Now Reading: The Illiquidity Premium: Why Real Estate’s 2-6 Month Exit Horizon Is Actually a Feature, Not a Bug

- 01

The Illiquidity Premium: Why Real Estate’s 2-6 Month Exit Horizon Is Actually a Feature, Not a Bug

The Illiquidity Premium: Why Real Estate’s 2-6 Month Exit Horizon Is Actually a Feature, Not a Bug

Imagine holding an asset so valuable that patience itself becomes currency. That’s luxury real estate in 2025—where the very constraint that makes most investors uncomfortable becomes the mechanism that builds generational wealth.

While the world obsesses over instant liquidity, algorithmic trading, and same-day settlements, sophisticated investors are discovering something counterintuitive: the ability to wait 2-6 months to sell a property isn’t a weakness. Illiquidity premium is the quiet edge that separates disciplined wealth builders from reactive traders.

The market is telling a compelling story. Dubai is experiencing an investment renaissance. Mumbai’s luxury segment is attracting wealth like never before. London’s best properties are being quietly accumulated by patient capital. And behind every successful transaction sits the same insight: illiquidity, when understood properly, is wealth creation in disguise.

The Paradox That’s Creating Millionaires

There’s something almost counterintuitive happening in luxury real estate right now. As the world gets obsessed with instant gratification—instant messaging, instant streaming, instant stock trading—the ultra-wealthy are doing the opposite. They’re deliberately locking capital into assets that take months to sell.

Why? Because the market rewards patience.

Think about the psychology of a seller. When you know your buyer can close in 60 days instead of 180, you negotiate from a position of weakness. But when you can afford to wait? Everything changes. Suddenly, you’re the one holding the leverage. You can wait for the right buyer, the right price, the right moment.

This isn’t just theory. During the 2020 COVID crash, when liquid portfolios were collapsing 30-40% in real-time, real estate investors experienced something remarkable: forced patience. They couldn’t panic sell. And while it felt painful at the moment, that forced discipline preserved wealth that evaporated from more “liquid” portfolios. By 2022, those same real estate holdings had appreciated dramatically, while investors who’d liquidated their equities at market lows were still bitter about missed recoveries.

Controlled illiquidity, it turns out, is a behavioral superpower.

Why the 2-6 Month Exit Actually Matters

The obvious answer is returns. Real estate’s long-term returns are compelling. But the real answer is subtler.

The Discipline Effect

When you know you can’t panic-sell, something shifts psychologically. You stop reacting to market noise. You stop checking prices obsessively. You focus on the fundamental question: “Is this asset fundamentally sound?” rather than “What’s the short-term sentiment?”

During volatile periods, this becomes a superpower. While equity investors are making catastrophic decisions based on CNBC headlines, real estate investors are reading their rental payments and continuing to sleep well. The forced patience eliminates the worst version of human financial decision-making.

Research on investor behavior consistently shows that longer holding periods correlate with better outcomes. Not because the assets themselves perform better—though they often do—but because the behavioral constraints prevent devastatingly poor timing decisions.

Access to Different Opportunities

Here’s something the retail real estate platforms won’t tell you: the best properties rarely hit the open market. Instead, they’re acquired through relationships, off-market introductions, and networks that only exist between serious long-term players.

Why? Because savvy sellers offer such properties to buyers they believe will hold long-term. They’re not looking to sell to a quick trader who’ll flip in 12 months. They’re looking to sell to someone building something lasting.

This creates an asymmetry of opportunity. Patient capital gets access to properties others never see. And these properties—specifically selected because they’re positioned for long-term value creation—tend to outperform public market alternatives.

Negotiating Power

Time is leverage. When you control supply and demand dynamics, you also control pricing.

A buyer who needs to close in 30 days has minimal negotiating power. They’re desperate. They’ll overpay, accept unfavorable terms, and make suboptimal structural decisions.

A buyer who can wait 4-6 months? Entirely different story. You can negotiate. You can walk away from bad deals. You can wait for market conditions to shift. You can condition the sale on seller financing or creative structures that extract value invisible to desperate buyers.

The Allocation Question: Who Should Own Real Estate?

Not everyone should allocate heavily to real estate. This isn’t an argument for real estate universalism.

