Now Reading: From Mansions to Metaverse: Why Billionaires Now Buy Both

- 01

From Mansions to Metaverse: Why Billionaires Now Buy Both

From Mansions to Metaverse: Why Billionaires Now Buy Both

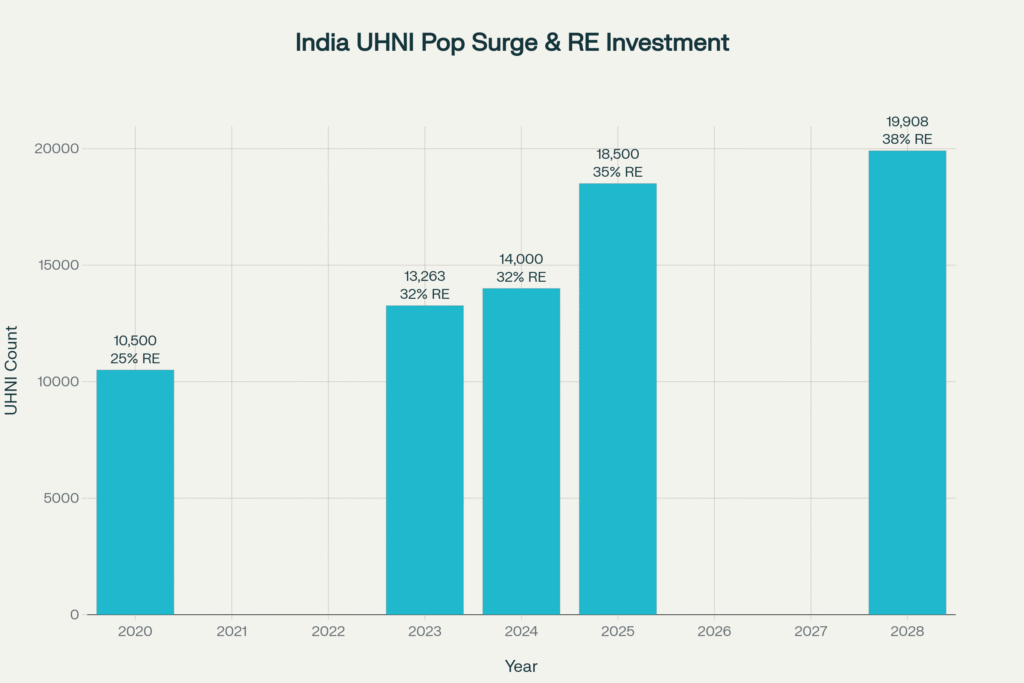

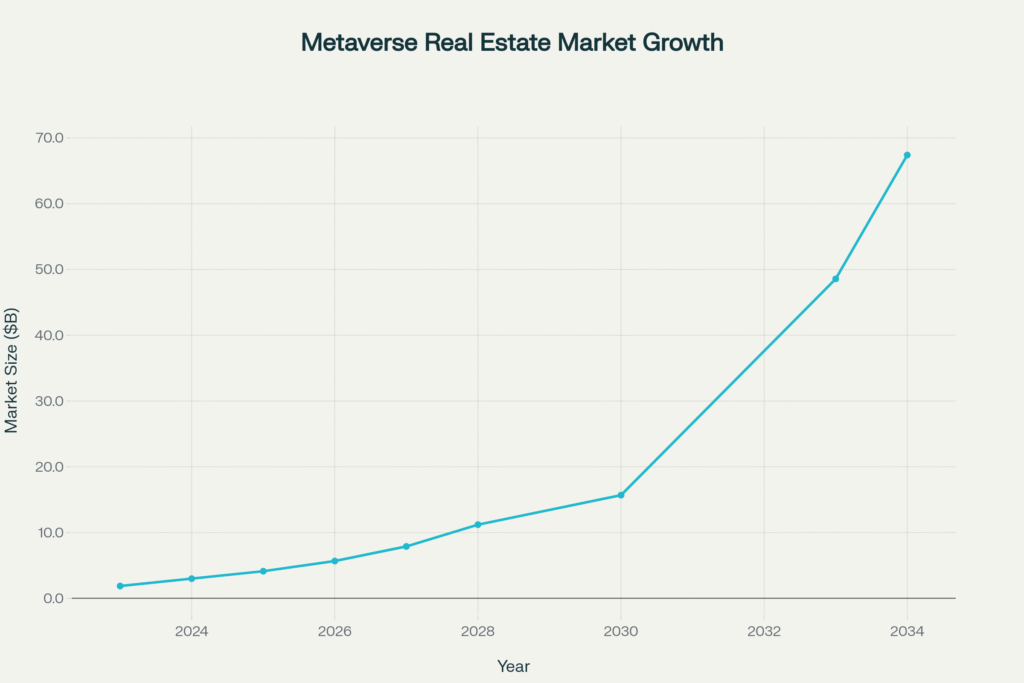

The ultra-wealthy are pioneering a revolutionary investment paradigm that seamlessly bridges physical and digital real estate portfolios. Today’s billionaires are no longer choosing between luxury mansions and virtual metaverse properties—they’re strategically acquiring both. With India’s Ultra High Net Worth Individual population projected to grow 50% by 2028 and the metaverse real estate market exploding from $1.87 billion in 2023 to a projected $67.4 billion by 2034, this dual-asset approach represents the next evolution in elite wealth management. Keywords: UHNI portfolio diversification, luxury real estate trends, and metaverse property investment are converging into a singular strategy that maximizes both tangible security and digital opportunity.

The Great Convergence of Physical and Digital Wealth

Market Shift Reshaping Elite Investment Strategies

Ultra-High Net Worth Individuals are fundamentally reshaping luxury investment strategies by treating physical and digital real estate as complementary assets rather than competing alternatives. This paradigm shift reflects deeper economic forces: the digitization of wealth, the emergence of Web3 ecosystems, and the recognition that virtual scarcity can be as valuable as physical exclusivity.

The numbers tell a compelling story. Mark Zuckerberg’s vindication exemplifies this trend—after his metaverse investments initially wiped over $100 billion from his net worth, his fortune has climbed to $201 billion, making him the world’s second-richest person. His success demonstrates why billionaires increasingly view metaverse real estate as generational wealth strategy rather than speculative gamble.

Regional Powerhouses Leading the Transformation

India’s UHNI Explosion Powers Dual-Asset Strategy

