Now Reading: India’s New Luxury Buyer Is Under 45—and Thinks Very Differently About Ownership

- 01

India’s New Luxury Buyer Is Under 45—and Thinks Very Differently About Ownership

India’s New Luxury Buyer Is Under 45—and Thinks Very Differently About Ownership

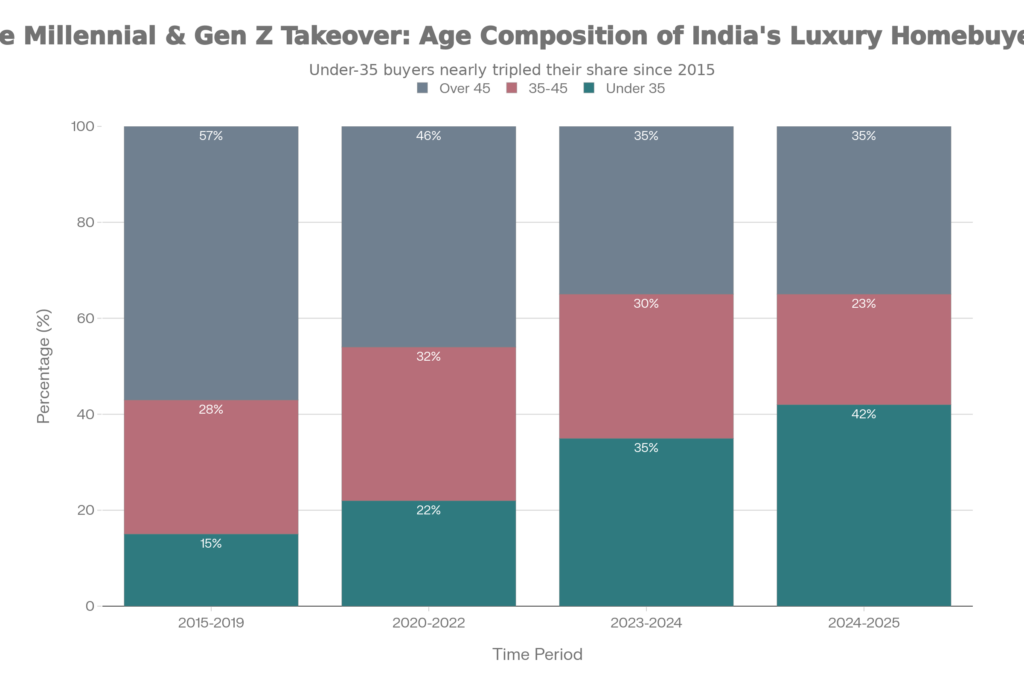

India’s luxury real estate market has entered a generational inflection point. For the first time in the nation’s property history, buyers under 45 now command a decisive majority—65% of all luxury transactions according to a 2024 Savills survey—reshaping how India’s most exclusive homes are conceived, marketed, and valued.

This is not a cyclical softening. It represents a structural realignment in wealth, taste, and intention. Where previous generations viewed luxury apartments as trophies and tax shelters, today’s affluent millennials and Gen Z professionals see them as platforms for identity, purpose, and global optionality. They want homes that mirror their ambitions but also align with their values. The distinction matters, and developers who miss it will find themselves holding inventory.

A Structural Wealth Inflection

The numbers tell a story of velocity. India is projected to experience a $1.5 trillion to $2.5 trillion intergenerational wealth transfer over the next 15 years, with Gen Z and millennial heirs already influencing spending decisions across 70 lakh crore rupees annually—43% of total household consumption. By 2035, their discretionary spending alone will exceed $1.8 trillion.

Meanwhile, India’s Ultra-High-Net-Worth population (those holding over $30 million in net worth) will surge 50% by 2028, from 13,263 individuals in 2023 to nearly 20,000. The broader HNI cohort—investors with $1 million or more—is projected to expand from 60 million to 100 million by 2027, according to Goldman Sachs research. Not all of this wealth will deploy into property, but the concentration among younger inheritors is unmistakable.

