Now Reading: Luxury Residences with Concierge Services: The New Benchmark of Lifestyle

- 01

Luxury Residences with Concierge Services: The New Benchmark of Lifestyle

Luxury Residences with Concierge Services: The New Benchmark of Lifestyle

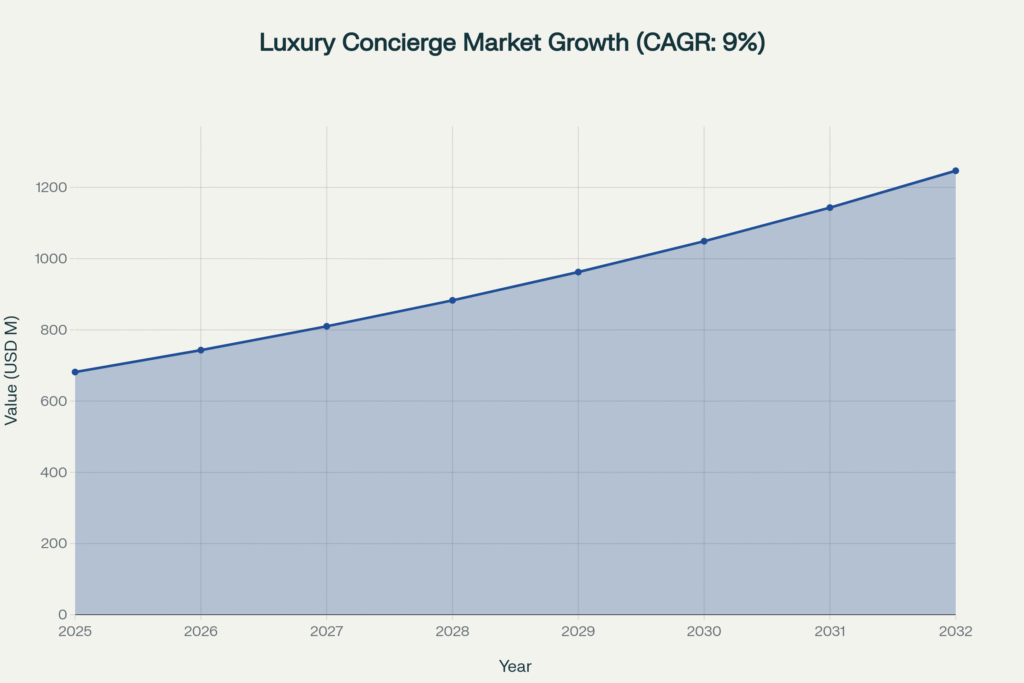

The global luxury residential landscape is witnessing an unprecedented transformation as Ultra High Net-Worth Individuals (UHNIs) and High Net-Worth Individuals (HNIs) increasingly gravitate toward branded residences with comprehensive concierge services—a paradigm shift that transcends traditional real estate investment and enters the realm of curated lifestyle architecture. With the global luxury concierge service market projected to surge from USD 681.6 million in 2025 to USD 1,246.9 million by 2032 at a compound annual growth rate (CAGR) of 9.0%, this segment represents far more than opulent addresses; it embodies a strategic convergence of hospitality excellence, capital appreciation, and generational wealth preservation.

