Now Reading: India’s Branded Residence Revolution: How the $5 Billion Luxury Segment Claimed the World’s 6th Spot

- 01

India’s Branded Residence Revolution: How the $5 Billion Luxury Segment Claimed the World’s 6th Spot

India’s Branded Residence Revolution: How the $5 Billion Luxury Segment Claimed the World’s 6th Spot

India has ascended to the 6th position globally in the branded residences sector, a remarkable achievement that signals the nation’s arrival as a premier luxury real estate destination. With a market valuation of $5 billion in 2025 and contributing 4% to global branded residence supply, India’s ultra-luxury segment has experienced a transformative 160% growth over the past decade. This expansion is propelled by a rapidly growing base of 85,698 ultra-high-net-worth individuals (UHNWIs) with net worth exceeding $10 million, alongside 378,810 high-net-worth individuals (HNWIs) commanding $1.5 trillion in wealth. As global investors, NRIs, and domestic affluent buyers increasingly seek properties that blend international brand prestige with hotel-caliber service standards, India’s branded residences—commanding 30-40% premiums over traditional luxury properties—have emerged as the definitive asset class for wealth preservation, legacy creation, and sophisticated living in an era where exclusivity transcends mere opulence.

The Global Power Shift: India’s Ascent in the Branded Residence Hierarchy

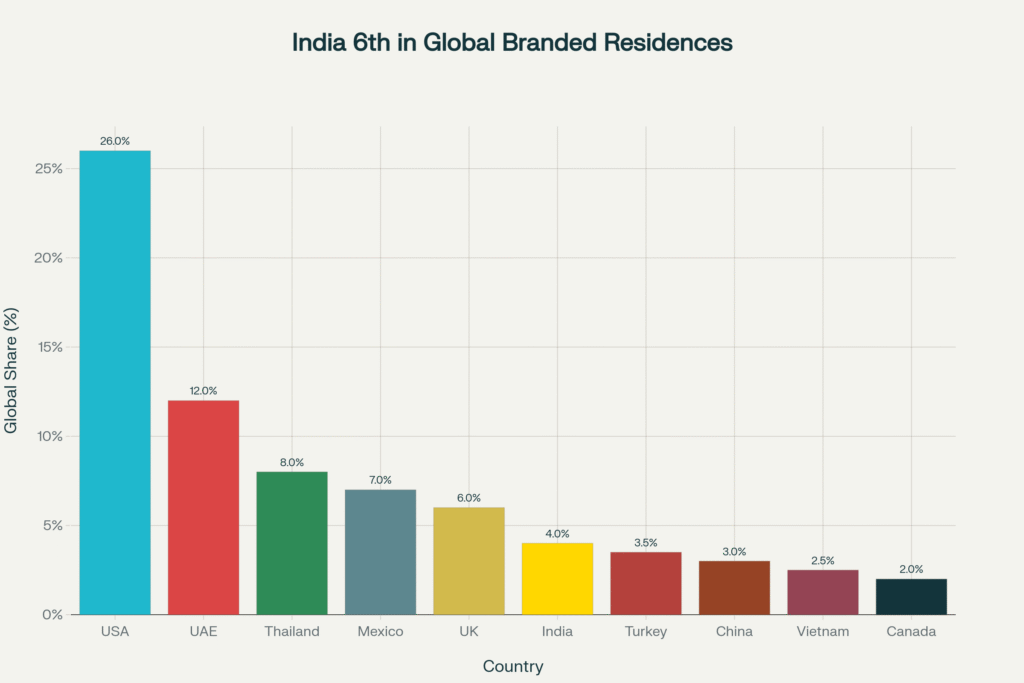

The branded residences landscape has undergone a seismic transformation, and India stands at the epicenter of this evolution. According to Knight Frank’s authoritative The Residence Report 2025, India now ranks 6th worldwide among 83 surveyed nations for live branded residence projects, contributing a significant 4% to global supply. The nation simultaneously holds the 10th position in the pipeline of upcoming projects, accounting for 2% of future supply—a trajectory that positions India among the world’s fastest-growing frontiers for luxury branded living.

