Now Reading: India’s $1.18 Trillion Real Estate Boom: Why Global Investors Are Turning to Luxury Assets

- 01

India’s $1.18 Trillion Real Estate Boom: Why Global Investors Are Turning to Luxury Assets

India’s $1.18 Trillion Real Estate Boom: Why Global Investors Are Turning to Luxury Assets

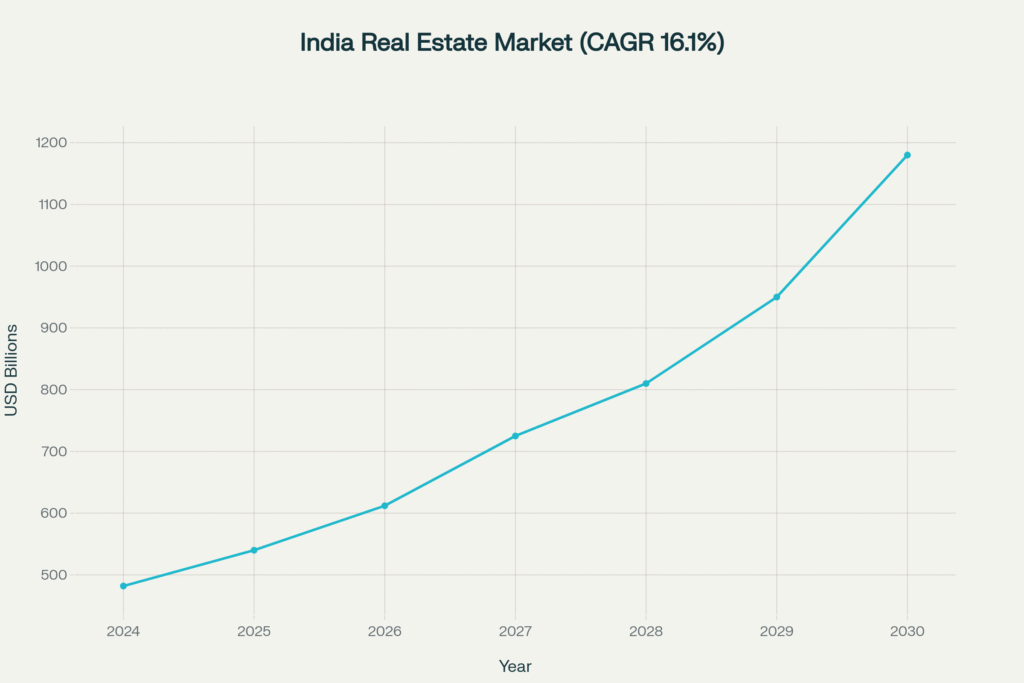

India’s luxury real estate investment sector has entered an unprecedented growth trajectory, with market valuation projected to surge from $482 billion in 2024 to $1.18 trillion by 2030—a remarkable 16.1% compound annual growth rate that positions it as one of the world’s most compelling investment destinations. This transformation is being driven by a perfect storm of factors: a burgeoning ultra-high-net-worth population growing at 39% annually, infrastructure modernization across tier-1 cities, and an influx of global capital seeking stable, high-yield assets amid market volatility. For affluent investors and global decision-makers, India’s luxury real estate market represents not merely an investment opportunity, but a strategic positioning in the world’s fastest-growing major economy, where premium residential assets are commanding 30-40% higher premiums over standard luxury properties and delivering rental yields of 4.5-5% alongside exceptional capital appreciation potential.

India’s Real Estate Market Trajectory: $1.18 Trillion by 2030

The Trillion-Dollar Transformation: Market Fundamentals Driving Unprecedented Growth

India’s real estate renaissance reflects deeper economic fundamentals that extend far beyond cyclical market dynamics. The sector’s contribution to GDP is projected to increase from 7% in 2024 to 13% by 2030, underscoring its evolution from a domestic growth story to a global investment magnet. Foreign institutional investment surged 242% quarter-on-quarter in Q2 2025 to $1.19 billion, with the United States, Japan, and Hong Kong accounting for 89% of inflows—a testament to international confidence in India’s macroeconomic stability and long-term growth prospects.

The luxury segment has emerged as the primary growth driver, with properties priced above ₹1 crore now representing 62% of all residential sales in H1 2025, up from 51% the previous year. This shift toward premiumization reflects not just rising affluence, but evolving lifestyle aspirations among India’s expanding high-net-worth population, which Knight Frank projects will reach 93,753 individuals by 2028.

