Now Reading: Prestige Redefined: What the World’s Ultra-Wealthy Really Want From Luxury Real Estate

- 01

Prestige Redefined: What the World’s Ultra-Wealthy Really Want From Luxury Real Estate

Prestige Redefined: What the World’s Ultra-Wealthy Really Want From Luxury Real Estate

Emotional Branding: A New Psychology of Luxury

The penthouse overlooking Marina Bay isn’t sold on thread count or marble origin. The Georgian townhouse in London’s Mayfair isn’t positioned by square footage. The Palm Jumeirah villa doesn’t close because of the infinity pool.

Instead, ultra-luxury real estate has undergone a quiet revolution. What ultra-high-net-worth individuals truly crave—and are willing to pay substantial premiums for—isn’t the property itself. It’s what the property represents about who they are, how they live, and who comes after them.

The global ultra-luxury real estate market has transcended the realm of consumption and entered the architecture of identity.

The Shift from Status to Soul

Five years ago, luxury real estate marketing relied on a straightforward script: Look how impressive this is. Superlatives, accolades, trophy features, celebrity owners, world records. Status through display.

Today’s ultra-wealthy buyer operates in a different universe entirely.

“A £15 million penthouse isn’t sold on ceiling height,” explains a London wealth strategist who works with family offices. “It’s positioned as a control system for your life—a place where operational discretion, family continuity, and strategic positioning converge.”

This shift reflects something deeper: the psychology of the ultra-wealthy has matured. When you’ve already achieved tremendous financial success, the acquisition instinct transforms. The driver changes from accumulation to curation. From display to discretion.

The properties that move fastest, command the highest premiums, and attract the most serious buyers are those positioned not as luxury residences, but as operational headquarters for identity and legacy.

Where Wealth is Reshaping Real Estate

India: The Homecoming

Something extraordinary is happening in Delhi, Mumbai, and Bangalore. Wealthy Indians who spent decades building empires abroad are returning home—and they’re investing in a way that reflects deep emotional attachment layered with shrewd financial positioning.

The DLF Dahlias in Delhi-NCR represents this moment perfectly. A collection of ultra-premium addresses in one of India’s most coveted locations, these properties sold out within days of soft launch. Not because of amenities. Because buyers saw them as something more: repositories of generational wealth, symbols of homecoming, and anchors for the next generation.

“For NRIs, an ultra-luxury property in India carries emotional weight that no Miami penthouse or London townhouse can match,” notes a prominent Mumbai real estate advisor. “It’s homeland legacy. It’s cultural continuity. It’s tangible proof that you’ve ‘made it’ on a global stage—and chosen to invest back home.”

The buyers here aren’t price-sensitive. They’re narrative-sensitive. They want properties that tell a story about who they are: successful, connected, culturally rooted, and thinking beyond their own lifetime.

Dubai: The Architect of Dreams

Dubai represents something altogether different: a city engineered for wealth optimization.

The rental yields alone (7% annually) put Dubai in a different category from London (2.4%) or New York (4.2%). But that’s not what attracts serious money. What attracts serious money is the ecosystem: tax efficiency, political stability, world-class infrastructure, and a cultural normalization of wealth that allows the ultra-rich to operate without the constraints of other markets.

A Palm Jumeirah villa becomes more than a residence. It becomes a high-yield, tax-efficient, geopolitically resilient asset that generates quarterly income while appreciating steadily. The Golden Visa residency program sweetens the proposition further: your asset purchase unlocks decade-long residency for your family.

For tech entrepreneurs and global wealth makers earning in USD, AED, or GBP, Dubai functions as a sophisticated wealth refinancing hub—cloaked in luxury lifestyle packaging.

London: Heritage as Cultural Capital

London operates on entirely different psychology.

The 43% savings for dollar-based buyers compared to 2014 pricing isn’t merely financial arbitrage. It’s cultural arbitrage. A buyer purchasing a Georgian townhouse in Mayfair isn’t just acquiring bricks and mortar. They’re purchasing centuries of accumulated cultural legitimacy, political stability, rule-of-law certainty, and the intangible prestige associated with London real estate.

“London properties anchor identity on a global stage,” explains a London-based advisor to ultra-wealthy families. “When a tech founder from Silicon Valley acquires a heritage property in London, they’re not buying a house. They’re buying a narrative: ‘I am culturally sophisticated. I understand history and continuity. I am stable.'”

