Now Reading: The Millennial Heir Effect: How Gen Z Wealth Transfer Is Reshaping Luxury Real Estate Priorities

- 01

The Millennial Heir Effect: How Gen Z Wealth Transfer Is Reshaping Luxury Real Estate Priorities

The Millennial Heir Effect: How Gen Z Wealth Transfer Is Reshaping Luxury Real Estate Priorities

The largest intergenerational wealth transfer in history is underway, with an unprecedented $84 trillion flowing from Baby Boomers to younger generations by 2048. This seismic shift is fundamentally redefining luxury real estate markets worldwide, as millennial heirs and Gen Z heirs bring distinctly different priorities to property investment—demanding technology integration, sustainability credentials, and wellness-focused amenities over traditional opulence. With India’s ultra-high-net-worth individual population projected to surge 50% by 2028 and luxury residential markets growing at a 11.7% CAGR, this transformation represents both a challenge to traditional developers and an unprecedented opportunity for forward-thinking investors who understand the new language of aspirational living.

The Seismic Wealth Redistribution Transforming Global Markets

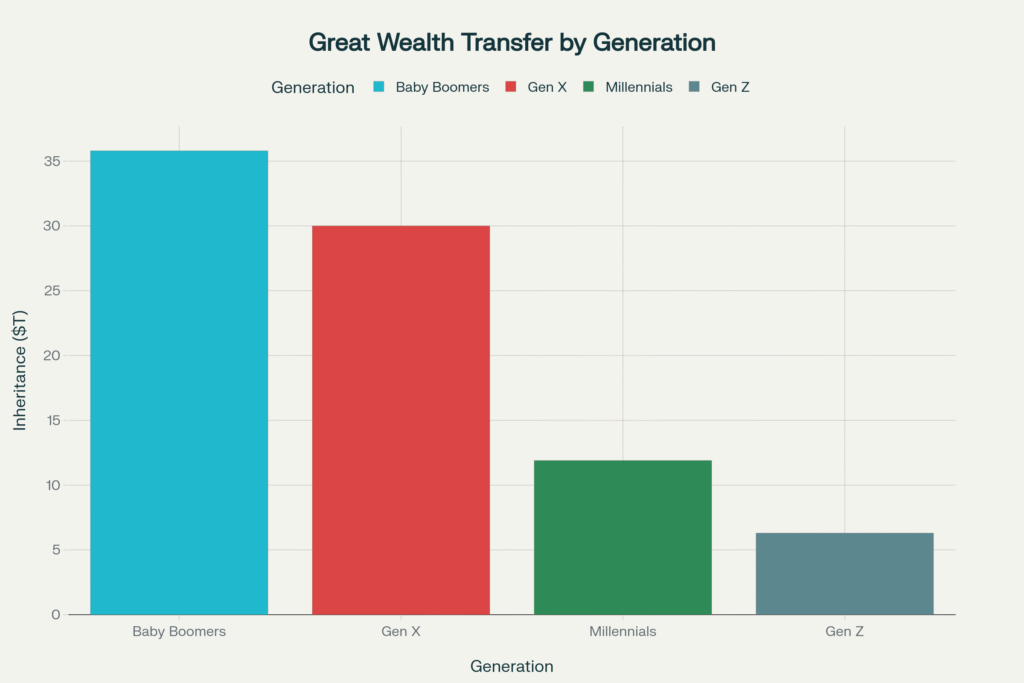

The mechanics of the Great Wealth Transfer extend far beyond simple inheritance patterns. According to Cerulli Associates’ landmark 2022 report, approximately $84 trillion in assets will transition from the Silent Generation and Baby Boomers to their descendants by 2045, with Baby Boomers commanding the lion’s share at $35.8 trillion (42.4% of total transfers). Gen X follows with $30 trillion (35.7%), while millennials and Gen Z will inherit $11.9 trillion and $6.3 trillion respectively.

