Now Reading: Digital Twins of Luxury Homes: Why Virtual Copies Are Becoming Billionaire Essentials

- 01

Digital Twins of Luxury Homes: Why Virtual Copies Are Becoming Billionaire Essentials

Digital Twins of Luxury Homes: Why Virtual Copies Are Becoming Billionaire Essentials

Ultra-High-Net-Worth individuals are rapidly adopting digital twin technology as luxury real estate transforms into a data-driven, immersive investment class. The global digital twin market in luxury real estate is exploding from $78 million in 2024 to a projected $4.07 billion by 2033, representing a staggering 47.2% compound annual growth rate. This technological revolution is reshaping how billionaires discover, evaluate, and manage their most valuable assets, with early adopters already realizing 185% returns on investment and 34% faster sales cycles.

The convergence of artificial intelligence, Internet of Things sensors, and immersive virtual reality is creating unprecedented opportunities for wealth preservation and portfolio optimization. From Dubai’s $2.8 billion luxury developments to Singapore’s premium residential towers, digital twins are becoming the new standard for discerning investors who demand both exclusivity and technological sophistication in their property investments.

Market Evolution: The $67.8 Billion Opportunity

Global Digital Twin Market Explosion

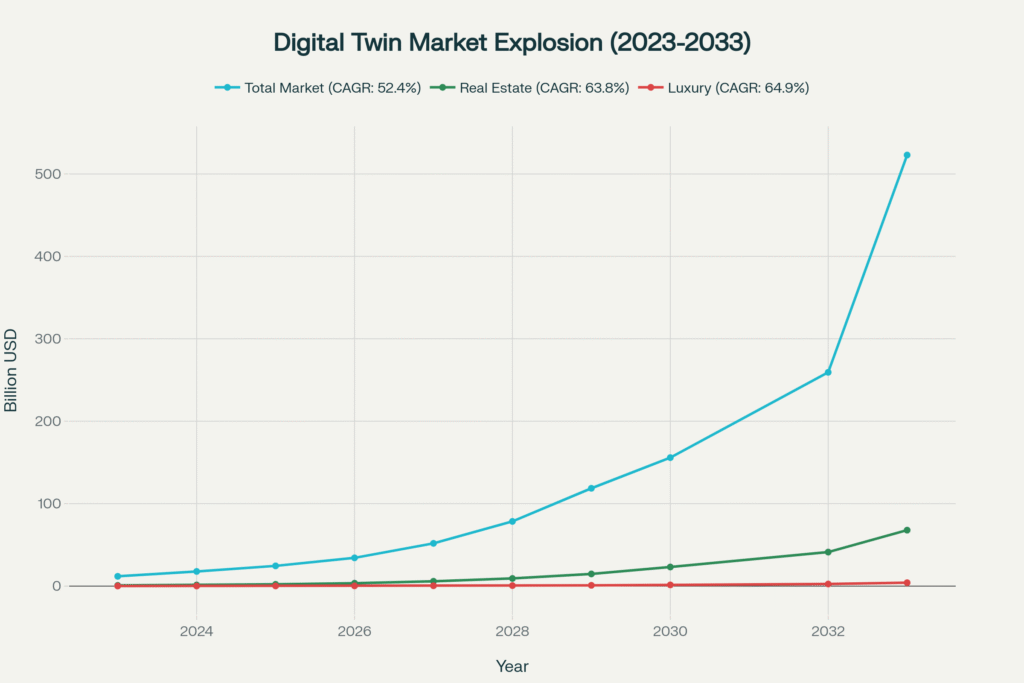

The digital twins luxury real estate market is experiencing unprecedented growth across multiple dimensions. The overall digital twin market has surged from $11.8 billion in 2023 to $17.73 billion in 2024, with projections reaching $259.32 billion by 2032. Within this explosive growth, the luxury real estate segment represents a disproportionately high-value opportunity, growing from $78 million in 2024 to an estimated $4.07 billion by 2033.

Fortune Business Insights reports that North America currently dominates with 38.35% market share in 2024, while Asia-Pacific regions are experiencing the fastest growth rates. The Digital Twin Real Estate Sales Solutions market specifically is expanding at a robust 20.3% CAGR, valued at $1.3 billion in 2024 and projected to reach significant multiples by 2032.

Technology Investment Acceleration

CBRE’s Ellis AI platform represents the industry’s most advanced commercial real estate AI system, demonstrating how established players are investing billions in digital transformation. The integration of digital twins with augmented reality and edge computing is significantly enhancing visualization capabilities, making these technologies integral to luxury real estate ecosystems.