This achievement places India in distinguished company. The United States leads the global market with a commanding 26% share, followed by the UAE at 12%, Thailand at 8%, Mexico at 7%, and the United Kingdom at 6%. India’s 6th-place ranking ahead of established luxury markets such as Turkey, China, Vietnam, and Canada underscores the nation’s rapid maturation as a sophisticated luxury destination that appeals to the global ultra-wealthy.

Comparative Regional Analysis: Asia-Pacific vs. Middle East Momentum

The Asia-Pacific region, including India, is experiencing unprecedented growth in branded residences. While North America historically dominated with over 50% market share before 2015, its proportion has declined to approximately 26% of pipeline projects. Meanwhile, the Asia-Pacific region is projected to rival North America’s market share within 12 years, driven substantially by India’s burgeoning luxury appetite.

The Middle East and Africa region demonstrates even more dramatic expansion, with a staggering 270% growth trajectory from 2024. Dubai alone commands 140 branded residence projects slated for delivery by 2031, positioning it as the global branded residence capital. The UAE’s success stems from tax advantages, accessible luxury pricing, and rapid project execution—factors that have generated $4.2 billion in branded residence sales during 2024, marking a 43% year-on-year increase.

In contrast, traditional European markets face headwinds. London’s branded residences, despite premium pricing reaching £8,000-£12,000 per square foot, contend with substantial tax burdens and regulatory complexity that dampen investor enthusiasm. Miami’s luxury market, featuring properties like Aston Martin Residences commanding up to $25,000 per square foot, offers comparable brand appeal but at significantly higher absolute costs.

India’s competitive advantage lies in its unique positioning: delivering international luxury standards at valuations substantially lower than Western markets while offering superior capital appreciation potential. Branded residences in Mumbai’s Worli district or Delhi-NCR’s premium corridors provide global brand assurance combined with India’s robust economic growth fundamentals—a combination increasingly irresistible to sophisticated global investors.