This wealth concentration is arriving at a moment when India’s economy is growing at 8.2%—faster than any other major economy—and when the nation’s stock markets have appreciated 18% annually over the past decade. For a generation that came of age during India’s tech boom, this is not abstract wealth. These are entrepreneurs, startup founders, CXOs at multinational firms, and second-generation heirs. They have global exposure. They have options. And they are choosing India’s premium real estate market with deliberation, not desperation.

The Numbers Tell an Inflection Story

The luxury residential market—properties priced at INR 1 crore and above—accounted for 50% of all residential unit sales in 2024, a milestone never before achieved. This is the inflection point where luxury ceased to be niche. In absolute terms, luxury home sales surged 85% year-on-year in the first half of 2025, with Delhi-NCR leading the charge with a staggering 72% YoY increase in transaction volume.

The market’s scale reflects this momentum: currently valued at approximately $42 billion, India’s luxury residential sector is projected to reach $105 billion by 2029—nearly a threefold expansion—representing a compound annual growth rate of 21% to 24%. These are venture-capital-grade returns, achieved through what investors perceive as a tangible, locally-rooted asset class insulated from the volatility of global equity markets.

Delhi-NCR has emerged as the primary engine of this growth, recording 5,855 luxury unit sales in the first nine months of 2024 alone, a 72% year-on-year increase. Gurugram, the nexus of Delhi’s corporate wealth, witnessed sales reaching ₹1.07 lakh crore in 2024, a 66% surge from the prior year. Meanwhile, Bengaluru’s premium micro-markets are experiencing 45% to 48% year-on-year price appreciation, driven by a younger demographic of tech entrepreneurs and venture-backed founders seeking trophy addresses.

Mumbai, traditionally the bellwether, recorded a more measured but still robust 18% year-on-year growth in luxury transactions, though specific micro-markets tell a more dramatic story. Worli, the city’s ultra-premium neighborhood, has appreciated 49% over five years. A single Lodha Sea Face residence sold for ₹187.5 crore in 2024—a price point that was virtually unthinkable a decade prior.

Meet the New Buyer

The archetypal Indian luxury buyer of the 2010s was typically a 55-year-old industrialist or real estate developer acquiring a primary residence as the capstone of a lifetime of accumulation. He was buying what his wealth had earned.

Today’s typical luxury buyer is a 32-year-old software entrepreneur, physician, or finance professional with a salary in the ₹1.5 crore to ₹3 crore range, often complemented by equity upside or performance bonuses. She is often unmarried at first purchase, or in a dual-income power couple arrangement. She has lived or worked abroad—Singapore, London, San Francisco, Dubai. She speaks fluent English, follows global design trends on Instagram, and views her primary residence as a reflection of identity, not merely asset.

This buyer is 54% of all luxury transactions according to Knight Frank data. She is the 65% under 45. She thinks differently.

For this demographic, a luxury home is not purchased for its investment thesis alone. Investment return remains important—nowhere near irrelevant—but it operates in concert with lifestyle, wellness, privacy, and what might be called “purposeful appreciation.” These buyers are asking questions their parents never posed: Does this building have a carbon footprint certification? Are there wellness amenities that support circadian rhythm? Can I customize the space to reflect my aesthetic? Is there a community here aligned with my values? These are not peripheral questions. They are dealbreakers.

