Now Reading: When Your Dog Lives Better Than Most: The Rise of Luxury Pet Friendly Real Estate

- 01

When Your Dog Lives Better Than Most: The Rise of Luxury Pet Friendly Real Estate

When Your Dog Lives Better Than Most: The Rise of Luxury Pet Friendly Real Estate

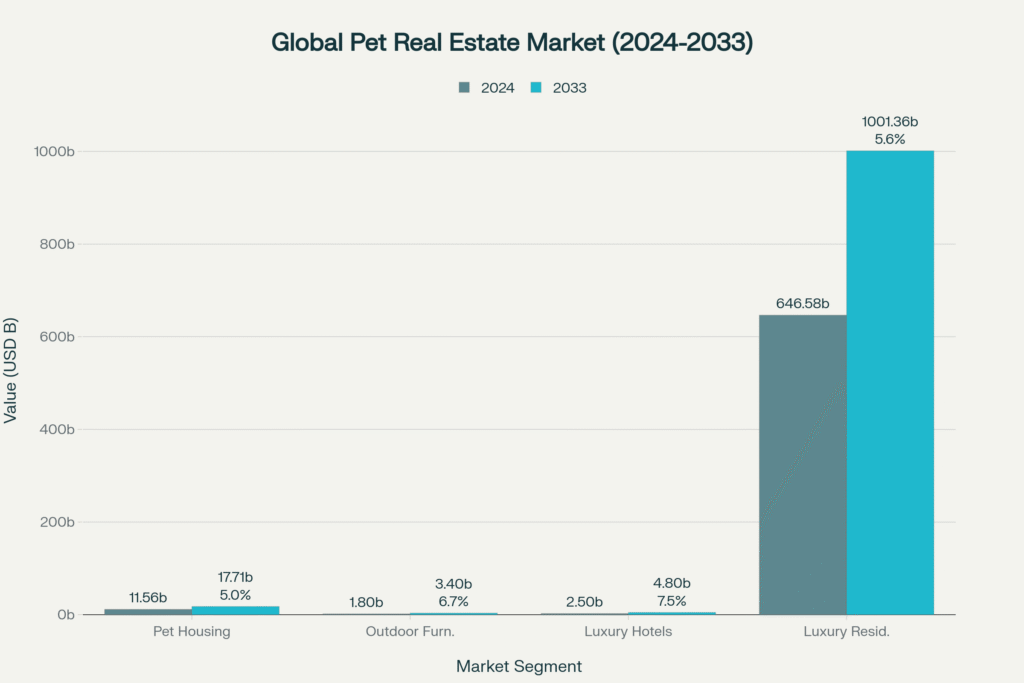

Picture this: A Dubai penthouse where your golden retriever has his own climate-controlled park. A Mumbai villa with a grooming spa that rivals any five-star hotel. A Manhattan apartment where the concierge knows your cat’s dietary restrictions better than you do. Welcome to the new frontier of luxury pet-friendly real estate, where pet amenities aren’t just add-ons—they’re deal-breakers. As the global pet care market races toward $17.71 billion by 2033, ultra-high-net-worth investors are discovering what every pet parent already knows: family is family, whether they walk on two legs or four. And in the rarefied world of ultra-luxury properties, this realization is reshaping everything from architectural design to investment strategies.

The Penthouse Suite Isn’t Just for Humans Anymore

There’s a quiet revolution happening in the world’s most expensive zip codes. Walk into any ultra-luxury property showing today, and you’ll notice something different. The developer isn’t just talking about Italian marble and smart home systems. They’re leading with the dog park. The pet spa. The on-call veterinarian.

This isn’t marketing fluff—it’s responding to a fundamental shift in how the wealthy think about family. When a billionaire shells out ₹80 crore for a Mumbai penthouse or $20 million for a New York apartment, their Labradoodle’s happiness isn’t negotiable. It’s essential.

Consider the story of Kaushik, a tech entrepreneur we’ll call him, who walked away from his dream apartment in Bangalore’s Whitefield area. The property had everything: panoramic views, a private theater, even a temperature-controlled wine cellar. But when the building manager mentioned “some restrictions” on pets in common areas, the deal died instantly. “My dogs are my children,” he explained simply. “Would you move somewhere your kids weren’t welcome?”