Real estate constitutes a staggering component of this transfer. Federal Reserve data indicates that the Silent Generation and Baby Boomers collectively hold nearly $25 trillion in real estate assets—encompassing primary residences, vacation homes, and investment properties. This property wealth, accumulated during decades of rising valuations, compulsory superannuation, and favorable economic policies, now stands poised for the most dramatic ownership shift in modern history.

Yet the implications transcend mere asset transfer mechanics. Capgemini’s World Wealth Report 2025 reveals that 81% of younger high-net-worth individuals plan to switch wealth management firms after inheritance unless these institutions rapidly adapt to next-generation expectations. This statistic underscores a fundamental truth: inherited wealth will not simply replicate previous investment patterns but will catalyze transformative change across luxury real estate markets globally.

Regional Divergence: How Geography Shapes the Heir Effect

North America: The Stock Market-Real Estate Nexus

North American high-net-worth individual wealth expanded 8.9% in 2024, driven primarily by robust stock market performance, with the S&P 500 delivering a 23.3% year-over-year increase—the first consecutive 20%+ gain since 1998. This financial market strength directly influences luxury real estate decisions, as HNWIs increasingly make property purchases based on equity portfolio performance.

The United States sees Generation X now holding the most significant property wealth at $1.31 million average, marginally surpassing Baby Boomers at $1.30 million, while millennials hold $750,000 and Gen Z just $69,000. This disparity illuminates the challenging entry barriers younger generations face, yet also explains their heightened focus on maximizing value through technology and sustainability features when they do invest.

Asia-Pacific: The New Wealth Creation Engine

Asia-Pacific witnessed 4.8% HNWI wealth growth and 2.7% population increase in 2024, establishing the region as a critical wealth creation hub. India stands at the epicenter of this expansion, with the Knight Frank Wealth Report 2024 projecting India’s UHNI population to reach 19,908 by 2028—a staggering 50% increase from 13,263 in 2023. Goldman Sachs forecasts India’s affluent consumer base will balloon from 60 million in 2023 to 100 million by 2027.

This demographic explosion fuels India’s luxury residential market, valued at $57.87 billion in 2025 and projected to reach $98.04 billion by 2030, growing at an exceptional 11.7-15% CAGR depending on segment and geographic focus. The ultra-luxury segment (properties above ₹4 crore) experienced remarkable 37.8-39% year-over-year growth during January-September 2024 across India’s top seven cities. Properties priced ₹10-20 crore more than doubled to 360 units in 2024, while homes above ₹1 crore captured 62% market share in H1 2025, up from 51% the previous year.

Europe: Navigating Modest Growth

European HNWI wealth grew just 0.7% in 2024 alongside a 2.1% decline in HNWI population, influenced by weakened demand in luxury and automotive sectors. This tepid performance contrasts sharply with Asia-Pacific and North American dynamism, yet European markets retain distinct advantages: heritage properties, stringent sustainability standards, and established luxury ecosystems continue attracting discerning international buyers seeking legacy assets.

Data-Driven Insights: The Numbers Behind the Transformation

Portfolio Reallocation: The Real Estate Ascendancy

The most striking revelation in next-generation wealth management lies in asset allocation shifts. Altrata’s 2025 UHNW Asset Allocation study documents a fundamental rebalancing: while previous generations allocated approximately 17% to real estate, next-gen investors increase this to 20-25%—a 35% relative increase. Simultaneously, public equity allocations decline from 45-50% to 30-35%, while private equity holdings rise from 25-30% to 30-35%.

This reallocation reflects younger investors’ desire for tangible assets offering both utility and appreciation. Real estate provides something digital securities cannot: physical spaces that align with lifestyle aspirations while generating passive income and preserving wealth across generations. The 2025 Long Angle Annual High-Net-Worth Asset Allocation Study confirms 81% of HNWIs own primary residences, with 30% owning rental properties, making real estate a preferred asset for income generation and diversification.

