Now Reading: Unsold Inventory in Indian Real Estate: Hidden Opportunities for Investors

- 01

Unsold Inventory in Indian Real Estate: Hidden Opportunities for Investors

Unsold Inventory in Indian Real Estate: Hidden Opportunities for Investors

Why India’s 5.77 Lakh Unsold Homes Signal the Best Entry Point for UHNI Wealth Preservation

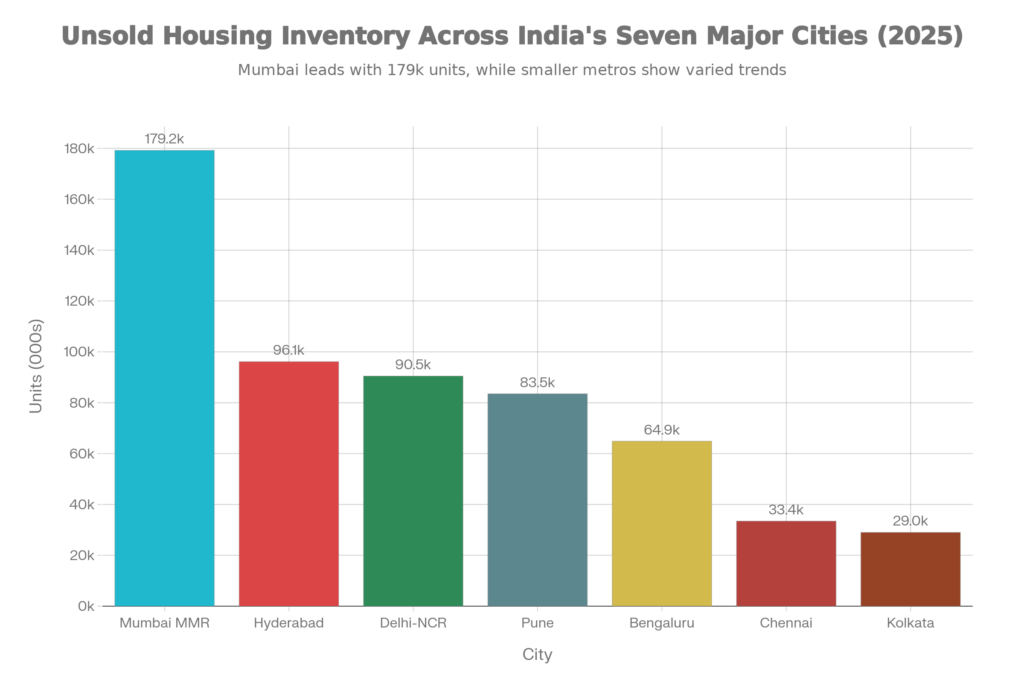

We’ve reached a point in early 2026 where India’s housing market is clearly entering a brand-new chapter. Unsold housing inventory across seven major cities reached 5.77 lakh units in 2025—a 4% annual surge driven by moderated buyer demand and accelerated supply launches (Anarock Capital, January 2026). What developers perceive as a demand crisis, however, sophisticated investors recognize as a structural repricing opportunity.