Some investors need daily access to capital. Some are in life phases where liquidity is critical. Some have behavioral profiles where illiquidity becomes a source of anxiety rather than discipline.

Real Estate Works Best For:

Those who’ve built genuine wealth cushions. When you have enough liquid capital that 2-6 months of illiquidity doesn’t threaten your lifestyle or obligations, real estate’s behavioral advantages activate powerfully.

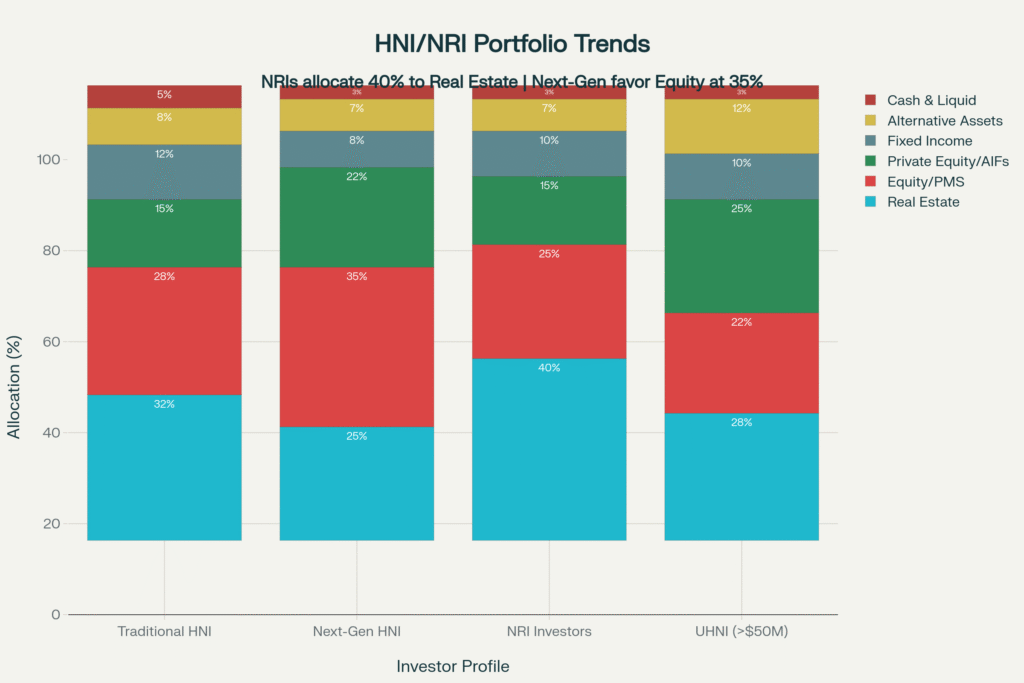

Non-resident Indians specifically. For NRIs, real estate serves triple duty: portfolio diversification, currency hedging against rupee movements, and a tangible connection to India that finances often crave. The 40% allocation many NRIs maintain reflects this multi-dimensional value beyond pure returns.

Family offices and dynastic wealth. Real estate’s illiquidity is actually a feature for intergenerational planning. The forced holding periods perfectly align with succession planning horizons. Properties don’t get liquidated impulsively by inheritors because they can’t be—the timeline enforces discipline the family might otherwise lack.

Individuals age 40-60 in accumulation mode. This is the life phase where long time horizons and established income streams align perfectly with illiquid investing. You have decades before you’ll need the liquidity, and disrupting portfolio peace doesn’t benefit you.

Real Estate Requires Caution For:

Retirees living off portfolio income. When you need monthly distributions, illiquid investments create tension with your capital access needs.

Early-career wealth builders under $10 million. Illiquidity becomes more material when your total net worth is smaller. A 2-year exit delay matters less when you’re worth $100 million than when you’re worth $5 million.

Anyone with debt service or major anticipated expenses. If you might need capital in 18 months, real estate concentration becomes counterproductive.

The Behavior Shift That’s Happening Now

Something interesting is accelerating in late 2025: a generational wealth transition is beginning.

Roughly six decades worth of accumulated wealth is beginning to transfer from baby boomers to millennials and Gen X. This isn’t distant future—it’s happening now. And it’s reshaping real estate flows in ways that create opportunity for observant investors.

