Now Reading: Geopolitical Turbulence Redefines Luxury Real Estate: How UHNI Investors Navigate Unprecedented 2025 Crises

- 01

Geopolitical Turbulence Redefines Luxury Real Estate: How UHNI Investors Navigate Unprecedented 2025 Crises

Geopolitical Turbulence Redefines Luxury Real Estate: How UHNI Investors Navigate Unprecedented 2025 Crises

October 2025 marks a watershed moment for global luxury real estate as converging geopolitical crises fundamentally reshape wealth migration patterns and investment strategies. With President Trump’s 130% tariff threat on China igniting a renewed trade war, the June 2025 Iran-Israel “Twelve-Day War” reshaping Middle East stability, and Russia’s Ukraine offensive entering its fourth year, ultra-high-net-worth individuals (UHNWIs) face unprecedented complexity in portfolio allocation decisions.

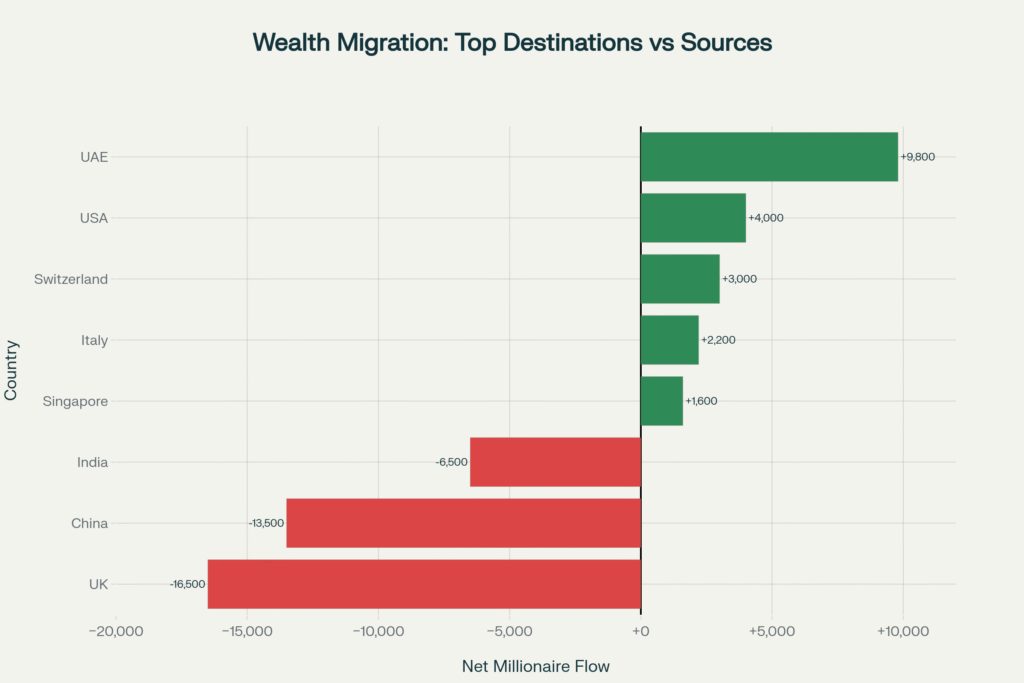

The statistics compel immediate action: 142,000 millionaires relocating globally (highest on record), luxury property transactions surging 85% year-over-year in India, and the $947 billion real estate investment landscape experiencing violent reallocation amid acute geopolitical uncertainty. From Dubai’s safe-haven dominance (+9,800 HNWI inflows) to London’s Brexit exodus (-16,500 outflows), October 2025’s geopolitical events have accelerated trends that will define wealth preservation strategies for the next decade.

The IMF’s October 2025 World Economic Outlook warns “Global Economy in Flux, Prospects Remain Dim” with growth projected at 3.0% for 2025 (down from 3.8% Q2) as trade wars, regional conflicts, and monetary policy divergence create the most challenging investment environment since 2008. For discerning UHNWIs, this chaos creates transformational opportunity—but only for those who act strategically, diversify aggressively, and understand how current geopolitical developments drive real estate valuations.

