Now Reading: Luxury Real Estate in a Recession: Why Crisis Periods Create Generational Buying Opportunities

- 01

Luxury Real Estate in a Recession: Why Crisis Periods Create Generational Buying Opportunities

Luxury Real Estate in a Recession: Why Crisis Periods Create Generational Buying Opportunities

When financial markets convulse and conventional wisdom screams retreat, the world’s most discerning investors do something counterintuitive: they hunt for trophy properties. History has proven repeatedly that economic downturns don’t diminish luxury real estate value—they redistribute it. From Jeff Bezos expanding his Indian Creek Island sanctuary to a Delhi industrialist quietly acquiring ₹380 crore worth of Camellias penthouses, ultra-high-net-worth individuals understand that real estate in recessions create once-in-a-generation windows to secure legacy assets at advantageous terms. This isn’t speculation—it’s a century-old playbook for building dynastic wealth through strategic ultra-prime property acquisition during market dislocation.

When Markets Falter, Trophy Assets Shine

Picture this: It’s 2009, and London’s Mayfair district feels eerily quiet. The financial crisis has just eviscerated portfolios worldwide. Yet inside discreet private offices, family wealth advisors are moving swiftly—not to liquidate, but to acquire. What the headlines called a disaster, they recognized as a rare opening.

Fast forward fifteen years, and those crisis-era acquisitions have appreciated exponentially, becoming cornerstones of multigenerational portfolios. A Belgravia townhouse purchased at a 30% discount in 2009 now commands triple its crisis valuation. An Upper East Side penthouse snapped up during market panic has become an irreplaceable legacy asset.

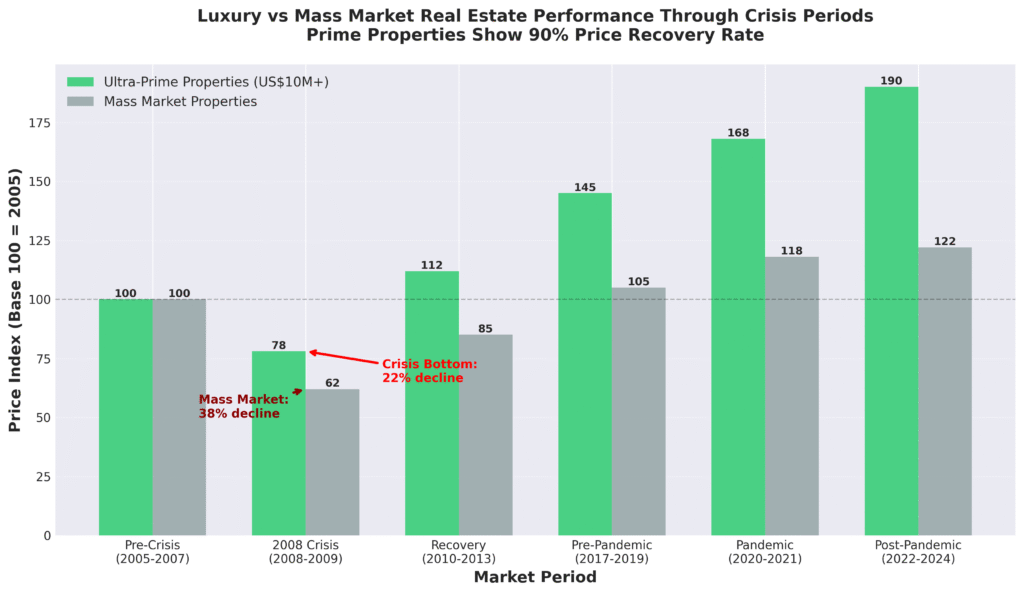

This pattern isn’t coincidental—it’s structural. While mass-market properties experience severe volatility during economic contractions, ultra-prime real estate demonstrates remarkable resilience. During the 2008 financial crisis, luxury properties declined approximately 22% before recovering robustly, while mainstream residential markets plummeted 38% and struggled for years to regain footing.

