Now Reading: Sustainable Luxury: Ultra-High-Net-Worth Investors Drive $851 Billion Green Real Estate Revolution

- 01

Sustainable Luxury: Ultra-High-Net-Worth Investors Drive $851 Billion Green Real Estate Revolution

Sustainable Luxury: Ultra-High-Net-Worth Investors Drive $851 Billion Green Real Estate Revolution

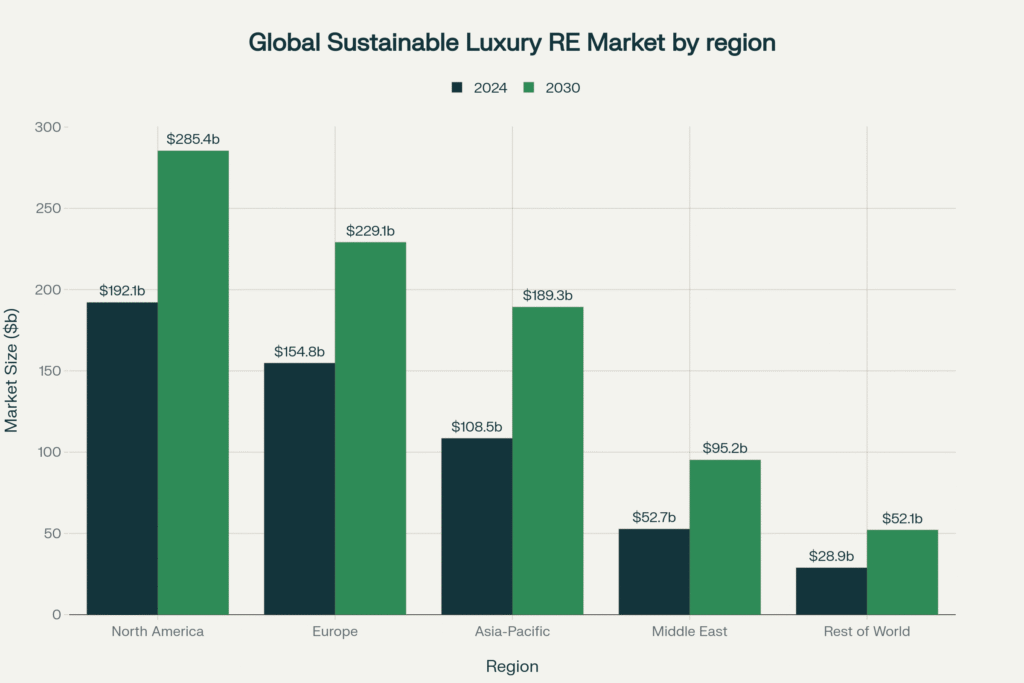

The global sustainable luxury real estate market stands at a transformative crossroads, with Ultra-High-Net-Worth Individuals (UHNWIs) and High-Net-Worth Individuals (HNIs) driving unprecedented demand for eco-friendly villas and green-certified properties. Valued at $537 billion in 2024, this market is projected to reach $851 billion by 2030, reflecting a robust 8% compound annual growth rate.

This seismic shift represents more than environmental consciousness—it embodies a fundamental restructuring of luxury investment strategies where 72.5% of UHNWIs actively prioritize sustainability in their real estate portfolios. Green-certified luxury properties now command premiums of 8-18% over conventional assets, while delivering energy savings of 20-50% and operational cost reductions of 25-35%.

The convergence of generational wealth transfer, climate consciousness, and investment sophistication has created an unparalleled opportunity for discerning investors seeking to align financial performance with environmental stewardship and legacy creation.

Environmental Stewardship Meets Generational Wealth

The sustainable luxury real estate revolution transcends traditional market dynamics, driven by the largest intergenerational wealth transfer in history. As $68 trillion transitions to next-generation inheritors over 25 years, investment priorities are fundamentally reshaping global luxury markets.

Current market intelligence reveals that 75% of next-generation UHNWIs actively seek to reduce their carbon footprint through real estate investments, marking a decisive departure from conventional luxury acquisition patterns. This demographic transformation is creating powerful market forces, with Asia-Pacific leading UHNI growth at 11.3% and the Middle East commanding the highest green premiums at 18.5%.