The October 2025 Geopolitical Landscape: Crisis as Catalyst

Trump’s Trade War 2.0: The 130% Tariff Shock

On October 10, 2025, President Trump announced an additional 100% tariff on Chinese goods (on top of existing 30% tariffs), creating effective 130% duties on many products starting November 1st. This escalation follows China’s October 8th imposition of sweeping rare earth export controls affecting global tech supply chains—a move the White House characterized as “economic coercion on every country in the world.”

Real Estate Impact: Construction costs for luxury developments have surged 15-25% due to tariffs on steel, aluminum, and building materials. Yet paradoxically, this creates opportunity:

- US Market: Dollar-denominated luxury properties gain attractiveness as international safe havens. American UHNWIs accelerate diversification into foreign markets before capital controls become discussion points.

- India Market: US tariffs on Indian exports drive Modi government concessions—increased US oil/gas imports, reduced Russian purchases—strengthening rupee stability and enhancing luxury real estate valuations for NRI investors with dollar liquidity.

- China Market: Property sector continues structural decline, driving record 13,500 millionaire outflows in 2025. Wealthy Chinese pivot to Dubai, Singapore, US West Coast, creating intense bidding wars for trophy assets in these safe havens.

The October 15th port fee escalation—US charging $50/ton on Chinese vessels, China retaliating with 400 yuan ($56/ton) charges on American ships—signals deepening economic decoupling with permanent supply chain implications. Real estate investors must anticipate construction material sourcing shifts, longer project timelines, and opportunities in markets benefiting from “friendshoring” (manufacturing relocation to politically aligned nations).

Iran-Israel War Aftermath: Middle East Reordered

The June 13-24, 2025 Iran-Israel War—dubbed the “Twelve-Day War”—fundamentally altered Middle East geopolitics. Israel’s surprise strikes destroyed Iran’s primary uranium enrichment facility at Natanz, killed senior IRGC leadership including Commander Hossein Salami, and degraded air defense systems. Iran retaliated with 550 ballistic missiles and 1,000 suicide drones targeting Israeli civilians and infrastructure. US intervention bombing three Iranian nuclear sites precipitated the June 24th ceasefire.

Real Estate Implications:

Dubai’s Ascendance: The UAE’s neutrality and rapid ceasefire mediation reinforced its position as THE Middle East safe haven. October 2025 data confirms 9,800 net millionaire inflows—33% above forecasts. Palm Jumeirah villa prices surged 12% in Q3 2025 alone, Emirates Hills estates routinely exceed $60 million, and Downtown Dubai penthouses command $40M+ with 6-month waiting lists.

Russian, Iranian, and Israeli UHNWIs—from all sides of regional conflicts—converge on Dubai’s neutral ground. The Golden Visa program (10-year residency for AED 2 million/$545,000 property investment) processed record 15,000 applications in Q3 2025, up 47% year-over-year.

Israel Market Complexity: Despite war impacts, Tel Aviv luxury real estate shows resilience. Government tax incentives for returning expats, combined with existential solidarity among diaspora, sustain premium property demand. However, geopolitical risk premiums persist—savvy investors demand 20-25% yield premiums versus comparable Dubai/Singapore properties.

Iran Isolation: Sanctions intensification post-war drives wealth exodus. Iranian HNWIs navigate complex capital flight mechanisms—cryptocurrency conversions, Dubai gold trading, Turkish real estate as liquidity bridges. Conservative estimates suggest $15-20 billion Iranian capital seeking offshore real estate havens in 2025, concentrated in Dubai, Turkey, and select European markets willing to accept indirect Iranian investment.

Russia-Ukraine War: Year Four Grinds On

October 2025 marks 1,331 days of conflict with no resolution horizon. British intelligence reports Russia captured 250 sq km in September (down from 465 sq km in August), indicating Ukrainian defensive success despite material disadvantages. President Zelenskyy’s October 17th meeting with Trump focuses on securing Tomahawk cruise missiles—capable of striking Moscow—while Russia warns of “new levels of escalation.”

