Now Reading: Luxury Real Estate: Portfolio Powerhouse Or Hedonic Haven? Global Insights For UHNI Investors

- 01

Luxury Real Estate: Portfolio Powerhouse Or Hedonic Haven? Global Insights For UHNI Investors

Luxury Real Estate: Portfolio Powerhouse Or Hedonic Haven? Global Insights For UHNI Investors

The ultra-high-net-worth (UHNI) and non-resident Indian (NRI) investment community stands at an inflection point. In today’s volatile capital markets, luxury real estate is asserting itself as both an ultimate aspirational asset and a sophisticated instrument of wealth preservation. With global luxury transaction volumes hitting a record USD 9.3 billion in 2024 and the international luxury residential market projected to reach USD 1.001 trillion by 2032 at a CAGR of 5.62%, the urgency for strategic allocations is undeniable. Dubai, Mumbai, London, Singapore, and Miami are witnessing unprecedented activity from global decision-makers seeking not merely unmatched lifestyle prestige but robust portfolio insulation against economic volatility. New regulatory frameworks, evolving tax landscapes, and currency fluctuations make luxury real estate a critical linchpin in UHNI wealth management. For discerning investors, this is not merely a discretionary purchase—it is an entrance into an elite ecosystem offering generational value, global leverage, and enduring returns. Luxury real estate investment strategy is now, more than ever, a necessity for those seeking both legacy and liquidity.

Luxury Real Estate as Dual-Purpose Capital

The luxury real estate market is experiencing a fundamental transformation. What was once viewed exclusively as a lifestyle aspiration has evolved into a cornerstone of sophisticated wealth management. The data is unequivocal: the global luxury residential real estate market stood at USD 646.58 billion in 2024 and is forecast to reach USD 1,001.36 billion by 2032, representing a CAGR of 5.62%. This trajectory outpaces traditional equities, bonds, and commodities, establishing real estate as the preferred asset class for capital preservation and appreciation among the global elite.

More critically, ultra-high-net-worth individuals (UHNI population exceeding USD 30 million) are recalibrating their allocation strategies. In 2024, this cohort reached 395,000 globally, up 8% year-over-year, with India’s UHNI segment projected to surge 50%—from 13,260 in 2023 to 19,908 by 2028. This acceleration in wealth creation, coupled with limited trophy property availability, is driving competition for marquee assets across multiple geographies.

Geographical Disparities & Strategic Implications

The luxury real estate landscape reveals striking regional variations that warrant sophisticated investor analysis:

Dubai: Leading with an extraordinary 46% CAGR from 2020-2024, Dubai remains the apex predator of global luxury markets. In Q1 2025 alone, 111 USD 10 million-plus sales were recorded—the highest Q1 on record. The emirate welcomed 7,200 millionaires in 2024, bringing total resident HNWIs to 134,000. Prime villa prices have surged 94% since 2020, with Palm Jumeirah recording 34 USD 10 million-plus transactions in Q1 2025 valued at USD 562.8 million. The market’s resilience stems from zero property taxation for foreigners, favorable residency incentives, and strategic geopolitical positioning.