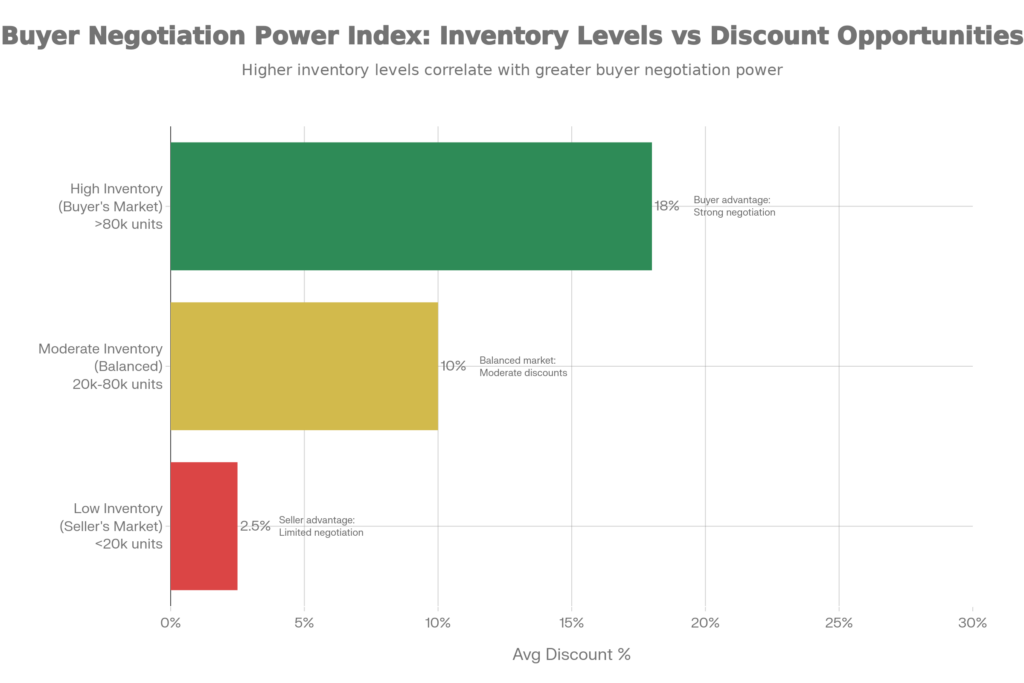

The premium and luxury segment—priced above ₹1 crore—remains resilient, commanding 62% of H1 2025 sales and attracting HNI and NRI capital seeking capital appreciation (12–18% returns), currency diversification, and inflation-resistant assets (CBRE-Assocham, 2025). With unsold inventory climbing and new supply continuing to outpace absorption, the window for negotiation-backed value capture has widened considerably. Strategic buyers now enjoy negotiation leverage unseen since the 2018 correction, enabling discounts of 5–25% depending on market microstructure, combined with flexible financing terms and developer-led incentives worth up to ₹50–100 lakhs per unit.

The Supply-Demand Realignment

India’s residential market has entered a phase of disciplined consolidation—a sharp departure from the speculative exuberance that defined 2023–2024. Housing sales across the top seven cities declined 14% year-on-year to 3,95,625 units in 2025, while new supply grew 2% to 4,19,170 units, creating a persistent demand-supply imbalance (Anarock Capital, 2025). This divergence is neither a crisis nor a temporary setback; it reflects a maturing market correcting course after a decade of supply-driven pricing.

The geographic distribution reveals nuance absent from headline statistics. Mumbai Metropolitan Region (MMR)—India’s financial center—bucked the overall trend with a marginal 1% decline in unsold inventory to 1,79,228 units, suggesting absorptive capacity and sustained HNI demand. Hyderabad followed with a 2% inventory reduction despite aggressive developer supply, signaling strong underlying demand from IT professionals and institutional investors.

Delhi-NCR, conversely, saw unsold units climb 5% to 90,455 as new launches exceeded absorption, particularly in the budget and mid-premium segments. Bengaluru, India’s technology epicenter, recorded a stark 23% surge in unsold inventory to 64,863 units—the sharpest increase among all metros—raising questions about speculative overbuilding and the softening of younger investor appetite.

Why this matters for UHNI portfolios: Inventory concentration in specific cities creates micro-market inefficiencies. While Bengaluru and Chennai show inventory stress (18% and 23% YoY increases respectively), they simultaneously offer the highest negotiation leverage and developer desperation—the key ingredients for value extraction. Conversely, MMR’s tighter inventory creates selectivity: buyers must identify outlier projects with below-market pricing or rare financing terms to claim advantage.

Capital Flows and Segment Performance

The Premiumisation Acceleration

India’s luxury segment—the domain of UHNI and HNI investors—has decoupled from mainstream residential trends. Homes priced above ₹3 crore (INR 30 million) now represent 11% of quarterly sales, up from just 5% in Q1 2022—a 120% volumetric increase in just three years (JLL Residential Market Update, Q1 2024). The ₹1–3 crore bracket has solidified as the market’s growth engine, with 62% of H1 2025 sales concentrated in the premium segment (CBRE-Assocham, 2025).