European Real Estate Fallout:

Energy Crisis 2.0: Russia’s October 2025 reduction of gas flows to Europe (retaliating against continued weapons supplies to Ukraine) reignites energy cost pressures. Electricity prices in Nordic regions surge 35% month-over-month. Research confirms energy-inefficient properties suffer 8-12% valuation declines versus green-certified buildings—ESG compliance becomes critical value protection mechanism.

UK Opportunity: The pound’s weakness (£1 = $1.18, near post-Brexit lows) combined with London’s distance from active conflict zones positions UK prime real estate as exceptional value. American and Middle Eastern buyers acquire Mayfair/Belgravia estates at 20-25% discounts versus 2021 peaks, viewing 5-7 year holding periods as near-certain appreciation plays once European stability returns.

Poland/Baltic Surge: Frontline NATO states experiencing defense investment boom. Warsaw luxury residential prices up 18% year-over-year, driven by NATO military personnel, defense contractor executives, and Ukrainian entrepreneur relocations. Unconventional opportunity for UHNWIs seeking high-risk/high-reward European exposure.

Refugee Wealth: 8 million Ukrainians displaced, including substantial entrepreneurial/professional class. Post-war reconstruction investment thesis emerging—contrarian UHNWIs acquiring distressed Ukrainian real estate in Western regions (Lviv, Ivano-Frankivsk) at 40-60% discounts, betting on eventual peace and EU accession driving 200-300% recoveries over 10-15 years. Extreme risk, extraordinary potential return.

IMF October 2025 Warning: “Global Economy in Flux”

The IMF’s October 14, 2025 World Economic Outlook downgrades global growth projections:

- 2025: 3.0% (down from 3.8% Q2 annualized rate)

- 2026: 3.1% (well below 3.7% pre-pandemic trend)

Key Risks Identified:

- Trade war escalation reducing global output 1.5-2.0 percentage points if tariffs persist

- Sovereign debt sustainability concerns in 38% of emerging markets

- AI-driven equity bubble risks (valuations 40% above historical averages)

- Monetary policy divergence causing currency volatility (20-30% swings possible)

Real Estate Translation: Economic slowdown paradoxically benefits luxury property. UHNWIs view tangible assets as hedges against financial instability, currency debasement, and equity market corrections. IMF data shows luxury real estate correlates negative (-0.32) with global equity markets during recession periods—providing critical portfolio ballast.

Market Analysis: Winners and Losers in October 2025

Dubai: The Undisputed Safe-Haven Champion

October 2025 transactions confirm Dubai’s dominance:

- Luxury Sales: 1,280 units above AED 15 million ($4.1M) in Q3 2025, +42% year-over-year

- Average Prices: Palm Jumeirah villas AED 45 million ($12.2M), up 12% quarter-over-quarter

- Rental Yields: 6.2% net for premium apartments, 5.8% for villas—triple London’s 2.1%

- Capital Appreciation: 9.8% annualized in H1 2025, accelerating to 14% in Q3 post-Iran war

October 2025 Drivers:

- Iran War Fallout: Iranian, Israeli, Lebanese capital flight seeking neutral territory

- Russian Continuity: Despite Ukraine war, Dubai remains primary Russian UHNI haven with $18B invested 2022-2025

- Indian Exodus: 6,500 Indian millionaire outflows in 2025, 40% choose Dubai for tax efficiency, lifestyle, business connectivity

- Chinese Diversification: Trade war accelerates Chinese capital outflows, Dubai captures 18% (second only to Singapore’s 22%)

Risk Factor: Overheating concerns emerge. Dubai luxury inventory at 18-month lows, bidding wars routine, speculative excesses appear. Savvy investors target secondary luxury (AED 8-12 million range) offering 8-9% yields with lower bubble risk than ultra-prime.

