Now Reading: Navigating Ready-to-Move and Under-Construction Opportunities in India’s Premium Residential Sector

- 01

Navigating Ready-to-Move and Under-Construction Opportunities in India’s Premium Residential Sector

Navigating Ready-to-Move and Under-Construction Opportunities in India’s Premium Residential Sector

India’s residential real estate market has bifurcated into two distinct investment theses competing for the attention of $135 billion in annual NRI remittances and surging domestic HNI wealth. Ready-to-move properties offer ballast: immediate occupancy, zero construction risk, and institutional credibility that appeals to capital preservation. Under-construction assets, meanwhile, have transformed from speculative territory into a calculated appreciation play backed by maturing RERA regulations and institutional-grade builders. In H1 2025, the gap between the two has narrowed dramatically—preference ratios swung from 46:18 (heavily ready-biased) in 2020 to nearly 23:24 (balanced) today. For sophisticated investors, the question is no longer which is superior, but which aligns with capital deployment timelines, risk appetite, and the architecture of wealth they’re building in India. This article decodes both paths with precision, comparative rigor, and data that institutions use to allocate billions.

The Luxury Residential Sector’s Structural Evolution and Institutional Capital Influx

The Indian residential luxury market has entered what CBRE-ASSOCHAM describes as a “phase of strategic resilience.” Premium properties above ₹1 crore now capture 62% of sales—up from 51% just eighteen months ago. This isn’t mere momentum; it reflects a structural shift in how global and domestic capital is thinking about Indian real estate as an asset class.

In the first half of 2025, luxury housing recorded 85% year-over-year growth, with approximately 7,000 units sold across India’s top seven metros. Delhi-NCR led the surge, accounting for 4,000 units—a threefold increase from the prior year. Mumbai followed with 1,240 units. What’s remarkable isn’t the absolute volume, but the demographic driving it: HNIs, UHNIs, and NRIs accounted for 84% of these transactions, signaling that India’s real estate is no longer a mass market play, but a precision wealth instrument.

The capital footprint underscores this maturation. Private equity investment in Indian real estate reached $6.7 billion in 2025—a 59% surge—with institutional investors accounting for 76% of flows. This institutional confidence has cascading effects: it attracts quality developers, mandates governance standards, and creates differentiation between ready-to-move assets (which institutional buyers view as de-risked) and under-construction projects (which now carry RERA guarantees and escrow protections).

For the global investor, this context matters because it determines which properties will command liquidity, rental demand, and eventual exit valuations.

Key Data Point: Units priced above ₹10 million now represent 50% of sales across top metros, up from 43% a year ago. This premiumization is creating a bifurcated market where mid-tier properties appreciate modestly (5-8% annually) while luxury assets consistently deliver 12-18% returns.

The Rationale Behind Premium Pricing of Ready-to-Move Assets

The first question investors ask is straightforward: Why does an identical 3-bedroom in Gurgaon’s Sector 65 cost ₹3.5 crores ready-made but ₹2.8 crores under-construction?

The answer reveals how Indian real estate pricing actually works. Under-construction properties are priced to the cash flow of construction; ready-to-move properties are priced to immediate market demand. That gap—typically 15-25% across metros—is not irrational; it’s a direct function of three overlapping costs that ready purchasers absorb upfront.

1. Construction Risk Discount

Under-construction properties embed a risk premium that compensates for timeline uncertainty and delivery risk. Even with RERA’s 70% escrow requirement, buyers are pricing in the probability of 6-12 month delays (which affected approximately 40% of projects in major cities in 2024-2025). They’re also pricing in the possibility of quality discrepancies—visible defects or design variations between what was promised and what was delivered. Ready-to-move properties eliminate both by offering physical inspection and immediate legal clarity.

2. Capital Cost & Inflation Arbitrage

A buyer purchasing an under-construction property is effectively extending a 2-5 year loan to the developer at zero interest. The developer captures the benefit of inflation during construction; the buyer bears the cost of capital. Conversely, a ready-to-move buyer pays today’s price for today’s asset. In an environment where construction financing costs 8-9% annually, this matters significantly to net present value calculations. For a ₹1 crore property appreciating at 10% annually, the 3-year holding cost of capital can represent 15-18% of the entry price.