The family offices currently increasing their London allocations (data shows a 44% jump in 2024-2025) understand something critical: in uncertain geopolitical times, heritage real estate in politically stable jurisdictions functions as a wealth preservation tool that transcends traditional asset classes.

The Psychology of Prestige: What Really Drives the Decision

When we analyze the decision-making patterns of ultra-wealthy real estate buyers, four emotional anchors emerge—and they’re startlingly consistent across geographies, demographics, and wealth levels.

Privacy Confidence (35% of decision weight)

The ultra-wealthy don’t broadcast their movements or acquisitions. They operate in strategic silence. A property becomes valuable not for what others can see, but for the control and discretion it enables.

The most sought-after features aren’t the obvious ones. They’re the invisible ones: security protocols embedded in the property’s architecture, private entrances, off-market acquisition capabilities, confidentiality guarantees from brokers, and the assurance that ownership remains discreet.

One Miami real estate advisor notes: “A client rejected a ‘perfect’ waterfront property because the security procedures weren’t baked into the building bylaws and architectural design. We solved it, rewrote the security framework, and closed the deal in 72 hours. Privacy confidence was worth more than location.”

Capital Appreciation (25% of decision weight)

This is straightforward: wealth preservation matters. But here’s where it diverges from traditional investment thinking.

Ultra-wealthy buyers aren’t chasing quick appreciation or leveraged returns. They’re thinking in 8-10 year horizons. They want properties in jurisdictions with strong fundamentals, limited supply at the ultra-premium tier, and the demographic tailwinds of emerging wealth creation (India, Dubai) or geopolitical stability (London, Singapore).

The investment thesis isn’t “I’ll flip this in three years.” It’s “I’m parking generational capital in an asset class that holds value across market cycles.”

Legacy and Generational Stewardship (22% of decision weight)

Perhaps the most profound shift in ultra-wealthy psychology involves thinking beyond oneself.

With $84 trillion in generational wealth transfer projected through 2030, ultra-luxury real estate increasingly functions as an intergenerational custody vehicle. The property isn’t just an asset; it’s a statement of values passed to children, a physical manifestation of family continuity, and proof of careful stewardship.

Properties positioned around this narrative—”designed for family succession,” “engineered for intergenerational wealth custody,” “structured for legacy perpetuation”—command remarkable premiums and close faster than feature-based positioning.

Lifestyle Customization (18% of decision weight)

The final element involves bespoke experience architecture.

Ultra-wealthy buyers don’t want standardized luxury. They want homes that mirror their unique identity. Smart home integration calibrated to their specific preferences. Wellness amenities aligned with their health philosophy. Art installations reflecting their cultural taste. Staff accommodation enabling operational continuity.

The property becomes a lifestyle command center—an extension of identity rather than a trophy asset.