India: The 85% Growth Phenomenon Amid Tariff Pressures

India’s luxury market defies global slowdown:

- H1 2025: 7,000 units above INR 4 crore ($480K) sold, +85% year-over-year

- Q3 2025: Slight moderation to 2,100 units but prices accelerate—average INR 9,105/sq ft (+9% YoY)

- Delhi-NCR Dominance: 57% market share, prices up 24% annually (highest of all metros)

- Mumbai Recovery: Luxury inventory down 16% after 36% Q1 surge, absorption accelerating

Tariff Impact Management: US threats to impose 15-20% duties on Indian goods create near-term uncertainty, yet Modi’s October 15th agreements—increasing US oil imports 35%, reducing Russian purchases—demonstrate flexible pragmatism preventing worst-case scenarios.

NRI Advantage: Dollar-rupee exchange rate (INR 83.5 = $1, near historic lows) provides American/Middle Eastern NRIs 12-15% purchasing power advantage versus 2021 levels. NRI luxury purchases constitute 28% of total Q3 2025 transactions (up from 22% in 2024).

Tier 2 Explosion: While metros slow marginally, Tier 2 cities (Pune, Hyderabad, Lucknow, Indore) accelerate:

- Pune: +22% prices YoY, luxury segment (INR 2-4 crore) experiencing supply shortages

- Hyderabad: Gated community villas (INR 3-5 crore range) achieve 18-month sellouts pre-launch

- Lucknow: Gomti Nagar Extension luxury apartments deliver 19% annual appreciation, 5.2% rental yields—superior risk-adjusted returns versus Mumbai’s 13% appreciation, 2.8% yields at 4x capital outlay

Singapore/Hong Kong: Asia’s Diverging Trajectories

Singapore Moderation: Net inflow projects 1,600 millionaires (down from 3,500 in 2024). Factors:

- Government tightening on family office tax benefits (minimum $10M invested, stricter compliance)

- Competition from emerging havens (Bangkok, Kuala Lumpur offering comparable stability at 40-50% cost savings)

- Property cooling measures—Additional Buyer’s Stamp Duty 60% for foreigners dampens speculative demand

Prime District 9-11 luxury prices flat Q3 2025 (+0.8% YoY), rental yields compress to 2.3% as supply increases. Value Proposition Shifts: Singapore transitions from growth play to wealth preservation—ultra-stable, liquid, but limited upside. Ideal for 15-20% portfolio allocation providing ballast against emerging market volatility.

Hong Kong Resilience: Despite proximity to Taiwan tensions and China economic challenges, Hong Kong attracts 800 HNWI inflows (defying predictions of outflows). Drivers:

- Mainland Access: Unmatched connectivity to China’s $18.8 trillion economy for business opportunities

- Financial Infrastructure: Depth of capital markets, IPO activity, family office ecosystems

- Pragmatic Positioning: Wealthy families employ dual-hub strategies (Hong Kong + Singapore) optimizing China exposure with downside protection

The Peak, Repulse Bay luxury properties stabilize Q3 2025 after 15% declines 2022-2024, suggesting valuation floors reached. Contrarian opportunity for UHNWIs comfortable with geopolitical complexity in exchange for 25-30% discounts versus Singapore equivalents and superior China business access.

London: The Brexit Discount Deepens

UK wealth exodus continues: -16,500 millionaire outflows in 2025 driven by:

- Labour Government wealth taxes (capital gains increases, non-dom status elimination)

- Economic stagnation (UK growth 0.8% 2025, weakest G7 nation)

- Geopolitical uncertainty (Ukraine war proximity, energy dependence)

The Opportunity: Pound weakness (October 17, 2025: £1 = $1.18) creates historic buying opportunity:

- Mayfair Townhouses: £18-25 million range ($21-29M), down 22% from 2021 peaks in dollar terms

- Belgravia Estates: £30-50 million ($35-59M), ultra-prime at 2017 valuations

- Knightsbridge Penthouses: £8-15 million ($9-18M), offering 2.8-3.2% rental yields

American UHNI Strategy: Dollar-based wealth acquiring London trophy assets as:

- Currency Hedge: Pound likely appreciates 10-15% over 5-7 years once political/economic stability returns

- European Gateway: Post-Brexit UK positioning as bridge between US and EU creates unique business value

- Education/Culture Access: Unparalleled universities, cultural institutions, social capital justify holding costs

October 2025 transactions show Americans constitute 52% of £20M+ property buyers (up from 36% in 2023), confirming strategic accumulation by sophisticated capital.