How Priorities Have Inverted

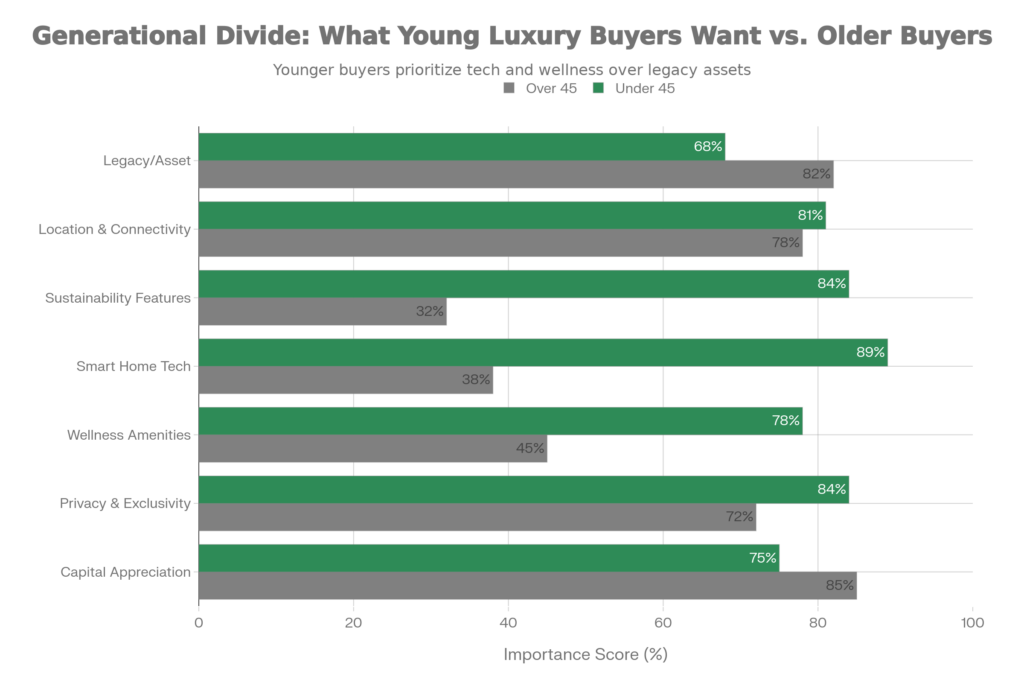

The data reveals a striking inversion in priorities. While buyers over 45 continue to emphasize capital appreciation (scoring 85 out of 100) and legacy considerations (82 out of 100), their younger counterparts score appreciation at only 75, placing it third behind privacy and exclusivity (84) and wellness amenities (78). Smart home technology ranks at 89 for under-45 buyers versus 38 for over-45 buyers—a chasm that speaks to fundamentally different conceptions of what modern living entails.

Sustainability features command an 84-point importance score among young luxury buyers, compared to just 32 among older cohorts. Seventy percent of high-net-worth individuals under 45 are willing to pay a premium for homes in green-certified developments, according to research from the property advisory sector. This is not performative environmentalism. These buyers have lived through climate discourse their entire adult lives. They are writing checks that reflect that.

Wellness amenities—dedicated meditation spaces, air purification systems, access to health-monitoring technologies, spa facilities—are now considered table stakes rather than luxuries. Developers report that properties integrating biophilic design (natural light, vertical gardens, indoor-outdoor transitions) and smart environmental systems are selling faster and at premiums, particularly among under-35 buyers.

Customization and personalization have become non-negotiable. Mass-market luxury is an oxymoron to this generation. They want homes configured around their particular life, not shoe-horned into a developer’s standard playbook. Some are requesting home gyms, gourmet kitchens, or dedicated offices that reflect remote-work flexibility. Others are requesting open-plan layouts that dissolve traditional boundaries between living and working. A minority are requesting art galleries or personal wine cellars. What unites these requests is a demand for agency—for the home to be a canvas for self-expression rather than a display case for wealth.

Where the Money Concentrates

Three cities are emerging as primary destinations for this younger luxury cohort, each with distinct buyer psychography and investment drivers.

Gurugram: Corporate Ambition

Gurugram has established itself as the luxury capital of North India, attracting a demographic of corporate executives, startup founders, and HNI professionals seeking seamless connectivity to business districts. The city recorded sales of ₹1.07 lakh crore in 2024, with luxury contributing disproportionately. Golf Course Road and the precincts around DLF Cyber City have become addresses synonymous with professional success, particularly for younger CXOs and fintech founders.

