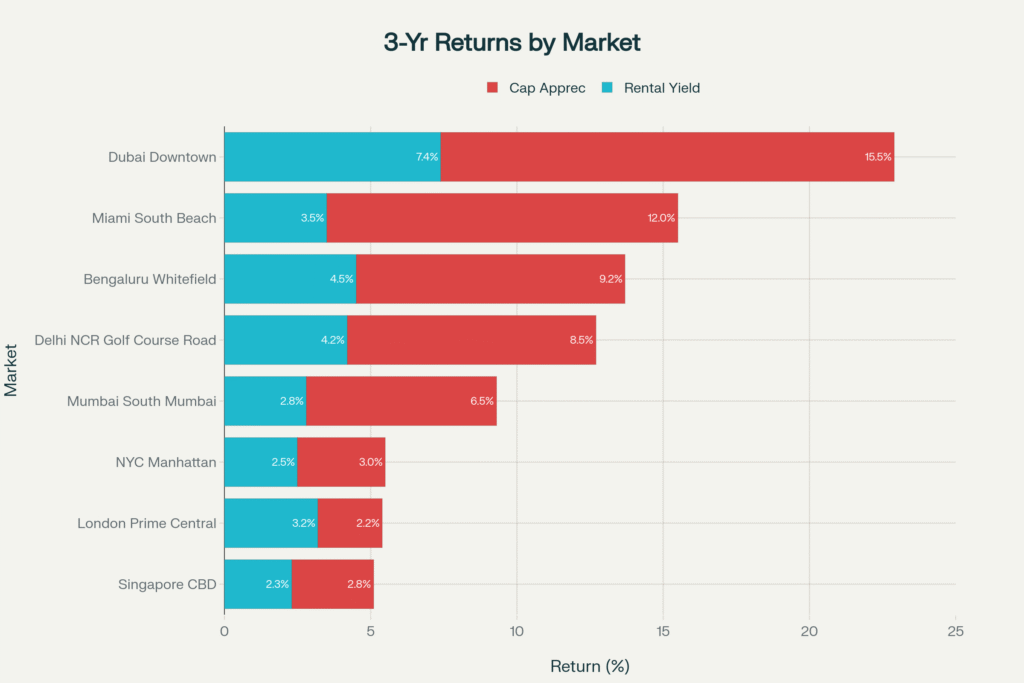

- Dubai Marina: 6.5-7.4% yields from expatriate professionals in waterfront luxury

- Bengaluru Tech Corridors: 4-4.5% yields plus tech sector stability

- Commercial Offices: 8-10% returns from corporate tenants with multi-year lock-ins

- Delhi NCR Suburban Premium: 3.8-4.2% from growing satellite cities

The psychological comfort of predictable income cannot be overstated. While your friends obsess over property price fluctuations, you’re collecting rent checks and compounding wealth systematically.

The Growth Maverick: Building Generational Fortunes

Now meet Priya, a 38-year-old tech executive with equity compensation creating wealth faster than she can spend it. She doesn’t need rental income—her salary covers lifestyle multiples over. What she needs is legacy.

Her play: Pre-launch luxury projects in Delhi NCR’s Golf Course Road, branded residences commanding ₹80,000 per square foot, Dubai Downtown properties positioned in the path of progress. She’s betting on property values tripling within a decade, accepting zero interim cash flow for explosive terminal value.

In 2022, she purchased a DLF pre-launch apartment for ₹18 crore. Today? It’s worth ₹32 crore. That’s ₹14 crore of wealth creation while she focused on her career—no tenants, no maintenance calls, just pure appreciation.

The Appreciation Strategy Fits When You:

- Have substantial income covering lifestyle needs

- Possess long time horizons (7-15+ years)

- Can stomach market volatility without panic selling

- Prioritize building net worth over generating cash flow

- Seek tax-efficient wealth creation (12.5% long-term capital gains in India)

Where Growth Mavericks Dominate:

- Dubai Downtown: 15.5% annual appreciation riding the emirate’s explosive growth

- Delhi NCR Prime: 6.7-8.5% appreciation in supply-constrained micro-markets

- Branded Residences: 12-18% appreciation from brand premium and scarcity

- Mumbai Ultra-Luxury: Sea-facing properties with cultural cachet and limited supply

The appreciation strategy requires nerve. You’re essentially saying, “I believe this asset will be worth dramatically more in a decade than anyone thinks today.” But when you’re right? The wealth creation can be genuinely life-changing.

