Now Reading: The Future of Elegant Aging: Why the World’s Most Discerning Investors Are Betting on Smart Home Technology

- 01

The Future of Elegant Aging: Why the World’s Most Discerning Investors Are Betting on Smart Home Technology

The Future of Elegant Aging: Why the World’s Most Discerning Investors Are Betting on Smart Home Technology

The New Status Symbol Isn’t a Yacht—It’s Aging Gracefully at Home

Picture this: A sun-drenched penthouse overlooking Central Park. No visible medical equipment. No institutional feel. Just seamless, invisible technology that knows when something’s wrong before you do. This isn’t science fiction—it’s the reality that Ultra-High Net Worth families are quietly building for themselves and their loved ones.

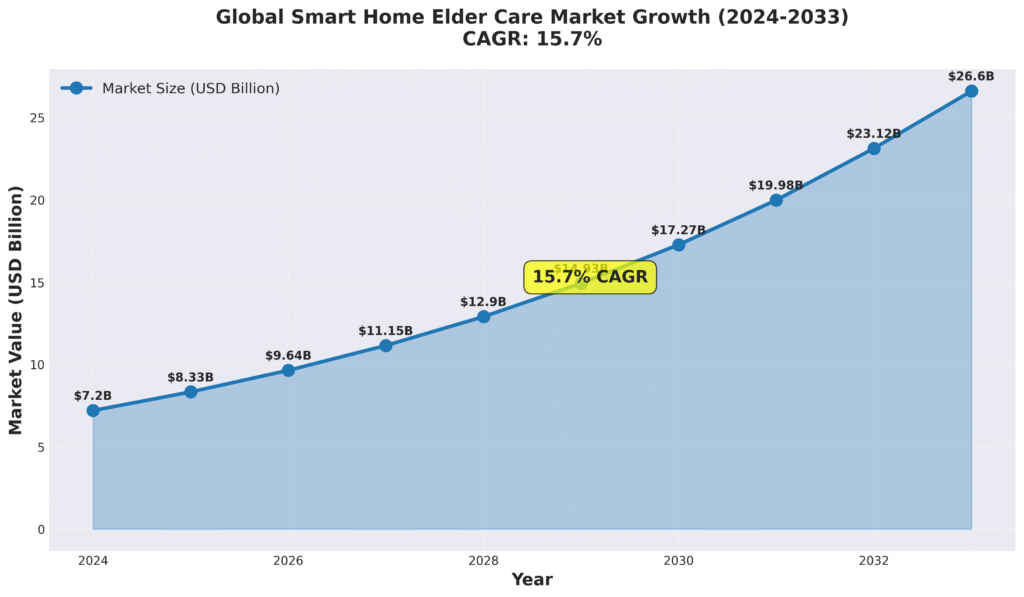

While the world obsesses over anti-aging creams and longevity clinics, the truly affluent are investing in something far more profound: the ability to age with dignity, independence, and grace within the sanctuary of their own homes. And it’s creating a $26.6 billion investment opportunity that’s attracting everyone.

Welcome to the era of “ElderTech”—where Silicon Valley meets silver hair, and where the smartest money in the world is betting that the future of luxury isn’t just living longer, but living better.

The Invisible Upgrade: Technology You’ll Never See

The first rule of truly elegant design? It disappears. And that’s exactly what’s happening with the latest generation of elderly care technology. Forget the clunky medical alert pendants of yesteryear. Today’s smart home systems are so sophisticated, so seamlessly integrated, that guests would never know your home is quietly monitoring every breath, every movement, every deviation from routine.

Think of it as having a vigilant guardian angel, minus the wings and halo.

Hidden sensors track movement patterns without cameras (because privacy matters). AI algorithms learn your daily rhythms—when you wake, how long you linger over morning coffee, whether you’re taking your usual evening walk. Voice assistants respond to casual conversation, not robotic commands. Wearables that look like luxury timepieces monitor heart rhythms with clinical precision.

This is technology that respects your intelligence, your independence, and most importantly, your dignity. It’s the difference between being watched and being cared for. And for families managing wealth across continents, it’s become as essential as a good estate attorney.

Why Japan’s 85-Year-Olds Are More Connected Than Most 25-Year-Olds

Here’s something fascinating: While we debate whether our teenagers are too plugged in, Japan has created a society where octogenarians are seamlessly integrated into the digital ecosystem—not despite their age, but because of it.