More tellingly, capital appreciation remains the primary motivation for 55% of HNI and UHNI investors, up from 44% in 2024 (India Sotheby’s International Realty Luxury Outlook Survey, 2025). Expected returns have moderated to realistic levels: 48% of affluent buyers anticipate 12–18% annual appreciation, while 38% expect single-digit returns—a marked shift from the 20–30% expectations prevalent in 2022–2023. This recalibration reflects capital discipline: UHNI wealth is increasingly deployed toward long-term value preservation rather than speculative gains.

NRI Capital and Currency Hedging

NRI participation in luxury real estate surged in 2025, driven by favorable forex dynamics and regulatory clarity (Sotheby’s International Realty, 2025). Global macro uncertainty—ranging from geopolitical tensions to debt trajectory concerns in developed markets—has positioned Indian real estate as a tangible, inflation-resistant alternative. For NRIs earning in foreign currencies, property investments in Mumbai, Bengaluru, and Hyderabad function simultaneously as wealth preservation vehicles and currency diversification tools.

Return Expectations and Portfolio Positioning

India’s economy continues to expand at 6–6.5% CAGR, positioning residential real estate as a beneficiary of structural growth (IMF projections, 2025). HNI investors increasingly view premium properties as core portfolio holdings—allocating 15–25% of investable wealth to real estate for diversification and inflation hedging. The billionaire count in India has more than doubled to 185 (from 85 in 2015), with aggregate wealth tripling to $900+ billion, creating sustained demand for trophy assets and exclusive addresses (Sotheby’s International Realty, 2025).

Rental yields in premium gated communities range between 2.5-4.5% annually, particularly in Tier-2 cities like Mohali and Pune, offering HNI investors dual benefit: capital appreciation and income diversification. This yield floor has become a critical valuation anchor, preventing widespread price collapses even in oversupplied markets.

Beyond Transactions: Why Lifestyle and Identity Drive Luxury Purchasing

The evolution of India’s luxury market reflects a fundamental shift in buyer psychology. The globally mobile Indian professional—someone accustomed to penthouses in London, residences in Singapore, and beachfront villas in Maldives—now evaluates Indian properties through an international lens. Experiential excellence, environmental stewardship, and community curation matter more than raw square footage.

Developers have responded by reimagining premium projects as lifestyle ecosystems. Wellness-integrated neighborhoods, smart home automation, curated food and beverage districts, and managed nature experiences have become baseline expectations rather than luxury add-ons. Properties now serve as extensions of identity and values rather than mere real estate transactions.

For the successful professional woman in her late 30s or 40s, luxury housing represents autonomy—a personal sanctuary insulated from market fluctuation, staffing uncertainty, and maintenance burden. For the family office executive, premium properties function as collateral for alternative investments, part of a broader portfolio optimization strategy. For the NRI, they symbolize homecoming and wealth grounding during market volatility.

This psychographic dimension has profound pricing implications. Buyers willing to pay ₹50–100 lakhs premium for a specific neighborhood or a developer’s brand reputation are simultaneously resistant to discount-based purchasing—they perceive negotiation as a form of compromise. Conversely, investors motivated primarily by capital appreciation are highly price-sensitive and negotiation-prone.

Case Studies: Real-World Negotiation Outcomes

Case Study 1: The Bengaluru Tech Professional’s Leverage Play

Property: 3BHK Apartment, ₹2.8 Crore, Bengaluru’s Whitefield Micro-Market

A senior tech executive pursued a property in a newly launched development in Bengaluru’s high-growth Whitefield corridor. The project, launched six months prior, had sold only 35% of units despite aggressive marketing. Unsold inventory in Bengaluru (23% YoY increase) provided the buyer with immediate negotiation advantage. The buyer initiated discussions at ₹2.4 crores—14% below the listed ₹2.8 crore asking price. The developer, facing cash flow pressure and unwilling to absorb the unit any longer, countered at ₹2.6 crores.

