Now Reading: India’s Luxury Farmhouses: The Billionaire’s Rural Escape

- 01

India’s Luxury Farmhouses: The Billionaire’s Rural Escape

India’s Luxury Farmhouses: The Billionaire’s Rural Escape

India’s luxury farmhouse market has emerged as the definitive alternative asset class for ultra-high-net-worth individuals and NRI investors, representing a seismic shift from urban luxury apartments to experiential rural estates. With market valuations reaching $38.02 billion in 2024 and projected growth at 20.1% CAGR through 2034, farmhouses now offer superior investment returns of 15-18% ROI compared to traditional city properties’ 8-10%. This transformation, driven by post-pandemic lifestyle preferences and India’s expanding billionaire population of 191 individuals (+12% growth), positions luxury farmhouses as the ultimate status symbol and wealth preservation strategy for the global Indian elite.

Market Shift & Global Context

The Urban Exodus

India’s UHNI demographic is orchestrating an unprecedented migration from cramped urban penthouses to sprawling rural estates, fundamentally redefining luxury living paradigms. Delhi NCR leads this transformation with 20% year-over-year price appreciation, establishing farmhouses as the fastest-appreciating luxury asset class in the country. This shift mirrors global trends observed in the Hamptons, Cotswolds, and Dubai’s Emirates Hills, where post-pandemic affluent buyers prioritize space, privacy, and wellness over urban convenience.

The Indian luxury real estate landscape now exhibits clear segmentation: while Mumbai commands premium pricing at ₹28.7 crore average for luxury apartments, Delhi NCR farmhouses offer compelling entry points at ₹2.5 crore with 85% five-year appreciation potential. This value proposition has attracted sophisticated international capital, with NRIs representing 15-25% of luxury project investments—a dramatic increase from single-digit participation rates five years ago.

Comparative Global Analysis

India’s farmhouse market demonstrates remarkable resilience compared to established luxury markets. While London’s luxury segment grows at modest 3.2% annually and New York maintains 4.8% appreciation, India’s rural luxury estates surge ahead at 12.8% compound growth. Dubai, despite its 19.1% price appreciation, lacks the emotional connectivity and generational wealth-building potential that Indian farmhouses provide for NRI families.

Singapore’s luxury market, valued at $28.9 billion, offers institutional stability but limited growth potential compared to India’s dynamic expansion trajectory. The UAE’s farmhouse restrictions for foreign nationals further amplify India’s attractiveness, where NRIs enjoy freehold ownership rights in residential farmhouse developments, subject to FEMA compliance.

India’s luxury real estate market demonstrates robust growth with market size reaching $38.02 billion in 2024, supported by a growing HNI population of 85,698 individuals—a 6% year-over-year increase