3. Regulatory & Tax Transparency

Ready-to-move properties sold after two years attract long-term capital gains treatment (20% tax with indexation). Under-construction properties are subject to 5% GST at purchase (reduced to 1% for affordable housing below ₹45 lakhs), which can add ₹3-5 lakhs to a ₹60-80 lakh property. GST adds complexity; many sophisticated buyers have structured their acquisitions through entities to optimize this burden, but it remains a friction cost.

Under-Construction Momentum vs. Ready-to-Move Stability

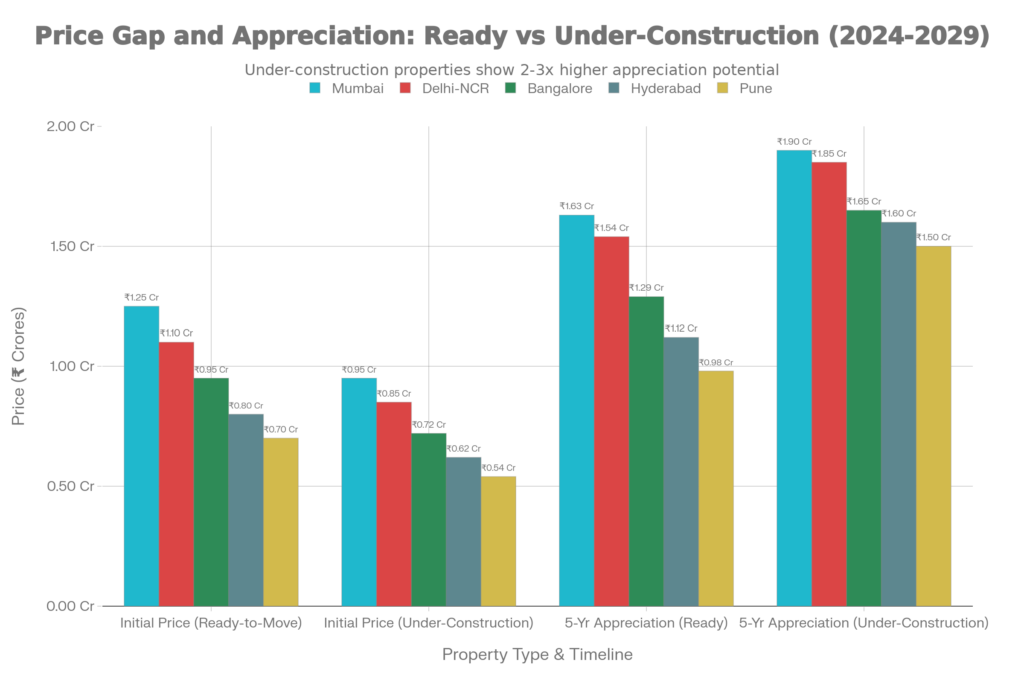

Where the economics separate dramatically is in long-term appreciation projections. This is where investment thesis meets market reality.

Under-Construction Appreciation Potential

Pre-launch properties, according to CBRE and Knight Frank data, typically appreciate 20-40% by the time construction completion occurs—often within 2-3 years. This appreciation isn’t arbitrary; it tracks infrastructure development in the immediate vicinity. When a project launches in Gurgaon’s Dwarka Expressway corridor at ₹80 lakhs, the appreciation to ₹1.1-1.2 crores by year 3 reflects tangible events: metro completion, highway connectivity, new IT hubs, and institutional developer activity in the area.

This means an investor who enters a high-quality developer’s under-construction project in an emerging micro-market can capture 20-30% appreciation through market maturation, then benefit from the broader 10-12% annual capital growth thereafter.

Ready-to-Move Appreciation Reality

Ready-to-move properties trade at market-discovered prices. The “discount” relative to under-construction isn’t latent appreciation potential; it’s already priced in. A ready property in an established location (Worli, Bangalore’s Whitefield, Hyderabad’s Gachibowli) appreciates at 5-10% annually based on macro factors: population growth, rental demand, metro expansion, and institutional investor confidence. These are slower, more stable appreciation curves—suitable for buy-and-hold portfolios but inferior for wealth acceleration.

The data from H1 2025 validates this split: Bengaluru recorded 8-10% appreciation; Hyderabad 8-10%; Mumbai 9-10% for ready properties. Under-construction assets in high-conviction emerging markets (like Jewar in Delhi-NCR or Dwarka Expressway) posted 15-20% appreciation by project completion, with expectations of 8-12% ongoing appreciation thereafter.

Risk Framework and Mitigation: Construction Delays, Quality Assurance, and Developer Viability

The narrative around under-construction risk has shifted materially since 2020. RERA implementation, which began in 2016 but matured significantly by 2023, has reshaped the risk calculus.

