Now Reading: Wellness-Oriented Luxury Homes: From Oxygen Chambers to Private Spas

- 01

Wellness-Oriented Luxury Homes: From Oxygen Chambers to Private Spas

Wellness-Oriented Luxury Homes: From Oxygen Chambers to Private Spas

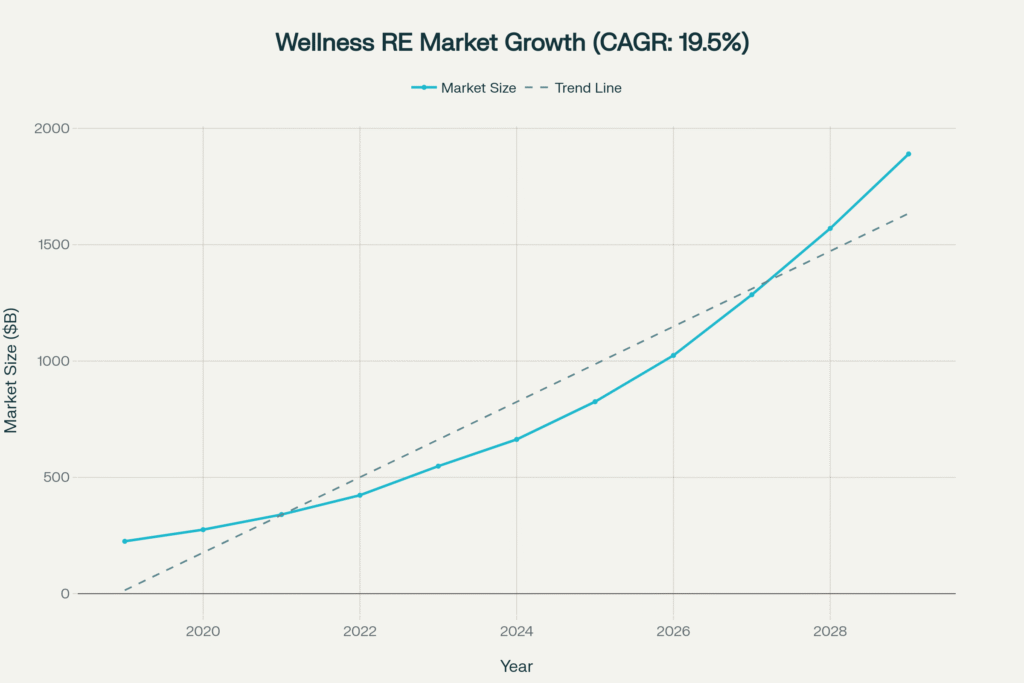

The global wellness real estate market has experienced unprecedented expansion, growing from $225 billion in 2019 to $548 billion in 2024 at a remarkable 19.5% compound annual growth rate. This explosive growth reflects a fundamental paradigm shift among Ultra-High-Net-Worth Individuals (UHNIs) and High-Net-Worth Individuals (HNIs), who increasingly view their homes as comprehensive wellness sanctuaries rather than mere luxury residences. With projections indicating the market will reach $1.1 trillion by 2029, wellness-oriented luxury properties now command 10-30% premiums over traditional luxury homes, establishing themselves as essential components of sophisticated investment portfolios.

Global Market Revolution and International Perspective

The wellness real estate revolution represents the fastest-growing segment within the broader $6.3 trillion global wellness economy. The Global Wellness Institute’s comprehensive analysis reveals that wellness real estate has been doubling every five years, significantly outpacing overall global construction growth of 5.5%.

Cross-Regional Market Forces

Asia-Pacific Leadership: The region dominates with 22.4% annual growth, driven by rapid urbanization and rising disposable incomes. China accounts for 38% of the Asia-Pacific wellness real estate market, valued at $574.34 billion by 2032.

Middle East Excellence: The Middle East-North Africa region showcases 22.6% annual expansion, with Dubai emerging as the global benchmark for luxury wellness living. Properties offer exceptional 8-10% annual yields, consistently outperforming established markets like London and New York.

Indian Market Explosion: India stands as the most dynamic market, with luxury residential values projected to surge from $38.02 billion in 2024 to $101.92 billion by 2029. The country’s UHNI population is expected to grow by 50% through 2029, the fastest globally.

