Now Reading: How Smart Homes Are Quietly Becoming the Next Blue-Chip Play for India’s Wealthiest Investors

- 01

How Smart Homes Are Quietly Becoming the Next Blue-Chip Play for India’s Wealthiest Investors

How Smart Homes Are Quietly Becoming the Next Blue-Chip Play for India’s Wealthiest Investors

Something’s shifting in how India’s wealthy think about residential real estate. It’s not subtle, but most investors are still missing it.

India’s smart homes market has grown from a nice-to-have luxury feature to something that fundamentally changes how properties perform. We’re talking about a market that started at $5.2 billion in 2025 and is heading toward $19.3 billion by 2030. That’s roughly 30% annual growth—faster than most emerging sectors.

But the real story isn’t market size. It’s what happens to your returns when you own property in this space versus sitting on the sidelines.

HNIs, UHNIs, and NRIs are noticing something concrete: properties with intelligent infrastructure rent faster, command higher rents, and appreciate steadily as adoption spreads. Those aren’t theoretical numbers—they’re what’s showing up in actual rental collections and property valuations across India’s major metros right now.

Union Budget 2025 just threw open the doors even wider. The regulatory shifts, tax incentives, and infrastructure spending are pointing toward one conclusion: this isn’t hype. It’s structural change happening in real-time.

For investors willing to see this clearly, the window is open now. But it won’t stay open forever.

What’s Actually Changing

When Nice Extras Become Deal Breakers

Walk into a premium project in Gurugram or Bangalore these days. Five years ago, smart home features were something developers marketed with pride—”Look, we have voice-controlled lighting.” Buyers would nod politely. Some paid extra for it. Most didn’t care.

Today? That conversation has flipped completely.

Buyers aren’t asking if you have smart features anymore. They’re asking which ecosystem you use, whether the system actually works, and what happens when they need support. The assumption is already there—that the property will have some form of intelligent infrastructure. The question is just execution quality.

This is what happens when technology crosses from novelty to necessity. Nobody cares about electricity when they turn on the light—they just expect it to work. Smart homes are hitting that threshold right now in India’s premium residential segment.

The Numbers Everyone Needs to See

Multiple research firms have been tracking this, and the data converges around something clear: the Indian smart homes market is actually accelerating.

Market sizes by 2030 range from $15.3 billion to $19.3 billion depending on which scenario plays out. Even the conservative estimate means the market triples. The base case suggests 4x growth. The bullish case gets to 5x.

What makes this credible isn’t just one research firm saying it. Mordor Intelligence, Verified Market Research, Future Market Insights, and Statista all published forecasts between 22.6% and 31% compound annual growth. That convergence suggests something real is happening under the surface.

Currently, only 8-12% of Indian households have meaningful smart home features. By 2028, that’s projected to reach 22%. By 2030, we’re looking at 30-40%. For India’s 280+ million households, that’s a massive swing—from roughly 25 million smart homes today to 85-100 million homes.

HNI adoption tells the story even more clearly: over 75% of luxury buyers now list smart home integration in their top three purchase criteria. That’s not peripheral. That’s core decision-making.

Who’s Actually Driving This

India’s affluent population is expanding faster than people realize. Goldman Sachs projects India’s HNI population will balloon from 60 million in 2023 to 100 million by 2027. That’s not just more wealth—it’s a qualitative shift in market size.

These aren’t first-time buyers making emotional purchase decisions based on where they grew up. These are experienced investors asking: “Where will this property stand in 10 years? Will it be outdated? Will it rent well? Will it appreciate?”

NRI capital is flowing in at $14.9 billion annually as of 2025, with projections crossing $20 billion by 2027. That’s not because NRIs are sentimental about Indian real estate. It’s because smart homes solve their biggest problem: managing properties from abroad.

A Dubai-based NRI doesn’t want to wonder whether their property manager is honest. They want real-time visibility into occupancy, maintenance issues, tenant payment history, and security events through a unified cloud dashboard. Smart infrastructure makes that possible. For NRI investors, this isn’t luxury—it’s operational necessity.