Quantifying the Branded Residence Boom

Market Valuation and Exponential Growth Trajectory

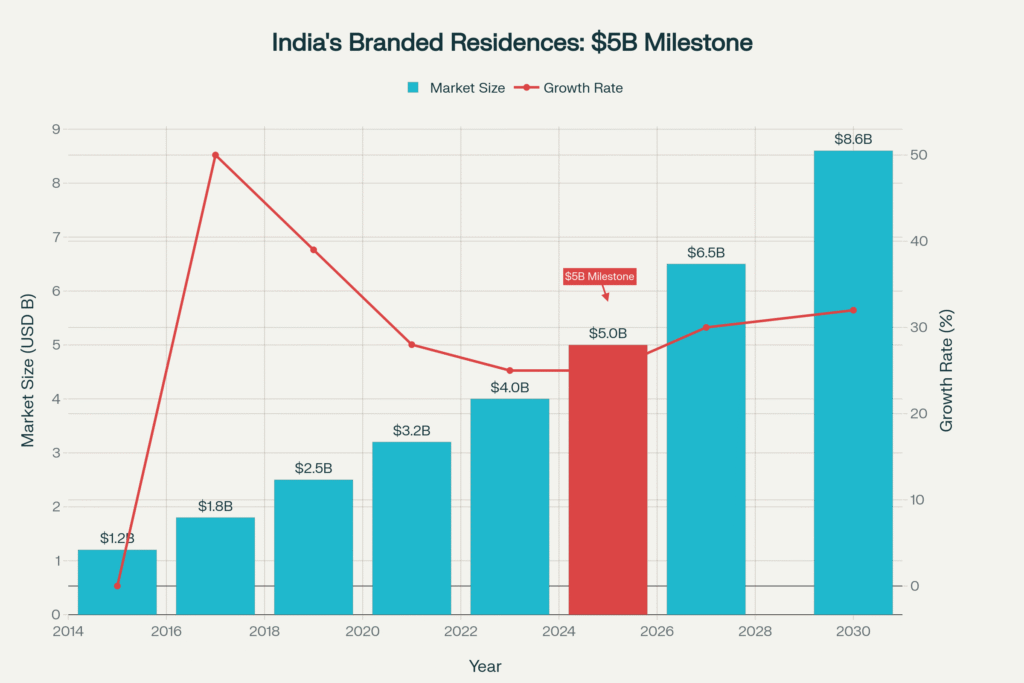

India’s branded residences market has achieved the $5 billion milestone in 2025, representing a remarkable 160% surge over the past decade. Industry projections from Savills India and NAREDCO indicate the segment will reach $8.6 billion by 2030, translating to a compound annual growth rate (CAGR) of 11-15%. By 2031, Savills anticipates a staggering 200% cumulative growth from current levels, propelling India firmly into the top tier of global luxury real estate markets.

This growth substantially outpaces India’s overall luxury residential real estate sector, which Mordor Intelligence estimates will expand from $57.87 billion in 2025 to $98.04 billion by 2030 (11.12% CAGR). The branded residences segment’s superior growth rate reflects its unique value proposition: combining tangible real estate assets with intangible brand equity, professional management, and service excellence.

The HNWI and UHNWI Expansion Powering Demand

India’s wealth creation engine operates at full throttle. According to the Capgemini Research Institute’s World Wealth Report 2025, India added over 33,000 new millionaires in 2024 alone, elevating the HNWI population to 378,810 individuals—a 5.6% year-on-year increase. Collectively, these HNWIs command $1.5 trillion in wealth, representing an 8.8% expansion in total HNWI wealth during 2024.

This wealth demographic forms the natural constituency for branded residences. With 62% of HNIs expressing intent to purchase property within the next 12-24 months (down modestly from 71% in 2024, reflecting cautious optimism), and 55% citing capital appreciation as their primary investment motivation (up from 44% in 2024), the shift toward strategic wealth preservation through premium real estate has never been more pronounced.

Transaction Value Analysis Across India’s Luxury Corridors

The geographic distribution of branded residence activity reveals concentrated demand in India’s wealthiest metropolitan regions. Mumbai dominates transaction values with an estimated $850 million in branded and ultra-luxury residential sales during 2024-25, registering 27% year-on-year growth. The city’s preeminent submarkets—Worli, Bandra, and Lower Parel—host flagship developments including Four Seasons Private Residences Mumbai (80% sold, 41 exclusive homes across 64 floors) and Armani Casa-branded Lodha World Towers.

Delhi-NCR follows with approximately $620 million in transaction value (22% YoY growth), driven by the region’s commanding 57% share of India’s luxury housing sales during H1 2025. The capital region recorded sales of approximately 4,000 luxury units priced above ₹4 crore during January-June 2025—a threefold increase compared to the corresponding period in 2024, according to CBRE-ASSOCHAM research.

Bengaluru, India’s technology capital, generated $380 million in high-end residential transactions (18% YoY growth), while Pune contributed $220 million (15% YoY growth). These cities attract tech entrepreneurs, startup founders, and multinational executives seeking branded, amenity-rich living environments that mirror global standards.

Notably, India’s emerging second-home luxury destinations demonstrate exceptional growth velocity. Goa’s coastal branded residence market achieved $180 million in transaction value with a remarkable 35% year-on-year expansion, driven by NRI demand and domestic buyers seeking beachfront retreats. Uttarakhand’s mountain luxury segment reached $120 million (28% YoY growth), reflecting surging appetite for wellness-oriented, nature-immersive branded properties in pristine Himalayan settings.