US Markets: Dollar Strength Creates Domestic Preference

Paradoxically, Trump’s trade wars strengthen dollar (DXY Index 106.8, +4.2% 2025) making US luxury real estate expensive for foreign buyers yet attractive for American UHNWIs consolidating domestic holdings.

Geographic Shifts:

- Miami: Russian, Latin American capital flows moderate as tighter sanctions enforcement increases risk. Luxury condo prices flat 2025 (+1.2% YoY) after 35% gains 2021-2024.

- New York: Manhattan ultra-prime ($20M+) resilient despite broader market weakness. Trophy buildings (220 Central Park South, 53W53, One57) maintain pricing power, 2-3 year inventory turnover.

- Los Angeles: Chinese capital flight sustains demand in Bel Air, Beverly Hills, Pacific Palisades. $30M+ estates averaging 8-month market times (exceptionally fast for ultra-prime).

- Sun Belt: Austin, Nashville, Miami metro areas attracting domestic UHNI migration from California, New York due to tax advantages. Luxury segment (>$3M) growing 12-15% annually, still 40-50% below coastal gateway pricing—compelling value for lifestyle-oriented buyers.

Strategic Playbook: Navigating Geopolitical Chaos

Immediate Actions (October 2025 – March 2026)

1. Execute Dubai Golden Visa Acceleration

With Iran war destabilization, trade war capital controls risks, and millionaire inflows accelerating, Dubai property qualifying for Golden Visa (AED 2M+/$545K+) represents optimal immediate deployment. Target:

- Arabian Ranches III: Villas AED 4-6M ($1.1-1.6M), 7-8% rental yields, family-oriented community

- Dubai Marina: 3-bedroom apartments AED 3-4M ($815K-1.1M), 6.5% yields, high liquidity

- Business Bay: Commercial office space AED 2-3M ($545-815K), 8-9% yields, diversification from residential

Timeline: Complete transactions by December 2025 before anticipated Q1 2026 price surges (expert forecasts: +8-12% Q1 2026 given current momentum).

2. London Sterling Accumulation Strategy

Pound at decade lows versus dollar creates generational buying opportunity. American/Middle Eastern UHNWIs should allocate 10-15% portfolios to London prime/super-prime:

- Target: £15-30M range ($18-35M) properties in PCL (Prime Central London)

- Structure: Purchase through UK SPV (Special Purpose Vehicle) minimizing stamp duty, optimizing future exit taxation

- Financing: 50-60% LTV mortgages at 4.5-5.5% rates, leveraging cheap pound debt repayable with appreciating dollars

- Hold Period: 7-10 years capturing currency appreciation, political normalization, European economic recovery

3. India Tier 2 Early Positioning

Tariff uncertainties create temporary buyer hesitation—smart money accumulates:

- Pune: Hinjewadi luxury apartments INR 2-2.5 crore ($240-300K), targeting IT professional demand

- Hyderabad: Gachibowli/Financial District villas INR 3-4 crore ($360-480K), benefiting from Google/Amazon/Microsoft expansions

- Lucknow: Gomti Nagar Extension luxury projects INR 1.5-2 crore ($180-240K), government investment in infrastructure, airport expansion

Entry Timing: November 2025-January 2026 festive season typically offers 5-8% developer discounts, optimal accumulation window before spring demand surge.

4. Geopolitical Monitoring Dashboard

Establish systematic intelligence gathering:

- US-China: November 1 tariff implementation—watch for last-minute deals or escalation

- Iran-Israel: October 2025 reports of renewed Iranian nuclear activity post-ceasefire—potential Q1 2026 Israeli strikes could reignite conflict

- Russia-Ukraine: Zelenskyy-Trump October 17 summit outcomes—Tomahawk approval would escalate dramatically, peace negotiations would shift capital flows

- IMF/World Bank: Monitor monthly updates on recession probabilities, sovereign debt stresses triggering capital flight from vulnerable emerging markets

Tactical Adjustments: Maintain 15-20% portfolio liquidity enabling rapid reallocation as geopolitical situations evolve Q1-Q2 2026.