Data-Rich Insights

Financial Performance Metrics

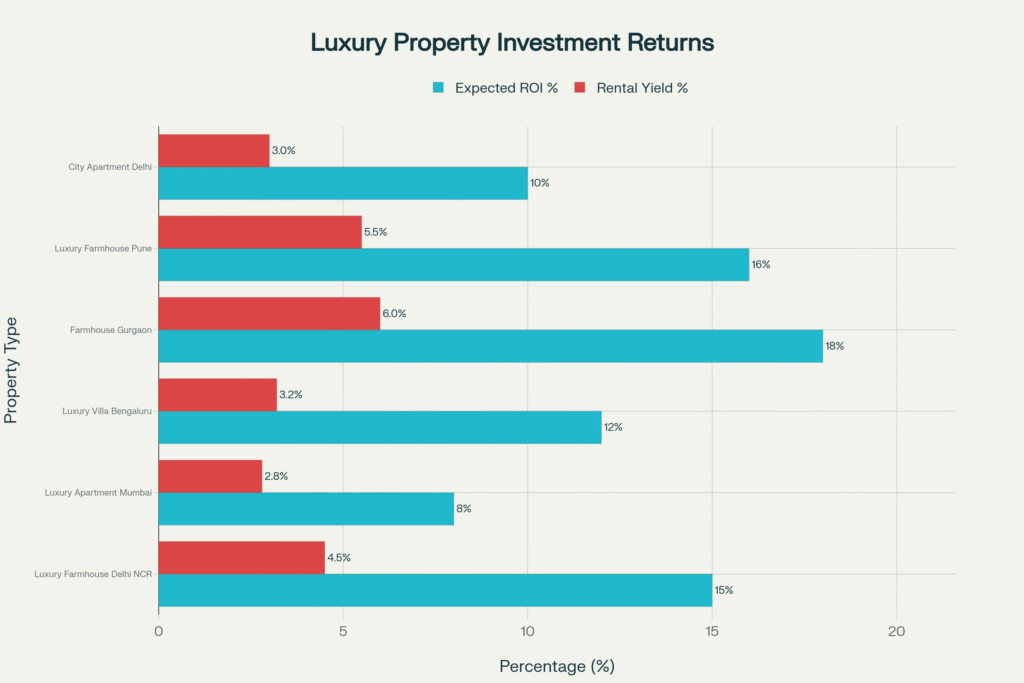

Knight Frank’s Prime Global Cities Index positions Delhi at 6th rank globally for luxury price appreciation, with 6.7% annual growth outpacing Mumbai’s 6.1% and Bengaluru’s 4.1%. This performance translates into tangible investment returns: luxury farmhouses in Gurgaon generate 18% ROI with 6.0% rental yields, substantially exceeding Mumbai apartments’ 8% ROI and 2.8% yield metrics.

Transaction Volume Analysis

Luxury housing sales across India’s top seven cities reached ₹5.1 trillion in 2024, with over 300,000 units sold—marking the third consecutive record-breaking year. Delhi NCR captured 39% of transactions in the luxury segment (properties above ₹1.5 crore), while luxury farmhouse transactions averaged ₹2.5-5.0 crore, positioning them as accessible luxury compared to Mumbai’s ₹8.5 crore apartment averages.

DLF Limited’s The Dahlias project exemplifies market dynamics, generating ₹11,816 crore in pre-launch sales with 12% NRI participation. This represents a structural shift from 5% NRI participation in FY22 to 23% in FY24, indicating sustained international confidence in India’s luxury real estate fundamentals.

Emotional & Lifestyle Drivers

Generational Wealth & Status Signaling

Luxury farmhouses transcend mere property investment, embodying generational legacy creation for India’s business dynasties and startup unicorn founders. Unlike depreciating urban apartments, farmhouses appreciate as living heritage assets, allowing families to create multi-generational compounds with dedicated spaces for traditional ceremonies, business retreats, and family gatherings.

The status hierarchy within India’s elite circles now prioritizes land ownership over apartment square footage. Owning a 2-acre Gurgaon farmhouse signals greater affluence than a South Mumbai penthouse, particularly among younger billionaires and second-generation business families who value experiential luxury over traditional location premiums.

Wellness & Privacy Premium

Post-pandemic health consciousness has fundamentally altered luxury living preferences, with 71% of India’s affluent individuals expressing interest in secondary homes within 12-24 months. Farmhouses offer private gymnasiums, organic farming opportunities, meditation spaces, and custom wellness facilities impossible to replicate in urban environments.

The privacy quotient cannot be understated: farmhouses provide gated security, controlled access, and intimate entertaining spaces for India’s business elite who require discretion for high-stakes meetings and family gatherings. This exclusivity premium commands rental rates of ₹50,000-₹2,50,000 per day for luxury farmhouse experiences.

Strategic Takeaways

Immediate Opportunities (2025)

Delhi NCR corridor investments represent the highest conviction opportunity for UHNI portfolios, with Dwarka Expressway properties demonstrating 58% appreciation potential and Golf Course Road estates maintaining premium valuations. Entry points of ₹1.8-2.5 crore in Gurgaon offer superior risk-adjusted returns compared to ₹6.2 crore Delhi apartment alternatives.

NRI investors should prioritize FEMA-compliant residential farmhouses over agricultural land purchases, ensuring clear title deeds and professional property management arrangements. Currency arbitrage opportunities remain compelling, with favorable INR exchange rates enhancing purchasing power for US and UK-based Indian professionals.

Mid-term Strategy (2025-2027)

Pune and Bengaluru periphery present emerging market opportunities as tech sector wealth creation expands beyond traditional metros. Infrastructure development projects, including metro extensions and highway connectivity improvements, will drive appreciation in currently undervalued farmhouse corridors.

Portfolio diversification should target 2-3 strategic locations rather than concentrated single-market exposure, balancing rental yield opportunities (Gurgaon farmhouses) with capital appreciation plays (Delhi NCR greenfield developments). Professional asset management becomes crucial for NRI investors managing multi-property portfolios.

Long-term Vision (2027-2030)

Tier-2 city expansion will create compelling value opportunities as India’s HNI population grows to 93,753 individuals by 2028. Cities like Chennai, Hyderabad, and Kochi will develop luxury farmhouse markets as local business ecosystems mature and infrastructure improves.