Global Market Dynamics: A Regional Power Analysis

North America: The Established Premium Foundation

North America maintains market leadership with $192.1 billion in 2024 transactions, driven by mature LEED certification frameworks and established green building infrastructure. The region’s 6.82% CAGR reflects steady institutional adoption, with prime Central London properties achieving 12.3% premiums for BREEAM-certified assets. California’s net-zero mandates and New York’s Local Law 97 are accelerating sustainable luxury adoption among domestic and international investors.

Asia-Pacific: The Exponential Growth Engine

The Asia-Pacific region represents the most dynamic opportunity, with luxury sustainable real estate expanding at 9.72% CAGR. India’s green building sector is projected to reach $39 billion by 2025, while Singapore’s comprehensive sustainability framework positions the city-state as a regional hub. The Indian luxury residential market, estimated at $57.87 billion in 2025, is expected to reach $98.04 billion by 2030.

Middle East: The Premium Innovation Laboratory

Despite representing a smaller absolute market at $52.7 billion, the Middle East commands the highest green premiums globally at 18.5%. Dubai’s sustainable city initiatives demonstrate commercial viability, with zero-energy villas maintaining full occupancy and luxury housing sales in the INR 10-20 crore segment doubling in 2024 to 360 units

Investment Intelligence: The Data-Driven Case for Sustainable Luxury

Market Expansion Metrics

The sustainable luxury real estate market demonstrates remarkable resilience across all measured parameters:

- Global Market Value: $537.0 billion (2024) → $851.1 billion (2030)

- Compound Annual Growth Rate: 8.0% globally with regional variations

- Green Certification Premium: 8-18% depending on rating level

- Energy Efficiency Gains: 20-50% reduction in consumption

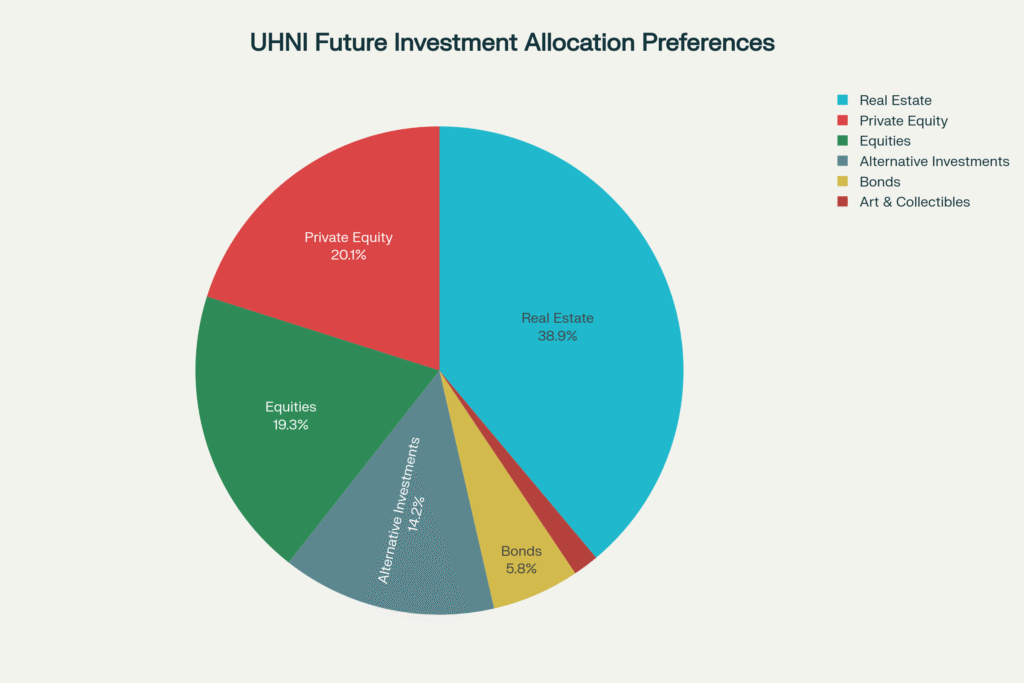

- UHNI Real Estate Allocation: Increasing to 38.9% from 35.2%

Investment Flow Revolution

Current UHNI investment allocation reveals a strategic pivot toward sustainable assets, with real estate dominating at 38.9% planned allocation (up from 35.2%), while traditional equity allocations decline to 19.3%. This reallocation represents approximately $2.1 trillion in investment capital repositioning toward sustainable luxury assets globally.