Transaction Velocity and Decision Dynamics

The millennial heir effect dramatically accelerates transaction timelines. India Sotheby’s International Realty reports luxury real estate deals that previously required 12-18 months now conclude in as little as one month. This compression reflects younger buyers’ digital fluency, decisive research methodologies, and confidence in India’s economic trajectory—with 79% expressing optimism about the nation’s prospects in 2024, up from 59% the previous year.

Luxury property prices in India surged approximately 40% over 24 months (2022-2024), yet buyer optimism remained resilient, anticipating favorable interest rate reductions. Delhi NCR led appreciation metrics with 24% year-over-year growth, followed by Bengaluru at 14%, Chennai and Kolkata at 11%, demonstrating sustained demand across metropolitan markets.

Global Luxury Market Trajectory

The global luxury real estate market, valued at $276 billion in 2024, is projected to reach $538 billion by 2034, representing a 6.9% CAGR. India’s luxury residential segment shows even more robust expansion: from $44.11-57.87 billion in 2024-2025 to $98.04-118.30 billion by 2030, achieving 11.7-21.81% CAGR across various estimates. This growth substantially outpaces general real estate market expansion, underscoring affluent buyers’ willingness to pay premiums for properties meeting their elevated expectations.

Emotional and Lifestyle Drivers Redefining Luxury

The Sustainability Imperative

Perhaps no factor distinguishes millennial and Gen Z buyers more dramatically than their sustainability focus. Deloitte research reveals 90% of millennials actively minimize their ecological footprint—a consciousness that fundamentally shapes real estate decisions. Unlike previous generations viewing luxury primarily through opulence lenses, younger buyers gravitate toward biophilic designs, energy-efficient systems, renewable energy sources, and sustainable materials as essential rather than optional features.

Properties with LEED, GRIHA, IGBC, WELL, or BREEAM certifications command 10-30% premiums while delivering 15-30% lower operational costs. These certifications transcend mere environmental virtue signaling—they represent tangible financial benefits through reduced energy consumption, enhanced property appreciation, and superior rental yields as ESG-conscious tenants increasingly dominate luxury markets.