Quantitative Market Analysis and Performance Data

Ultra-Wealthy Population Expansion Trends

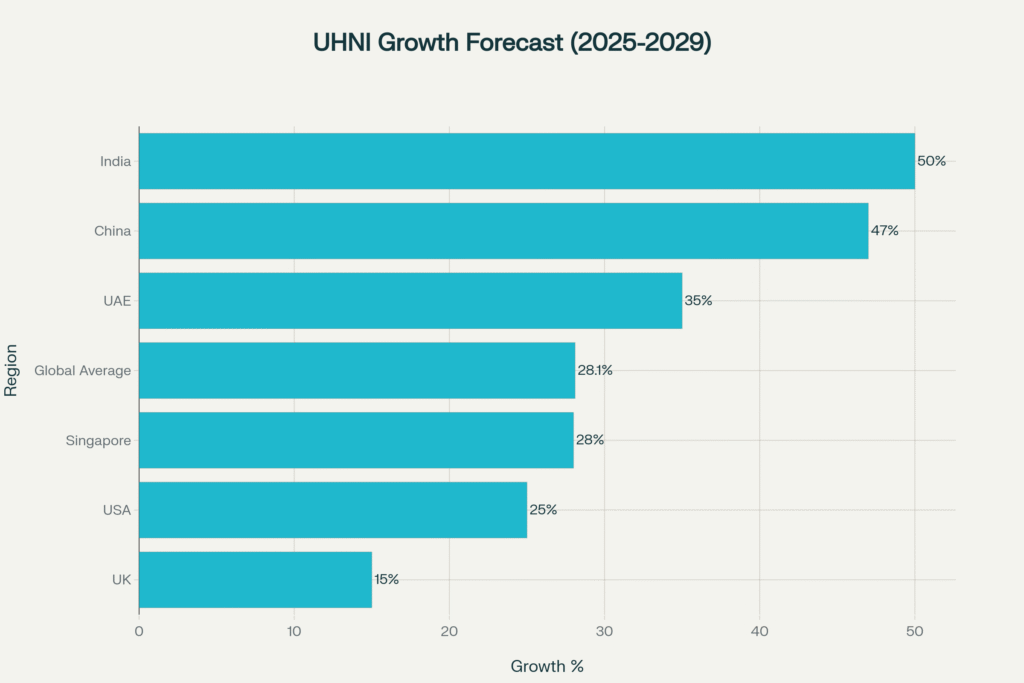

Knight Frank’s Wealth Report 2024 documents explosive growth in global UHNI populations, with total numbers reaching 626,619 individuals in 2024, representing 4.2% annual growth. This demographic expansion directly correlates with wellness real estate demand.

Key Growth Metrics by Region:

- India: 6.1% current growth, 50% projected (2025-2029)

- China: 4.2% current growth, 47% projected expansion

- UAE: 8.5% annual growth, 35% five-year projection

- Singapore: 5.8% current growth, 28% medium-term outlook

- USA: 7.9% annual expansion, 25% projected growth

Investment Transaction Analysis

CBRE’s India Market Monitor reveals that luxury housing segments (₹4 crore and above) witnessed 37.8% year-on-year growth in sales during January-September 2024, with total luxury unit sales reaching 12,625 compared to 9,160 units in the previous year. Delhi NCR led with 5,855 luxury unit sales, representing a 72% year-on-year increase.

Psychological and Cultural Lifestyle Motivators

Post-Pandemic Wellness Prioritization

The COVID-19 pandemic fundamentally reshaped luxury living expectations, with 90% of Indian UHNIs anticipating wealth increases in 2024, and 63% expecting significant increases exceeding 10%. This confidence translates into substantial investments in wellness-oriented properties that serve as personal health sanctuaries.

Next-Generation Wealth Dynamics

India’s UHNI demographic is experiencing a remarkable shift, with 20% of the country’s super-wealthy now under 40 years old, fueled by startup success and technology IPOs. This younger cohort demonstrates heightened wellness awareness and technology integration preferences, driving demand for cutting-edge wellness amenities.

Status Symbol Evolution

Traditional luxury markers like swimming pools and home theaters are being superseded by sophisticated wellness amenities. Private hyperbaric oxygen chambers, medical-grade air purification systems, and AI-powered wellness environments now define ultimate luxury status, with hyperbaric chambers commanding 35% price premiums despite 45% adoption rates.