India stands at the epicenter of this wealth revolution. The country’s UHNI population reached 13,263 individuals in 2023, with projections indicating explosive growth to 19,908 by 2028—a staggering 50% increase. These investors are allocating an unprecedented 32% of their wealth to real estate, up from 25% in 2020, with this figure expected to reach 38% by 2028.

India’s Ultra High Net Worth Individual population is projected to grow 50% by 2028, with an increasing allocation of wealth toward real estate investments, reaching 38% by 2028.

Leena Gandhi Tewari’s record-breaking ₹639 crore purchase of two sea-facing duplex apartments in Mumbai’s Worli exemplifies this surge. At ₹2.83 lakh per square foot, her investment reset India’s luxury property benchmarks while signaling UHNI confidence in premium real estate markets.

Dubai’s Digital-Physical Fusion Hub

Dubai has emerged as the global epicenter where physical and virtual luxury investments converge. Property values rose 16.9% in 2024, while the emirate simultaneously positions itself as a metaverse hub. Indian buyers lead international investment with an average spend of $44.6 million, second only to Saudi Arabia’s $45.7 million.

The city’s tax-efficient structure and regulatory clarity make it ideal for billionaires managing dual-asset portfolios spanning both physical penthouses and virtual estates.

Singapore’s Tech-Luxury Nexus

Singapore’s luxury market has grown 8.5% year-over-year, driven by tech billionaires who seamlessly transition between acquiring physical properties and virtual land parcels. The city-state’s regulatory clarity for digital assets makes it an ideal base for sophisticated dual-asset strategies.

Data-Rich Market Analysis: $67.4B Metaverse Explosion

Physical Real Estate Momentum

The luxury real estate sector shows unprecedented strength across key markets. India’s luxury residential market was valued at $36.73 billion in 2024, projected to reach $229.32 billion by 2034—representing a compound annual growth rate of 20.1%. This growth is driven by fundamental shifts in wealthy demographics and investment preferences.