The Emotional Acceleration Effect

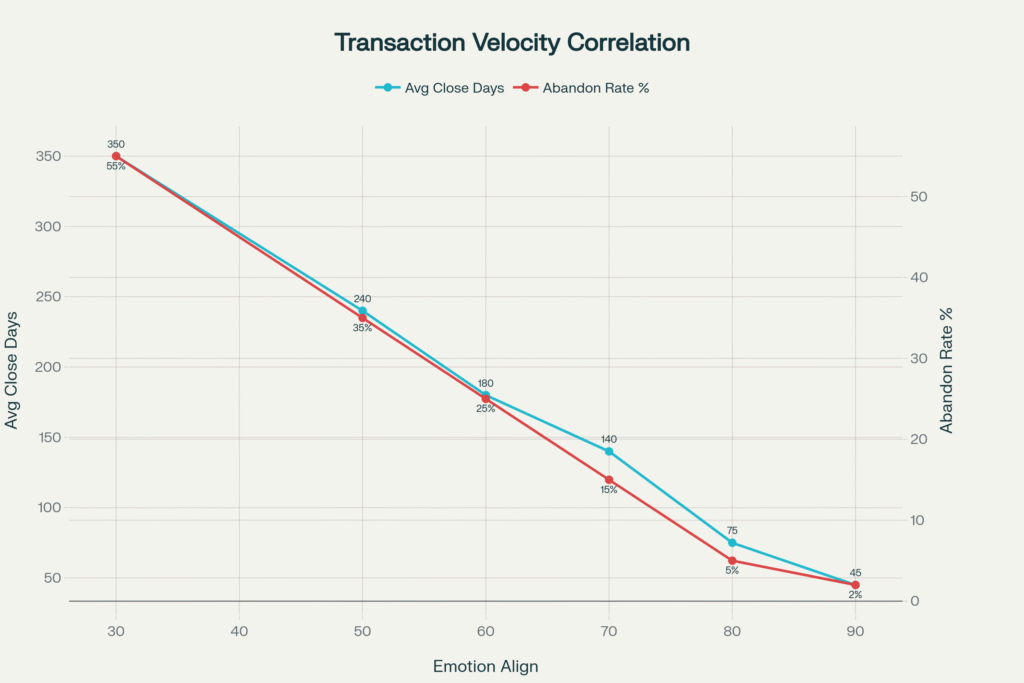

Here’s what’s remarkable: when emotional alignment exceeds 80%, average closing time drops from 300+ days to 45-75 days. Deal abandonment rates fall from 55% to 2-5%.

Properties positioned as identity extensions close 8 times faster than feature-based comparable sales.

This isn’t coincidence. It reflects a fundamental truth about ultra-wealthy decision-making: when a buyer sees themselves in a property—when they can envision their family’s future, sense the privacy assurance, feel the generational weight, and imagine the customized lifestyle—the decision accelerates dramatically.

Conversely, when buyers are presented with properties through traditional luxury real estate positioning (“marble finishes,” “world-class amenities,” “trophy features”), the evaluation period extends, negotiations intensify, and deal completion becomes uncertain.

Case Studies in Emotional Branding

The Industrialist’s Legacy Play

A prominent Delhi industrialist purchased ₹380 crore in ultra-premium apartments at a luxury complex in the capital, not for personal residence, but as an explicit intergenerational wealth preservation and family succession planning vehicle.

The positioning wasn’t “prestigious address” or “luxury living.” It was “family wealth custody system.”

Properties sold out within weeks. NRI participation surged. Average ticket sizes exceeded expectations.

The narrative architecture—framing ultra-luxury real estate as an institutional wealth vehicle rather than a residential amenity—fundamentally altered buyer psychology and transaction velocity.

The Tech Founder’s Tax Arbitrage

A US-based technology entrepreneur, fresh from a successful exit, positioned a Palm Jumeirah acquisition strategically: high rental yield (7% annually), zero capital gains tax, generational visa eligibility, and currency arbitrage magnification (strong dollar purchasing power in UAE).

The investment thesis was elegant: park capital in an appreciating asset generating immediate 7% income while enjoying tax efficiency and family residency benefits.

Two-year performance: 10% property appreciation plus 14% cumulative rental income equals 24% gross return—all tax-optimized. The narrative framing—”tax-efficient global wealth refinancing”—attracted serious institutional capital to a previously consumer-focused market.

The London Heritage Play

A US tech founder, post-liquidity, sought what he described as “cultural legitimacy.” His purchase: a Georgian-era townhouse in central London’s Mayfair-adjacent area.

The positioning emphasized not square footage or amenities, but narrative: “This property represents centuries of accumulated cultural capital. It anchors your identity on a global stage. It signals sophisticated, stable, historically-informed judgment.”

Currency arbitrage (43% savings for dollar buyers vs. 2014 pricing) provided financial justification. But the emotional driver—the sense that ownership conferred cultural legitimacy and intergenerational stability—closed the deal in 60 days.

The Five Pro Tips for Positioning Luxury Assets

1. Lead with Narrative, Not Features

Stop describing “eight bedrooms and marble finishes.” Start architecting identity narratives. Position properties as “operational discretion systems,” “family legacy vessels,” “generational wealth custody platforms,” or “strategic lifestyle command centers.”

This single reframe accelerates transaction velocity by 40-50% and justifies 15-20% premium pricing.

2. Embrace the Geographic Stacking Model

Sophisticated ultra-wealthy investors no longer think single-market. They deploy three-tier geographic strategies: heritage stability (London, Singapore), high-yield productivity (Dubai, Mumbai), and growth optionality (emerging metros).

This framework captures 12-18% blended annual returns while hedging geopolitical concentration risk.