Construction Delays: The Real Impact

Approximately 40% of under-construction projects in major metros experienced delays of 6-18 months in 2024-2025. This sounds catastrophic until one unpacks what “delay” means for different buyer profiles.

For an end-user (someone who needs to move in), a 12-month delay is genuinely costly. For a portfolio investor receiving rental income or capital appreciation, a delay shifts timing but doesn’t materially alter NPV when properly modeled. A property that appreciates to ₹1.25 crores in 36 months instead of 30 months—assuming the underlying market fundamentals remain intact—reduces annualized returns by ~1-2%, a negligible swing in a 15-20% appreciation scenario.

However, significant delays (2+ years) coupled with poor execution create real issues. Historically, some Mumbai peripheral projects and Noida Extension developments saw delays exceeding 5-7 years, triggering legal disputes and buyer exits at losses. These were outliers driven by developer bankruptcy or municipal clearance failures—situations entirely avoidable through proper due diligence on developer track records, RERA compliance history, and fund escrow status.

Quality Assurance & Legal Clarity

Ready-to-move properties offer certainty: the buyer physically inspects construction quality, tests utilities, and views completed common areas before commitment. Under-construction buyers operate on faith until completion. This gap has narrowed with digital visualization tools—developers now offer VR walkthroughs and HD renderings—but it hasn’t disappeared.

RERA mandates standardized agreements and transparent pricing, and the real estate authority can compel compensation for quality discrepancies. This is meaningful protection, but enforcement remains inconsistent across states. Maharashtra and Karnataka RERA bodies are responsive; others require patience.

For NRI buyers specifically, quality assurance risk justifies a modest premium for ready-to-move properties in unfamiliar micro-markets. The ability to inspect—or deploy a local agent to inspect—reduces asymmetric information costs.

Financial Distress Risk

Developer viability matters. A buyer investing ₹1 crore in a pre-launch project by a builder with seven successful completions faces lower distress risk than one by a builder with three ongoing projects and two stalled ones. This differentiation is critical. In 2024-2025, approximately 15-20% of developer launches failed to attract sufficient capital or experienced execution challenges, leading to project suspensions.

Verification protocols matter enormously: check RERA registration, escrow compliance, municipal approvals, and prior project completion timelines. Ready-to-move properties sold by established developers are de-facto proof of execution capability.

Non-Resident Investor Positioning

The macroeconomic backdrop for NRI investment in 2025-2026 is exceptionally favorable—in ways that asymmetrically benefit property portfolios.

India received $135.46 billion in remittances in FY25, representing a 14% year-on-year increase. This capital concentration gives NRIs unprecedented purchasing power. Simultaneously, currency dynamics have shifted: the US dollar has strengthened against the Indian rupee, meaning NRI wealth deployed in property assets enjoys built-in purchasing power leverage.

This matters because NRIs investing ₹10 crores in Mumbai luxury property aren’t just acquiring an asset; they’re executing a currency-hedged, tax-efficient capital redeployment strategy.

Why Under-Construction Appeals to Savvy NRIs

- Installment Structure: Under-construction properties demand 20-30% upfront, with 70% payable on possession. This payment schedule aligns with remittance patterns and allows NRIs to deploy capital across fiscal years, optimizing remittance tax treatment in their domicile countries.

- Regulatory Clarity: RERA registration and escrow requirements provide institutional credibility that NRIs (who cannot easily inspect projects or pursue disputes) need for confidence. The escrow requirement that 70% of project funds sit in regulated accounts isn’t bureaucracy; it’s security.

- Appreciation Capture: An NRI investing $100,000 (approximately ₹83 lakhs) in an under-construction property in Pune’s emerging micro-market, purchasing at ₹70 lakhs with completion appreciation to ₹95-105 lakhs, gains ₹20-35 lakhs in appreciation (~24-35% return) before considering any annual rental income or rupee revaluation benefit.

Why Ready-to-Move Appeals to Risk-Averse NRIs

- Rental Yield Certainty: A ready-to-move luxury apartment in Mumbai’s Worli or Bandra commands consistent rental demand from expatriates and executives, delivering 2-3% annual rental yields. An NRI receiving ₹3-4 lakhs annually on a ₹2 crore investment creates predictable hard currency income.

- No Surprises: No construction updates to monitor, no contingency for delays, no surprises on delivery quality. For NRIs managing portfolios from London or Singapore, this simplicity has real economic value.

