Now Reading: India–Sri Lanka: The Forgotten Luxury Corridor Investors Are Revisiting

- 01

India–Sri Lanka: The Forgotten Luxury Corridor Investors Are Revisiting

India–Sri Lanka: The Forgotten Luxury Corridor Investors Are Revisiting

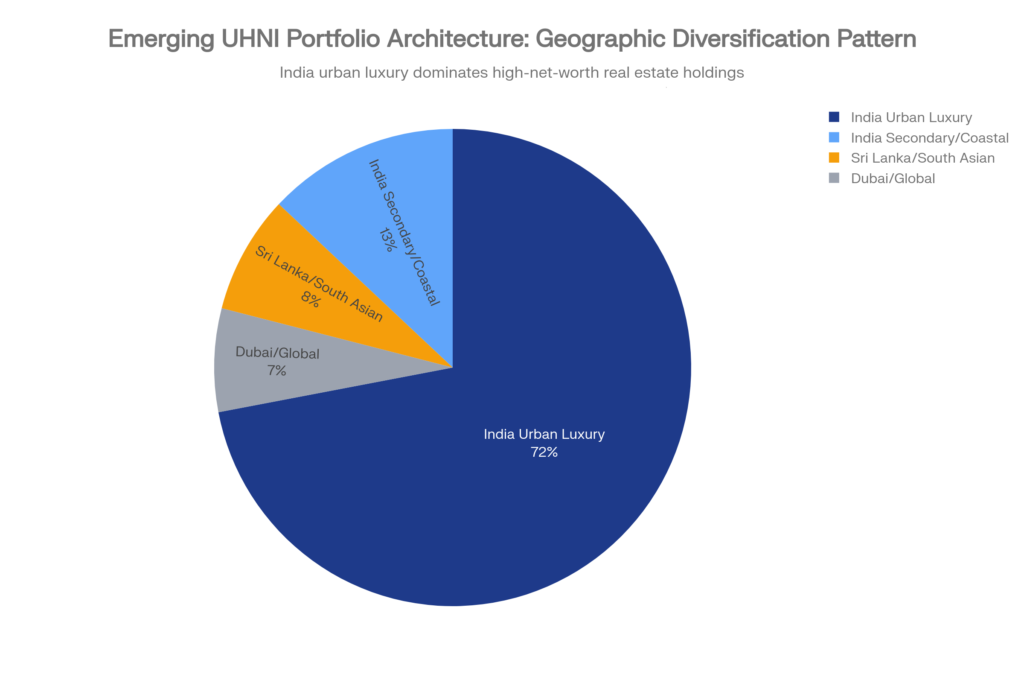

For the past decade, India’s luxury real estate boom has captured global attention. But a quieter story is unfolding at the periphery: sophisticated Indian investors—UHNI families, NRIs, and family offices—are now allocating meaningful capital to Sri Lanka’s resurgent property market, a shift that reveals deeper patterns in how ultra-wealthy Indians think about regional diversification and legacy wealth architecture.

This isn’t speculation. Data from the Central Bank of Sri Lanka shows residential asking prices up 10.4% year-over-year in Q1 2025, while Port City Colombo—Sri Lanka’s flagship $15 billion development—has just confirmed $300 million in fresh foreign direct investment. Simultaneously, India’s premium and luxury segment now represents 62% of residential sales, growing at 28% annually.

For Indian investors, Sri Lanka represents a complementary rather than competing opportunity: lower entry valuations, improving political stability, and a regulatory framework actively courting foreign capital. The result is a small but meaningful reallocation of allocations—one that sophisticated global investors tracking South Asian capital flows should understand.

India’s Global Positioning

India’s position within global wealth architecture has fundamentally shifted. A decade ago, luxury real estate in India was treated as a niche asset class—concentrated, illiquid, driven by traditional industrialists. Today, it is structural demand, created by the first wave of significant wealth creation from India’s digital and technology economies.

The numbers are unambiguous. According to Knight Frank’s 2024 Wealth Report, India has witnessed an increase in ultra-high-net-worth individuals (those with net worth exceeding $30 million). Each UHNI typically maintains 3 to 5 premium properties. ANAROCK research shows that luxury homes priced at ₹4 crore and above rose 28% year-over-year across India’s seven major cities in H1 2025.