With over 28% of Japan’s population now above 65, the country has become the world’s laboratory for aging innovation. Humanoid care robots. AI companions that remember your grandchildren’s names. Homes that adjust lighting, temperature, and ambiance based on your biorhythms.

The result? A blueprint that’s being eagerly studied from Manhattan to Mumbai.

Europe isn’t far behind. In the UK, luxury retirement communities—we’re talking £4 billion worth of real estate—now come standard with technology suites that would make a Google engineer jealous. Telehealth integration. Predictive wellness monitoring. Emergency response systems that know the difference between a fall and bending to tie your shoes.

And then there’s India, where a fascinating convergence is happening. You have 32 million Non-Resident Indians scattered across the globe, many of whom left aging parents back home. Technology has become the bridge—allowing a daughter in Silicon Valley to check on her mother in Mumbai with the same ease as ordering a Starbucks.

The Papa Revolution: How Companionship Became a Billion-Dollar Business

Let’s talk about something rarely discussed in investment circles: loneliness. Half of all older adults report feeling alone. It’s not just emotionally devastating—it’s medically dangerous, correlating with outcomes as severe as smoking 15 cigarettes a day.

Enter Papa, a Miami startup that cracked the code on something pharmaceutical companies never could: human connection.

The concept is beautifully simple: Match vetted young companions (they call them “Papa Pals”) with seniors who need help with everyday tasks—grocery shopping, tech support, or just someone to talk to over tea. But here’s the genius: instead of asking families to pay, Papa partnered with insurance companies.

Suddenly, companionship isn’t a luxury—it’s a covered benefit.

Tiger Global wrote a $60 million check because they understood what many missed: the best healthcare intervention isn’t a pill or procedure. Sometimes it’s just having someone who remembers that you take your coffee with two sugars.

Today, over a million people have access to Papa through their health plans. That’s not just good business—it’s elegant problem-solving.

What the Smart Money Is Really Buying

Let’s decode the investment thesis that’s attracting the world’s most sophisticated capital allocators.

First, demographic certainty. Every day, 10,000 Americans turn 65. That’s not a projection—it’s as inevitable as sunrise. By 2050, the global population over 65 will hit 1.5 billion. Unlike crypto or meme stocks, this isn’t speculation. It’s arithmetic.

Second, ESG alignment. Family offices managing generational wealth increasingly want investments that align with values. ElderTech checks every box: it’s socially impactful, economically sustainable, and demographically defensive. When markets tumble, people still age.

Third, personal relevance. Unlike investing in, say, cryptocurrency mining operations in Kazakhstan, ElderTech is something every investor can understand viscerally. We all have parents. We’ll all age. This isn’t abstract—it’s deeply personal.

The UK Aristocracy’s Secret: Retirement Communities That Appreciate Faster Than Art

Here’s a delicious piece of investment data that rarely makes headlines: since 2005, homes in UK Integrated Retirement Communities have appreciated 99%—outpacing the broader housing market by nearly 20 percentage points.

These aren’t your grandmother’s retirement villages. Think: Five-star hotel meets country club meets Mayo Clinic.

Each residence comes equipped with smart home infrastructure that makes a tech CEO’s house look primitive. Telehealth platforms for instant virtual consultations. Wearable biometrics feeding data to on-site medical teams. AI systems that can predict a health event 72 hours before it happens based on subtle behavioral changes.

The amenities? Michelin-worthy dining. Concierge services. Wellness programs curated by Harley Street physicians.

Knight Frank, the real estate firm that tracks billionaire property movements like others track stocks, notes “unwavering investor commitment” to the seniors housing sector. Why? Because unlike most real estate, this has a guaranteed tenant base growing every single day.

The pipeline is staggering: 30,000 new luxury elderly residences currently under construction across the UK alone. Each one embedding technology infrastructure as foundational as plumbing.

How India’s Tech-Savvy Billionaires Are Solving an Ancient Problem

India presents one of the most fascinating ElderTech stories globally—because it’s being driven not by government policy, but by guilt and love.

Here’s the dynamic: India’s economic miracle created millions of professionals who moved to Mumbai, Bangalore, London, New York. Their parents stayed in smaller cities, aging in homes that suddenly felt very distant.