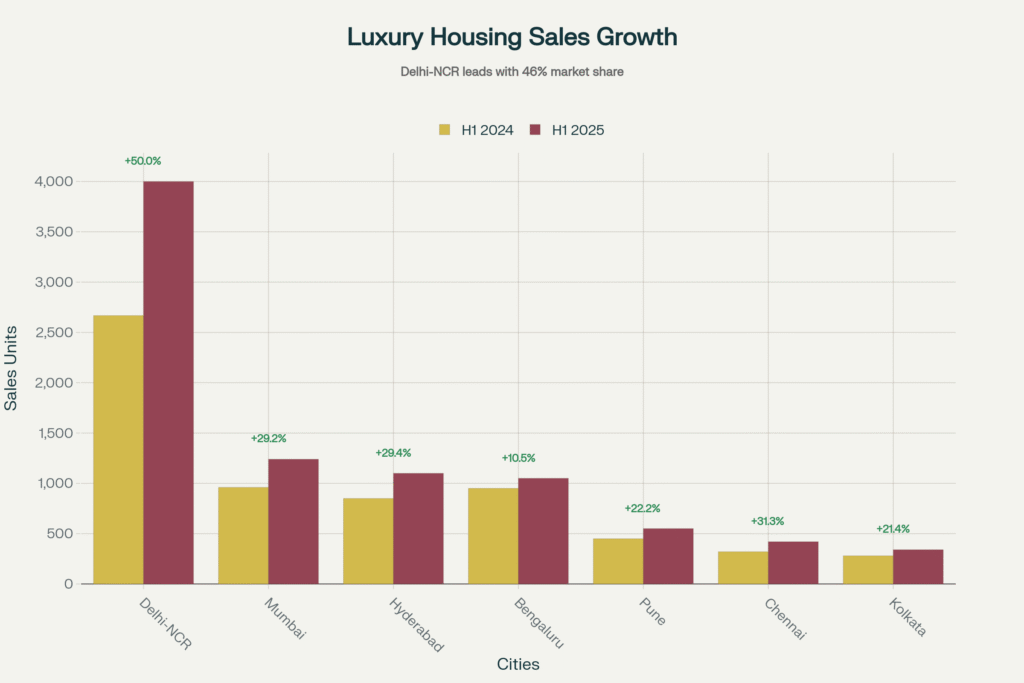

India stands at the epicenter of this revolution. The nation’s UHNI population—individuals with net worth exceeding USD 30 million—has expanded to 14,883 in 2025 and is projected to reach 19,908 by 2028, representing a staggering 39% growth trajectory. This wealth explosion, coupled with luxury housing sales surging 85% year-over-year in H1 2025 across India’s top seven cities, has created unprecedented demand for properties that deliver not merely square footage, but holistic lifestyle ecosystems where world-class service infrastructure meets architectural distinction.

The value proposition is compelling: branded residences command 30-35% price premiums over comparable non-branded luxury properties, yet deliver superior annual appreciation rates of 12% versus 7% for traditional luxury apartments, alongside higher rental yields of 5.5% compared to 4.0%—metrics that underscore why discerning investors are recalibrating their portfolios toward this asset class.

Market Intelligence: Data-Rich Analysis

Global Concierge Service Market Trajectory

North America currently dominates with 42.2% market share, while Asia Pacific emerges as the fastest-growing region at 11.2% CAGR through 2032, driven predominantly by India, China, and Southeast Asian wealth creation. The Middle East & Africa projects the highest growth rate at 12.5% CAGR, led by Dubai’s branded residence proliferation with 132 projects housing 43,000+ units.

India’s Luxury Housing Explosion

Delhi-NCR commands 46% market share with 4,000 luxury unit sales (a 50% YoY surge), followed by Mumbai at 1,240 units (+29% YoY). This growth is underpinned by India’s HNWI segment expanding from 798,000 in 2023 to 1 million+ in 2025, with Goldman Sachs projecting 100 million affluent consumers by 2027.

Case Studies: Emblematic Projects

Case Study 1: Four Seasons Private Residences Mumbai

Project Overview: One of the world’s tallest branded residential towers at 64 floors housing only 41 residences, developed in partnership with Provenance Land.

Design Pedigree:

- Architecture: Gensler (Shanghai Tower designers)

- Interiors: Yabu Pushelberg (New York-based global Four Seasons specialists)

- Landscape: P Landscape (Bangkok-based tropical luxury experts)

Unit Configuration:

- 3-bedroom full-floor residences: 3,200-3,400 sq.ft.

- 5-6 bedroom duplexes: 5,000-6,500 sq.ft.

- Vastu-compliant design for Indian cultural preferences

Concierge & Amenities:

Four Seasons operates the property with a dedicated Director of Residences. Services include in-residence dining, housekeeping, access to Four Seasons Hotel spa/fitness, Residents’ Club with media room, elevated pool with cascading water, meditation garden, rooftop lounge on 65th floor, and over 1 acre of landscaped greenery.

Sales Performance: 80% sold pre-completion—remarkable in India’s luxury market. Buyer profile: 40% NRIs, 35% domestic UHNIs, 25% corporate executives.

Investment Validation: Buyers at ₹60-70 crore can expect 12-15% annual appreciation with rental potential of ₹8-12 lakh monthly (6-7% gross yield).

Case Study 2: Ritz-Carlton Pune—Redefining Tier-1 Expectations

Airport Road location provides connectivity to Pune International Airport (15 minutes), corporate tech parks, and Poona Club Golf Course views. The 198-room hotel offers serviced residences with Level 18 Club Lounge, Wellness Floor spa, rooftop dining (Aasmana, Ukiyo), and 24/7 concierge including drop-off limousine service.

Market Impact: Properties within 1km experienced 18-22% appreciation since 2019 opening, outpacing Pune’s 10-12% CAGR. Branded residences now command ₹15,000-20,000 per sq.ft. versus ₹8,000-12,000 non-branded.

Buyer Profile: 55% NRI (USA tech executives with Pune connections), 30% corporate relocations, 15% local entrepreneurs.

