Now Reading: India’s Festive Season Sparks Historic Luxury Real Estate Boom: The UHNI Investment Opportunity of 2025

- 01

India’s Festive Season Sparks Historic Luxury Real Estate Boom: The UHNI Investment Opportunity of 2025

India’s Festive Season Sparks Historic Luxury Real Estate Boom: The UHNI Investment Opportunity of 2025

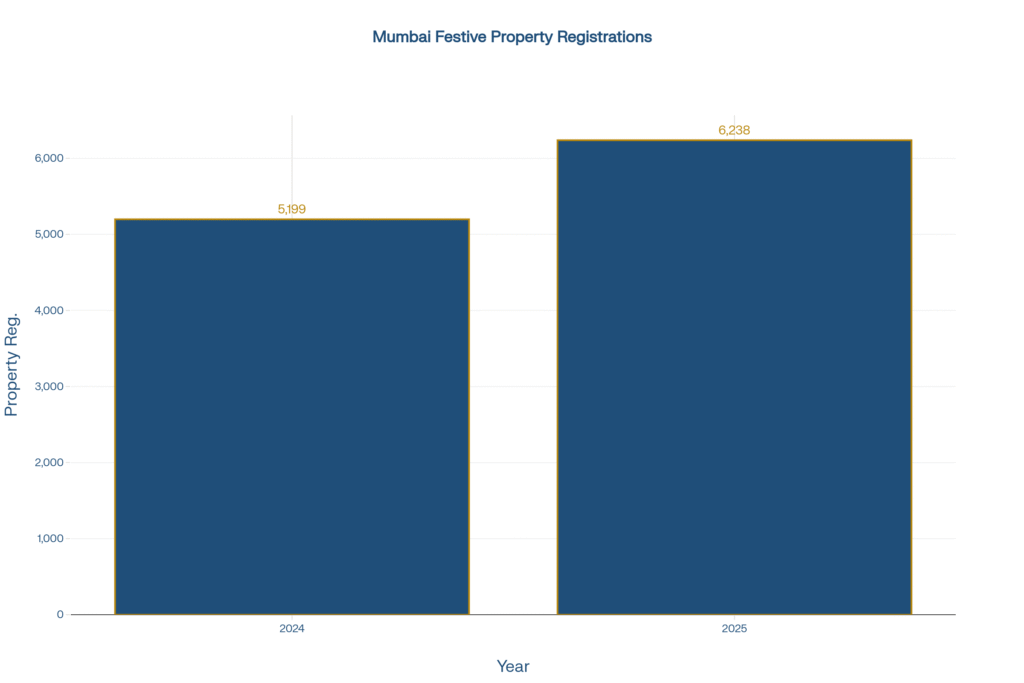

India’s festive season has ignited an extraordinary luxury real estate surge in 2025, with high-net-worth individuals (HNIs) and ultra-high-net-worth individuals (UHNIs) driving an 85% year-on-year spike in premium property sales. Mumbai’s Navratri period alone recorded 6,238 property registrations—a stunning 20% jump from 2024—while record-breaking transactions like DLF Camellias’ ₹190 crore penthouse sale redefine market ceilings. As India’s real estate sector races toward a projected USD 845.7 billion valuation by 2030, the current festive quarter represents a once-in-a-decade convergence of cultural momentum, policy support, and unprecedented HNI wealth expansion. For global investors seeking emerging market exposure with developed-world quality, India’s Diwali season offers immediate incentives and transformational long-term positioning.

Why India’s Festive Season is Real Estate’s Golden Quarter

The Cultural-Financial Convergence Driving Record Sales

India’s festive period—spanning Navratri through Diwali—accounts for an astonishing 25-35% of annual housing sales, a concentration unmatched globally. This isn’t mere seasonal fluctuation; it’s the intersection of millennia-old beliefs about auspicious timing and sophisticated modern investment strategy. When Mumbai’s property registrations surge 20% during a ten-day Navratri period, generating ₹587 crore in state revenue, we’re witnessing what market analysts now call “cultural liquidity events”—moments when traditional sentiment unlocks massive capital deployment.

The 2025 festive season has shattered previous benchmarks. Luxury housing sales (properties above ₹4 crore) exploded 85% year-on-year in H1 2025, with approximately 7,000 units sold across India’s top seven cities. Developers aren’t simply responding to demand—they’re strategically architecting supply to match it, launching 7,300 new luxury units, a 30% increase. This synchronized supply-demand catalyst, amplified by festive promotional offers saving buyers 8-12% through waived stamp duties and complimentary upgrades, creates immediate equity before occupancy.