What This Means For Your Returns

Why Smart Homes Actually Generate Better Rental Income

The premium isn’t magical. It’s straightforward operational advantage that shows up in cash returns.

Consider a typical rental property in Bangalore’s Whitefield—a three-bedroom apartment, ₹1 crore valuation, standard 4.8% rental yield. That’s ₹4.8 lakhs annually, or ₹40,000 monthly.

Now add smart home features: biometric locks, AI-powered security monitoring, IoT-enabled energy management, cloud-based tenant communication. That same property now attracts a different tenant profile. It rents to IT professionals who value certainty and convenience. Vacancy periods drop by 30-40%. When it does rent, it commands ₹46,000-48,000 monthly instead of ₹40,000—a 15% bump.

That ₹6,000-8,000 additional monthly income isn’t just a percentage gain. It compounds over years. On a ₹1 crore property, that’s an extra ₹72,000-96,000 annually. On a ₹3-10 crore portfolio, it scales into meaningful wealth creation.

Insurance companies are already pricing this in. Properties with AI-powered security systems often see 15-20% insurance premium reductions because risk profiles improve. That’s another cash benefit that doesn’t show up in headline rent figures but stacks into returns.

How Appreciation Works Differently

Most real estate appreciation is driven by location, developer reputation, and market cycle timing. Smart home properties add another layer: future-readiness.

A building that integrated intelligent infrastructure in 2023 will age better than a conventional building of similar vintage. Ten years from now, when smart homes are baseline in premium residential, that early-integrated property will have fewer modernization concerns. The systems will have proven track records. The building will signal “I was ahead of the curve” rather than “I’m outdated tech.”

It’s the same dynamic that happened with LEED-certified buildings. Five years ago, they commanded 15-20% premiums because they were perceived as forward-thinking. Today, they’re becoming standard in premium segments, and that premium has started to normalize. But the buildings themselves have appreciated faster than comparable non-certified properties because the premium wasn’t purely speculative—it was based on real operational advantages.

Smart homes are following the same pattern, just earlier in the curve.

Expect 2-4% annual appreciation upside from smart home integration during the growth phase (2025-2030). As adoption expands, that upside narrows. But the properties themselves become more valuable absolutely, even as the relative premium compresses.

The Technology That Actually Matters

What Smart Home Features Actually Do (Not Just Sound Nice)

Security systems dominate the smart home market—roughly 36.5% of revenue. Not because they’re the most exciting, but because they solve the most acute problem: fear.

In India’s metropolitan context, security concerns drive residential purchasing decisions. AI-powered CCTV that can distinguish humans from pets, reducing false alarms by 80%. Biometric locks that eliminate key management hassles. Geofenced alarm systems that arm automatically when residents leave. These aren’t gadgets. They’re practical solutions that change daily life and reduce anxiety.

Insurance companies quantify this: properties with these systems see 15-20% premium reductions. That’s actuarial recognition that the risk profile has genuinely improved.

Energy management is the emerging powerhouse—28% of market and growing at 30% CAGR. Smart HVAC systems with occupancy sensors reduce electricity consumption by 20-25% because they don’t cool empty rooms. Integrate those with rooftop solar panels and battery storage, and you’ve unlocked something economically real: monthly electricity bills drop by ₹3,000-5,000 for a typical three-bedroom apartment.

For a tenant paying ₹45,000 monthly rent, an additional ₹3,500 saved on electricity is meaningful. They notice. They stay longer. They’re willing to pay slightly more rent because the total cost equation improves.

Connected living—voice control, automated lighting, smart thermostats—represents 22% of the market. This is where “luxury” lives. It’s also where the lowest tangible ROI sits. But it justifies 3-5% valuation uplift because it signals future-readiness and appeals to aspirational buyers.

Why Architecture Matters More Than Features

Most investors focus on which features a property has. That’s actually less important than how those features are integrated.

A centralized system where all smart home devices depend on a single hub is fragile. If that hub fails, everything stops. Residents can’t unlock doors. Security cameras go offline. That’s why sophisticated developers are moving to decentralized mesh networks where devices communicate independently and can function locally if cloud connectivity drops.