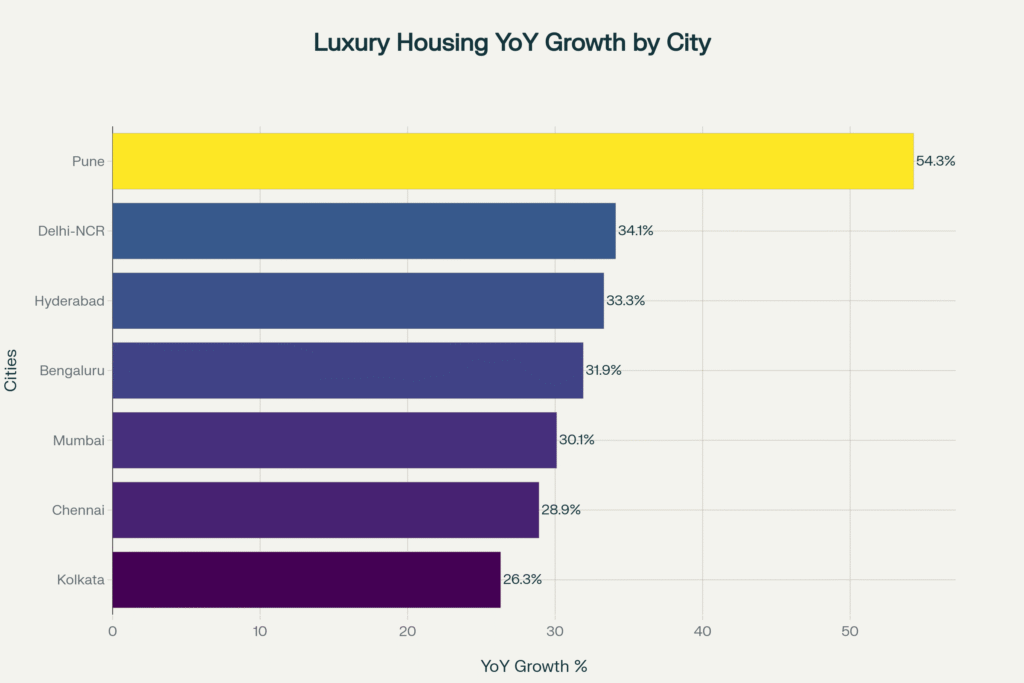

Delhi-NCR leads this transformation with luxury unit sales surging 72% year-on-year, while Mumbai’s ultra-premium segment (above ₹10 crore) recorded ₹14,750 crore in H1 2025 sales alone. These figures underscore a structural shift in buyer preferences toward larger, amenity-rich residences that offer both lifestyle enhancement and robust investment returns.

Luxury Housing Sales Surge: YoY Growth Across Indian Metro Cities

Global Capital Convergence: Why International Investors Are Choosing India

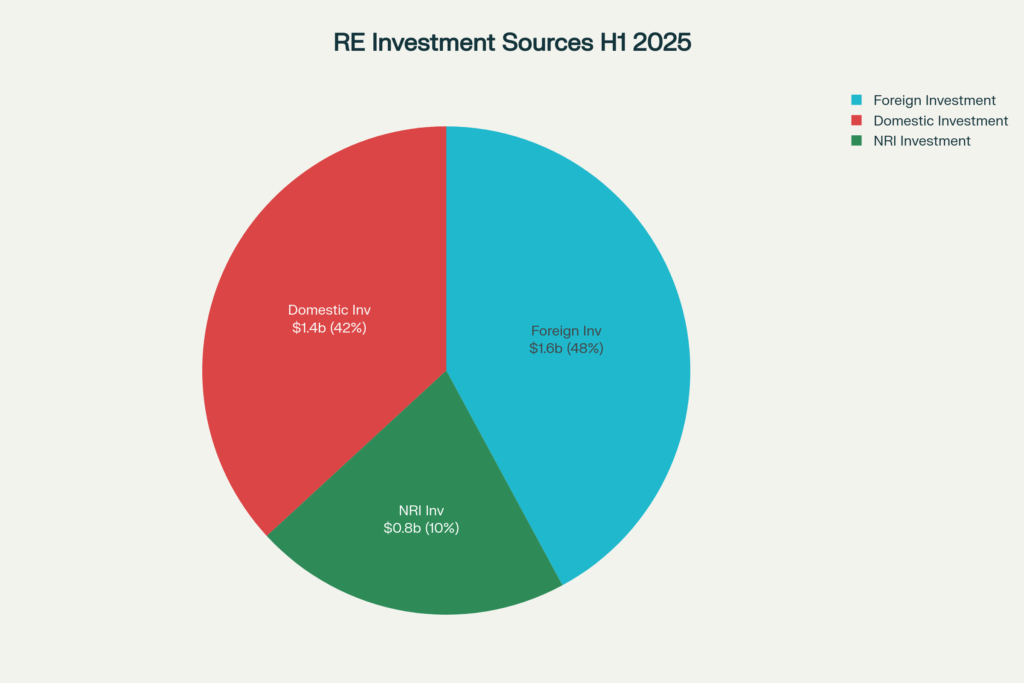

The influx of global capital into India’s real estate market reflects a strategic reallocation of international investment portfolios. Over the past 15 years, the sector has attracted $80 billion in investments, with foreign investors contributing 57% of that total. This sustained international interest stems from India’s unique positioning as a stable democracy with transparent regulatory frameworks, particularly following the implementation of RERA (Real Estate Regulation and Development Act) in 2017.