Premium Pricing Power: The Brand Advantage Quantified

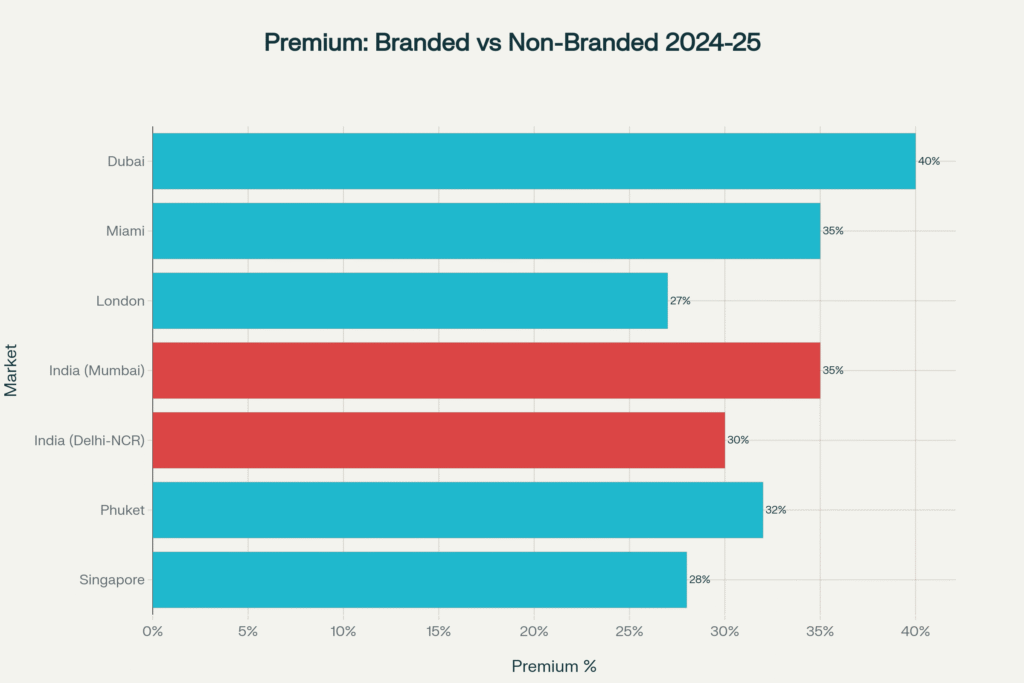

Branded residences command substantial premiums over comparable non-branded luxury properties—a phenomenon consistent across global markets. In India, Knight Frank and industry analysis reveal branded residences extract 30-40% price premiums, with Mumbai properties commanding approximately 35% and Delhi-NCR developments achieving 30% premiums.

This pricing power aligns closely with international benchmarks. Dubai’s branded residences secure 40% premiums, with properties like Bugatti Residences commanding a staggering 237% premium over baseline luxury. Miami’s branded offerings achieve 35% premiums, while London’s Mayfair branded residences extract 27% premiums despite elevated baseline pricing. Phuket’s branded villas command 32% premiums, and Singapore’s branded properties achieve 28% premiums.

The premium reflects multiple value drivers: guaranteed quality standards enforced by international brands, professional property management by hospitality operators, access to hotel-grade amenities (concierge, housekeeping, dining, spa facilities), enhanced security protocols, superior capital appreciation potential, and stronger resale liquidity. Four Seasons residences globally have demonstrated 20-25% resale gains, while Dubai’s Atlantis The Royal Residences achieved an extraordinary 194% resale premium, validating the branded model’s investment merit.

Portfolio Composition and Return Expectations

The investment case for branded residences extends beyond aspirational living to encompass robust financial performance. Nearly half of surveyed HNIs expect branded residence investments to deliver 12-18% annual returns, while 38% anticipate returns below 12%. Fewer than 15% project returns exceeding 18%, reflecting more realistic expectations following three years of exceptional luxury market gains.

Rental yields in India’s branded residence sector range from 3-4% in prime markets, comparing favorably to under 2% yields in mature Western markets. Dubai and Miami branded residences achieve superior 6-8% rental yields, though India’s combination of yield plus capital appreciation often produces superior total returns. Properties in high-tourism areas such as Goa demonstrate 80-95% occupancy rates, translating rental income into meaningful cash flow while asset values appreciate.

From a portfolio construction perspective, branded residences offer HNWIs and UHNWIs essential diversification. With 15% of global HNWI portfolios now allocated to alternative assets including private equity and cryptocurrency, tangible luxury real estate provides ballast—offering inflation protection, currency diversification (particularly valuable for NRIs), and wealth preservation during equity market volatility.