The appeal is functional—proximity to business districts, metro connectivity—but also aspirational. Gurugram represents India’s image of itself as a global business center. For younger professionals, particularly those who have worked in Singapore or London, Gurugram offers a familiar infrastructure—good roads, reliable utilities, global-standard office spaces—that allows for a seamless transition from expat life back to India. NRI investments account for 15% to 25% of new luxury projects in Gurugram, with a meaningful portion coming from second-generation Indian-origin professionals seeking to establish a domestic base.

Bengaluru: The Tech Founder Magnet

Bengaluru’s luxury market is being driven by a younger, more entrepreneurial demographic. Central Bengaluru has experienced 45% to 48% year-on-year price appreciation, with premium launches surging 49% year-on-year in the first half of 2025—the highest among major metros. The driver is straightforward: the city is the epicenter of India’s venture capital ecosystem. Founders who have exited or are scaling businesses generating valuations in the multi-billion-dollar range are acquiring primary residences in prestigious precincts like Koramangala, Indiranagar, and the emerging ultra-luxury enclaves around the airport corridor.

This demographic is younger than the Gurugram buyer—often in their early thirties—and more digitally native. They are comfortable with fractional ownership, real estate investment trusts (REITs), and other alternative structures that facilitate entry or exit. They are also more likely to view a primary residence as one node in a globally distributed portfolio that might also include a pied-à-terre in Singapore, a holiday home in Goa, and international equity exposure through family offices or self-directed platforms.

Mumbai: The Wealth Epicenter

Mumbai remains the gravitas center of Indian luxury real estate, though the demographic profile is more heterogeneous. The city attracts corporate wealth (banking, finance), old money (family conglomerates), and international capital seeking exposure to India’s largest financial center. NRI investments are particularly pronounced, with inquiries from the Middle East, United Kingdom, and United States rising notably in 2024 and early 2025, fueled by favorable rupee dynamics and geopolitical uncertainty abroad.

Worli has emerged as the symbolic address—a sea-facing micro-market where ultra-premium residences command prices exceeding ₹15 crore and beyond. The appeal transcends investment metrics. Worli offers what younger luxury buyers seek: identity, location prestige, and a concentration of peers who share similar values and income levels. It is not merely a neighborhood; it is a statement of arrival.

NRI Capital: A Second Engine

A significant and growing proportion of India’s luxury purchases are being driven by Non-Resident Indians, who now account for 15% to 25% of new project investments. NRI participation jumped from roughly 10% pre-pandemic to 15% by 2023, and is projected to reach 20% by 2025. These investors are typically second-generation diaspora—individuals born or raised abroad who retain emotional ties to India and are seeking to establish or maintain a domestic foothold.

Their motivations are layered. Some are recognizing India as a high-growth market and view luxury real estate as an alternative to equities or bonds in their home countries, where valuations have compressed. Others are making a multigenerational play—acquiring a property for themselves while also positioning it as a potential inheritance for children or as a base for future retirement. Still others are diversifying away from increasingly expensive markets in the US, UK, and UAE, where capital controls or immigration uncertainty have prompted a rethink of where to store wealth.

The rupee’s depreciation actually amplifies NRI interest. When converted to dollars or dirhams, properties in Mumbai or Delhi appear relatively attractive compared to equivalent real estate in Toronto, Singapore, or London. This dynamic—particularly pronounced in 2024 and 2025—is driving measurable increases in NRI inquiries and pre-launch sales commitments.

The Wealth Transfer Question: Inheritance as Accelerator

An estimated 50% of India’s HNWIs will inherit wealth by 2030, rising to 93% by 2040. This is not gradual. This is concentrated. The question is not whether younger wealth will accumulate, but how quickly it will deploy and where it will flow.