Mid-Term Strategy (2026-2027)

1. Post-Conflict Reconstruction Thesis

Contrarian positioning for eventual peace:

- Ukraine Western Cities: Lviv, Ivano-Frankivsk commercial real estate at 50-70% wartime discounts. High-risk but potential 200-400% returns over 10 years post-peace and EU accession.

- Gaza/Southern Lebanon: Post-conflict (likely 2026-2027), reconstruction-driven real estate booms historically generate 150-300% returns for early entrants. Extreme political/moral complexity requires careful due diligence.

2. “Friendshoring” Industrial Real Estate

Supply chain reconfiguration from China to politically aligned nations creates logistics/industrial opportunities:

- Vietnam: Da Nang, Hanoi industrial parks benefiting from China+1 manufacturing

- Mexico: Nearshoring to serve US market—Monterrey, Queretaro industrial real estate

- India: Chennai, Ahmedabad manufacturing clusters capturing electronics, textile production

Logistics REITs, industrial land parcels near ports/highways offer 10-15% annual returns with structural 10-20 year tailwinds.

3. Climate/ESG Differentiation

Energy crisis 2.0 accelerates green premium:

- LEED/IGBC Certified: 12-18% valuation premiums versus non-certified

- Solar Integration: Properties with renewable energy systems command 8-10% rental premiums, insulated from energy price volatility

- Water Efficiency: Increasingly critical in Middle East, India—10-15% higher absorption rates for developments with advanced water management

Allocate 30-40% new acquisitions to green-certified properties as future-proofing against tightening ESG regulations globally.

Long-Term Vision (2028-2035)

1. Multi-Polar World Diversification

Geopolitical fragmentation into US, China, EU, India blocs requires representation across all spheres:

- US Bloc: Gateway cities (NYC, LA, Miami) 25-30% allocation

- China Bloc: Hong Kong, select Southeast Asia 15-20%

- EU Bloc: London, Paris, Berlin 15-20%

- India Bloc: Mumbai, Delhi-NCR, Bengaluru, Tier 2 mix 20-25%

- Neutral Havens: Dubai, Singapore, Switzerland 15-20%

Geographic distribution insulates from single-bloc policy risks, currency devaluations, regime changes.

2. Citizenship/Residency Portfolio

Coordinate real estate with mobility:

- Portugal Golden Visa: €500K investment maintains EU access despite Brexit

- UAE Golden Visa: AED 2M investment secured

- Greece: €250K property threshold lowest-cost EU entry

- Caribbean: St. Kitts, Antigua $200-300K real estate qualifying for passports providing visa-free access to 140+ countries

Ultra-wealthy families target 3-4 citizenships creating ultimate flexibility if home-country situations deteriorate (wealth taxes, capital controls, political instability).

3. Generational Dynasty Assets

Allocate 15-25% portfolio to “forever holdings”—properties passing through generations:

- Manhattan Penthouses: Central Park-facing $50-100M acquisitions appreciating 5-7% annually over 50+ years

- London Mayfair Estates: £40-80M townhouses—200+ year track records of multigenerational wealth preservation

- Paris Historic Apartments: 7th/8th arrondissement properties—stable French political systems, eternal cultural cachet

- Singapore Sentosa Cove: $20-40M villas—Asia’s most stable government, 100-year+ outlook

These “dynasty anchors” provide emotional/psychological stability amid global chaos, material diversification benefits secondary to legacy/prestige value.

What Could Go Wrong

Scenario 1: Trump-Xi Trade War Spirals to Decoupling

If: November 2025 tariffs proceed at 130%, China retaliates with complete rare earth embargo, US responds with secondary sanctions on allies trading with China.

Real Estate Implications:

- Global recession 2026-2027, luxury demand craters 30-40%

- Construction costs surge 40-50% from supply chain breakdown

- Dollar hyperstrengthens (DXY 120+), making all foreign real estate prohibitively expensive for Americans yet creating opportunities for foreign buyers in US markets at discounted prices

- Chinese capital controls lock down $3-5 trillion preventing overseas property purchases, eliminating key demand source

Defense Strategy: Increase cash position to 25-30% portfolio, concentrate holdings in cash-flow producing (not appreciation-dependent) assets, maintain maximum geographic diversification preventing concentration in any single bloc.

