Now Reading: Sustainability as Status: Why UHNWIs Are Hunting for Net-Zero Trophy Assets

- 01

Sustainability as Status: Why UHNWIs Are Hunting for Net-Zero Trophy Assets

Sustainability as Status: Why UHNWIs Are Hunting for Net-Zero Trophy Assets

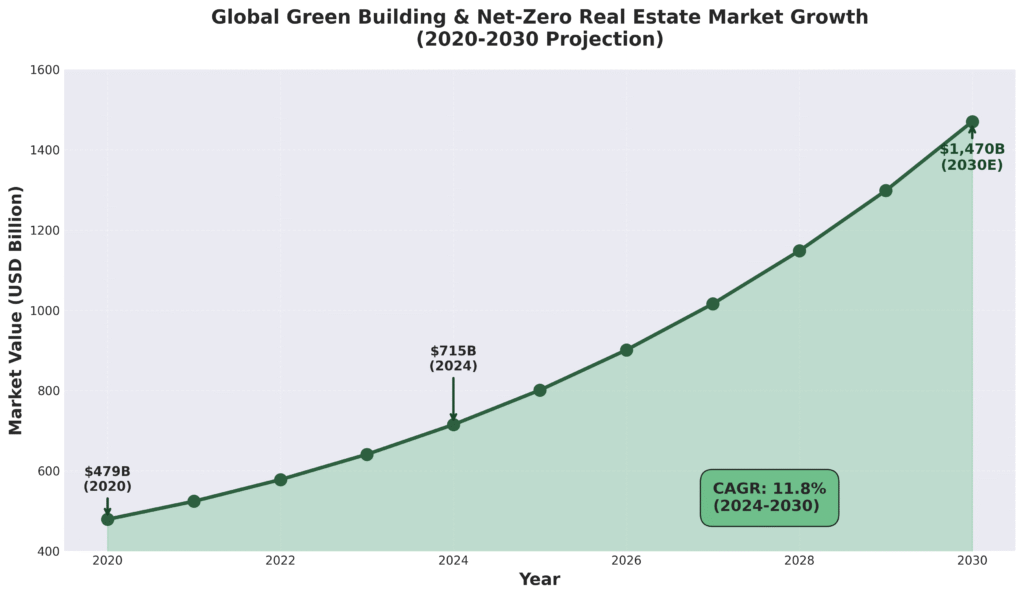

The world’s wealthiest are rewriting the rulebook on luxury real estate. No longer content with merely opulent estates, ultra-high-net-worth individuals are now seeking properties that marry environmental consciousness with exclusivity—net-zero trophy assets that signal both prestige and planetary responsibility. From Mumbai’s IGBC-certified penthouses commanding 15% premiums to Larry Ellison’s half-billion-dollar sustainable transformation of Hawaii’s Lanai island, the elite are proving that green is the new gold. With the global green building market projected to reach $1.47 trillion by 2030 and luxury sustainable properties delivering 10-18% higher returns than conventional estates, sustainability has transcended buzzword status to become the ultimate marker of sophistication among the ultra-wealthy.

When Green Became the Ultimate Luxury Statement

There’s a quiet revolution happening in the world’s most exclusive real estate markets, and it’s being led not by activists or policymakers, but by billionaires.

Picture this: A tech entrepreneur walks away from a $50 million Malibu oceanfront mansion—not because the infinity pool isn’t impressive enough or the wine cellar lacks capacity, but because the property doesn’t have LEED Platinum certification. Meanwhile, in Bengaluru’s prestigious “Billionaire’s Street,” homeowners are voluntarily spending 20% more on sustainable infrastructure than their neighbors—rainwater harvesting, solar arrays, energy-efficient HVAC systems—turning their estates into showcases of environmental engineering.

This isn’t performative environmentalism. It’s a fundamental shift in how the world’s wealthiest define status itself.

“The luxury consumer of 2025 sees sustainability not as a compromise, but as an indicator of intelligence, future-proofing, and premium value,” explains a recent market analysis tracking UHNWI behavior. And the numbers back this up spectacularly. According to data from multiple luxury market reports, 31% of luxury consumers now prioritize sustainability in their purchasing decisions, with that figure climbing to over 57% among high-net-worth individuals under 40.

The transformation is dramatic. Where previous generations of ultra-wealthy buyers sought sprawling estates with manicured lawns and energy-guzzling amenities, today’s elite are hunting for net-zero energy homes, carbon-neutral compounds, and properties that function as “sustainability laboratories”.

Larry Ellison, the Oracle co-founder worth over $270 billion, exemplifies this shift. After purchasing 98% of Hawaii’s Lanai island for $300 million in 2012, he’s invested an additional half-billion dollars transforming it into what he calls “a laboratory for sustainability”—complete with hydroponic farms powered by renewable energy, the exclusive Sensei Retreat, and experimental agriculture projects.

