Now Reading: Blockchain’s Fortress: How India is Securing ₹3.45 Trillion in Land Assets for UHNI Investors

- 01

Blockchain’s Fortress: How India is Securing ₹3.45 Trillion in Land Assets for UHNI Investors

Blockchain’s Fortress: How India is Securing ₹3.45 Trillion in Land Assets for UHNI Investors

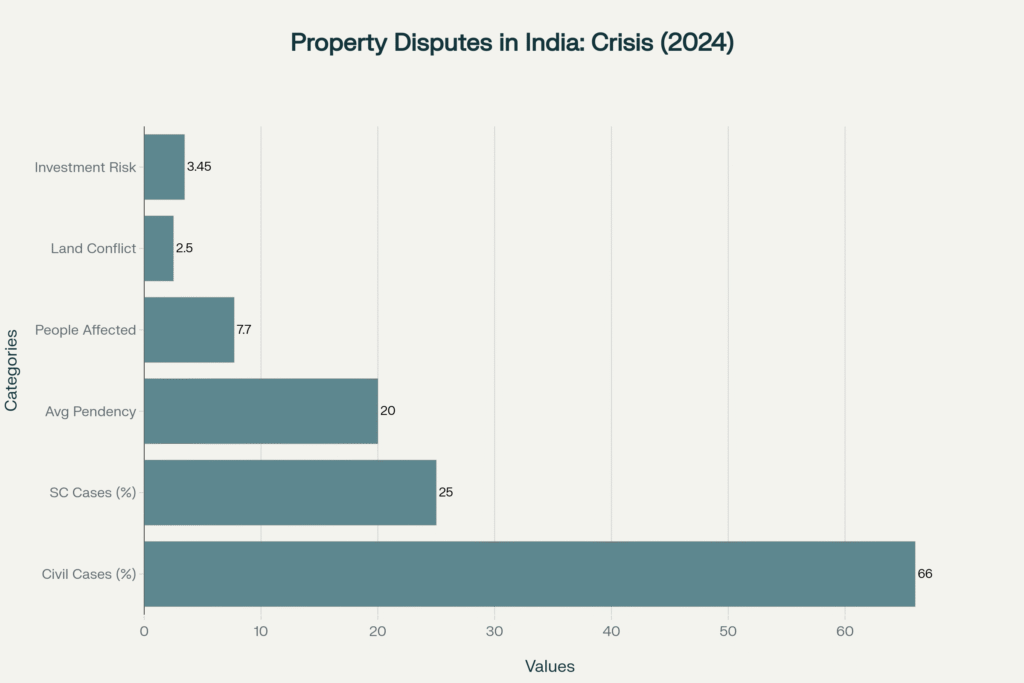

Land records in India stands at a transformative crossroads. With 66% of civil litigation stemming from land disputes and an average pendency of 20 years per case, the nation’s property ecosystem has hemorrhaged ₹3.45 trillion in threatened investments while affecting 7.7 million citizens. Yet, emerging from this crisis is a technological revolution: blockchain-secured land registries that promise to redefine property ownership for Ultra-High-Net-Worth Individuals (UHNIs) and High-Net-Worth Individuals (HNIs) across India and globally.

