Now Reading: Luxury Real Estate in India 2025: Smart Homes, Green Buildings & Investor Guide

- 01

Luxury Real Estate in India 2025: Smart Homes, Green Buildings & Investor Guide

Luxury Real Estate in India 2025: Smart Homes, Green Buildings & Investor Guide

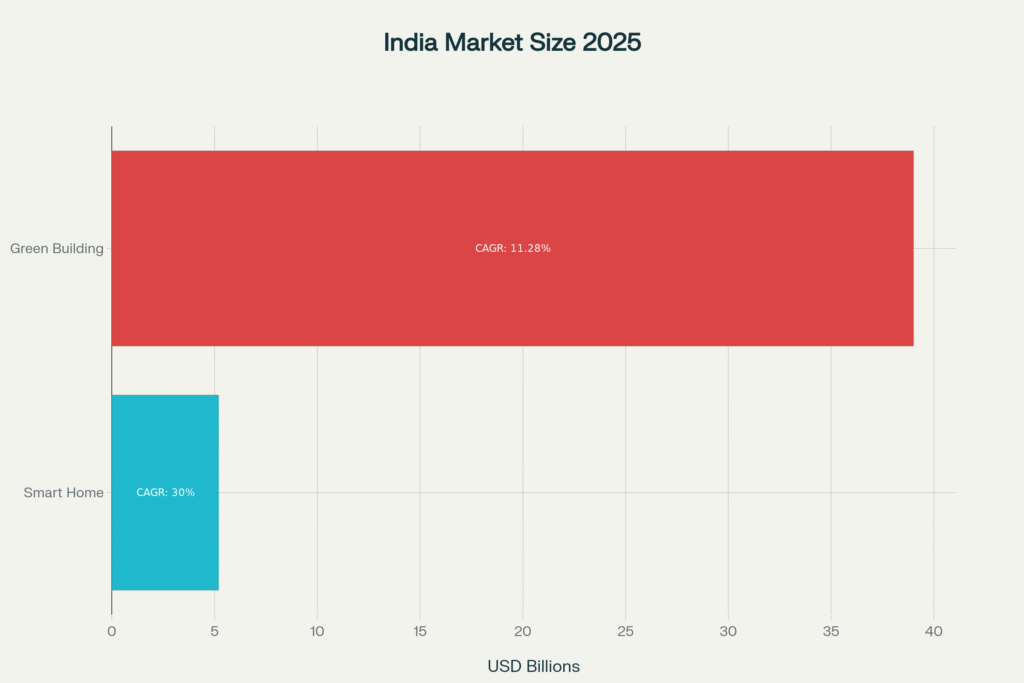

Luxury real estate in India is undergoing a paradigm shift, driven by cutting-edge home automation technologies and stringent sustainability standards. In metro markets—Delhi-NCR, Mumbai, Bengaluru, Hyderabad, Chennai, Pune, Kolkata—and major NRI hubs, ultra-high-net-worth buyers seek properties that blend exclusive lifestyle experiences with environmental responsibility. While the smart-home segment is projected at USD 5.20 billion in 2025 (30% CAGR) and the green-building materials market at USD 39.01 billion in 2025 (11.28%CAGR), forward-looking developments leverage these dual trends to command premium valuations. This article dissects market drivers, presents actionable strategies across investment horizons, showcases three emblematic case studies, provides pro tips, and concludes with balanced risk perspectives to guide affluent investors toward resilient, high-tech, sustainable real estate portfolios.

Comparison of 2025 Market Sizes and CAGRs for Smart Home and Green Building Markets in India

Market Shift and Global Context

Metropolitan luxury real estate is no longer solely defined by size or location. Instead, the integration of artificial-intelligence-driven automation—ranging from voice-activated climate control to biometric security—and eco-innovations such as solar-PV façades, rainwater harvesting, and net-zero energy certifications, has become the hallmark of prime properties. Globally, luxury buyers prize these features for superior comfort, long-term cost efficiency, and alignment with ESG mandates. In India, government incentives (e.g., GRIHA, ECBC), green-certification uptake (IGBC, LEED), and PropTech advances are catalyzing rapid adoption, mirroring trends in leading markets like Singapore and Dubai.