Sustainability integration will become mandatory for premium properties, with solar power, water harvesting, and organic farming features commanding valuation premiums. Smart home technology and hospitality-grade amenities will differentiate investment-grade properties from lifestyle-oriented purchases.

Case Studies

Delhi NCR: The Gurgaon Gold Rush

Gurgaon’s luxury farmhouse market exemplifies the sector’s explosive growth trajectory, with premium properties along Golf Course Road commanding ₹5-15 crore valuations for 2-5 acre estates. DLF’s private farmhouse developments demonstrate institutional-quality construction with professional landscaping, infinity pools, and smart home integration.

Knight Frank data reveals Gurgaon farmhouses generating 18% ROI through capital appreciation and luxury rental income, substantially outperforming traditional real estate asset classes. Connectivity improvements, including rapid rail networks and expressway expansions, enhance accessibility for Delhi-based business families while maintaining rural tranquility and privacy.

NRI participation in Gurgaon farmhouse projects reaches 27%, with US and UK-based Indian professionals leveraging currency advantages for legacy asset creation. Professional management companies now offer comprehensive services, from landscaping and security to event coordination and property maintenance, enabling hands-off investment strategies for overseas owners.

Mumbai Belt: Aspirational Luxury Redefined

Mumbai’s farmhouse corridor, extending from Lonavala to Alibag, represents established luxury with ₹3-8 crore properties offering sea views, hill stations access, and proximity to financial capital amenities. Bollywood celebrities and business tycoons maintain weekend estates here, creating prestigious neighborhood effects that enhance property valuations.

CBRE research indicates Mumbai farmhouses maintain 12-15% appreciation rates despite higher entry costs, with luxury rental potential serving corporate retreats and high-end event hosting. Infrastructure investments, including coastal road projects and helicopter landing facilities, position Mumbai belt properties as ultra-luxury lifestyle assets.

International buyer interest remains strong, with Dubai-based Indian businessmen acquiring Mumbai farmhouses as Indian base operations while maintaining UAE business interests. Professional property management and concierge services enable seamless property utilization for globally mobile UHNI families.

Bengaluru Corridor: Tech Wealth Transformation

Bengaluru’s emerging farmhouse market capitalizes on India’s technology sector wealth creation, with startup founders and tech executives investing IPO proceeds in rural luxury estates. Properties in Whitefield, Electronic City periphery, and Devanahalli corridor offer ₹2-4 crore investment opportunities with strong appreciation potential.

JLL analysis shows Bengaluru farmhouses delivering 12-16% ROI through rental income from corporate events and wedding celebrations, leveraging the city’s cosmopolitan culture and event industry. Climate advantages and year-round usability enhance investment attractiveness compared to seasonal Delhi NCR properties.

NRI interest particularly strong among Silicon Valley-based Indian tech professionals who understand lifestyle value propositions and maintain strong Bengaluru professional networks. Sustainable development focus aligns with tech sector environmental consciousness, creating premium market segments for eco-friendly luxury farmhouses.

The Connoisseur’s Guide

Due Diligence Excellence

UHNI farmhouse investments demand institutional-grade due diligence beyond traditional residential property assessments. Land title verification must trace agricultural conversion histories, ensuring clean development rights and FEMA compliance for NRI ownership structures. Professional legal counsel specializing in luxury real estate transactions becomes essential for complex ownership arrangements.

Strategic Location Selection

Prime farmhouse locations maintain 1-2 hour connectivity to major business centers while offering genuine rural experiences and privacy. Proximity to established luxury developments creates network effects and appreciation potential, while infrastructure development pipelines signal future connectivity improvements and valuation upside.

Portfolio Integration Strategy

Sophisticated investors integrate farmhouse holdings within diversified real estate portfolios, balancing liquid city properties with illiquid rural estates. Allocation ratios typically maintain 60-70% urban luxury exposure with 20-30% farmhouse holdings for lifestyle enhancement and portfolio diversification. Professional asset management enables hands-off ownership for globally mobile UHNI families.

Tax Optimization Framework

NRI investors leverage residential property classifications for optimal tax treatment, avoiding agricultural land restrictions while maximizing depreciation benefits and repatriation flexibility. FEMA compliance requires proper documentation and fund source verification, but enables unrestricted property appreciation and rental income generation.

Exit Strategy Planning

Luxury farmhouse liquidity requires longer investment horizons compared to urban property transactions, but premium buyers pay substantial multiples for well-maintained properties with clear titles. Professional property management maintains asset conditions and documentation, facilitating smooth resale transactions when portfolio rebalancing becomes necessary.