Enter companies like Emoha and Goodfellows (yes, backed by Ratan Tata himself). They’re building platforms that let a son in Seattle monitor his father’s medication adherence in Pune. That let a daughter in Dubai arrange emergency response for her mother in Delhi with a single app.

The market is exploding: $3.8 billion in 2024, projected to hit $9.7 billion by 2031. And it’s being fueled by a population segment that understands technology, has disposable income, and carries profound cultural obligations toward parents.

What’s remarkable is the innovation happening at Indian price points. While American startups burn venture capital on Silicon Valley salaries, Indian companies are building comparable technology for a tenth of the cost. WhatsApp-based family coordination. Local language support. Integration with India’s existing healthcare infrastructure.

For Non-Resident Indians looking to invest? It’s the rare opportunity that combines emotional connection, market arbitrage, and genuine impact.

Five Moves the Ultra-Wealthy Are Making Right Now

1. Testing Before Investing

Smart family offices are installing these systems in their own homes first. Not as a trial—but as due diligence. You learn more about product-market fit from six months of real-world use than from fifty pitch decks. Plus, if it genuinely helps your aging parents, the investment has already paid off emotionally.

2. Playing Both Ends of the Barbell

Combining safe, liquid exposure (Apple’s wearables business, Amazon’s Alexa healthcare push) with high-conviction venture bets on category-defining startups. Think of it like having Treasury bonds and a small position in early-stage Tesla. Different risk profiles, same mega-trend.

3. Following Insurance Money, Not Consumer Dollars

The pattern is clear: ElderTech companies that crack insurance reimbursement codes grow 5-10x faster than those selling direct to consumers. When United Healthcare becomes your distribution partner, you don’t worry about customer acquisition costs.

4. Hunting for Geographic Arbitrage

Invest in Asian companies at Asian valuations, then wait for American strategics to acquire them at American multiples. It’s happened in SaaS, fintech, and e-commerce. ElderTech is next.

5. Partnering with Developers on Smart Infrastructure

Rather than just investing in technology, some family offices are co-developing luxury residences with smart elderly care baked into the architecture. It’s the difference between buying tech stocks and owning the data center.

The Contrarian Take: What Could Go Wrong?

Let’s be honest: not every technology revolution pans out as predicted. Remember when everyone thought 3D TV was the future?

Privacy concerns are real. No matter how much you claim sensors are “privacy-preserving,” the idea of constant monitoring makes people uncomfortable. There’s a fine line between helpful and creepy, and not every company navigates it gracefully.

Adoption barriers persist. Your 82-year-old father who still uses a flip phone might not embrace AI health monitoring, no matter how many TED Talks you show him. Technology is only valuable if people actually use it.

But here’s the thing: even acknowledging these risks, the fundamental trend remains irrefutable. People are aging. They want independence. Technology enables it. The only question is which companies execute best.

The Mansion Global Moment: When Real Estate Meets Reality

The most interesting development isn’t happening in Silicon Valley boardrooms—it’s happening in luxury real estate showrooms.

High-net-worth homebuyers are now requesting smart elderly care infrastructure the way they once demanded wine cellars and home theaters. Builders are responding, pre-wiring homes with sensor networks, installing hospital-grade air filtration, designing bathrooms with discretely placed emergency alerts.

It’s becoming a selling point: “This $15 million residence includes a comprehensive aging-in-place technology suite.”

Why? Because wealthy buyers are planning ahead. They’re in their 50s and 60s, buying what might be their final primary residence. They want homes that can adapt as they age—adding support as needed without requiring institutional care or dramatic renovations.

Real estate developers are catching on. Smart elderly infrastructure is becoming as standard in luxury developments as SubZero appliances.

The Ultimate Luxury: Time, Independence, Dignity

Let’s end on what actually matters.

The ultimate luxury isn’t a bigger yacht or a third home. It’s time—specifically, more high-quality years with the people you love. It’s independence—the ability to age without becoming a burden. It’s dignity—maintaining autonomy over your own life until the very end.

Smart home elderly care technology, at its best, delivers all three.

And if it happens to generate 25% IRR along the way? Well, that’s just elegant alignment of incentives.

The future of aging isn’t institutional. It’s personal, dignified, and increasingly, it’s smart.

The question isn’t whether this transformation will happen. It’s whether you’ll be part of building it.