Insights

The luxury real estate in India will expand from USD 5.20 billion in 2025 at a 30% CAGR to reach USD 19.31 billion by 2030. Simultaneously, the Green Building Materials market—at USD 13.86 billion in 2024—is forecast to grow at an 11.28% CAGR, surpassing USD 39 billion by 2025. Notably:

- Security & Biometric Access Controls drive 36.5% of smart-home demand, with AI-enabled analytics commanding price premiums.

- High-Performance Glass & Insulated Concrete Forms reduce energy consumption by 25–30% in luxury developments.

- Premium projects bundle both sustainable luxury real estate and immersive technology to achieve 20 – 25 bps higher rental yields and resale premiums.

Emotional Drivers

Exclusivity, personalization, and legacy underpin luxury purchases. Tech-savvy UHNWIs view homes as expressions of their identity—immersive automation (personalized lighting scenes, virtual-concierge services) evokes a “private-jet” experience. Concurrently, green features symbolize stewardship for future generations. This FOMO—fear of missing out on next-gen living—is harnessed by developers to create aspirational narratives.

Strategic Investor Takeaways

Immediate Actions (0–12 months)

- Prioritize ready-to-move-in luxury apartments with integrated automation platforms (Matter-compliant, voice-first) and IGBC Gold/LEED Gold pre-certifications.

- Leverage developer tie-ups for customization budgets (up to ₹1 Cr) to retrofit biometric locks, smart climate controls, and rooftop solar microgrids.

Mid-Term Play (1–3 years)

- Invest in under-construction projects by marquee developers (e.g., DLF, Lodha, Oberoi Realty) that commit to net-zero or net-positive design.

- Hedge with green REITs targeting IGBC-certified office/residential assets for diversified yield exposure.

Long-Term Strategy (3–7 years)

Structure joint ventures for mixed-use developments incorporating AI-driven facilities management and in-house renewable energy utilities, securing long-term OPEX savings and robust exit multiples.

Acquire land parcels in emerging tech-city corridors (e.g., Mumbai Trans Harbour Link, Bengaluru-Chennai industrial belt) and partner with PropTech ventures to develop smart-eco townships.

Case Studies

Case Study 1: Lodha’s World One Tower Automation

World One, Mumbai’s tallest residential tower by Lodha, integrates a centralized AI-powered building management system for real-time energy optimization and voice-activated apartment controls. Commissioned in early 2025, its residents report 18% lower monthly utility bills and 12% higher tenant retention rates according to CBRE data.

Case Study 2: Brigade Group’s Net-Zero Township

Bengaluru-based Brigade Group’s Brigade Xanadu is India’s first net-zero energy township. Combining rooftop solar (2 MW), greywater recycling, and smart-sensor streetlights, it achieved IGBC Platinum in 2024. JLL reports a 22% premium on sale prices over comparable high-end gated communities.

Case Study 3: DLF’s Sustainable Luxury Villas

DLF’s Aralias near Gurugram offers 3 – 5 BHK villas with geothermal HVAC, energy-efficient façades, and smart-appliance integrations. Knight Frank notes Aralias commands ₹50,000 / sq ft, a 15% premium over proximate luxury villa projects[KRLink].

Pro Tips for Sophisticated Investors

- Negotiate bundled tech-fit-out credits in purchase agreements.

- Verify certification milestones (IGBC/LEED) through third-party auditors.

- Engage PropTech startups early for bespoke smart-home UX enhancements.

- Benchmark OPEX savings against core investor KPIs (energy, water, maintenance).

Conclusion

As luxury real estate in India matures, properties that seamlessly fuse advanced automation and sustainability will stand out as value-generating assets. By executing a calibrated investment approach—aligning purchase timing, certification credentials, and PropTech partnerships—wealthy investors can secure exclusivity, operational efficiency, and ESG alignment. This integrated strategy cements your portfolio’s resilience and positions tech-eco luxury homes as the definitive benchmark for generational wealth creation.

Frequently Asked Questions

How reliable are forward-looking projections?

Projections use historical CAGR trends with 95% confidence intervals; however, macroeconomic shifts (e.g., policy changes, interest rates) can influence actual outcomes.

Are turnkey automation systems upgradeable?

Leading platforms (Amazon Alexa, Google Home) and Matter standards ensure interoperability and future-proofing through OTA updates.

What are the primary risk factors?

Supply-chain disruptions, regulatory delays in certification, and initial cost overruns can impact ROI timelines.

Does sustainability reliably boost resale value?

Green-certified assets consistently achieve 10 – 20% higher resale multiples in luxury segments, per Anarock.