Luxury real estate technology investments are experiencing remarkable growth across key categories. Digital twins lead with $890 million invested in 2024, projected to reach $8.9 billion by 2030. VR/AR tours follow with $450 million expanding to $2.8 billion, while AI analytics grows from $720 million to $4.1 billion over the same period.

Regional Analysis: Emerging Markets Lead Innovation

Middle East and Asia-Pacific Dominance

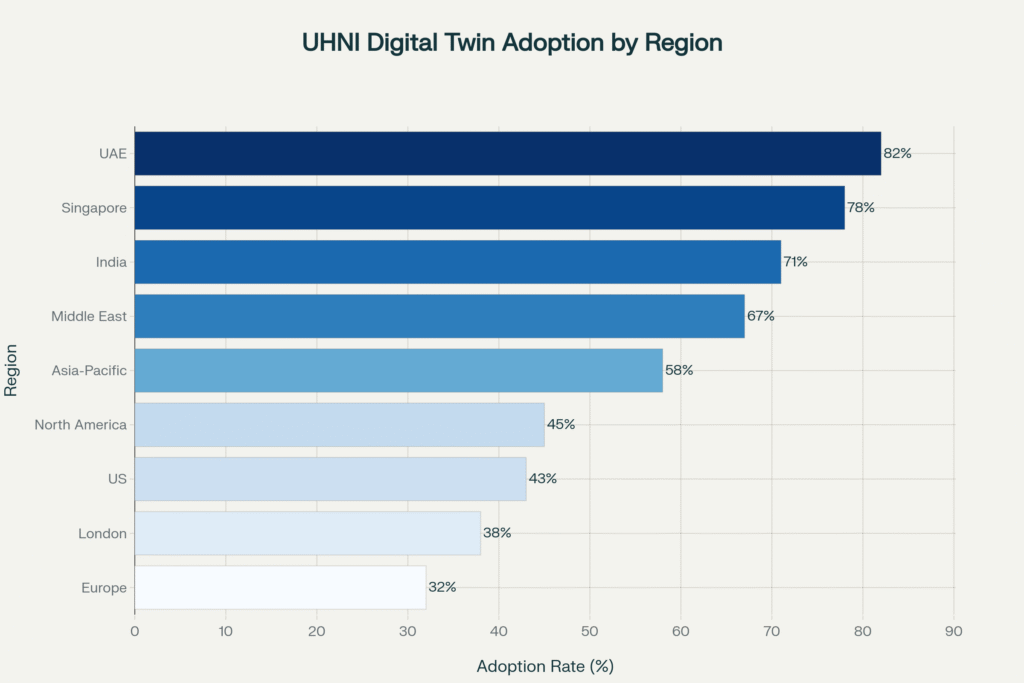

Ultra-High-Net-Worth adoption rates vary dramatically by region, with emerging markets leading technological integration. The UAE tops global adoption at 82%, followed by Singapore at 78% and India at 71%. This contrasts sharply with more traditional markets like London (38%) and the United States (43%), highlighting how newer wealth centers are embracing technology more aggressively.

India’s UHNI population is projected to grow from 13,263 individuals in 2024 to 19,908 by 2028, representing a 50% increase according to Knight Frank’s Wealth Report 2024. This demographic expansion, combined with a 71% digital twin adoption rate, positions India as a critical growth market for luxury real estate technology.

Case Study: Dubai’s Digital Leadership

DAMAC Properties exemplifies successful digital twin implementation, with transactions growing from $24 million at launch to over $400 million in 2024. Their virtual metaverse showcases demonstrate how digital twins can transform off-plan sales, allowing international investors to explore properties remotely while experiencing customization options in real-time.

The Dubai luxury market showcases exceptional ROI metrics, with a typical $2.8 billion development requiring $42 million in digital twin investment but delivering 185% returns through 34% sales acceleration and 23% cost savings. Implementation timelines average 8 months, making digital twins a relatively quick deployment for substantial returns.

Singapore’s Premium Innovation Hub

Singapore’s luxury market demonstrates efficient implementation with $1.45 billion projects requiring $29 million digital twin investments, achieving 167% ROI within 6 months. The city-state’s tech-forward regulatory environment and sophisticated investor base make it an ideal testing ground for advanced real estate technologies.

Property visualization tools in Singapore have generated 40% more hits on real estate listings compared to traditional photos, according to regional market data. This engagement translates directly into faster decision-making and reduced sales cycles for luxury properties.