Strategic Investment Horizons

Immediate Opportunities (2025-2026)

Market Focus: Established wellness markets with proven track records

- Primary Targets: Mumbai (10% price growth), Dubai (15.9% appreciation), Singapore (stable luxury demand)

- Investment Criteria: Properties with existing medical-grade wellness facilities

- Expected Returns: 8-15% annual appreciation with strong rental yields

Medium-Term Expansion (2027-2029)

Emerging Market Penetration: High-growth markets with developing wellness infrastructure

- Target Markets: Pune (810 luxury unit sales in 2024), Hyderabad, Bangkok

- Strategic Focus: Pre-construction wellness developments with customization options

- Growth Drivers: Rising HNI populations and increasing wellness awareness

Long-Term Wealth Preservation (2030+)

Technology Integration: Next-generation wellness properties with AI optimization

- Innovation Focus: Biometric integration, personalized wellness environments

- Sustainability Emphasis: Net-zero developments with regenerative living concepts

- Market Evolution: Adaptation to emerging wellness paradigms and technologies

In-Depth Property Analysis

Case Study 1: Bentley Villas, Dubai – Automotive Luxury Meets Wellness Excellence

Located in Mohammed Bin Rashid City’s prestigious District 11, Bentley Villas represents the pinnacle of branded wellness living. This exclusive development features 36 fully-furnished five-bedroom villas, each incorporating comprehensive wellness amenities designed by Bentley Home.

Wellness Infrastructure:

- Private crystal-clear lagoon access for aquatic therapy and water sports

- State-of-the-art Technogym fitness centers with Italian-engineered equipment

- Dedicated spa facilities within mansions featuring steam rooms and treatment areas

- Community wellness amenities including yoga studios and meditation gardens

- Business hub with wellness-focused meeting spaces and executive services

Investment Profile:

- Completion Timeline: Q1 2026 delivery

- Target Demographics: International UHNIs, NRIs, and wellness-conscious executives

- Pricing Strategy: Ultra-luxury segment with complete Bentley Home furnishing packages

- Unique Value Proposition: Move-in ready properties with branded luxury authentication

Market Performance Indicators:

- Location Premium: 16 minutes from Burj Khalifa, prime connectivity

- Rental Yield Potential: 8-10% annual returns typical for Dubai luxury segment

- Appreciation Outlook: Strong capital growth supported by Dubai’s UHNI influx

Case Study 2: Surrenne Wellness Club, London – Medical-Grade Residential Wellness

The revolutionary Surrenne Spa at London’s Emory Hotel exemplifies the future of residential wellness integration. This 18,000-square-foot subterranean sanctuary spans four floors and represents the convergence of medical technology with luxury hospitality.

Advanced Wellness Technologies:

- Medical-grade 2.0 Hyperbaric Oxygen Chambers for enhanced recovery and longevity

- Comprehensive VO2 Max testing facilities for personalized fitness optimization

- Microbiome mapping capabilities for customized wellness protocols

- AI-generated soundscapes developed with neuroscientists for optimal relaxation

- Interactive digital fitness studios with virtual reality and on-demand classes

Market Impact Analysis:

- Membership Model: Exclusive private club attracting London’s wellness elite

- Usage Patterns: Health-conscious Londoners checking into the hotel specifically for wellness access

- Technology Leadership: Collaboration with Virtusan neuroscientists for multi-sensorial experiences

- Revenue Premium: Members paying £40,000+ annually for comprehensive wellness access

Investment Implications:

- Market Validation: Proven demand for ultra-premium wellness facilities

- Technology Integration: Blueprint for residential wellness technology adoption

- Premium Pricing: Successful monetization of advanced wellness amenities

Case Study 3: Indian Luxury Developments – Mainstream Wellness Integration

India’s luxury real estate transformation showcases the mainstream adoption of wellness features across multiple markets. Leading developers including BHADRA Group, Trident Realty, and others are integrating comprehensive wellness amenities as standard offerings rather than premium add-ons.

Market Transformation Indicators:

- Wellness Premium: Properties commanding 10-20% premiums over traditional luxury homes

- Adoption Acceleration: 60% of luxury buyers in 2024 specifically sought customized wellness spaces

- Feature Evolution: Meditation zones, indoor gardens, and air purification systems becoming standard

- Demographic Drivers: Millennials and NRIs as primary wellness-focused buyers

Regional Performance Metrics:

- Delhi NCR: Luxury sales surge of 72% year-on-year, establishing as India’s wellness capital

- Mumbai: Ultra-luxury segment (₹40+ crore) generated ₹2,443 crore in sales volume

- Emerging Markets: Pune’s 810 luxury unit sales demonstrate tier-2 city potential

- Technology Integration: IoT-enabled homes and smart wellness systems becoming prevalent

Investment Outlook:

- Market Maturation: Wellness features transitioning from luxury to mainstream expectation

- Pricing Power: Sustained premiums supporting developer margins and investor returns

- Geographic Expansion: Wellness concepts spreading to tier-2 and tier-3 cities

Elite Investment Strategies and Pro Tips

UHNI Portfolio Diversification Strategy

Optimal Allocation Framework: Sophisticated investors should allocate 15-25% of real estate portfolios to wellness-oriented properties across multiple geographic markets to capitalize on demographic trends while maintaining diversification.