Early signals suggest that generational transition is accelerating luxury real estate purchases. Young heirs are entering the market with inherited capital, supplemented by their own earning power, creating a combined purchasing capacity that exceeds their predecessors. Family office structures are becoming more professionalized, with younger heirs demanding digital access, transparent reporting, and investment autonomy—all of which tends to favor tangible assets like real estate over paper assets vulnerable to market volatility.

Some family offices are establishing dedicated luxury real estate allocations specifically for younger-generation investors, recognizing that the asset class offers both growth and psychological appeal. In a low-yield global environment where fixed deposits return 5% to 6% annually, a property appreciating 10% to 15% per year in a constrained-supply market like Mumbai or Delhi appears compelling.

The Counterargument: Why Some Young Wealth Is Looking Elsewhere

The concentration of young wealth in luxury real estate is not universal. A meaningful and growing segment of young HNIs is deploying capital into alternative asset classes—private equity, venture capital, hedge funds, and even cryptocurrencies—rather than real estate. This reflects both the demographic profile of wealth creation (tech founders naturally gravitate toward PE and VC) and a philosophical stance that real estate, while stable, may be less compelling than growth-oriented alternatives.

Alternative investments currently represent 7% to 8% of HNI portfolios, but projections suggest this could expand to 15% to 25% within five years. Younger investors, in particular, are drawn to private equity and venture capital, viewing these as alignment opportunities with India’s innovation ecosystem. Why buy a luxury apartment when you can back a Series B SaaS company or participate in a cleantech infrastructure fund with potential returns exceeding 20% annually?

This dynamic creates a bifurcation in the young wealth cohort. On one end are operator-entrepreneurs and salaried professionals seeking stability and lifestyle (buying luxury real estate). On the other are investor-entrepreneurs and inheriting family office managers seeking alpha and impact (deploying into alternatives). Both groups are under 45. Both are wealthy. But their capital deployment logic diverges.

For real estate to remain attractive to this cohort, the value proposition must transcend returns and encompass lifestyle, purpose, and global optionality.

When Ultra-Luxury Meets Generational Handoff: The ₹187.5 Crore Worli Sale

In late 2024, a 4,000 square foot penthouse at Lodha Sea Face in Worli sold for ₹187.5 crore (approximately $22.5 million USD)—a price that represents the upper boundary of India’s residential market. The buyer was reportedly a second-generation industrial family, with the purchase decision driven by a younger heir seeking an ultra-premium address that would serve as both a primary residence and a generational asset.

The transaction is notable not for its price alone but for what it signals about buyer expectations at the top end. The Lodha Sea Face brand carries significant prestige—it is considered Mumbai’s most prestigious residential address—but the price premium reflects more than brand. It reflects scarcity (only 180 units in the entire complex), location prestige (sea-facing in South Mumbai), architectural distinction (designed by internationally recognized architects), and the conviction that this asset will appreciate in perpetuity due to constrained supply.

The buyer’s selection of this specific property over other options—including newly launched ultra-luxury projects in the ₹15-20 crore range—suggests that younger wealth still values proven pedigree, architectural heritage, and established prestige. However, the purchase was contingent on customization rights, wellness amenities, and smart home integration—requirements that speak to the buyer’s desire to activate the space according to personal preferences rather than accepting a pre-determined vision.

Gurugram’s New Ultra-Premium Test: DLF The Dahlias

DLF’s recent super-luxury project, The Dahlias, achieved pre-formal launch sales of ₹11,816 crore, with 12% of units presold to NRIs and a meaningful proportion purchased by young entrepreneurs and wealth inheritors. The project’s positioning—ultra-premium gated villas with private amenities, limited units, and entry pricing in the ₹8-15 crore range—attracted buyers seeking exclusivity without the iconic prestige of established neighborhoods.