Risks & Contrarian Perspectives

Market Concentration Risks

Delhi NCR’s farmhouse market dominance creates geographic concentration risk for over-weighted portfolios, particularly vulnerable to regulatory changes affecting agricultural land conversion policies. Local government policy shifts could restrict development rights or impose additional taxation on luxury rural properties.

Infrastructure dependencies pose connectivity risks if planned road and rail projects face delays or cancellations due to political changes. Farmhouse values closely correlate with accessibility improvements, making infrastructure execution a critical investment variable beyond property management control.

Liquidity & Market Depth

Farmhouse resale markets remain relatively shallow compared to urban luxury segments, potentially extending transaction timelines during market downturns or forced liquidation scenarios. Niche buyer demographics require specialized marketing approaches and extended sales processes that may not suit all investment strategies.

Rental income consistency depends on luxury event markets and corporate retreat demand, which fluctuate with economic cycles more than residential rental markets. Professional management costs can erode yields during low occupancy periods or economic slowdowns affecting luxury spending.

Regulatory & Compliance Challenges

FEMA regulations create ongoing compliance requirements for NRI ownership structures, with potential policy changes affecting foreign investment parameters or repatriation rights. Agricultural land classification ambiguities could trigger regulatory scrutiny or require expensive legal resolutions.

Environmental regulations increasingly restrict construction activities near water bodies, forest areas, and agricultural zones, potentially limiting development rights or requiring expensive compliance measures for existing properties. Property tax assessments may increase substantially as luxury farmhouse values become more visible to local authorities.on fundamental design principles that remain valuable regardless of technology evolution.

Frequently Asked Questions

What defines a luxury farmhouse investment in India’s current market?

Luxury farmhouses typically feature 2-10 acre land parcels with modern architecture, premium amenities (swimming pools, landscaped gardens, smart home technology), and strategic locations within 1-2 hours of major metros. Investment-grade properties command ₹2-15 crore valuations depending on location, size, and development quality, offering 15-18% ROI potential through capital appreciation and rental income.

How do NRIs ensure FEMA compliance for farmhouse investments?

NRI farmhouse investments require residential property classification rather than agricultural land purchases, which remain restricted under FEMA regulations. Proper documentation includes fund source verification, NRE/NRO account routing, and professional legal counsel ensuring clean title deeds and development rights. Repatriation flexibility allows sale proceeds transfer up to $1 million annually with proper tax compliance.

What rental yields can investors expect from luxury farmhouses?

Premium farmhouses generate 4.5-6.0% rental yields through luxury vacation rentals, corporate events, and wedding celebrations. Gurgaon properties command ₹50,000-₹2,50,000 daily rates for exclusive events, while weekend rentals generate ₹15,000-₹75,000 depending on property size and amenities. Professional management essential for maximizing occupancy and maintaining premium positioning.

How do farmhouse investments compare with Dubai luxury real estate for Indian buyers?

Dubai offers higher rental yields (7-11%) and tax-free environment, but lacks emotional connectivity and generational wealth-building potential of Indian farmhouses. Indian properties provide freehold ownership, cultural resonance, and superior long-term appreciation (12.8% vs Dubai’s 19.1% short-term surge). Currency risk and residency requirements make Dubai more suitable for portfolio diversification rather than primary wealth creation strategies.

The Next Chapter of Indian Luxury

India’s luxury farmhouse market represents more than an investment opportunity—it embodies the evolution of Indian wealth consciousness from urban status symbols to experiential legacy assets. As India’s HNI population approaches 94,000 individuals by 2028 and billionaire wealth exceeds $1 trillion, farmhouses will increasingly define elite lifestyle preferences and generational wealth strategies.

The convergence of demographic dividend, infrastructure development, and changing lifestyle preferences creates unprecedented opportunity for sophisticated investors who recognize rural luxury as urban luxury’s successor. NRI participation will accelerate as currency advantages persist and emotional connections drive homeland investment strategies beyond pure financial calculations.

Strategic investors positioned ahead of this transformation will capture disproportionate returns while building lifestyle assets that appreciate across generations. The billionaire’s rural escape has evolved from weekend retreat to primary wealth creation strategy—marking a definitive shift in India’s luxury real estate paradigm.

For exclusive consultation on luxury farmhouse investment opportunities and comprehensive market intelligence, connect with leading advisory firms specializing in UHNI real estate strategies and NRI investment optimization.

Free resources to download

India’s Luxury Farmhouses – Executive Summary