Insights And Strategies

- UHNI Portfolio Diversification Strategy: Allocate 15-25% of real estate holdings to branded residences across multiple markets (primary residence metro + second home destination + international property). This diversification captures geographical arbitrage, lifestyle utility, and downside protection through uncorrelated market dynamics.

- Pre-construction Entry with Brand Verification: Target projects at pre-launch or early construction stages offering 15-20% discounts. Conduct rigorous brand partnership verification: confirm legal agreements between developer and brand, validate brand’s operational involvement (passive licensing vs. active management), and assess developer’s track record for completion quality and timeliness.

- NRI Tax Optimization through Structure Selection: NRIs should consult cross-border tax specialists to optimize ownership structures. Options include direct individual ownership, purchasing through NRO/NRE accounts, forming Indian private limited companies (for portfolio investors), or utilizing trusts for estate planning. Each structure carries distinct tax implications for rental income, capital gains, repatriation, and inheritance.

- Rental Yield Enhancement through Professional Management: Maximize rental returns by engaging branded residence management companies offering short-term rental programs, corporate leasing, or guaranteed minimum returns. Four Seasons, for instance, offers rental programs for owners willing to include properties in rental pools, generating passive income while maintaining personal use rights.

- Strategic Exit Timing and Liquidity Planning: Branded residences, while appreciating robustly, face liquidity constraints due to high absolute pricing. Plan exit strategies around favorable market cycles (typically 5-7 year hold periods optimize capital gains tax treatment while capturing appreciation). Target exits to NRI buyers, corporate executives relocating to India, or UHNWIs seeking turnkey luxury—segments with capacity and urgency.

Navigating Headwinds

Despite compelling fundamentals, branded residences carry material risks that sophisticated investors must weigh carefully.

Market Downturn Vulnerability

Luxury real estate historically demonstrates procyclicality—performing exceptionally during economic expansions but suffering pronounced corrections during recessions. During the 2008 global financial crisis, luxury property markets in cities like London experienced 10-15% value declines, while branded residences in some markets fell 5% (demonstrating relative resilience but not immunity).

India’s branded residence market, though nascent, would likely experience similar dynamics during a severe economic contraction. With properties priced ₹10-50 crore ($1.2-6 million), buyer pools narrow substantially during downturns as discretionary luxury spending contracts. The 85% growth in luxury sales during H1 2025 reflects India’s current economic strength; however, projections assuming linear growth ignore cyclical realities.

Contrarian perspective: High absolute pricing creates downside risk if India’s economic growth decelerates materially (e.g., GDP growth falling below 5% sustained, significant currency depreciation, or major financial sector stress). Investors should maintain liquidity reserves and avoid excessive leverage on branded residence purchases.

Regulatory and Compliance Complexity

India’s RERA framework, while providing buyer protections, imposes substantial compliance burdens on developers. Project delays, though less common with branded developments, occur periodically. Compensation mechanisms (investment amount plus MCLR + 2% interest for delay periods) provide remedies but cannot fully offset opportunity costs or emotional frustration.

Additionally, land acquisition challenges, environmental clearances for certain regions (Goa, Uttarakhand), and evolving state-level regulations create execution risks. Branded residence projects typically involve multi-year development timelines—exposure to regulatory changes, market condition shifts, or developer financial stress.

Foreign investors, particularly NRIs, face additional complexity: repatriation restrictions (limits on foreign currency repatriation from property sales), taxation across multiple jurisdictions (Indian capital gains tax plus home country taxation), and estate planning challenges for cross-border assets.

Mitigation strategies include thorough developer due diligence (verify financial strength, completion track record, and legal compliance), purchasing only RERA-registered projects from established developers, and engaging legal/tax advisors specializing in luxury real estate transactions.

Oversupply Risk in Selective Markets

While overall branded residence supply remains constrained (less than 2% of luxury inventory), individual micro-markets face potential oversupply. Mumbai’s Worli and Lower Parel, Delhi-NCR’s premium corridors, and emerging markets launching multiple branded projects simultaneously risk inventory accumulation if absorption rates decline.

Oversupply manifests through extended selling periods, pricing pressure, and reduced negotiating leverage for sellers. Unlike mass-market housing where government policies support affordable supply, luxury oversupply receives no policy backstop—market forces alone dictate corrections.