The other critical distinction: is the system vendor-neutral or proprietary-locked? A property integrated around a single vendor ecosystem (all Amazon, all Google, all Xiaomi) creates stranded asset risk. If that vendor loses market share or discontinues support, the property’s smart infrastructure can become orphaned.

Forward-thinking developers are adopting Matter Protocol—an open standard that lets smart devices from different manufacturers communicate seamlessly. This future-proofs properties and gives residents flexibility to upgrade components without ripping out the whole system.

For investors evaluating smart home properties, this distinction matters more than the flashy feature list. Ask whether the system is decentralized, whether it supports multiple brands, whether it can function locally if the internet drops. These architectural choices determine whether smart infrastructure adds value long-term or becomes technical debt.

Where The Money Is Actually Flowing

Geographic Arbitrage: The Real Edge

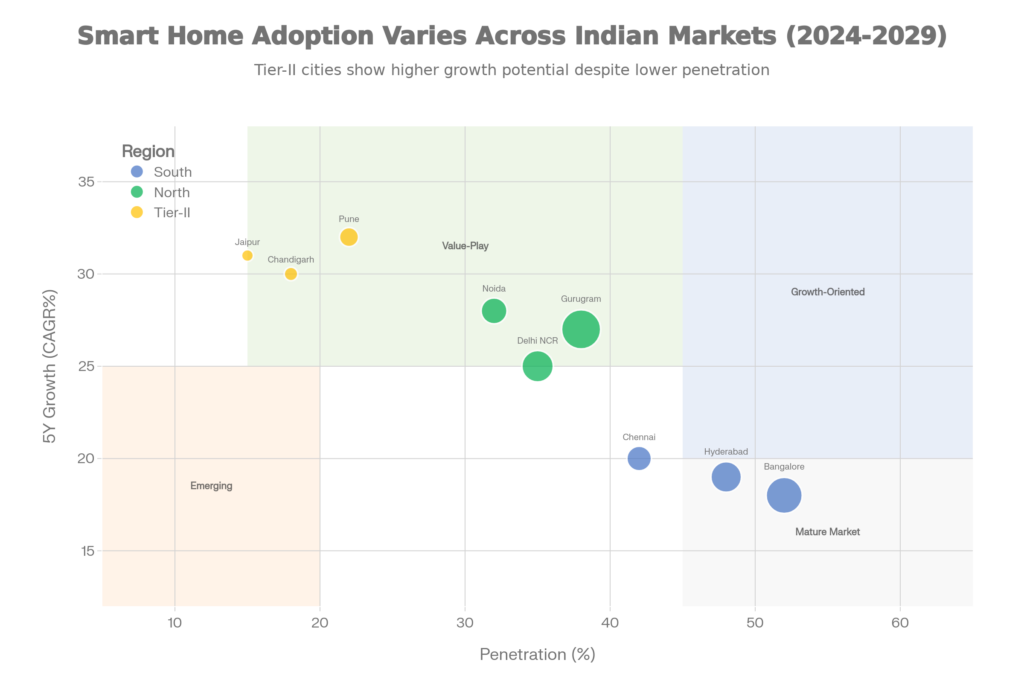

Smart home market adoption isn’t uniform across Indian metros. That’s where opportunity concentrates.

Bangalore and Hyderabad (48-52% penetration) are mature markets. Smart home features are already priced into valuations. You’re buying good properties in good markets, but you’re not capturing a premium that compensates for the adoption curve—you’re paying for the premium that’s already built in.

Gurugram and Delhi-NCR (32-38% penetration) are in active growth phase. Smart home premiums are still expanding. Properties here are still capturing appreciation from both market growth and adoption deepening. This is where 8-12% annual capital appreciation potential sits.

Pune, Jaipur, and Chandigarh (15-22% penetration) are in the value zone. These cities show 30-32% smart home adoption CAGR—faster than metros because baselines are lower. For patient capital with 12+ year horizons, these represent highest growth optionality. Higher execution risk, lower absolute liquidity, but better return potential.

The play isn’t “buy smart homes everywhere.” It’s “understand where each geography sits in the adoption curve, then allocate capital accordingly.”