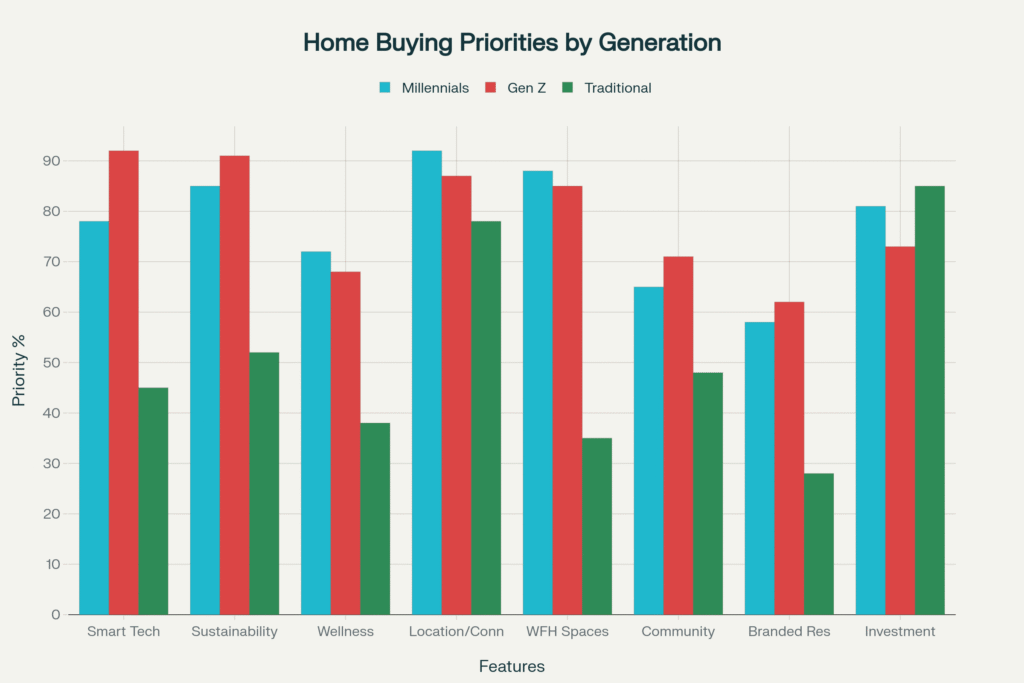

The emotional resonance of sustainability extends beyond economics. For Gen Z and millennials, green features signify alignment with personal values, social responsibility, and intergenerational stewardship—transforming homes from mere investments into expressions of identity and purpose. This psychological dimension explains why 85% of millennials and 91% of Gen Z prioritize sustainability when selecting properties, compared to just 52% of traditional buyers.

Wellness as Non-Negotiable Infrastructure

Post-pandemic priorities have elevated wellness amenities from luxury add-ons to essential infrastructure. ANAROCK research indicates wellness real estate commands 10-30% premiums, with India’s wellness spend projected to exceed ₹1 lakh crore by 2028 from current levels of ₹60,000-80,000 crore. Millennials and NRIs lead adoption, recognizing that wellness features represent investments in health, reduced long-term costs, and stronger property values.

Popular wellness amenities include gyms, yoga/meditation rooms, roof gardens, enhanced natural lighting and ventilation, art studios, hobby rooms, and Zen gardens. Luxury projects increasingly incorporate air purification systems, biophilic tones, low-VOC materials, jogging tracks, sports courts, and recreation areas that keep all age groups active and engaged. These features acknowledge that homes serve as sanctuaries for mental clarity, emotional resilience, and holistic well-being—not merely physical shelter.

Technology Integration: The Smart Home Revolution

Generation Z demonstrates particularly intense technology expectations, with 92% prioritizing smart home features compared to 78% of millennials and just 45% of traditional buyers. India’s smart home market, valued at $6.5 billion in 2024, grows substantially driven by tech-savvy younger demographics who view digital integration as fundamental rather than aspirational.

Essential smart features include AI-powered home automation, energy management systems, biometric access control, app-controlled security, IoT-enabled appliances, virtual concierge services, and health monitoring systems. These technologies deliver not just convenience but efficiency, security, and lifestyle enhancement that younger buyers consider indispensable to modern luxury living.

The Work-From-Home Paradigm

Remote and hybrid work models, accelerated by the COVID-19 pandemic, permanently altered residential design requirements. 88% of millennials and 85% of Gen Z prioritize work-from-home spaces, compared to just 35% of traditional buyers—a 2.5x differential underscoring this priority’s centrality. Luxury apartments now routinely incorporate dedicated work zones with enhanced spatial comfort, strategically placed power and data outlets, multifunctional spaces like balconies or rooftops doubling as focus areas, and coworking pods.

This shift explains rising demand for larger homes with flexible layouts. ANAROCK’s H1 2025 survey shows 36% of buyers now prefer properties priced ₹90 lakh-1.5 crore, up from 18% before COVID-19, reflecting desires for additional space accommodating professional and personal needs. The trend simultaneously fuels suburban and secondary city demand as location-independent workers seek better living standards and budget-friendly housing outside congested metros.

Branded Residences: Trust and Prestige Converge

Branded residences represent one of luxury real estate’s fastest-growing segments, with the global market valued at $66 billion in 2024—having grown 150% over the past decade. These properties sell at 25% premiums compared to non-branded condos, demonstrating affluent buyers’ willingness to pay for established brand associations, hotel-like service standards, and curated experiences.

JLL India reports over 75% of luxury buyers now place brand reputation at purchase decisions’ center, marking a transition from purely asset-based ownership to lifestyle-led living experiences. India’s branded residences segment is projected to reach $5 billion by 2025, driven by partnerships between developers and global hospitality brands offering 24/7 concierge services, in-house dining, wellness management, and personalized attention.

Miami and Dubai have emerged as key testing markets for branded residences, connecting global HNWI networks while offering vibrant international cultures. India’s metros—particularly Mumbai, Delhi NCR, and Bengaluru—rapidly develop similar ecosystems as developers recognize younger buyers’ preference for trust, differentiation, and comprehensive lifestyle packages over conventional luxury metrics.