Investors should assess local supply pipelines, absorption velocity, and pricing trends before committing capital. Avoid markets with excessive upcoming inventory relative to demonstrated demand, and favor established branded developments with strong sell-through rates over speculative new launches.

Maintenance Cost Escalation and Fee Structures

Branded residences impose annual maintenance fees typically ranging 2-3% of property value—substantially higher than conventional luxury apartments (0.5-1%). These fees fund professional management, amenity maintenance, security, and brand service standards. While justifiable for services rendered, they represent ongoing cash outflows that erode net yields and long-term returns.

Fee escalation represents a particular concern. If annual fee increases (often indexed to inflation or service cost growth) outpace rental income growth, net cash flows compress, reducing investment attractiveness. Additionally, some brands reserve rights to impose special assessments for major capital improvements—unanticipated expenses disrupting financial projections.

Prospective buyers must scrutinize fee structures, understand escalation mechanisms, and model long-term cash flow scenarios incorporating rising fees. Properties with capped annual fee increases or transparent governance around fee-setting provide greater financial predictability.

Cultural Misalignment and Service Expectations

International hospitality brands bring global service standards—a key value proposition. However, cultural adaptation challenges can emerge. Service protocols designed for Western markets may not fully align with Indian family structures, privacy norms, or lifestyle preferences. Instances where brand management decisions conflict with resident preferences (e.g., food and beverage offerings, event restrictions, amenity usage policies) create friction.

Unlike property ownership where owners exercise full control, branded residences involve shared governance with brand operators. Residents cede certain autonomy in exchange for brand consistency—a trade-off not all ultra-wealthy individuals embrace comfortably.

FAQ Section

What exactly defines a “branded residence” and how does it differ from regular luxury apartments?

A branded residence is a luxury residential property developed in partnership with a globally recognized brand—typically a hospitality brand (Four Seasons, Ritz-Carlton, Mandarin Oriental) or lifestyle brand (Armani, Versace, Bentley). Unlike regular luxury apartments where developers independently manage projects, branded residences feature active brand involvement in design, construction oversight, operational management, and ongoing service delivery. Residents access hotel-grade amenities (concierge, housekeeping, spa, dining), professional property management, and brand-enforced quality standards. The brand provides its name, expertise, and operational systems in exchange for licensing fees and management contracts, creating aligned incentives for excellence that traditional luxury developers cannot replicate.

Are branded residences a good investment for NRIs compared to other Indian real estate options?

Branded residences offer NRIs distinct advantages: (1) Currency Arbitrage – Strong foreign currency purchasing power makes Indian branded residences more accessible than equivalent properties in Western markets; (2) Superior Yields – 3-4% rental yields in India exceed <2% yields in mature markets like London or New York, while capital appreciation (7-8% annually) outpaces Western markets; (3) Professional Management – Brand-managed properties eliminate absentee ownership challenges through turnkey management, rental programs, and property maintenance; (4) Emotional Connection – Owning premium Indian property maintains cultural ties while diversifying global portfolios; (5) Legacy Creation – Branded residences serve as generational wealth assets transferable to children. However, NRIs must navigate repatriation restrictions, dual taxation (though India has tax treaties with major countries), and higher transaction costs versus domestic buyers, making professional tax/legal advice essential.

How can investors verify that a branded residence project is legitimate and not just “brand washing”?

Conduct multi-layer due diligence: (1) Verify Legal Agreements – Request developer disclosure of brand partnership contracts confirming whether the brand provides passive licensing only or active operational involvement (the latter is vastly superior); (2) Brand Confirmation – Independently contact the brand’s corporate office (e.g., Four Seasons’ global development department) to confirm the project’s legitimacy and the brand’s level of involvement; (3) RERA Registration – Ensure the project is registered under RERA with verified approvals and escrow accounts; (4) Developer Track Record – Assess the developer’s history of completed projects, financial stability, and brand partnerships (established developers like Lodha, DLF, or Shapoorji Pallonji carry lower execution risk); (5) Third-Party Validation – Review coverage from reputable sources (Knight Frank, CBRE reports, credible media) confirming the project and brand relationship. Avoid projects where brand involvement is superficial or limited to design consultation without ongoing operational commitment.