Key performance indicators demonstrate sustained momentum:

Global smart home market valuations are projected to surge from $147.5 billion in 2024 to $537.3 billion by 2030, representing a compelling 27% compound annual growth rate. Simultaneously, AI integration in real estate is experiencing exponential expansion, with market size anticipated to reach $1.8 trillion by 2030, driven by a remarkable 35% CAGR. For discerning UHNIs, these trends signal unprecedented opportunities to leverage smart luxury homes as both lifestyle sanctuaries and high-performing investment vehicles.

- India Luxury Sales Growth: 37.8% year-over-year increase in luxury home sales (₹4+ crore) during January-September 2024

- Ultra-Luxury Segment Performance: ₹4,754 crore in sales value across India’s top seven cities in 2024, representing 17% growth

- Transaction Volume Records: 302,867 residential unit sales in 2024, marking 11% year-over-year growth

Metaverse Real Estate Market Explosion

Virtual real estate markets are experiencing exponential expansion across multiple platforms and use cases. The global metaverse real estate market has grown from $1.87 billion in 2023 to $2.99 billion in 2024, with projections reaching $67.4 billion by 2034. This represents a compound annual growth rate of 36.6%, significantly outpacing traditional real estate appreciation.

Platform dominance reveals where smart money is flowing:

- The Sandbox: Commands 62% market share with $580 million in 2024 transaction volume

- Decentraland: Holds 28% share with $420 million annual volume

- TCG World: Despite 3% market share, recorded highest single sale at $5 million

Notable transactions demonstrate the sector’s maturation. Republic Realm’s record $4.3 million purchase for virtual land development in The Sandbox and the $2.4 million Fashion Street Estate acquisition in Decentraland established benchmarks that continue driving institutional interest.

Cross-Platform Investment Intelligence

Elite investors are developing sophisticated allocation strategies spanning both realms. Current patterns show traditional UHNWIs allocating 35% to physical real estate and 5% to digital properties, while tech billionaires pursue more aggressive 25% physical, 15% digital allocations. Next-generation wealth inheritors are pioneering 20%-20% splits, recognizing that virtual worlds will be as important as physical spaces for their lifestyles.

Return expectations vary significantly between asset classes. Physical luxury real estate yields 15-25% annually in prime markets like Mumbai and Dubai, while metaverse properties demonstrate higher volatility but potential returns of 300-700% during growth phases. Portfolio diversification across both dimensions proves most effective for risk-adjusted performance.

Emotional & Lifestyle Drivers Behind Dual Ownership

The Psychology of Omnipresence

Billionaires are driven by more than financial returns—they seek omnipresence across multiple dimensions of influence and social interaction. Owning both a $50 million Manhattan penthouse and a $2 million virtual estate in Decentraland allows them to host exclusive events in physical and digital realms simultaneously.

This dual presence satisfies psychological needs for control and status that transcend traditional wealth display. When Snoop Dogg’s neighbor paid $450,000 for adjacent virtual land in The Sandbox, they weren’t just making an investment—they were securing social proximity in a digital realm where physical geography becomes irrelevant.

Generational Wealth Evolution

Ultra-wealthy families view metaverse properties as digital heirlooms—assets that can be passed down to tech-native heirs who will inhabit virtual worlds as naturally as physical spaces. This generational thinking explains why investors like Zuckerberg maintain massive virtual world investments despite initial market skepticism.

The strategy acknowledges that future generations will likely derive equal social status and economic value from virtual environments. Early positioning in premium metaverse locations represents forward-thinking wealth preservation that traditional assets cannot provide.

Status Symbol Revolution

Traditional status markers—private jets, yachts, mansions—are being complemented rather than replaced by virtual equivalents. A billionaire’s virtual mansion carries social currency in Web3 communities, while their physical estate maintains prestige in traditional circles.

This dual approach maximizes influence across generational divides, allowing wealthy individuals to maintain relevance among both traditional power structures and emerging digital-native communities.

Strategic Investment Takeaways for UHNIs

Immediate Opportunities (2025)

Smart money is identifying specific entry points across both asset classes. In physical real estate, luxury properties in Tier-2 Indian cities are showing 20% growth rates, while Dubai continues offering tax-efficient opportunities with 16.9% appreciation. The branded residences segment shows particular promise, with 71% of Indian HNIs planning luxury purchases in 2024-2025.