But Ellison isn’t alone. From Elon Musk’s solar-powered residences to Richard Branson’s Caribbean island estate with rainwater harvesting and natural ventilation systems, the billionaire class is leading a movement where environmental credentials have become as important as square footage.

The Economics of Net-Zero Trophy Assets

Here’s where sustainability gets interesting from an investment perspective: green-certified luxury properties aren’t just good for the planet—they’re exceptional for portfolios.

Across global markets, properties with green certifications like LEED, BREEAM, or India’s IGBC rating command significant premiums. In Singapore, the premium reaches 17.6% for rental yields. In Bengaluru, green-certified properties sell for 14.2% more than comparable non-certified estates. Even in established markets like New York and London, premiums range from 10-12%.

Global Green Building Market Growth (2020-2030)

| Year | Market Value (USD Billion) | YoY Growth % |

|---|---|---|

| 2020 | 479 | – |

| 2021 | 524 | 9.4 |

| 2022 | 578 | 10.3 |

| 2023 | 641 | 10.9 |

| 2024 | 715 | 11.5 |

| 2025E | 801 | 12.0 |

| 2030E | 1,470 | 13.2 (CAGR: 11.8%) |

Source: Global Carbon Credits Market Data 2023-2024, IEA Net-Zero Buildings Report

But the financial appeal extends beyond sale prices. Energy-efficient luxury homes deliver dramatic operational savings. HGTV star Anthony Carrino’s net-zero farmhouse in upstate New York, equipped with triple-paned windows, solar panels, and efficient HVAC systems, produces more electricity than it consumes annually—with his wife charging her electric vehicle entirely from solar power.

“The sun pays for our drive,” Carrino notes, acknowledging the roughly five-year payback period for his solar investment but emphasizing the long-term financial and environmental returns.

For UHNWIs managing multi-property portfolios, these savings compound significantly. More importantly, as governments worldwide tighten building regulations—the UK’s Future Homes Standard requires 75-80% lower CO₂ emissions from new homes by 2025—early adopters of sustainable luxury are positioning themselves ahead of regulatory curves that will eventually render conventional properties obsolete.

Status Signaling for the Conscious Elite

Luxury has always been about signaling—but what’s being signaled has evolved dramatically.

In previous decades, conspicuous consumption ruled: the biggest yacht, the most cars, the largest estate. Today’s ultra-wealthy, particularly those under 40, are signaling something different: conscious capital.

“Despite their wealth, many UHNWIs are environmentally conscious and interested in sustainable luxury real estate featuring energy-efficient technology and smart building automation,” notes a recent behavioral economics analysis of UHNWI mindsets.

This shift is generational. Younger billionaires like those profiled in recent industry reports are moving away from “trophy estates” toward what one analyst calls “mission-driven holdings with measurable environmental returns”. They’re purchasing land not to develop, but to rewild. They’re building private eco-compounds that double as sustainability labs, complete with regenerative farming systems, native pollinator corridors, and carbon monitoring dashboards.

Consider the Tompkins legacy: Kristine McDivitt Tompkins and her late husband Doug (founder of The North Face) purchased over one million acres across Chile and Argentina—not to build luxury resorts, but to restore ecosystems and create national parks. Their vision has inspired a new wave of young billionaires to view land ownership as environmental stewardship.

This isn’t sacrifice—it’s the new standard of sophistication. When 88% of HNWIs plan international travel and luxury travel spending is projected to grow 15% in 2025, these same individuals are seeking accommodations that reflect their values: hotels with LEED ratings, private villas with carbon-neutral operations, resorts funding reef restoration.

The message is clear: environmental responsibility has become inseparable from luxury authenticity.

Geographic Hotspots: Where Sustainable Luxury Thrives

India

India’s luxury real estate market is experiencing explosive growth in sustainable properties. The ultra-luxury segment (₹5 crore and above) saw an 80% year-on-year increase in sales, with sustainability features driving significant premiums.

Mumbai’s green-certified properties command 12.5% sales premiums and 15.8% rental yield premiums over non-certified equivalents. In Bengaluru—particularly along the famed “Billionaire’s Street”—homeowners are investing 20% more in sustainable infrastructure including solar power, rainwater harvesting, and energy-efficient designs.

India’s green building market is projected to reach $39 billion by 2025, with IGBC (Indian Green Building Council) certifications becoming essential for luxury developments. Developers like Trident Realty are prioritizing expansive green zones over maximizing floor space index, recognizing that environmental integration is now synonymous with premium positioning.

Dubai

Dubai’s luxury real estate market—already known for record-breaking sales—is incorporating sustainability into its trophy properties. The Six Senses Residences Dubai exemplifies this trend, merging natural materials with energy-efficient innovation in what the development calls “fluent eco-luxury”.

Despite being built in a desert climate, Dubai’s developers are integrating smart building systems, renewable energy solutions, and LEED certifications that command market premiums while future-proofing properties against increasing environmental regulations.