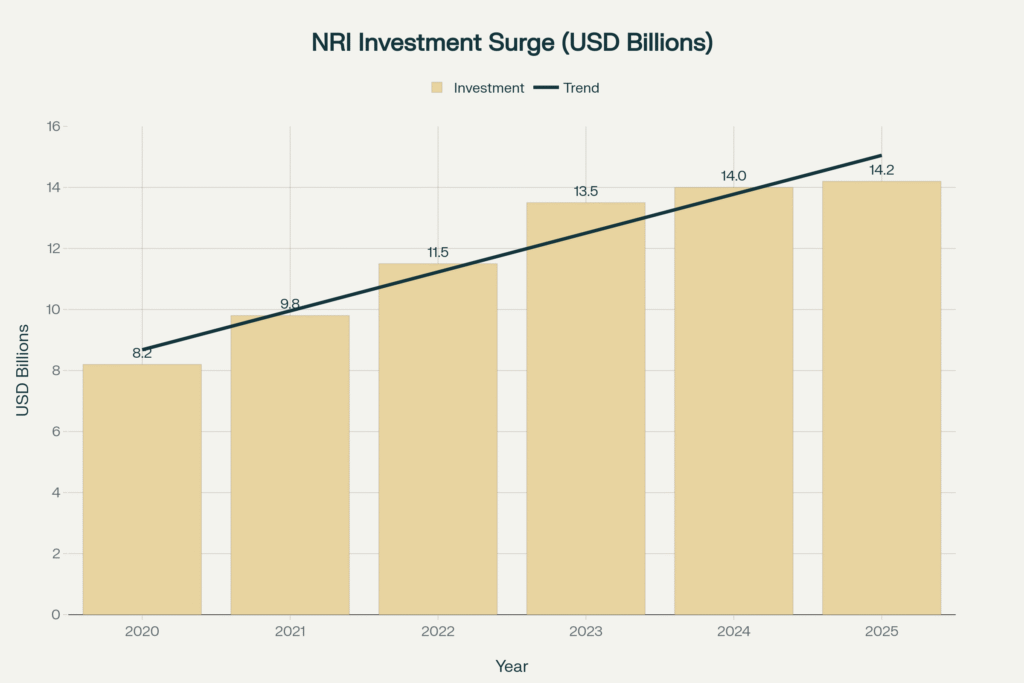

Mumbai & India: India’s luxury segment is experiencing a renaissance. Mumbai’s luxury residential market recorded INR 14,750 crore (approximately USD 1.77 billion) in sales above INR 10 crore in H1 2025—an 11% year-over-year increase. Ultra-luxury homes above INR 40 crore saw 53 units sold in 2024, compared to just 17 two years prior. The CAGR for Mumbai luxury properties stands at 7.8% (2021-2025), with NRI capital flows reaching USD 14.2 billion in 2025, up 73% from USD 8.2 billion in 2020.

London & Prime Central Districts: JLL’s forecast projects 21.6% price growth in London from 2025-2029, underpinned by severe supply constraints. Mayfair remains a global luxury bastion, with 2024 recording 38 deals above £20 million, increasingly dominated by Indian and Gulf investors. The city’s cultural capital, institutional resilience, and legacy appeal ensure consistent demand despite post-Brexit economic headwinds.

Singapore: Singapore’s Core Central Region (CCR) recorded 141 luxury home transactions exceeding USD 5 million in Q2 2025, with 94 luxury condos sold for USD 584.26 million—a 53.9% year-on-year increase. Average luxury apartment prices rose 6.2% to SGD 12,140 per sq ft (approximately USD 3,736 psf), driven by new launches and favorable financing conditions.

Miami & United States: Miami’s luxury condo market closed Q1 2025 at USD 1,080 per square foot—a 9.2% year-over-year increase. While inventory stands at 22 months (indicating a buyer’s market), the Knight Frank Wealth Report ranks Miami No. 4 for projected five-year growth among global luxury markets. The city’s tax advantages, lifestyle appeal, and relative affordability (approximately 625 sq ft per USD 1 million versus 314 sq ft in New York) continue attracting UHNI migration.

The Psychology of Luxury Investment: Beyond Returns

For the UHNI demographic, luxury real estate transcends financial metrics. The intangible benefits often dwarf numerical returns:

Status & Prestige: A USD 20 million penthouse in Dubai’s Palm Jumeirah or a Mayfair townhouse is far more than brick and mortar—it is a modern insignia of global influence and arrival. These properties signal membership in an elite club, opening doors to networks, opportunities, and relationships impossible to quantify on a balance sheet.

Legacy & Generational Wealth: Ultra-wealthy families increasingly view trophy properties as anchors for multi-generational wealth transfer. Unlike equities vulnerable to market volatility or currencies subject to devaluation, physical trophy real estate offers tangible, enduring security. Property transfers to heirs come with clarity, historical appreciation, and emotional resonance.