For metaverse investments, prime plots in established platforms like The Sandbox and Decentraland remain undervalued relative to growth projections. Early positioning before mainstream adoption accelerates offers optimal risk-adjusted entry points.

Virtual real estate investment follows straightforward processes that mirror traditional property acquisition. Setting up digital wallets, acquiring platform-specific cryptocurrencies, and conducting due diligence on virtual locations require similar analytical frameworks to physical property evaluation.

Mid-term Strategic Positioning (2025-2028)

Portfolio evolution should target rebalancing from traditional 80-20 physical-digital allocations toward more aggressive 70-30 splits. This adjustment captures metaverse market maturation while maintaining stability through physical asset foundations.

Platform diversification becomes critical as the virtual real estate ecosystem expands beyond current leaders. Emerging metaverses may offer superior returns, but established platforms provide stability and liquidity advantages.

Integration technologies linking physical and virtual properties represent the next frontier. Investments in AR/VR infrastructure that connect real-world and digital spaces will enhance both asset categories’ utility and appreciation potential.

Long-term Vision (2028-2034)

The metaverse real estate market’s projected growth to $67.4 billion creates unprecedented wealth creation opportunities. Regulatory frameworks will mature, providing clarity on digital property rights and taxation structures that currently create uncertainty.

Cross-reality integration will reach maturation, where seamless experiences between physical and virtual spaces become standard expectations rather than novelty features. This convergence will fundamentally alter how luxury property is conceptualized and valued.

Case Studies: Billionaire Pioneers Leading Dual-Asset Strategies

Jeff Bezos’ $200M Compound Strategy

Amazon founder Jeff Bezos exemplifies the billionaire compound strategy through his methodical acquisition of three adjacent properties in Indian Creek, Florida, totaling over $200 million. His purchases—$68 million, $79 million, and $90 million respectively—created a “Bezos Effect” throughout South Florida’s luxury market, with real estate broker Jill Hertzberg noting that “no one had ever paid that before.”

This compound approach translates directly to metaverse strategies, where billionaires acquire multiple adjacent plots in premium virtual locations. The principle of securing contiguous properties for ultimate privacy and control applies equally in physical and digital realms. Bezos’ methodology demonstrates how ultra-wealthy buyers can single-handedly reshape entire markets through strategic positioning and price leadership.

Mark Zuckerberg’s Metaverse Vindication

Meta CEO Mark Zuckerberg’s $201 billion fortune represents the ultimate vindication of metaverse investment strategies. After losing over $100 billion during 2021-2022 market skepticism, his persistence has generated $78 billion in wealth growth during 2024 alone—more than any tracked billionaire.

Zuckerberg’s dual approach combines extensive physical real estate holdings, including a 1,400-acre Hawaii compound, with massive virtual world investments through Meta’s Reality Labs division. His success attracts other UHNWIs to dual-asset portfolios, demonstrating that metaverse properties can appreciate faster than physical alternatives when properly positioned and managed.

India’s Record-Breaking Pharmaceutical Heiress

Leena Gandhi Tewari’s ₹639 crore acquisition of two sea-facing duplex apartments in Mumbai’s Worli represents India’s luxury market evolution. At ₹2.83 lakh per square foot, her transaction reset national benchmarks while exemplifying how Indian UHNWIs leverage both traditional and emerging opportunities.

Tewari’s strategy reflects broader Indian billionaire trends of securing trophy physical assets while exploring metaverse opportunities. With India’s UHNI population growing 50% by 2028, her approach positions Indian investors at the forefront of next-generation wealth preservation strategies combining tangible luxury with virtual asset diversification.

Professional Investment Strategies for Elite Portfolios

UHNI Portfolio Optimization Framework

Sophisticated investors are implementing UHNI portfolio diversification strategies that balance risk across physical and digital asset categories. The optimal allocation for most ultra-wealthy individuals involves 70% physical luxury real estate and 30% metaverse properties, providing risk-adjusted returns while maintaining liquidity across traditional and emerging asset classes.

Location Intelligence for Virtual Properties

Traditional real estate location principles translate directly to metaverse investments. Proximity to high-traffic areas, development potential, and platform stability determine long-term appreciation prospects. Prime virtual locations adjacent to popular venues, established businesses, or celebrity properties command premium valuations similar to physical real estate hotspots.