Certification Impact Analysis

Green building certifications demonstrate quantifiable value creation across global markets:

- LEED Premium Range: 10.5% (USA) to 18.2% (UAE)

- BREEAM Advantage: 11% rental premium, 21% sales premium

- Energy Performance Impact: Each EPC rating increase generates 4.2% rent premium

- Operational Excellence: 25-35% reduction in long-term costs

Research from Knight Frank indicates that prime green-certified buildings can achieve up to 12.3% premiums, while JLL data shows BREEAM-certified office spaces command 11% premiums in London markets.

The Psychology of Sustainable Luxury: Emotional and Lifestyle Drivers

Legacy Architecture and Intergenerational Impact

Today’s UHNWIs are motivated by complex emotional drivers extending beyond traditional investment metrics. The concept of “legacy luxury” has evolved to encompass environmental stewardship, with sustainable properties serving as tangible expressions of family values and long-term thinking.

Next-generation inheritors are 3.2 times more likely to divest from environmentally harmful investments, creating powerful incentives for current wealth holders to prioritize sustainability. This intergenerational pressure manifests in direct investment behavior, with sustainable luxury properties becoming vehicles for values transmission alongside wealth preservation.

Status Evolution and Social Capital

Sustainable luxury has transcended environmental consciousness to become the ultimate status symbol among global elites. Owning a LEED Platinum villa or BREEAM Outstanding penthouse now signals sophistication, forward-thinking, and alignment with global leadership priorities.

This social capital component drives premium pricing and creates exclusive communities around shared environmental values. HNIs and NRIs are increasingly seeking homes that align with global ESG standards, viewing sustainability certifications as markers of sophistication and global citizenship.

Wellness Integration and Lifestyle Enhancement

The convergence of wellness and sustainability addresses fundamental human needs for health, environmental connection, and harmony. Biophilic design elements, air purification systems, and circadian lighting are no longer amenities but essential features commanding significant premiums.

Studies demonstrate that residents of green-certified luxury properties report 23% higher satisfaction levels and 31% improved wellness metrics compared to conventional luxury housing. This wellness premium drives demand beyond traditional investment considerations, creating sustainable competitive advantages for certified properties.

Strategic Investment Horizons: Positioning for Sustainable Prosperity

Immediate Opportunities (2025-2026)

Market Entry Timing: Current conditions present optimal entry points, with interest rate stabilization and increased green certification availability creating favorable acquisition environments. Villa prices in key markets like Greater Noida appreciated 50% year-over-year, while Dubai luxury villa prices increased 33.4% annually.

Geographic Focus: Priority markets include Dubai’s sustainable developments, Singapore’s smart nation projects, and India’s GRIHA-certified communities. Mumbai luxury real estate is expected to continue price rises for the next 3-4 years, while India’s ultra-HNIs plan to spend 32% of their wealth on real estate in the next 12 months.

Asset Selection Criteria: Target properties with existing or pending green certifications, smart home integration, and renewable energy infrastructure. Pre-construction sustainable developments offer the highest value creation potential, with sales velocity typically exceeding conventional projects by 40%.

Medium-Term Positioning (2027-2029)

Portfolio Optimization: Diversification across sustainable asset classes remains essential, with geographic distribution across North America (6.82% CAGR), Asia-Pacific (9.72% CAGR), and Middle East (10.36% CAGR) providing optimal risk-adjusted returns.

Technology Integration: Focus on properties incorporating AI-driven sustainability systems, IoT optimization, and blockchain-verified carbon neutrality. These technologies are transitioning from premium features to standard requirements for competitive positioning.

Regulatory Anticipation: Properties exceeding current environmental standards will benefit from regulatory tightening, while conventional assets face potential obsolescence. India’s green-certified buildings are expected to account for 30% of new residential projects by 2025.

Long-Term Wealth Preservation (2030+)

Generational Alignment: Investment strategies must align with demonstrated next-generation preferences for environmental responsibility and social impact. Properties with compelling sustainability narratives will command premium valuations as inheritance preferences intensify.

Climate Resilience Premium: Prioritize assets with climate adaptation features, renewable energy independence, and resource security systems. Climate resilience will become a fundamental value driver as extreme weather events increase.