The Global Landscape: Where the Smart Money Is Moving

Dubai: The Tax-Free Wealth Accelerator

Imagine earning ₹50 lakh in annual rental income and keeping every single rupee. No income tax. Then imagine that same property appreciating 16% annually. This isn’t fantasy—it’s Dubai in 2024.

A ₹5 crore Dubai Marina apartment delivers ₹32.5 lakh annual rent (6.5% yield) while the property value surges toward ₹8.2 crore over five years. Total wealth creation: ₹4.8 crore, mostly tax-free.

The emirate’s Golden Visa program sweetens the deal—invest $545,000+ and receive 10-year residency for your entire family, with zero tax on global income and the freedom to conduct business across the Middle East.

For HNI/UHNI investors, Dubai isn’t just a market—it’s a jurisdiction arbitrage play, combining high yields, strong appreciation, and tax optimization in one elegant package.

India: The Emotional and Economic Powerhouse

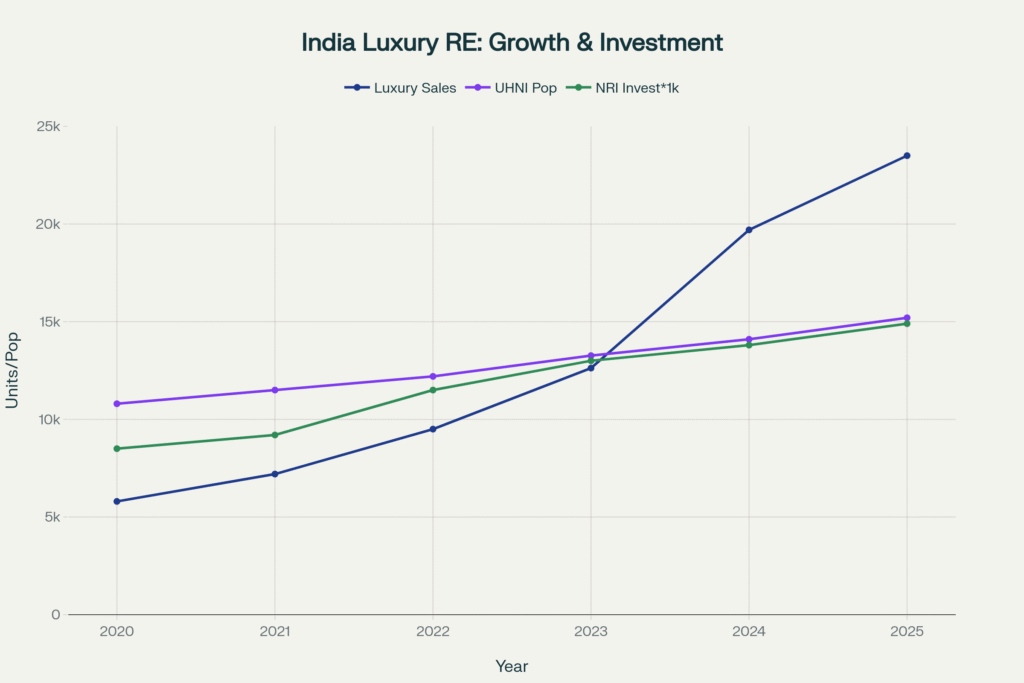

India’s luxury market isn’t just growing—it’s exploding. From 5,800 luxury units sold in 2020 to 23,500 projected for 2025, the trajectory resembles a rocket more than a real estate market.

Why? Three forces converging:

The Wealth Tsunami: India’s UHNI population surging from 10,800 to 15,200 between 2020-2025, with these individuals collectively controlling $1.5 trillion. They’re younger, bolder, and unapologetic about showcasing success through real estate.