Strategic Investment Horizons for Elite Portfolios

Immediate Term (2025-2027): Capturing Current Momentum

Sophisticated investors should prioritize high-growth metropolitan markets where infrastructure development, employment growth, and luxury demand converge. Delhi NCR, exhibiting 24% annual price appreciation and 90% year-over-year luxury segment growth, offers exceptional near-term opportunities. Mumbai, despite 16% volume decline, maintains highest absolute sales at 30,260 units quarterly, demonstrating sustained market depth.

Bengaluru’s tech-professional concentration drives consistent demand, with 14% average price increases and negligible volume decline. The city’s millennials and Gen Z comprise over 60% of property purchases in 2024, validating its alignment with next-generation preferences. Chennai emerges as a surprise performer with 33% year-over-year growth, suggesting emerging market potential for early investors.

Strategic focus areas include:

- Branded residences with proven operational track records offering immediate credibility and service infrastructure

- Properties with existing technology and wellness amenities requiring minimal adaptation

- Pre-construction opportunities in RERA-compliant projects providing 15-20% entry discounts with substantial appreciation potential through completion

- Locations near upcoming infrastructure (metro lines, expressways, commercial hubs) maximizing accessibility and future value

Mid-Term (2027-2030): Expanding Geographic Diversification

As primary metros mature, attention should shift toward Tier-2 cities exhibiting strong fundamentals. Pune, Ahmedabad, and Hyderabad combine lower entry costs with improving infrastructure and growing professional populations. These markets offer 8-15% annual appreciation potential while maintaining better rental yields than established metros.

Sustainability certifications become increasingly critical during this horizon. Properties with LEED, GRIHA, or WELL certifications will command growing premiums as ESG considerations mainstream and younger buyers dominate market share. Developers incorporating natural ventilation, renewable energy, rainwater harvesting, and waste management systems from design phases will capture disproportionate demand.

Mixed-use developments in emerging corridors represent particularly compelling opportunities, combining residential, commercial, retail, and recreational spaces within integrated communities. These projects align with millennial and Gen Z preferences for live-work-socialize environments minimizing commutes and maximizing convenience.

Strategic considerations include:

- RERA-compliant developers with transparent execution records minimizing project completion risks

- Locations with planned metro connectivity or expressway access ensuring long-term accessibility

- Second homes in tourist destinations (Goa, Kerala, Uttarakhand) capitalizing on 55% of wealthy Indians’ interest in premium vacation properties

- Commercial real estate for income generation, particularly Grade-A office spaces in growing business districts

Long-Term (2030-2035): Legacy Construction and Alternative Formats

Beyond 2030, focus should pivot toward legacy asset creation, geographic diversification, and alternative real estate formats. International property diversification hedges against domestic market volatility while providing lifestyle flexibility and potential citizenship advantages in select jurisdictions.

Real Estate Investment Trusts (REITs) and fractional ownership platforms offer liquidity, diversification, and lower capital requirements compared to direct ownership. These instruments particularly appeal to Gen Z investors seeking flexibility and reduced management responsibilities while maintaining real estate exposure.

Commercial real estate—including office complexes, industrial facilities, self-storage units, and data centers—provides steady income streams and institutional-grade assets suitable for multi-generational wealth preservation. The shift toward hybrid work models, e-commerce logistics, and digital infrastructure creates sustained demand across these segments.

Strategic priorities encompass:

- Portfolio rebalancing to maintain 20-25% real estate allocation as other assets appreciate

- Estate planning through trusts and strategic gifting to next generation, minimizing transfer taxes

- International diversification in stable, tax-efficient jurisdictions (Dubai, Singapore, London, Miami)

- Alternative formats (REITs, fractional ownership, real estate funds) providing liquidity and professional management

Navigating Risks

The Affordability Paradox

While wealth transfer headlines suggest widespread luxury access, reality presents complications. LegalZoom’s 2025 survey reveals 42% of young Americans don’t feel financially prepared to maintain inherited homes, with 20% specifically concerned about property taxes and another 20% worried about maintenance costs. Generation X carries highest median non-mortgage debt among generations, while over half of millennials have more debt than savings, and 56% of Gen Z live paycheck-to-paycheck.