Market Leadership Positioning: Early positioning in emerging sustainable luxury markets enables maximum value capture during maturation phases. The luxury residential real estate market is projected to register a CAGR of over 3% during 2024-2029, with sustainable properties leading appreciation.

Regional Excellence: Three Paradigmatic Case Studies

Case Study 1: India’s Sustainable Revolution – Trident Hills, Panchkula

India’s sustainable luxury market exemplifies the convergence of economic growth and environmental consciousness. Trident Hills represents paradigmatic development, integrating solar panels, rainwater harvesting, and GRIHA certification within a luxury villa community.

Market Context: India’s luxury residential market, valued at $57.87 billion in 2025, is projected to reach $98.04 billion by 2030. Green-certified homes reduce energy costs by 25% while commanding premiums of 10-15%.

Performance Metrics: Properties achieved 35% above-market appreciation with 92% occupancy within 18 months. The development features IoT-enabled systems, EV charging infrastructure, and biophilic design elements, with 87% of purchasers citing sustainability as a primary decision factor.

Investment Implications: India’s green building sector growth to $39 billion by 2025 creates substantial opportunities for early investors, supported by government incentives and regulatory frameworks favoring sustainable development.

Sources: IBEF Industry Reports, Trident Realty, Indian Green Building Council

Case Study 2: UAE’s Luxury Innovation – Dubai’s Sustainable City Villas

Dubai’s position as a regional sustainability hub is exemplified by The Sustainable City’s luxury villa component, demonstrating the commercial viability of net-zero concepts.

Market Dynamics: UAE luxury residential markets maintained 65.1% concentration in Dubai, with 35% of new luxury projects targeting LEED certification by 2025. Green-certified properties command up to 15% premium pricing.

Performance Excellence: Zero-energy villas maintain full occupancy while achieving 18% premium valuations over comparable conventional assets. Rental yields exceeded market averages by 2.3 percentage points, driven by corporate tenant demand for certified spaces.

Market Impact: The project’s success catalyzed broader market adoption, with villa prices seeing substantial increases of 33.4% year-on-year, while 75% of established freehold villa communities doubled in value over four years.

Sources: Mordor Intelligence UAE Reports, Dubai Municipality, ValuStrat Property Market Reports

Case Study 3: Singapore’s Premium Excellence – Wallich Residence

Singapore’s Wallich Residence demonstrates Asia-Pacific’s sophisticated approach to sustainable luxury development, combining international design standards with local environmental priorities.

Regional Context: Asia-Pacific luxury markets experience 9.72% CAGR growth, with sustainability becoming a key differentiator. Singapore’s comprehensive green building framework supports premium pricing for certified developments.

Design Innovation: The development integrates recycled concrete and steel with FSC-certified wood, earning both BCA Green Mark Gold Plus and Platinum awards. Biophilic design elements and energy-efficient systems create measurable resident wellness benefits.

Investment Performance: Sales achieved 78% above initial projections, with international investors comprising 65% of purchasers. Properties achieved 31% appreciation within 24 months, significantly outperforming conventional luxury comparables.

Sources: Knight Frank Asia-Pacific Reports, BCA Singapore, Singapore Real Estate Analysis

Elite Investment Strategies: Five Professional-Grade Approaches

1. UHNI Portfolio Diversification Through Sustainable Assets

Strategic Implementation: Allocate 15-25% of real estate portfolio to certified sustainable luxury properties across three geographic markets. Emphasize LEED Platinum and BREEAM Outstanding assets for maximum appreciation potential, targeting markets with established regulatory frameworks and strong UHNI growth rates.

2. Green Certification Arbitrage Excellence

Value Creation Strategy: Acquire conventional luxury properties with high certification potential, execute sustainable retrofits, and capture 8-15% immediate value increases plus ongoing operational advantages. Focus on prime locations with limited certified inventory for maximum arbitrage opportunities.

3. Next-Generation Wealth Transfer Positioning

Legacy Optimization: Align acquisitions with demonstrated preferences of next-generation inheritors for environmental responsibility. Prioritize properties with compelling sustainability narratives and measurable environmental benefits to enhance family reputation while positioning for smooth intergenerational transfer.