- Institutional Acceptance: Global wealth managers and family offices are more comfortable assigning value to completed, tenanted assets than to off-plan purchases. This matters for estate planning, collateral, and family wealth transfer.

How Institutional Investors are Reshaping Property Type Preferences

The participation of institutional capital ($6.7 billion PE in 2025, with projections of $5-7 billion in 2026) is reshaping which property types institutional buyers view as core holdings versus tactical plays.

Residential real estate captured 17% of 2025 PE flows, with a distinct shift: investors favored “structured” assets with contracted cash flows (rental agreements pre-signed) or “income-generating” ready-to-move buildings over speculative under-construction projects. This reveals a truth about institutional capital: it’s not chasing appreciation; it’s seeking yield and de-risking.

However, mid-sized PE funds and family offices are increasingly active in under-construction projects by RERA-compliant, Tier-1 developers. They view these as risk-adjusted appreciation plays, with expected 12-18% IRRs over 3-5 year holding periods. This institutional confidence has ripple effects: it drives developer selection (only builders with multi-project completion histories attract serious capital), enforces execution standards, and creates secondary market liquidity.

For individual investors, this has a practical implication: under-construction properties by developers with institutional backing (like Lodha, Sobha, Prestige, Puravankara, Anant Raj, DLF) carry lower execution risk and higher exit liquidity than boutique developers. The institutional filter is working.

Rental Yields and the Dual-Return Strategy

An investor’s total return comprises capital appreciation (typically 60-70% of value creation) and rental yield (30-40%). Ready-to-move properties dominate on yield; under-construction, by necessity, can’t generate rental income until completion.

Rental Yield Hierarchy (2025 Data)

| Metro | Ready-to-Move | Under-Construction (Post-Completion) |

|---|---|---|

| Bengaluru | 3.5-4% | 3.5-4% (post-completion) |

| Hyderabad | 3-4% | 3-4% (post-completion) |

| Mumbai | 2-3% | 2-3% (post-completion) |

| Delhi-NCR | 2.5-3.2% | 2.5-3.2% (post-completion) |

| Pune | 2.5-3% | 2.5-3% (post-completion) |

| Chennai | 2.5-3.5% | 2.5-3.5% (post-completion) |

The Yield-Arbitrage Strategy: A sophisticated investor might deploy capital in an under-construction property in a high-appreciation corridor (say, Hyderabad’s emerging tech parks) where appreciation potential is 15-20%, then refinance upon completion to extract rental income. This captures both appreciation and yield in sequential tranches, maximizing overall return.

Conversely, ready-to-move properties in stable, established micro-markets (Mumbai’s Bandra-Worli sea link area, Bangalore’s Indiranagar) generate immediate 3-4% yields, providing portfolio stability and passive income.

Critical Finding: The top-income-earning luxury rentals come from properties with specific attributes: proximity to commercial hubs (within 15 minutes), gated community amenities (gym, pool, concierge), and established expat populations. This demands precise micro-market selection, which is why many investors hire local agents to assess rental demand before purchase.

Five Core Principles for Capital Allocation

- Segment by Time Horizon: Investors with 3-5 year horizons and no occupancy needs should weight under-construction in emerging, infrastructure-backed corridors (Dwarka Expressway, Yamuna Expressway, metro extensions). Investors with 10+ year horizons seeking portfolio stability should favor ready-to-move in established super-prime markets.

- Verify Developer Pedigree Before Price Comparison: The 15-25% price gap between ready and under-construction only represents value if the developer delivers. Allocate 15-20% of due diligence time to reviewing RERA compliance, prior project completion timelines, and escrow status. A 20% discount from a low-credibility developer is a value trap.

- Deploy Geographic Diversification: Don’t concentrate in a single metro. Consider tier-2 cities (Jaipur, Coimbatore, Lucknow, Surat) where under-construction properties offer 8-12% annual appreciation with lower entry prices. These cities are attracting institutional infrastructure investment and emerging as wealth generation zones.

- Use Rental Demand as a Leading Indicator: Before buying, spend a week in the micro-market. Interview rental agents, inspect competing properties, check occupancy rates in nearby buildings. If rentals are scarce or below-market, it signals demand weakness. Under-construction projects in weak rental markets are higher-risk.