The NRI Factor: 32 million diaspora Indians sending home $15 billion annually for property, driven by emotional connection, rupee advantages (their dollars buy 20-30% more), and eventual return plans.

The Prestige Revolution: Real estate has become India’s ultimate status symbol. Owning a ₹25 crore apartment in DLF Camellias or Lodha World Towers signals you’ve arrived in ways luxury cars and watches simply cannot.

Delhi NCR rocketed from 16th to 6th globally in prime price growth. Mumbai commands the world’s 7th position. Bengaluru jumped from 27th to 13th, fueled by returning Silicon Valley executives.

But India’s magic lies in balance—modest 3-4% yields combined with robust 5-9% appreciation create total returns of 8-13% annually, attractive without the regulatory uncertainty of pure emerging markets.

London: The Wealth Preservation Vault

Ultra-prime London offers something Dubai and India cannot: centuries of rule-of-law, political stability, and cultural prestige. Yes, yields are modest (3-3.5%) and appreciation subdued (2-2.5%), but that’s precisely the point.

A ₹25 crore Mayfair apartment isn’t an investment—it’s a statement. It provides your children access to Harrow and Oxford, offers a hedge against rupee depreciation, and serves as a safe haven during geopolitical turbulence.

Think of London real estate as the “gold” of your property portfolio—not for explosive returns, but for insurance against chaos.

The Convergence Strategy: Having Your Cake and Eating It

Here’s what the most sophisticated wealth managers aren’t telling their clients: you don’t have to choose.

The optimal strategy blends both approaches, creating a portfolio that generates income while appreciating aggressively. Here’s the blueprint:

The ₹10 Crore Balanced Portfolio

₹4 Crore: Appreciation Core (40%)

- Delhi NCR pre-launch luxury (₹2 crore)

- Dubai Downtown emerging zones (₹2 crore)

- Target: 10-15% annual appreciation, zero cash flow

₹3 Crore: Yield Foundation (30%)

- Commercial office space, Gurugram Cyber City (₹1.5 crore)

- Dubai Marina apartment (₹1.5 crore)

- Target: 6-8% annual yield, steady income

₹2 Crore: Branded Prestige (20%)

- DLF, Oberoi, or Four Seasons branded residence

- Target: 12-15% appreciation + lifestyle utility

₹1 Crore: Liquid Buffer (10%)

- Real Estate Investment Trusts (REITs)

- Target: 7-9% distributions, 3-day exit liquidity

Expected Outcome:

- Annual rental income: ₹30-40 lakh (3-4% portfolio yield)

- Annual appreciation: ₹60-80 lakh (6-8% value growth)

- Total return: 9-12% annually with diversification reducing single-market risk

This architecture delivers the psychological comfort of regular income while positioning for wealth-multiplying appreciation. You’re not guessing which strategy will win—you’re capturing both.

The Branded Residences Revolution: Why Ultra-Luxury Matters

Walk into a DLF Camellias apartment priced at ₹35 crore and ask yourself: what justifies paying 40% more than comparable non-branded luxury?

The answer reveals itself the moment the 24/7 concierge greets you by name, when the hotel-grade housekeeping disappears your daily clutter, as the spa therapist arrives at your door for your weekly massage. This isn’t real estate—it’s curated living.

But forget the fluff—let’s talk numbers. Branded residences deliver:

- 12-18% annual appreciation vs 5-10% traditional luxury (50-80% higher)

- 15-25% rental yield premiums from professional management and brand pull

- 6-9 month sale timelines vs 12-15 months for non-branded (critical for UHNI liquidity)

A Mumbai business leader explained his ₹80 crore purchase simply: “I’m not buying an apartment. I’m buying access to 450 families of my caliber. The gentry matters more than the amenities.”

That’s the essence of branded luxury—social capital. These properties function as exclusive clubs, networking platforms, and status validators that financial statements cannot capture.

For family offices and industrialists allocating ₹100+ crore to real estate, 10-15% in branded residences provides both prestige positioning and superior financial performance.

Strategic Plays: The Moves That Create Outsized Returns

The Pre-Launch Discount Arbitrage

Imagine buying ₹100 worth of stock for ₹85, then watching it hit ₹130 before you’ve paid the full amount. That’s the pre-launch luxury property game.

