Now Reading: Fractional Ownership: Democratizing Luxury Without Diluting Exclusivity

- 01

Fractional Ownership: Democratizing Luxury Without Diluting Exclusivity

Fractional Ownership: Democratizing Luxury Without Diluting Exclusivity

Imagine owning a slice of a ₹10 crore office tower in Mumbai’s Bandra-Kurla Complex—without writing a check for the full amount. Or picture yourself as a co-owner of a Palm Jumeirah penthouse in Dubai, spending just a fraction of what traditional ownership demands. This is not fantasy. This is the fractional ownership revolution reshaping how the world’s wealthy invest in luxury real estate.

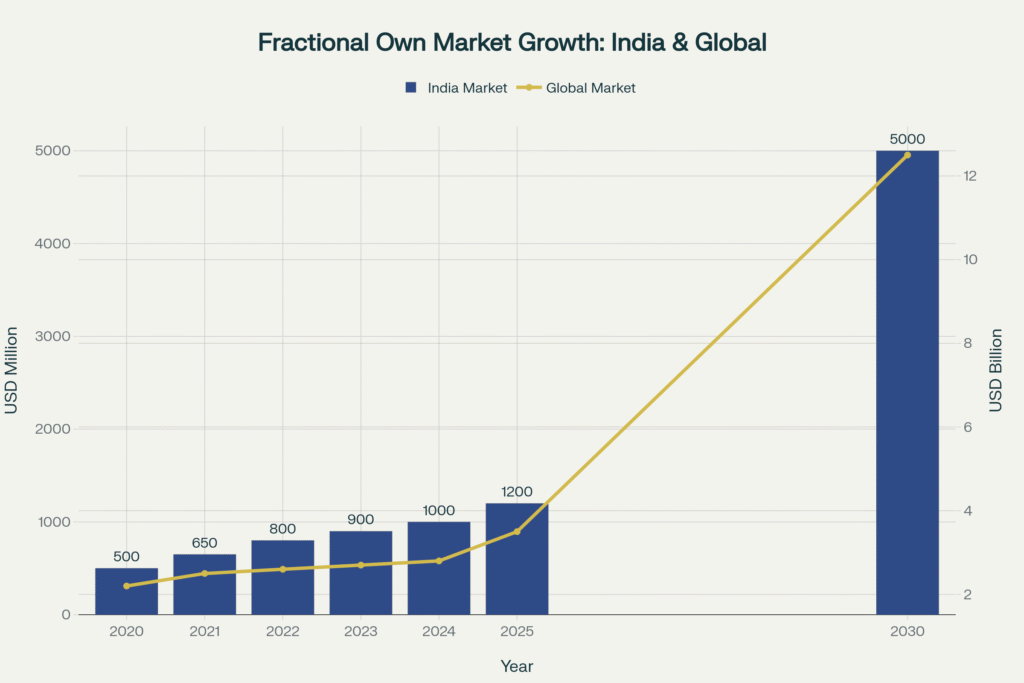

For decades, premium property investment remained the exclusive domain of institutional investors and ultra-high-net-worth individuals. Today, fractional ownership platforms are dismantling those barriers, offering UHNI and HNI investors unprecedented access to elite assets with entry points starting at $25,000. India’s fractional ownership market, valued at $1 billion in 2024, is projected to explode to $5 billion by 2030. With regulatory frameworks maturing and investor confidence soaring—64% of HNI investors now prefer fractional models for commercial real estate—this is no longer an alternative investment. It’s the future of intelligent capital deployment.

The question is not whether fractional ownership will reshape luxury real estate portfolios. The question is: will you position yourself ahead of the curve?

When Exclusivity Meets Accessibility

The Old Guard vs. The New Wave

Not too long ago, owning a premium commercial property in Bengaluru or a beachfront villa in Goa required deep pockets and deeper patience. You needed millions in capital, the bandwidth to manage complex transactions, and the tolerance for illiquidity that could lock your money away for years.

Then came the fractional ownership revolution.

Today, platforms like Strata, hBits, PropertyShare, FracSpace and MYRE Capital are rewriting the rules. They’re taking high-value assets—think Grade-A office buildings leased to multinational corporations, luxury vacation homes in Lonavala, or commercial warehouses in Chennai—and dividing them into investable fractions. The result? You can own a piece of a ₹50 crore property for as little as ₹25 lakh.

But here’s where it gets interesting: this democratization isn’t diluting exclusivity. It’s amplifying it.

The Psychology of Prestige: Why Smart Money is Moving In

Luxury has always been about more than price tags. It’s about identity, accomplishment, and belonging to an elite club. Research shows that 68% of luxury purchases are driven by emotional fulfillment and self-reward, not just status signaling. For today’s investors, fractional ownership satisfies both the rational and emotional: the thrill of co-owning a Worli penthouse, the pride of being part of a select investor group, and the smart diversification of spreading capital across multiple trophy assets.