Privacy, Security & Sovereignty: In an era of geopolitical uncertainty, ultra-wealthy individuals prioritize properties in stable jurisdictions with robust legal frameworks. Gated estates, private elevators, and dedicated security offer sanctuary from the world’s chaos—a commodity whose value cannot be underestimated.

Experiential Excellence: Luxury properties increasingly incorporate world-class amenities: spas, private cinemas, infinity pools, wellness centers, and concierge services. These are not merely nice-to-haves; they represent a curated lifestyle that money alone cannot purchase elsewhere.

Marquee Transactions Across Global Markets

Case Study 1: Mumbai’s Billionaire Corridor – Antilia & Ultra-Luxury Ultra-Concentration

Market Significance: Mukesh Ambani’s Antilia, valued at approximately USD 4.6 billion as of 2023 and constructed at a cost of USD 2 billion (2006-2010), stands as the world’s most expensive private residence. This 27-story, 400,000 sq ft mansion on Altamount Road, Mumbai, has fundamentally transformed South Mumbai’s luxury real estate calculus.

Market Impact: The presence of Antilia has elevated property values in the surrounding Altamount Road and Malabar Hill neighborhoods to INR 80,000-85,000 per sq ft (approximately USD 970-1,030 per sq ft), making it the nation’s most expensive address. Following Antilia’s construction, luxury property prices in the vicinity surged 3x. In H1 2025, Mumbai recorded sales of 722 flats above INR 10 crore (USD 1.2 million), far exceeding new launches at 532 units. Worli emerged as the market leader, contributing 22% of total luxury sales.

Strategic Insight: The Antilia effect demonstrates how iconic trophy properties serve as market anchors, elevating entire neighborhoods. For UHNI investors, proximity to such landmarks carries a visibility premium and hedge against localized downturns. The market shift from completed luxury (1-32% YoY appreciation) to under-construction ultra-luxury (40-44% appreciation in Mumbai, 35% in Bangalore) signals that patient capital seeking maximum appreciation should target pre-completion inventory in branded developments.

Case Study 2: Dubai’s Ultra-Prime Ascendancy – Palm Jumeirah Penthouse Record-Breaking Transaction

Transaction Highlight: In Q1 2025, a six-bedroom villa on Palm Jumeirah sold for USD 106.3 million—having originally purchased for USD 6.6 million in 2015. This extraordinary transaction reflects a 1,635% price appreciation, or approximately 34.6% annual growth over a decade.

Market Dynamics: Palm Jumeirah recorded 34 USD 10 million-plus transactions in Q1 2025 valued at USD 562.8 million combined. More broadly, Dubai recorded 435 deals valued at USD 7.1 billion in 2024—the highest global transaction volume in any single market. The emirate’s ultra-prime segment (USD 25M+ properties) saw 12 transactions in Q1 2025, demonstrating consistent UHNWI appetite despite global uncertainties.

Key Drivers: Zero property taxation for foreign residents, investor-friendly residency visas, proximity to superyacht marinas, Dorchester Collection-branded residences offering hotel-level services, and strategic positioning as a wealth migration hub (9,800 millionaires projected to relocate to UAE in 2025) sustain the market’s momentum.

Risk Consideration: Analysts caution potential market correction, noting property prices climbed nearly 70% over four years. New supply pipelines entering the market in late 2025 and 2026 may moderate appreciation rates. However, luxury segment resilience (defined as USD 10M+ properties) typically outperforms broader markets during cyclical downturns.

Case Study 3: London Mayfair – Institutional Resilience & Cross-Border Wealth Inflows

Market Profile: Mayfair’s 2024 recorded 38 transactions above £20 million (approximately USD 25 million), with Indian and Gulf investors emerging as leading acquirers. The historic Claridge’s building and surrounding Grosvenor Square developments have undergone major restorations, attracting ultra-wealthy global residents seeking permanence over speculation.