Non-Resident Indians have emerged as particularly influential players, now accounting for 15-25% of investments in newly launched luxury projects. NRIs are capitalizing on favorable exchange rates and emotional connections to their homeland, with ANAROCK projecting NRI real estate investments to reach $14.9 billion by 2025. The depreciation of the rupee by approximately 18% against the dollar between 2019-2024, while challenging for domestic investors, has created compelling value propositions for foreign buyers.

Real Estate Investment Sources: Global Capital Flows into India (H1 2025)

Family offices and institutional investors are also expanding their real estate allocations, with Knight Frank’s survey revealing that nearly half of 150 family offices globally intend to increase property investments over the next 18 months. In India, this translates to growing interest in structured real estate funds and alternative investment vehicles, particularly commercial assets offering 8-10% rental yields with professional management.

The Luxury Ecosystem: Best cities to invest in India real estate

India’s luxury real estate boom is not uniformly distributed but concentrated in strategic metropolitan corridors that offer the infrastructure, connectivity, and lifestyle amenities demanded by affluent investors. Bengaluru has emerged as a global luxury hotspot, ranking 4th worldwide with 10.2% year-on-year prime property price appreciation, surpassing established markets like London and New York. This performance is driven by the city’s tech wealth concentration and increasing global exposure among high-net-worth individuals.

Mumbai maintains its position as India’s most expensive market while recording 8.7% prime housing growth globally, ranking 6th among 46 international cities. The city’s luxury segment has been bolstered by projects like DLF’s Dahlias in Gurugram—India’s most expensive residential project with revenue potential of ₹34,000 crore—and Oberoi’s 360 West in Mumbai’s prestigious Worli neighborhood.

Delhi-NCR demonstrates the most dramatic growth trajectory, with luxury housing prices jumping 49% in certain corridors and overall residential prices rising 14% year-on-year. The region’s appeal stems from its position as the national capital, robust infrastructure development, and proximity to major corporate headquarters attracting domestic and international executives.

Emerging markets like Hyderabad and Pune are experiencing rapid appreciation, with luxury sales doubling in Hyderabad over the past 18 months and Pune recording the highest growth rate at 54.3% in luxury unit sales. These cities benefit from expanding economic bases, cosmopolitan demographics, and infrastructure upgrades that make them attractive to both end-users and investors.

Luxury apartment interior showcasing premium Indian real estate investment opportunities

Strategic Investment Framework: Maximizing Returns Across Time Horizons

For sophisticated investors, India’s real estate market offers multiple strategic pathways depending on investment objectives, risk tolerance, and time horizons. The immediate opportunity (0-6 months) lies in luxury residential projects in high-growth corridors, particularly properties above ₹4 crore that have demonstrated consistent demand and price appreciation. The premiumization trend suggests continued outperformance of high-end assets relative to mass-market properties.

Mid-term strategies (6-18 months) should focus on diversification across asset classes and geographies. Commercial real estate, particularly through Alternative Investment Funds (AIFs), offers compelling risk-adjusted returns with rental yields of 8-10% and professional management that eliminates operational headaches for busy HNIs. The GCC (Global Capability Centre) boom has driven record-high office leasing activity, creating sustained demand for quality commercial space.

Long-term positioning (2-5 years) requires anticipating structural shifts in India’s urban landscape. The government’s Smart Cities Mission and infrastructure investments are creating new growth corridors that savvy investors can capitalize on before they become mainstream. Additionally, the maturation of India’s REIT market offers increasing opportunities for liquid real estate exposure with institutional-quality assets. year-on-year luxury residential price increases.