The Global Luxury Real Estate Landscape: A Tale of Strategic Divergence

Today’s ultra-wealthy aren’t simply buying homes—they’re architecting global portfolios with surgical precision. Dubai has emerged as the world’s branded residence capital, with over 140 projects delivering by 2031, representing a staggering 160% growth over the past decade. In 2024 alone, Dubai recorded over 13,000 branded home sales generating AED 60 billion in transactions—a 43% year-on-year surge.

Compare this with London, where heritage prestige meets tax complexity, or Miami, where waterfront scarcity drives premiums approaching $25,000 per square foot for ultra-prime branded residences like Aston Martin Residences. Yet Dubai’s Bvlgari Residences command approximately $2,857 per square foot (AED 10,500), offering comparable brand cachet with superior entry points.

Meanwhile, India’s luxury market is experiencing its own seismic shift. Homes priced above ₹5 crore witnessed an 80% year-on-year increase in 2024, now representing 5% of total annual sales versus just 3% in 2023. Ultra-high-net-worth individuals are allocating 32% of their wealth to residential real estate, treating trophy properties not as lifestyle indulgences but as blue-chip assets analogous to equity holdings.

The Emotional Calculus: Why Legacy Transcends Leverage

Numbers tell part of the story. Emotion completes it.

When Laurene Powell Jobs spent $94 million acquiring another Paradise Cove property in Malibu—expanding her beachfront holdings to $174 million—she wasn’t chasing rental yields. When Jeff Bezos assembled his Indian Creek Island compound through successive $87 million and $68 million acquisitions, the decision transcended financial optimization.

These ultra-wealthy buyers understand something fundamental: certain addresses cannot be replicated. A Central Park West penthouse. A Lake Geneva waterfront villa. A Tuscan vineyard estate with 300 years of history. These aren’t merely properties—they’re irreplaceable legacy anchors.

“You don’t buy a legacy property for yourself—you acquire it for your children’s children,” explains one London-based wealth advisor specializing in multigenerational estate planning. This perspective transforms the investment thesis entirely. Instead of evaluating quarterly returns, families architect 30- to 50-year wealth preservation strategies.

Consider the psychological drivers:

Permanence in an uncertain world: While digital assets fluctuate and geopolitical tensions escalate, a Parisian hôtel particulier in the 8th arrondissement provides tangible, enduring value.

Identity and heritage: Trophy properties become physical manifestations of family achievement, creating gathering places where memories compound across generations.

Exclusivity and access: Membership in ultra-elite enclaves—whether Indian Creek Island’s “Billionaire Bunker” or Dubai’s Palm Jumeirah—confers social capital beyond financial metrics.

Control and autonomy: Unlike equities subject to market whims, luxury real estate offers owners direct stewardship over appreciation through strategic enhancements.

Strategic Frameworks: Three Investment Horizons

Sophisticated buyers approach recession-era luxury acquisitions across distinct timeframes:

Immediate Opportunity (0-18 months)

During acute market dislocations, liquidity-constrained sellers create advantageous pricing. The 2008-2009 window saw prime London properties trading at 25-35% discounts. Ultra-wealthy buyers with accessible capital deployed aggressively, recognizing forced sellers’ vulnerability.

Current indicators suggest selective opportunities emerging in certain overleveraged markets. Properties lingering beyond 180 days on market, particularly in secondary luxury destinations, merit investigation. However, gateway cities—London, New York, Dubai, Mumbai—demonstrate persistent pricing power even during broader economic uncertainty.

Mid-Term Positioning (2-5 years)

This horizon focuses on value-add opportunities in emerging luxury corridors. Portugal’s Golden Visa program has attracted significant HNI investment, with Lisbon and Algarve experiencing substantial ultra-prime development. Greece’s burgeoning luxury sector similarly appeals to Middle Eastern and Asian buyers seeking lifestyle diversification with residency optionality.

Strategic buyers identify nascent luxury markets before peak discovery. Miami’s Brickell district transformation from regional financial center to global ultra-luxury hub occurred across this timeframe, rewarding early movers exponentially.