Strategic Positioning: London’s luxury market benefits from institutional depth (wealth management infrastructure), legal clarity, currency diversification (exposure to GBP), and heritage. Unlike emerging markets subject to regulatory unpredictability, London offers predictability for family office structures. JLL forecasts 21.6% price growth in London from 2025-2029, driven by severe supply constraints and limited new prime inventory reaching the market.

Investment Thesis for NRIs: For returning Indians and global wealth holders, London represents a portfolio hedge. Properties here typically generate 1-2% rental yields but appreciate 4-7% annually. When combined with currency appreciation (INR depreciation versus GBP), total returns can approach 8-10% for rupee-denominated investors. Claridge’s House, reconstructed in 1924 and recently renovated, exemplifies branded residential appeal, offering concierge access to hotel amenities—a hybrid model increasingly adopted across global luxury markets.

Pro Tips & Strategies

1. Diversify Across Geographies with Contrarian Timing:

UHNI portfolio diversification requires positioning in countercyclical markets. While Dubai and Miami command premium valuations, emerging luxury markets in Bangkok, Lisbon, and Bucharest offer 18-25% appreciation potential over 5-7 year horizons with lower entry prices. Strategic capital allocation to 3-4 geographies hedges single-market downturn exposure.

2. Master Tax-Efficient Structuring Through Holding Companies:

Luxury real estate acquisitions should be structured through Singapore or UAE-domiciled holding companies to optimize capital gains taxation, avoid double taxation on rental income, and facilitate seamless intergenerational transfers. Specialized advisors can reduce tax liability by 25-40% through legitimate structuring.

3. Capture the Under-Construction Premium:

Data reveals under-construction luxury homes in India appreciate 40-44% versus 1-32% for completed units. UHNI investors with patient capital should deploy capital into branded developments 12-18 months before completion, capturing appreciation through pre-completion resales or enjoying completed asset with minimal depreciation risk.

4. Leverage Branded Residence & Amenity Arbitrage:

Luxury properties affiliated with Dorchester Collection, Four Seasons, or designer collaborations command 15-30% premiums over comparable non-branded properties. These command higher rental yields (5-7% vs. 2-3%) due to professional management, concierge services, and guaranteed maintenance standards attractive to tenants willing to pay premium rents.

5. Establish Multi-Generational Holding Structures via Family Offices:

For UHNIs seeking true wealth preservation, creating a dedicated family office with professional property management achieves three objectives: tax optimization, professional stewardship, and simplified succession planning. Properties held under family trusts appreciate unencumbered by individual taxation events, facilitating seamless transfer across generations.

Market Risks

Valuation Correction Potential: Property price appreciation of 46% (Dubai), 44% (Mumbai under-construction), and 70% (4-year price surge in Dubai) raises questions of sustainability. Historical bubbles in London (2008), Dubai (2009-2012), and India (2015) suggest that when CAGRs exceed 20%, market corrections of 15-30% are frequent.

Liquidity Constraints: Unlike equities or REITs, luxury real estate illiquidity can trap capital. Off-market trophy properties may require 6-18 months for sale completion. In market downturns, buyers disappear entirely, rendering properties unmortgageable and forcing distressed sales at 20-40% discounts.

Regulatory & Political Risks: India faces RERA compliance complexities, evolving tax structures, and frequent policy amendments. UAE’s residency frameworks, while currently favorable, remain subject to geopolitical shifts. London’s post-Brexit regulatory environment and proposed wealth taxes create medium-term uncertainty.

Currency & Macroeconomic Volatility: For INR-denominated investors, foreign luxury properties offer currency diversification but expose portfolios to FX fluctuations. A 20% INR depreciation against USD negates 3-4 years of real estate appreciation. Global recession scenarios could trigger synchronized market corrections across multiple geographies.

When NOT to Invest in Luxury Real Estate

High-Interest-Rate Environments: When mortgage rates exceed 6-7%, financing costs make rental yields irrelevant. Capital-appreciation-only strategies become speculative. Conservative investors should await rate normalization (4-5% range) before deploying capital.