India vs. The World: A Value Proposition Unlike Any Other

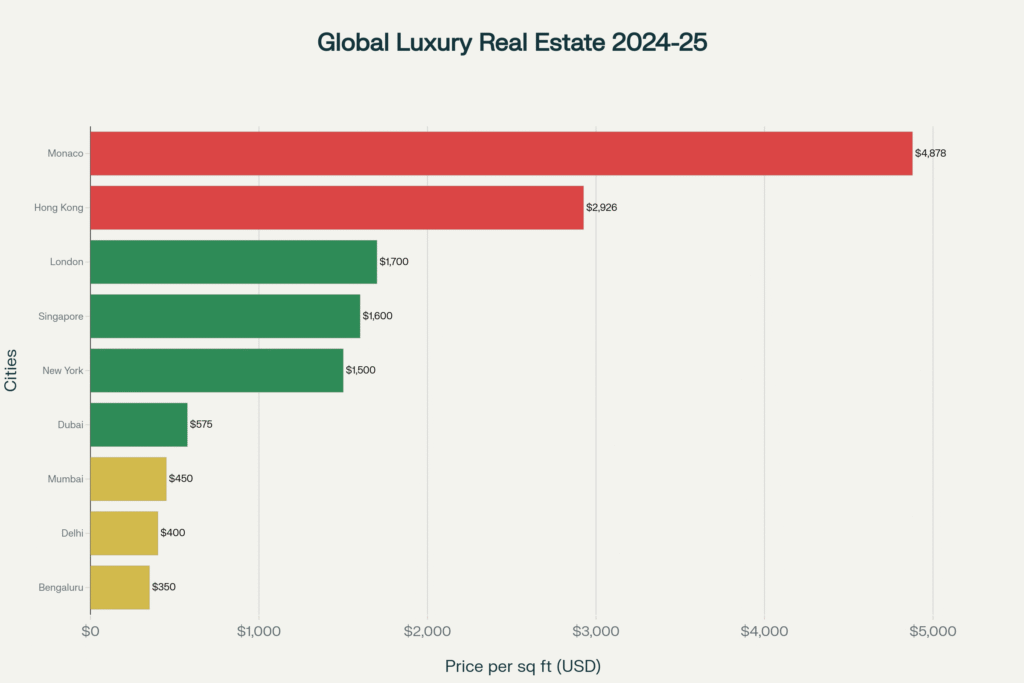

Global benchmarking reveals India’s transformational pricing advantage. Mumbai’s luxury real estate averages $400-500 per square foot, Delhi NCR $350-450, and Bengaluru $300-400—representing 70-85% discounts to London ($1,700/sq ft), Singapore ($1,600/sq ft), and New York ($1,500/sq ft). Yet India delivers superior appreciation: Delhi NCR surged 20-24% annually, Mumbai 6.1%, and Bengaluru 10%—vastly outpacing London’s 4.5% or New York’s 5.2%.

Even Dubai, at $550-600 per square foot with 16.9% price growth, offers closer comparison but derives value primarily from tax arbitrage rather than fundamental economic dynamism. India’s luxury market momentum stems from genuine GDP growth (6.5% projected CAGR through 2030), rapid urbanization (38% urban population target by 2030), and explosive HNI wealth creation. This isn’t speculation—it’s structural transformation.

The Wealth Tsunami: Who’s Buying and Why It Matters

India’s Expanding UHNI Universe

India’s High Net Worth Individual population (USD 10+ million net worth) grew 6% to 85,698 in 2024, with projections reaching 93,758 by 2028. The billionaire count jumped 12% to 191, with combined wealth of USD 950 billion ranking India third globally. Critically, nearly 20% of India’s HNIs are now under 40—a generational shift toward technology-enabled wealth seeking contemporary luxury over inherited estates.

Goldman Sachs forecasts India’s affluent consumer base will explode from 60 million in 2023 to 100 million by 2027—a 67% increase fundamentally broadening the luxury property market. This demographic expansion, combined with Non-Resident Indian (NRI) investments surging to USD 15 billion in 2025 (up 35% from FY24), creates sustained multi-decade demand unlike cyclical Western markets.

The NRI Factor: Currency Advantage Meets Cultural Connection

NRIs are reclaiming roots through real estate, projected to invest USD 22 billion by 2030 as remittances strengthen (India received record USD 135.46 billion in FY25, up 14% year-on-year). The USD-INR exchange rate advantage amplifies purchasing power—a USD 500,000 investment converts to approximately ₹4.15 crore, enabling premium acquisitions that would command significantly lower quality in Dubai or Singapore.

For NRIs in US technology hubs, a Bengaluru 3BHK at ₹2 crore ($237,000) provides 1,800-1,900 square feet—equivalent San Francisco Bay Area space exceeds USD 1.5 million. The Bangalore apartment generates 3-4% rental yield plus 8-10% appreciation (11-14% total returns), versus Bay Area’s 2-3% yield and 3-4% appreciation (7% total), making India investments superior despite distance considerations.