What Rental Income Actually Looks Like

Rental premiums aren’t theoretical—they’re showing up in actual platforms.

Bangalore’s Whitefield IT corridor: smart home rentals command 12-18% premiums.

Gurugram’s gated communities: 13-17% premiums.

Mumbai’s co-living platforms: 14-16% premiums.

Hyderabad’s HITEC City: 11-15% premiums.

Pune’s emerging tech parks: 10-14% premiums.

On a ₹1 crore property generating ₹40,000 base rent, a 15% premium means ₹6,000 additional monthly—₹72,000 annually. On a ₹3-10 crore portfolio spread across multiple properties, this compounds into material income uplift.

More importantly, these premiums reflect operational reality, not speculation. Tenants pay more because they experience fewer maintenance issues, faster problem resolution, lower utility bills, and greater security. The premium maps to real value delivered.

The Regulatory Tailwinds Nobody’s Talking About

Smart Cities Infrastructure Allocation

₹4.5 billion allocated to Smart City expansion, fiber rollout, and 5G infrastructure. This directly enhances smart home viability by ensuring digital backbone exists in target cities.

More fiber connectivity means smarter buildings can operate effectively. More 5G coverage means IoT devices can communicate reliably. For investors in Tier-II smart cities, this infrastructure spending directly translates to better property performance and higher smart home adoption rates.

The Real Risks (And Why They Matter)

When Smart Home Systems Actually Fail

A Bangalore high-rise integrated all smart home systems through a centralized building management platform in 2023. Single point of failure architecture. When the system crashed in 2024, residents couldn’t use smart locks, CCTV went offline, building communication systems froze. For three weeks, residents had zero visibility into security systems in a high-rise with 500+ units.

Residents demanded rent reductions. The property’s appreciation halted. The developer’s reputation took real damage.

This isn’t hypothetical. It demonstrates why architecture matters. Centralized systems sound efficient until they fail catastrophically. Residents paying premium prices tolerate technology convenience. They don’t tolerate technology liabilities.

For investors, this means: demand decentralized architecture with redundancy. Verify that the developer implemented proper failover protocols. Check whether other buildings by the same developer have experienced issues. These due diligence steps separate properties that deliver value from properties that become liabilities.

Data Privacy Isn’t Trivial

Connected homes generate data: occupancy patterns, when residents are away, security attempts, energy consumption profiles. In India’s evolving regulatory environment, where privacy frameworks are still settling, this data represents genuine risk.

A Delhi HNI whose smart home security data was breached, revealing absence patterns that enabled a burglary, faced not just financial loss but legal liability questions. Whose fault? The data controller? The resident? The system vendor?

Smart home vendors operating in India frequently aren’t bound by equivalent data residency and encryption standards that US/EU providers follow. An investor should verify:

Are occupancy and security logs stored in India (RBI-compliant, in-country processing)?

Is communication encrypted end-to-end (AES-256 minimum)?

Who bears liability if data is compromised?

High-quality developers (Embassy Group, Godrej, Sobha) have addressed these concerns through rigorous vendor selection. Mid-tier developers haven’t. This difference matters for long-term property performance.

The Market Penetration Plateau Risk

Current forecasts assume 30-40% penetration by 2030. But what if adoption plateaus at 15-20%? What if smart homes remain a luxury/premium phenomenon without broad diffusion?

If that happens, value premiums could compress 20-30% relative to current expectations. The market would still exist and function, but the outsized returns would narrow.

For investors in the luxury/HNI segment, this risk is lower because smart homes are already core to purchase decisions. For mass-market segments, the risk is material.

This is why geographic and segment diversification matters. Concentrate in HNI/luxury where adoption is structural, not speculative.

The Things That Keep Investors Up At Night

Technology Obsolescence: Real or Imagined?

A property with smart systems locked into a proprietary ecosystem in 2020 faces potential stranding if that vendor loses market share. The system becomes harder to repair, harder to upgrade, harder to sell to next owners.