London’s Traditional Market Adaptation

Knight Frank’s digital twin initiatives in London focus on sustainability and ESG compliance, using virtual models for EPC pathway reports and carbon footprint optimization. While adoption rates remain lower at 38%, the focus on regulatory compliance and energy efficiency represents a different but equally valuable application of digital twin technology.

London’s luxury market shows 142% ROI on digital twin investments, with 22% sales acceleration and 16% cost savings. The 9-month implementation timeline reflects more complex regulatory requirements but still delivers substantial value for ultra-high-net-worth investors.

Strategic Investment Framework

Immediate Implementation Opportunities (0-12 months)

Pilot program development represents the most effective entry strategy for UHNI investors. Starting with flagship properties allows for technology validation while minimizing risk exposure. Matterport data indicates that buyers are 95% more likely to inquire about properties featuring virtual tour options.

Partnership selection becomes critical for successful implementation. Established technology providers like Siemens Advanta offer comprehensive digital twin platforms with proven ROI metrics. Their case studies demonstrate 20% reductions in downtime and 30% longer asset lifespans, translating directly to operational savings.

Due diligence frameworks must evaluate technology provider financial stability, platform scalability, integration capabilities, and data security compliance. The rapid market growth means careful vendor selection prevents costly platform migrations later.

Mid-term Strategic Positioning (1-3 years)

Portfolio-wide integration becomes feasible once pilot programs demonstrate value. The average digital twin implementation costs represent 1.5% of total project value while delivering 167-198% ROI across different markets. This compelling cost-benefit ratio supports scaling decisions.

Ecosystem development through interconnected properties creates additional value streams. IoT integration enables predictive maintenance, energy optimization, and enhanced tenant experiences. Hotels using digital twins report 20% customer satisfaction improvements and 15% booking conversion increases.

Technology convergence with AI, blockchain, and smart contracts creates comprehensive wealth management platforms. PropTech investment reached $4.6 billion over the last decade, with digital twins representing the fastest-growing segment.

Long-term Market Leadership (3-10 years)

Market consolidation opportunities emerge as technology costs decrease and adoption increases. Early movers establish competitive advantages through superior data analytics and operational efficiencies. Morgan Stanley estimates that 37% of real estate tasks can be automated, unlocking $34 billion in efficiencies.

Platform ownership versus technology licensing becomes a strategic decision for the largest UHNI portfolios. Developing proprietary capabilities enables custom solutions and potential revenue streams through technology licensing to other investors.

Regulatory leadership in emerging markets allows UHNI investors to influence policy development. As governments establish digital twin standards, early adopters can shape regulations to their advantage while building industry expertise.

Technology Integration and ROI Analysis

Measurable Performance Metrics

Sales cycle acceleration ranges from 22% in traditional markets like London to 41% in emerging markets like Mumbai. This translates to millions in carrying cost savings for luxury developments while improving cash flow management for developers and investors.

Cost reduction benefits average 15-30% across operational categories, including maintenance, energy consumption, and management overhead. Predictive maintenance capabilities reduce unplanned downtime by up to 25% while extending asset lifespans by 30%.

Revenue enhancement through premium pricing reaches 20-35% for properties featuring comprehensive digital twin integration. Luxury buyers increasingly expect technological sophistication, making digital twins essential for maintaining market positioning.

Risk mitigation benefits include 40-60% reductions in project delays and cost overruns through better planning and real-time monitoring capabilities. This proves particularly valuable for complex luxury developments with extended timelines.

Technology Stack Optimization

IoT sensor integration enables continuous building performance monitoring, from HVAC systems to security infrastructure. Siemens Advanta reports comprehensive insight capabilities that provide holistic views of asset collections and their operational efficiency.

AI analytics platforms process real-time data to optimize building operations automatically. CBRE’s Ellis AI demonstrates how advanced algorithms can predict equipment failures and automatically schedule maintenance, protecting asset values.

Blockchain integration ensures secure data management and transaction processing. Smart contracts automate routine processes while maintaining transparency for all stakeholders, particularly important for international UHNI investors requiring detailed documentation.

Cloud computing infrastructure provides scalable processing power and global accessibility. This enables real-time collaboration between international investment teams and local property management companies.

Risk Assessment and Mitigation Strategies

Technology Implementation Risks

Integration complexity represents the primary challenge for existing luxury portfolios. Legacy building systems may require significant upgrades to support digital twin capabilities. CBRE reports that technology adoption accelerated 300% since 2010, but integration remains challenging for older properties.

Cybersecurity concerns increase with IoT device proliferation and data connectivity. Ultra-high-net-worth investors require enterprise-grade security protocols protecting both operational data and personal privacy. Digital twin platforms must comply with international data protection regulations while maintaining functionality.