What distinguishes this launch from earlier generations is the buyer profile. A significant proportion of purchasers are in their mid-thirties to early forties, having either accumulated wealth through technology ventures or inherited substantial capital. Unlike the 55-year-old industrial buyer who would have viewed The Dahlias primarily through a financial lens, younger purchasers emphasized lifestyle factors: the amenity profile, the gated community structure, the resale potential, and the ability to customize homes.

The 12% NRI pre-sales component is particularly revealing. It suggests that younger diaspora Indians are viewing premium addresses in India with the same seriousness they might approach a property purchase in London or Singapore—as part of a global wealth management strategy rather than a sentimental homecoming purchase.

Bengaluru’s Lifestyle Play: How Community Drives Younger Buyers

Brigade Orchards, a luxury residential enclave in Bangalore’s premium micro-markets, has recorded absorption rates exceeding 80% for its premium segment (₹3-7 crore) despite launching during elevated market conditions. The buyer profile skews significantly younger than traditional luxury projects, with over 55% of purchasers under age 40.

The primary draw is the neighborhood profile and the community orientation. Buyers are not merely purchasing apartments; they are acquiring membership in what the developer terms a “curated lifestyle ecosystem.” This includes co-working spaces, wellness centers, and social programming designed to create community among high-income professionals. For younger wealth, particularly in Bengaluru’s tech ecosystem, this community dimension is a material factor in purchase decisions.

Additionally, Brigade Orchards’ pricing strategy—entry points at ₹3 crore rather than ₹8-12 crore—allows for earlier-stage wealth accumulation to participate in ultra-premium real estate. This democratization of the luxury segment (democratization being relative, given the absolute price points) has expanded the addressable market for premium developers and created a pipeline of younger buyers who will graduate to higher-price-point luxury properties as wealth accumulates.

Five Moves for Younger Wealth

1. Diversify Across the Wealth Lifecycle

Rather than concentrating luxury real estate purchases in a single city or holding, deploy capital across geographic nodes that match life circumstances. A young entrepreneur might establish a primary residence in Gurugram (professional prestige, corporate connectivity) while acquiring a secondary asset in Goa or Alibaug (lifestyle, retreat value) and participating in a high-growth city like Bengaluru (capital appreciation). This approach balances lifestyle, optionality, and portfolio returns.

2. Prioritize Micro-Market Selection Over Macro Trends

National-level data on luxury real estate growth masks significant variation at the micro-market level. South Mumbai, Gurugram’s Golf Course Road, and central Bengaluru are experiencing qualitatively different dynamics than peripheral luxury developments. For young buyers, proximity to peers with similar income and values—what sociologists call “assortative mating” for wealth—is a material driver of both satisfaction and asset appreciation. Select neighborhoods where demographic clustering favors your cohort.

3. Integrate Wellness and Smart Home Features Into ROI Calculations

While younger buyers weight wellness and technology features highly, these should not be viewed as lifestyle premiums disconnected from financial returns. Properties with LEED certification, smart energy management, or dedicated wellness infrastructure are experiencing faster absorption and command price premiums of 8% to 15% versus comparable properties without these features. Frame these investments as return-enhancing rather than purely hedonic.

4. Establish a Global Real Estate Reserve Currency

India’s luxury real estate market, while compelling, represents a single-country bet. HNIs under 45 should consider establishing complementary positions in stable, globally-recognized addresses—Singapore condominiums, London townhouses, or US commercial real estate funds—as a portfolio hedge and as an optionality reserve for potential geographic mobility. The Liberalised Remittance Scheme (LRS) allows Indian residents to invest up to $250,000 USD annually abroad, a lever that earlier generations underutilized.

5. Factor in the NRI Liquidity Premium

When evaluating exit scenarios, younger wealth should recognize that ultra-premium addresses in Mumbai, Delhi, and Bengaluru have achieved meaningful NRI participation (15-25% of new projects). This international buyer segment provides an additional liquidity vector, particularly for properties in the ₹3-10 crore range that align with NRI preferences for trophy addresses. Structure purchases with resale to international buyers as a contingency scenario, ensuring that pricing and customization decisions don’t lock you into a purely domestic buyer pool.