London

London’s luxury property market, traditionally focused on Georgian townhouses and Victorian conversions, is undergoing a sustainability transformation. Four Seasons plans to expand from zero to 90 standalone residences by 2030, with London among the priority markets—all incorporating net-zero or energy-positive architecture alongside heritage preservation.

High-net-worth buyers in London are increasingly conducting due diligence on long-term maintenance costs, future legislation compliance, and resale implications of sustainability features, making green certifications essential for maintaining property values in prime locations.

Strategic Insights: What the Smart Money Knows

Immediate Horizon (2025-2026)

Pro Tip #1: Prioritize properties with recognized green certifications (LEED, BREEAM, IGBC) in primary markets. These credentials deliver immediate 10-15% premiums and insulate against regulatory obsolescence.

Pro Tip #2: Focus on markets with strong government incentives for sustainable construction. India’s green building incentives and Dubai’s sustainability mandates create favorable investment environments with policy tailwinds.

Mid-Term Strategy (2027-2029)

Pro Tip #3: Diversify into “blue economy” coastal properties with integrated marine conservation features. French Polynesia-style carbon-neutral luxury resorts funding reef restoration represent the next frontier of ultra-premium sustainable real estate.

Pro Tip #4: Consider fractional ownership models for ultra-premium sustainable second homes. This emerging structure democratizes access to properties like net-zero Patagonian eco-compounds while maintaining exclusivity and environmental impact.

Long-Term Vision (2030+)

Pro Tip #5: Position portfolios ahead of 2030-2050 net-zero targets. Properties achieving carbon neutrality today will command exponential premiums as global regulations tighten and conventional luxury estates face expensive retrofitting requirements.

Challenges and Considerations

While sustainable luxury represents an undeniable trend, sophisticated investors must consider potential headwinds.

Premium Volatility: Green certification premiums vary significantly by market and economic conditions. During downturns, luxury sustainable features may not maintain their premium positioning if overall demand contracts.

Greenwashing Risks: Not all “sustainable” claims are created equal. Some developers tout minor environmental features while lacking comprehensive certifications, potentially exposing buyers to reputational and resale risks.

Retrofit Economics: For existing luxury properties, achieving net-zero status can require $200,000-$700,000+ in renovations. The payback period may extend beyond typical UHNWI holding periods, making new sustainable construction more attractive than retrofitting.

Geographic Disparity: While sustainable luxury premiums are robust in Singapore (17.6%), Bengaluru (14.2%), and Mumbai (12.5%), they’re more modest in established Western markets like London (8.7%), potentially limiting upside in certain geographies.

Regulatory Uncertainty: While environmental regulations are tightening globally, the specific timelines and requirements remain fluid, creating potential misalignment between investment timelines and policy implementation.

Frequently Asked Questions

What defines a “net-zero” trophy asset?

Net-zero properties produce as much energy as they consume annually, typically through solar panels, energy-efficient systems, and smart design. Trophy assets add exceptional location, architecture, and amenities while maintaining environmental credentials.

Do sustainable certifications genuinely increase property values?

Yes. Green-certified properties command 8-18% premiums across global markets, with Singapore, India, and Dubai showing the strongest premium performance. These premiums reflect both buyer preference and operational savings.

How are UHNWIs approaching sustainable real estate differently than mass-market buyers?

UHNWIs view sustainability as status signaling and portfolio risk management rather than purely environmental concern. They’re investing in carbon-neutral compounds, conservation-focused land banking, and properties that serve as “sustainability laboratories” demonstrating innovation leadership.

What’s the typical ROI timeline for sustainable luxury investments?

Green certification premiums materialize immediately (10-15% higher sale prices). Operational savings from energy efficiency show 5-7 year payback periods. Long-term appreciation potential increases as regulations favor sustainable construction.

The Future of Prestige: Where Sustainability Leads

As we look toward 2030 and beyond, the trajectory is unmistakable: sustainability isn’t competing with luxury—it’s defining it.

The global UHNWI population continues expanding, with wealth concentrated among individuals who increasingly view environmental responsibility as inseparable from sophistication. Smart home technology integration, biophilic design, carbon-neutral operations, and wellness certifications are becoming baseline expectations rather than premium features.

The visionaries—Ellison transforming Lanai into a renewable energy showcase, young billionaires rewilding Patagonian estates, Bengaluru’s elite voluntarily investing 20% premiums for sustainable infrastructure—aren’t outliers. They’re early adopters of what will become the standard definition of trophy properties.

For wealth managers, family offices, and UHNWI investors, the strategic imperative is clear: sustainable luxury represents not just ethical alignment but extraordinary financial opportunity. As one industry analyst succinctly captured: “Today’s UHNW clients want homes and land that reflect their values—net-zero architecture, cultural integration, sustainability tracking, and climate resilience aren’t extras. They’re expectations”.

The ultra-wealthy aren’t just buying homes. They’re building legacies. And increasingly, those legacies are painted in shades of green.

YouTube Learning Resources

Free resources to download

Sustainability as Status_ UHNWI Net-Zero Trophy Assets: Executive Summary