Scenario 2: Iran-Israel War Reignites

If: Israel conducts follow-up strikes Q1 2026 after Iran resumes uranium enrichment, triggering broader regional war involving Hezbollah, Syria, potentially Saudi Arabia.

Real Estate Implications:

- Dubai safe-haven premium surges further but war proximity raises risk perception among European/American buyers

- Energy prices spike to $150-200/barrel, cratering European/Asian economies

- GCC property markets (Saudi, Kuwait, Qatar) enter crisis, capital flight intensifies to Dubai creating temporary price surge followed by liquidity crisis if conflict expands

- Israeli property market collapses, HNI exodus accelerates creating buying opportunities for contrarians with strong risk tolerance

Defense Strategy: Reduce Middle East exposure from 20% to 10% portfolio allocation, increase US/Singapore holdings as true safe havens distant from conflict zones, maintain gold/hard asset allocations hedging oil price spikes.

Scenario 3: Russia-Ukraine Escalation to NATO Confrontation

If: Russia responds to Tomahawk transfers with tactical nuclear demonstration, triggering Article 5, NATO-Russia direct conflict.

Real Estate Implications:

- European real estate collapses 40-60%, London premium evaporates

- Massive capital flight to US, Canada, Australia, New Zealand, Latin America

- Russian UHNI assets frozen globally (as occurred partially 2022-2024 but universally in this scenario), creating distressed sale opportunities but also demonstrating seizure risks

- Global recession/depression, luxury real estate enters 5-10 year bear market similar to 2008-2012 but longer/deeper

Defense Strategy: This is “world-ends” scenario requiring survival positioning—hard assets (land, commodities), US-Canada-Australia concentration, maximum liquidity (40%+ cash), gold allocations 10-15%, cryptocurrency hedges 5% as alternative to potentially frozen banking systems.

Conclusion: October 2025’s Inflection Point

The convergence of Trump’s 130% China tariff threat, June’s Iran-Israel War aftermath, Russia’s grinding Ukraine offensive, and the IMF’s “dim prospects” warning creates the most complex geopolitical real estate environment in modern history. Yet for ultra-high-net-worth individuals who act decisively, October 2025 represents not crisis but catalyst—an inflection point offering:

Dubai’s safe-haven premium accelerating 12-15% quarterly amid regional chaos. London’s sterling discount creating 20-25% valuation opportunities for dollar-based wealth. India’s Tier 2 cities delivering 17-22% total returns despite tariff headwinds. Singapore/Switzerland providing stability ballast even at compressed yields.

The data demands action: 142,000 millionaire migrations, $947B capital deployment, 85% Indian luxury growth. These aren’t statistics but signals—the greatest wealth reallocation since World War II. Markets experiencing inflows offer validation. Markets experiencing outflows offer value. The sophisticated investor captures both.

Unlike equities vulnerable to Trump tweets or bond yields hostage to central bank whims, physical property endures. Tangible, income-generating, emotionally satisfying. For families building multi-generational wealth, real estate’s combination of stability, appreciation, prestige, and practical utility remains unmatched.

The window narrows daily. Dubai properties securing Golden Visas before December price surges. London estates before pound recovers 15%. India Tier 2 before tariff uncertainties resolve and competition intensifies. These opportunities won’t persist into 2026.

Act with urgency. Invest with intelligence. Build with confidence. October 2025’s geopolitical chaos isn’t the end of luxury real estate—it’s the beginning of the next great accumulation phase for those courageous and clever enough to see beyond headlines to underlying value.

The next decade belongs to investors who embraced complexity, diversified fearlessly, and recognized that geopolitical turbulence creates the precise conditions for transformational wealth creation.

YouTube Learning Resources

Free resources to download

Geopolitical Turbulence and Luxury Real Estate in October 2025: Summary