What Could Go Wrong

The luxury real estate narrative has momentum, but momentum is not destiny.

Inventory Risk

Mumbai’s unsold luxury inventory grew 36% year-on-year in Q1 2025, reaching 8,420 units. While developers attribute this to market recalibration rather than structural oversupply, the concentration of unsold inventory in ultra-premium segments (above ₹20-50 crore) with an overhang of 12.8 quarters-to-sell signals that certain price points are disconnected from fundamentals. Young buyers entering at the top end may find limited exit options if circumstances require liquidity.

Regulatory Uncertainty

While RERA (the Real Estate Regulation and Development Act) has strengthened buyer protections and developer accountability, emerging policies around foreign investment, capital gains taxation on real estate, and the potential for real estate windfall taxes remain uncertain. A change in tax treatment of luxury property appreciation could materially shift the investment calculus.

Macro Headwinds and Currency Risk

For NRIs, the attractive returns of India’s luxury market are partially a function of rupee depreciation. A reversal—if the rupee appreciates against the dollar or pound—would compress returns and potentially trigger capital outflows from NRI investors. Additionally, global economic slowdowns could curtail both NRI liquidity and the earning power of young domestic wealth creators, creating a demand shock.

Alternative Asset Competition

The migration of young wealth into private equity, venture capital, and venture debt is not a peripheral trend. If India’s startup ecosystem delivers the outsized returns that historical precedent suggests (private equity funds targeting 20%+ IRRs), capital will continue to migrate away from real estate. For luxury real estate to remain attractive, property appreciation must sustain 10-15% annual returns; anything below 8% will appear uncompetitive against alternatives.

FAQ Section

What’s the difference between buying a luxury primary residence versus a luxury investment property in India?

A primary residence in a trophy neighborhood like Worli or Golf Course Road offers lifestyle benefits, peer clustering, and appreciation upside, but with limited ability to optimize tax treatment or implement value-add strategies (renovation, repositioning, rental optimization). A pure investment property in an emerging luxury micro-market offers higher appreciation potential but lower liquidity and no lifestyle utility. Young wealth often benefits from purchasing the primary residence in the established address (accepting slightly lower return profile for lifestyle) and deploying investment capital into alternatives or emerging micro-markets.

Should young buyers finance luxury real estate purchases or pay in cash?

Indian banks offer mortgage rates of 8-9% for salaried professionals purchasing primary residences. Given long-term real estate appreciation of 10-15% annually in constrained-supply markets, leverage is financially rational—the spread between appreciation and financing cost creates positive carry.

What’s the emerging trend in second homes and leisure real estate for young HNIs?

A meaningful subset of young HNIs are acquiring second homes in leisure destinations like Goa, Alibaug, and the Nilgiris, positioned as lifestyle retreats and long-term appreciation plays as urban mobility increases. The trend reflects a shift toward “lifestyle diversification,” where wealth is deployed across multiple geographies to match seasonal patterns and life phase transitions (urban professional years, semi-retirement, legacy).

The Next Decade

India’s luxury real estate market is at an evolutionary inflection. The generation now entering prime wealth accumulation years—millennials and Gen Z—are fundamentally different wealth holders than their predecessors. They are more global, more purposeful, more technology-enabled, and more insistent that their capital reflect their values.

This will reshape how properties are marketed, designed, and priced. Developers who persist with mid-2000s luxury templates—open foyers, marble finishes, ornamental gardens—will find their product becoming obsolete. The luxury of the next decade will be defined by wellness integration, smart technology, sustainability credentials, and community orientation.

The real estate industry that responds will thrive. Those that resist this generational recalibration will find their inventory increasingly difficult to move.