Generational Wealth Architecture (10+ years)

This approach prioritizes irreplaceable trophy assets in established prestige locations. Think: a Kensington townhouse, a Geneva lakefront compound, or a Mumbai Malabar Hill residence. These properties appreciate through scarcity rather than speculation.

Family offices increasingly structure these holdings through trusts, limited partnerships, and holding companies—enabling seamless generational transfers while optimizing tax efficiency. One Delhi-based industrialist recently acquired four Camellias apartments totaling 35,000 square feet for ₹380 crore, explicitly positioning the portfolio for multigenerational family occupation and eventual legacy transfer.

Case Studies: Crisis Opportunism in Action

Dubai’s Meteoric Ascent: From Regional Hub to Global Capital

Dubai’s transformation epitomizes strategic luxury real estate evolution. Between 2010-2020, the emirate’s prime residential market appreciated 1,796% in select ultra-luxury segments. Even more remarkably, Dubai achieved this growth while maintaining investor-favorable taxation and regulatory frameworks.

The COVID-19 pandemic accelerated this trajectory. While other markets froze, Dubai’s transaction volumes surged 33% in 2025’s super-prime segment (properties exceeding $10 million). Buyers recognized the emirate’s structural advantages: zero property tax, visa-linked residency programs, robust infrastructure investment, and lifestyle amenities rivaling established luxury capitals.

Leading this charge are branded residences—Bulgari, Armani, Bugatti—offering not merely homes but curated lifestyle ecosystems. Buyers pay 40-60% premiums over comparable non-branded luxury properties, valuing the experiential component and long-term brand affiliation.

India’s Luxury Resilience: Defying Conventional Market Gravity

India presents a fascinating paradox: While affordable housing faces accessibility challenges, the luxury segment is experiencing unprecedented expansion. The country’s ultra-high-net-worth population is projected to grow 50.1% between 2023-2028—the fastest rate globally.

This demographic surge fuels voracious luxury property appetite. A British businessman recently acquired an 11,416-square-foot Camellias apartment for ₹100 crore. Another buyer secured a 16,290-square-foot penthouse in the same development for ₹190 crore, paying ₹13.30 crore in stamp duty alone.

What’s driving this? India’s thriving equity markets have created nouveau wealth seeking tangible asset diversification. Post-RERA regulatory confidence has eliminated previous buyer hesitancy. And crucially, ultra-wealthy Indians increasingly view prime residential real estate through an 8-10 year investment lens rather than short-term speculation.

Aspen’s Recession-Proof Mystique: Scarcity as Ultimate Defense

When examining recession-resilient luxury markets, Aspen, Colorado, offers instructive lessons. During the 2008 financial crisis, while Vail and other ski resort markets experienced 30-40% corrections, Aspen’s ultra-prime segment declined only 12% before recovering within 18 months.

Why? Extreme supply constraints coupled with generational family ownership create pricing floors. Aspen’s development restrictions ensure minimal new inventory, while multi-decade family compounds rarely transact publicly. This combination insulates valuations during broader market stress.

The lesson: Scarcity-constrained luxury markets with high barriers to entry demonstrate superior recession resilience compared to luxury destinations with expandable supply.

Five Elite-Level Investment Insights

1. Deploy Counter-Cyclical Capital with Conviction

Ultra-wealthy buyers maintain dedicated opportunity capital specifically for market dislocations. When recession anxiety peaks, trophy assets become available at advantageous terms from liquidity-stressed sellers.

2. Prioritize Irreplaceable Over Impressive

A unique Central Park-facing residence appreciates differently than a generic luxury high-rise, regardless of finishes. Scarcity creates enduring value; specifications become commoditized.

3. Structure Ownership for Generational Optimization

Sophisticated families employ trusts, family limited partnerships, and offshore holding structures to facilitate wealth transfer, optimize taxation, and maintain multigenerational governance.