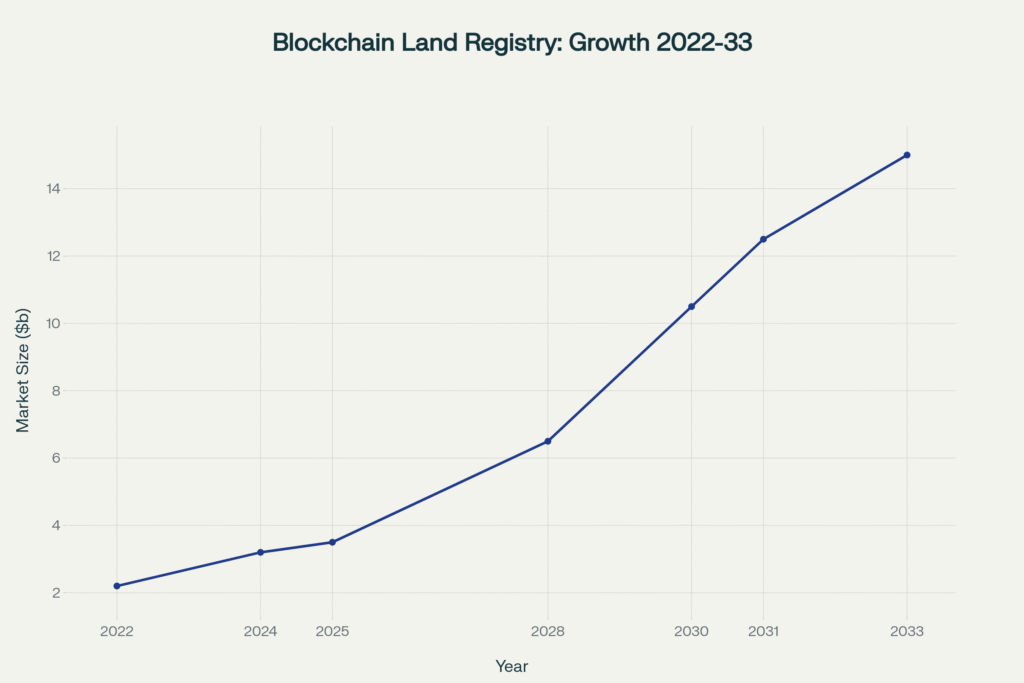

As India’s UHNI population surges from 13,263 in 2023 to a projected 19,908 by 2028—a staggering 50% increase—these affluent investors are allocating 32% of their wealth to real estate. The global blockchain land registry market, valued at USD 3.2 billion in 2024, is expected to explode to USD 15 billion by 2033 at a CAGR of 21.4%. This convergence of wealth creation, technological innovation, and regulatory reform positions blockchain-secured land records as the cornerstone of India’s next-generation property market—where transparency, immutability, and speed replace opacity, fraud, and decades-long litigation.

The ₹3.45 Trillion Crisis: Why India’s Land Records Are Bleeding Wealth

The Magnitude of Market Failure

India’s land administration system represents one of the world’s most complex examples of institutional dysfunction meeting digital-age aspirations. The numbers tell a story of systemic paralysis: 25% of all Supreme Court cases involve land disputes, while 66% of all civil litigation relates to property conflicts. With over 2.5 million hectares of land embroiled in disputes and investments exceeding ₹3.45 trillion at risk, the property sector has become a graveyard for capital and trust.

The average land acquisition dispute takes 20 years from filing to Supreme Court resolution—a timeline that spans entire business cycles and generational wealth transfers. For HNIs and UHNIs seeking to preserve and grow capital through real estate, this represents an unacceptable risk premium. Knight Frank’s 2024 Wealth Report reveals that India’s 85,698 individuals with net worth exceeding USD 10 million are increasingly demanding institutional-grade transparency and security in their property transactions.

The Anatomy of Property Fraud

The presumptive land title system—where ownership is established through registered sale deeds rather than conclusive state-guaranteed titles—creates a vulnerability matrix exploited by sophisticated fraud networks. The 2015 Manesar land scam exemplifies this dysfunction: ₹1,500 crore (USD 180 million) vanished when builders acquired 400 acres from farmers at ₹100 crore using government acquisition threats, while market value stood at ₹1,600 crore. The Supreme Court’s intervention and CBI investigation revealed how fragmented record-keeping across Revenue, Survey, and Registration departments enables large-scale manipulation.

Benami transactions—properties held under fictitious names—proliferate in this opacity. The Digital India Land Records Modernization Programme (DILRMP) reports that while 95.08% of land records have been digitized, only 68.02% of cadastral maps are digital, and merely 87.48% of Sub-Registrar Offices are integrated with land records. These gaps create arbitrage opportunities for fraud while imposing massive transaction costs on legitimate buyers.

Digital India’s Blockchain Breakthrough: From Pilots to Production

DILRMP and ULPIN: Building the Foundation

The Government of India’s Digital India Land Records Modernization Programme (DILRMP), launched in 2016 as a Central Sector Scheme with 100% funding, has invested ₹2,428 crore (approximately USD 290 million) through 2024-25. The program has achieved substantial milestones:

- 625,062 of 657,396 villages (95.08%) have digitized Records of Rights (RoR)

- 24,957,221 of 36,692,728 cadastral maps (68.02%) are now digital

- 5,060 of 5,329 Sub-Registrar Offices (94.95%) are computerized

- 4,662 of 5,329 SROs (87.48%) are integrated with land records

The Unique Land Parcel Identification Number (ULPIN) system—dubbed “Aadhaar for land”—represents the structural innovation enabling blockchain implementation. This 14-digit alphanumeric identifier, assigned based on geo-coordinates of land parcel vertices, provides a standardized, unambiguous identification compliant with Electronic Commerce Code Management Association (ECCMA) and Open Geospatial Consortium (OGC) standards.

Blockchain Pilots: Assam, Karnataka, Jharkhand, and Dantewada’s Breakthrough

India’s blockchain land registry evolution accelerated dramatically in 2024. In February 2024, the Department of Land Resources launched a blockchain pilot in Assam’s Darrang District, integrating ULPIN seeding with geo-referenced maps and the National Generic Document Registration System (NGDRS).