He’s not alone. Across Dubai’s Palm Jumeirah, Manhattan’s Tribeca, and Mumbai’s Malabar Hill, variations of this scene play out daily. Pet-friendly amenities have evolved from nice-to-haves into non-negotiables, fundamentally altering what luxury means.

From Tolerance to Celebration: How Pets Became Status Symbols

The transformation started subtly. A decade ago, luxury buildings grudgingly “allowed” pets, often with weight limits, breed restrictions, and hefty deposits. Today’s ultra-luxury developments don’t just permit pets—they celebrate them.

Dubai’s My Second Home facility exemplifies this shift. Calling it a “pet hotel” feels inadequate. Spread across 60,000 square feet with three swimming pools and 180 private suites, it’s where Dubai’s expatriate elite leave their pets when traveling. Not in cages or kennels, but in rooms nicer than most people’s bedrooms, complete with orthopedic beds and flat-screen TVs.

“We’re not babysitting,” the facility’s manager explains. “We’re providing a lifestyle experience that matches what these pets enjoy at home.”

This sentiment echoes globally. In New York’s Chelsea neighborhood, D Pet Hotels commands $200 per night for their “uber suite”—featuring a full-size human bed, 42-inch television, and premium linens. Guests joke that the accommodations surpass their own apartments. The waiting list speaks volumes: these aren’t struggling businesses offering niche services. They’re printing money by recognizing a simple truth: wealthy people want their pets to live well.

Pet-friendly real estate: Designing for Four-Legged Family Members

Modern luxury developments are being reimagined from the ground up with pets as primary stakeholders. Architects now consult with veterinarians and animal behaviorists during the design phase—a practice unthinkable five years ago.

Mumbai’s latest ultra-luxury projects feature dedicated pet parks with agility equipment, separate washing stations with professional-grade tubs, and even pet-friendly swimming pools with gradual entry steps. But the innovation goes deeper than amenities.

Consider air quality systems. Premium buildings now install advanced filtration specifically addressing pet dander—not to accommodate allergies, but to ensure optimal respiratory health for pets themselves. Climate control extends to pet areas, maintaining temperatures ideal for different breeds. Smart home systems monitor pet activity, sending alerts if your usually-active beagle seems lethargic.

Singapore’s Marina Bay developments pioneered “biophilic design” that benefits both humans and animals: vertical gardens, sky parks with natural grass, organic materials that feel good under paws. It’s architecture that acknowledges we share our homes with creatures who experience space differently than we do.

The investment isn’t trivial. Retrofitting a luxury apartment with comprehensive pet amenities costs ₹2-5 lakh. But for UHNI buyers, this investment yields returns measured not just in rupees but in quality of life—for every family member.

Why Smart Money Is Going Where the Pets Are

Talk to wealth managers today, and a fascinating trend emerges: pet-amenitized properties aren’t just lifestyle choices anymore. They’re strategic investments.

The logic is compelling. Pet ownership among affluent demographics continues climbing. Millennials and Gen Z—who’ll inherit unprecedented wealth over coming decades—view pet ownership as essential, not optional. Properties without comprehensive pet facilities face a shrinking buyer pool.

The premium is real. Properties with integrated pet amenities command higher resale values, and the gap is widening. More importantly, they move faster. In Mumbai’s ultra-luxury segment, pet-friendly properties sell 20-30% quicker than comparable non-pet units. For investors needing liquidity, this matters enormously.

Rental markets tell the same story. Pet-friendly luxury apartments achieve higher yields and retain tenants longer—often years longer. The math is straightforward: finding a genuinely pet-welcoming luxury property is difficult enough that once tenants secure one, they’re reluctant to move.