Cross-Platform Risk Management

Virtual real estate hedging requires diversification across multiple metaverse platforms to mitigate platform-specific risks while capturing overall market growth. Investment allocation across The Sandbox, Decentraland, TCG World, and emerging platforms provides optimal exposure while managing technological and regulatory uncertainties.

Tax-Optimized Dual-Asset Structuring

Elite investors utilize jurisdiction arbitrage by holding physical properties in tax-efficient locations like Dubai and Singapore while structuring virtual assets through blockchain-friendly regulatory environments. This approach maximizes after-tax returns across both asset categories.

Generational Wealth Transfer Innovation

Family offices increasingly establish expertise in both traditional and virtual real estate management, ensuring seamless succession planning across physical and digital property portfolios. This preparation addresses the reality that future generations will derive equal value from both asset types.

Risk Analysis & Contrarian Perspectives

Market Vulnerabilities

Despite explosive growth potential, dual-asset strategies face significant risks that sophisticated investors must carefully manage. Regulatory uncertainty surrounding virtual property rights creates potential valuation disruptions. Platform obsolescence risk in rapidly evolving metaverse ecosystems could render significant investments worthless if dominant platforms lose market position.

Liquidity constraints affect both ultra-luxury physical properties and virtual real estate markets during economic stress periods. Interest rate sensitivity impacts luxury property valuations, while technological barriers may limit mainstream metaverse adoption rates.

Contrarian Investment Viewpoints

Market critics argue that metaverse real estate represents speculative bubble behavior similar to 2021 NFT mania. Traditional real estate professionals question the long-term value proposition of intangible virtual assets, particularly given their dependence on platform continuity and technological infrastructure.

Regulatory crackdowns represent existential threats to virtual property markets, while economic downturns might force billionaires to liquidate less liquid virtual holdings before touching traditional assets. These perspectives require serious consideration in portfolio construction and risk management frameworks.

Frequently Asked Questions

How much do billionaires typically invest in metaverse real estate?

Ultra-wealthy investors typically allocate 5-15% of their real estate portfolio to virtual properties, with tech billionaires reaching 20% allocation. Average metaverse property investments range from $100,000 to $5 million, with exceptional purchases exceeding $5 million in premium virtual locations like TCG World’s record $5 million sale.

Which metaverse platforms offer optimal investment opportunities for UHNWIs?

The Sandbox leads with 62% market share and $580 million in 2024 transaction volume, followed by Decentraland’s 28% share and $420 million volume. TCG World recorded the highest single sale at $5 million despite smaller market share, while Axie Infinity maintains strong gaming-focused demand with $350 million annual volume.

What returns can sophisticated investors expect from dual physical-virtual strategies?

Physical luxury real estate typically yields 15-25% annually in prime markets like Mumbai and Dubai. Metaverse properties show higher volatility but potential returns of 300-700% during growth phases. Diversified portfolios targeting 20-30% blended returns prove most sustainable for UHNI investment objectives.

How do billionaires structure dual-asset investments for tax optimization?

Sophisticated investors utilize international holding structures, placing physical properties in tax-advantaged jurisdictions while holding virtual assets through blockchain-friendly regulatory environments. Family offices increasingly employ specialist advisors for both traditional and digital asset optimization, maximizing after-tax returns across both categories.

Investment Conclusion

The convergence of physical mansions and metaverse properties represents more than portfolio diversification—it signals the emergence of omnipresent wealth strategies that transcend traditional investment boundaries. As India’s UHNI population explodes by 50% through 2028 and metaverse real estate markets mature toward $67.4 billion by 2034, early adopters of dual-asset approaches position themselves at the vanguard of generational wealth creation.

Ultra-wealthy investors who master both dimensions—tangible luxury and virtual scarcity—will command unprecedented influence across physical and digital realms. The billionaires pioneering these strategies today are laying foundations for wealth preservation and growth that extend far beyond traditional asset categories.

The future belongs to investors who think beyond conventional boundaries, recognizing that tomorrow’s elite will inhabit multiple realities simultaneously. Those who embrace dual-asset strategies now will dominate both physical and virtual luxury markets as they mature and converge into integrated wealth ecosystems.

Relevant YouTube Videos

Free resources to download

Dual-Asset Wealth Strategies: Key Summary