Inheritors, statistically, prefer liquidity. They’re more comfortable with public markets, liquid alternatives, and securities they understand through news consumption and social media. They’re less likely to hold physical real estate out of personal preference.

This creates a supply shock. Patient capital has the opportunity to acquire high-quality properties from inheritors who prefer to convert them to liquid alternatives. The discount? Material.

Similarly, the wave of tech wealth from the last two decades—PayPal mafia dispersions, pre-IPO option holders, startup founders achieving liquidity—tends to be held by younger, more technologically-minded wealth holders who again prefer liquidity and simplicity.

The math is simple: when an asset you want is being sold by someone who doesn’t want it, pricing dislocation favors buyers.

Three Markets, Three Stories

Let’s move past statistics and examine what’s actually happening on the ground in the world’s three most interesting luxury markets.

Dubai: The Execution Premium

Dubai isn’t beautiful in the way Venice or Paris are beautiful. It’s beautiful in the way human ambition and capital deployment are beautiful—the visual representation of people building on vision rather than inherited advantage.

What’s happening there now is remarkable. The emirate has solved a market problem that plagues most luxury destinations: depth. Traditional wealth hubs like London or New York have constrained supply (limited new construction, tight planning rules). Dubai, through deliberate urban planning, has created enough new premium inventory that an actual buyer pool exists.

The effect? Someone can genuinely exit a Dubai property when they want. Try that in London prime central. You might wait 12+ months for the right buyer. In Dubai? 3-4 months gets you to market.

This liquidity in what’s otherwise an illiquid asset class changes the game. It means you get the benefits of real estate (leverage, cash flow, tangibility) without the drawback of being permanently locked in.

Mumbai: The Demographic Play

Mumbai’s transformation over the past five years has been underappreciated by global wealth allocators. The city has moved from being a real estate market attractive to Indian families and diaspora to being a genuine institutional investment target.

This shift correlates precisely with India’s economic maturation and wealth creation. There’s a generation of Indian entrepreneurs and professionals whose wealth rivals global norms but whose assets remain concentrated domestically. Real estate, for this cohort, is the natural diversification vehicle.

What you’re watching in Mumbai isn’t real estate appreciation—it’s wealth reallocation to physical assets in the context of a rising economic power. The momentum is multidecadal, not cyclical.

London: The Discount Play

London prime is having a difficult moment. Tax changes have spooked certain investor classes. Brexit residual uncertainty lingers. The combination has created pricing that doesn’t reflect fundamentals.

This is the classic moment when patient capital should be accumulating. London’s characteristics—legal system, institutional quality, cultural staying power—haven’t changed. The pricing has, temporarily.

The Quiet Art of Exit Planning

Here’s something experienced real estate investors know that others don’t: exit planning begins at acquisition, not at sale.

Sophisticated buyers aren’t just asking “what’s the cap rate?” They’re mentally running three exit scenarios: emergency, opportunistic, and optimized.

Emergency Exit (60-90 days): “If life circumstances changed dramatically, how quickly could I close?”

Opportunistic Exit (4-6 months): “When market conditions are favorable, what’s the speed to market with professional marketing?”

Optimized Exit (9-12 months): “If I time this perfectly with market cycles and buyer interest, what’s achievable?”

Properties acquired with this framework built in—before purchase, during due diligence—tend to outperform. Not because different properties are selected, but because the discipline of pre-planning creates different decisions around tenant mix, property positioning, and portfolio management.

It’s the difference between playing chess and playing checkers.

When Illiquidity Becomes the Wrong Tool

Before we make illiquidity sound universally positive, let’s be direct: it’s not.

If you need monthly distributions from your portfolio to fund your life, illiquid real estate creates genuine friction. You might own something valuable you can’t easily convert to cash when family circumstances demand it.

If you’re paying a property mortgage and facing income interruption, illiquidity becomes a source of anxiety rather than discipline. The forced holding period stops being an asset and becomes a liability.

If you’ve overleveraged and market conditions shift against you, illiquidity can crystallize losses into catastrophic disasters. During 2008-2009, numerous investors who overleveraged their real estate portfolios faced forced sales at 40-60% discounts because they couldn’t weather the wait for market recovery.