The most spectacular success emerged from Dantewada district in Chhattisgarh, where the administration digitized over 700,000 land records dating back to the 1950s and secured them on the Avalanche blockchain in collaboration with Indian startup LegitDoc. District Collector Mayank Chaturvedi reported: “For decades, citizens experienced significant delays in accessing their land records, where the verification process could take weeks. By digitizing and securing these documents on the blockchain, we ensure easier accessibility and prevent data falsification”.

The Global Playbook: Sweden, Georgia, Dubai Lead the Blockchain Land Revolution

Sweden: From Months to Minutes

Sweden’s land registry authority Lantmäteriet launched blockchain pilots in 2016, demonstrating how blockchain enables property title registration reduction from 4 months to a few days through smart contracts that automatically execute ownership transfers once conditions are met.

Georgia: Rebuilding Trust Through Immutability

The Republic of Georgia, partnering with blockchain company Bitfury in 2016, became one of the first nations to register land titles on the Bitcoin blockchain. According to Transparency International, 20% of land service users worldwide have paid bribes for property registration or ownership verification. Georgia’s immutable system aims to eliminate this corruption.

Dubai: Tokenization at Scale

Dubai represents the most ambitious blockchain property initiative globally. The Dubai Land Department (DLD) launched Prypco Mint in 2024, enabling UAE residents to invest in fractional property ownership from as little as AED 2,000 (approximately EUR 480). Dubai’s blockchain strategy aims to save 5.5 billion dirham annually in document processing—equivalent to one Burj Khalifa’s worth of value every year.

Smart Contracts: The Automation Engine Transforming Real Estate Transactions

Eliminating Intermediaries, Accelerating Closings

Smart contracts—self-executing code with agreement terms directly written into blockchain—automate property transactions while ensuring trustless execution. The process streamlines dramatically:

- Agreement Coding: Terms encoded into smart contract

- Fund Escrow: Payment transferred to blockchain address

- Condition Verification: Automatic checking of all requirements

- Automatic Execution: Simultaneous fund transfer and title update

- Immutable Record: Permanent blockchain timestamp

This automation reduces property registration time from months to minutes. Studies indicate 80% cost reduction and 10-fold efficiency improvement through blockchain implementation.

The UHNI Investment Thesis: Why Blockchain-Secured Property Is the New Gold Standard

India’s Wealth Explosion: 50% UHNI Growth by 2028

India’s affluent investor class is experiencing unprecedented expansion. The Knight Frank Wealth Report 2024 documents that India counted 85,698 individuals with net worth exceeding USD 10 million in 2024. The UHNI segment (net worth above USD 30 million) is projected to reach 19,908 by 2028—a 50% increase.

HNIs and UHNIs are allocating 32% of their wealth to real estate, with 80-90% of holdings concentrated within India. Luxury home sales (priced above ₹4 crore) surged 37.8% year-on-year from January to September 2024.

NRI Capital Flows: USD 14.9 Billion Opportunity

ANAROCK Research projects NRI investments in Indian real estate to reach USD 14.9 billion by 2025. Blockchain-secured land records eliminate NRIs’ traditional pain points: inability to physically verify property titles, dependence on unreliable intermediaries, and vulnerability to fraud.

Strategic Imperatives: Immediate, Mid-Term, and Long-Term Action Frameworks

Immediate Actions (0-12 Months)

1. Portfolio Audit and Blockchain Exposure Assessment

- Review existing property holdings

- Identify properties in pilot blockchain states

- Engage blockchain-specialized legal counsel

2. Early-Mover Positioning in Tokenization Markets

- Explore Dubai’s Prypco Mint platform

- Monitor India’s tokenization regulations

- Allocate 5-10% to tokenized assets

Mid-Term Strategy (1-3 Years)

1. Regulatory Arbitrage Strategy

- Acquire properties in blockchain-advanced states

- Multi-jurisdiction diversification

- Tax optimization structures

2. Smart Contract-Enabled Passive Income

Long-Term Vision (3-5 Years)

1. Ecosystem Participation

- Invest in blockchain PropTech startups

- Partner with state pilot programs

- Build family office investment vehicles

2. Generational Wealth Preservation

- 100% blockchain-verified portfolio

- AI-powered management systems

- Dispute-free succession planning

Case Study 1: Dantewada District – 700,000 Records on Avalanche

Dantewada partnered with LegitDoc to secure 700,000+ land records dating to the 1950s on Avalanche blockchain. Results included:

- Efficiency: Retrieval time from weeks to minutes

- Fraud Prevention: Immutable records eliminate tampering

- Legal Cost Reduction: Definitive ownership proof

- Scalability: Model for nationwide expansion

Case Study 2: Dubai Land Department – Government-Integrated Tokenization

Dubai’s Prypco Mint platform enables investments from AED 2,000, processing via XRP Ledger with dirham denomination. Economic impact includes 5.5 billion dirham annual savings and enhanced market liquidity.