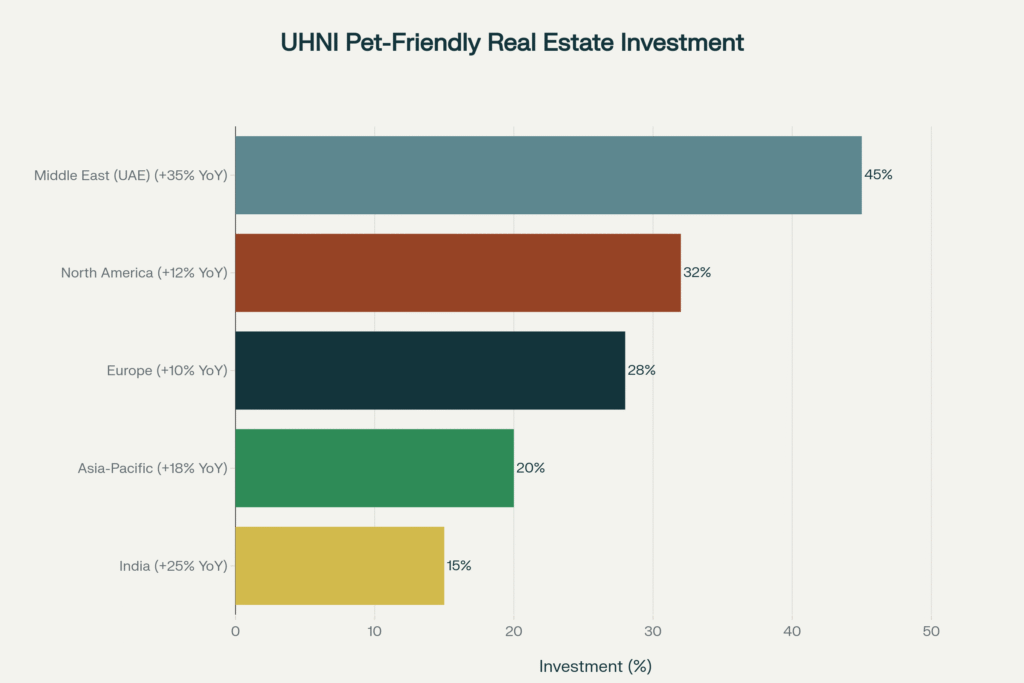

Geography matters too. Dubai leads globally, with Middle Eastern investors allocating substantial portions of their real estate portfolios to pet-amenitized assets. Why? Zero property taxes, a massive expatriate population expecting international standards, and cultural acceptance of pets as family members.

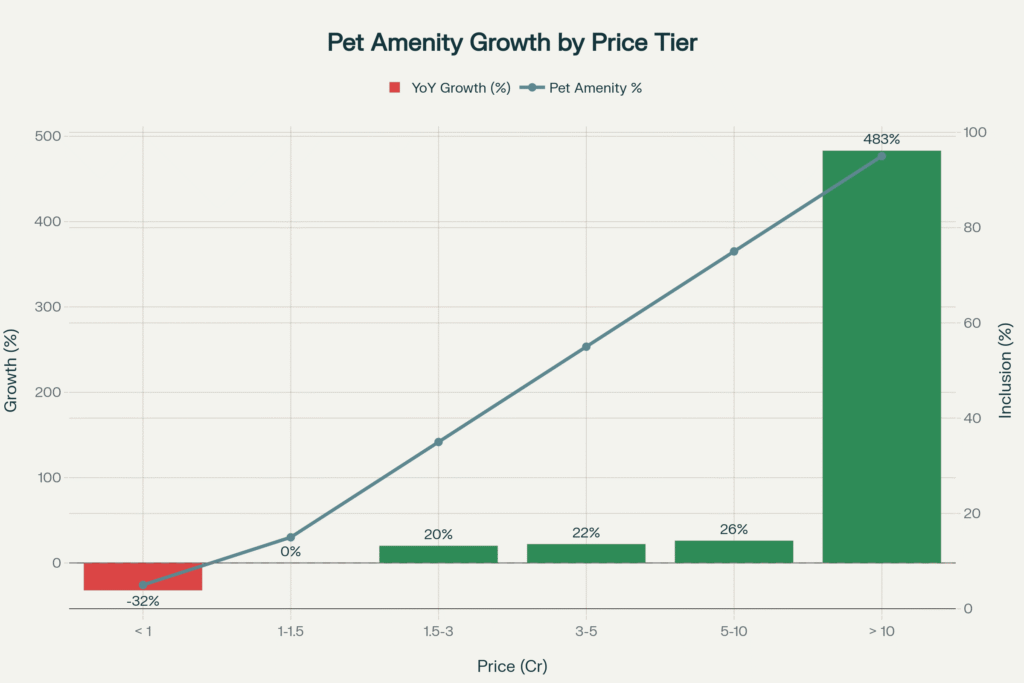

India represents the growth story. While current allocation levels trail Dubai’s, the trajectory is explosive. India’s ultra-luxury segment—properties exceeding ₹10 crore—has seen remarkable growth, and pet amenity inclusion in this segment is nearly universal. This isn’t coincidence; it’s recognition of non-negotiable buyer expectations.