Case Study 3: Dubai’s Bulgari Resort & Residences—Global Benchmark

Private Jumeirah Bay Island location with estimated 165 residences. Bulgari design DNA features black marble, gold accents, Italian travertine. Concierge includes private beach, yacht berthing, on-property Bulgari boutique, Michelin dining, and spa treatments.

Price Premium: At AED 10,668 per sq.ft., Bulgari commands 86% premium over Dubai’s luxury baseline. Properties resell within 90 days average—exceptional liquidity for ultra-luxury segment.

Strategic Lesson: Price premium sustainability requires multi-dimensional differentiation: location scarcity + authentic brand heritage + service excellence + design distinction.

Tips & Insights

Pro Tip 1: Shadow Market Entry

Engage Tier-1 brokers (India Sotheby’s, Knight Frank Private Office) who receive pre-launch allocations. Shadow market entry offers 5-10% pricing advantage plus best unit selection.

Pro Tip 2: Multi-Currency Portfolio Diversification

Structure branded residence portfolio across currencies: India (INR), Dubai (USD-pegged), London (GBP), Singapore (SGD). Real estate provides natural currency hedge with lifestyle utility.

Pro Tip 3: Concierge API Arbitrage

Layer external memberships (Quintessentially ₹5-8 lakh annually) onto property concierge for exponential capability expansion via API integration.

Pro Tip 4: Hybrid Usage Tax Classification

Designate self-occupied (years 1-2 for ₹2 lakh interest deduction), then rented (years 3-5 for unlimited deduction), reverting to self-occupied pre-sale for Section 54 exemption. Cumulative 5-year savings: ₹1.9-2.1 crore on ₹50 crore property.

Pro Tip 5: Club Rights Portability

Negotiate lifetime club membership independent of ownership during purchase. Developer concession worth ₹1.5-2.4 crore present value over 30 years.

Risks & Mitigation Strategies

Market Risks

Oversupply Risk: Mumbai’s unsold luxury inventory rose 36% YoY, but branded residences demonstrate 80%+ pre-sales. Focus on brand-authentic, service-operational properties.

Economic Downturn: Maintain 30-40% portfolio liquidity to weather downturns without distress-selling.

Regulatory Shifts: Wealth tax reintroduction, LTCG increases possible. Structure through tax-efficient vehicles and diversify geographies.

Operational Risks

Service Degradation: Verify brand has operational control with termination rights if standards fall. Request annual audit results.

Brand Termination: Purchase contracts should include developer compensation (10-20% of price) or buyback rights.

FAQ Section

What is the average price premium for branded residences vs. traditional luxury apartments in India?

Branded residences command 30-35% price premiums over comparable non-branded luxury properties. Four Seasons Mumbai trades at ₹75,000+ per sq.ft. versus ₹50,000-60,000 for traditional Worli luxury, justified by hotel-standard concierge, global brand equity, and faster resale liquidity (3 months vs. 5-6 months).

How much does concierge service cost in luxury branded residences?

Concierge services are typically included in monthly maintenance fees ranging ₹2-4 lakh monthly (₹24-48 lakh annually) for properties valued at ₹40-80 crore. This covers 24/7 access, maintenance, housekeeping, and basic lifestyle services.

Are branded residences a good investment for NRIs?

Yes, particularly attractive due to: (1) Hassle-free ownership with zero operational involvement; (2) Currency advantage—USD/GBP strength creates 20-25% purchasing power benefit; (3) RERA compliance ensures transparent repatriation; (4) Superior returns—12% appreciation + 5-6% yields outperform traditional 7% + 3-4%.

What is the projected growth rate for luxury concierge services globally?

Conclusion

As we navigate this decade, the luxury residential landscape increasingly bifurcates into properties with comprehensive concierge infrastructure and those without—a divide manifesting not merely in pricing premiums but in fundamental liquidity, portfolio performance, and generational wealth preservation outcomes.

India’s UHNI population growing 39% through 2028, luxury housing sales surging 85% YoY, and branded residence market expanding to 1,000+ schemes by 2030 constitute structural market evolution. For discerning investors, this moment represents mature investment thesis (proven appreciation, yields, liquidity) intersecting with early-stage market penetration (India at 4% global supply despite top-6 ranking).

The question confronting India’s HNI and UHNI community is no longer WHETHER to incorporate luxury residences with concierge services into portfolios, but HOW to structure allocations, WHICH brands to prioritize, and WHEN to deploy capital to optimize for both financial returns and lifestyle elevation.

The benchmark has shifted. Will your portfolio shift with it?

YouTube Learning Resources

Free resources to download

Luxury Residences with Concierge Services: Executive Summary