This “house-rich, cash-poor” phenomenon threatens to transform anticipated luxury bequests into financial burdens rather than windfalls. Properties requiring extensive maintenance, significant property tax obligations, or substantial debt encumbrances may force heirs into quick sales at suboptimal prices, undermining intergenerational wealth preservation objectives. Rising home maintenance costs—with property values increasing 27% faster than inflation since 2020—exacerbate these pressures.

Contrarian investors should consider this reality when evaluating luxury markets. Properties positioned as turnkey, low-maintenance assets with reasonable tax profiles and modern infrastructure will command premiums as inheritors seek to avoid renovation burdens. Conversely, heritage properties requiring substantial upkeep may face pricing pressure despite architectural appeal, as cash-constrained heirs prioritize liquidity over sentiment.

Market Oversupply Risks in Specific Segments

India’s luxury market, despite strong headline growth, exhibits concerning volume trends. Housing sales across top seven cities declined 9% year-over-year in Q3 2025 even as total sales value increased 14%. This divergence—fewer transactions at higher values—suggests market concentration in ultra-luxury segments while mid-luxury faces headwinds. Mumbai and Pune specifically recorded 16% and 13% volume declines respectively, indicating potential oversupply as developers chase premium segment profits.

New luxury launches grew just 3% year-over-year, yet unsold inventory remained elevated at 5.61 lakh units across monitored cities, barely changed from 5.64 lakh units a year prior. This inventory overhang, combined with slowing absorption in certain price bands, raises questions about near-term pricing power sustainability in select markets.

Sophisticated investors should conduct granular micro-market analysis rather than relying on aggregate statistics. Specific projects in emerging micro-markets may perform exceptionally while headline numbers stagnate. Developer credibility, location fundamentals, and differentiated offerings matter more than ever in potentially oversupplied conditions.

Regulatory and Geopolitical Uncertainties

India’s real estate sector, while benefiting from government infrastructure investments, faces ongoing regulatory complexities. Uneven state-level approval processes, volatile input costs, and shifting tax policies create execution risks for developers and investors alike. Karnataka’s recent high-rise fire safety cess, for example, introduces new cost structures affecting affordability and developer margins.

For NRI investors, FEMA regulations, repatriation limits, and currency fluctuations add layers of complexity. Changes to capital gains taxation frameworks or repatriation rules could materially impact investment economics, necessitating continuous monitoring and adaptive strategies.

Globally, interest rate trajectories, geopolitical tensions, and potential economic slowdowns introduce macro risks affecting luxury markets. While luxury segments demonstrate relative resilience compared to mass markets, they’re not immune to severe economic disruptions. Portfolio construction should incorporate sufficient diversification and liquidity buffers (30%+ of investable assets) to weather potential volatility.

The “Not Everyone Should Own” Perspective

Real estate experts increasingly question homeownership’s universal suitability. Amir Korangy, founder of The Real Deal and Columbia/NYU professor, argues “not everyone should be an owner,” particularly in high-cost markets where renting offers superior financial flexibility. In 49 of America’s 50 largest metros, renting saves over $900 monthly compared to buying, after accounting for mortgages, insurance, taxes, HOA fees, and maintenance.

For young professionals prioritizing career mobility, technology-driven location independence, or portfolio diversification, luxury rentals may deliver better lifestyle value per dollar than ownership. This perspective challenges conventional wisdom equating real estate ownership with wealth building, suggesting alternative strategies deserve consideration.