This isn’t temporary enthusiasm. It reflects a structural shift in how Indian capital perceives real estate: not as speculation but as legacy infrastructure—a portfolio anchor that combines inflation protection, currency hedging, and intergenerational wealth transfer. The shift has also attracted NRI capital at unprecedented scale. ANAROCK estimates NRI investments in Indian real estate will reach $14.9 billion, a figure that masks deeper behavior: NRIs are leveraging favorable exchange rates (offering 15–20% purchasing power advantage), targeting rental yields of 3–4% plus 8–12% annual appreciation, and increasingly viewing India as a permanent portfolio allocation rather than cyclical play.

The India Story Matures; Sri Lanka Emerges

Yet for sophisticated allocators, a more nuanced story is forming. India’s marquee micro-markets—Mumbai’s Worli, Gurugram’s Golf Course Road, Delhi’s Lutyens’ Zone—have already experienced substantial appreciation. These are not vulnerability signals; rather, they indicate market maturity. When price appreciation accelerates faster than rental yields expand, sophisticated investors typically begin considering complementary or alternative markets within the same geographical zone.

This is where Sri Lanka enters the narrative.

Post-2024, Sri Lanka’s economy has stabilized markedly. Central Bank data from Q1 2025 shows residential asking prices in the Colombo District up 10.4% year-over-year for houses, with land prices rising 7.3%. More significantly, investor confidence is visibly returning. Port City Colombo—a $15 billion multi-service special economic zone under development on reclaimed land adjacent to Colombo’s port—has just secured $300 million in fresh foreign direct investment for Phase II development (January 2026), a signal that even Chinese state-backed developers view Sri Lanka as strategically sound for multi-decade infrastructure commitment.

The Luxury Marina Development within Port City Colombo—a $120 million investment that broke ground in January 2025—will berth 200 to 250 yachting vessels and connect regional luxury circuits from Dubai and the Maldives to Singapore. For Indian HNIs and UHNIs who maintain properties across multiple jurisdictions, this signals the emergence of lifestyle infrastructure that complements traditional residential holdings.

Data-Backed Intelligence: Why Now?

Three structural factors explain the timing:

First: Regulatory Opening

Sri Lankan authorities are actively simplifying foreign acquisition procedures and considering relaxation of land purchase restrictions in designated areas, particularly for tourism and development projects. This contrasts sharply with India’s stable but complex FEMA framework, offering Indian investors familiar regulatory infrastructure without the liquidity constraints of maturing Indian markets.

Second: Currency and Tax Arbitrage

The Sri Lankan rupee has stabilized following the 2022–23 crisis. Double taxation avoidance agreements between India and Sri Lanka are clarifying. NRIs can access Sri Lankan rental income and potential capital appreciation without the withholding complexity that affects international property transactions.

Third: Portfolio Rationale

For ultra-high-net-worth families managing assets across 8–12 global jurisdictions, Sri Lanka offers a rare combination: proximity to India (reducing complexity), English-language legal systems, and a regulatory framework that explicitly courts FDI. More subtly, it provides portfolio diversification at the South Asian level—reducing concentration risk in any single Indian micro-market.

Emotional & Legacy Drivers

This is not purely financial calculus. Conversations with family office advisors reveal a consistent pattern: ultra-wealthy Indian families increasingly view regional real estate holdings as part of generational wealth architecture, not speculation. A second home in Sri Lanka—whether a luxury apartment in Colombo, a villa in the emerging hill-station markets, or a fractional stake in a Port City Colombo development—serves multiple functions:

- A hedge against Indian currency volatility and policy uncertainty

- A lifestyle anchor for the growing cohort of Indian executives with regional business interests

- A tax-efficient wealth preservation vehicle within a legally transparent framework

- An intergenerational “legacy asset” that can be held across decades with appreciation potential

For Indian investors with global exposure, the psychological shift is meaningful: Sri Lanka stops being a vacation destination and becomes a portfolio component.

Case Studies

Case 1: The NRI Tech Exit Strategy — Mumbai to Colombo (2024–2025)

A Bangalore-based tech founder sold his startup stake for $45 million in Q3 2024. After deploying $8 million into a ₹12 crore ultra-luxury apartment in Worli, Mumbai (part of a branded residences project by a tier-1 developer), he faced a classic allocator dilemma: further India concentration or geographic diversification.

Through his family office advisor, he identified an opportunity in Port City Colombo’s residential precinct. He committed $2 million to a luxury apartment pre-launch in the Central Park Living zone, targeting completion in 2027. The structure: direct investment via a local Sri Lankan company (permitted under Board of Investment guidelines), with contractual protection via an international escrow arrangement.