4. Underwrite Lifestyle ROI Alongside Financial Returns

The world’s most successful luxury property investors factor emotional dividends—family gatherings, social capital, legacy pride—into their calculus. These intangible returns often exceed financial appreciation.

5. Maintain Global Portfolio Diversification

Geographic concentration creates vulnerability. Leading family offices maintain luxury holdings across 3-5 jurisdictions, balancing lifestyle preferences, tax optimization, currency diversification, and geopolitical risk mitigation.

Balanced Perspective: Navigating Inherent Risks

Luxury real estate’s advantages shouldn’t obscure legitimate risks. Illiquidity remains the asset class’s primary challenge—trophy properties can require 12-24 months to monetize, particularly during market stress. Transaction costs (often 8-12% including taxes, legal fees, and commissions) create meaningful friction.

Regulatory risk varies dramatically by jurisdiction. London’s evolving non-dom taxation, India’s luxury segment taxation adjustments, and shifting visa-linked residency programs introduce policy uncertainty. Currency fluctuation presents additional complexity for international buyers—a strengthening home currency can erode foreign property returns despite local appreciation.

Market timing risk persists despite luxury real estate’s historical resilience. Buyers deploying capital immediately before prolonged recessions may experience extended holding periods before appreciation materializes. The 2008 crisis demonstrated that even ultra-prime properties aren’t immune to valuation pressure during extreme market dislocations.

The Horizon: Where Luxury Real Estate Is Heading

As we navigate an era of persistent economic uncertainty, luxury real estate’s role in sophisticated portfolios will intensify rather than diminish. The next generation of ultra-wealthy individuals—digital entrepreneurs, family office successors, emerging market billionaires—brings fresh perspectives on property ownership.

They’re not seeking ostentation. They’re architecting ecosystems.

Multi-generational compounds that accommodate extended families. Wellness-centric estates integrating biophilic design and sustainable systems. Branded residences offering five-star services within private ownership. Properties that function simultaneously as homes, offices, wellness retreats, and social hubs.

This evolution transforms luxury real estate from passive asset to active wealth strategy. And recessions? They remain what they’ve always been for the informed and liquid: rare windows to secure tomorrow’s legacy at yesterday’s valuations.

The question isn’t whether crisis periods create generational opportunities. History has settled that debate conclusively. The question is whether you’ll recognize the window when it opens—and possess the conviction to step through.

Pro Tips for UHNI Portfolio Diversification Strategy

Integrate citizenship-by-investment programs (Portugal, Greece, UAE) with luxury acquisitions for compound strategic value

Maintain 18-24 months liquidity reserves to capitalize on distressed luxury opportunities during market dislocations

Leverage 1031 exchanges (US) or similar tax-deferred mechanisms to continuously upgrade portfolio quality without triggering capital gains

Establish family governance protocols before acquiring multigenerational properties to prevent future succession disputes

Conduct meticulous due diligence on developer track records—brand reputation matters exponentially in ultra-luxury segments

Frequently Asked Questions

How do luxury properties perform during recessions compared to mainstream real estate?

Ultra-prime properties ($10 million+) typically experience 40-60% less price volatility than mass-market residential real estate during recessions, with significantly faster recovery trajectories. This resilience stems from ultra-wealthy buyers’ reduced leverage dependency and longer investment horizons.

What percentage of UHNWI portfolios should luxury real estate represent?

Leading family offices typically allocate 25-40% of investable assets to real estate, with 15-25% specifically in ultra-prime residential holdings. This provides tangible asset diversification while maintaining sufficient liquidity for opportunistic deployment.

Which global luxury markets offer optimal recession-era opportunities?

Markets with structural scarcity, favorable tax treatment, and lifestyle appeal demonstrate superior recession performance. Current opportunity zones include Dubai (infrastructure investment cycle), select Indian gateway cities (demographic tailwinds), and established European capitals with temporary pricing dislocations.

YouTube Learning Resources

Free resources to download

Luxury Real Estate in Recession: Executive Summary