However, this argument overlooks several factors: forced savings through mortgage payments, long-term appreciation in quality markets, inflation hedging, and intergenerational wealth transfer. The optimal approach depends on individual circumstances, time horizons, and opportunity costs. For inheritors receiving properties without acquisition costs, the calculus differs dramatically from first-time buyers stretching to enter expensive markets.

Pro Tips for Ultra-Sophisticated Investors

Negotiation and Timing Strategies

- Year-end and Quarter-end Advantages: Developers facing completion deadlines or quarterly revenue targets offer 5-15% discounts on inventory. Patient investors with ready financing capitalize on these windows.

- Bulk Purchase Leverage: Acquiring multiple units within single projects or from single developers unlocks preferential pricing, customization allowances, and priority support. This strategy particularly benefits family offices and HNI syndicates.

- Pre-Launch Entry: Committing to projects during initial planning phases secures 10-20% discounts while providing maximum customization flexibility. Risk mitigation requires rigorous developer due diligence and RERA compliance verification.

- Payment Term Extensions: Negotiating construction-linked payment schedules rather than traditional structures preserves capital flexibility while providing built-in exit points if market conditions deteriorate.

- Inclusive Customization: Negotiating interior upgrades, appliance packages, and technology integration into base pricing rather than post-purchase additions delivers substantial savings while ensuring cohesive design.

Due Diligence Essentials Beyond Standard Checklists

- Developer Financial Health: Beyond project-specific RERA compliance, assess overall corporate debt levels, completion track records across multiple projects, and litigation histories. Financially stressed developers risk construction delays or quality compromises.

- Micro-Market Infrastructure Analysis: Investigate planned metro extensions, expressway routes, commercial development pipelines, and educational institution expansions within 3-5 km radius. Infrastructure development drives long-term appreciation more reliably than current amenities.

- Climate Resilience Assessment: Evaluate flood zone mapping, water table levels, groundwater recharge systems, and climate adaptation features. As climate impacts intensify, properties lacking resilience face depreciation risks.

- Title and Legal Deep Dive: Engage specialized real estate advocates for comprehensive title verification, encumbrance certificate review, and regulatory compliance confirmation. Legacy title issues can surface years post-purchase, creating expensive legal battles.

- Exit Liquidity Analysis: Research historical transaction velocities, buyer demographics, and resale price trends for comparable properties. Illiquid micro-markets, regardless of paper appreciation, trap capital when exit becomes necessary.

Tax Optimization Advanced Strategies

- Section 54F Strategic Utilization: When selling investment properties, purchasing residential properties within specified timeframes enables capital gains exemptions. Strategic timing of purchases and sales minimizes tax leakage.

- Trust and Gift Structures: High-net-worth individuals should establish revocable and irrevocable trusts for estate planning, enabling tax-efficient wealth transfer while maintaining control during lifetime.

- NRI Repatriation Optimization: Strategically timing property sales and repatriation across multiple financial years maximizes the $1 million annual limit while leveraging favorable exchange rate periods.

- Rental Income Structuring: Registering properties under appropriate entity structures (individual, LLP, company) optimizes tax treatment of rental income, depreciation benefits, and estate planning flexibility.

- Capital Gains Reinvestment Timing: Rather than immediate reinvestment under pressure, deposit capital gains in specified accounts providing extended timeframes for identifying optimal replacement properties while preserving exemptions.

FAQ Section

What makes this wealth transfer different from previous generational shifts?

The current $84 trillion transfer represents the largest in absolute terms in human history, concentrated over a compressed 20-25 year timeframe. Unlike gradual historical transitions, this creates simultaneous supply (Baby Boomers divesting) and demand (younger inheritors reinvesting) dynamics that fundamentally reshape markets. Additionally, younger inheritors bring dramatically different priorities—sustainability, technology, wellness—compared to previous generations, forcing complete market ecosystem adaptation.

How can first-time luxury buyers compete with inherited wealth?