Geographic Distribution Matrix:

- 40% – Established Premium Markets (Mumbai, Dubai, Singapore, London)

- 35% – High-Growth Emerging Markets (Pune, Hyderabad, Bangkok, Riyadh)

- 25% – Innovation Hubs (New York, Tokyo, Sydney)

Technology Integration Assessment Criteria

Future-Proofing Evaluation Framework:

- Smart Home Compatibility: Seamless integration with evolving home automation platforms

- Wellness Technology Upgrade Pathways: Infrastructure supporting future wellness innovations

- Telemedicine Integration: Built-in capabilities for remote health monitoring and consultations

- Sustainable Systems: Advanced energy and water management supporting wellness amenities

- Biometric Integration: Capabilities for personalized wellness environment optimization

Market Timing and Entry Strategies

Optimal Investment Entry Points:

- Pre-Construction Phase: Maximum customization opportunities and early-bird pricing advantages

- Market Correction Periods: Acquiring established wellness properties at favorable valuations

- Technology Upgrade Cycles: Renovation opportunities during wellness technology evolution

- Regulatory Catalyst Events: Policy changes favoring wellness amenities and health-focused development

Premium Wellness Amenity Prioritization

High-Impact Investment Features (Based on adoption rates and price premiums):

- Home Gyms: 92% adoption rate, 15% price premium – Essential baseline amenity

- Saunas/Steam Rooms: 85% adoption rate, 18% premium – Strong market acceptance

- Private Spas: 78% adoption rate, 25% premium – Significant value addition

- Air Purification: 73% adoption rate, 8% premium – Health-conscious necessity

- Hyperbaric Chambers: 45% adoption rate, 35% premium – Ultimate luxury differentiator

Revenue Optimization Strategies

Rental Income Enhancement:

- Wellness Tourism Integration: Properties marketed for short-term luxury wellness retreats

- Corporate Executive Housing: Targeting companies providing wellness-focused executive accommodations

- Medical Tourism Partnerships: Collaboration with healthcare providers for recovery-focused stays

- Wellness Event Hosting: Premium pricing for wellness workshops and private health consultations

Risk Assessment and Mitigation Framework

Market Risk Analysis

Economic Sensitivity Factors: Luxury wellness properties demonstrate higher volatility during economic downturns, requiring careful market timing and geographic diversification strategies to maintain portfolio stability.

Technology Obsolescence Risk: Rapid advancement in wellness technologies necessitates properties with flexible infrastructure and upgrade capabilities to prevent amenity depreciation.

Regulatory Compliance Evolution: Increasing health and safety regulations for wellness amenities require ongoing compliance investments and professional management oversight.

Comprehensive Risk Evaluation and Protection Measures

Multi-Market Diversification: Spread investments across established and emerging markets, property types, and wellness amenity categories to reduce concentration risk and enhance portfolio resilience.

Professional Wellness Management: Engage specialized property management companies with wellness facility expertise, medical equipment maintenance capabilities, and regulatory compliance knowledge.

Advanced Insurance Coverage: Obtain comprehensive coverage for high-value wellness equipment, liability protection for medical-grade amenities, and business interruption insurance for rental properties.

Legal Structure Optimization: Utilize appropriate holding structures for international investments, considering tax implications, succession planning, and regulatory requirements across jurisdictions.

Alternative Viewpoints and Market Obstacles

Market Saturation Concerns

While wellness real estate demonstrates exceptional growth, investors should acknowledge potential oversupply risks in popular markets. Rapid development increases in Dubai, Mumbai, and Singapore may temporarily affect pricing power and rental yields.

Wellness Trend Evolution Risk

The dynamic nature of wellness preferences could impact specific amenity valuations. Today’s cutting-edge hyperbaric chambers and cryotherapy facilities may be superseded by emerging wellness technologies, requiring continuous amenity updates.