Developers offer 10-15% discounts 12-18 months before launch, plus flexible 20:80 payment schemes (20% upfront, 80% on possession). During construction, surrounding market prices rise, creating instant equity.

Example: Bengaluru luxury project listed at ₹18,000 per square foot. Pre-launch booking at ₹15,300 psf (15% off). Market appreciates to ₹22,000 psf by possession. You’ve created ₹6,700 psf equity (44% gain) before moving in.

The catch? Only RERA-registered projects from listed developers (DLF, Godrej, Lodha, Prestige). Developer bankruptcy risk is real—due diligence non-negotiable.

The Commercial-Residential Yield Arbitrage

Commercial Grade A offices yield 8-10% annually—double residential rates. But they lack the appreciation punch of prime residential.

The elegant solution: 70% commercial for income + 30% residential for growth.

A ₹7 crore portfolio split this way generates ₹46 lakh annual rent (6.6% blended yield) while the residential component appreciates 8% annually, adding ₹17 lakh in value gains.

Even better: commercial property depreciation benefits (10% annually on building value) offset residential rental income for tax purposes, saving 25-30% in taxes.

The Golden Visa Stack

Why settle for one country’s residency when you can have three?

- Dubai Golden Visa: $545K property → 10-year residency, tax-free income, business setup rights

- Portugal Golden Visa: €500K property → 5-year residency → EU citizenship path

- Greece Golden Visa: €500K property → 5-year residency, family inclusion, Schengen access

Total investment: $1.5-1.8M for Middle East + EU mobility, tax optimization across jurisdictions, global education access for children, and exit optionality from any single country’s policy shifts.

This isn’t just property investment—it’s geopolitical insurance for your family’s next 50 years.

The Risks Nobody Discusses (Until It’s Too Late)

Market Cycles: The Inconvenient Truth

Dubai crashed 40% between 2009-2015. India’s luxury segment fell 30-40% in 2008. Even the mighty recovered, but it took 5-7 years of patience and nerve.

The lesson? 7+ year hold periods aren’t optional—they’re mandatory for smoothing cycle impacts. Short-term speculators get crushed. Patient wealth-builders compound.

Climate Reality: The Unpriced Risk

Mumbai’s Marine Drive penthouses command ₹100,000 per square foot. But climate models project 30-50 cm sea-level rise by 2050. Insurance costs already climbing 15-20% annually for coastal properties.

Bengaluru’s 2024 water crisis revealed aquifer depletion. Properties without municipal water connections now trade at 10-15% discounts.

The uncomfortable truth: climate risk is systematically underpriced in luxury real estate today. Due diligence must include flood zone mapping, water availability studies, and comprehensive climate event insurance.

Technology Disruption: Remote Work’s Long Shadow

Post-COVID, 30-40% of tech workforce remains permanently remote. This reduces demand for prime CBD office district rentals—the exact properties yielding 8-10%.

Dubai’s 90% expatriate market depends on corporate relocations. But AI and automation increasingly replace international transfers. What happens when physical presence becomes optional?

The adaptation: satellite city investments (lower density, larger spaces suited for remote work), co-working integration within residential complexes, and amenities emphasizing lifestyle over office proximity.

Pro Tips: Elite-Level Insights

1. The “Pre-Launch Discount Arbitrage” Strategy

Target RERA-registered projects 12-18 months pre-launch when developers offer 10-15% early-bird discounts. During construction, market appreciates creating instant equity—sometimes 40%+ gains before possession.

2. The “Dual-Market Currency Hedge” Approach

Split portfolio 50% India (rupee assets, domestic growth) + 30% Dubai (dollar-pegged, tax-free) + 20% London/Singapore (developed market stability). Rupee depreciation against dollar is offset by Dubai/London holdings appreciating in rupee terms.

3. The “Commercial-Residential Yield Arbitrage”

Allocate 70% to commercial Grade A offices (8-10% yields) + 30% residential luxury (3-4% yields + higher appreciation). Blended yield: 6.6% with residential appreciation upside. Tax optimization: commercial depreciation offsets residential rental income.