“It’s not just about the returns,” says Priya, a Thane-based entrepreneur who invested ₹5 lakh in a fractioned retail building in Andheri. “It’s about being part of something aspirational. I’m co-owner of a property leased to an international brand. That changes how I think about my portfolio—and myself.”

This is the new prestige: intelligence over indulgence, strategy over spectacle.

The Numbers Tell a Compelling Story (But They’re Not the Whole Story)

Let’s talk numbers—briefly—because context matters more than spreadsheets.

India’s fractional ownership market has grown from $500 million in 2020 to $1 billion in 2024, with projections pointing toward $5 billion by 2030. Globally, the market is racing toward $12.5 billion by decade’s end. But here’s what those numbers really mean:

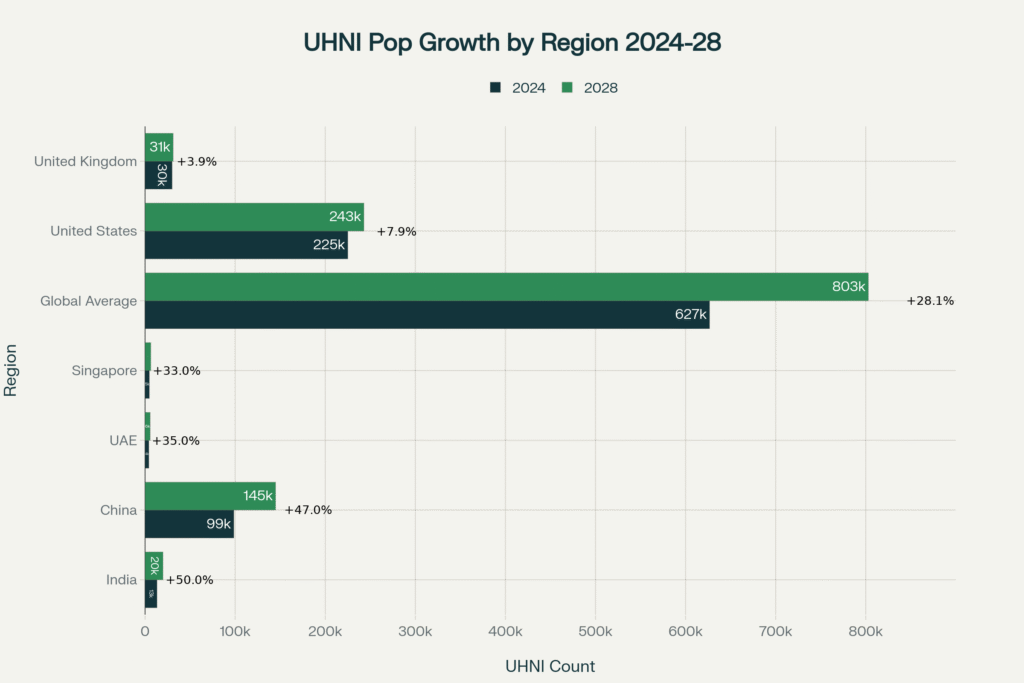

More wealth creators, more opportunities. India’s UHNI population is set to grow by 50% by 2028—from 13,263 to nearly 20,000 individuals. China is close behind at 47% growth. This isn’t just demographic data; it’s a seismic shift in where global wealth is being created and how it’s being deployed.

Rental yields that matter. Fractional ownership delivers 8-12% returns compared to 6-8% for traditional real estate and 5-7% for REITs. That difference compounds powerfully over time.

Cities where opportunity concentrates. Bengaluru leads with 31% of HNI preference for fractional investments, followed by Pune (24%) and Mumbai (22%). These aren’t random choices—they’re strategic bets on India’s economic engines.

The takeaway? The wealth is shifting eastward, and fractional ownership is capturing that momentum.

The Real Talk: Risks, Realities, and What They Don’t Tell You

Let’s be honest. Fractional ownership isn’t a fairy tale. It’s a sophisticated investment model with trade-offs, and elite investors deserve the unvarnished truth.

Liquidity: The Achilles’ Heel

Unlike REITs, which you can sell on an exchange in seconds, fractional ownership requires finding a buyer—often on a platform-specific secondary market. Exit timelines range from 6 to 18 months, and in a downturn, that could stretch longer.

The Upside: Platforms are rapidly developing secondary marketplaces and guaranteed exit mechanisms. SEBI’s SM REIT framework is also pushing for more liquidity solutions.

Regulatory Evolution

India’s SM REIT regulations, introduced in 2024, brought much-needed clarity. But the rules are still evolving. Minimum investment thresholds (₹10 lakh) and compliance costs could impact yields by 1-3%.

The Upside: Regulatory maturity attracts institutional capital and weeds out bad actors. This is a feature, not a bug.

Co-Ownership Complexity

When you co-own with others, decisions about property management, renovations, and exit timing require consensus. Disputes can arise.

The Upside: Professional SPV structures and clear legal agreements minimize friction. Many platforms handle all management, so you’re truly passive.

Platform Risk

Your investment’s liquidity and management depend on the platform’s health. If the intermediary fails, ownership claims can become murky.