Case Studies in Strategic Positioning

Case Study 1: DLF’s Dahlias Project Success

DLF Limited’s super-luxury project Dahlias in Gurugram exemplifies the premium market’s strength, recording pre-launch sales of ₹11,816 crore with 12% from NRI investors as of January 2025. Located on Golf Course Road, apartments range from 9,500 to 16,000 square feet with prices starting at ₹100 crore, demonstrating sustained appetite for ultra-luxury assets despite global economic uncertainty. Source: PropEquity, DLF Investor Relations

Case Study 2: Mumbai’s Ultra-Premium Surge

Mumbai’s luxury residential segment achieved ₹28,750 crore in sales over 12 months ending June 2025, with 1,335 high-end units sold across primary and secondary markets. Properties above ₹10 crore recorded ₹14,750 crore in H1 2025 alone, marking the highest half-year sales ever witnessed. Key micro-markets like Worli, Prabhadevi, and Bandra West led this surge, supported by infrastructure improvements and India’s expanding billionaire population, which more than doubled in the past decade. Source: India Sotheby’s International Realty, CRE Matrix

Case Study 3: Foreign Investment Momentum

Q2 2025 witnessed foreign institutional investment surge 242% quarter-on-quarter to $1.19 billion, with 69% directed toward commercial assets demonstrating strong investor confidence in India’s macroeconomic fundamentals. The United States, Japan, and Hong Kong accounted for 89% of foreign inflows, reflecting strategic diversification by international investors seeking stable, income-generating assets amid global uncertainties. This influx coincided with India’s economic growth forecasts exceeding 6% for FY26 and recent repo rate cuts improving borrowing conditions. Source: Vestian, IBEF

Pro Tips for Sophisticated Investors

Leverage Regulatory Advantages: Utilize the RERA framework to ensure transparency and project delivery timelines. Verify all RERA registration numbers and developer track records before committing capital.

Currency Hedging Strategies: For NRI investors, consider natural hedging by generating rental income in rupees while benefiting from potential currency depreciation on acquisition costs.

Tax Optimization: Explore the benefits of India’s 20% long-term capital gains tax with indexation, particularly attractive compared to global markets with higher tax burdens.

Technology Integration: Prioritize properties with smart home technologies and sustainable features, which command premium rentals and attract environmentally conscious tenants.

Exit Strategy Planning: Maintain flexibility through fractional ownership models or REITs that offer liquidity advantages over direct property ownership.

Risk Assessment and Future Outlook

While India’s real estate market presents compelling opportunities, sophisticated investors must navigate several risk factors. Rising construction costs, which have increased 40% over the past five years, could pressure developer margins and ultimately property prices. Interest rate sensitivity remains a concern, though recent repo rate cuts and forecasted economic growth above 6% provide supportive macroeconomic conditions.

Regulatory evolution continues to shape the market landscape, with states like Karnataka tightening compliance on land titles while streamlining approval processes for luxury projects. These changes, while initially disruptive, ultimately build long-term investor confidence by eliminating inefficiencies and ensuring transparent operations.

Supply-demand imbalances in certain markets, particularly Hyderabad’s 26-month inventory overhang, signal potential oversupply risks that astute investors can navigate by focusing on undersupplied premium segments and established developers with strong execution track records.

Frequently Asked Questions

What makes India’s real estate market particularly attractive to global investors now?

India offers a unique combination of robust GDP growth (6%+ projected for FY26), stable democratic institutions, transparent regulatory frameworks post-RERA implementation, and significant currency arbitrage opportunities for foreign investors, particularly with the rupee’s depreciation creating attractive entry points for dollar-denominated wealth.

How do luxury real estate returns in India compare to global markets?

While India’s residential rental yields average 4.5-5% (modest compared to USA’s 6-6.5%), the capital appreciation potential is significantly higher. Indian cities like Bengaluru rank 4th globally in prime property price growth at 10.2%, while commercial real estate offers 8-10% rental yields through professional AIFs, competitive with developed markets but with higher growth potential.

What are the key risks investors should consider in India’s luxury real estate market?

Primary risks include currency volatility (rupee depreciation can benefit foreign buyers but creates repatriation challenges), regulatory changes across different states, rising construction costs (40% increase over five years), and potential oversupply in certain markets like Hyderabad, requiring careful market selection and developer due diligence.

How can NRIs and foreign investors ensure smooth property transactions in India?

Utilize RERA-registered projects and established developers, engage local legal counsel for title verification, leverage digital transaction platforms offered by premium developers, consider co-investment structures to mitigate risks, and maintain compliance with FEMA regulations for seamless fund transfers and eventual repatriation.

Conclusion

India’s $1.18 trillion real estate trajectory represents more than market expansion—it embodies a fundamental shift in global capital allocation toward emerging market stability and growth potential. For affluent investors and global decision-makers, the question is not whether to participate in this transformation, but how strategically to position for maximum value creation across multiple time horizons. As India’s economy continues its ascent toward the $5 trillion milestone, luxury real estate assets offer both immediate yield generation and long-term wealth preservation in one of the world’s most dynamic and resilient markets.