Case Study 3: Sweden’s Lantmäteriet – Smart Contract Pioneers

Sweden’s pilot with ChromaWay demonstrated 30-40% cost reduction and title transfers completing in days instead of months. The project proves blockchain viability in highly regulated developed markets.

Risks and Challenges

Technological Constraints

- Scalability: Current blockchain networks face throughput limitations

- Energy Consumption: Environmental concerns with Proof-of-Work systems

- Interoperability: Multiple platforms create fragmentation

Regulatory Uncertainties

- Legal Recognition: Indian law lacks explicit blockchain title framework

- Smart Contract Enforceability: Limited judicial precedent

- Data Privacy: Blockchain transparency vs. personal data protection

Market Resistance

- Incumbent Opposition: Title insurers and intermediaries face disruption

- Digital Literacy: Rural populations lack technological sophistication

- Cybersecurity: Wallet and exchange vulnerabilities

Five Elite-Level Pro Tips for UHNI Blockchain Property Strategy

1. Multi-Jurisdiction Blockchain Arbitrage

Concentrate acquisitions in jurisdictions with mature blockchain infrastructure (Karnataka, Jharkhand, Dubai, Singapore) before neighboring regions adopt, capturing 10-15% title premium.

2. Smart Contract-Powered Rental Arbitrage

Convert luxury rentals to automated management, reducing costs from 8-12% to 2-3% while commanding 5-8% rental premium through enhanced tenant experience.

3. Tokenization-First Development Strategy

Structure projects as blockchain-tokenized securities enabling 100+ UHNI co-investors vs. 5-10 in traditional syndication, creating liquid secondary markets.

4. Blockchain-Verified Title Insurance Disruption

Establish captive insurance or negotiate 70-90% premium discounts based on reduced risk profile, deploying savings into additional acquisitions.

5. Dynastic Wealth Succession via Smart Contract Trusts

Encode succession terms in blockchain trusts with time-lock conditions and multi-signature requirements, eliminating probate disputes lasting decades.

Frequently Asked Questions

How does blockchain prevent land title fraud in India’s property market?

Blockchain creates an immutable, time-stamped ledger where every property transaction is permanently recorded with cryptographic signatures. Unlike traditional systems where records can be altered, blockchain’s decentralized architecture distributes data across multiple nodes, making tampering computationally impossible. Each land parcel receives unique identifier (ULPIN), functioning as digital fingerprint. India’s Dantewada pilot demonstrates this: 700,000 records secured with zero tampering since 2024.

What percentage of land records in India have been digitized under DILRMP?

As of 2024, 95.08% of land records (625,062 of 657,396 villages), 68.02% of cadastral maps, and 87.48% of Sub-Registrar Offices are integrated. ULPIN is operational in 29 of 36 states/UTs. Blockchain pilots active in Karnataka, Jharkhand, Assam, and Chhattisgarh. Experts project phased national implementation between 2026-2028.

How do smart contracts work in real estate transactions?

Smart contracts are self-executing programs on blockchain where agreement terms are coded. Contract holds buyer’s payment in escrow, monitors predefined conditions (title clearance, inspections), and automatically releases funds while transferring title when all conditions verify. This eliminates escrow agents and reduces closing time from weeks to minutes.

What are tax implications for UHNIs investing in blockchain-tokenized real estate?

Tokenized real estate may be classified as securities rather than virtual digital assets, bringing standard capital gains taxation: 20% LTCG (with indexation) for 24+ month holdings. Rental income taxed as income from house property with standard deductions. International tokenized properties require foreign asset reporting. Structure via SPVs or trusts for optimization. Consult specialized CA for compliance.

Conclusion

The confluence of India’s 50% UHNI population growth, ₹3.45 trillion threatened by land disputes, and global blockchain land registry market expansion to USD 15 billion by 2033 creates a once-in-a-generation wealth preservation opportunity. For Ultra-High-Net-Worth Individuals, early positioning in blockchain-verified properties—through acquisitions in pilot states, tokenized international holdings, or proprietary developments—will compound advantages over coming decades.

The transition from 20-year property dispute pendency to minutes-long blockchain verification represents an efficiency gain approaching two orders of magnitude. This paradigm shift—comparable to paper ledgers to digital databases—positions blockchain property as the foundational asset class of the next generation. UHNIs who recognize this inflection point and allocate 5-15% of real estate portfolios to blockchain-verified assets as bridgehead positions will capture appreciation as mainstream adoption accelerates.

The call to action is unambiguous: Begin blockchain property journey immediately. Acquire pilot-state properties. Structure tokenized developments. Advocate for regulatory clarity. The fortress of blockchain-secured land records is being erected—those who enter early will occupy the commanding heights of India’s next property boom.

YouTube Resources

Free resources to download

Blockchain’s Fortress: How India is Securing ₹3.45 Trillion in Land Assets for UHNI Investors