Three Trophy Developments Defining India’s Luxury Evolution

DLF Camellias, Gurugram: Where ₹190 Crore Penthouses Set New Benchmarks

DLF Camellias on Gurugram’s Golf Course Road has become India’s ultra-luxury temple, with December 2024’s ₹190 crore penthouse sale by Info-X Software CEO Rishi Parti establishing the nation’s highest per-square-foot residential pricing. Zomato founder Deepinder Goyal’s 2022 purchase at ₹52.3 crore now values at ₹125-150 crore—more than doubling in three years. British businessman Sukhpal Singh Ahluwalia’s August 2025 acquisition of a first-floor unit for ₹100 crore—pricing typically reserved for penthouses—validates exceptional scarcity value.

The development’s “bare shell” model enables UHNI customization, while amenities replicating 5-star hotel operations (24/7 concierge, spa, infinity pools, private cinema) justify ₹5-7 lakh monthly maintenance fees. Current trading prices of ₹87,800 per square foot and monthly rentals reaching ₹12-16 lakh demonstrate sustained liquidity rare in ultra-luxury markets.

Lodha Altamount, Mumbai: Vertical Estates on Billionaire’s Row

Lodha Altamount’s 43-story postmodern glass tower on Altamount Road—Mumbai’s “Billionaire’s Row”—delivers “villa in the sky” living with one residence per floor. The 2015 record sale at ₹160,000 per square foot remains India’s benchmark. Current 5BHK units starting at ₹55 crore ($6.5-7 million) represent 70-75% discounts to comparable Mayfair or Central Park South properties while delivering equivalent service.

Hadi Teherani’s all-black glass façade maximizes privacy while providing unobstructed Arabian Sea views. The entrance lobby’s authentic Picasso masterpiece and 8th-floor podium amenities (infinity pool, spa, boardroom) signal artistic sophistication beyond material opulence. For globally mobile NRIs evaluating against London, Dubai, and Singapore standards, Altamount offers superior value with Mumbai’s fundamental growth drivers.

Prestige Southern Star, Bengaluru: New Generation Luxury for Tech Wealth

Prestige Group’s March 2025 launch across 42 acres on Begur Road captures India’s millennial luxury shift. The 4,300-apartment development ranges from ₹81.75 lakh (1BHK) to ₹3.2 crore (4BHK), deliberately creating demographic diversity. Approximately 60-65% of buyers are aged 28-40 working in technology—substantially younger than traditional luxury cohorts.

Dedicated home office configurations (3B+3T+Home Office at ₹2.5 crore) address work-from-home permanence, while LEED Silver certification, EV charging infrastructure, and co-working lounges reflect sustainability consciousness marking generational distinction. Two-bedroom units generate 3.3-3.6% gross rental yields—above Bengaluru’s 2.8-3.2% average—with capital appreciation targeting 8-10% as Bangalore Metro’s Yellow Line extension to Electronic City (2026-27 completion) triggers typical 12-18% premiums.

Five Pro Moves for Elite Investors

1. Festive Front-Loading: Capture 11-17% Immediate Equity

India’s property prices historically appreciate 3-5% in January-March as developers reset pricing post-festive closures. Strategic investors should finalize purchases during October-December, capturing festive incentives (waived stamp duties, complimentary upgrades worth 8-12%) while avoiding Q1 price hikes. This timing arbitrage generates 11-17% immediate equity before occupation.

2. Metro Corridor Pre-Positioning: Bank on Infrastructure Catalysts

Properties within 1km of announced-but-not-operational Metro stations consistently appreciate 15-25% upon line commencement. Study Delhi Metro Phase IV, Mumbai Metro Lines 3/6, and Bangalore Metro extensions—purchase 18-24 months before anticipated opening for predictable, time-bound returns independent of broader market cycles.

3. Bare-Shell Customization Premium Play

Acquire bare-shell luxury units at base pricing, invest 15-20% of purchase price in designer interiors by recognized names (Gauri Khan Designs, Sussanne Khan), then capture 35-50% premiums in resale markets. This effectively generates 20-30% returns on interior investments while enabling personalized luxury.

4. NRI Currency Hedge via Rupee-Denominated Assets

NRIs holding concentrated USD/GBP/AED assets should allocate 15-25% of real estate portfolios to rupee-denominated luxury properties. While the rupee depreciates 3-4% annually versus USD, property appreciation of 8-12% generates net 4-8% USD-terms returns plus 3-4% rental yields (7-12% total)—superior to equity/bond emerging market investments with tangible asset downside protection.