Strategic advantages available to first-time buyers include: pre-construction entry (10-20% discounts), emerging micro-market focus (lower absolute entry costs with comparable appreciation potential), fractional ownership platforms (lower capital requirements maintaining luxury exposure), and leverage optimization (strategic mortgage usage for tax benefits and portfolio diversification). Additionally, digital fluency and decisive decision-making compress transaction timelines, enabling capture of time-sensitive opportunities inherited-wealth competitors miss.

What red flags should investors watch for in luxury projects?

Critical warning signs include: delayed or missing RERA registrations, developers with multiple stalled previous projects, micro-markets with oversupply (inventory-to-sales ratios exceeding 24 months), unrealistic pricing (30%+ premiums to comparable properties without clear differentiation), limited buyer inquiry (despite launches, indicating market rejection), aggressive payment schedules (front-loading cash flows suggesting financial stress), and vague sustainability/technology claims (lacking certifications or specific specifications).

How should NRIs structure inheritance for tax efficiency?

Optimal NRI inheritance strategies involve: immediate property assessment (valuation for future capital gains basis), strategic retention vs. liquidation analysis (considering personal use, rental income potential, and capital appreciation prospects), capital gains exemption utilization (Sections 54, 54EC, 54F), repatriation planning (timing sales across financial years to maximize $1 million annual limits), and estate planning updates (ensuring inherited assets integrate into comprehensive wealth transfer plans). Engaging specialized NRI tax advisors familiar with both Indian and residence country taxation prevents costly mistakes.

Positioning for the Next Decade

The millennial heir effect transcends a temporary market phenomenon—it represents a permanent paradigm shift in how wealth is constructed, deployed, and preserved across generations. As the $84 trillion transfer accelerates through 2048, luxury real estate will increasingly serve as the intersection of financial strategy, lifestyle expression, values alignment, and legacy construction.

Winners in this transformed landscape will be those who recognize that traditional luxury markers—square footage, opulent finishes, prestigious addresses—while still relevant, no longer suffice. The new luxury paradigm demands intelligent integration of technology, authentic commitment to sustainability, comprehensive wellness infrastructure, and alignment with occupants’ evolving life patterns.

For UHNI and HNI investors, the strategic imperative is clear: reallocate portfolios toward real estate (20-25% target allocation), prioritize quality over quantity, embrace professional management, and maintain flexibility as markets continue evolving. Geographic diversification across domestic metros and select international markets hedges against localized risks while capturing growth across multiple wealth creation engines.

For NRI investors, the wealth transfer presents exceptional opportunities to leverage favorable exchange rates, inheritance advantages, and India’s robust growth trajectory while maintaining global portfolio diversification. Strategic property selection in luxury segments serving next-generation preferences ensures sustained appreciation even as inheritor priorities reshape demand patterns.

For developers and asset managers, the message is equally unambiguous: adapt or face obsolescence. Projects lacking technology integration, sustainability credentials, and wellness amenities will struggle to command premiums—or even maintain market share—as millennials and Gen Z dominate buyer pools. The 81% of younger HNWIs planning to switch wealth managers post-inheritance serves as a stark warning: understand next-generation priorities or lose assets.

The transition underway represents more than wealth changing hands; it embodies fundamental societal value shifts regarding environmental stewardship, work-life integration, wellness prioritization, and technology adoption. Real estate, as society’s most tangible physical infrastructure, must reflect and enable these evolving values to retain relevance and command premium pricing.

As we navigate this historic transformation, one certainty emerges: those who understand that the millennial heir effect is fundamentally about values, not valuations, will capture disproportionate returns. The properties succeeding in this new paradigm will be those serving as enablers of better lives, expressions of deeply held values, and foundations for multi-generational wealth rather than mere financial assets or status symbols.

For investors prepared to embrace this new reality—conducting rigorous research, maintaining strategic flexibility, and prioritizing next-generation preferences—the wealth transfer represents not a challenge but an unprecedented opportunity to participate in the largest reallocation of capital and property in human history. The question is not whether the millennial heir effect will reshape luxury real estate, but rather: will you position yourself to benefit from or be disrupted by this transformation?

Free resources to download

The Millennial Heir Effect: Executive Summary