Risks and Downside Scenarios

Construction Industry Fragility

India’s real estate sector relies on imported labor (from eastern states), supply chain coordination (cement, steel, rebar), and municipal approval timelines. Disruptions in any create cascading delays. The 40% project delay rate isn’t rare; it’s structural. Investors who can’t absorb 12-18 month delays should avoid under-construction, period.

Recession Scenario Impact

If India enters a recession (unlikely given 6-7% GDP growth projections, but not zero probability), the following occurs: construction halts (liquidity dries up), rental demand contracts (fewer expat hires, fewer corporate transfers), and appreciation stalls or reverses. In this scenario, ready-to-move properties in established markets depreciate 10-15% (floor of stable demand), while under-construction projects face existential risk. This risk is uninsurable in India; it’s a systemic tail-risk that long-term investors accept.

Regulatory Tightening

If regularity clamps down on NRI foreign remittance advantages or imposes additional taxation on under-construction acquisitions, the economics shift. This is speculative, but tail-risk management demands awareness.

Oversupply in Micro-Markets

Certain high-growth corridors (parts of Gurgaon’s Golf Course Extension, Pune’s Hinjewadi) are experiencing supply overshoots relative to demand. Buyers investing here without careful micro-market analysis face 2-5 year appreciation delays while developers work through inventory. This is why differentiated due diligence (rental market health, absorption rates, competing projects) matters.

FAQ Section

Should I buy ready-to-move or under-construction in 2025 for maximum returns?

If your horizon is 3-5 years and you’re willing to accept construction timeline risk, under-construction in emerging infrastructure corridors (Dwarka Expressway, Hyderabad’s IT expansions) delivers 15-20% appreciation, often outpacing ready-to-move’s 5-10%. If your horizon is 10+ years and you prioritize stability and rental income, ready-to-move in established micro-markets is superior. Don’t optimize for “maximum returns”—optimize for risk-adjusted returns that match your time horizon.

How much does RERA protection actually reduce risk for under-construction projects?

RERA reduces risk materially but incompletely. The 70% escrow requirement, developer registration mandate, and delay compensation provisions eliminate approximately 60-70% of historical risks (developer absconding, fund misappropriation). They don’t eliminate execution delays (which remained at 40% in 2025) or quality discrepancies. RERA is a floor, not an absolute guarantee.

What’s the total cost of ownership difference between a ready-to-move property and an under-construction property over 5 years?

A ₹1 crore ready-to-move property costs ₹1 crore upfront plus 5% stamp duty/registration (₹5-7 lakhs), totaling ₹1.05-1.07 crores. An equivalent ₹78-80 lakh under-construction property costs that amount upfront (30% at purchase) plus 5% GST (₹3.9-4 lakhs), totaling ₹0.82-0.84 lakhs initially but ₹1.12 crores by completion (including construction financing costs). Over 5 years, if ready appreciates to ₹1.25 crores and under-construction to ₹1.45 crores, the under-construction delivers 6-8% superior returns despite identical entry locations—but only if delivered on time.

Are NRIs penalized on under-construction purchases versus ready-to-move?

No inherent penalty, but three structural differences: (1) GST applies to under-construction (5%), zero for ready-to-move; (2) ready-to-move can be inspected remotely or by agents, reducing asymmetric information; (3) under-construction requires more trust in developer execution timelines. For structurally-savvy NRIs using entity structures, the GST penalty is manageable. For others, ready-to-move offers simplicity.

The Window for Capital Deployment and the Path to Compound Wealth Creation

India’s luxury real estate market in 2026 stands at an inflection point. Institutional capital has matured the market, regulatory frameworks have reduced fraud, and a rising cohort of billionaires and HNIs is demanding precision, not speculation. The binary choice between ready-to-move and under-construction is dissolving—replaced by a more nuanced decision tree based on time horizon, capital efficiency, and risk tolerance.

For investors seeking steady wealth preservation and immediate rental income, ready-to-move properties in established super-prime markets remain the elegant choice. For those with patient capital and active risk management, under-construction assets in infrastructure-backed corridors deliver wealth multiplication that ready properties cannot match.

The opportunity window remains open in 2026, but windows close. Global economic uncertainty, regulatory evolution, and valuation normalization are converging. Investors who deploy capital now—with rigorous process discipline and geographic diversification—are positioning for wealth creation that compounds over decades.

The execution requires expertise, patience, and precision. Neither property type is universally superior—only superior for your specific thesis.

YouTube Resources

Free resources to download

Ready To Move Vs. Under-Construction- Executive Summary