5. RERA-First Due Diligence: Eliminate Non-Compliant Projects

All investment consideration must begin with RERA verification through state portals. Non-RERA projects—regardless of developer reputation—expose buyers to unlimited timeline delays without legal recourse. This single filter eliminates 30-40% of market risk before engaging developers.

Navigating the Risks: What Sophisticated Buyers Must Know

The Oversupply Trap in Specific Micro-Markets

While India’s luxury segment demonstrates robust aggregate demand, micro-markets like Gurugram’s Golf Course Extension Road face 2:1 supply-demand imbalances—8,000-10,000 units supply against 4,000-5,000 units annual absorption. Employ quarter-to-sell (QTS) analysis: markets exceeding 8-10 QTS signal saturation warranting caution, while sub-4 QTS indicates healthy supply constraints.

Developer Execution Risk and the 18-24 Month Delay Reality

Indian real estate suffers persistent completion delays averaging 18-24 months beyond promised possession dates. While RERA provides legal recourse, enforcement remains inconsistent. Mitigate through multi-factor developer assessment: evaluate historical on-time delivery rates, current project pipeline scale, financial leverage ratios, and transparent land acquisition methods.

Interest Rate Sensitivity: Stress-Test Your Leverage

India’s luxury market benefited from RBI’s 100 basis point repo rate cuts in 2025, maintaining EMI affordability. However, persistent inflation could force 50-100 basis point reversals. Stress-test purchases assuming 150-200 bps rate increases; maintain loan-to-value ratios under 60% to preserve borrowing capacity for opportunistic acquisitions during corrections.s.

FAQ Section

Why is the festive season crucial for Indian real estate transactions?

The festive season (Navratri-Diwali) represents 25-35% of annual housing sales due to cultural beliefs about auspicious timing converging with developer incentives. Buyers perceive festive purchases as prosperity-aligned, while developers offer waived stamp duties (5-7% savings), zero GST on select inventory, and complimentary upgrades—effectively reducing acquisition costs 8-12% versus off-season purchases.

How do Indian luxury prices compare globally?

Indian luxury properties deliver 70-85% discounts to global peers: Mumbai averages $400-500/sq ft versus London’s $1,700, Singapore’s $1,600, and New York’s $1,500. Yet India delivers superior appreciation—Delhi NCR +20-24% annually, Mumbai +6.1%, Bengaluru +10%—vastly outpacing mature markets’ 3-5% growth. Total returns (appreciation + 3-4% rental yields) favor India materially.

What are the primary investment risks?

Five key risks: (1) Project execution delays (18-24 months average), mitigated through developer track record verification and RERA compliance; (2) Micro-market oversupply, avoided via QTS analysis; (3) Interest rate volatility, managed through conservative 60% LTV ratios; (4) Title complexities, requiring comprehensive legal due diligence; (5) Ultra-luxury liquidity constraints (12-18 month exits), addressed by limiting ultra-luxury allocation to 30-40% of portfolios.

How should NRIs structure purchases for tax optimization?

Utilize NRE accounts funded with foreign-earned income for easier capital repatriation. Hold properties beyond 24 months to qualify for long-term capital gains treatment (12.5% without indexation). Leverage tax treaty provisions—India maintains double-taxation avoidance treaties with 94 countries—to prevent duplicate taxation. Engage cross-border tax advisors to optimize structures before purchase rather than attempting retroactive restructuring.

Seizing India’s Defining Luxury Moment

India’s festive season 2025 transcends traditional real estate cycles—it’s a structural inflection point where cultural tradition, demographic transformation, and economic ascendance converge. The 85% luxury housing surge, 20% festive registration jumps, and ₹190 crore record transactions signal not temporary euphoria but market evolution toward global standards with India-specific advantages.

For UHNI and HNI investors navigating global allocations, India’s festive quarter presents rare timing convergence: entry pricing 70-85% below Western equivalents, appreciation rates 3-5x mature markets, and NRI currency advantages amplifying purchasing power. Strategic positioning in RERA-compliant trophy developments by track-recorded developers (DLF, Lodha, Prestige) during festive incentive periods captures immediate 8-12% cost reductions while securing exposure to India’s USD 845.7 billion real estate trajectory by 2030.

The call-to-action is unambiguous: engage during October-December 2025 through targeted acquisitions in infrastructure-advantaged locations (Metro corridors, airport proximities), leverage construction-linked payments to optimize capital deployment, and structure holdings for tax efficiency. Whether seeking primary residences, rental-yield portfolios, or pure appreciation assets, India’s festive season delivers immediate incentives and generational positioning within Asia’s defining luxury market.

The auspicious timing, financial opportunity, and strategic foresight characterizing India’s festive season makes this not merely another transaction period but a landmark entry window for global capital. The momentum is here. The data is compelling. The opportunity is now.