Rationale: The Mumbai apartment provides 3–4% rental yield plus India-linked currency appreciation. The Colombo holding offers lower entry valuation (approximately 40% discount to comparable Mumbai properties), currency diversification, and optionality to hold long-term or exit via Port City Colombo’s anticipated commercial maturation.

Sources: Knight Frank, ANAROCK, Port City Colombo Development Timeline

Case 2: Family Office Generational Wealth Transfer — Delhi NCR to Colombo (2025)

A New Delhi–based pharmaceutical family with $180 million in liquid assets formalized a single-family office in 2024, consolidating holdings across real estate, equities, and private markets. The family’s geographic portfolio was heavily concentrated: ₹35 crore in Delhi NCR (Golf Course Road, Lutyens’ Zone), ₹18 crore in Mumbai (Worli, Bandra), ₹12 crore in Bangalore tech corridor properties.

During portfolio rebalancing in Q4 2024, the family’s advisors (EY Family Enterprise and a Big Four international firm) flagged concentration risk: nearly 92% of residential holdings were in India, all exposed to similar macroeconomic and regulatory shifts. They recommended a “South Asian Regional Anchor” strategy, allocating 8–12% of real estate holdings to an emerging market with improving governance signals.

Sri Lanka was identified as meeting three criteria:

- Regulatory framework improving (government actively courting FDI, tax incentives for sustainable projects)

- Market entry valuations favorable (25–35% discount to India on per-square-foot basis)

- Intergenerational story (long-term hold compatible with family wealth transfer timelines)

The family committed $4 million to a mixed allocation: a luxury villa in the Colombo Hills (emerging residential area), and a fractional stake in Port City Colombo’s Luxury Marina Development (targeting 8–12% IRR via capital appreciation and spillover lifestyle asset value).

Allocation Logic: The Sri Lankan holdings serve as a “satellite” to the Indian core, reducing geographic concentration from 92% to 85% while maintaining the family’s core India-linked wealth preservation thesis.

Sources: CBRE-Assocham H1 2025, Henley Private Wealth Migration Report, IFSCA Family Investment Fund Framework

Case 3: NRI Rental Yield Optimization — Bengaluru to Coastal Sri Lanka (2024)

A Singapore-based Indian entrepreneur with regional business interests (operations in Singapore, India, and Sri Lanka) owns three ₹2.5 crore luxury apartments in Bengaluru’s IT corridor (purchased 2019–2021). Rental yields have compressed from 4.5% (2019) to 2.8% (2025) as property appreciation outpaced rental growth—a common dynamic in maturing luxury markets.

Seeking enhanced yield without increasing India concentration risk, she identified an opportunity in Sri Lanka’s emerging coastal luxury market: a new development in Mirissa (southern coast), marketing toward short-term rental tourists and luxury vacation rentals.

She committed $600,000 to a 2-bedroom villa in a managed resort community (structured as a long-term lease), targeting:

- 6–8% gross rental yield via international tourism booking platforms (Airbnb, Luxury Retreats)

- Currency appreciation on rupee-to-rupee hedge (USD holdings)

- Portfolio diversification outside the Bengaluru tech corridor

- Optionality to hold for personal use (family vacation property) or exit via developer buyback clauses

Early data (9 months post-purchase) shows 6.2% gross rental yield, with occupancy rates near 70% during peak seasons and 45% during off-season—in line with management company projections.

Rationale: For NRIs with regional business operations, the asset serves dual function: financial (yield), lifestyle (vacation use), and operational (business anchor in South Asia).

Sources: Sri Lanka Board of Investment FDI Data, Coastal Development Authority Reports, Tourist Authority Data

Conclusion

The India–Sri Lanka luxury corridor is not a corrective narrative; it reflects how the world’s wealthiest individuals think about regional capital architecture. India’s luxury market remains primary, but it is no longer sole. As UHNI wealth expands, as first-generation entrepreneurs seek intergenerational wealth vehicles, and as Sri Lanka signals genuine regulatory openness, a small but meaningful reallocation of capital is occurring—one that disciplined investors are watching closely.

For family offices, high-net-worth individuals, and global allocators with Asia exposure, the emerging lesson is simple: optimize patience over speed. Sri Lanka’s market is real but nascent. Prioritize structures with clear optionality and maintain long-term horizons (7–15 years). The corridor is nascent, not mature. The advantage belongs to early movers willing to think in decades.

For institutional investors tracking South Asian wealth flows, this is no longer a peripheral observation. It is central architecture.