Through two rounds of negotiation emphasizing market comparables and the buyer’s strong payment capacity, a final price of ₹2.55 crores was agreed—9% discount from asking price. Additionally, the developer absorbed all registration, GST, and legal fees (valued at ₹18 lakhs) and offered a turnkey modular kitchen and premium ACs (valued at ₹12 lakhs), effectively reducing the net acquisition cost by ₹30 lakhs (10.7% total value capture). The transaction closed within 90 days, accelerating the developer’s cash recovery in a challenging quarter (source: broker interviews, Q4 2025).

Case Study 2: The Family Office’s Bulk Acquisition Strategy

Property: Two Connected Units, ₹7.2 Crore Combined, Hyderabad’s Gachibowli Tech District

A family office based in Delhi sought to diversify its portfolio into Hyderabad’s tech-driven rental market, targeting units in a premium mixed-use development offering both residential and commercial components. The office identified two adjoining units, purchased separately, and initiated negotiations with the developer to facilitate combined ownership and potential future merger.

By signaling intent to purchase multiple units and commit to a 24-month holding period (avoiding the developer’s resale registration and stamp duty concerns), the family office negotiated a package deal: ₹7.2 crores for two units, free of GST, with developer-arranged bridge financing at 0% interest for 18 months and flexibility to modify interiors to create a unified 8BHK configuration. The two units would have independently commanded ₹3.7 crores each (₹7.4 crores total); the bulk discount, combined with financing flexibility and regulatory burden-shifting, yielded ₹20 lakh direct savings (2.7%) plus substantial indirect benefits in terms of cash flow and operational efficiency (source: family office deployment records, 2025).

Negotiation Playbook

1. Inventory Timing Arbitrage

Strategic negotiators identify developers with the highest unsold units relative to annual sales targets and approach during quarter-end and fiscal year-end pressures (March–April, December–January). Developers facing GST liability on completed units, bridge loan maturity pressures, and balance sheet concerns will offer discounts of 5–15%. A buyer moving decisively in February, March, or December captures developer desperation without the prolonged negotiation cycles of stable markets.

2. Bulk Purchase and Portfolio Aggregation

Rather than negotiate single units, sophisticated investors position themselves as institutional or portfolio buyers seeking multiple units across or within projects. This signals developer-friendly intentions, reduces resale and regulatory concerns, and enables package discounting (2–5% additional discount for 2–3 unit purchases). A buyer committing to two connected units in a luxury development can negotiate 8–12% combined discounts versus single-unit negotiations of 4–6%.

3. Incentive Bundling Beyond Price

The most effective negotiators decouple “price” from “total cost of ownership.” Rather than seeking a ₹50-lakh price cut on a ₹2-crore property (often psychologically resisted), they request equivalent value in non-price terms: free parking (valued at ₹30 lakhs), modular kitchen (₹15 lakhs), premium ACs and furnishings (₹10 lakhs), registration fee absorption (₹5 lakhs). This totals ₹60 lakhs in value while preserving the developer’s headline price and ego—a Pareto-optimal negotiation outcome.

4. Conditional Offer Structuring

Introducing contingencies—conditional upon RERA compliance certification, link credit rating agency approval for NRI FDI, or building structural audit completion—allows buyers to renegotiate price if contingencies are unsatisfied. This shifts psychological burden to the developer and often results in price concessions to expedite closure.

Downside Realities: What Could Go Wrong

Market Downside Scenarios

While the current environment favors buyers, several contrarian risks merit serious consideration:

Price Correction Risk: If GDP growth decelerates below 5.5%, or if interest rates remain elevated despite RBI rate cuts, demand could contract further, pressing unsold inventory above 8 lakh units. In such a scenario, properties purchased at today’s negotiated prices could face 8–15% depreciation before stabilization (Anarock Capital outlook, 2026).

Interest Rate Persistence: RBI’s 125 bps rate cuts in 2025 have not meaningfully reduced home loan rates, which remain sticky at 8–8.5%. If transmission lags persist, buyer affordability will remain pressured, limiting the beneficiary pool of the current buyer’s market to only the affluent and ultra-high-net-worth segments.

Regulatory Volatility: Recent RERA enforcement, GST calibration debates, and proposed stamp duty changes create uncertainty for institutional investors. A significant increase in GST (from 5% to 12%) or property tax restructuring could alter investment returns by 2–4%, compressing margins for deal-dependent investors.