The real estate allocation decision must be stress-tested against your actual worst-case scenarios, not average scenarios. “Could I maintain my lifestyle for 18 months if I couldn’t access this capital?” isn’t a rhetorical question—it’s a prerequisite for sizing real estate properly.

The Strategic Framework: Where to Start

If you’re considering real estate allocation and the illiquidity thesis resonates, the path forward has a specific architecture.

First: Build Your Liquidity Foundation

Before allocating to direct property ownership, establish clear liquid reserves. A good starting point: 12-18 months of your complete financial obligations (living expenses, debt service, anticipated outlays) in completely accessible form. This isn’t capital you’ll deploy—it’s insurance that illiquidity won’t force bad decisions.

With this foundation in place, the 2-6 month property exit timeline becomes genuinely manageable.

Second: Choose Your Markets Strategically

Rather than trying to analyze 46 global markets, focus on 3-4 where you have conviction:

A growth market where appreciation is likely to exceed investment-grade yields. Dubai, Mumbai, select Southeast Asian markets fit this profile.

A stability core where capital preservation and income generation matter more than appreciation. Singapore, London prime, established US markets.

A counter-cyclical opportunity where pricing has temporarily disconnected from fundamentals, creating value for patient capital.

This three-pillar approach balances return generation with risk management far more effectively than concentrated allocation to single markets.

Third: Build Relationships Before Capital

This is where most investors stumble. They arrive in a market with capital ready to deploy and wonder why they’re seeing only mediocre opportunities. The answer: good deals flow to relationships, not to capital.

Spend 6-12 months building networks, understanding market dynamics, visiting properties, meeting developers and brokers. Capital deployed without this foundation tends to buy what’s obvious rather than what’s valuable.

The Emerging Wealth Moment

We’re at an inflection point with luxury real estate. Simultaneously:

Generational wealth is beginning to transfer, creating supply from sellers who prefer liquidity. Patient capital can acquire assets at favorable terms.

Geographic wealth is dispersing from traditional hubs (London, New York) toward emerging centers (Dubai, Singapore, Mumbai). This capital flow creates opportunities and creates dislocation.

Tax regimes are fragmenting, with some jurisdictions becoming far more favorable than others. Strategic geographic positioning creates material return enhancement.

Regulatory arbitrage opportunities are emerging before they become well-known. The investors who position early—before full market repricing—capture disproportionate value.

These conditions don’t persist indefinitely. Windows of opportunity, by definition, are temporary.

Why Controlled Illiquidity Is the Edge

At its core, the illiquidity premium works because it selects for investor quality.

You can’t accidentally own illiquid real estate the way you can accidentally own a stock (inherited in a family portfolio, forgot you owned it after changing jobs). You have to intentionally decide to access capital differently. This self-selection—people who deliberately accept illiquidity tend to be more thoughtful about capital deployment overall—creates performance differences.

Additionally, illiquidity forces long-term thinking. When you can’t sell instantly, you focus on fundamental value rather than momentum. This orientation—asking “what will this be worth in 5-10 years?” rather than “what might someone pay tomorrow?”—drives superior decision-making.

The market rewards you for this discipline. The 2% illiquidity premium isn’t charity. It’s the market compensating you for doing something difficult: resisting the urge to react to short-term volatility.

Forward View: 2025-2030

The next five years will likely see continued wealth migration toward emerging markets, geographic diversification of ultra-high-net-worth individuals, and acceleration of tax-driven relocation to favorable jurisdictions.

Real estate, specifically luxury real estate in gateway cities, will remain the vehicle of choice for this wealth mobility. Not because it’s the highest returning asset—equities can match or exceed real estate returns. But because it’s the most tangible, the most controllable, and the most integrated with lifestyle decisions.

For investors with the liquidity cushion to handle 2-6 month exit timelines, this moment represents a compelling opportunity to build positions before global wealth allocation fully reprices these geographies.

The Bottom Line

The 2-6 month exit timeline in luxury real estate isn’t a bug waiting to be fixed. It’s the feature that makes wealth building possible for patient capital.

In a world optimized for instant gratification, this friction is your advantage.

The market is rewarding those who understand this. Are you positioned among them?

YouTube Resources

Free resources to download

The Illiquidity Premium in Luxury Real Estate: Executive Summary