4. The “Golden Visa Stack” for Global Mobility

Multi-jurisdiction strategy: Dubai Golden Visa ($545K) + Portugal Golden Visa (€500K) + Greece Golden Visa (€500K) = $1.5-1.8M total for Middle East + EU residency, tax optimization, education access, exit optionality.

5. The “UHNI Portfolio Diversification Blueprint”

₹100 crore allocation: 40% India luxury residential + 20% commercial Grade A + 20% international (Dubai/London/Singapore) + 15% branded residences + 5% REITs. Expected portfolio return: 9.2% annually with geographic and asset class diversification.

FAQ: Your Questions Answered

Should I prioritize rental yield or capital appreciation?

Your strategy depends on goals and timeline. Rental yield (3-8% annually) suits income seekers—retirees or conservative portfolios. Focus on Dubai (6.5-8.4%), commercial offices (8-10%), or Bengaluru (4.5%) for steady cash flow. Capital appreciation (5-15% annually) builds long-term wealth for HNI/UHNI with 7-15 year horizons. Target Delhi NCR, Dubai emerging zones, branded residences. Recommended: 60% appreciation + 40% yield for balanced income and growth.

What are typical rental yields across markets?

How much capital gains tax in India?

Long-Term Capital Gains (>2 years holding): 12.5% flat rate (Budget 2024, reduced from 20% with indexation). Short-Term (<2 years): Taxed at income slab rate (30% for HNI). Section 54 exemption: Reinvest capital gains in another residential property within 2 years for full tax exemption. Strategic: Always hold 2+ years for lower LTCG rate vs 30% STCG.

Are branded residences worth the 30-40% premium?

Branded residences deliver 12-18% appreciation (vs 5-10% traditional), 15-25% rental yield premiums, and 6-9 month sale timelines (vs 12-15 months). Case: DLF Camellias delivered 42% appreciation over 2 years vs 33% comparable non-branded. For UHNI prioritizing prestige + performance, 10-15% portfolio allocation justified. Pure financial return seekers may find traditional luxury better value.

The Verdict: Your Personal Formula

The rental yield vs capital gains question has no universal answer—only a personal one aligned with your wealth stage, risk tolerance, and life vision.

For Income Seekers (Retirees, Conservative Portfolios):

- 70% yield-focused: Dubai Marina, commercial offices, Bengaluru tech corridors

- 30% appreciation hedge: Established luxury with steady 3-5% growth

- Target: 4-5% net yield, 6-8% total return

For Aggressive Builders (Entrepreneurs, Executives):

- 30% yield foundation for psychological comfort

- 70% appreciation focus: Pre-launch, infrastructure corridors, emerging markets

- Target: 8-12% net appreciation, 10-15% total return

For UHNI Legacy Planners (Multi-Generational Wealth):

- 40% branded residences: Prestige + lifestyle + capital preservation

- 30% international: Currency hedge, global mobility (Dubai, London, Singapore)

- 30% India prime: Emotional connection, rupee exposure, emerging market premium

- Target: 6-8% balanced return with generational asset quality

The Convergence Thesis: Building Wealth That Lasts

The most important insight from analyzing luxury markets across Dubai, India, London, Singapore, and the US is this: the binary choice is an illusion.

Elite investors don’t agonize over yield vs appreciation—they architect portfolios capturing both, diversified across geographies and asset classes, rebalanced annually, held patiently through cycles.

They understand rental income provides stability and funds lifestyle. Capital appreciation builds net worth and legacy. Tax optimization preserves wealth. Geographic diversification hedges geopolitical risk.

In 2025, with India’s luxury market surging 305% since 2020, Dubai delivering 23% total returns, and mature markets offering stability, the opportunity window is wide open.

The strategic move isn’t choosing between rental yields and capital gains. It’s mastering the convergence of both—building portfolios that generate income today while creating generational wealth tomorrow.

That’s not just investment strategy. That’s wealth architecture.

And it’s how fortunes that last centuries are built.

YouTube Learning Resources

Free resources to download

Rental Yields vs Capital Gains – Key Points Summary