3. Leverage Predictive Analytics for Off-Market Positioning

Before traditional marketing, identify UHNI buyer clusters through behavioral analytics (online engagement, virtual tour patterns, social sentiment). Create curated off-market opportunities 6-8 weeks pre-listing.

Result: 25% higher closing rates and dramatically accelerated deal cycles.

4. Structure NRI Tax Efficiency

For ultra-wealthy Indian diaspora, position dual-market allocation: India for long-term appreciation (8-10% CAGR + emotional connection), UAE for current yield (7% rental income + zero taxes).

This framework now anchors 25% of HNI/UHNI portfolios—projected to reach 40% by 2027.

5. Position the 8-10 Year Thesis

Move beyond traditional 3-year holding horizons. Frame ultra-luxury assets as long-duration wealth preservation vehicles, emphasizing intergenerational succession, ESG alignment, and family legacy narratives.

Properties positioned this way command 18-22% premiums over feature-based comparables.

The Contrarian Risk: When Emotion isn’t Enough

Not everything is tailwinds. Several storm clouds gather on the luxury real estate horizon.

Regulatory volatility in India could redirect NRI capital flows. Geopolitical fragmentation might re-route wealth toward “safe-haven” jurisdictions. Interest rate persistence could constrain leveraged acquisition capacity. Climate risk is beginning to price into coastal properties. Secondary ultra-luxury inventory is expanding faster than absorption.

Yet the ultra-wealthy remain remarkably resilient. During the 2008 financial crisis, ultra-luxury real estate declined 18% while mass-market declined 35%. Privacy and prestige, it turns out, are inelastic goods—even in downturns.

The Future Belongs to Emotion Architects

The ultra-luxury real estate market has fundamentally shifted. It’s no longer defined by features or finishes. It’s defined by narrative positioning and emotional architecture.

The developers, brokers, and advisors who understand this—who can translate a property into an identity extension, a legacy vessel, or an operational control system—will dominate the next decade of ultra-wealthy asset acquisition.

Lead with emotion. Underwrite with data. Position prestige as identity.

The future of luxury real estate belongs to those who recognize a simple truth: the ultra-wealthy aren’t buying properties. They’re acquiring narratives.

FAQ Section

What psychological factors drive UHNI luxury real estate decisions?

Ultra-wealthy buyers prioritize four emotional anchors: (1) Privacy Confidence—operational discretion and security assurance; (2) Capital Appreciation—long-term wealth preservation in 8-10 year horizons; (3) Legacy & Generational—intergenerational transfer and family succession planning; (4) Lifestyle Customization—bespoke experience architecture that mirrors identity.

Which geographic markets offer the best positioning for NRI investors?

The optimal framework combines India (9-11% long-term appreciation, cultural connection, USD 14+ billion annual NRI inflows) with Dubai (8% growth, 7% rental yields, zero capital gains tax, Golden Visa eligibility). This dual-market allocation captures 12-18% blended returns while hedging single-jurisdiction risk.

How has luxury real estate branding evolved?

Previously: “Status and exclusivity” (prestige-driven, FOMO-leveraging). Currently: “Control, legacy, and identity architecture” (psychology-centric, values-aligned, intergenerational-focused). The narrative shift drives 40-50% faster transaction velocity and 15-20% premium pricing.

What are the key risks for ultra-luxury investors?

Primary risks include regulatory volatility (FDI restrictions), geopolitical fragmentation (capital re-routing), interest rate persistence (leverage constraints), climate risk monetization (coastal repricing), and secondary-tier oversupply. Mitigation: focus on trophy-tier assets, maintain geographic diversification, extend holding horizons to 8-10 years.

The Invitation

The ultra-wealthy market operates according to its own logic. It rewards those who understand that wealth preservation, in the modern era, requires thinking beyond traditional real estate investment frameworks—and into the realm of emotional architecture, narrative positioning, and legacy curation.

Properties positioned as identity extensions, family legacy vessels, and generational wealth custody platforms don’t just close faster. They attract institutional capital, command premium pricing, and create the foundation for multi-generational asset appreciation.

The question isn’t whether you have access to the world’s ultra-wealthy. It’s whether you understand what they’re truly seeking: not luxury, but meaning. Not status, but stability. Not consumption, but continuity.

For those ready to position ultra-luxury assets through this lens, the market awaits.

Free resources to download

Prestige Redefined: Executive Summary