Overheated Local Markets: Dubai’s current 70% price surge in 4 years and Mumbai’s 44% under-construction appreciation in 6 months suggest potential mean reversion. Investors entering during peaks face 5-7 year holding horizons before achieving positive real returns.

Emerging Political Instability: Geopolitical tensions (Middle East dynamics, India-Pakistan border issues, UK-EU regulatory divergence) create tail risks for trophy property portfolios. Conservative wealth preservation mandates should prioritize stable democracies (US, Switzerland, Singapore) over high-growth but politically uncertain markets.

FAQ Section

Is luxury real estate a better investment than equities for UHNI wealth preservation?

Luxury real estate delivered 14% average returns over five years versus 12% for S&P 500, but with lower volatility and tangible asset backing. However, real estate illiquidity requires 10+ year holding horizons. For UHNI seeking diversification, a 40% real estate / 35% equities / 25% alternatives allocation balances growth and stability. Real estate excel during equity bear markets and inflationary periods, making it a superior inflation hedge.

Q2: What is the optimal entry point for NRI investors targeting Indian luxury real estate?

Under-construction ultra-luxury properties (INR 10-40 crore range) in branded developments in Mumbai, Bengaluru, and Pune offer best risk-adjusted returns. Target pre-completion acquisition 12-18 months before handover to capture appreciation while avoiding long holding periods. Structural tax advantages (NRI remittance benefits, no capital gains on repatriation for certain tenure) make India particularly attractive. For INR conversion, entry during rupee weakness (USD 84-85 per INR) optimizes rupee-based returns.

What are the key metrics to evaluate luxury properties before acquisition?

Beyond location and price, evaluate (i) developer track record (zero delays, premium brand affiliation), (ii) supply scarcity (properties in top 5-10% by value in given market), (iii) rental yield potential (minimum 3-4% in emerging markets, 2-3% in mature markets), (iv) currency diversification benefits, (v) regulatory clarity, and (vi) liquidity depth (number of comparable recent transactions). Use Knight Frank’s Wealth Report and Savills’ World Cities Prime Index as benchmarks.

Conclusion: Charting the Ultra-Wealth Trajectory

As geopolitical volatility intensifies and global equity markets face structural headwinds, luxury real estate emerges not as a discretionary luxury but as a strategic imperative for UHNI capital allocation. The convergence of three megatrends—explosive UHNI wealth creation (particularly in India and Asia-Pacific), severe scarcity of trophy properties in prime locations, and institutional recognition of real estate’s superior risk-adjusted returns—will continue attracting global capital.

For the next 3-5 years, expect sustained momentum in markets offering favorable fundamentals: Dubai’s tax incentives and residency frameworks; India’s rapid UHNI wealth creation and sub-USD 5M pricing versus global peers; Singapore’s governance and stability; London’s institutional depth; and Miami’s relative affordability and tax advantages. Secondary markets—Bangkok, Lisbon, Bucharest, Cape Town—will capture patient capital seeking longer-term appreciation.

However, investors must remain vigilant. Current valuations in Dubai (+70% in 4 years) and Mumbai under-construction segment (+44% in 6 months) suggest cyclical peaks. Conservative wealth preservation mandates should employ a barbell strategy: (i) 60% in established, lower-appreciation but high-stability markets (London, Singapore, New York), and (ii) 40% in high-growth, higher-volatility markets (Dubai, Mumbai, Miami).

The future of UHNI wealth lies not in choosing between lifestyle and preservation—it lies in understanding that trophy real estate seamlessly delivers both. Properties that command prestige, generate resilient returns, offer tax optimization, and provide generational anchors represent the evolution of wealth management itself. For those positioned strategically across geographies, entry points, and structuring, the next decade presents unprecedented wealth-creation opportunities.

YouTube Learning Resources

Free resources to download

LUXURY REAL ESTATE INVESTMENT_ KEY INSIGHTS SUMMARY