What are realistic return expectations for branded residence investments in India over 5-10 years?

Conservative projections suggest total returns (capital appreciation + rental yield) of 10-15% annually over 5-10 year horizons in established markets (Mumbai, Delhi-NCR). This comprises 7-8% annual capital appreciation and 3-4% net rental yields (after maintenance fees and vacancy periods). Optimistic scenarios in high-growth emerging markets (Goa, Pune, Tier-II cities) could deliver 15-20% total returns if appreciation accelerates beyond historical averages. However, investors must account for: (1) Liquidity Discounts – Ultra-luxury properties may require 6-12 months to sell versus weeks for mid-market properties, necessitating liquidity planning; (2) Fee Drag – Annual maintenance fees of 2-3% reduce net yields significantly; (3) Market Cycle Risk – Economic downturns could produce 0-5% returns or negative returns during severe contractions; (4) Tax Implications – Long-term capital gains taxation (20% with indexation benefits) and rental income taxation reduce after-tax returns. Sophisticated investors model multiple scenarios (base case, optimistic, pessimistic) and stress-test assumptions before committing capital.

Positioning for India’s Luxury Ascent

India’s emergence as the 6th-ranked global market for branded residences represents far more than a statistical milestone. It signals a profound transformation in how the nation’s ultra-wealthy perceive, pursue, and preserve prosperity. The $5 billion branded residence segment stands at the intersection of multiple powerful forces: explosive wealth creation producing 33,000+ new millionaires annually, urbanization dynamics driving 50 million people toward major metros by 2030, generational transitions transferring $534.77 billion in UHNWI wealth within the next decade, and evolving luxury consciousness that prioritizes experience, wellness, and legacy over ostentatious display.

For sophisticated global investors, NRIs, and domestic HNWIs, branded residences offer a rare convergence: tangible assets with intangible brand premiums, use value combined with exchange value, local market exposure with global quality standards, and capital appreciation potential enhanced by exclusivity and scarcity. The 30-40% price premiums these properties command reflect not irrational exuberance but rational recognition that brand-backed quality, professional management, and lifestyle excellence generate measurable value.

The path forward requires strategic thinking. Immediate-term, capitalize on pre-construction discounts and currency arbitrage opportunities in established Mumbai and Delhi projects. Mid-term, position in Tier-II markets (Pune, Hyderabad) and emerging second-home destinations (Goa, Uttarakhand) before mainstream recognition drives price escalation. Long-horizon, construct diversified branded residence portfolios balancing primary residences, lifestyle properties, and income-generating assets across geographies—creating resilient wealth preservation vehicles that transcend market cycles.

Yet success demands diligence. The risks—market downturns, regulatory complexity, maintenance cost escalation, and liquidity constraints—are real and material. Investors who conduct rigorous due diligence, verify brand partnerships, assess developer capabilities, model conservative return scenarios, and maintain adequate liquidity will capture upside while protecting downside. Those who chase hype, overlever, or neglect proper structuring risk painful lessons.

Ultimately, India’s branded residence revolution represents the maturation of a market—the transition from real estate as shelter or speculation to real estate as strategic asset allocation within sophisticated wealth portfolios. As India ascends toward becoming the world’s third-largest economy, as its UHNWI population swells toward 20,000 individuals by 2028, and as global brands intensify competition for ultra-luxury positioning, the branded residence segment will cement its status as the pinnacle of Indian luxury living.

For those positioned strategically, the opportunity is not merely financial. It’s the chance to participate in India’s luxury real estate coming-of-age, to secure tangible stakes in world-class developments rivaling anything in Dubai, Miami, or London, and to create legacy assets that preserve and transmit wealth across generations. The branded residence revolution has arrived. The question is not whether to participate, but how to position most advantageously for the transformation ahead.

YouTube Learning Resources

Free resources to download

India’s Branded Residences Revolution: Executive Summary