Economic Cycle Sensitivity

Luxury wellness properties may experience more pronounced sensitivity to economic downturns compared to essential housing. During recessions, discretionary wellness spending typically contracts first, potentially affecting both sale values and rental demand.

Legal and Standards Complexity

Medical-grade wellness amenities often require specialized licensing, regular inspections, and compliance with evolving health regulations. These requirements can increase operational costs and complexity for property owners.

Future Market Transformation Outlook

Emerging Technology Integration

The next generation of wellness real estate will incorporate AI-powered optimization systems that learn individual preferences and automatically adjust environmental conditions, lighting, air quality, and wellness protocols. Biometric integration will enable real-time health monitoring and personalized wellness recommendations.

Sustainable Wellness Convergence

Future developments will seamlessly integrate wellness amenities with sustainable building practices, featuring regenerative design concepts, renewable energy systems, and circular water management specifically supporting wellness facilities.

Wellness Community Ecosystems

Mixed-use developments will evolve into comprehensive wellness ecosystems, combining residential properties with integrated medical facilities, wellness education centers, and wellness tourism amenities, creating self-contained wellness communities.

Frequently Asked Questions

What specific features define a wellness-oriented luxury home in 2025?

Modern wellness-oriented luxury homes integrate comprehensive health amenities beyond traditional fitness facilities. Essential features include medical-grade air and water purification systems, circadian lighting optimization, dedicated meditation and yoga spaces, private spa facilities with hydrotherapy options, and advanced wellness technologies like hyperbaric oxygen chambers. The Global Wellness Institute defines these properties as designed to actively support occupant health through thoughtful materials, design elements, and technological integration.

How do wellness amenities impact luxury property valuations across different markets?

Research consistently demonstrates that wellness-oriented luxury properties command 10-30% premiums over comparable traditional luxury homes. Specific high-impact amenities show varying premium levels: private spas add approximately 25% to property values, hyperbaric chambers can increase valuations by 35%, while essential features like air purification systems contribute 8% premiums. Market maturity significantly influences these premiums, with established markets like London and Dubai showing more consistent premium maintenance compared to emerging markets.

Which global markets currently offer optimal wellness real estate investment opportunities?

India leads global opportunity rankings with 50% projected UHNI growth through 2029, supported by 6.1% current annual expansion and strong luxury market fundamentals. China follows with 47% projected growth, while UAE offers 35% expansion potential combined with attractive 8-10% annual yields. Established markets like Singapore (28% projected growth) and London provide stability with proven wellness demand, while emerging Asian markets present higher growth potential with correspondingly increased risk profiles.

What are the key due diligence considerations for international wellness real estate investments?

International wellness real estate investments require comprehensive evaluation of tax structures, currency risk exposure, legal frameworks, and specialized property management requirements. Markets like UAE offer significant tax advantages and currency stability, while India provides exceptional growth potential with more complex regulatory landscapes. Essential due diligence includes wellness equipment maintenance requirements, regulatory compliance for medical-grade amenities, local wellness market maturity, and availability of specialized property management services.

Conclusion

Wellness-oriented luxury homes represent a transformative investment opportunity positioned at the convergence of powerful demographic trends, technological innovation, and fundamental lifestyle evolution. The sector’s extraordinary 19.5% compound annual growth rate, underpinned by expanding UHNI populations and increasing wellness consciousness, establishes these properties as essential components of sophisticated investment portfolios.

Investment Thesis Validation:

- Demographic Tailwinds: Global UHNI population growth of 28.1% through 2029 provides sustained demand foundation

- Premium Pricing Sustainability: Consistent 10-30% premiums over traditional luxury properties demonstrate strong value proposition

- Geographic Diversification Opportunities: Multiple high-growth markets across Asia-Pacific, Middle East, and established Western markets

- Technology Integration Advantages: Properties designed for wellness technology evolution provide future-proofing benefits

- Portfolio Enhancement Value: Low correlation with traditional real estate sectors offers meaningful diversification

The convergence of luxury living with comprehensive wellness represents more than a transient market trend—it embodies a fundamental shift toward holistic value creation in premium real estate investment. As demographic pressures intensify globally and wellness awareness continues expanding, early strategic positioning in this transformative sector will yield superior risk-adjusted returns for discerning UHNI and HNI investors.

For sophisticated wealth preservation and growth strategies, wellness-oriented luxury real estate offers an unparalleled combination of lifestyle enhancement, capital appreciation potential, and portfolio optimization. The sector’s continued evolution, driven by technological advancement and changing consumer priorities, ensures sustained relevance for long-term investment success.