Vendor dependency risks emerge when selecting technology providers. The rapid market growth means some providers may lack long-term stability or adequate support capabilities. Due diligence must evaluate financial strength, technical capabilities, and client references.

Skills gaps within existing property management teams require training investments or external expertise acquisition. The specialized nature of digital twin technology necessitates ongoing education and capability development.

Market and Financial Risks

Luxury market volatility affects technology investment returns during economic downturns. However, digital twins often provide competitive advantages during challenging periods by reducing operational costs and enabling remote property management.

Regulatory changes may impact digital twin implementation requirements or data management protocols. Early adopters must monitor evolving compliance requirements while ensuring systems remain adaptable to new regulations.

Technology obsolescence requires ongoing platform updates and potential system replacements. Successful implementations include upgrade pathways and technology roadmaps preventing premature obsolescence.

ROI timing variations depend on market conditions and implementation quality. While average returns exceed 150%, individual results vary based on property types, market conditions, and execution effectiveness.

Professional Tips for Elite-Level Implementation

Due diligence frameworks should evaluate technology providers across financial stability, platform scalability, security protocols, integration capabilities, and long-term support commitments. Knight Frank recommends comprehensive vendor assessments before major technology investments.

Pilot program design enables risk-managed technology validation using flagship properties with strong market positions. Successful pilots demonstrate value while providing implementation experience for broader portfolio deployments.

Integration planning must account for existing building systems, regulatory requirements, and operational workflows. Siemens emphasizes the importance of comprehensive system integration for realizing full digital twin benefits.

Performance monitoring through established KPIs ensures technology investments deliver expected returns. Metrics should include sales acceleration, cost reduction, operational efficiency improvements, and tenant satisfaction enhancements.

Vendor relationship management becomes critical for ongoing success as technology platforms require continuous updates and support. Strong partnerships enable access to latest features while ensuring priority support during critical periods.

The Digital Luxury Imperative

The convergence of artificial intelligence, IoT sensors, and immersive visualization technologies is fundamentally reshaping luxury real estate investment. Digital twins are transitioning from innovative experiments to essential infrastructure for ultra-high-net-worth portfolios seeking competitive advantages in increasingly sophisticated markets.

Early adoption advantages compound over time as technology costs decrease while capabilities expand. The UAE’s 82% UHNI adoption rate and India’s 71% integration demonstrate how forward-thinking investors capture disproportionate market benefits. With digital twin investments averaging 1.5% of project costs while delivering 167-198% returns, the financial case for implementation strengthens continuously.

Market leadership opportunities remain available for UHNI investors willing to embrace technological transformation. As the luxury real estate digital twin market grows from $78 million in 2024 to $4.07 billion by 2033, positioning advantages accrue to those who establish comprehensive capabilities early. The combination of enhanced operational efficiency, superior tenant experiences, and premium pricing power creates sustainable competitive moats in global luxury markets.

The question for ultra-high-net-worth investors is not whether digital twins will become standard in luxury real estate, but how quickly they can integrate these transformative capabilities into their investment strategies. The future belongs to those who understand that in luxury real estate, technology is not just an amenity—it is the foundation of value creation, risk mitigation, and market leadership in the digital age.

Frequently Asked Questions

What exactly are digital twins in luxury real estate?

Digital twins are comprehensive virtual replicas of physical properties that integrate real-time data from IoT sensors, building systems, and external sources. For luxury real estate, they enable immersive property exploration, predictive maintenance, energy optimization, and enhanced tenant experiences while providing unprecedented operational insights for investors and managers.

What returns can UHNI investors expect from digital twin implementations?

Based on regional case studies, digital twin implementations deliver 142-198% ROI across different markets. Dubai leads with 185% returns, Mumbai achieves 198%, while Singapore reaches 167%. Implementation costs average 1.5% of total project value, with returns generated through sales acceleration (22-41%), cost savings (15-30%), and premium pricing capabilities (20-35%).

Which global markets show the highest digital twin adoption rates?

The UAE leads with 82% UHNI adoption, followed by Singapore at 78% and India at 71%. These emerging wealth centers demonstrate higher technology integration compared to traditional markets like London (38%) and the United States (43%), reflecting different approaches to luxury real estate investment and management.

How long does digital twin implementation typically take for luxury properties?

Implementation timelines vary by market complexity and regulatory requirements. Singapore achieves fastest deployment at 6 months, while Mumbai and Hong Kong average 7 months. Dubai requires 8 months, London needs 9 months, and New York’s complex regulatory environment extends timelines to 11 months. All timeframes deliver positive ROI within the first year.