The Emotional Equity That Money Can’t Buy

Beyond spreadsheets and IRR calculations lies something harder to quantify but equally valuable: emotional resonance.

Gulam Zia from Knight Frank captured this beautifully: “If you acquire a ₹100-crore apartment in Delhi, you’re not expecting ₹200 crore in 5-10 years. It’s about society knowing you acquired something highly placed.”

Now extend that logic to pet amenities. Owning a property where your dog has a private park, spa access, and concierge services isn’t just about the dog’s comfort—though that matters deeply. It’s signaling values. It says: “My family—all of them—deserve the best. I can provide it.”

This positioning resonates particularly with millennial and Gen Z wealth inheritors, who reject the old “pets are property” mindset entirely. For them, pet-friendliness is a litmus test for broader values. A building that accommodates pets thoughtfully suggests management that thinks holistically about community, wellness, and quality of life.

Post-pandemic, this consideration intensified. Lockdowns revealed how central pets are to mental health, companionship, and daily structure. People who might have tolerated subpar pet amenities pre-2020 now view them as essential wellness infrastructure—like gyms, meditation rooms, and air purification systems.

Tales from the World’s Most Pampered Pets

In Mumbai’s Juhu, a pharmaceutical executive recently purchased a sea-facing bungalow for ₹101 crore. The extra crore, added for auspiciousness, made headlines. Less discussed: the property’s custom-designed dog park, complete with agility course, misting systems, and separate entry so his three German Shepherds never encounter vehicle traffic.

Across the Arabian Sea in Dubai, a British expatriate family chose their Palm Jumeirah villa specifically for its proximity to dedicated dog beaches and walking trails. “London didn’t have this,” the wife laughed. “We moved to Dubai and our dogs’ quality of life improved dramatically.”

In New York, a hedge fund manager pays $4,500 monthly for a Tribeca loft. The building fee includes $200 monthly “pet rent” for her two rescue mutts. She considers it the best money she spends. “I work 80-hour weeks,” she explains. “Knowing my pets have a rooftop park, washing stations, and 24/7 concierge access? That peace of mind is priceless.”

These aren’t outliers. They’re the new normal in luxury real estate, where pet amenities have moved from afterthought to priority.

Investment Strategies for the Pet-Forward Portfolio

For investors evaluating this space, several strategies emerge from current market dynamics.

Target Properties Above ₹3 Crore: Below this threshold, pet amenities remain inconsistent. Above it, they become standard. The ₹5-10 crore range offers optimal balance of amenity comprehensiveness and acquisition cost.

Prioritize Branded Residences: Four Seasons, Ritz-Carlton, and similar hospitality brands bring operational expertise that independent developments lack. Their pet services mirror hotel-grade standards, commanding premiums that hold through market cycles.

Geographic Diversification Matters: Dubai offers tax advantages and mature pet infrastructure. India provides growth potential, particularly in Bangalore and Mumbai. Singapore adds regulatory clarity. A portfolio spanning these markets captures different risk-return profiles.

Technology Integration Adds Value: Properties with IoT pet monitoring, smart feeding systems, and integrated climate control command premiums. These aren’t gadgets; they’re selling points that matter to tech-savvy buyers.

Vacation Properties Complement Primary Residences: Goa, Alibaug, and Coorg offer second-home opportunities where pet-friendly design is even more critical. Families won’t vacation where their dogs aren’t genuinely welcome.

The hold period matters too. This isn’t a flip strategy. Plan for 5-7 years minimum, allowing pet-friendly premiums to compound alongside general luxury appreciation.

The Risks Nobody Talks About

Honesty requires acknowledging challenges. Ultra-luxury markets can correct sharply during economic downturns. Pet amenities provide some insulation—sticky demand from committed pet owners—but they’re not magic shields against 20% market corrections.

Regulatory environments vary wildly. While Indian courts consistently uphold pet owners’ rights, enforcement at the society level remains inconsistent. Stories abound of buyers purchasing pet-friendly properties only to battle resident welfare associations over access to common areas. Legal recourse exists, but litigation is expensive and stressful.