This risk is real but manageable. The move toward open standards (Matter Protocol) and regulatory mandates (BIS IoT compliance) means that intelligent infrastructure integrated now with proper architecture won’t become technologically orphaned in 10 years.

Compare to HVAC and electrical systems in 10-year-old buildings—they remain valuable because standards have been consistent. Smart systems are trending the same direction. That’s why architecture and vendor-neutral design matter more than flashy features.

Cybersecurity: The Overlooked Liability

A property where hackers gain security system access poses genuine risk. Not just to residents, but potentially to property owners if liability terms are poorly written.

Demand explicit security standards in property management contracts. Verify that the developer carries cyber liability insurance. Ensure that breach liability is clearly assigned to the developer/building management, not to individual residents.

These contractual details protect you when things go wrong.

Interest Rates and NRI Capital Flows

Smart home premiums depend on strong demand from HNIs and NRIs with capital to deploy. If global interest rates remain elevated and NRI repatriation becomes attractive, capital flows could shift. Smart home premiums might compress if demand softens.

This is a real macro risk, but it’s also manageable with proper diversification and long hold periods (10+ years). By the time interest rate environment normalizes, smart home adoption will have become standard infrastructure, not a premium feature.

The Honest Risks

Technology Failures Are Real: Centralized systems fail catastrophically. This happens. Decentralized architecture reduces this risk but doesn’t eliminate it. Demand proper system design.

Penetration Could Plateau: Smart homes might plateau at 15-20% adoption in mass market while remaining concentrated in HNI segment. If that happens, growth projections compress. Market exists, but returns normalize. Not a disaster, but not the outsized returns analysts project.

Cybersecurity Breaches Create Liability: A property breach isn’t just about money—it’s about liability exposure and reputation risk. Ensure contracts clearly assign liability to developers/building managers, not residents.

Regulatory Changes Could Shift Economics: New data privacy regulations, IoT standards, or building codes could change implementation costs or viability. Monitor regulatory developments. This risk is low but present.

FAQ Section

How realistic is the 30% CAGR projection? Could market growth plateau?

Market growth has been accelerating, not slowing. Current adoption sits at 8-12% of households. Penetration reaching 30-40% by 2030 is plausible given HNI wealth expansion, regulatory support, and technology maturation. Could it plateau below expectations? Yes. But even conservative scenarios show 3x market growth. The base case supports 4x growth. Risk is asymmetric to the upside.

Will rental premiums compress as smart homes become standard?

Yes. Premiums will normalize from “15% above base” to “built into base expectations” as adoption reaches 50%+. But that compression happens gradually over 5-7 years. By then, if you bought during 20-40% penetration phase, your property has appreciated such that the absolute value is higher even if the relative premium has shrunk. It’s like LEED-certified buildings today—the premium has compressed, but those buildings still appreciate faster than conventional properties because they were ahead of the adoption curve.

Should NRIs prioritize smart homes, or are conventional properties just as good?

Smart homes solve the NRI’s core problem: remote management. A smart-home-integrated property in professional property management platform (co-living, platforms like Anarock) gives you real-time visibility, digital tenant verification, and cloud-based rent collection. Conventional properties require more trust in intermediaries. For NRIs, smart infrastructure is operational necessity, not luxury.

Conclusion

India’s smart homes market has moved past the “interesting trend” phase into “structural transformation” territory. The evidence is in HNI purchase preferences, NRI capital flows, government policy alignment, and hard rental yield improvements.

For UHNI and HNI investors—and especially for NRIs seeking remote-manageable assets—the opportunity is real. Not because smart homes are flashy or exciting, but because they solve genuine problems (security, energy efficiency, remote oversight) and generate measurable returns (12-18% rental premiums, 2-4% appreciation upside during growth phase).

The wealth creation is there. So is the risk. The difference between success and mediocrity lies in geographic placement (understanding adoption curves), system architecture assessment (demanding proper technical design), and exit discipline (rotating out before market saturation).

The connected property isn’t tomorrow’s opportunity. It’s today’s infrastructure transition. For those positioned correctly, the returns will reflect that timing.

YouTube Resources

Free resources to download

India’s Smart Homes Investment Guide_ Executive Summary