The Upside: SEBI registration and institutional backing are de-risking this space fast.

The Contrarian View

Some critics argue fractional ownership adds complexity without proportional value—why not just buy REIT shares? Others worry about lack of price discovery and potential regulatory crackdowns.

The Rebuttal: Fractional ownership offers tangible asset exposure that REITs don’t. You own a specific property, not a diversified fund. For investors seeking control, exclusivity, and direct rental income, fractional beats REITs on emotional and strategic grounds.

Tips for Investors (That Actually Matter)

1. Platform Due Diligence is Non-Negotiable

Verify SEBI registration for India-based platforms. Review management team credentials—real estate and finance expertise matter. Scrutinize track record: exits delivered, investor returns, complaint history. Understand fee structures: acquisition fees, annual management fees, exit/performance fees.

2. Follow the Cash Flow, Not the Hype

Prioritize 95%+ pre-leased properties with investment-grade tenants (think multinational corporations, government entities). Verify lease tenure (5+ years remaining) and escalation clauses that guarantee rent growth. Avoid under-construction or speculative assets. Cash-flowing assets protect your downside.

3. Legal Structure Defines Your Protection

SPV (Special Purpose Vehicle) structures provide clean ownership and tax efficiency. Ensure ownership rights are documented—either in title deeds or blockchain certificates. Review exit clauses: secondary market access, buyback options, lock-in periods. Understand co-owner rights for decision-making and dispute resolution.

4. Diversify Across Geographies and Asset Classes

Commercial (offices, warehouses): stable, 8-10% yields

Residential luxury (vacation homes): 6-8% yield plus lifestyle benefits

Retail/hospitality: higher risk/return, cyclical

Geographic spread: India for growth, UAE for innovation, London/Singapore for stability

5. Tax Optimization is Where Wealth Compounds

Leverage Section 80C deductions in India (property tax, mortgage interest). Understand LTCG taxation: 12.5% vs. 20% with indexation (pre-July 2024 investments). NRIs should utilize Double Taxation Avoidance Agreements (DTAA). Structure investments through holding entities for estate planning and succession benefits.

The Strategic Horizons: Where to Deploy Capital Now

Immediate Actions (Next 12 Months)

Allocate 5-10% of your real estate portfolio to fractional ownership as a diversification play. Target Grade-A commercial assets in Bengaluru, Pune, and Mumbai for 9-12% yields. Prioritize SEBI-registered SM REIT platforms for regulatory safety. Consider Dubai tokenized properties for international diversification and NRI-friendly tax structures.

Mid-Term Strategy (1-3 Years)

Increase allocation to 15-20% as regulatory frameworks mature and secondary markets develop. Explore vacation home fractional ownership in Goa, Lonavala, and Dubai Marina—lifestyle plus returns. Monitor blockchain-based platforms for transparency and fractional trading innovations. Rebalance toward platforms demonstrating track records of successful exits.

Long-Term Positioning (3-5+ Years)

Position for exit when fractional markets reach maturity and liquidity premiums emerge. Leverage generational wealth transfer—millennials and Gen Z favor fractional models over traditional ownership. Diversify globally: India (growth engine), UAE (innovation hub), London (stability anchor). Target optimal portfolio mix: 30% fractional, 50% traditional, 20% REITs.ss-test assumptions; avoid emotional attachment to trophy assets.

FAQ Section

How is fractional ownership different from REITs?

Fractional ownership gives you direct ownership of a specific property through an SPV. You receive rental income from that asset and benefit from its appreciation. REITs are pooled investment vehicles holding diversified property portfolios, traded like stocks. Fractional offers tangible asset control; REITs offer instant liquidity.

What happens if other co-owners want to sell and I don’t?

Most platforms have secondary markets where co-owners can sell their shares without affecting your stake. SPV agreements typically outline buyback mechanisms and dispute resolution processes. Professional platforms manage these transitions to minimize friction.

Are fractional ownership returns guaranteed?

No investment guarantees returns. However, fractional ownership in pre-leased commercial properties with long-term corporate tenants provides predictable rental income (8-12% yields). Capital appreciation depends on market conditions. Always review lease terms, tenant quality, and location fundamentals.

How do I exit my fractional investment?

The Future is Fractional—And It’s Happening Now

The democratization of luxury real estate isn’t coming. It’s here.

What began as a niche experiment has evolved into a sophisticated asset class backed by regulatory frameworks, institutional capital, and a new generation of investors who value intelligence over ostentation. India’s UHNI population is growing 50% by 2028. Fractional platforms are capturing $1 billion in assets today, racing toward $5 billion by 2030. Dubai is tokenizing Palm Jumeirah. London is fractionalizing Mayfair.

This isn’t a trend. It’s a transformation.

For UHNI and HNI investors, the question isn’t whether fractional ownership deserves a place in your portfolio. The question is how much upside you’re willing to miss by waiting.

The smart money isn’t watching from the sidelines. It’s already moving.

Your move.

YouTube Learning Resources

Free resources to download

Fractional Ownership: Executive Summary