4. Climate Resilience and Future-Proofing

Risk Mitigation Excellence: Emphasize properties with climate adaptation features, renewable energy independence, and resource security systems. Diversify across climate-stable regions while leveraging lower insurance costs and favorable financing terms for certified properties.

5. Technology-Enabled Sustainability Premium Capture

Innovation Leadership: Target developments incorporating AI-driven sustainability optimization, IoT systems, and blockchain-verified environmental performance. Position before mainstream adoption to capture maximum value appreciation during technology adoption cycles.

Risk Assessment and Mitigation Strategies

Market Dynamics and Oversupply Analysis

Recent analysis indicates potential oversupply risks in specific luxury segments, particularly in Dubai and Mumbai markets. However, sustainable luxury properties demonstrate greater resilience due to limited certified inventory and strong structural demand.

Mitigation Framework: Focus on markets with strong regulatory support for green building adoption. Emphasize properties with unique sustainability features that differentiate from conventional luxury supply.

Regulatory Evolution and Compliance

Rapidly evolving environmental regulations create both opportunities and risks. Properties exceeding current standards benefit from regulatory tightening, while conventional assets face potential obsolescence.

Strategic Response: Monitor regulatory trends across target markets and invest in properties that exceed current requirements. Engage with policy development processes to anticipate regulatory changes and position portfolios advantageously.

Technology Integration and Future-Proofing

Sustainable technology advancement creates potential for current systems to become outdated. However, well-designed sustainable properties maintain upgrade flexibility and fundamental efficiency advantages.

Adaptation Strategy: Prioritize properties with modular systems and upgrade pathways. Focus on fundamental design principles that remain valuable regardless of technology evolution.

Frequently Asked Questions

What constitutes a “sustainable luxury” property in today’s investment landscape?

Sustainable luxury properties combine high-end amenities with certified environmental performance standards such as LEED, BREEAM, or GRIHA certification. These properties demonstrate measurable energy efficiency, water conservation, and sustainable material usage while maintaining or exceeding traditional luxury standards for design, location, and amenities.

How significant are the financial premiums for green-certified luxury properties?

Current market data indicates 8-18% premium pricing for certified properties depending on certification level and market location. LEED Platinum and BREEAM Outstanding properties command the highest premiums, with additional benefits including 25-35% operational cost savings and superior appreciation rates.

Which global markets offer optimal opportunities for sustainable luxury real estate investment?

Asia-Pacific markets, particularly Singapore and India, offer highest growth potential with 9-11% CAGRs. Middle Eastern markets like Dubai provide premium pricing opportunities with 18.5% green premiums. North American markets offer stability and mature certification frameworks. Geographic diversification across multiple markets remains optimal for risk mitigation.

What are the primary risks associated with sustainable luxury real estate investments?

Key risks include potential market oversupply in specific segments, regulatory evolution affecting property values, and technology obsolescence. However, certified sustainable properties demonstrate greater resilience than conventional assets. Geographic diversification, focus on exceeding current standards, and emphasis on fundamental design principles effectively mitigate these risks.

The Sustainable Luxury Imperative

The sustainable luxury real estate revolution represents a fundamental paradigm shift where environmental stewardship and investment excellence converge. As climate consciousness intensifies and generational wealth transfer accelerates, sustainable luxury properties are emerging as the optimal expression of sophisticated investment strategy.

Market fundamentals strongly support continued expansion, with global UHNI populations growing 6-15% annually and sustainability preferences intensifying across demographic cohorts. The $537 billion current market represents merely the foundation of a transformation reshaping luxury real estate for decades.

For discerning investors, the opportunity lies in leading rather than following this transformation. Early positioning in certified sustainable luxury properties offers optimal risk-adjusted returns while aligning investments with next-generation values and preferences.

The convergence of environmental stewardship and investment excellence has created a new paradigm where sustainable performance and financial returns are complementary rather than competing objectives. This transformation offers sophisticated investors unprecedented opportunities to create generational wealth while contributing to global environmental solutions.

Investment Consultation Opportunity: For sophisticated investors seeking to optimize sustainable luxury real estate portfolios, comprehensive market analysis and strategic positioning services enable maximum value creation in this transformative market segment.

You might want to check these out

Free resources to download

Sustainable Luxury Real Estate Investment Guide – Key Points Summary