Maintenance costs run higher—sometimes significantly higher. Climate-controlled pet parks, grooming facilities, and specialized cleaning require ongoing investment. Budget 10-15% premium over comparable non-pet properties.

Brand dependencies create risks too. Branded residences tied to hotel operators face vulnerability if those partnerships dissolve. A 2023 Dubai case saw property values decline when a hotel partner exited, eliminating the very amenities that justified premium pricing.

And there’s the cultural question: Is pet humanization a permanent shift or a generational blip? Current data suggests permanence, but wise investors acknowledge uncertainty. Diversifying beyond pure pet-focused plays makes sense.

What the Next Decade Holds

Looking forward, several trends appear inevitable. Technology integration will deepen—imagine AI systems monitoring pet health metrics and automatically scheduling vet appointments. Sustainability will matter more, with eco-friendly pet facilities becoming standard in LEED and WELL-certified developments.

India’s tier-two cities represent untapped opportunities. As Jaipur, Chandigarh, and Indore develop luxury markets, early movers establishing pet-friendly standards will capture advantages. The playbook exists; it just needs execution in new geographies.

Mixed-use developments combining residential, veterinary, retail, and hospitality around pet-centric themes could emerge. Imagine a township where every element—from cafés to parks to medical facilities—designs for pets and humans equally.

The fundamental insight remains: pets aren’t going anywhere. As wealth grows and urbanization intensifies, the desire to provide exceptional lives for furry family members only strengthens. Real estate that recognizes this captures a premium that transcends typical market cycles.

Your Next Steps

For investors ready to explore this space, start with education. Tour 8-10 properties across different price points and geographies. Experience firsthand how pet amenities differ between ₹3 crore and ₹15 crore properties. The gap is revelatory.

Engage specialized luxury advisors—Knight Frank, CBRE, JLL—who understand UHNI buyer psychology. They’ll identify off-market opportunities and navigate complex RWA pet policies.

Consider your hold period and exit strategy upfront. Are you building a portfolio for rental income? Long-term appreciation? Legacy planning? Each goal suggests different property profiles.

And perhaps most importantly: if you’re a pet owner yourself, trust your instincts. Properties where you immediately imagine your dog thriving probably appeal to other pet-loving buyers too. That emotional connection translates into market value.

FAQ Section

What is the minimum investment for pet-friendly luxury real estate in India?

Entry begins at ₹3 crore (55% amenity inclusion), optimal ROI at ₹5+ crore (75-95% inclusion). Ultra-luxury (₹10+ crore) offers 95% adoption and 483% YoY growth.

How do pet-friendly properties perform during downturns?

Pet-amenitized luxury properties show 10-15% greater resilience than non-pet assets due to sticky demand. Extreme downturns (>25%) eliminate this buffer.

Can NRI investors claim tax benefits on pet-friendly properties?

Yes. Section 24(b) allows ₹2 lakh home loan interest deduction, Section 80C permits ₹1.5 lakh principal deduction. Pet amenities enhance resale values.

What are the best regions for UHNI pet-friendly investment in 2025?

(1) UAE Dubai – 45% allocation, 35% growth; (2) India Mumbai/Bangalore – 25% growth, 483% ultra-luxury; (3) Singapore; (4) North America.

The Bigger Picture: What This Says About Us

Step back from investment strategies and market data, and something beautiful emerges. The rise of pet-focused luxury real estate reflects humanity at its best.

We’re wealthy enough to choose how we live, and we’re choosing to include those who can’t advocate for themselves. We’re using resources not just for personal comfort but to ensure our companions—who give us unconditional love—receive the same in return.

There’s something profound about a billionaire who insists on a dog park before closing a ₹50 crore deal. It suggests values money alone can’t buy. It demonstrates that even in capitalism’s upper reaches, love and loyalty matter more than marble countertops.

The luxury real estate market is responding to this sentiment not out of altruism but recognition: the future of luxury is inclusive, thoughtful, and holistic. It’s not just about square footage or zip codes anymore. It’s about creating sanctuaries where every family member thrives.

As investments go, that’s not just financially sound. It’s beautiful. That’s why it’s here to stay.test assumptions; avoid emotional attachment to trophy assets.