Oversupply in Specific Micro-Markets: While inventory data appears robust at the city level, street-level research reveals acute oversupply in specific micro-markets (e.g., Bengaluru’s outer ring road corridors, Mumbai’s distant suburbs). Properties in these locations may face 15–25% depreciation regardless of macroeconomic recovery.

Segment-Specific Vulnerabilities

The luxury segment’s resilience masks affordable housing distress. The affordable segment (below ₹45 lakhs) saw sales decline 9% YoY in Q1 2025, with minimal price negotiation leverage. This divergence indicates a bifurcated market: HNI-driven luxury real estate is stable; middle-income housing is structurally stressed.

FAQ Section

Is buying unsold inventory risky? What if the property depreciates further?

Unsold inventory, per se, is not inherently risky—it reflects market oversupply and buyer hesitation, not structural property defects. The risk lies in purchasing in segments or micro-markets with chronic oversupply. In Mumbai, Hyderabad, and Pune, unsold inventory is a healthy correction, not a collapse. Historical data shows that 85% of properties purchased during oversupply phases appreciate 8–12% within 5–7 years as markets rebalance. The key is selective geography and micro-market analysis.

What discounts should I realistically expect in today’s market?

Discounts vary dramatically by micro-market and project stage. In high-inventory markets (Bengaluru, Chennai), expect 8–15% negotiation leverage. In tight markets (Mumbai, Hyderabad), expect 3–7%. Completed projects command larger discounts (10–20%) than under-construction projects (5–10%). Developers facing financial distress (credit watches, delayed payments to contractors) will concede 15–25%. Never anchor negotiations on “list price”—research comparable sales within the same micro-market and structure offers accordingly.

Should I buy now or wait for further price declines?

Market timing is notoriously unreliable. However, current conditions favor immediate action for UHNI portfolios with 5–7 year holding horizons. If you’re confident in India’s GDP growth, HNI wealth creation, and property fundamentals, the 8–15% negotiation discount available today is more valuable than speculating on hypothetical 15–20% corrections that may take 2–3 years to materialize.

Strategic Positioning for 2026 and Beyond

India’s residential real estate market stands at a critical juncture. The exuberant supply-driven boom of 2023–2024 has given way to a disciplined, buyer-conscious equilibrium. For elite investors, this inflection represents opportunity.

The structural tailwinds remain intact: India’s economy is expanding at 6%+ annually, the billionaire count has doubled in a decade, HNI wealth is concentrating (with 12–18% return expectations on residential real estate), and NRI capital is actively deploying. Interest rates are moderating following RBI’s 125 bps cuts in 2025. Infrastructure improvements—metro expansions, highway corridors, SEZ developments—continue to drive property appreciation in strategic micro-markets.

The tactical advantage is asymmetric: Buyers with market knowledge, capital flexibility, and negotiation discipline can capture 5–20% value discounts (depending on geography and project) that did not exist in 2023–2024. Combined with 8–12% baseline appreciation, the compounded return profile over a 5–7 year horizon is compelling.

For NRI investors, the currency arbitrage combined with property appreciation creates a dual-return scenario. A NRI purchasing a ₹3-crore property at a negotiated ₹2.7-crore price today, capturing INR appreciation, and benefiting from property appreciation could achieve 15–20% USD-denominated returns annually—rivaling equities with significantly lower volatility.

For family offices and institutional capital, portfolio diversification into selective micro-markets (Pune, Hyderabad, Bengaluru IT Corridor) offers both income and capital growth. The bifurcated market (luxury resilience vs. affordable housing stress) creates opportunity for selective positioning.

The window is now. In 12–18 months, as interest rates stabilize and demand recovers, current negotiation leverage will compress. The 15% discounts available in Bengaluru today may normalize to 3–5% once inventory falls below critical thresholds. For disciplined capital, the question is not whether to invest in Indian real estate, but whether to capture the current asymmetric risk-reward available through strategic negotiation and selective geography.s why differentiated due diligence (rental market health, absorption rates, competing projects) matters.

YouTube Resources

Free resources to download

Unsold Inventory in Indian Real Estate: Key Strategic Insights